Where does the high value judgment of Lumoz tokens come from?

Written by: Shaofaye123, Foresight News

As the Ethereum ecosystem continues to develop, issues such as on-chain congestion, high transaction fees, and difficulty in customization are becoming increasingly prominent. Scalability and customization have become the main focus for application developers, with Rollup significantly improving the throughput and efficiency of blockchains like Ethereum as a mainstream scaling solution. As a leading entity in the RaaS sector, Lumoz is about to launch its mainnet, and this article will deeply analyze Lumoz and the value locking behind its tokens.

How valuable is the airdropped token?

With the cryptocurrency market heating up again, the last major wave of 2024 is slowly arriving. The modular computing layer and the RaaS platform Lumoz are about to welcome their mainnet launch and TGE. The airdrop event launched on November 5 accounts for 10% of the total token supply (with a total of 10 billion tokens), and based on the valuation from the last round of financing, the total value of this airdrop is approximately 30 million USD. The airdrop covers the ETH ecosystem, Move ecosystem, and more, attracting widespread attention in the market, with over 5 million users checking and confirming their esMOZ amounts.

Currently, the Lumoz token is designed as a dual-token economic model, mainly consisting of the functional token MOZ and the equity token esMOZ. The functional token MOZ is primarily used for transaction fees, resource usage fees, etc.; esMOZ can be used for participation incentives, delegating to zkVerifier nodes, exchanging for functional tokens, and more. The airdropped users will receive the equity token esMOZ, which can be exchanged 1:1 for the functional token MOZ, although there is a certain unlocking period. However, considering the community members' desire for immediate unlocking, Lumoz team members have cleverly designed the OG NFT, allowing esMOZ to be exchanged directly for MOZ without locking. Additionally, all official channels for obtaining Lumoz OG NFT are free, and Lumoz has received widespread praise from the community. As of the date of this article, Lumoz OG NFT remains at the top of the hot search and trading lists on NFT trading markets like Element and AlienSwap, with its value rising alongside its rarity and the approaching TGE. It is understood that Lumoz OG NFT can still be used and maintain a 1:1 exchange ratio after the Lumoz TGE mainnet launch. Given the community's anticipation and attention, the rise of Lumoz OG NFT is bound to be even more remarkable.

What is the actual value of Lumoz's functional token MOZ, and how much room for growth will it have after launch?

MOZ Token Valuation Analysis

According to the tokenomics published by Lumoz, the total supply of MOZ tokens is 10 billion, of which 66% will be allocated to the community, ecosystem, nodes, and miners. The zkProver network accounts for 25% of the total token supply, zkVerifier nodes account for 25%, early contributors account for 16%, early investors account for 18%, the ecosystem accounts for 10%, and the community accounts for 6%. The design of the tokenomics truly prioritizes community and users in its allocation. Currently, the initial circulation of MOZ tokens is only 11%, and the remaining tokens will be gradually unlocked over the next 10 years. This design effectively reduces the selling pressure at launch, enhances market stability, and aligns with the project's long-term development goals. Additionally, the MOZ token will never be reissued, further ensuring that its value will not be diluted.

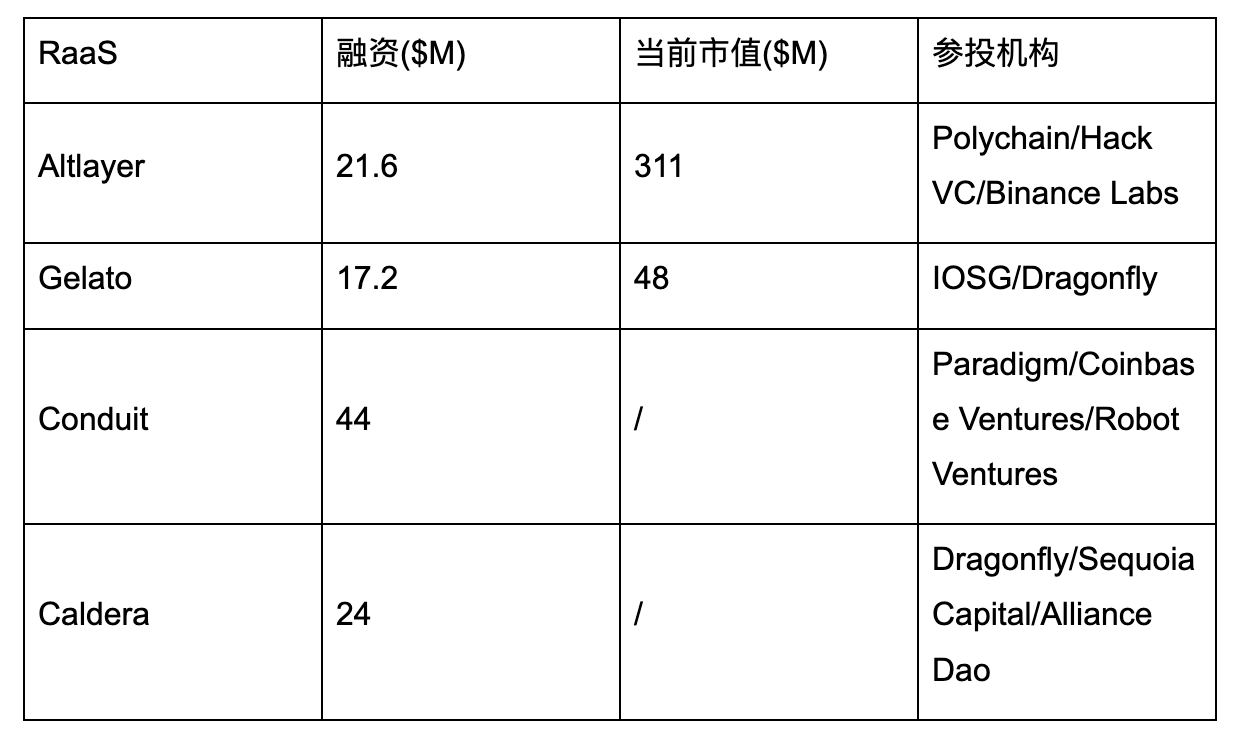

Compared to other projects in the RaaS (Rollup-as-a-Service) sector, although projects like Altlayer and Gelato have launched no-code chain services, Lumoz demonstrates unique technical advantages and competitiveness through its RaaS Launch Base platform.

In contrast to Altlayer and Gelato, Lumoz has a clear advantage in the compatibility of Rollup technology and ecological scalability. While Altlayer has certain advantages in no-code chain deployment, its tech stack is concentrated on a single solution, limiting developers' flexibility. Gelato mainly focuses on automation and improving developer toolchains, which, while reducing some operational complexity, does not possess the extensive compatibility in Rollup scalability that Lumoz has. Lumoz, by integrating various leading ZK Rollup technologies, comprehensively meets the diverse needs of developers, making its ecosystem more attractive and innovative.

This diversified integration provides strong support for the long-term value of Lumoz tokens. By ensuring compatibility with various ZK Rollup technologies, Lumoz significantly reduces the complexity of development and deployment, providing more developers with the possibility to enter the Rollup ecosystem, which directly drives the demand for tokens. Furthermore, the diverse tech stack allows Lumoz to maintain a high level of adaptability and risk resistance in the market, meaning that against the backdrop of technological evolution and market changes, Lumoz tokens are more likely to sustain their market demand and achieve value growth.

With the mainnet launch approaching, the high value of Lumoz tokens is gradually becoming apparent. From an investment perspective, based on currently disclosed information, it has already secured $14 million in strategic round financing, with a valuation reaching $300 million, comparable to Altlayer's current market cap of $311 million.

As a potential hot narrative for speculation, the RaaS sector is an ideal choice for capital inflow. Unlike projects in the sector targeting relatively low technical difficulty Optimistic Rollup, the pure ZK Rollup currently only has Lumoz, which plays a crucial role in promoting the large-scale application and popularization of ZK-Rollup technology, and its token value may become a leading entity that breaks through the sector's ceiling.

Moreover, the Lumoz project team not only maintains a high level of technical capability in the sector, supporting over 20 L2s, but is also continuously innovating. Operationally, it is actively building a series of market activities in cryptocurrency prosperous regions such as Japan, South Korea, Turkey, and Russia, creating significant brand influence and a large audience.

As the market thrives, CZ recently tweeted hints about ALT, causing Altlayer's token price to surge close to $0.19, with an FDV nearing $2 billion. As a mainstream narrative in modularization, Celestia's valuation has reached $9 billion. In contrast, TIA's pre-listing valuation of $1 billion has already achieved a return on investment of 900%.

From this perspective, it is estimated that the fully diluted market cap of Lumoz tokens may reach around $1 billion initially.

High Valuation Potential Driven by AWS in the Web3 World

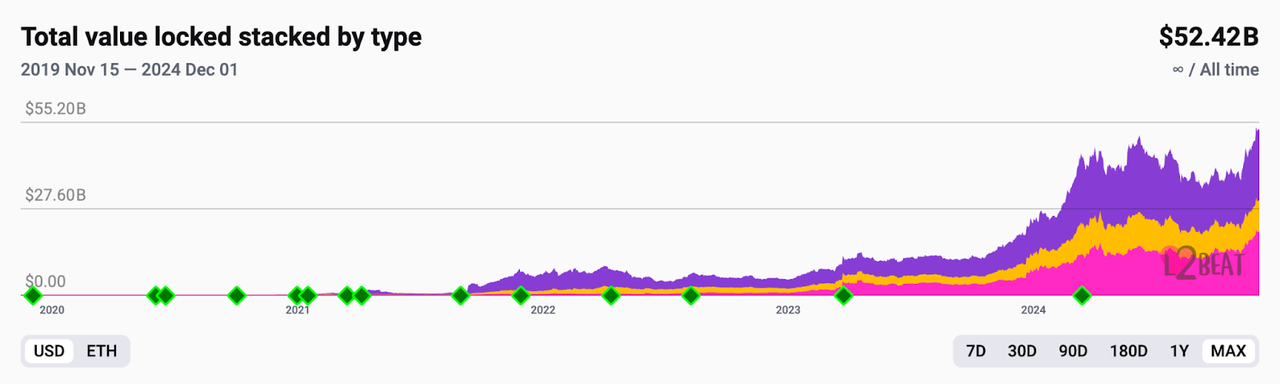

Under the blockchain's impossible triangle, scalability has always been the core bottleneck troubling the industry. The continuously growing TVL reflects the market's demand for L2. Effectively solving the scalability issue remains key to achieving Web3 mass adoption.

As a scaling solution, ZK Rollup effectively addresses the above dilemmas, leading the way for Layer 2 scaling solutions with its advantages in scalability and privacy protection. However, behind this increasing attention and deployment of technology, profound challenges still exist.

RaaS Sector Leader

Computational complexity, high development difficulty, and hardware dependency have become labels for ZK Rollup. This has caused many projects to shy away from ZK Rollup or be forced to spend more energy on underlying infrastructure, losing focus on their core business.

This predicament is very similar to the early days of the internet. It wasn't until the emergence of Amazon Web Services (AWS) that this deadlock was broken. Comparing the market situation after its emergence, it is clear that projects that can host in the cloud and focus more on their core business tend to go further. AWS significantly reduced computing and storage costs, allowing applications to focus on product development, lowering costs, and enhancing innovation, thereby improving their competitive advantage.

Similar to AWS, Lumoz, as the leader in the RaaS sector, also provides various modules such as decentralized storage, smart contract execution, identity verification, and data computation, offering fertile ground for developers and applications. Compared to AWS's centralization issues, such as single points of failure and potential data privacy risks, Lumoz, as a decentralized application, leverages the immutability and decentralization of blockchain technology to eliminate reliance on a single entity, providing a more secure and transparent infrastructure for Web3 applications. Furthermore, AWS serves as a cornerstone for various industries, enabling almost all sectors, from the internet to finance and healthcare, to build their technological architecture through AWS. Lumoz is also continuously advancing into multiple industries and application scenarios, especially in the early stages of Web3's rapid development, with fields like DeFi, GameFi, RWA, and the metaverse expanding rapidly. By collaborating with other blockchain projects and protocols, Lumoz can empower decentralized applications to develop more diversely, thus promoting the Web3 transformation of more vertical industries. Lumoz is not just a modular tool but also the foundation for the prosperity of other ecosystems.

In this light, Lumoz is viewed as the AWS of the Web3 world, not merely a simple analogy. Its role in the decentralized network bears profound similarities to AWS's role in the traditional internet. Since Lumoz's launch, the ZK-PoW mechanism has attracted participation from 145 miners globally, with over 20,000 testnet verification nodes, more than 1.5 million users, over 200 projects, and 28,137 validators. Lumoz, as the AWS of the Web3 world, is one of the few applications in blockchain with real value. It exists not just as simple middleware; it is the foundation for the prosperity of the Web3 ecosystem. Therefore, Lumoz, as the AWS of Web3, has unlimited potential compared to AWS's current trillion-dollar market cap and remains extremely undervalued.

Strong Comprehensive Strength

After analyzing the extremely high valuation ceiling of Lumoz, we need to make a rational judgment about its value floor. From the comprehensive strength of the team, project technology, and ecological advantages, we can assess whether its tokens are worth long-term value investment.

Team strength and community building are key drivers of sustainable development. Lumoz has performed well in both areas. The core team of Lumoz has been deeply engaged in ZK technology since 2018, consistently committed to making zero-knowledge computation more efficient and accessible: "Making ZK-Rollup Within Reach." On the capital side, Lumoz has completed a strategic round of financing, raising $14 million, supported by top investors such as OKX Ventures, HashKey Capital, KuCoin Ventures, Polygon, and IDG Blockchain.

In terms of community, Lumoz has always focused on sustainable development. Whether through testnet activities or airdrop distributions, there is a strong emphasis on the rights of community members, attracting numerous users to participate. The Pre-Alpha testnet had 87,567 participants, the Alpha testnet gained 286,179 followers, and the Quidditch testnet saw participation exceed one million.

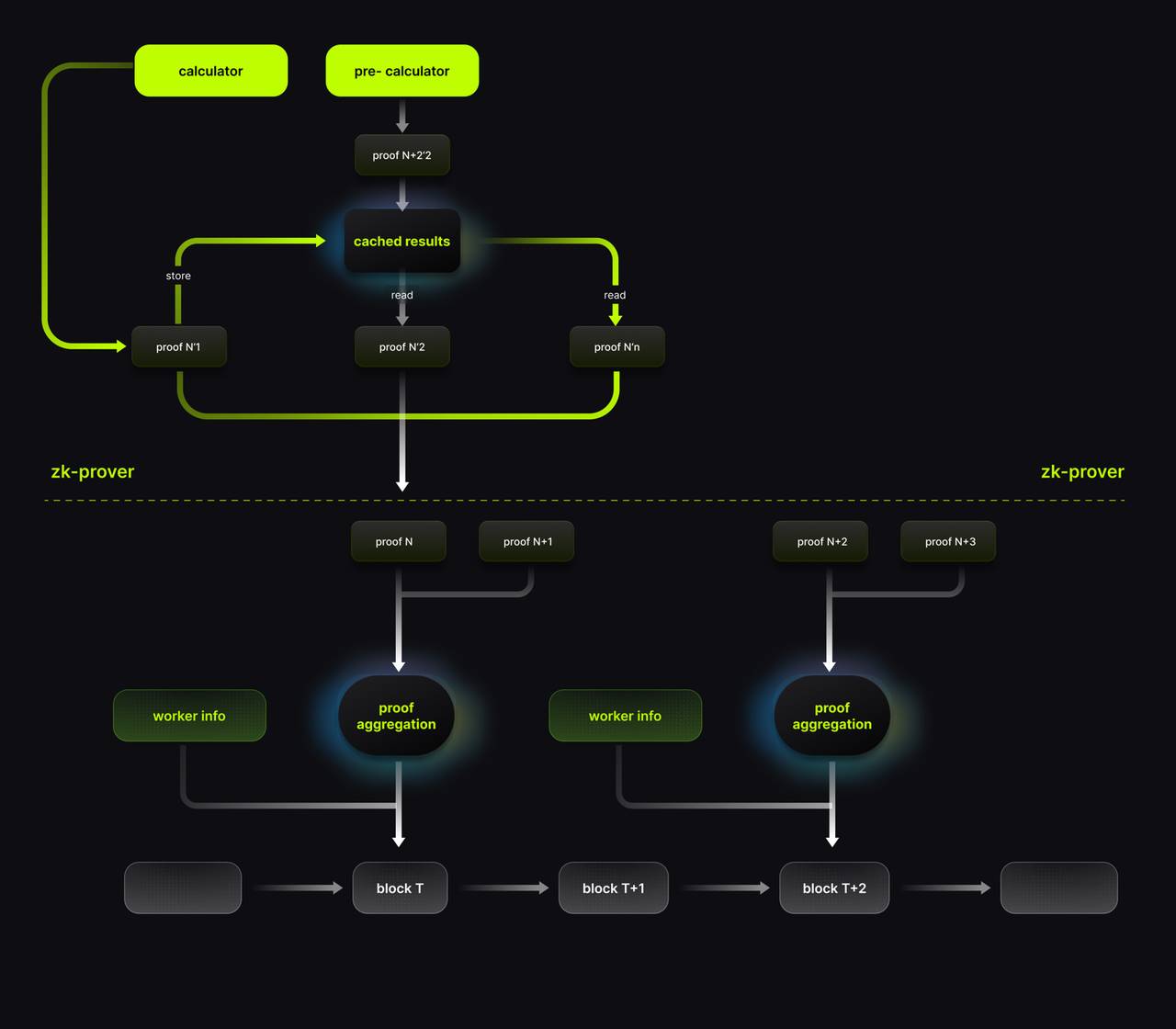

Establishing technical barriers and leading solutions is a key force in shaping the future market landscape. Lumoz occupies an important position with its unique technical advantages and innovative solutions. Lumoz's ZK-PoW algorithm provides a unified market for ZKP computing capabilities, eliminating unnecessary proofs and address aggregation calculations. The two-step submission algorithm enables parallel ZKP computation and sequential submission while allowing miners to concurrently execute multiple ZKP generation tasks, significantly accelerating ZKP generation efficiency. Its "OP Stack + ZK Technology Optimization Architecture" has created a new zk-proposer component, reducing integration and maintenance costs while enhancing network security and stability. The "ZK Fraud Proof Module Optimization" greatly improves ecological flexibility. The NCRC Protocol achieves a trustless native cross-chain bridge solution for ZK-Rollup, allowing users to seamlessly perceive asset transfers during cross-chain operations.

Lumoz stands at the forefront of the modularization track, providing technical services or support to over 20 high-quality projects or L2s, including CARV, UXLINK, ZKFair, Merlin Chain, MATR1X, Ultiverse, and more. Lumoz's technological innovations also give a significant boost to the development of the ecosystem. On one hand, Lumoz continuously expands its ecosystem, enhancing the potential value of its tokens through partnerships. On the other hand, Lumoz's layout showcases its broad global vision and the organic combination of localized strategies. Lumoz collaborates with the Web3 social platform UXLINK and its fund UFLY to jointly create a Social Growth Layer (SGL), which will leverage the power of social applications to drive growth and user adoption in the Japanese and Korean cryptocurrency markets. A week before announcing the partnership with UXLINK, Lumoz also revealed its collaboration and airdrop for the CARV community, where both parties will empower the community in areas such as AI computing power and market collaboration, promoting the continuous growth of the ecosystem. Additionally, Lumoz has conducted a series of market activities in cryptocurrency prosperous regions such as Turkey and Russia, actively building brand awareness and deepening connections with local communities. Through these market strategies, Lumoz not only expands its geographical influence but also effectively promotes the social collaborative development of the platform, further breaking through the geographical boundaries of value.

Therefore, from the above perspectives, Lumoz, as a project with long-term sustainable development, has strong value locking, and the token valuation has the most basic guarantee.

Conclusion

The current blockchain ecosystem faces dilemmas similar to those of the early internet, which requires RaaS to break through the boundaries of scalability. As the AWS of the Web3 world, Lumoz has an extremely high valuation ceiling, and as a continuously developing project, the MOZ token has at least five times the potential for long-term growth. The RaaS narrative will eventually see an explosion, and Lumoz, as a unique presence in the sector, faces both opportunities and challenges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。