Asian Companies' Investment in Bitcoin is Still in Its Early Stages

Author: Tiger Research Reports

Translated by: Deep Tide TechFlow

Abstract

The trend of corporate investment in Bitcoin is expanding: Since the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin spot ETF, corporate investment strategies have gradually warmed up. This trend is not limited to Western markets and is extending to Asia.

Why companies choose Bitcoin: Bitcoin has shown great appeal in diversifying asset allocation, improving capital management efficiency, and enhancing corporate value.

Participation and development prospects in the Asian market: Investment in Bitcoin by Asian companies is still in its early stages, but successful cases like Metaplanet indicate significant market expansion potential. However, regulatory uncertainty and lack of institutional support remain major obstacles.

1. Introduction

This year, the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin spot ETF. This move has become a milestone event for the institutionalization of crypto assets. Since then, more and more companies have begun to incorporate Bitcoin into their investment strategies. For example, MicroStrategy has made Bitcoin one of its key financial assets. This trend is rapidly expanding from Western markets to Asian markets, gradually becoming a global phenomenon. This article will analyze the main strategies driving corporate adoption of Bitcoin and the influencing factors behind them.

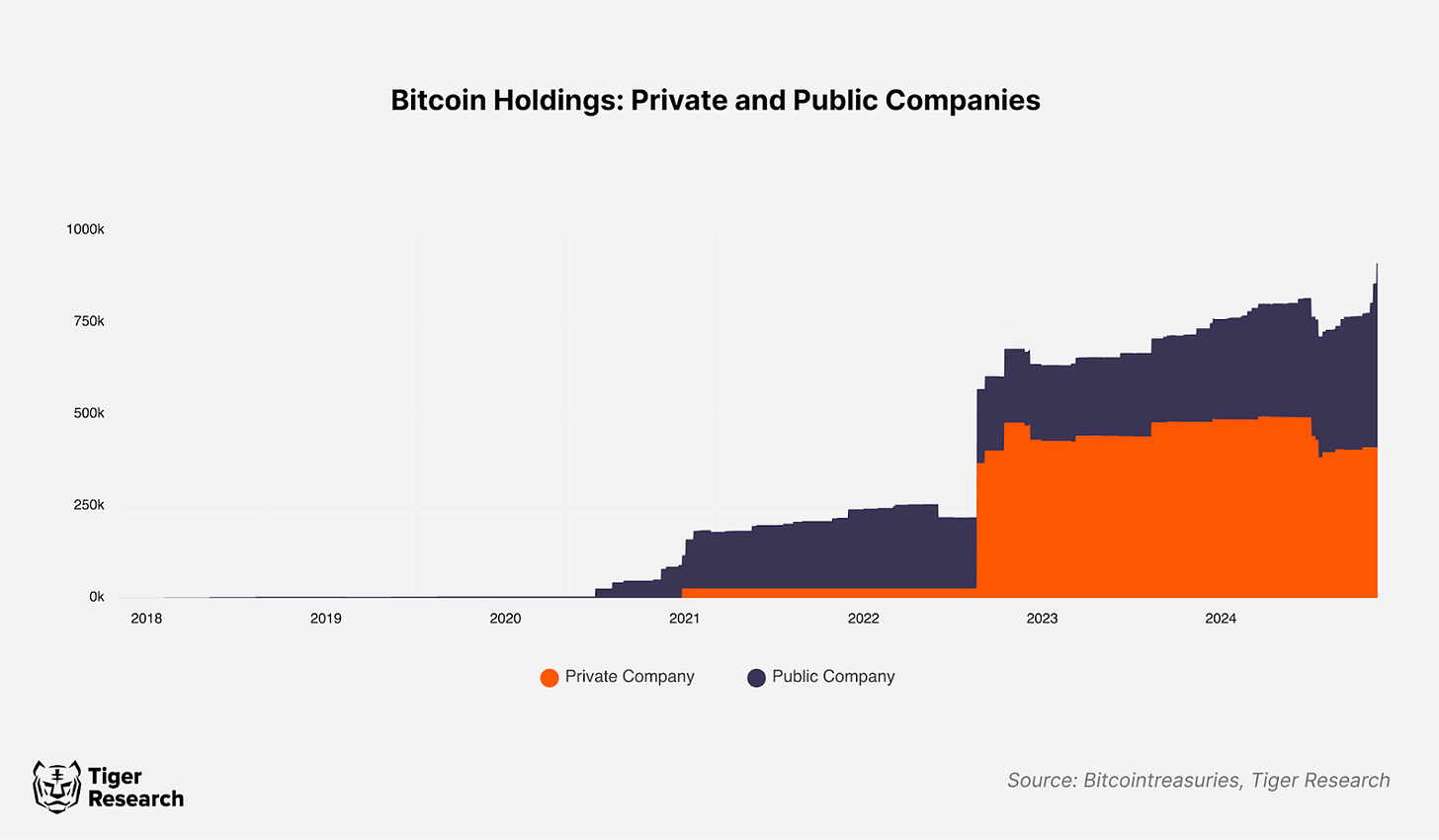

2. The Surge in Corporate Investment in Bitcoin

As the value of Bitcoin is gradually recognized, its appeal continues to grow. At the national level, some governments have also begun to discuss investing in Bitcoin. For instance, El Salvador has taken proactive steps to continuously purchase Bitcoin. In the U.S., discussions about President Trump’s plan to reserve Bitcoin have become a focal point. Additionally, Poland and Suriname are also exploring the possibility of using Bitcoin as a strategic asset.

However, aside from El Salvador, most countries' investments in Bitcoin remain at the policy discussion or campaign promise stage, with actual implementation still some time away. The U.S. has not yet directly invested in Bitcoin but holds some Bitcoin to recover criminal proceeds. Furthermore, due to the high volatility of Bitcoin prices, many central banks prefer to choose gold as a more stable reserve asset.

Government actions regarding Bitcoin have been slow and limited, but corporate participation is showing an accelerating trend. Companies like MicroStrategy, Semler Scientific, and Tesla have made bold investments in the Bitcoin space. This sharply contrasts with the cautious attitude taken by most governments.

3. Three Reasons Companies Focus on Bitcoin

Investing in Bitcoin is no longer just a trend; it is gradually becoming a core financial strategy for companies. Bitcoin attracts companies due to its unique characteristics, with its value primarily reflected in the following three aspects:

3.1. Achieving Asset Diversification

Traditionally, corporate financial assets are usually allocated around stable options like cash and government bonds. These assets can ensure liquidity and help mitigate risks, but their returns are relatively low and often fail to outpace inflation, potentially leading to a decrease in the real value of assets.

Source: Michael Saylor X

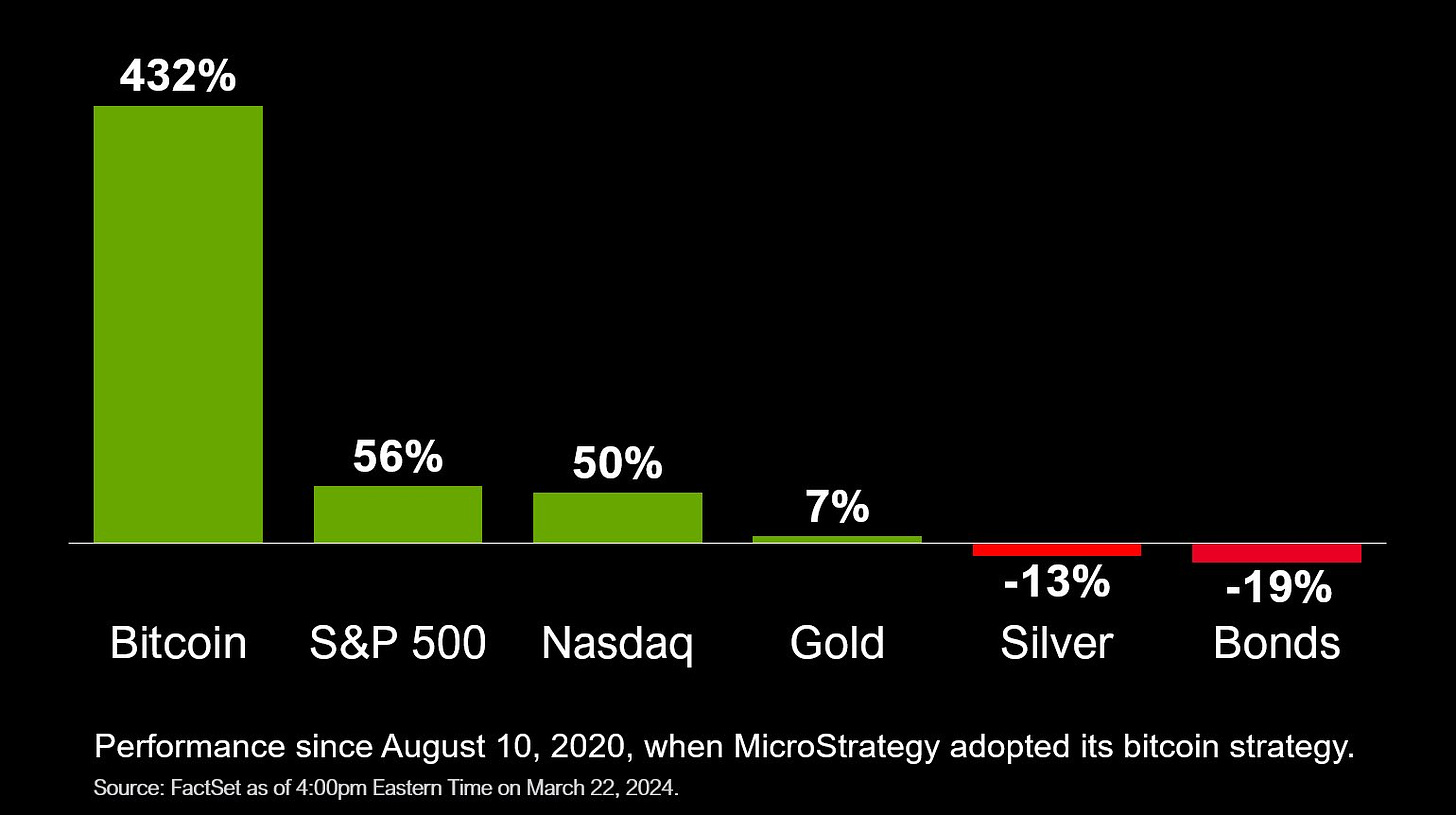

Bitcoin, as an emerging alternative asset, can effectively compensate for these shortcomings. It not only has high return potential but also diversifies investment risks, providing companies with a new asset allocation option. Over the past five years, Bitcoin has significantly outperformed traditional assets like the S&P 500 index, gold, and bonds, even surpassing high-risk, high-return junk bonds. This indicates that Bitcoin is not just an alternative choice but an important tool in corporate financial strategy.

3.2. Improving Asset Management Efficiency

Another important reason Bitcoin attracts companies is its efficient asset management characteristics. Bitcoin supports 24/7 trading, providing companies with great flexibility to adjust their asset allocation at any time. Additionally, compared to traditional financial institutions, the process of liquidating Bitcoin is more convenient, free from the constraints of bank operating hours or cumbersome procedures.

Source: Kaiko

Although companies still worry that liquidating Bitcoin may impact prices, this issue is gradually alleviating as market depth increases. According to data from Kaiko, Bitcoin's "2% market depth" (the total amount of buy and sell orders within a 2% range of the current market price) has steadily increased over the past year, with an average daily market depth reaching about $4 million. This indicates that the liquidity and stability of the Bitcoin market are continuously improving, creating a more favorable environment for companies to use Bitcoin.

3.3. Enhancing Corporate Value

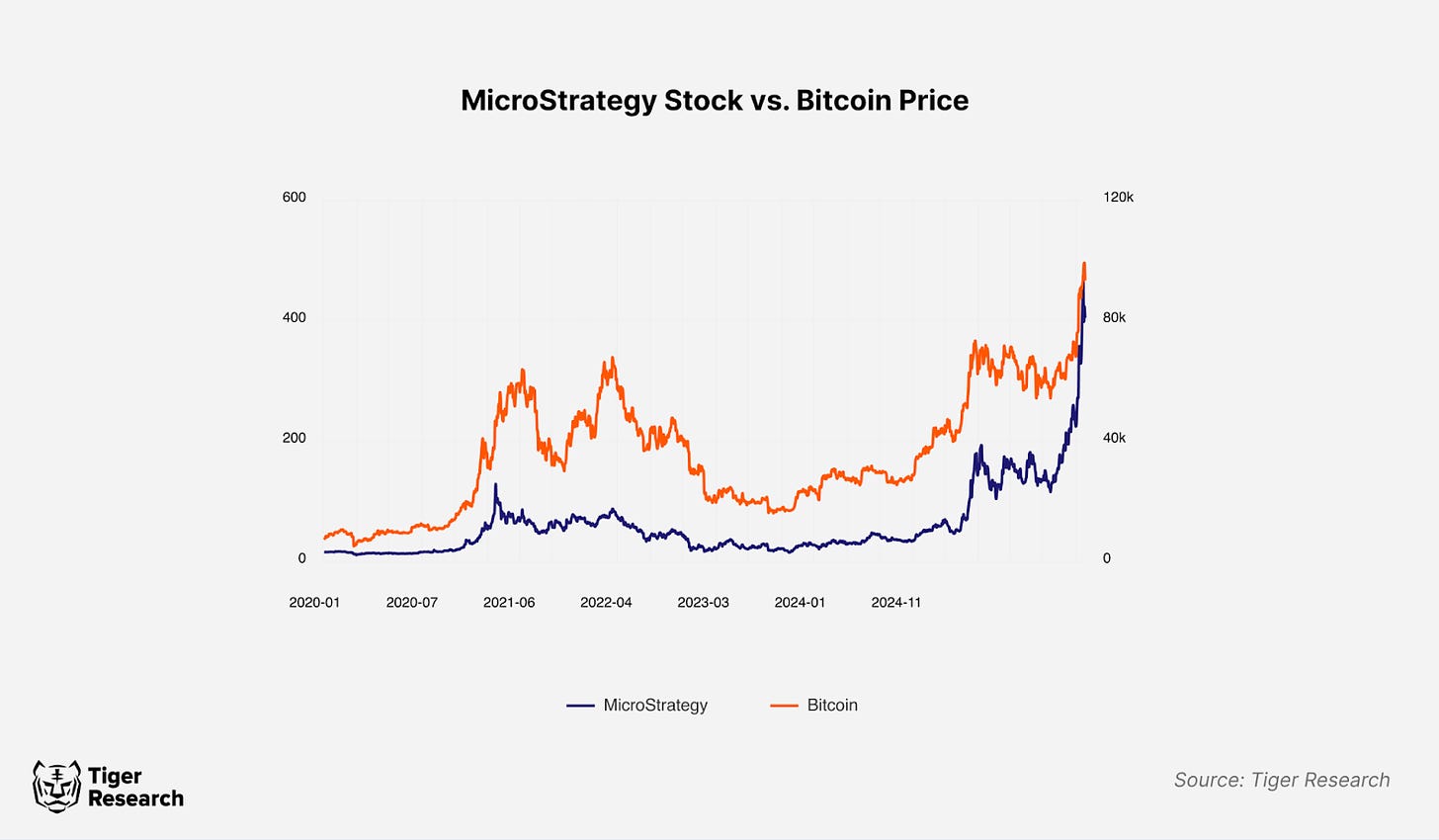

Holding Bitcoin is not only a financial choice; it can also significantly enhance corporate value and stock prices. For example, after MicroStrategy and Metaplanet announced their Bitcoin acquisitions, their stock prices saw substantial increases. This strategy serves not only as an effective marketing tool in the digital asset industry but also provides companies with a way to seize growth opportunities in this field.

4. Investment in Bitcoin by Asian Companies is Increasing

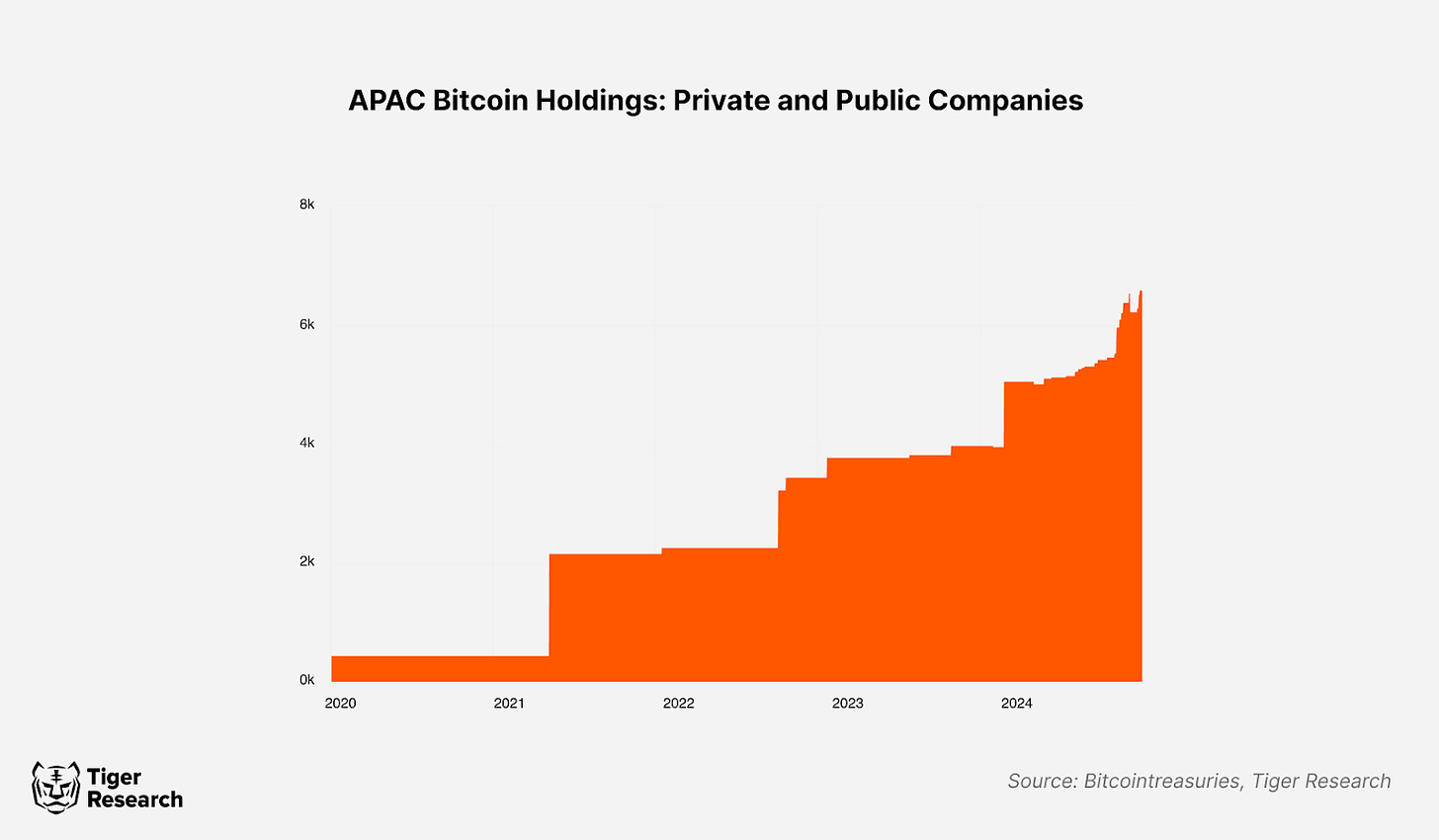

Although Asian companies are still in the early stages of investing in Bitcoin, they are gradually increasing their holdings. For instance, China's Meitu, Japan's Metaplanet, and Thailand's Brooker Group have regarded Bitcoin as a strategic financial asset. Nexon has also made large-scale Bitcoin purchases. Notably, Metaplanet has been particularly active, acquiring 1,142 Bitcoins in the past six months.

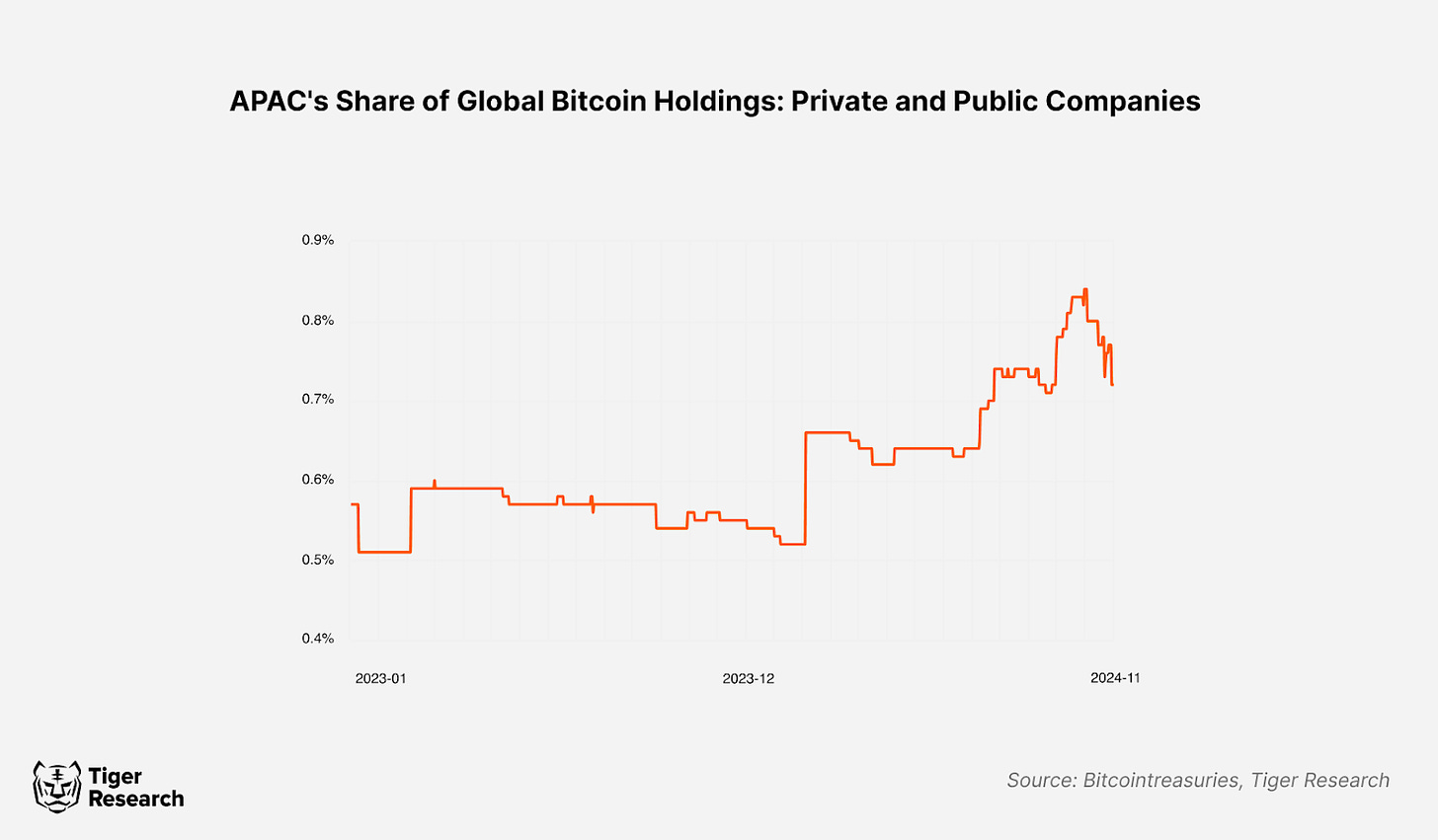

However, the current participation of Asian companies in the Bitcoin market remains low. Statistics show that the total amount of Bitcoin held by Asian companies accounts for less than 1% of the global total, primarily due to regulatory restrictions in many countries. For example, in South Korea, companies cannot open accounts on cryptocurrency exchanges and face numerous obstacles to investing in overseas Bitcoin ETFs or launching funds related to cryptocurrency trading. As a result, these companies are almost unable to invest in Bitcoin through formal channels.

Despite the many challenges posed by the regulatory environment, the potential for Asian companies to participate in the Bitcoin market remains promising. Some companies are circumventing regulatory restrictions by establishing overseas subsidiaries for investment. At the same time, countries like Japan have made some progress in relaxing relevant policies. Leading investment cases like Metaplanet are attracting more market attention. These positive changes may pave the way for broader participation of Asian companies in the Bitcoin market in the future.

5. Conclusion

Investment in Bitcoin is gradually becoming a popular financial strategy adopted by companies. However, its price volatility remains a significant challenge for companies, especially under the influence of external factors such as international politics. The market crash in 2022 clearly exposed the potential risks of companies holding Bitcoin. Therefore, companies should remain cautious when investing in Bitcoin and reasonably pair it with safer assets to reduce overall risk.

Moreover, for Bitcoin to further develop in corporate investment portfolios, a clear institutional framework needs to be established. Currently, there is a lack of clear guidance on the holding and accounting of crypto assets, which often leaves companies confused in practical operations. Once these uncertainties are resolved, Bitcoin may play a more important role in corporate asset diversification.

Disclaimer

This report is based on information deemed reliable. However, we make no express or implied guarantees regarding the accuracy, completeness, or applicability of the information in the report. We are not responsible for any losses resulting from the use of this report or its content. The conclusions and recommendations in this report are based on information available at the time of its preparation and may change at any time without notice. All items, forecasts, targets, and opinions mentioned in this report are subject to change and may differ from those of other institutions or individuals.

This document is for reference only and does not constitute legal, business, investment, or tax advice. The securities or digital assets mentioned are for illustrative purposes only and do not constitute an offer of investment advice or investment consulting services. This material is not specifically targeted at investors or potential investors.

Terms of Use

Tiger Research allows reasonable use of its reports. The principle of "fair use" permits specific content from the report to be used for public interest purposes, provided it does not harm its commercial value. If the use falls within the scope of fair use, prior permission is not required to use the report. However, when citing Tiger Research's report, the following requirements must be met: 1) Clearly indicate "Tiger Research" as the source, 2) Include the Tiger Research logo (black or white). If adaptation or republication of the report content is needed, separate negotiations are required. Unauthorized use of the report may lead to legal liability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。