Author: GCR Research Team

Compiled by: Felix, PANews

Fantom was a major success story in DeFi in 2021, with its TVL peaking at $8 billion. However, after chief developer Andre Cronje left and the bear market hit, Fantom lost its former glory. Now that Cronje has returned, Fantom has rebranded to Sonic. This is not just a name change, but a new beginning.

This article will explore Sonic's core innovations, market reactions, and whether it will pave the way for Fantom's redemption.

What is Sonic?

Sonic is not just a new name for Fantom. Michael Kong, CEO of Sonic Labs, stated that this is a complete reboot. It is a new chain based on new technology, utilizing a brand new but fully EVM-compatible virtual machine. The team is building a new blockchain from scratch because they could not make the changes they wanted to the old blockchain. Kong explained, "You can't rebuild an airplane while it's flying. It's much easier to build a new airplane on the ground and then get it into the air."

The new chain will process 10,000 transactions per second, with confirmation times of less than one second. This is much faster than the L2 networks that Sonic aims to compete with. While L2s are becoming increasingly popular, locking up $34 billion, Sonic believes there are fundamental issues with their model. According to Sonic Labs, these networks survive by earning money from sequencer fees, which they believe should belong to developers—the ones truly building useful applications. They feel that the value created by application developers is not being adequately compensated.

To address this issue, Sonic puts developers first. Its core feature is that developers can earn up to 90% of the gas fees generated by their applications. Additionally, Sonic will provide developers with true control over their applications. They can set their own fee structures and create a smoother payment experience for users. Everything in Sonic is built around this idea: providing developers with the tools and incentives to build better applications. The chain supports languages like Solidity and Vyper, allowing developers to focus on innovation rather than learning new tools.

Sonic is set to launch in December 2024, joining the ranks of fast blockchain networks like Solana, Sui, and Aptos. While it does not have the same level of security as Ethereum L2s, it offers something unique—the speed of a modern chain using familiar Ethereum tools. This places Sonic in an interesting position: it is built for developers who need more performance than L2s provide but want to stick with the Ethereum development environment. Currently, only Sei offers this, while Monad is attempting to achieve it. Therefore, aside from Ethereum L2s, these two chains may be Sonic's main competitors.

How Does the Technology Work?

Sonic Virtual Machine

To eliminate the bottlenecks caused by EVM's lack of scalability, the Sonic Labs team has built their own version of the EVM, called the Sonic Virtual Machine (SVM). SVM is fully compatible with EVM but improves the way code execution is handled. When someone's code runs, SVM converts it into a more efficient format on the client side. It looks for common patterns in the code and replaces them with optimized "super instructions." This makes everything run faster without changing how developers work. All commonly used tools still function, and developers can continue to write in Solidity and Vyper, with the chain still supporting Geth 1.4.

Sonic Consensus Mechanism

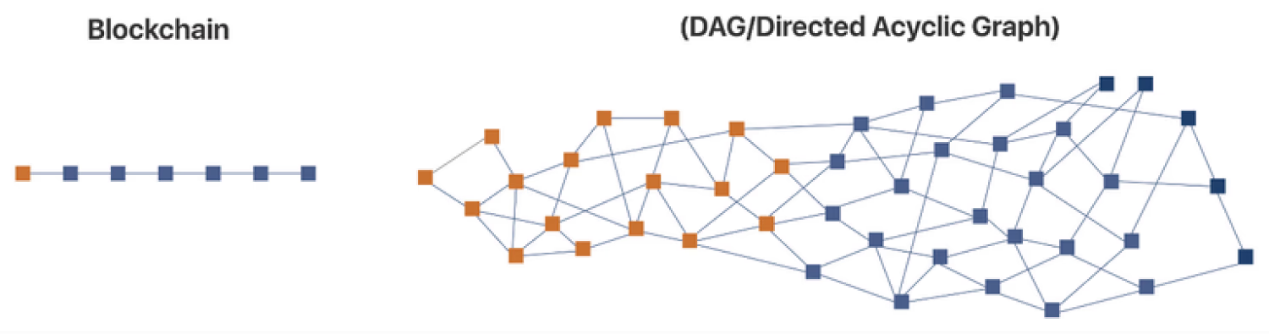

Sonic uses a Directed Acyclic Graph (DAG)-based consensus mechanism and employs proof of stake. Unlike a single chain where blocks must follow one another in order, each validator maintains its own local set of transaction blocks (called a DAG). When transactions come in, validators bundle them into "event blocks" and add them to the DAG.

Before creating a new event block, validators check two things: all transactions in the current block and some transactions they have received from other validators. They then share these blocks with other validators through a process that does not require everything to happen in strict order.

Source: https://docs.soniclabs.com/technology/consensus

Unlike traditional blockchains, this DAG-based approach does not force validators to process the currently generating blocks, which can limit transaction speed and finality. Validators can freely create event blocks containing transactions and share these blocks asynchronously with other validators on the network, creating a non-linear transaction record. This enhances transaction speed and efficiency.

When validators create event blocks, they propagate them to other validators on the network. Once a majority of validators agree on a block, it becomes what is known as a "root event block." These root blocks are then added to the main chain, which is the final permanent record of all transactions agreed upon by everyone.

The entire process takes less than a second from start to finish. Transactions go through four steps: first, the user sends a transaction. Then, the validator places it into an event block. Next, this block propagates until a majority of validators accept it. Finally, it becomes part of the main chain. When you view Sonic through a block explorer, you only see this final main chain. All the complex work of event blocks in the DAG happens in the background.

Each validator keeps its own copy of the main chain, which helps them process new blocks faster. This creates a clever balance: the DAG structure allows validators to work independently and quickly, while the main chain ensures that everyone ultimately has the same final record.

Sonic Token

The Sonic (S) token will be a traditional L1 token—used for paying gas fees, participating in governance, and securing the network through staking. At launch, Fantom (FTM) can be converted to Sonic (S) at a one-to-one ratio. The total supply will start at 3.175 billion Scoins, matching Fantom's current total supply. Approximately 2.88 billion tokens will be in circulation at launch.

Sonic aims to avoid early inflation of validator rewards. The chain will use the remaining Fantom block rewards instead of minting new coins for a period of four years. When half of the network is staked, these rewards (approximately 70 million per year) will provide validators with a 3.5% return. After these four years, the network will mint new tokens in each period to maintain a 3.5% reward rate.

Developer Incentives

Sonic has created several programs to attract developers using its tokens. An innovation fund has allocated 200 million S tokens to support new projects based on Sonic. These tokens will be awarded as grants to developers creating innovative applications.

The fee monetization program changes how transaction fees operate but only applies to approved applications. Normal transactions on Sonic will consume 50% of the fees, with 45% going to validators and 5% sent to the ecosystem treasury. Developers can apply to join the fee monetization program. If approved, their applications will receive 90% of the fees they generate, with validators receiving the remaining 10%. This structure allows successful applications to earn sustainable income while supporting network security.

Airdrop

Sonic plans to distribute 190.5 million tokens through an airdrop, rewarding past Fantom users and future Sonic adopters. The team stated that they learned from previous user incentive campaigns—the focus should not just be on rewarding large amounts of locked funds but on actual usage. This means that applications that do not require large TVL (such as DEXs, NFTs, games, etc.) can also benefit from user adoption metrics from this activity, not just DeFi applications like lending protocols and AMMs that require large TVL.

Past activities on Fantom and future participation in Sonic will be rewarded in this airdrop. Significant past activities may include providing liquidity, validating, holding staked tokens (like sFTMx), and using NFTs. Future eligibility criteria may include providing liquidity on Sonic staking, deploying contracts, participating in community activities, and using bridges. The exact criteria are not yet clear, but based on information shared by the Sonic Labs team, it can be assumed that activities will receive higher rewards than passive liquidity provision.

Additionally, the "Sonic Boom" program allows 30 projects to win additional airdrop allocations to distribute to their users.

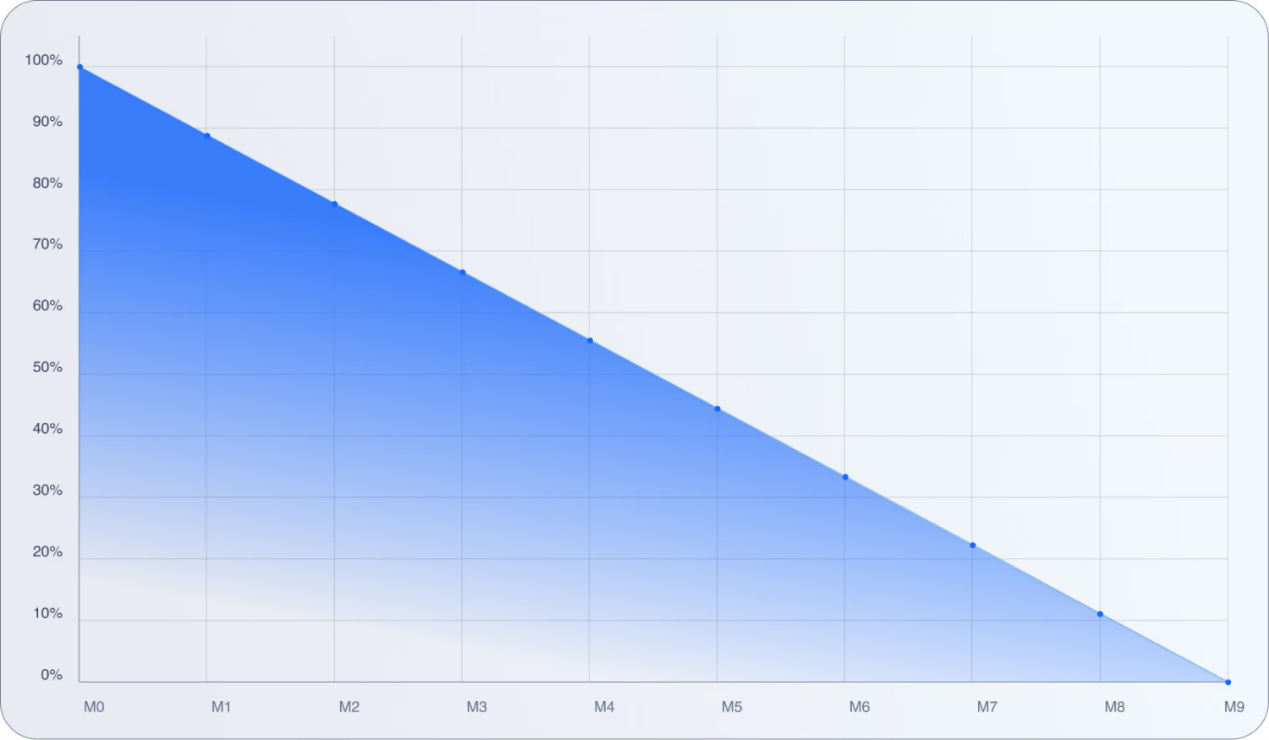

Finally, this airdrop includes a novel claiming mechanism with a 270-day vesting period. The system releases 25% of the tokens on the first day, with the remaining 75% as NFT positions. Users can claim the remaining airdrop at any time, but if they redeem early, a portion of the tokens will be burned. The longer these positions go unclaimed, the fewer tokens will be burned upon redemption. Those who want immediate liquidity without burning tokens can sell their NFT positions on the market.

Source: https://docs.soniclabs.com/funding/airdrop

How is the Market Responding?

Since the release of Sonic in August 2023, the price of Fantom's token has seen a slight increase. The price rose from $0.41 to $0.71, a gain of 75%, while Bitcoin increased from $64,000 to nearly $100,000, a rise of about 50%. Although this performance is not particularly remarkable, it is still a decent showing, especially since Bitcoin outperformed many altcoins during the same period. However, it lags far behind top-performing tokens like Sui, which saw its price increase fivefold, from $0.70 to $3.60. Particularly after Bitcoin recently broke its all-time high, Fantom's price has consistently fallen behind other altcoins, indicating that the market seems skeptical about Sonic. Currently, there is no overwhelming enthusiasm in the market.

The total value locked in the Fantom protocol also lacks highlights. Despite the promise of an airdrop, the network's TVL remains stable at around $100 million, far below the peak of $8 billion during the last bull market.

This situation may change when the Sonic mainnet launches, but recent history suggests caution is warranted. Other networks, such as Scroll, experienced a temporary surge in activity during their airdrop periods, but once the rewards dried up, those funds quickly dissipated. High initial activity or TVL growth at launch may indicate short-term interest rather than lasting adoption.

Future Potential

Sonic is in a crowded field, where block space is more abundant than ever. While Ethereum L2s may not reach the speeds promised by Sonic, their speeds are sufficient to meet current demand. As a result, most Solidity developers choose to build on these L2s, making it difficult for other L1 networks to attract builders and users. Sonic will face the same challenges.

The team emphasizes rewarding developers through gas fee sharing, but this approach also faces its own obstacles. History shows that this may not be the compelling feature Sonic hopes to achieve. Major applications like Uniswap, Aave, and Raydium have built successful businesses without gas rebates. The NEAR Protocol attempted a similar approach but saw limited success; ultimately, it was not its incentives for developers that revived NEAR, but its focus on AI applications. The anticipated low transaction fees for Sonic complicate this challenge further, as they will diminish the value of gas rebates.

For Sonic to achieve long-term success, it needs to attract applications with its superior speed and scalability. Consider the current DeFi protocols, perpetual DEXs, DePIN networks, and complex financial applications. The elements to achieve this are in place—ample development and incentive funding, well-designed incentive programs, and one of DeFi's most inspiring leaders, Andre Cronje. The team seems to understand this, as Andre Cronje is actively seeking partnerships with credit card companies and international banks.

Simply becoming another high-speed blockchain for hosting Memecoin casinos will not ensure lasting success. While such activities may provide early momentum, Sonic needs to establish a foothold in a clearly defined niche market where its performance is paramount. From the team's carefully designed incentive activities and airdrops to institutional expansion, there is some hope. However, succeeding in this competitive environment requires more than just good intentions. Sonic's future depends on translating these plans into practice to demonstrate the true value of its high-performance infrastructure.

Related article: Fantom is set to launch the new chain Sonic: Can token swaps + MEME activate the ecosystem?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。