Meme Coin Super Cycle + AI Super Cycle = AI Meme Coin Ultimate Cycle.

Author: Taiki Maeda, HFAresearch Founder

Translation: Deep Tide TechFlow

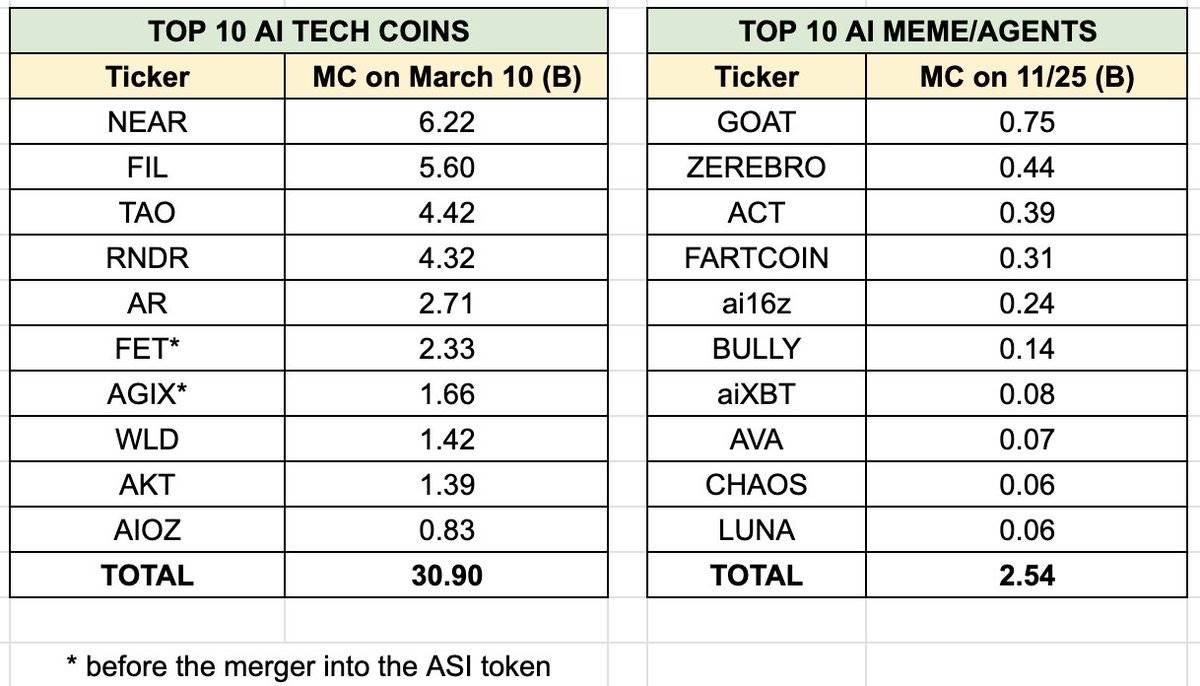

In the first quarter of 2024, at the market peak, the total circulating market capitalization of the top 10 "AI technology coins" reached $30.9 billion. On the other hand, despite attracting more attention, the total market capitalization of the top 10 AI Meme coins was only $2.54 billion.

I believe the emergence of $GOAT and @truth_terminal has opened up a whole new field in AI, which may achieve a hundredfold growth in the future. This is a great opportunity to seize the initiative in a PvE (player versus environment) mode, much like the early days of DeFi summer in 2020.

Market Opportunity

Meme Coin Super Cycle + AI Super Cycle = AI Meme Coin Ultimate Cycle

In the first quarter of 2024, with the crazy surge in NVIDIA (NVDA) stock prices, many AI-related tokens also exhibited parabolic growth, despite certain issues with their fundamentals and token economics. We saw the total valuation of the top 10 "AI technology coins" surpass $30 billion, not including fully diluted valuation (FDV) and smaller market cap tokens. I believe this is merely a market price push in the crypto and AI fields, and in 2025, we will see larger-scale parabolic growth.

However, I believe that most of the excess returns will occur in the AI Meme coin category. Currently, the total market capitalization of AI Meme coins is only equivalent to Ethereum Classic. AI Meme coins will gradually attract capital from AI technology coins, static memes, and venture capital tokens through "bloodsucking attacks."

"DeFi Summer" Moment

Many people compare the phenomenon of $GOAT rising from $0 to $1 billion to the "YFI moment" in this new field. An important catalyst for the DeFi summer in 2020 was the emergence of $YFI. It was "fairly launched" in July and reached a market cap of $1 billion within two months. This phenomenon activated a large influx of on-chain capital into the DeFi space, as it validated the possibility of a fairly launched DeFi token starting from $0 and reaching a $1 billion market cap.

DeFi became a hot area in the last cycle because it was novel, attractive, and filled people with imagination about the future. Against a backdrop of 0% interest rates, the narrative of DeFi was to attract capital from traditional finance (TradFi) through "bloodsucking attacks" and become the future financial system. This sparked a speculative frenzy on-chain, helping DeFi applications gain total value locked (TVL) and users, and put the ecosystem to the test. When $YFI launched, the total market cap of DeFi was about $5 billion, and at the market peak, this number reached about $170 billion, a 34-fold increase. If we compare $GOAT to $YFI, we are indeed in a very early stage now, as the total market cap of AI Meme coins is still less than $5 billion.

The rise of the DeFi cycle relied on both internal catalysts within the crypto space (such as liquidity mining, high-yield mining mechanisms, and speculative behavior) and external conditions (such as interest rates dropping to zero, with capital flooding into the crypto space seeking returns). This process ultimately formed a bubble.

The ultimate cycle of AI Meme coins is similar. In the crypto space, the current mainstream narrative is the super cycle of meme coins, while in the stock market, AI technology has brought sustained growth momentum. The combination of these two creates ideal conditions for a bull market.

In the crypto space, areas that can inspire limitless imagination often present opportunities for parabolic growth.

Reflexivity in the New Paradigm

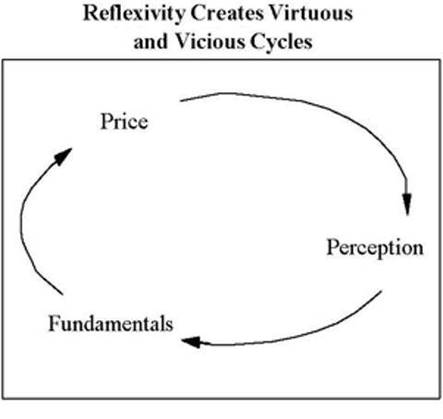

The theory of reflexivity posits that investors' decisions are not based on reality but on their perceptions of reality. This perception-driven behavior can, in turn, change reality (or fundamentals), further influencing investors' perceptions and market prices.

In this context:

Price refers to the overall market capitalization of the AI Meme coin space.

Perception is the market's view of what these tokens represent.

Fundamentals are based on attention and how much dreams these tokens can inspire.

I believe these tokens are not "pure meme coins," but closer to "Tokenized AGI." They were all fairly launched on the pumpfun platform. If these tokens were launched by venture capital (VC), they might be sold at a fully diluted valuation (FDV) of $1 billion with 10% circulation, and then sold off to retail investors by VCs. But these AI Meme coins started from $0, providing everyone with an early participation opportunity. This phenomenon is similar to the ICOs (Initial Coin Offerings) we are currently replaying in real-time.

Here’s how I believe reflexivity plays a role:

The "AI Meme coin" category attracts speculators. Most people overlook it because "it's just another PvP meme coin narrative." (We are currently at this stage)

Over time, the capabilities of AI entities gradually improve (e.g., Zerebro launching a record label, Truth Terminal releasing Infinite Backrooms v2, etc.), and investors' views of these tokens shift from "just meme coins" to "a whole new field."

This shift will attract more capital and attention from both inside and outside the crypto space, sparking more speculative activity. Some failed AI startups may pivot to issuing tokens as a last-ditch effort, while wealthy tech billionaires may also start investing in a few tokens.

Unlike "static memes," these AI entities will execute activities on-chain, launch NFT and DeFi projects, and even have real-world impacts. They are not static but continuously evolving, attracting more attention.

All of the above factors collectively drive the potential valuation to rise infinitely, ultimately forming a bubble and ending in a boom-bust cycle.

It is particularly important that these tokens all launched on the pumpfun platform. This launch method aligns with current trend dynamics, including the formation of cult culture, the overlap of meme coins and the AI super cycle, and anti-VC sentiment. If you believe in the four-year cycle theory, then the arrival of AGI predicted by Elon Musk in 2025-26 may coincide with the peak of the crypto market in the fourth quarter of 2025.

My Investment Strategy

To be honest, I am not sure how to allocate funds correctly. If this is just a "meme" category, then the current winners may continue to lead, so it is worth betting on them. On the other hand, if $GOAT performs similarly to YFI, it may experience a significant surge—but ultimately may be replaced by "better technology." Personally, I am clear that I cannot accurately predict which tokens will ultimately win, so I choose to build a portfolio of AI Meme coins to profit in a "rising tide lifts all boats" scenario as the market overall rises.

Here’s a rough framework for how I allocate funds in this emerging field:

For Tokenized AGI, you are essentially betting on which AI entity can continuously attract and grow attention. Here, "attention" is akin to "revenue" in traditional markets, a core metric for measuring value.

Large language models (LLMs) will continuously improve over time, so you need to bet on founders or developers who are motivated to create the best agents through fine-tuning models.

This field is in a long-term bull market. Pay attention to AI entities that have the potential to attract attention beyond crypto Twitter/X, as they can break through the small bubbles in the crypto space and gain broader attention.

As the market develops, token economics (Tokenomics) will become increasingly important. You need to think about what the token's utility is? What does it represent? If the token price rises, will it help the AI entity further achieve its goals? The interaction of price, perception, and fundamentals (i.e., reflexivity) is crucial for each token.

In the last cycle, the total market capitalization of DeFi reached $170 billion. If this field can achieve a similar valuation, it would mean a growth of about 40 times from the current level. However, given that the overall market capitalization of the current crypto market is higher, it is entirely possible for us to surpass these levels. The key is to have firm belief, maintain patience, and flexibly adjust investment strategies based on market fluctuations and rotations to maximize your "sleep-friendly returns"—that is, achieving the best returns without affecting your sleep.

Please take my words seriously; I really don't know what I'm doing. In fact, I believe no one truly knows what they are doing. This situation can change at any moment, but my current AI Meme coin portfolio includes:

$GOAT: The current leader, performing the strongest in the market.

#ZEREBRO: Led by native founders in the crypto space, well-versed in cultural trends, and developing at a rapid pace.

#Fartcoin: Catering to the needs of "left, middle, and right curves," aimed at satisfying different levels of investors. After all, everyone farts.

#Ai16z: Although controversial, it has maintained a developer community with a "cult" nature. If they can survive this period, they will become more antifragile.

$FOREST: An AI monkey project attempting to save the rainforest, with real-world impact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。