While optimists see this as a step towards more mainstream Bitcoin adoption, skeptics argue that it is merely a short-term hype from some small companies.

Written by: Aoyon Ashraf, Nick Baker

Translated by: BitpushNews

Summary:

- Following the success of MicroStrategy's accumulation strategy, many companies (some small-cap and unrelated to cryptocurrency) have begun to announce similar initiatives.

- This strategy has led to significant short-term increases in the stock prices of some of these companies, but market observers say the long-term sustainability remains uncertain.

- While optimists see this as a step towards more mainstream Bitcoin adoption, skeptics argue that it is merely a short-term hype from some small companies.

Main Text:

Fitness equipment manufacturers, biopharmaceutical companies, battery material producers… what do these diverse companies have in common?

Of course, it's Bitcoin.

With BTC soaring to unprecedented levels this month, at least 12 publicly traded companies previously unrelated to crypto have announced plans to purchase Bitcoin (BTC) as a means of storing idle cash—indeed, quite profitable recently. This is the path illuminated by Michael Saylor since 2020 when he began transforming his relatively unknown software company MicroStrategy into a Bitcoin treasury.

This has led to tremendous success for MicroStrategy in the U.S. stock market—since Saylor began purchasing Bitcoin for the company, its value has increased approximately 30 times, accumulating a massive reserve worth about $38 billion (as of the time of writing).

Just this month, the company's stock price nearly doubled since Donald Trump promised to embrace cryptocurrency and was elected President of the United States. (Other crypto stocks have also seen increases. Exchange operator Coinbase has risen nearly 70% since the day before the election.)

Other companies are trying to replicate this success.

On Friday, biotech company Anixa Biosciences (ANIX) announced that its board approved the purchase of a certain amount of Bitcoin to diversify the company's cash reserves. The stock initially rose 19%, but closed up only 5%. Meanwhile, fitness equipment company Interactive Strength (TRNR) stated on Thursday that after its board approved the use of cryptocurrency as a treasury reserve asset, the company plans to purchase up to $5 million worth of Bitcoin. Following the announcement, the company's stock surged over 80% at one point but ended the day "only" up 11%.

Earlier last week, biopharmaceutical company Hoth Therapeutics (HOTH) announced a $1 million Bitcoin purchase plan, causing its stock price to rise as much as 25%—though nearly the entire gain was erased by the close. Similarly, companies including LQR House (LQR), Cosmos Health (COSM), Nano Labs (NA), Gaxos (GXAI), Solidion Technology (STI), and Genius Group (GNS) saw brief surges in stock prices after announcing Bitcoin treasury plans in November. Only one company saw a decline after announcing the news: Acurx Pharma (ACXP).

"The recent Bitcoin craze, combined with MicroStrategy's stock price rising over 500% in 2024, has sparked a wave of companies (especially small caps) announcing Bitcoin purchase strategies," said Youwei Yang, chief economist at BIT Mining (BTCM).

Whether these companies following MicroStrategy will achieve success like Saylor remains uncertain.

Youwei Yang stated, "This behavior may end in the same way as previous bull markets: unsustainable hype followed by a significant correction as the market realizes that many of these announcements lack substance."

Additionally, whether the latest entrants will stick it out is also unknown. So far, only the AI company Genius Group is known to have actually purchased Bitcoin.

But who can blame them?

Early investors in MicroStrategy have made a fortune, and even recent investors can easily profit. Saylor primarily raised funds through issuing stocks and bonds, which were then used to purchase Bitcoin. These followers may thus gain access to capital market channels they otherwise could not.

The market follows the old adage "never fight the market," meaning that regardless of fundamentals, one should go with the flow. Companies want to meet market demand; no one wants to be the one to tell the boss or shareholders that poor performance was due to not following in MicroStrategy's footsteps.

"Just a few years ago, buying Bitcoin was almost too risky. However, now the risk seems to be the opposite—failing to buy is the real risk," said Brian D. Evans, CEO and founder of BDE Ventures, adding, "Not being involved with Bitcoin is really painful."

For those filled with hope, this sudden corporate scramble may signal that mainstream Bitcoin adoption is finally arriving, especially in the context of President-elect Trump's expressed desire for the U.S. government to also accumulate Bitcoin.

"For BTC supporters, macro factors like expected inflation and new regulatory friendliness will stimulate more companies to incorporate this asset into their balance sheets," stated a report from Toronto-based crypto platform FRNT Financial.

Moreover, Bitcoin purchase strategies can open up capital markets for companies, just as MicroStrategy and miner MARA Digital (MARA) have done. Both companies have recently been able to raise funds through convertible bonds that do not pay interest to investors, meaning these investors are willing to forgo current income in exchange for the ability to eventually convert debt into equity, thus gaining exposure to Bitcoin.

Evans of BDE stated that indicating plans to purchase Bitcoin "is a useful way for companies to raise funds, not much different from what MicroStrategy has done in recent years."

However, for some, this sounds like a fleeting trend reminiscent of the late 2010s when many companies unrelated to cryptocurrency added the term "blockchain" to their names.

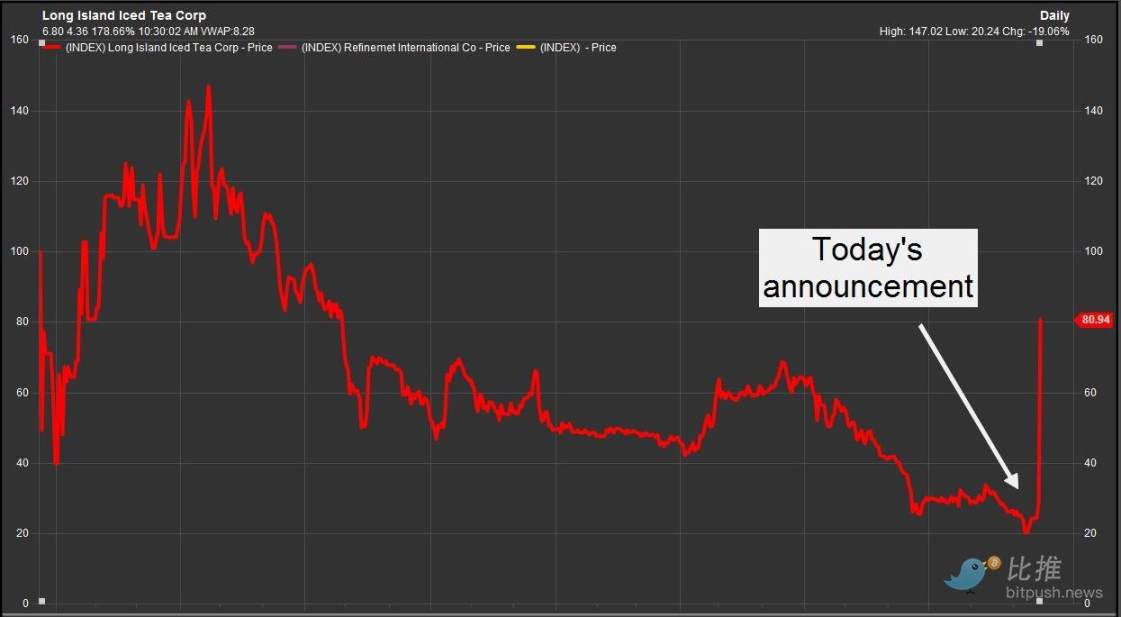

The most famous example is the obscure beverage manufacturer Long Island Iced Tea renaming itself Long Blockchain, which initially achieved explosive results: its stock price nearly doubled in a day after the name change to a cryptocurrency. The gains did not last, and the stock was later delisted by Nasdaq. (Three individuals were charged with insider trading by the U.S. Securities and Exchange Commission.)

There were other "magic" buzzwords. During the 2021 crypto bull market, many large companies jumped on the "Web3," "metaverse," and "NFT" bandwagons, trying to boost their stock prices. Even Facebook rebranded as Meta, betting heavily on the metaverse. However, these moves ultimately led to massive losses.

Meanwhile, some struggling companies unrelated to cryptocurrency began to dabble in Bitcoin mining, which was then seen as a lucrative business. However, the subsequent brutal bear market brought these once-promising crypto concepts crashing down, turning them into "street rats."

Youwei Yang noted that while MicroStrategy has been able to raise billions from capital markets to fund Bitcoin purchases, if others adopt this strategy, it could have adverse effects on small companies. "For small caps, it may be seen as a short-term gimmick, thus deterring serious investors. If Bitcoin's price stabilizes or declines, the speculative appeal of these stocks may diminish, making these companies vulnerable to investor skepticism and regulatory scrutiny."

David Siemer, co-founder and CEO of Wave Digital Assets, echoed this sentiment, stating, "While this approach may yield short-term gains in a bull market, it also carries significant risks. Unlike directly holding assets, leverage amplifies potential losses during market corrections, highlighting its inherent dangers," he pointed out that some companies are using the hype around Bitcoin to increase debt on their balance sheets.

Whoever is right, after Trump won the U.S. election, Bitcoin has repeatedly set historical highs, and the magic remains: announce a Bitcoin plan similar to Saylor's and see if your stock can take off.

"It seems we are at a point where many companies feel they must do this," said BDE founder Brian D. Evans.

In any case, welcome to the new cryptocurrency bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。