In this blockchain revolution, Typus's attempt may become a key step in breaking the fate of "institutional coins."

Author: kyrie, Typus Finance Founder

In the world of cryptocurrency, "institutional coins" have always been a term that makes retail investors shudder. But why is it so difficult for project teams to escape the influence of institutional investors? There are complex business logics and practical considerations behind this.

The Dilemma of Token Issuance: High Costs and Institutional Dependence

Source: Simon’s X (@sjdedic)

To successfully issue a cryptocurrency project, the costs often far exceed what most people imagine. Just the token issuance process can cost between $1 million to $3 million. This expense is mainly used for:

Development and auditing of smart contracts

Provision of initial liquidity

Fees for market maker collaboration

Listing fees for exchanges

Marketing expenses

This exorbitant cost forces many project teams to bow to "institutional forces" such as institutional investors, centralized exchanges, and market makers. Once on this path, projects fall into a vicious cycle:

Early-stage financing dilution: A large number of tokens are sold to institutions at discounted prices

Increased listing costs: Major exchanges charge listing fees that can reach hundreds of thousands of dollars

High market-making costs: Professional market makers demand high fees and token shares

Market cap management pressure: Institutional investors require token prices to be maintained, increasing marketing expenses

The consequences of this dependence are:

Token distribution tilts towards institutions, making it difficult for retail investors to obtain fair participation opportunities

Project potential is overdrawn in advance, with retail investors bearing the risks after institutions take profits

Contradicts the original intention of blockchain decentralization

Project teams lose focus on product development, forced to invest significant energy in price maintenance

Innovative Attempts in the Sui Ecosystem: Typus Finance's Path to Breakthrough

"If we can provide sufficient liquidity like centralized exchanges from day one, retail investors will no longer have to rely on institutions." This seemingly simple idea has become the mission of the Typus Finance team within the Sui ecosystem.

On the high-performance public chain Sui, Typus sees the possibility of breaking through the dilemma. Their solution cleverly combines the Deepbook order book system, essentially building a professional exchange infrastructure on-chain. However, having infrastructure alone is not enough; the real innovation lies in how they solve the liquidity problem.

Imagine if we could combine idle funds from lending protocols with the technology of professional market makers, and then use options tools to balance risks—what would happen? Typus is working in this direction. Their goal is not only to replace second-tier centralized exchanges but also to gain more negotiating power for Sui ecosystem projects when dealing with large exchanges.

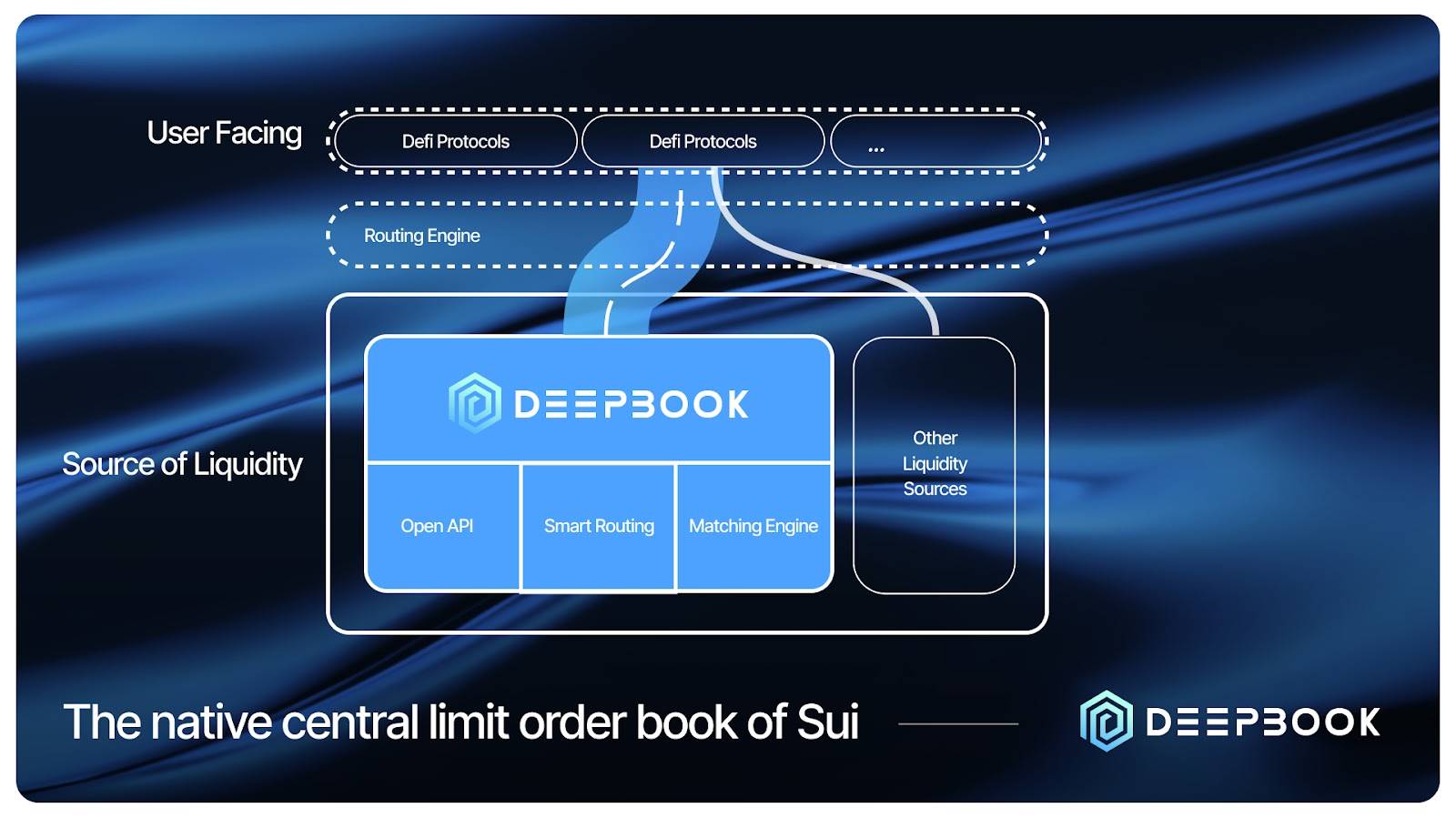

Deepbook: Redefining Order Book Infrastructure

Source: Sui Blog

In the crypto market, the order book system is like the "heart" of an exchange, and its efficiency directly determines the vitality of the entire platform. For a long time, this core infrastructure has been monopolized by centralized exchanges, which have built a high wall to keep decentralized projects out.

Typus chose to collaborate with Deepbook precisely because of the groundbreaking potential of this native order book system in the Sui ecosystem. It’s like opening a new door in the high wall, allowing decentralized trading to achieve performance comparable to centralized exchanges.

Deepbook's advantages are reflected in three key dimensions:

First is its extreme performance:

Capable of processing tens of thousands of orders per second, with response times fast enough to satisfy the most demanding high-frequency traders

Latency as low as milliseconds, giving on-chain traders a pair of wings

Supports various complex order types to meet different trading strategies

Second is its native liquidity advantage. Imagine a flowing river; Deepbook is the main channel of this river:

Directly connects all liquidity providers in the Sui ecosystem

Significantly reduces opportunities for cross-platform arbitrage, making prices more authentic

Provides deeper liquidity pools for the market, allowing large trades to be handled smoothly

Finally, and most revolutionary, is its cost advantage:

Fully utilizes Sui's low gas fee characteristics, minimizing the cost of each transaction

Eliminates multiple layers of middlemen fees, allowing more profits to remain with market participants

Creates greater profit space for market makers, attracting more professional players to enter the market

These combined advantages make Deepbook not just a simple order book system, but an infrastructure capable of reshaping market rules. It’s like a modern trading port that can handle massive transactions while providing every participant with an unprecedented trading experience.

In Typus's vision, Deepbook is a crucial cornerstone for achieving decentralized token issuance. When high-performance infrastructure meets innovative liquidity solutions, new projects finally see hope in breaking free from institutional dependence.

Typus's Innovation: Options-Driven Liquidity Solutions

In the traditional cryptocurrency market, market makers are like tightrope walkers. They need to constantly adjust their positions on both buying and selling ends, seeking balance amid price fluctuations. This job seems simple but is filled with challenges and risks.

Imagine this: when the market suddenly surges or plummets, market makers find themselves trying to maintain balance in a storm. They face two major threats: one is directional risk (Delta risk) from price changes, like the tightrope being blown off course; the other is the cost of constantly adjusting positions (Gamma risk), like continuously shifting their center of gravity on the tightrope.

To cope with these risks, market makers typically adopt conservative strategies:

Widening the bid-ask spread, effectively increasing their "insurance premium"

Reducing the liquidity provided, equivalent to lowering the height of the tightrope

Directly withdrawing during market volatility, choosing to temporarily abandon the performance

This is why we often see severe price fluctuations when the market needs liquidity the most—because market makers choose to hedge.

Typus offers a highly creative solution. Instead of letting market makers face risks alone, it provides them with a complete "protection system":

First, Typus has established an innovative options liquidity pool. It’s like providing a safety net for tightrope walkers, allowing them to operate in the market with more confidence. Project teams can create options pools here, providing market makers with risk-hedging tools, all managed automatically by smart contracts, ensuring transparency and efficiency.

Second, Typus cleverly integrates lending protocols. Imagine a vast amount of funds lying dormant in the Sui ecosystem; Typus awakens these funds, providing market makers with more ammunition. This not only reduces the capital costs for market makers but also improves the overall capital utilization efficiency of the ecosystem.

Finally, Typus has designed a sophisticated incentive mechanism. It’s like setting up a reasonable reward system for performers:

Market makers who provide stable liquidity over the long term can earn more rewards

The interests of all participants are cleverly balanced

The entire system forms a sustainable development ecosystem

The highlight of this innovative mechanism is that it allows market makers to provide liquidity at lower costs and in a more stable manner. When market volatility arrives, they no longer need to panic and withdraw; instead, they can use options tools to hedge risks and continue providing necessary liquidity support to the market.

For project teams, this means they can obtain more stable market liquidity at lower costs; for traders, it represents smaller slippage and a better trading experience. This is the uniqueness of the Typus solution: it not only addresses the pain points of market makers but also brings unprecedented stability to the entire market.

Ecological Win-Win: The Beginning of a Positive Cycle

Imagine that in the traditional token issuance process of crypto projects, entrepreneurs often feel like they are walking a thorny path. They need to constantly "bow" to institutions, exchanging discounted prices for support, only to end up with a label of "institutional coin." But in the new world created by Typus, this story can unfold in a completely different way.

When a new project is ready to issue tokens on Sui, they no longer need to "beg" everywhere. Through Typus's infrastructure, they can directly obtain professional-level liquidity support. It’s like paving a smooth road for entrepreneurs—prices can form naturally, large players can enter and exit without causing a storm, and small investors can enjoy fair prices.

This new paradigm brings fresh opportunities for every participant in the ecosystem:

For project teams, this is a true liberation:

No longer worrying about high token issuance costs

Able to independently control the distribution of tokens

Can invest valuable time and energy into product development Most importantly, they can finally realize value according to their vision, rather than being led by institutions.

For market makers, this is a more robust business model:

Equipped with better risk management tools, no longer anxious during market fluctuations

Significantly reduced operating costs, with profit margins more secure

More stable sources of income, allowing for long-term development strategies It’s like transforming a high-risk speculative business into a sustainably operated professional venture.

For retail investors, this is a complete turnaround:

Finally able to participate in quality projects at fair prices

Seeing real market supply and demand, rather than results manipulated by institutions

Lower trading costs, no longer "chives," but important participants in the market

And for the entire Sui ecosystem, these changes converge into an upward force:

More quality projects will be attracted by this fair mechanism

The ecosystem will gradually establish its own independent project distribution channels

An organic growth model from within will be formed

It's like planting a seed that gradually grows into a big tree. The entry of quality projects attracts more users to participate, and the growth of users can attract more projects to join, creating a virtuous cycle. Gradually, the entire ecosystem will become more robust, and every participant can find their own space to grow in this fertile ground.

In this new ecosystem, what we see is no longer a zero-sum game, but a beautiful picture of win-win for all parties. When every participant can fairly share in the development dividends, the entire market can truly achieve sustainable development.

Future Outlook

Typus's innovative attempt represents an important step towards the maturity of the crypto market. By redesigning the token issuance mechanism, it seeks to find a path where project teams, investors, market makers, and retail investors can all win.

The changes that this new paradigm may bring include:

More projects choosing a completely decentralized token issuance path

A repositioning of the role of institutional investors

Innovation in the market maker model

Increased participation from retail investors

In this blockchain revolution, Typus's attempt may become a key step in breaking the fate of "institutional coins." When every participant can find their value positioning within the system, true decentralized finance can transition from an ideal to reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。