开场:暴跌只是正片预告

如果你看过《速度与激情 7》,一定记得那个场景:范·迪塞尔驾驶红色超跑 Lykan Hypersport 从阿布扎比的 Etihad Towers 冲出,保罗·沃克坐在副驾驶座上,这辆价值 340 万美元的超跑在摩天大楼之间连续飞跃——从一栋楼冲向另一栋楼,再从第二栋楼飞向第三栋楼,车身在高空划过抛物线,玻璃碎片像钻石雨一样四散,引擎在尖叫,所有人的心脏都提到了嗓子眼——

下一秒,是着陆还是爆炸?比特币就是那辆 Lykan。

在 10 月 6 日的从 12.6 万的历史最高点急转直下——10 月底至 11 月初,加密资产累计回撤约 20%,跌破 10 万美元关口。数十亿美元的杠杆像连环车祸一样爆掉。美联储的审慎降息论调和美元走强,像两记追尾,让这场事故更加惨烈。

各大主流媒体的标题都写好了:"加密泡沫破裂""加密牛市转熊市了""加密寒冬再临"。

就在这场惨烈车祸发生的同时,真正的车神们——那些聪明的钱和敏锐的交易者都悄悄消失了——并没有离场。

他们悄悄转进了另一条赛道。

第一条线索:地下赛道突然爆满了

数据不会说谎,但会加速。

比特币开始暴跌的 10 月,去中心化交易所(DEX)的交易量不是萎缩,而是加速增长。

看看这些数字(来源:DefiLlama data):

- DEX 交易量:6133 亿美元(比 9 月暴涨 22.7%,创历史新高)

- Uniswap:从 1065 亿飙到 1709 亿(+60%)

- PancakeSwap:从 798 亿冲到 1019 亿(+28%)

关键数据:DEX 占总交易量从 18.83%跳到 19.84% :那 1 个百分点代表数百亿美元突然改变了赛道。 这就像东京湾高速公路大塞车,突然有赛车手们发现了涩谷地下停车场的秘密入口——而且那里不但不堵,还能让你跑出更快的圈速。

与此同时,中心化交易所(CEX)也创下 2.17 万亿美元新高,环比增长 28%。币安、Gate、Bybit、Bitget 分列前茅。这是双引擎共振:传统赛道加速,地下赛道更快。

为什么车神们选择"地下漂移"?

还记得电影里的场景吗?主角肖恩第一次被带到涩谷的地下停车场,发现整个东京的真正车手都在这里——不是在公开赛道上,而是在多层停车场的螺旋坡道上玩命漂移。

10 月的 DEX 就是那个地下停车场。

Kronos Research 的首席信息官表示:“交易员涌向链上不仅是为了自我托管和透明度,也是为了流动性挖矿和空投,从而最大限度地提高参与度。

暴跌不是让人逃离市场,而是让人重新选择赛道。当传统交易所像堵车的高速公路,聪明钱开始寻找新出口。

第二条线索:香港在建造"全球新赛道"

监管者的剧情翻转了

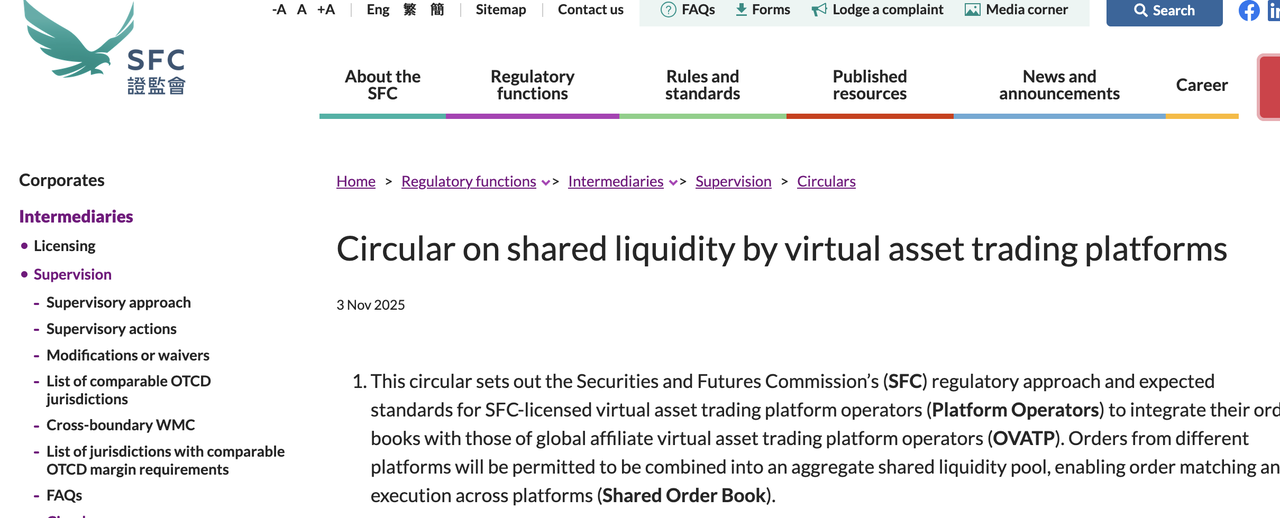

就在 DEX 交易量爆炸后不久,,香港证监会(SFC)在 2025 年 11 月初发布两份“重磅炸弹级”通告:

- 允许 SFC 许可的本地交易所共享全球订单簿,与海外平台连接,从而接入全球流动性。此举打破了传统“订单预融资、境内结算”的模式,使投资者能够更高效地获取全球市场流动性。

这就像给本地赛车装了传送门——突然间,你不只能在香港赛道跑,还能瞬移到纽约、伦敦、东京的赛道上。

- 放宽本地代币和稳定币向专业投资者发行的 12 个月交易历史要求,加快创新产品上市速度。

即新代币和稳定币不再需要等 12 个月的"见习期",可以直接对专业投资者开放。

香港证监会 CEO Julia Leung 的原话表示,这一举措旨在使投资者能够更有效利用全球市场流动性,实现更好的价格发现和更具竞争力的交易条件。”

这和比特币价格波动有什么关系?

有很大的关系。

当比特币暴跌时,传统交易所的流动性瞬间枯竭——就像《速度与激情 8》里,纽约街头突然出现数千辆被黑客控制的僵尸车,整个曼哈顿瞬间变成停车场。

但如果你能接入全球订单簿,就像突然打开了平行宇宙的传送门——这边市场恐慌性抛售,那边可能有人正在疯狂抄底。价格发现更快,套利机会更多,交易成本更低。

好的监管不是红绿灯,而是更好的路面设计。

香港正在做的,是把"地下赛道"升级成"全球超级高速公路"。

第三条线索:银行老板突然说要"改装引擎"

最保守的人说出了最激进的话——现在,最戏剧性的转折来了。

在香港金融科技周(Hong Kong Fintech Week)上,渣打银行 CEO Bill Winters——一位管理着全球数千亿美元资产、穿着手工西装的传统金融银行家——突然在公开场合说了一番听起来像科幻电影台词的言论:

"所有交易最终都会在区块链上结算。所有货币都会数字化。整个金融体系将被完全重新布线。"

这就像《速度与激情》里的 FBI 局长霍布斯突然说:"其实我们也想飙。"

更疯狂的是,汇丰银行 CEO Georges Elhedery 提出了该行计划投资 13.6 亿美元要私有化恒生银行,把它变成"金融创新实验室"。

为什么银行家突然变成了"改装狂魔"?

答案很残酷:因为他们发现 DEX 和稳定币正在蚕食他们的生意。

如果你经营全球最大的出租车公司,然后有一天发现 Uber 不但出现了,还开始提供私人飞机服务。你有两个选择:

A: 继续抱怨 Uber 违法经营——坐以待毙

B: 打不过就加入——自己造一架更好的飞机

聪明的银行选择了第二条路:渣打和汇丰都在香港建了区块链实验室,测试跨境支付、稳定币发行、资产代币化——所有 Web3 行业正在做的事情,但加上了银行级别的"制度信任"标签。

关键问题:当传统银行开始拥抱区块链,当监管者开始建造"合规的去中心化高速公路",当 DEX 交易量在市场的暴跌声中反而创新高——这真的还是"比特币崩盘"的故事吗?

剧透:给投资者的"驾驶手册"

片尾彩蛋:真正的问题

当 DEX 交易量在暴跌中反而爆炸,当香港打开全球流动性的大门,当银行 CEO 说"金融体系要重新布线"——你觉得 10 月的暴跌,下一步是什么剧情?

我的个人答案是:那是换挡的声音。

(全文完。现在你可以重新看一遍《速度与激情》,然后查看你的交易账户。)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。