Compiled by: Luan Peng, RootData

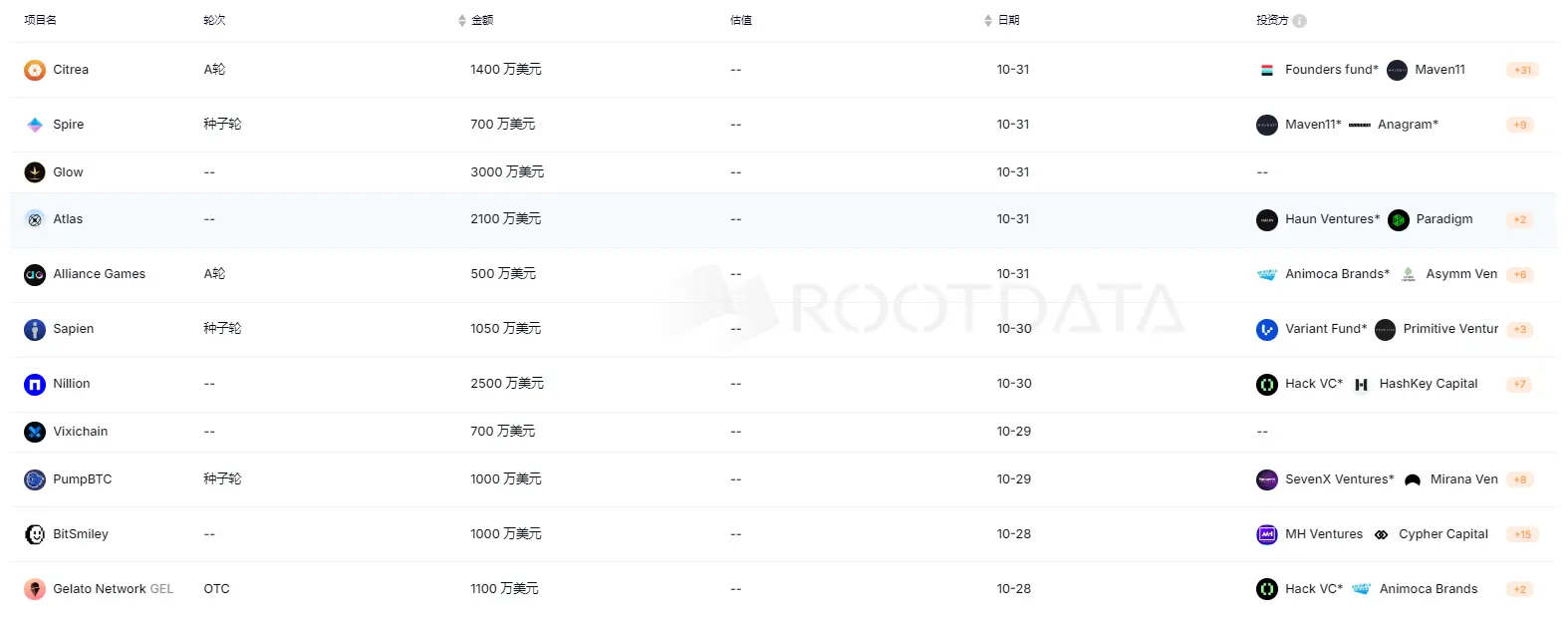

According to incomplete statistics from RootData, during the period from October 28 to November 3, 2024, there were a total of 25 public financing events in the blockchain and cryptocurrency industry, with a cumulative financing amount of approximately $182.5 million.

From the distribution of sectors, the projects that received financing were mainly concentrated in the infrastructure and DeFi sectors. Popular projects include the Bitcoin rollup project Citrea, the Monad ecosystem liquid staking protocol Magma, the Web3 game PARAVOX, and the blockchain solar company Glow.

In addition, the Solana ecosystem project Streamflow completed a new round of financing, led by John Lilic, with participation from Jump Crypto, Solana Ventures, IVC, GBV, Genblock, Hypersphere, Amber, VentureDAO, T3E, Huobi, and Primeblock, along with a group of angel investors. This round of financing brought its total funding to $5 million.

(List of projects with financing greater than $5 million last week, data source:Rootdata)

1. Infrastructure

According to Fortune, the blockchain content verification platform OpenOrigins has completed a $4.5 million seed round financing, led by Galaxy Interactive. The blockchain technology developed by the company can verify the authenticity of digital content such as photos and videos in real-time, and it has already partnered with ITN, a leading media production company in the UK.

The company plans to use the new funding to expand its commercial team and extend its business to the Indian and U.S. markets. At the same time, OpenOrigins will launch a marketplace platform to help news organizations authorize AI training on their verification data.

Manny Ahmed, founder of OpenOrigins and a PhD from Cambridge University, stated that the company's uniqueness lies in its ability to verify real-time content as well as certify historical content. This technology records content verification information on the Hyperledger blockchain, providing content authenticity assurance across various fields such as news media, insurance companies, and online dating platforms.

Bitcoin Rollup project Citrea completes $14 million Series A financing, led by Founders Fund

According to CoinDesk, the Bitcoin rollup project Citrea announced the completion of a $14 million Series A financing, led by Peter Thiel's Founders Fund, with participation from angel investors such as Erik Voorhees and Balaji Srinivasan. Citrea aims to utilize zero-knowledge (ZK) technology to transform Bitcoin into programmable assets, introducing Ethereum-like smart contract functionality.

Citrea employs the BitVM computing model, making it compatible with the Ethereum Virtual Machine, allowing applications on Ethereum to be deployed on Citrea without modification.

According to RootData, Citrea is a ZK rollup for Bitcoin and serves as an execution layer based on Bitcoin. Every transaction occurring on Citrea is fully protected by zero-knowledge proofs and verified through BitVM.

Ethereum scaling infrastructure developer Spire Labs has completed a $7 million seed round financing, led by Maven 11 Capital and Anagram, with participation from a16z Crypto Startup Accelerator, Digital Currency Group, Bankless Ventures, Volt Capital, Finality Capital, and angel investors Nick White and Jacob Arluck from Celestia Labs, as well as Amrit Kumar and Anthony Sassano from AltLayer.

Kaito Yanai, co-founder of Spire Labs, stated that the company began its seed round financing in June and completed it earlier this month. Yanai mentioned that this financing was conducted in the form of a Simple Agreement for Future Equity (SAFE). Spire Labs is currently developing the first testnet of Based Stack, which is planned to be launched by the end of this year, with the mainnet expected to launch in the first quarter of 2025.

Spire is a crypto startup focused on Ethereum scaling, developing "Based Stack," a framework designed to enable builders to deploy application-specific chains or application chains.

According to TheBlock, the verifiable autonomous agent network Axal announced the completion of a $2.5 million Pre-Seed round financing, led by CMT Digital, with participation from a16z Crypto Startup School, Escape Velocity, IDG Vietnam, Artichoke Capital, Trident Digital, Blockchain Builders Fund, Blockhunters Group, Echo, and Mentat Group, as well as angel investors Rushi Manche, Darius Rugys, and Comfy Capital.

As part of the Movement Labs Move Collective accelerator program, Axal plans to deploy on Movement's main chain at launch, supporting Movement DeFi applications such as Meridian and Echelon through verifiable agents.

Haun Ventures invests $20 million in Ellipsis Labs, funding to launch new chain Atlas

The team behind the Solana ecosystem decentralized exchange platform Phoenix, Ellipsis Labs, announced the completion of $20 million in financing, with Haun Ventures participating, aimed at accelerating the launch of the second-layer blockchain Atlas focused on verifiable finance. Haun Ventures described this round of financing as a "quick follow-up" to Ellipsis Labs' $20 million Series A financing completed in April.

Additionally, according to the Web3 asset data platform RootData, Ellipsis Labs completed $20 million in financing in April this year, led by Paradigm with participation from Electric Capital.

According to official news, Web3 game infrastructure Alliance Games has completed $5 million in Series A financing, led by Animoca Brands and Asymm Ventures, with participation from The Spartan Group, Dialectic, Kyros Ventures, Coin98 Ventures, and investors Loi Luu and Sebastien. With its previous seed round financing, Alliance Games' total financing has reached $8 million.

According to RootData, Alliance Games is a fully decentralized, community-driven platform that provides next-generation decentralized Web3 game infrastructure hosting and data storage services, dedicated to redefining the boundaries of gaming using blockchain technology to provide always-accessible immersive experiences.

Nitro Labs completes $4 million seed round financing, led by Lemniscap

According to The Block, the team behind the Solana scaling infrastructure platform Termina, Nitro Labs, has completed a $4 million seed round financing, led by Lemniscap, with participation from Animoca Ventures, Borderless Capital, Finality Capital, Race Capital, and No Limit Holdings. Additionally, undisclosed angel investors including Solana Foundation, Jump Crypto, and Spartan also participated in this round of financing. Termina is an open-source platform designed to enable developers to easily deploy custom Solana Rollups or SVM "network expansions."

DePIN data network AiGO Network (hereinafter referred to as "AiGO") announced today the completion of a new round of strategic financing, with a lineup of investors from various well-known overseas investment institutions, including Waterdrip Capital, Cryptomind Group, K300 Ventures, Chain Capital, and Ticker Capital.

Recently, AiGO has made significant breakthroughs in product development and ecosystem construction: as an innovator in the DePIN and AI sectors, AiGO has interacted and collaborated with traditional businesses in Southeast Asia and South Korea since its establishment, converting Web2 users to Web3 service experiences. The project recently launched mini applets and a mobile app, and innovatively proposed the "Trip to earn" concept, combining decentralized infrastructure with real-world scenarios.

Currently, AiGO's activity on the Base public chain is outstanding, with interaction volume ranking in the top ten, highlighting the project's strong development momentum.

Crypto AI data collection startup Sapien has completed a $10.5 million seed round financing, led by Variant, with participation from Primitive Ventures, Animoca, Yield Game Guild, and HF0.

The Sapien team is led by Rowan Stone, a former co-founder of Base, and Trevor Koverko, founder of Polymath and author of the RWA standard ERC1400, who are incentivizing an increasing number of data providers using USDC stablecoins or reward points systems.

According to RootData, Sapien is a scalable data labeling solution that gamifies the data labeling process using rewards on the blockchain.

Privacy-preserving computing network Nillion completes $25 million financing, led by Hack VC

According to CoinDesk, the privacy-preserving computing network Nillion has completed $25 million in financing, led by Hack VC. This financing brings Nillion's total funding to over $50 million, with investors including Hack VC, Distributed Global, and HashKey.

According to RootData, Nillion is a decentralized public network based on a new cryptographic primitive called Nil Message Compute (NMC), allowing nodes in a decentralized network to operate in a unique, non-blockchain manner. Nillion unlocks important new utilities in Web3 by enabling use cases such as decentralized credit scoring, decentralized trusted execution environments, private NFTs, and decentralized secure storage services.

Previously reported, in December 2022, Nillion completed $20 million in financing, led by Distributed Global, with participation from AU21, Big Brain Holdings, Chapter One, GSR, HashKey, OP Crypto, and SALT Fund.

Blockchain startup Vixichain completes $7 million financing

According to Arcticstartup, Lithuanian blockchain startup Vixichain announced the completion of $7 million in financing, with investor information not yet disclosed. The company primarily targets traditional financial markets, promoting institutional participation in public blockchains. The new funds will support its accelerated launch of the development network DevNet and mainnet, as well as the establishment of strategic alliances with financial institutions.

According to Chainwire, Web3 open software library KRNL Labs has completed $1.7 million in Pre-Seed round financing, with participation from TRGC, Superscrypt, Ryze Labs, Builder Capital, Blockchain Founders Fund, WAGMi Ventures, STIX, YAP Capital, and several strategic angel investors.

KRNL Labs is innovating at the RPC node level to achieve cross-chain communication, creating a new type of software management for Web3. KRNL Labs unlocks the ability to share libraries across blockchain networks, changing the way tasks are executed.

It is reported that KRNL Labs was founded in 2022 by Tahir Mahmood and Asim Ahmad, aiming to address fragmentation issues in Web3 and the inefficiencies of integrating existing solutions.

Rollup development platform Gelato completes $11 million A+ round financing, led by Hack VC

Rollup-as-a-Service platform Gelato has completed $11 million in A+ round financing, led by Hack VC, with participation from Animoca Brands, IOSG Ventures, and Bloccelerate VC. The latest round of financing brings Gelato's total funding to $23.2 million.

The new funds will be used to expand its team and services to support more enterprise-level blockchain projects.

Gelato aims to simplify the creation and management of Rollups, streamlining the building and scaling of web3 applications and ecosystems.

Decentralized real-time messaging infrastructure River Protocol acquires Llama

Decentralized real-time messaging infrastructure River Protocol has acquired the decentralized governance protocol Llama, with Llama's technology being integrated into River. This acquisition will enhance the governance capabilities of the web3 communication platform built on River Protocol.

Llama is a full-stack platform for on-chain access control and governance. The Llama protocol is designed for decentralized governance, consisting of open-source, fully deployed smart contracts that provide a comprehensive on-chain governance system with flexible requirements.

River is the first protocol designed to secure end-user communications. The River protocol is an EVM-compatible L2 chain that builds programmable communication tools in a permissionless manner, utilizing decentralized off-chain flow nodes and smart contracts deployed on Base.

2. DeFi

Monad ecosystem liquid staking protocol Magma has announced the completion of $3.9 million in seed round financing, with participation from Bloccelerate, Animoca Ventures, CMS Holdings, Maelstrom, Veil VC, Builder Capital, Infinity Ventures, RockTree Capital, Wise3 Ventures, Stake Capital, and Relayer Capital.

It is reported that Magma is building MEV-based liquid staking on Monad. Magma will collaborate with Ether.fi to establish the first re-staking integration on Monad.

According to RootData, Magma is a liquid staking protocol based on Monad, developed by Hydrogen Labs. It achieves fair token distribution through ecological competitive airdrops, focusing on community participation and decision-making, and is capable of self-funding protocol development and managing various activities.

Bitcoin liquid staking platform PumpBTC announced the completion of a $10 million seed round financing, led by SevenX Ventures and Mirana Ventures, with participation from UTXO, Mantle Ecosystem Fund, Arcane Group, and others.

This financing will help PumpBTC launch a new product, BTC-Fi, which is a CeDeFi BTC liquidity vault that combines CeFi-level security with DeFi's BTC yield optimization, providing automated yield strategies.

Since its launch in July 2024, PumpBTC has been deployed on over 10 public chains, attracting a total locked amount of 3,400 BTC (approximately $240 million) and collaborating with over 70 projects to build a multi-chain, multi-partner ecosystem, further promoting the development of CeDeFi.

Crypto Insurance Brokerage Native Completes $2.6 Million Seed Round Financing, Led by Nexus Mutual

Crypto insurance brokerage Native has completed a $2.6 million seed round financing, led by Nexus Mutual.

Native will provide $20 million of on-chain insurance for each risk and will operate a fund pool on Nexus Mutual.

Ben Davies, co-founder and CEO of Native, stated in an interview: "Native's role is to help address the long-standing issue of underinsurance in the market. Without a liquid insurance market, no industry can thrive, which is why we are building a commercial insurance broker on-chain, something that the market truly lacks."

Stablecoin developer CAP Labs announced the completion of a $1.9 million seed round financing, with participation from Robot Ventures, Anagram, Kraken Ventures, ABCDE Labs, and others.

Additionally, the official announcement stated that the mainnet will be launched in the first quarter of 2025.

According to RootData, CAP is a stablecoin engine designed to free users from the cycle of endogenous models. The CAP stablecoin engine will produce various denominations of redeemable stablecoins, such as USD, BTC, and ETH. Their goal is to democratize access to what was previously available only to a few seasoned and already wealthy participants, including the deepest layers of yield, such as arbitrage, MEV, and RWA.

Bitcoin DeFi infrastructure bitSmiley announced the completion of a $10 million second round of financing, with participation from MH Ventures and Skyland Ventures.

The new funds will facilitate the growth of bitSmiley, enhance cross-chain capabilities, and power multi-chain stablecoin initiatives.

According to RootData, bitSmiley is a Bitcoin-native DeFi project. As the first stablecoin project in the BTC DeFi ecosystem, bitSmiley has innovated in both application design and protocol layers. Its groundbreaking Fintegra framework consists of three main components: a decentralized over-collateralized stablecoin protocol, a native trustless lending protocol, and an on-chain derivatives protocol. bitSmiley will first introduce the native over-collateralized stablecoin bitUSD on the Bitcoin blockchain to address the lack of stable price-pegged tools.

III. Gaming

Web3 Game PARAVOX Developer 81RAVENS Completes $4.5 Million New Round of Financing

According to Crypto Briefing, Web3 game PARAVOX's developer 81RAVENS announced the completion of a $4.5 million new round of financing, co-led by Digital Hearts Holdings and Gree Ventures. This new capital injection will accelerate development and marketing, driving the game's continued expansion on Solana.

PARAVOX is a 3v3 competitive shooting game, and its global open Alpha phase has seen over 100,000 downloads on the Epic Games Store. To celebrate its migration to Solana, PARAVOX has launched a limited edition Solana-themed skin.

IV. DePIN

Blockchain solar company Glow has completed $30 million in financing, led by Framework and Union Square Ventures. This round of financing includes $6.5 million in funding for the company and $23.5 million in solar investments.

Glow's CEO and co-founder Vorick plans to use this funding to expand the company from 5 megawatts of power to 600 megawatts over the next 18 months and to expand into new countries.

Glow operates a DePIN network composed of solar power plants in the United States and India. To encourage its network's farms to move beyond "dirty" energy grids, the founders designed a holistic economy based on subsidies and token incentives.

DePIN Project GEODNET Receives Investment from Animoca Brands and Forms Partnership

Animoca Brands announced a partnership with GEODNET, a "decentralized" real-time kinematic (RTK) network aimed at driving mixed reality gaming and immersive experiences while integrating positioning technology into consumer applications.

Additionally, Animoca Brands has invested in GEODNET to support its development within the DePIN community while promoting the development of positioning and mixed reality technologies.

GEODNET will collaborate with Mocaverse, a consumer network with interoperable accounts, identities, reputations, and PointFi system infrastructure developed by Animoca Brands, to help "facilitate network growth and explore various consumer applications that integrate precise location into the Moca network."

V. Others

Security protocol Phylax Systems has completed $4.5 million in seed round financing. This round was led by Nascent and Figment Capital, with other participants including Robot Ventures, Hash3, Bankless Ventures, Breed VC, Public Works, Banteg, Hari Mulackal, Laurence Day, Ryan Lackey, Nic Carter, Nader Dabit, Eric Wall, and others.

According to bebee, community-oriented Web3 content platform Libraro announced the completion of its seed round financing (Phase One), led by Ayre Ventures, with specific financing amounts and valuation information not yet disclosed.

The new funds will be used to expand its Web 3 loyalty program and on-chain author identity features, prevent copyright infringement, and enhance transparency in content ownership and distribution rights.

Solana Ecosystem Project Streamflow Completes New Round of Financing, Led by John Lilic

Solana ecosystem project Streamflow has completed a new round of financing, led by John Lilic, with participation from Jump Crypto, Solana Ventures, IVC, GBV, Genblock, Hypersphere, Amber, VentureDAO, T3E, Huobi, Primeblock, and a group of angel investors. This round of financing brings its total funding to $5 million.

Streamflow is a comprehensive digital asset management infrastructure company dedicated to promoting the on-chain development of token-based economies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。