The author of this article is @0xmeme4fun. meme4fun is a meme platform on Solana, and all opinions expressed only represent the author's thoughts.

Why Create a Clone of pump.fun?

Starting a business is inherently a high-risk endeavor, with a 99.9% chance of failure. Choosing the right track can increase the probability of success by tenfold (with a success rate of up to 1%). Is the pump.fun clone one of those tracks?

My answer is certainly yes. From a business perspective, the current competition among meme launch platforms is insufficient. pump.fun stands alone, whether on Solana or EVM Layer 2. No other product doing similar things has reached even 1/10th of pump.fun's scale, and no one believes this will be a monopolized market.

The level of competition for the pump.fun clone is still an order of magnitude less than that of past DEX/Layer 2s. Looking at the competition in the NFT marketplace, it is also far from saturated; there are still many opportunities to explore.

From a product perspective, pump.fun has not yet created enough motivation for many people to engage in vampire attacks without issuing tokens. Other content will be discussed below.

VC Financing Environment

Insufficient competition and a sufficiently large market are also reasons why VCs are willing to pretend to pay attention to this track.

However, besides pretending to pay attention to this track, VCs are also pretending to understand memes and pretending to engage with them.

Here are two bold statements:

- Currently, among mainstream VCs, the proportion of investors/analysts who have bought any token on pump.fun is probably less than 1%. The actual participation rate of VCs in the meme space is below 5%, and very few have participated in early stages.

- The way mainstream VCs pretend to understand memes and engage with them is by reading media articles. The ratio of media editors seriously experiencing new products to those rushing to memes is far higher than that of VCs.

Once you realize this, when considering financing strategies, the first people you should reach out to are not VCs but rather users who are genuinely involved, directly DMing them on Twitter. They will have a better understanding of some issues within pump.fun and the entire meme ecosystem.

When your product has interesting features, you will receive the most authentic feedback, and community financing will be smoother. Let's fuck VCs.

By the way, support from top VCs will only help the project's operation and implementation in the short term; in the long run, VCs are actually useless.

Issues with Pump.fun and the Meme Ecosystem

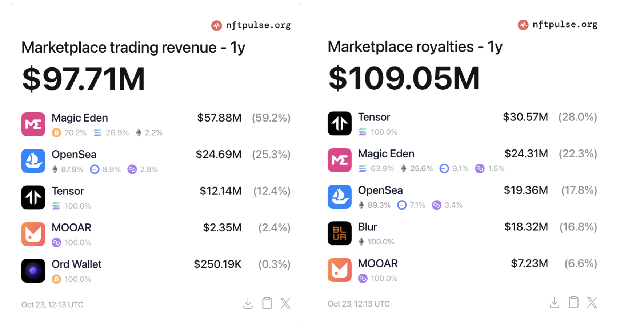

The first issue is already apparent. A set of data makes it clear:  In a market that has been labeled "NFT is dead" for a year, the income generated for creators in the past year has exceeded 100 million dollars, and the platform's revenue is also at a similar scale.

In a market that has been labeled "NFT is dead" for a year, the income generated for creators in the past year has exceeded 100 million dollars, and the platform's revenue is also at a similar scale.

As a new creator ecosystem representative, pump.fun aims to create a new era of entertainment content, and its past revenue is also 100 million dollars, with incentives for creators being 0.5 SOL on Raydium, and the total fees distributed are in the millions, a difference of 100 times.

To replace old products, new products need to achieve a tenfold improvement; this is the opportunity.

The second issue is also apparent: when will pump issue tokens? The situation where OpenSea is being challenged by LooksRare/Blur will inevitably happen. Everyone rushing to memes, besides seeking a laugh, also hopes to make money. When will the platform token recover?

By the way, although pump has publicly stated in AMAs that it will issue tokens, from any perspective, it is not a worthwhile endeavor for them. Currently, they are earning fees passively and have not seen any decent competitors; issuing tokens is more of a threat to teams looking to engage in vampire attacks.

The third issue is a long-term one that needs to be addressed, which is the planning of long-term products: the duality of meme content/assets. The logic of assets is very clear, but the content nature of memes has been overlooked.

Currently, various trading bots that rely on trading attributes have provided good distribution for these high-risk assets, making it easy for users to make speculative decisions based on the data behind asset attributes.

How to distribute the content nature of memes? This distribution is somewhat similar to a lottery rather than speculation. Good content can easily lead users to engage in lottery/tipping behaviors under 10 dollars. Long-tail liquidity requires new distribution methods, and how to construct this distribution method will be discussed in the product section.

Which Chain to Choose

Once you have chosen a track, identified some industry issues, and developed some financing ideas, the first step in taking action is to choose a chain, as EVM and Solana represent completely different development models, and the development resources available to everyone vary.

Ideally, I believe there are only two chains to choose from: Solana and Ethereum mainnet, as only these two chains have a sufficient number of meme developers and meme liquidity.

This is similar to how short videos in the U.S. initially thrived on Musical.ly, while in China, it was Kuaishou. Only with sufficient infrastructure and population can a new creator economy exist. Other Layer 2s currently do not meet this condition; platforms deployed on other chains will need to wait for the meme ecosystem on that chain to develop before they can succeed.

Of course, from a business perspective, if you can gain support from a public chain or directly receive investment from that public chain, it is indeed a worthwhile choice. Supporting a meme platform has become a necessary option for public chains, but from the perspective of long-term product development, other public chains have a significant difference in meme population compared to Solana/Ethereum.

How to Choose Core Products

Traders or Developers?

Many users, including those observing the industry, believe that PVP and high rug/pull are currently the biggest issues in the memecoin ecosystem. Whoever can better protect investors is likely to capture a larger market.

This should be the biggest wishful thinking in our industry.

The applications that have led to explosive growth in the industry, from 2017 to now, have always been about how to launch tokens and build liquidity more conveniently.

Traders are well aware of their trading targets; they come to trade not for refunds but for 100x returns. Therefore, products aimed at traders should not focus on how to guarantee the principal is not lost but rather on providing as many targets as possible for traders.

Meme platforms should prioritize incentivizing developers, as they create new narratives and targets.

Additionally, when you analyze all the pump developers' behaviors on the chain, you will find that developers are also traders with higher trading volumes.

Should we use new bonding curves or new issuance mechanisms?

Before pump.fun, how were tokens issued?

Here, we can refer to PinkSale, which has provided excellent templates for various liquidity locks, vesting, and refunds. But why did pump.fun emerge?

Because it is simple and direct; PVP is not a problem but a feature.

So when considering new bonding curves or issuance mechanisms, the core question remains: who are the users you need?

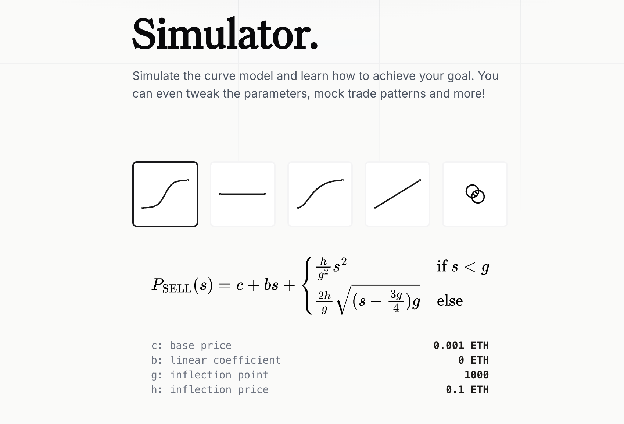

Mechanisms like PK, shorting, refunds, and fair launches—are they liked by users or by those who want to issue tokens?  In terms of bonding curves, there is actually a product that does it well, vv.meme, which everyone interested in new issuance methods should check out.

In terms of bonding curves, there is actually a product that does it well, vv.meme, which everyone interested in new issuance methods should check out.

As for new issuance methods, we are also researching whether they can incorporate some fair launch models during the PVP process. The current reality is that, including ourselves, we have not found a better solution than the current bonding curve. Our future new solutions may only provide users with a new option.

How to Provide Long-term Incentives?

Currently, the graduation rate of pump.fun on Raydium is about 1%.

After graduating from Raydium, the probability of rug & pull should be as high as 99%. The first batch of profit-takers will likely run away, necessitating new incentive mechanisms to extend the lifecycle of graduated memes.

Moonshot's new product last month proved that users have a demand for long-term construction. They built a new LP reward mechanism where meme DEX transaction fees are distributed to holders, which is a very good attempt.

This is also part of what we are building in our product. Besides transaction fee incentives, how should tokens incentivize, and how to build and incentivize sharing relationships are all aspects we are working on.

Of course, similar to constructing issuance mechanisms, both inside and outside the platform, we need to identify who is most deserving of incentives.

Concept of Distribution Mechanism

Earlier, we mentioned the duality of meme content and assets. How should content be distributed?

We have already seen that we.rich has made preliminary attempts by tagging each meme and using simple recommendation algorithms.

However, it is regrettable that due to the liquidity of Base and the number of developers, there may not be enough data accumulation to build a complete distribution mechanism.

This is something that pump should focus on constructing. They should not compete with trading bots like PepeBoost for trading asset distribution but rather consider how to distribute the content behind memes. Currently, with a daily launch volume of 10,000 memes and the attributes behind user wallets, there is already enough to attempt a new distribution mechanism.

A new opportunity may lie here, creating a nested mechanism for pump to build a new meme discovery mechanism, gathering long-tail liquidity, which would be immensely beneficial for the entire meme creator ecosystem.

Operational Choice: Build a Platform or a Creator Ecosystem

In the decision-making process to create pump.fun, one recurring suggestion is to build a platform.

You need to artificially create some wealth effects when launching a new platform, allowing early participating users (traders) to remain on the platform long-term.

For example, a meme platform promoted by a certain public chain had several 10 million memes in its first week of launch.

Some products attempting to start meme platforms on different Layer 2s have also adopted this approach. I have seen many such social media promotional materials:

"xxx is the pump.fun of xxx chain, and xxx token is the top one; everyone can pay attention."

The second promotional material is: "Top one has already increased by xx times; the second one might be xxx."

Many people are also financing for this purpose, to better acquire early users.

If you recognize that memes are a creator ecosystem, artificially building a platform actually harms the community. The developers and traders within the platform will only consider one question: has your project received official support? The opportunities that grow wildly are smoothed out; since they cannot get official support, they will go to pump.fun to seek new opportunities.

Building a platform is a way to quickly gain positive feedback in the short term, but in the long run, it will fall into the trap of platform building. Currently, the number of new tokens launched daily on these platforms is less than 100, and the reason lies here. The important thing is not to build a platform but to establish mechanisms that allow wild developers to emerge.

This choice will also determine the future product direction: to build a new meme distribution platform by providing more convenient issuance and community liquidity-building tools.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。