It is recommended to hold projects with good fundamentals and meme appeal.

Author: Ryan Watkins

Compiled by: Deep Tide TechFlow

“In their deep thoughts, the subtle sounds of omens entered their ears, and they listened devoutly, while the people outside in the street remained unaware.” — C. P. Cavafy

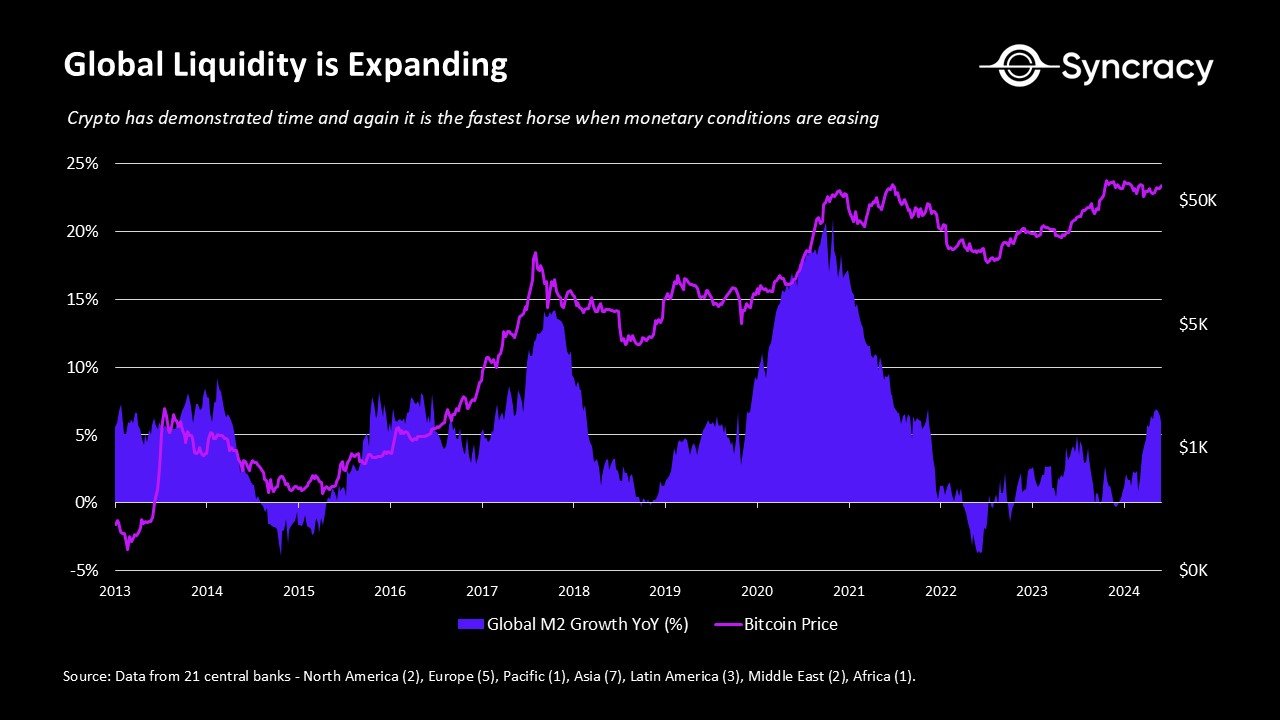

The crypto economy has repeatedly proven to be the fastest investment choice when monetary policy is loosened. Syncracy believes this time will be no exception, especially driven by increased institutionalization and regulatory clarity. However, compared to past cycles, the key difference today is that returns are less likely to be led by a single thematic trend and are more likely to be decentralized.

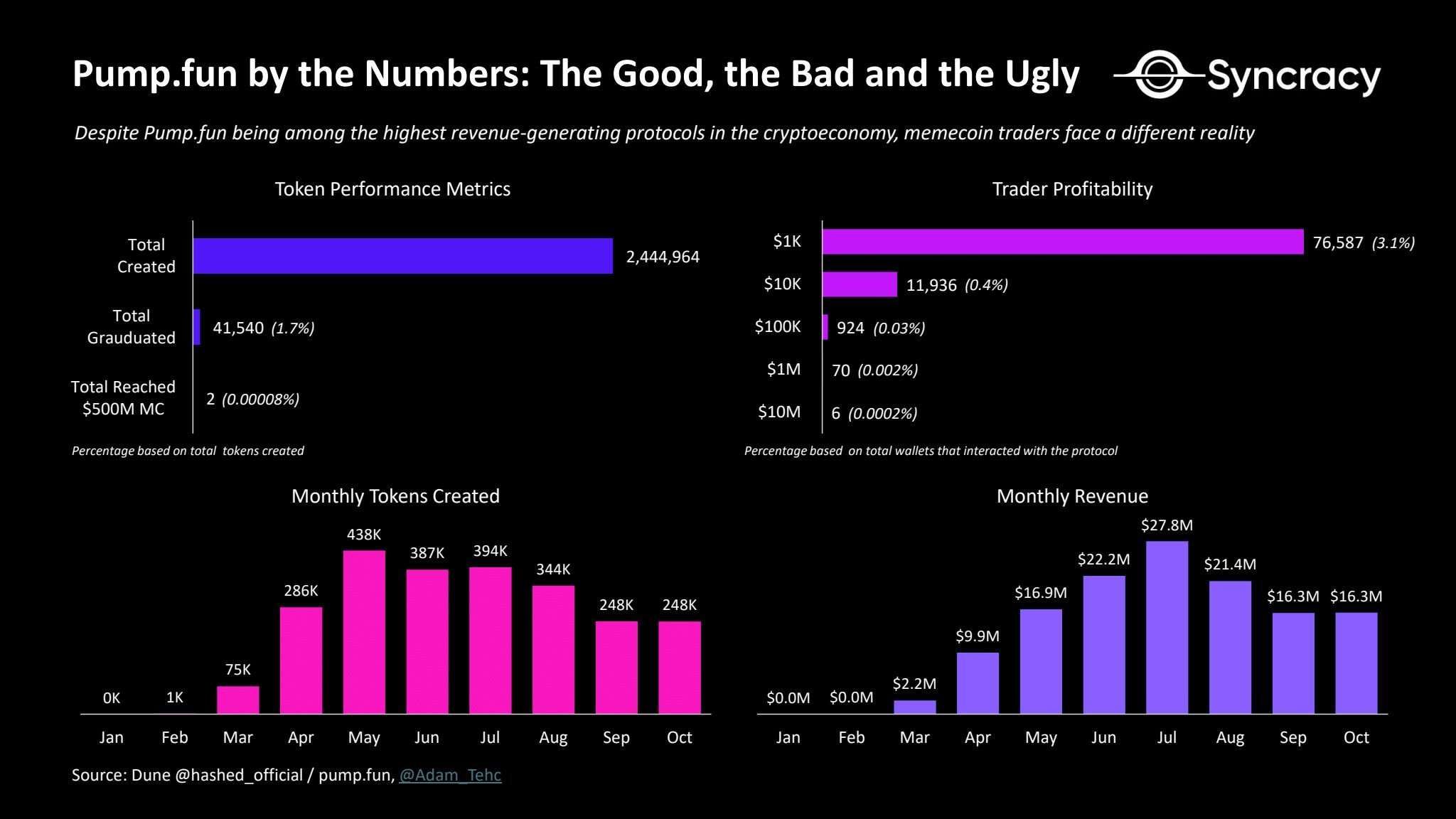

Unlike previous cycles, this market rebound has not been driven by innovation but rather by Bitcoin ETF and institutional commitments. This has led to a subsequent flow of speculative funds lacking clear direction. Unlike in 2021, there are no emerging DeFi or NFT projects generating excitement—only a general sense that the economic environment is improving and infrastructure is beginning to mature. At the same time, the number of assets in the crypto economy has increased by 10 to 100 times, making it difficult for the entire industry or even the entire asset class to rise in sync. Therefore, the flow of speculative funds lacks clear direction, and many ironically believe the only guiding logic is “financial nihilism”—perhaps the only significant technological advancement of this cycle is the launch of more efficient infrastructure to launch and trade tokens.

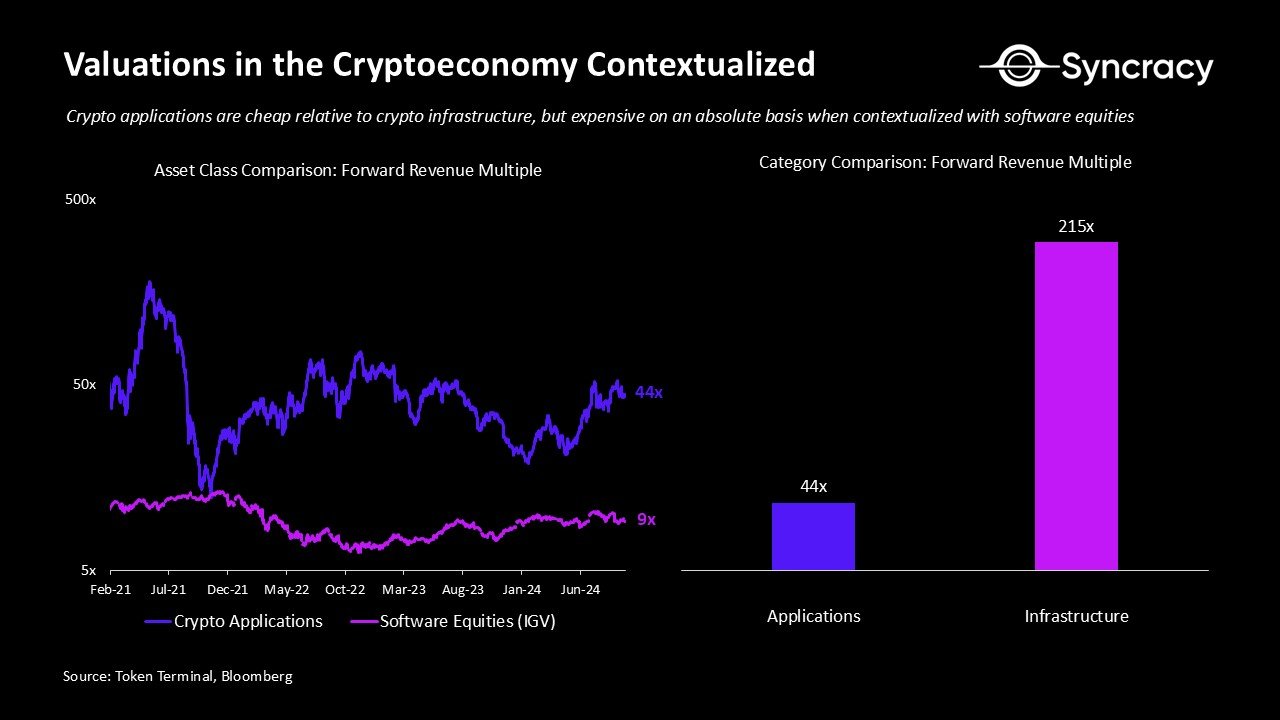

Currently, the challenge facing this asset class is that many “real” projects are not cheap in valuation. While they have just begun to show signs of overcoming cyclical impacts and shifting towards long-term growth, the average application has a price-to-earnings ratio as high as 44 times. Although some projects stand out with reasonable valuations in traditional stock markets, overall, these projects still need to grow to match their valuations. While there is reason to believe that these applications are undervalued in the long run, especially compared to non-monetary blockchain infrastructure with price-to-earnings ratios about 200 times higher, it remains unclear whether there is any urgency to make long-term investments on an absolute basis.

Meanwhile, there is growing fatigue towards projects that are venture capital-backed, listed at high valuations but lack fundamental support. As long-term winners emerge in the crypto economy, the issue of infrastructure oversupply within the industry becomes increasingly apparent, with over-financed venture capitalists continuing to invest in this infrastructure, likely facing losses due to capital misallocation. Retail investors have already realized this and are now refusing to blindly buy new tokens, as the upside potential of these tokens has already been fully (or even excessively) priced in the private market.

In this context, as speculative interest in the asset class rises while reasonable investment opportunities are limited, investors are increasingly inclined to invest in “meme” assets. These assets lack a clear valuation framework, making them highly reflexive and prone to bubbles. For example, primary assets are still traded based on relative valuations against BTC and ETH, while BTC and ETH themselves are viewed as non-sovereign currencies that cannot be intrinsically valued. Similarly, AI tokens are also traded based on relative valuations, although this is because AI is a potential emerging field with immense but difficult-to-quantify potential. Meanwhile, meme coins completely abandon the illusion of value, being priced purely based on market attention.

The appeal of meme assets in the crypto market is further amplified by the increase in short-term speculative behavior, a phenomenon that can be termed the “quick money trap.” In an investment environment increasingly influenced by social media and gamified trading, herd behavior and instant gratification are distorting investor psychology, with retail speculators chasing short-term gains at a faster pace. This phenomenon is not surprising, as it reflects a broader trend of the global economy shifting towards instant goods and services. Just as consumers expect food to be delivered quickly to their doorsteps, retail investors now expect instant returns through mobile trading apps like Robinhood. Increasing evidence suggests that these trends are lowering the efficiency of the stock market. Syncracy points out that these trends are also distorting the crypto market—few market participants can see beyond two weeks, let alone two months or two years. For many, trading has quietly turned into a form of gambling.

So, how should a fundamentally-oriented investor respond to this situation? Incorporating these perspectives, it is recommended to hold projects with good fundamentals and meme appeal. While assets that rely purely on fundamentals can generate returns, their valuations have a bottom line and upper limit, making them less attractive to retail investors unless they aresmall-cap stocks. On the other hand, pure meme assets, while benefiting from market reflexivity, have limited appeal to institutional investors due to oversupply, severe speculation, and extreme volatility. Assets like SOL combine both characteristics, providing a dual advantage—having solid fundamentals in reality, active on-chain activity, while also being able to attract speculative funds from both retail and institutional investors, who typically price it relative to ETH and BTC. Non-large-cap assets like TAO also fit this characteristic, with its economic growth accelerating and speculative enthusiasm focused on the potential of decentralized AI—TAO is referred to as “AI currency.”

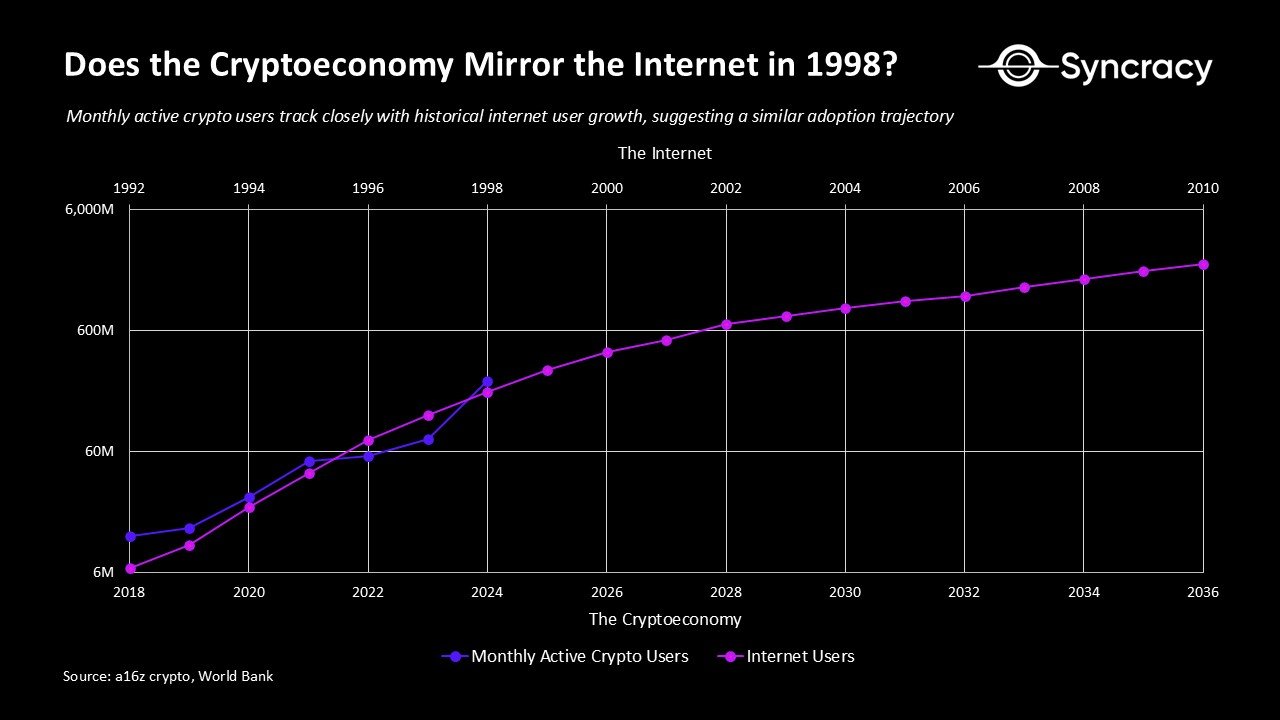

Overall, Syncracy believes that this asset class is beginning to show differentiation between Bitcoin and stablecoins. Bitcoin and stablecoins have reached a stable period of productivity, while other assets are at most in the early stages of enlightenment. From many standards, the crypto economy resembles the internet during the late 1990s dot-com bubble—at that stage, the revolutionary potential of the internet had become apparent, but valuations were astonishingly high, and a fundamental framework for assessing internet companies had yet to be formed. As previously mentioned, Bitcoin may have already passed through this uncertain phase and is on the path to becoming “digital gold” globally. However, other asset classes are once again showing signs of speculative frenzy reminiscent of the late 1990s.

“We always overestimate what we can do in two years and underestimate what we can achieve in ten.” — Bill Gates.

While many view this speculation as negative, we see signs of progress. It is encouraging that real projects are beginning to trade more based on fundamentals like stocks and are being forced to return value to token holders. This is a positive change, indicating that public market investors are becoming more discerning, prompting new projects to launch at more reasonable valuations. Optimistically, this may compress venture capital returns, driving capital into public markets, allowing for better allocation to emerging long-term winners. The crypto economy needs to digest these changes to take the next step as an asset class.

In the meantime, it is clear that we must go with the flow rather than against it. The significant structural changes we are witnessing—from the decline of venture capital to the increasing influence of institutional investors—will take time to fully manifest. The allure of this speculative chaos lies in the fact that the market provides an excellent opportunity for people to own foundational digital platforms as commodity currencies, offering highly attractive asymmetric growth potential and institutional-level liquidity. This opportunity will not last forever, but in the meantime, the game rules of the market are capital, memes, and speculation.

Special thanks to Chris Burniske, Sean Lippel, Qiao Wang, and Ansem for their feedback and discussions.

Important Legal Disclaimer

This article represents the views of Syncracy Fund Management LLC (“Syncracy”) and should not be construed as financial or investment advice.

The content of this article is not intended to constitute an offer, subscription, or invitation to sell any securities, including interests in any private investment funds managed by Syncracy. Any such offer is made solely pursuant to a formal confidential private placement memorandum, which will be provided to potential investors upon request and contains important information and risk factors related to the investment. Furthermore, this article does not constitute investment or tax advice. Recipients should consult their legal, tax, and other professional advisors before making investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。