Author: 1912212.eth, Foresight News

The massive unlocking of tokens always raises significant concerns in the market.

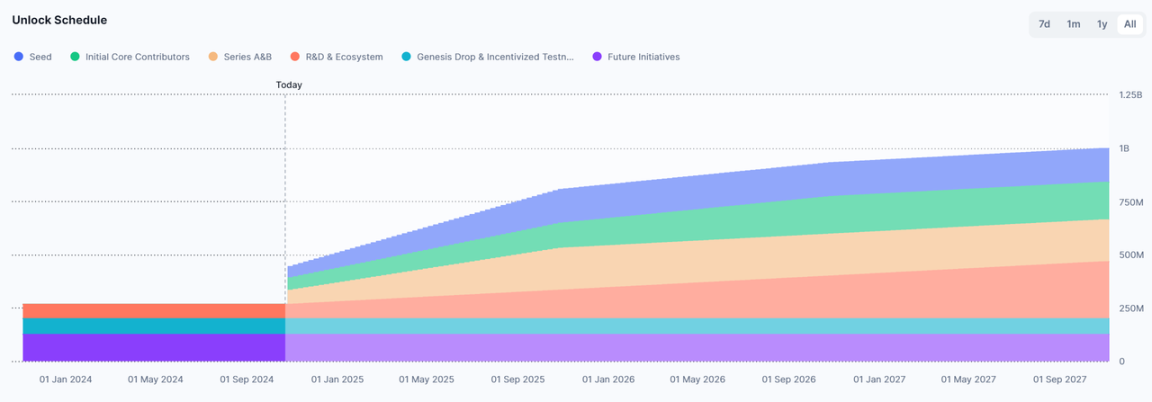

The modular leader Celestia's token TIA is set to unlock 175.74 million tokens on October 31. At a price of $6 per token, the total unlocking value exceeds $1 billion. This unlocking amount accounts for 16.3% of its total supply and 80.07% of the current circulating supply. As of the time of writing, the price of TIA has rebounded to above $6, currently priced at $6.16, with a daily increase of about 3%.

Additionally, among the unlocked tokens, the shares for seed round, Series A, and Series B investors amount to 117.38 million tokens, which is quite substantial.

Such a large unlocking has attracted widespread attention in the market. Will VCs sell off immediately after unlocking? Will there be a significant price correction? These have become common concerns in the market.

Recent Developments of Celestia

Since Celestia pioneered the concept of modularity, it has garnered significant attention and discussion in the market. Celestia's modular infrastructure, designed specifically for data availability networks (DA), can reduce data costs by 99.9% compared to Ethereum's mainnet, which is currently the largest DA layer in the industry.

According to Blockwork Research data, as of mid-September, its data publishing ratio had reached 57%, with costs amounting to only $243, which is 1% of Ethereum's mainnet fees. Since the launch of its autonomous network, Celestia has supported the deployment of over 20 Rollups.

As of October this year, Celestia's maximum throughput is currently 2MB/12 seconds, or 0.167MB/s. For this reason, the core development community of Celestia recently announced a roadmap to significantly expand data throughput, targeting 1GB.

Early Announcement of Financing

Before the large token unlock, the project team often announces a roadmap and financing news, which can help stabilize the token price.

Celestia's initial fundraising journey was not smooth, facing multiple rejections from investors in 2019. After establishing a foothold with the modular narrative and protocol, in October 2022, Celestia completed a $55 million financing round. In September 2024, the Celestia Foundation completed another $100 million financing round, with several prominent institutions participating. Following the announcement of the financing news, TIA surged by 24% on the same day, reaching above $6.5.

However, just as the community was celebrating, investor Sisyphus revealed that the financing was actually an over-the-counter deal reached months ago between the foundation and several institutions, with a valuation of $3.5 billion at that time. These token shares might be unlocked in October. Sisyphus also added that if institutions could sell all unlocked assets at $7.5, they would break even.

The brief excitement quickly returned to silence.

Negative Impact May Be Digested

Since the modularity boom combined with a major market rally, TIA has risen from around $2 at the end of last year to above $21. It has since experienced a continuous decline, dropping to below $4 at its lowest, and has now fallen back to around $6.

Generally speaking, large unlocks, especially those involving significant shares from teams and investors, tend to have adverse effects. Community participants, amidst the so-called anti-VC wave, naturally believe that once the unlocking occurs, VCs will sell off without hesitation.

News of the massive token unlock typically begins to spread widely about a month in advance, and the market starts preparing for these announcements within two to three weeks. Hesitant funds often adjust their positions in the weeks leading up to the unlock to prevent significant volatility.

Messari pointed out in a research report that unlocking more than 5% of the circulating supply can significantly impact token performance, and that token prices tend to perform poorly within seven days before and after the unlocking event.

So how will this TIA unlock play out?

Notable bull investor Placeholder partner Chris Burniske previously analyzed TIA on Twitter, suggesting that some investors might regret not buying below $5 when TIA rises. Chris made a large purchase when SOL dropped below $10 at the end of 2022 and gained fame for his accurate market predictions.

In a lengthy tweet, Chris stated that the negative impact of TIA's large unlock has been greatly exaggerated.

- Celestia's ecosystem is still developing, with passionate and ideologically diverse developers; it reminds him of early Bitcoin, Ethereum, and Solana.

- Those so-called "evil VCs" who received unlocked tokens are unlikely to sell off everything in October, as they see the ecosystem being built by the team is continuously growing, and many of TIA's biggest supporters are not as focused on short-term gains as many believe.

- When the unlocking occurs, the market may realize that the selling pressure is far less than the expectations for these airdrops; if the bulls have not been liquidated beforehand, the airdrop may lead to liquidations.

- Those marginalized and hesitant buyers worried about the unlock may start to take "buy" actions once they see positive price movements, reducing their uncertainty.

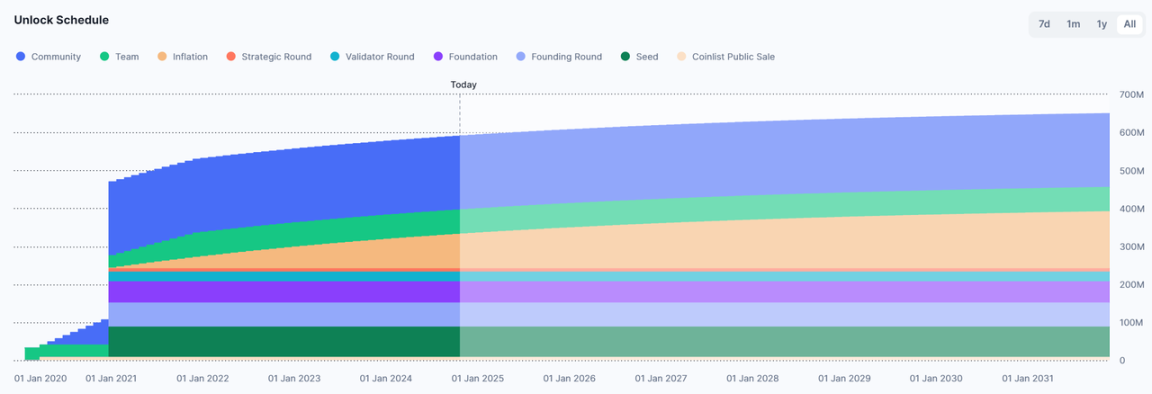

Chris also mentioned that in past cycles, SOL unlocked 80% of its total supply in December 2020. Although it experienced a correction afterward, SOL surged over 100 times in 2021. However, some have expressed skepticism; Blankless founder David Hoffman commented, "It's uncertain whether it's really appropriate to compare with the best-performing assets of 2021."

Currently, whether TIA can replicate SOL's upward trajectory remains to be seen. However, if the price does not experience a significant drop after the unlock and stabilizes within a range, it will undoubtedly have a positive impact on future trends.

TIA Staking Rewards May Alleviate Selling Pressure

Currently, on mainstream exchanges, such as Binance, TIA's annualized yield for flexible savings is as high as 14.36%, while Bybit offers 11%, and OKX's flexible annualized yield is around 20%.

With relatively good off-chain returns, what about on-chain? Taking Stride as an example, its annualized yield reaches 9.45%, while the Keplr wallet achieves 10.61%. The high annualized rates, combined with the market's general expectation that we are at the beginning of a new bull market, may lead some funds to choose to stake and wait.

It is worth mentioning that many previous modular concept projects have distributed airdrops to TIA's on-chain stakers. If history repeats itself, it may attract some staking funds again.

Recent Performance of Other Large Token Unlocks

When we are uncertain about what will happen, looking back at past events can be a useful approach.

The popular public chain SUI unlocked approximately 64.19 million tokens on October 1, valued at about $120 million. Among the unlocked tokens, the investor's share reached 39.16 million tokens, accounting for more than half of the total unlock.

However, SUI did not experience significant volatility, dropping from $1.93 to $1.65 on the day, with a decline of only 0.97%. Although there was some subsequent correction, the price trend remained extremely strong, reaching a historical high of $2.368 a week after the unlock on October 13.

Another MOVE system public chain, APT, also unlocked 11.31 million tokens on October 12, valued at approximately $100 million, with investors unlocking 2.81 million tokens.

On the day of the market price performance, it surged by 16.55%, reaching nearly $10. On October 22, APT's price jumped above $11, setting a new high since May 2024.

Even the long-dormant second-layer token track ARB saw a slight increase after the unlock, without the so-called significant drop. ARB unlocked 92.65 million tokens on October 16, valued at approximately $49.4 million.

On the day of the unlock and the following day, ARB experienced a total decline of about 3.7%, dropping from $0.58 to $0.54, but quickly rebounded with three consecutive increases, pushing the price above $0.6.

Summary

The performance of tokens after large unlocks is often influenced by a combination of factors, such as the sector, unlocking shares, ecosystem development, project progress, and community atmosphere. Of course, the overall market trend, whether upward or downward, also significantly impacts prices. During a bear market, weak buying pressure can lead to considerable selling pressure from large unlocks. However, once the market returns to a bull phase, examples of token unlocks leading to surges are not uncommon. Investors need to analyze and judge comprehensively to seize market opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。