原文标题:《Bitcoin Hashrate Slides Sparks Misconceptions - AGAIN!》

作者:BlocksBridge Consulting

编译:johyyn,BlockBeats

编者按:

近期比特币全网算力出现明显回调,引发了市场关于「哈希崩盘」与地缘政治因素的多重猜测,特别是在美国空袭伊朗核设施之后,社交平台上相关言论甚嚣尘上。然而,这类判断往往忽略了算力估算的概率性波动机制,以及北美夏季电网负荷管理对矿池运营的影响。本文基于难度调整模型和主流矿池数据,结合美国电力政策、伊朗合规限制与《GENIUS 法案》等最新立法趋势,旨在为读者厘清当前算力变化的真正逻辑,避免被碎片化舆论误导。

以下为原文内容(为便于阅读理解,原内容有所整编):

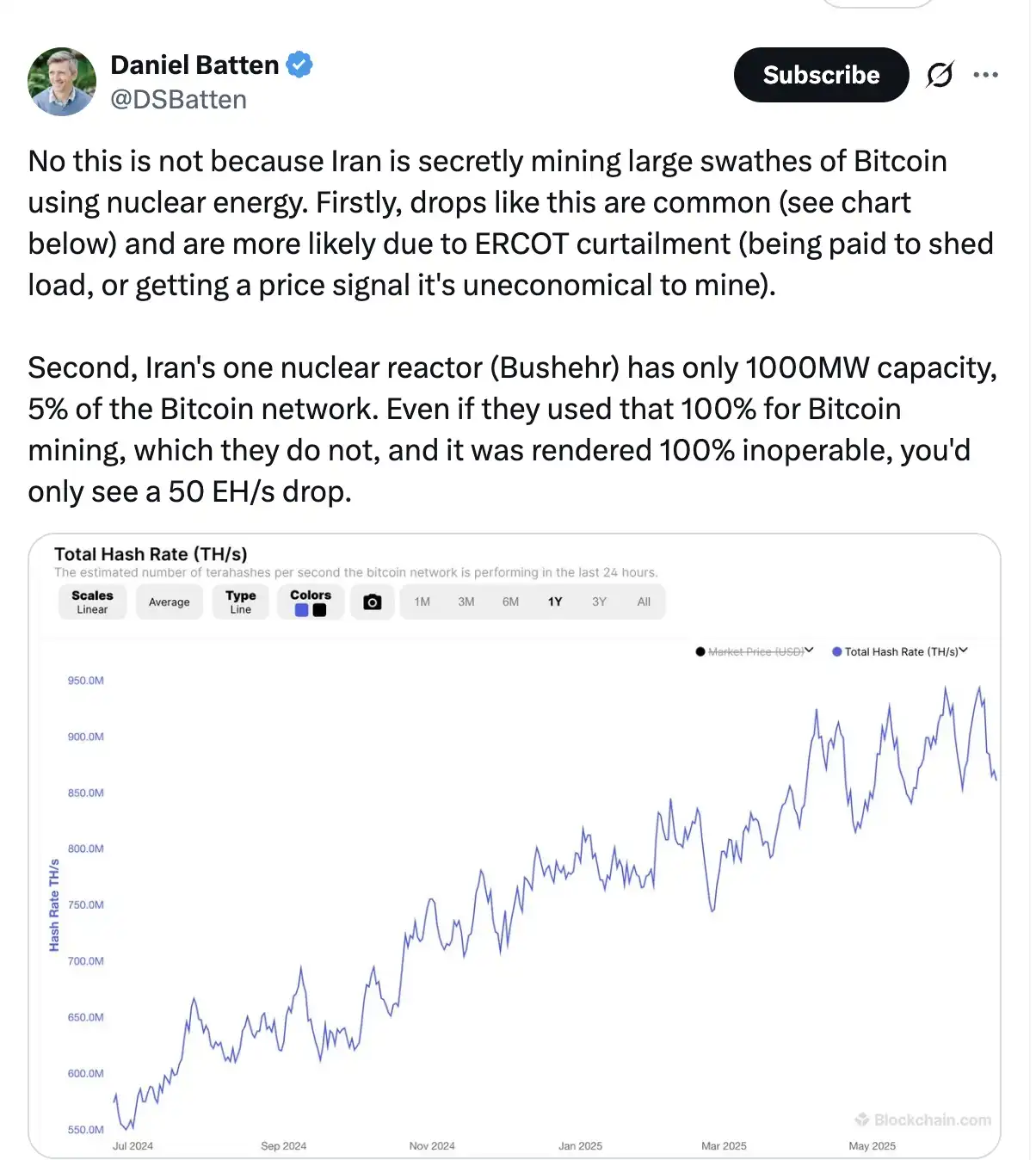

在本月早些时候比特币七日算力移动平均值创下接近 950 EH/s 的历史新高后,该指标已回落至约 810 EH/s,跌幅约为 15%,引发了广泛的市场猜测。部分声音将此次下跌归因于地缘政治紧张局势,尤其是在美国对伊朗核设施实施打击之后。

在社交平台 X 上广泛流传的帖子指出,此次军事行动与算力下滑时点高度重合,并猜测这可能导致伊朗本地矿工停机,进而从网络中「抽走」了部分「隐秘算力」。与此同时,市场上也再次出现对「算力崩塌」的担忧,尤其是在单日平均算力短暂跌至 600 EH/s 的背景下。

然而,这类解读往往忽视了比特币算力估算方式的基本原理,这是每轮减半周期都会重复上演的常见误区。

比特币的算力是通过当前网络挖矿难度与出块间隔时间共同估算得出的,这意味着短期数据波动通常源自概率性偏差。特别是单日算力数据极为波动,本质上更多反映的是矿工出块的「幸运程度」,而非网络实际算力的结构性变化。同理,仅凭某一日数据的短暂跃升就断言比特币算力突破 1 ZH/s(zettahash)也是不严谨的。

具体技术公式如下所示:

Hashrate(哈希率,单位为 H/s)= 挖矿难度 × 2³² / 平均出块时间(秒)

在同一难度周期内,该公式分子保持不变,因此算力估值的波动完全由出块时间的变化驱动。

随着每一轮市场周期的推进,总会有新进入者错误解读这些数据的短期波动。「算力崩溃」的叙事便是在此类下跌中反复出现的常规现象,尽管比特币挖矿的本质是一个高度概率化的过程。

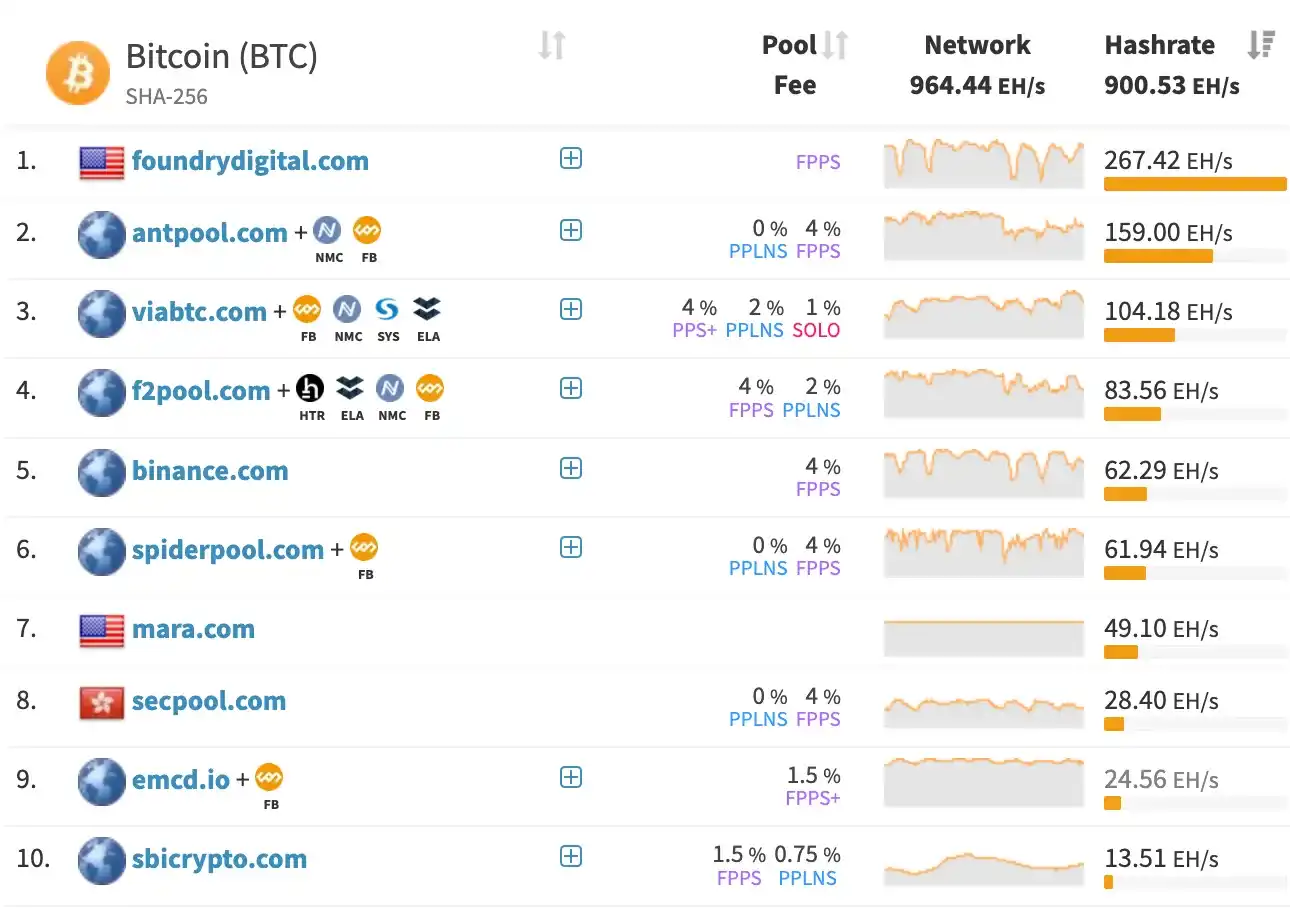

更为合理的解释是,近期算力的下滑可能源于北美地区的季节性限电。矿池级数据(如下图所示)显示,跌幅最明显的为 Foundry USA Pool,该矿池出现间歇性停机后又重新上线。这种运行模式与美国夏季电力高峰期间,为保障电网稳定而进行的矿场限电安排高度一致。

来源:Miningpoolstatson June 26

即便部分伊朗算力受到干扰,其影响相较于当前大规模波及美国主要矿池的限电现象而言仍属有限。考虑到制裁合规要求,伊朗的大规模算力也不太可能接入 Foundry USA 这类总部位于美国的矿池。

展望未来,比特币下一轮挖矿难度调整预计将于 6 月 29 日左右发生,可能创下自 2021 年中国矿业禁令实施以来最为陡峭的下调幅度,甚至超过 2022 年熊市期间矿工大规模出清时录得的 -7.32%。

不过,网络整体算力当前呈现出逐步回升态势。几日前曾预估本轮难度下调幅度接近 -10%,如今则修正至略低于 -8%。无论最终调整幅度如何,此次预期中的难度下调将为边际运营的矿工带来一定程度的短期缓解,尤其是在减半效应叠加夏季限电压力的背景下。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。