Tesla is the fourth largest holder of Bitcoin among publicly traded companies in the United States.

Written by: BitpushNews

On Tuesday, the cryptocurrency market rose, during which Tesla's Bitcoin holdings were almost entirely transferred after two years of dormancy.

According to Arkham Intelligence data, around 21:30 UTC on October 15, addresses associated with Tesla transferred approximately $765 million worth of BTC (11,509 coins) in batches to multiple unknown wallets, which seems to be the company's remaining Bitcoin reserves.

As previously reported by Bitpush, in the first quarter of 2021, after Bitcoin surged to nearly $62,000, Tesla sold $272 million worth of Bitcoin, realizing a profit of $128 million. The company also sold $936 million worth of Bitcoin in the second quarter of 2022, bringing in $64 million in profit.

The purpose of the latest transfers is unclear; some analysts believe Tesla may simply be strategically reallocating its assets, while others think these transfers could signal potential sales or a reintroduction of Bitcoin as a payment method for its electric vehicles.

According to BitcoinTreasuries data, Tesla is the fourth largest holder of Bitcoin among publicly traded companies in the United States. The top three are software company MicroStrategy, Bitcoin mining company MARA Holdings, and Riot Platforms.

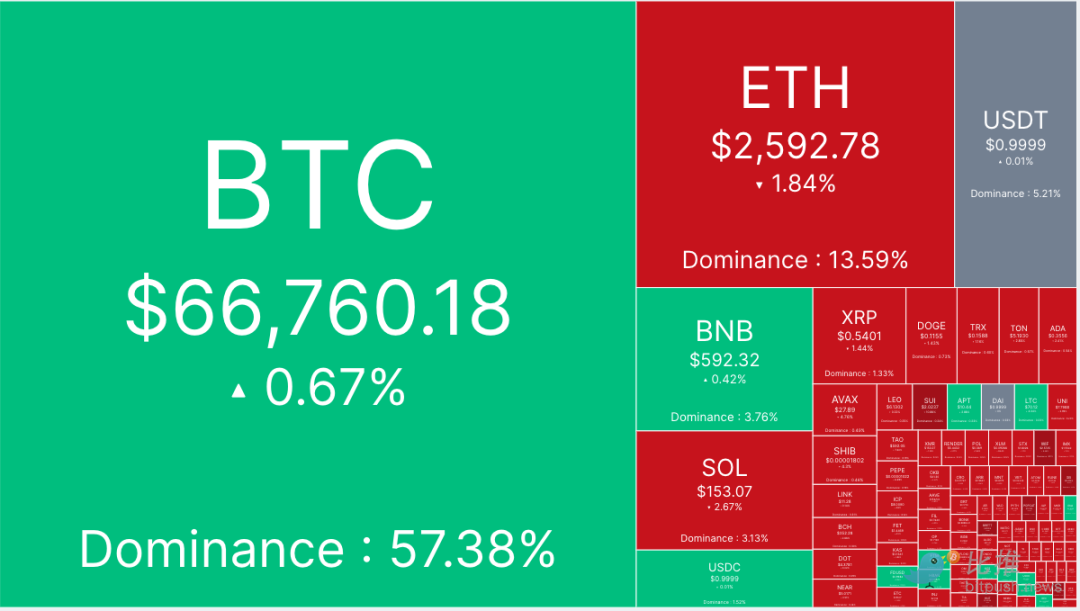

Data from Bitpush shows that on Tuesday morning, Bitcoin's price fluctuated upward, briefly soaring to a high of $67,960, the highest level since July 29. It then quickly fell to $64,787, before climbing back above $67,000 after lunch, with the next key resistance level at $68,000. At the time of writing, Bitcoin was trading at $66,760, with a 24-hour increase of 0.68%.

Most of the top 200 altcoins by market capitalization experienced losses that day. Storj (STORJ) led the gains, rising 22.1%, followed by Scroll (SCR) up 13.7%, and Metis (METIS) up 9.9%. Saga (SAGA) saw the largest decline, down 11.5%, followed by Mog Coin (MOG) down 10.7%, and Sui (SUI) down 9.4%. The overall market capitalization of cryptocurrencies is currently $2.3 trillion, with Bitcoin's market share at 57.5%.

In the U.S. stock market, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite were mostly in the red throughout the trading day, closing down 0.76%, 0.75%, and 1.01%, respectively.

Bitcoin Open Interest at Record Levels, Driven by Institutional Investors

Data shows that Bitcoin's open interest is at record levels, with Polymarket's market sentiment indicating a 64% chance of Bitcoin reaching a new high in 2024, an increase of 9% from last week. Analysts at Secure Digital Markets state that this is primarily driven by institutional investors, with the open interest weighted funding rate currently at a multi-month high, reflecting a bullish outlook in the short to medium term.

Additionally, spot Bitcoin ETFs saw a total inflow of $810 million over two trading days, with significant inflows from Fidelity and ARK. Meanwhile, Ethereum (ETH) attracted $17 million in inflows yesterday, mainly contributed by BlackRock's products.

JPMorgan Analysts Bullish

JPMorgan analysts released an alternative investment outlook and strategy report highlighting the bullish momentum of Bitcoin, led by Managing Director Nikolaos Panigirtzoglou.

The analysts stated, "In summary, we are optimistic about digital assets in 2025," pointing out several factors driving their outlook, including the emergence of "devaluation trades," a trend where investors turn to alternative asset classes (such as gold and Bitcoin) to hedge against economic instability.

The analysts noted that as geopolitical tensions escalate and the upcoming U.S. elections dominate the news, speculative institutional investors like hedge funds may view gold and Bitcoin as beneficiaries of this trend.

Polls indicate an increasing likelihood of a Trump victory, and the analysts mentioned that tariffs and expansionary fiscal policies (also known as debt devaluation) related to geopolitical tensions could further weaken the dollar, potentially strengthening devaluation trades.

Other positive factors include traditional wealth advisors like Morgan Stanley allowing recommendations of spot Bitcoin ETFs to clients, creditors of Mt. Gox and Genesis halting large-scale liquidations of Bitcoin, and cash payments expected to be made following the FTX bankruptcy, which analysts believe could be reinvested into the market.

The analysts also emphasized that the market capitalization of stablecoins is approaching its previous peak of around $18 billion (the level before the 2022 Terra/Luna collapse). U.S. stablecoin legislation is likely to emerge sometime in 2025, and once implemented, adoption rates are expected to increase, making stablecoins more mainstream.

Ledn Chief Investment Officer John Glover analyzed on the X platform that Bitcoin's price "has broken out of the parallel channel (flag pattern, lower blue line)."

John Glover stated, "Typically, for safety, I look for two consecutive days of closing prices above or below the trendline breakout point, so while now may not be the time to go all in, this breakout could signal the next upward move, retesting the $73,000 high. Please be patient for confirmation of the closing price, as we need to stay above $65,000, but from a technical perspective, BTC's trend looks positive."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。