Author: Black Swan

Translated by: Alex Liu, Foresight News

Background

Exchanges have always been important, haven't they? They are the starting point for trading and have become the backbone of the global financial system. However, the concentration of power in the hands of a few is problematic.

As things get crazier, everyone thinks centralization is the answer. But guess what? We are entering a new era — a truly decentralized perpetual contract exchange with its own L1 blockchain is leading the way, and that is @HyperliquidX. It offers you the speed of centralized trading but with lightning-fast transaction times and deep liquidity.

Now, traders can benefit from the above experience while retaining control over their assets, along with the inherent transparency and security of a decentralized system. This is precisely the key demand in the DeFi space that Hyperliquid addresses.

Moreover, the significance of Hyperliquid goes far beyond that.

So, what is Hyperliquid?

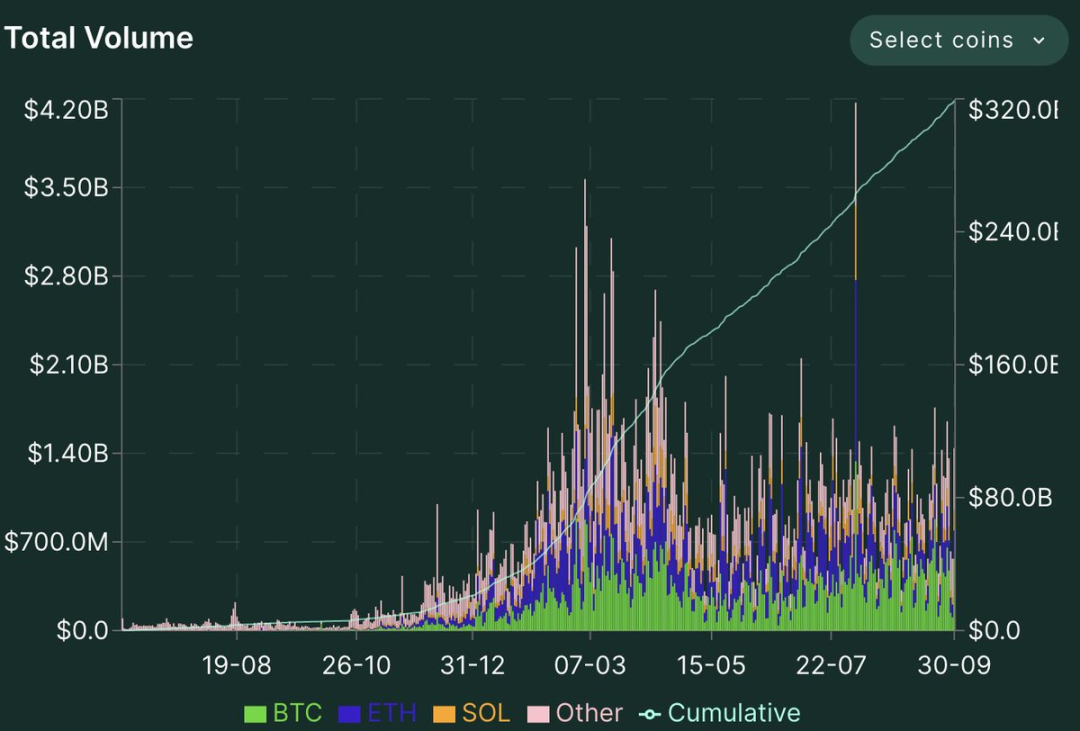

In short, Hyperliquid is a high-performance L1 optimized from the ground up for fast, secure, and inexpensive trading. Thanks to its premium user experience, diverse supported assets, and incentive programs, the flagship order book DEX of Hyperliquid L1 has achieved nearly $32 billion in derivatives trading volume since its launch early last year.

After using Hyperliquid for six months and exploring almost all decentralized perpetual exchanges: GMX, Zeta, Drift, LogX, you name it, I can somewhat ironically say that Hyperliquid is like the top student in class. It is faster, offers more features, and provides a great user experience.

Technical Overview

Hyperliquid Layer 1

The Hyperliquid blockchain is designed to run decentralized exchanges and support various financial applications. It uses a consensus algorithm called HyperBFT, inspired by Hotstuff. The key advantages of HyperBFT include:

- High Throughput: Capable of processing 200,000 orders per second, far exceeding current limitations.

- Non-Blocking Consensus: Allows transactions to be processed without waiting for previous block confirmations, enhancing efficiency.

- Fast Block Confirmation: Block production depends solely on network latency, allowing for quicker communication between validators.

Hyperliquid provides everything users might need:

- High leverage (up to 50x)

- Competitive trading fees

- Multiple order types

- Full or isolated margin

- Dozens of assets available for trading

- Profitable and customizable vaults

- Referral system

- ……

What is HLP?

Market Making for Everyone

Welcome to the new era of decentralized market making with Hyperliquid's HLP vault.

Hyperliquid has launched the HLP vault, making market making no longer an exclusive club for professionals. Now, anyone can participate in the liquidity game by depositing USDC into the HLP vault, with annual interest rates ranging from 0% to 20%.

With the HLP vault, everyday users can join in and earn a portion of the trading fees. You don’t need to be part of an elite team or institutional participant to enjoy the fun of market making.

Fee Distribution: The HLP vault distributes 20% of trading fees to liquidity providers. Shares depend on the proportion of liquidity contributed to the pool.

HIP-1 and HIP-2

In addition to the perpetual contract market, Hyperliquid also offers spot markets built around two innovations: HIP-1 and HIP-2.

HIP-1 and HIP-2 represent significant advancements in the DeFi space. HIP-1 simplifies token creation and distribution, while HIP-2 ensures liquidity.

HIP-1: Permissionless Token Deployment and Spot Order BooksKey

Key Features:

- Permissionless deployment of native tokens

- Creation of on-chain spot order books

- Flexible token distribution mechanisms

Benefits:

- Allows users to create and list new tokens without centralized approval

- Enables customizable token distribution strategies

- Supports a community-driven token ecosystem

HIP-2: Enhanced Liquidity Mechanism Concept: Inspired by Uniswap, HIP-2 introduces a new approach to enhance the liquidity of HIP-1 tokens.

Concept:

A novel mechanism inspired by Uniswap, aimed at enhancing the liquidity of the HIP-1 token spot order book.

Key Features:

- Permanent liquidity commitment to special spot order books

- Fully on-chain liquidity strategies

- Synergy with the liquidity of other market participants

Ecosystem and Community

Thus, beyond the technology behind L1, Hyperliquid possesses something that other L1s do not. In a world where every new token seems to have venture capital backing, Hyperliquid seizes the opportunity for independent development, considering a community-first approach, and honestly, their organic growth is quite impressive.

This community-oriented approach has attracted the attention and focus of builders and users alike.

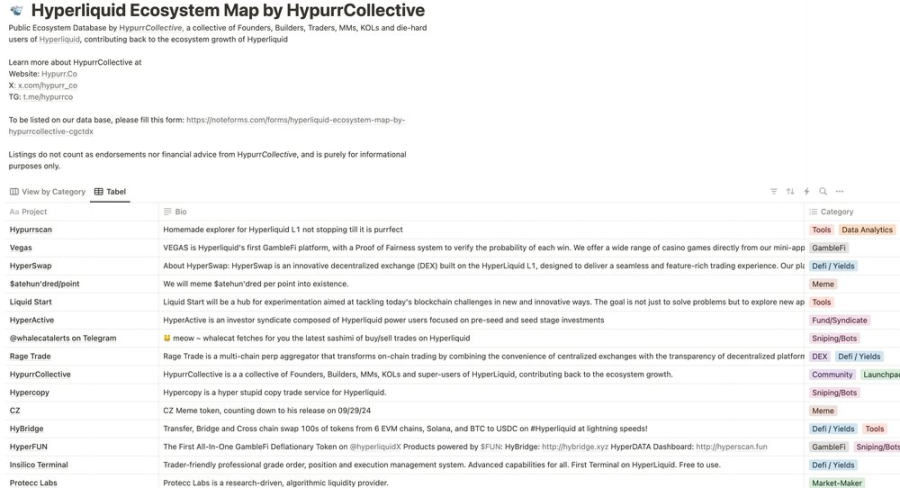

With its futures, spot markets, and HyperEVM L1, Hyperliquid is far more than just an on-chain perpetual contract exchange. The ecosystem is rapidly expanding, with numerous projects launching on L1.

A group of founders, builders, KOLs, market makers, and advanced users have decided to build on the Hyperliquid ecosystem. You can check out their work here: Hyperliquid Ecosystem Map by HypurrCollective

Hyperliquid vs. Binance

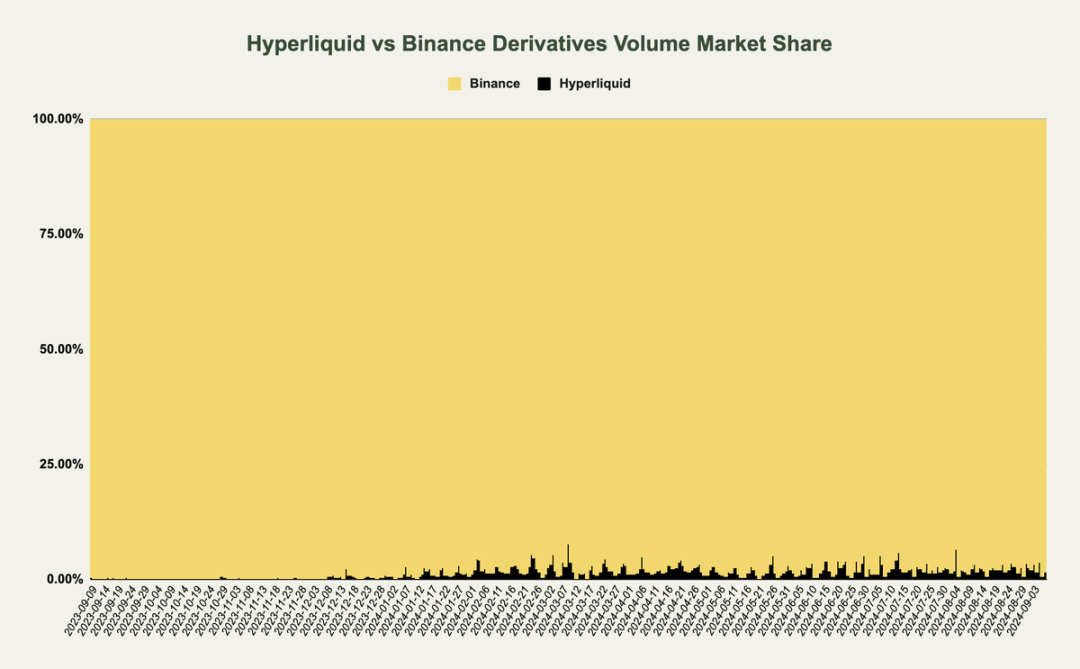

Of course, Hyperliquid is doing well in on-chain trading, but to be honest; it has a long way to go before dreaming of catching up with Binance.

Binance processes daily trading volumes of $4 to $60 billion through futures trading, while Hyperliquid handles $1 to $3 billion daily.

Hyperliquid has immense market potential, and the road ahead is long, but they are just getting started.

According to the chart, Hyperliquid is expected to account for about 2% to 3% of Binance's trading volume.

Hyperliquid Points Prediction

The second season of points ended on October 1, and now everyone is discussing whether there will be more seasons before the potential debut of the Hyperliquid token.

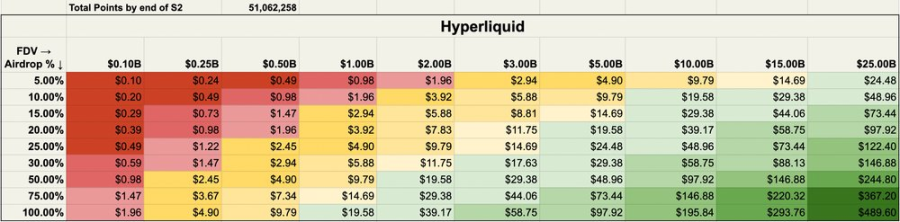

By the end of the second season, the total points reached an astonishing 51,062,258 points. The following chart shows how the price of 1 HL point performed under different token FDV and airdrop percentages.

So, here’s the thing: we might see significant selling pressure at TGE, as farmers may want to cash out. If we see a big discount, I would seize the opportunity to buy as many HYPE as possible. So, keep a close eye on the Hyperliquid TGE — it will be interesting.

Additionally, without venture capital support, there is a chance to get a larger airdrop pie. Some dream of up to 50% of the supply being allocated for airdrops.

Since the community is at the core of the project, I think a generous 20-25% airdrop is more realistic.

If the FDV reaches $2 billion, our target is $9.79 per point.

$800/Point Theoretical Reality

@crypto_adair popularized this theory, which has almost become a meme in the crypto space. To turn fiction into reality, the following scenarios are needed:

- Assume there are 51 million points, with 50% allocated to point holders at TGE.

- $80 billion FDV peak.

- $80 billion * 50% = $40 billion.

- $40 billion / 51 million points = $784 per point.

Can Hyperliquid reach such a valuation? It is possible.

Is it likely? That's another story. Therefore, to achieve sky-high valuations, our strategy is as follows:

- Bring in the big players (institutional adoption): Hyperliquid is rolling out the red carpet for institutional investors. It's like competing for money with Wall Street but with a decentralized twist.

- Open the doors to everyone: Hyperliquid is not just for the crypto crowd. Its mission is to provide financial services to regions that are often overlooked around the world. By offering decentralized trading and financial services to anyone with Wi-Fi.

Final Thoughts

In recent months, we have seen projects like Starknet and ZKsync still struggling to build loyal communities beyond airdrop hunters.

Maintaining user interest after the points season ends will be a significant challenge. However, Hyperliquid seems to be in a good position. According to The Block, despite the points activity ending on October 1, Hyperliquid continues to dominate in trading volume:

Hyperliquid will be seen as one of the most obvious bets of this cycle. You may say I am biased, but I am very optimistic about this project. I strongly encourage you to try the product and form your own opinion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。