Quick Read

✅ Macroeconomic Market Summary

Market Prosperity Index: 85 (Previous Value) → 80 (Current Value)

Bullish Factors Considered

- The options market still holds significant hope for the year-end market.

- As the high leverage below gradually clears, the upward price pull increases.

Bearish Factors Considered

- The trend of net inflows into ETFs has not sustained, weakening price support.

- The Federal Reserve's meeting minutes significantly reduced expectations for interest rate cuts this year.

? Market Summary

- The funding situation is not optimistic, with continuous outflows from the market.

- On the chip front, after a long period of consolidation, on-chain chips have loosened, forming a triangular structure.

- On the technical front, BTC may enter an upward structure, but there is a conflict between technical and funding aspects; while actively going long, one should also be cautious of risks.

? Popular Tracks Summary

- BTC has seen a pullback, and altcoins have followed suit.

- Altcoin indices and other indicators suggest we are still some distance from an altcoin season.

- In the track area, MEME frenzy continues, with fan tokens rotating.

? Popular Projects

1. Chiliz (Infrastructure, Layer 1)

Reasons for Popularity

- Jointly held airdrop event with Binance.

- The sports sector is experiencing a general rise.

- On-chain capital movements.

Suggestions to Watch

- Results of subsequent airdrop activities.

- Whether Chiliz continues its development.

2. Moonwell (Lending Protocol)

Reasons for Popularity

- Launched on Coinbase.

- Introduced cbBTC service.

- Resources from Coinbase.

Suggestions to Watch

- Whether it can maintain market leadership for cbBTC.

- Performance of token prices.

Key Data Release Days

Important data releases this week Source: Macromicro - @10xWolfdao Compilation

--(The following is a detailed explanation of this issue)--

I. Macroeconomic Market Interpretation

1. Summary of Federal Reserve Meeting Minutes

- Significant interest rate cuts are neither a sign of economic concern nor a signal for rapid rate cuts.

The Federal Reserve meeting minutes state that officials unanimously believe that larger interest rate cuts approved at the meeting should not be seen as a signal of concern about the economic outlook, nor should they be interpreted as a signal that the Fed is preparing to cut rates quickly. Officials generally agree that monetary policy remains restrictive, and policy decisions should be adjusted based on the actual evolution of the economy.

- Both delaying and prematurely cutting rates carry risks.

Some participants emphasized that delaying or insufficiently reducing the restrictive nature of policy could excessively weaken economic activity and employment. However, prematurely or excessively loosening policy could reverse progress in curbing inflation. In light of the uncertainty surrounding the long-term neutral interest rate, they advocated for a gradual reduction in policy restrictions.

- Inflation upward risks have weakened, while employment downward risks have increased.

The meeting also highlighted the balance between the increasing risk of a weak job market and the weakening inflation risk. Although geopolitical factors may lead to upward inflation, the risk of a significantly weakened job market has not yet increased.

- Economic activity continues to expand at a steady pace.

U.S. economic activity continues to expand steadily, with consumer spending showing resilience, although middle- and low-income households may face pressure for future spending to slow.

- Labor market conditions have eased.

While labor market conditions have eased and job growth has slowed, the overall situation remains solid, and participants believe there is no need for further cooling to help inflation return to 2%.

- Inflation remains high, but its trend is consistent with a return to target levels.

Although inflation remains high, it shows a trend toward returning to target levels. The decline in food and energy prices plays a key role, and the slowdown in nominal wage growth is unlikely to become a source of widespread inflationary pressure in the near term. Overall, participants firmly believe that sustained efforts to restore the inflation rate to the 2% target remain a priority.

II. Market Data Analysis

1. Capital Inflows

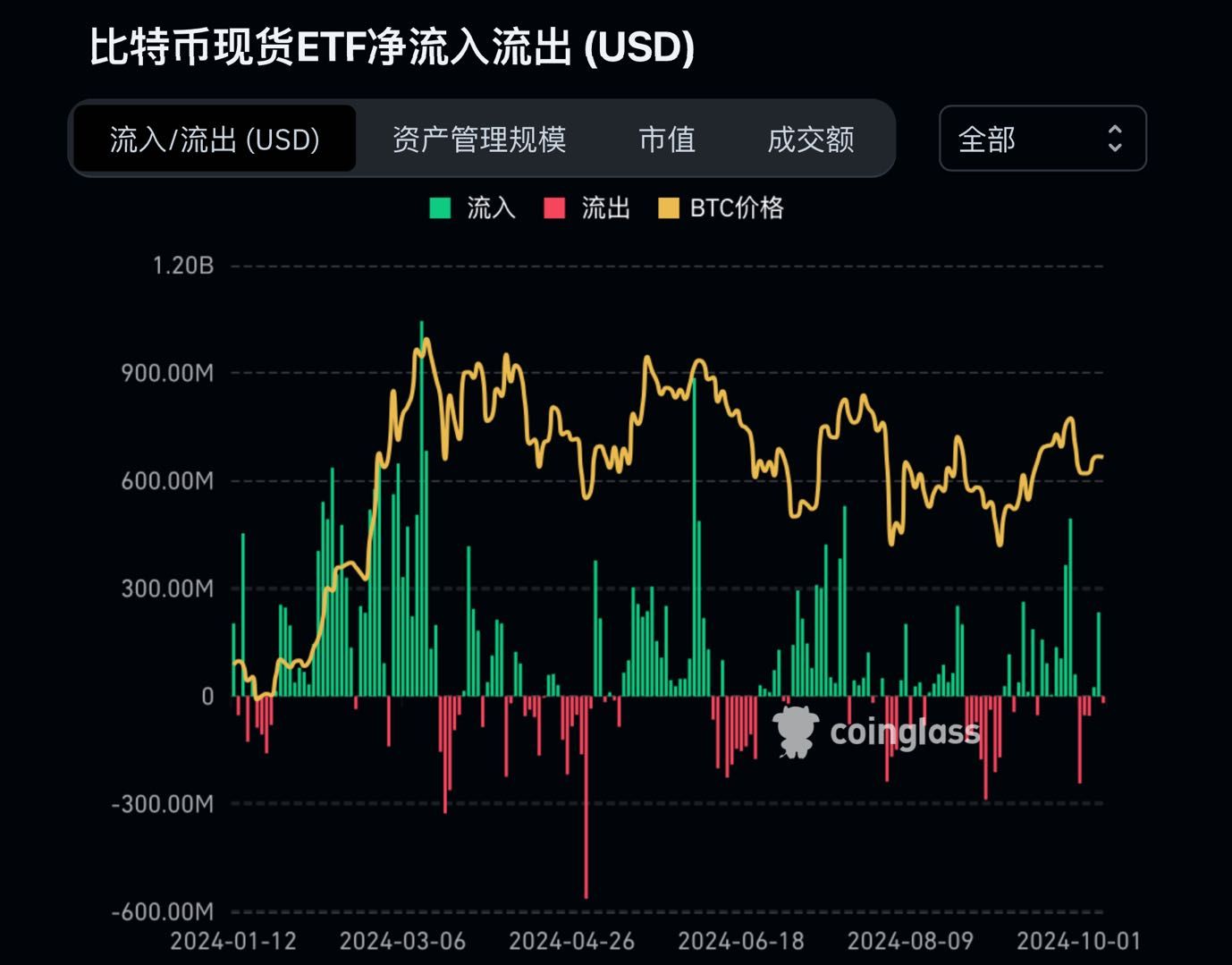

1.1 ETF Capital Inflows / Outflows

Bitcoin Spot ETF Net Inflows/Outflows (USD) Source: Coinglass - @10xWolfdao Compilation

Bitcoin Spot ETF Trading Volume Source: Coinglass - @10xWolfdao Compilation

The ETF has experienced the situation we were concerned about in the previous weekly report, with net inflows turning into net outflows, and the inflow amount decreasing, which has pushed prices down. Although there has been some return flow, the lack of stable inflow support has led to a net outflow situation again since Wednesday, so prices have not returned to previous levels.

1.2 USDC & USDT Stablecoin Circulation

This Thursday (10.10), the number of stablecoins was 154.464 billion, compared to 155.141 billion last Thursday (10.03), a decrease of 6.77 billion this week. Compared to 155.797 billion on September 29, it has decreased by 13.33 billion, indicating that the funding situation is not optimistic. Since September 30, BTC ETFs have seen a net outflow of 246 million USD, and capital is a confirming factor of trends. In the short term, capital is flowing out of the market, and the market lacks a fundamental basis for sustained upward cycles.

Source: Glassnode - @10xWolfdao Compilation

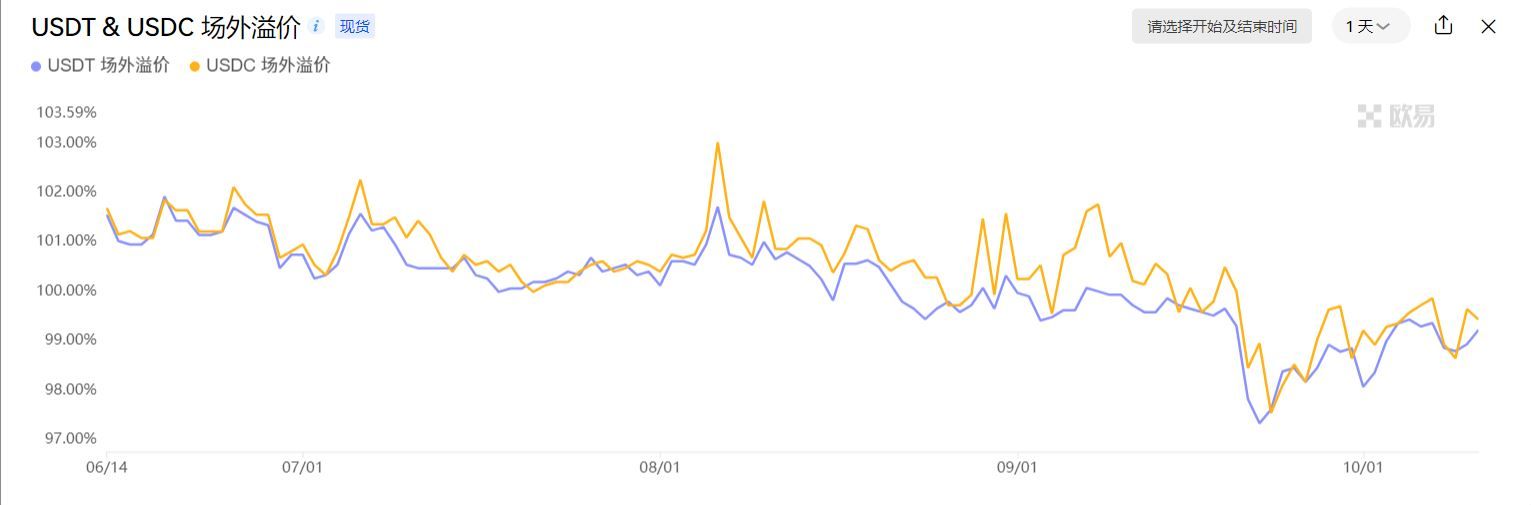

1.3 USDC & USDT OTC Premium/Discount

USDT & USDC OTC Premium Source: OKX - @10xWolfdao Compilation

Since September 20, both stablecoins have maintained a discount level, which can be said to be the lowest premium level observed since we started monitoring in our weekly report, and this has lasted for quite a long time. It remains to be seen how this will perform with the state of the domestic economy in China.

2. BTC Market Analysis

2.1 Macroeconomic Radiation

Source: Tradingview - @10xWolfdao Compilation

This week continues to maintain a volatile trend, with a pullback occurring as expected, but overall showing a trend of gradually narrowing volatility range. It is expected that 58,000 to 59,000 will be a key support-resistance exchange point, which is anticipated to be a critical support level for this downward trend and needs to be closely monitored.

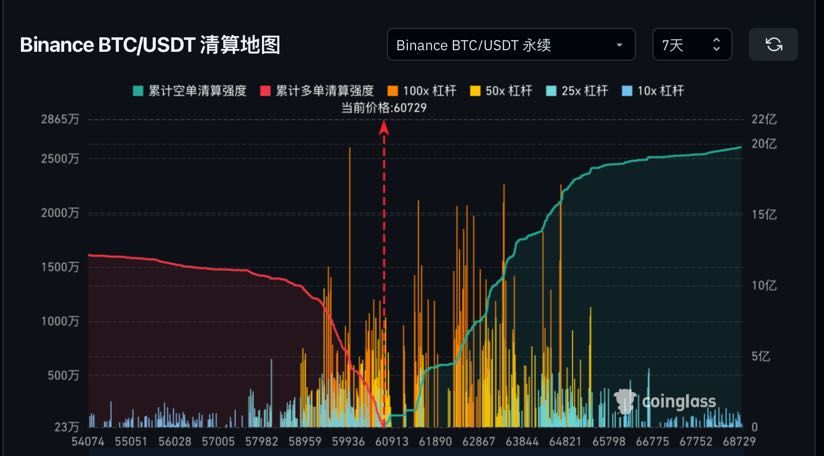

Binance BTC/USDT Liquidation Map Source: Coinglass - @10xWolfdao Compilation

According to the liquidation map, there are currently many high-leverage long positions concentrated around the price of 59,000, forming a strong price pull. If the price runs near 59,000 and clears the high leverage, and if there is no significant drop, it will continue to return to an upward trend, with a potential return to 64,000. Meanwhile, the maximum pain point for options contracts expiring on October 18 is also around 62,000, so the resistance for price upward movement is relatively small.

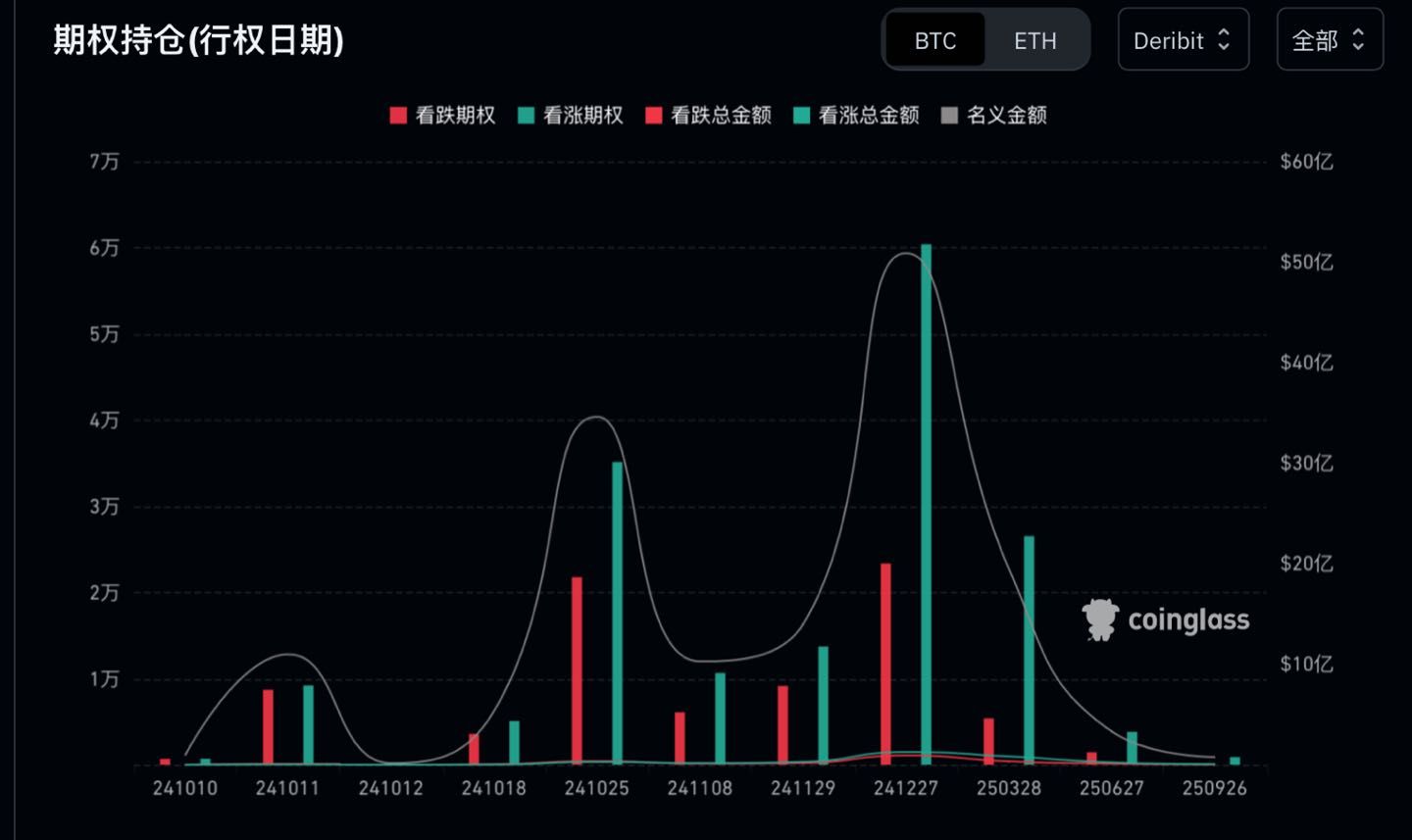

Source: Coinglass - @10xWolfdao Compilation

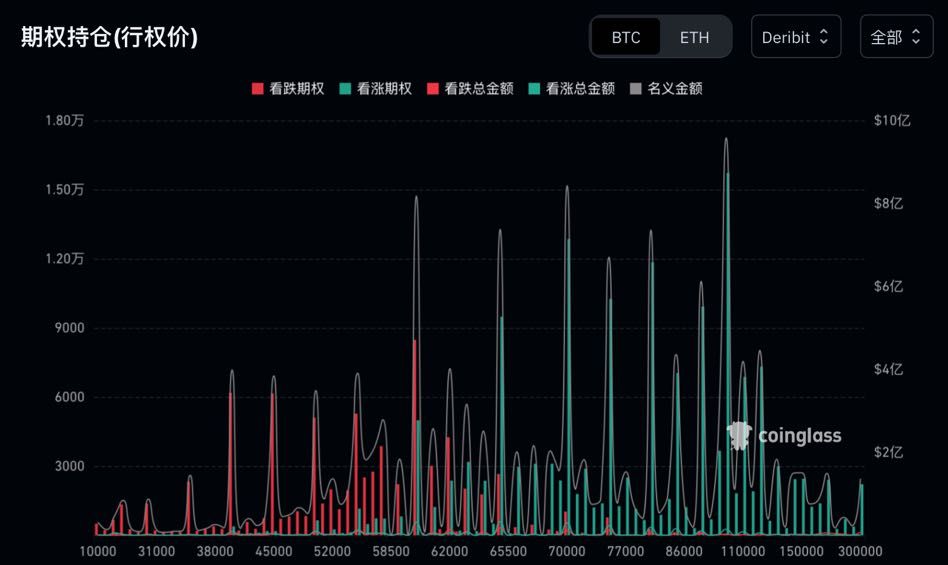

According to the options expiration date situation, more people are placing their expectations on the market after two rate cuts at the end of the year. Based on historical data, BTC's volatility is expected to increase significantly by the end of the year, and hedging positions are still concentrated on contracts expiring at the end of this month, with no excessive expectations for the November market.

Source: Coinglass - @10xWolfdao Compilation

Options positions still maintain a large proportion of deep out-of-the-money options, with 100,000 still being the peak for call options, followed by a peak for call options around 70,000. Therefore, these two points are psychological expectation levels for bulls and also positions that bears consider for hedging.

2.2 BTC Futures Market Data

The funding rate for perpetual contracts has significantly increased compared to last month and remains stable, indicating that there is no significant fluctuation in market sentiment at present. We previously mentioned that the market's rise before September 29 was largely influenced by the contract market, which would have poor sustainability. Ultimately, during the decline on October 1, the market deleveraged, and the contract open interest also decreased, but there has been a tendency to rise again in the last two to three days.

Source: glassnode - @10xWolfdao Compilation

2.3 BTC On-Chain Address Data

Change in the number of addresses holding more than 1000 BTC Source: Glassnode - @10xWolfDAO Compilation

Source: Glassnode - @10xWolfDAO Compilation

From the distribution ratio data of addresses by the number of coins held, the number of addresses holding between 1K and 10K coins has decreased by 0.291% in the past two weeks.

Change in holdings Source: Glassnode - @10xWolfDAO Compilation

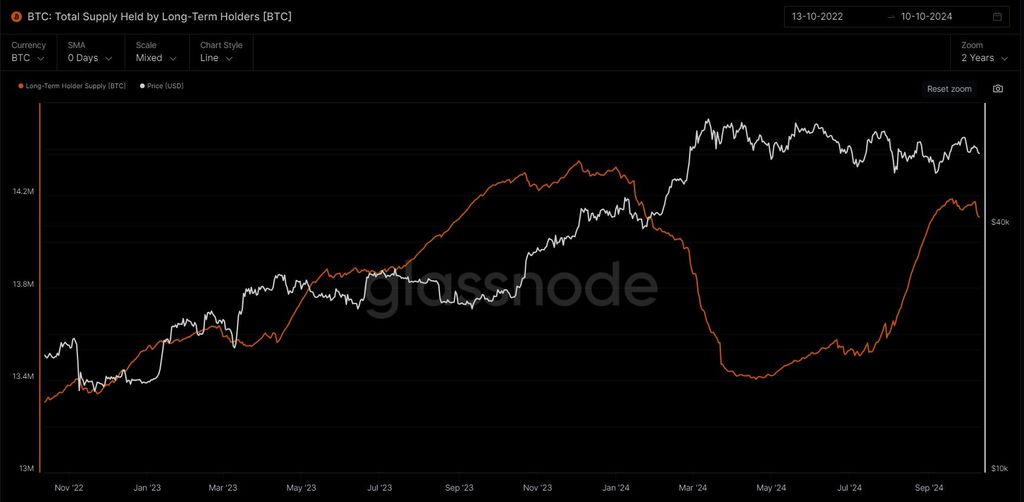

From the perspective of short-term and long-term chips, the data trend for short-term chips has stopped falling, while the data trend for long-term chips shows a stagnation in growth, which reflects a positive situation in the on-chain data.

2.4 BTC On-Chain Chip Data

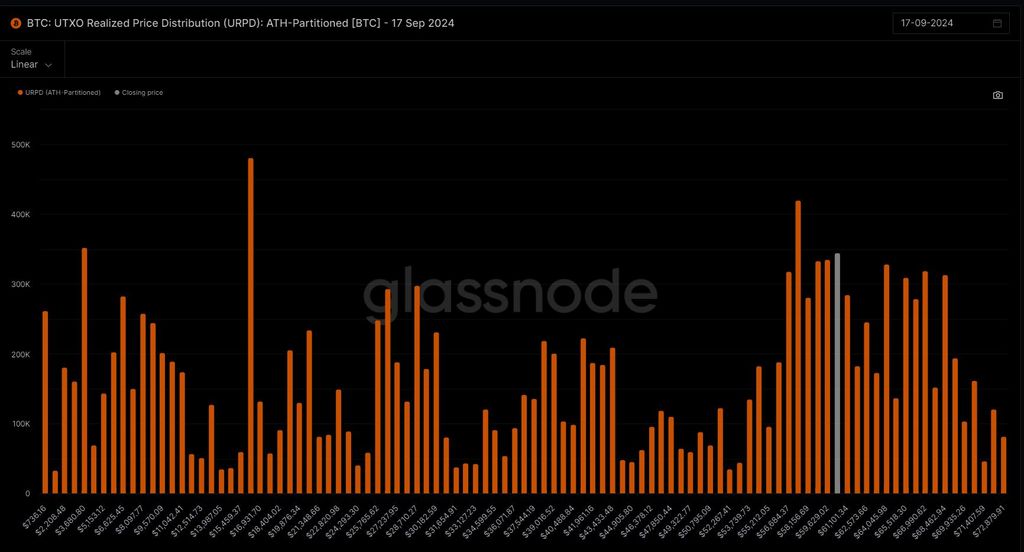

The current chip structure is undoubtedly healthier compared to the previous wide-range chip structure (taking September 17 as an example) and possesses momentum for both upward and downward movement.

Source: Glassnode - @10xWolfDAO Compilation

Currently, the two pillars at 61837-62573 hold 5.59% of the chips, clustering at this position. From the chip perspective, this will be an important price point for the long-short battle. After several months of consolidation, the chip proportion at 63309-68462 has decreased to 11.46%.

3. Technical Analysis & Trading Thoughts Review [Monthly]

The weekly chart is above the 21-week moving average, and we should still maintain a strong bullish mindset. The weekly MACD is about to golden cross but has not yet done so. The daily chart shows two phases of adjustment, with the second phase stopping the decline and entering an upward structure on the right side. The first target is 66,000, followed by a new high around 72,000, to see if it can quickly reach 66,000 and whether 66,000 can hold without destructive adjustments. The daily MACD is still in an adjustment structure.

After the decline, ETH has shown a rebound, and the second wave has demonstrated a resistance to falling. The market's rebound in the past two days is within expectations, and we need to see if the rebound can be sustained and whether ETH can reverse its weakness, at least recovering to the halfway point of the decline.

From the perspective of the external market, MicroStrategy in the U.S. stock market rose 18% this week. From its own structure, BTC has entered a rebound structure, so from a technical perspective, we should maintain a positive bullish mindset.

Three, Market Heat

1. Altcoin Overview

Abstract

- BTC has pulled back, and altcoins have followed suit;

- Altcoin indices and other indicators suggest we are still some distance from an altcoin season;

- In the track area, MEME frenzy continues, with fan tokens experiencing a general rise.

BTC Pullback Causes Altcoin Market to Follow, MEME Sector Strong

This week, BTC pulled back and briefly fell below the 60,000 mark, with the daily chart seeking support points again. Altcoins collectively fell, but the MEME market remains very hot.

Performance of the crypto market this week Source: CryptoBubbles - @10xWolfdao Compilation

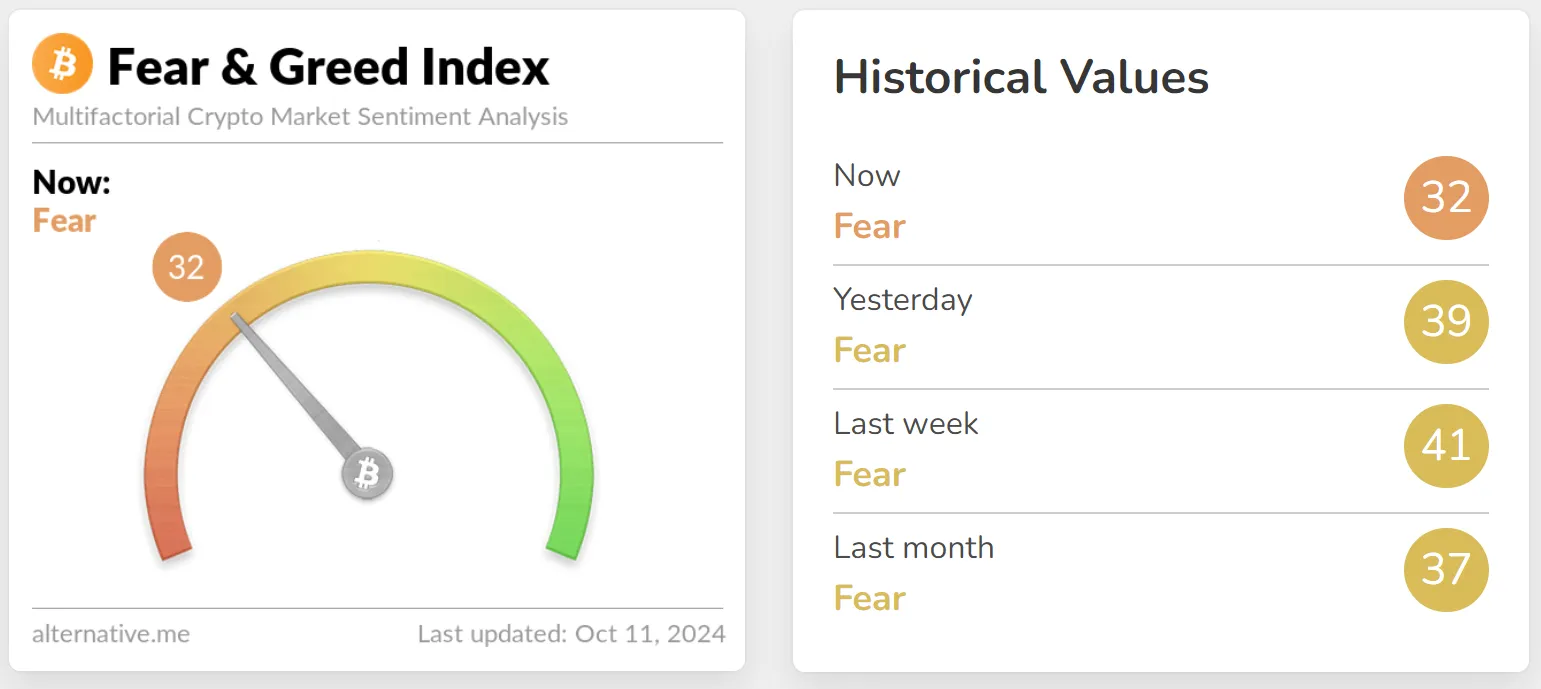

Market Sentiment Falls Back into the Panic Zone

This Friday, the sentiment index was 32, down 21% from last week.

Crypto market fear index this week Source: Alternative - @10xWolfdao Compilation

Altcoin Index Falls, BTC Market Share Hits September 2020 Resistance Level

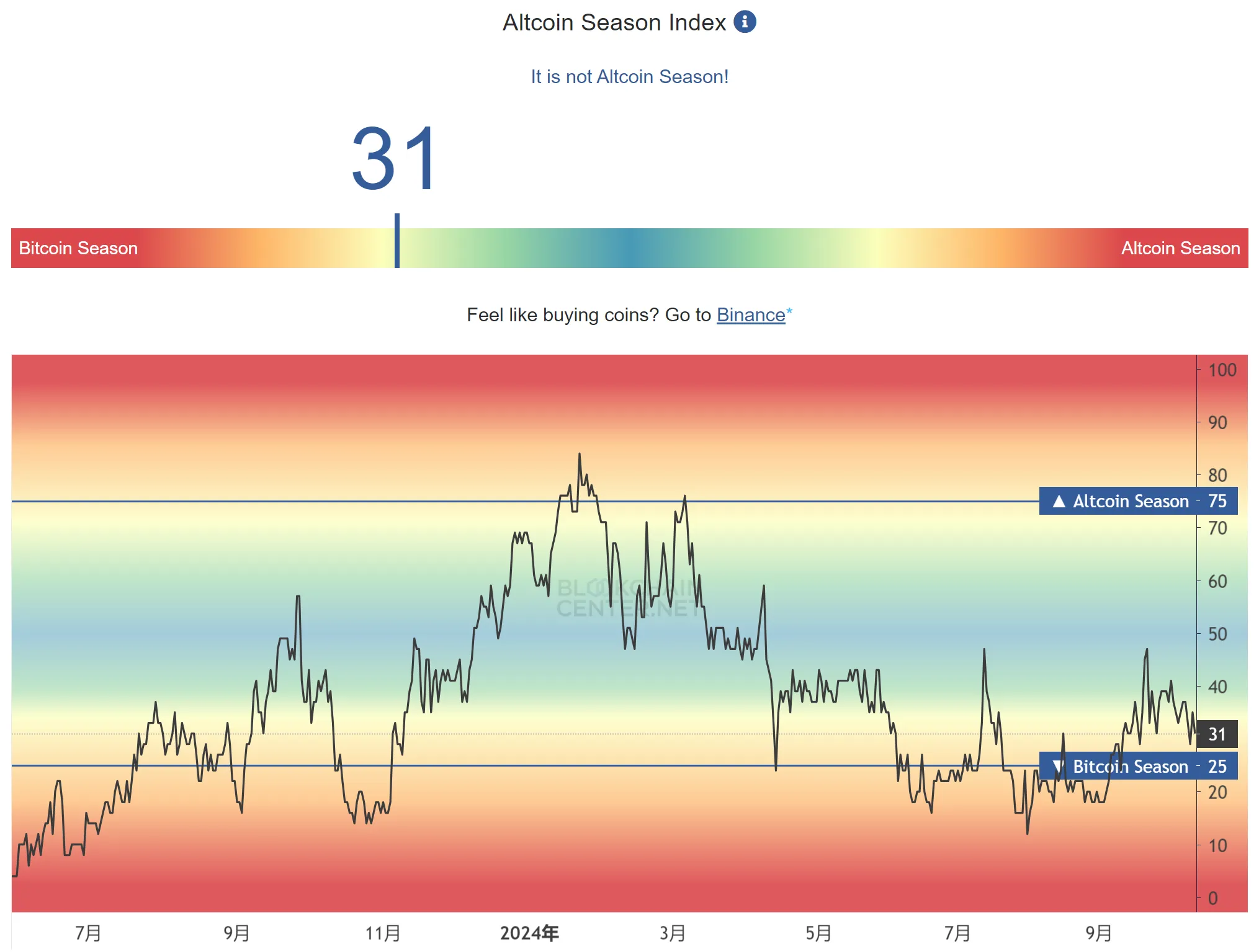

This Friday, the altcoin index fell to 31, having peaked at 46 a few weeks ago, and the altcoin market remains pessimistic.

On the weekly chart, BTC's market share has not shown signs of falling back in the short term, and the continuous increase has reached important resistance levels from June 2019 and September 2020. If it breaks through (officially starting the subsequent bull market), the three key resistance levels below may be at 62%, 65%, and 68%.

Source: Tradingview - @10xWolfDAO Compilation

TOTAL3 (the market cap of all tokens excluding BTC and ETH) has currently retraced to a key trend line;

Source: Tradingview - @10xWolfDAO Compilation

We still need to observe whether this trend line can truly form support, thereby establishing a new upward trend.

Source: Tradingview - @10xWolfDAO Compilation

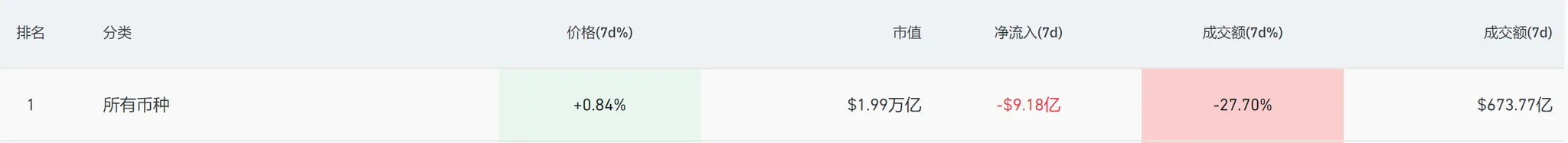

Funding Situation Weakens

This Friday, the total trading volume of all cryptocurrencies decreased by 27% compared to last week, with a net outflow of 918 million USD. The trading volume across all sectors has decreased to varying degrees compared to last week.

Source: Coingecko - @10xWolfdao Compilation

In terms of net inflows, there was a complete loss, with the sectors experiencing the least outflow being storage, Polkadot, and the Ethereum ecosystem, all below 20 million USD, while Layer 1, Solana, and smart contract sectors saw net outflows exceeding 100 million USD.

MEME Sector Flourishes, Fan Tokens Experience Rotation

- MEME

Recently, Muard Mahmudov's speech on "MemeCoin Supercycle" at Token 2049 ignited the market, with a series of MEME tokens rising by dozens to hundreds of times.

POPCAT's market cap has surpassed Brett, becoming the current largest cat MEME; some alternative culture MEME tokens with cult attributes have surged the most:

Cultsmeme Market Cap Classification - @10xWolfdao Compilation

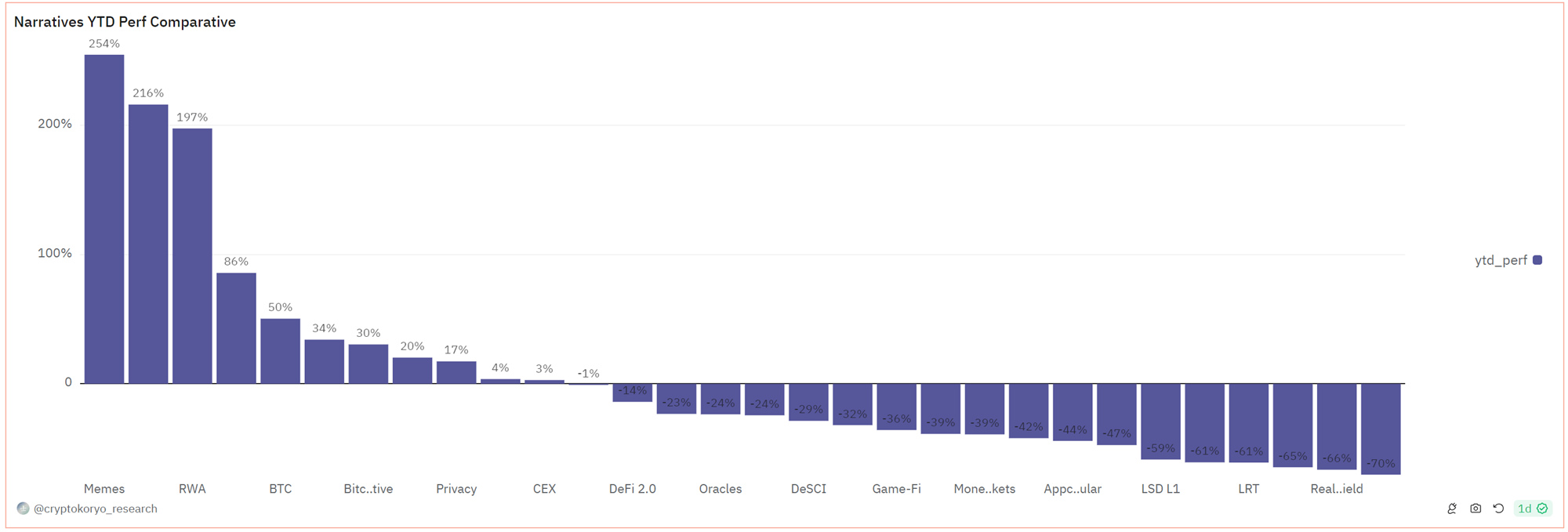

Based on the performance of the sector throughout this year, the MEME sector ranks first and still has the opportunity to maintain this trend in the upcoming bull market.

We believe that certain blue-chip MEME tokens with certainty, good liquidity, and a certain market cap are worth paying attention to and positioning in.

- Fan / Sports

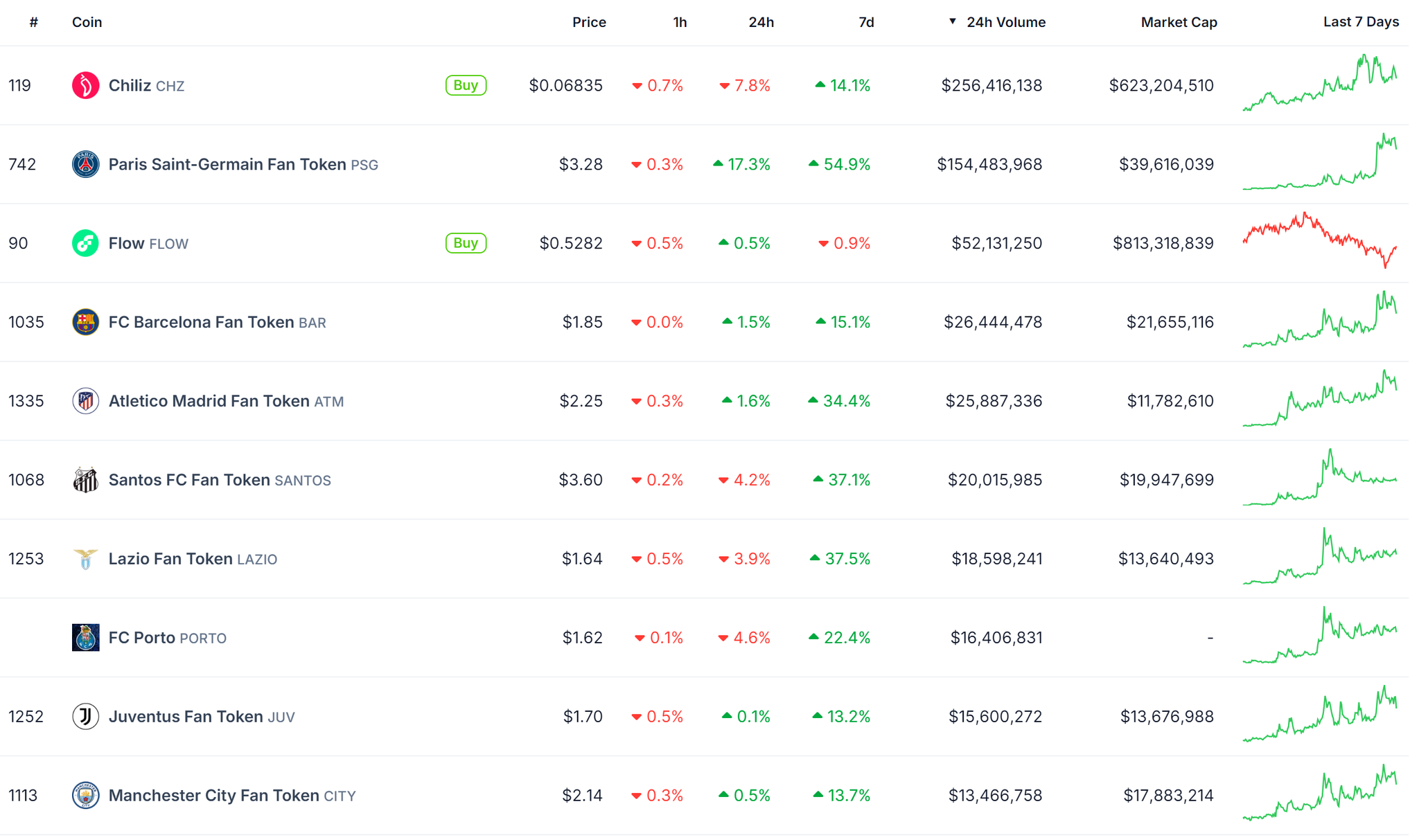

This week, most fan tokens experienced a general rise, driven by the joint airdrop event between Chiliz and Binance, which reignited interest in the entire sector, leading to a rotation in some altcoin market segments.

Source: Coingecko - @10xWolfdao Compilation

The attention on Chiliz was also included in this week's public sentiment project recommendations, which will be introduced by Teacher Dong in the next section.

Overall, the heat in the altcoin market this week has primarily focused on MEME, with market speculation around MEME becoming increasingly fervent, drawing in more retail investors.

As other narratives currently lack significant speculative momentum, and referencing the market from Q4 last year to Q1 this year, MEME has historically led the rally across all sectors. Therefore, we speculate that the MEME craze may continue in the short term. Other sectors still need to wait for BTC to initiate and for various catalysts that can drive the entire sector.

2. Public Sentiment Strategy Review and Hot Projects

2.1 Short-Term Public Sentiment Summary (One Week)

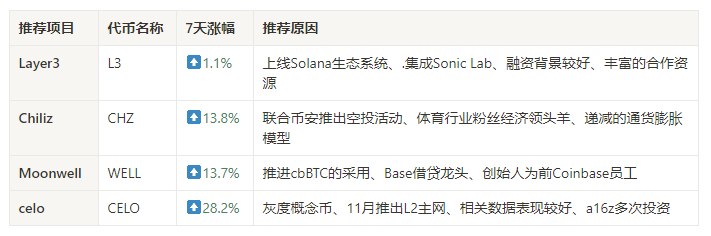

This week's public sentiment focus on project market fluctuations - @10xWolfdao Compilation

3. Popular Projects

1️⃣ Chiliz (Infrastructure, Layer 1)

Reasons for Popularity

- Joint airdrop event with Binance

- General rise in the sports sector

- On-chain capital movements

Suggestions for Attention

- Results of subsequent airdrop activities

- Whether Chiliz continues to build

Chiliz is a blockchain fintech provider focused on the sports and entertainment sectors. Chiliz developed the blockchain-based fan engagement and rewards platform Socios.com, which is built on the Chiliz blockchain infrastructure and uses CHZ as its exclusive platform currency. Fans can purchase and trade fan tokens branded by partner clubs, as well as participate in, influence, and vote on club surveys and polls. Chiliz aims to cultivate a blockchain ecosystem built for sports and entertainment.

General Rise in Fan Token Ecosystem

The long-silent fan token ecosystem has recently experienced a general rise, primarily led by fan tokens supported by Chiliz. This occurred in two waves: the first wave was led by the OG Fan Token of the OG esports team on October 8, and the second wave was triggered by the fan token PSG of Paris Saint-Germain on October 11. The current total market cap of the entire ecosystem is $292 million, with a 24-hour growth of 5%. This sudden surge did not have any actual positive news on the information level; rather, it is more of a rebound after a long period of consolidation. There is potential for overall token appreciation, but it is uncertain how long this enthusiasm will last, primarily depending on market capital reactions.

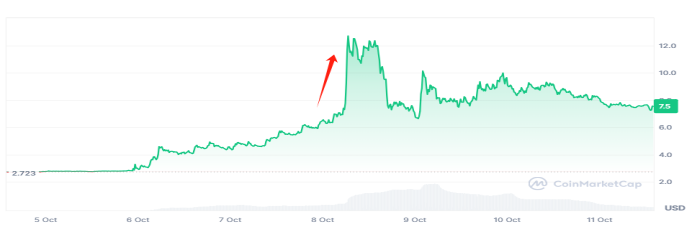

OG Fan Token Weekly Performance Source: coinmarketcap

Generally, the rise and fall of the fan token ecosystem are highly correlated with the corresponding real-life teams, squads, or recent important matches. For example, the fan token ARG of the Argentina national football team, which has superstar Messi, quickly surged after the start and victory of the 2022 World Cup. Similarly, this year's Argentina team reached the Copa America finals, and ARG also doubled in price, but later, as related enthusiasm and discussions declined, it experienced significant drops, indicating a high degree of timeliness and correlation with public sentiment.

ARG Price Performance in 2022 Source: coinmarketcap

Web3.0 Sports Industry Leader

As the foundational architecture for building the fan token economy, Chiliz has a vast market and profit space. Among various fields, the sports industry (including esports) has the strongest gathering power and a large supporter base. Particularly, football, as the world's number one sport, attracts the attention of over 3 billion people, with fans making considerable expenditures. Chiliz has already partnered with over 70 world-renowned teams, including Manchester City, Inter Milan, Barcelona, Juventus, and Paris Saint-Germain, to launch fan tokens.

Currently, Chiliz is collaborating with Binance and Bitget to launch the pepper series airdrop activities, which will take four snapshots before the end of October, attracting market attention. The official on-chain capital has also been active recently, continuously transferring assets, which not only facilitates airdrop distribution but may also indicate that CHZ will see some capital inflow. If we were to entertain conspiracy theories, the recent surge in fan tokens could also be orchestrated by the officials. Overall, further observation of Chiliz's overall development is needed.

2️⃣ Moonwell (Lending Protocol)

Reasons for Popularity

- Launched on Coinbase

- Introduced cbBTC service

- Coinbase resources

Suggestions for Attention

- Whether it can maintain market leadership in cbBTC

- Token price performance

Moonwell is an open decentralized DeFi lending protocol based on Moonbeam, Moonriver, and Base.

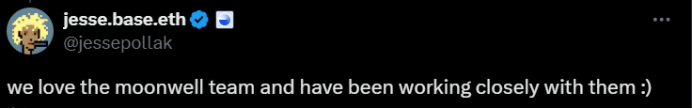

Support from Coinbase Resources

First, the core team of the Moonwell project consists of former engineers from Coinbase and Google, with co-founder Luke Youngblood being a former senior engineering advisor at Coinbase and chief engineer at AWS, responsible for building Coinbase's price oracle and staking rewards infrastructure. Therefore, key executives, including Base's founding contributors Jesse and Coinbase's technical leads, have expressed support for the project, and Coinbase Ventures has also become an early shareholder of Youngblood.

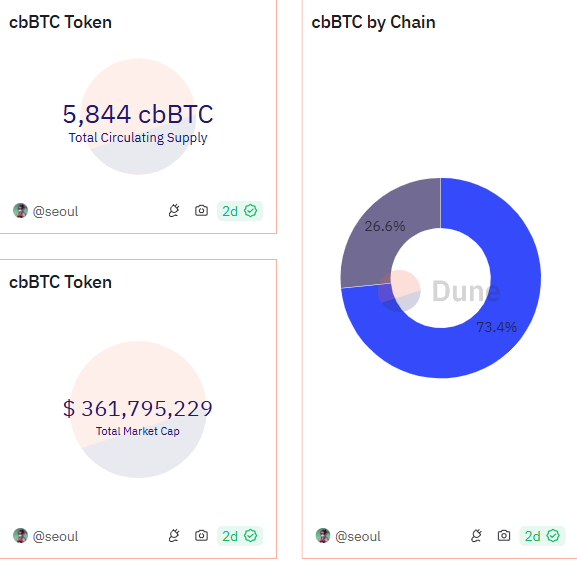

Secondly, Coinbase's core product is its wrapped Bitcoin, Coinbase Wrapped BTC (cbBTC), which had a circulating supply of 5,844 coins as of October 11, with 26.6% on the Ethereum chain and 73.4% on the Base chain. Moonwell is the first lending application on the Base chain to support cbBTC, and Coinbase will invest resources to promote cbBTC through Moonwell.

CbBTC Circulation Information Source: Dune

At the same time, compared to Aerodrome, another DeFi project on the Base chain, both are part of Coinbase's expectations for cbBTC DeFi summer. After launching on Coinbase, Aerodrome's token price saw a significant increase, with an FDV of $1.55 billion, while the recently launched Moonwell has an FDV of only $174 million. Considering the number of tokens, there is significant potential for appreciation. The main focus going forward will be whether Moonwell can maintain its leadership in the cbBTC market.

Special Thanks

Writers: Sylvia / Jim / Mat / Cage / Nora / WolfDAO

Editor: Punko

Thanks to the above contributors for their outstanding contributions to this week's report, which is collaboratively published by @10xWolfDAO for learning, research, or appreciation purposes only; the content is original, and please indicate the source if reprinted.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。