Unichain Leads a New Era in DeFi.

Written by: Heechang, Dan Elitzer

Translated by: Block unicorn

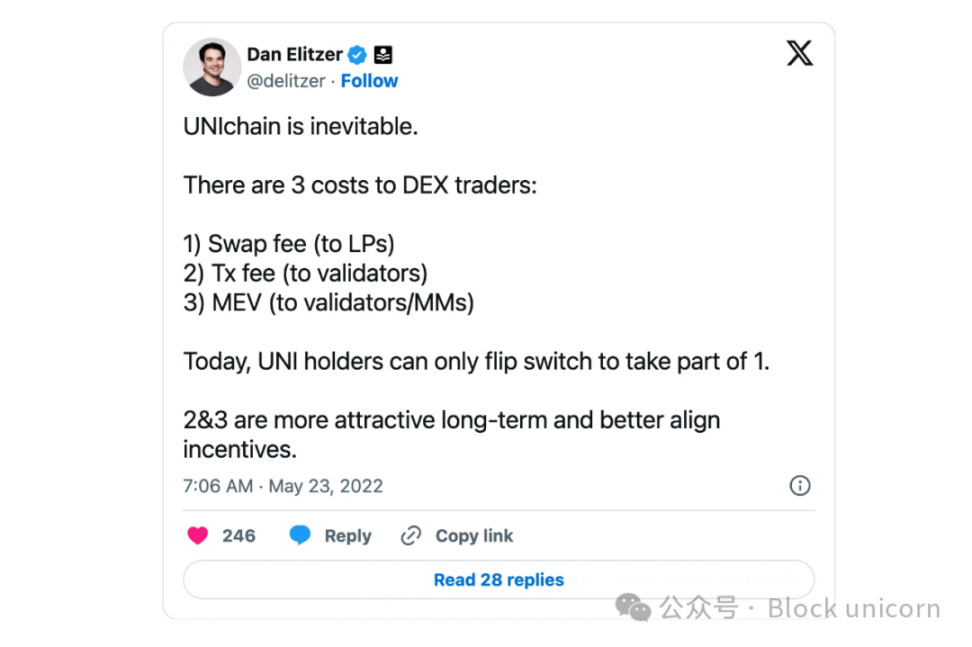

In 2022, Dan Elitzer pointed out (Dan is the founder of IDEO Futures and an industry veteran) that Unichain (the L2 chain launched by Uniswap) is inevitable, as he believes it will stem from the inefficiencies and value loss in the existing Uniswap system. He noted that current Uniswap traders face three costs: exchange fees paid to liquidity providers, transaction fees paid to Ethereum validators, and MEV (Miner Extractable Value) costs.

Today, this prediction has become a reality, as the most widely used decentralized trading protocol for cryptocurrencies, Uniswap, announced the launch of its dedicated Layer 2 solution called Unichain. This OP Stack-based Rollup aims to address key challenges in the DeFi ecosystem, focusing on improving the trading execution environment, enhancing user experience, and solving liquidity fragmentation issues.

1. Background - The Logic Behind Unichain

1.1 Dan Elitzer's Prediction

Dan Elitzer's research shows that the transaction fees paid to Ethereum validators and market makers, along with MEV costs, exceed the exchange fees received by liquidity providers. This means that entities outside of Uniswap are in a more advantageous position for value capture, indicating that the value that should belong to Uniswap users, liquidity providers, or $UNI token holders is being extracted externally.

Block unicorn Note: MEV refers to Miner Extractable Value. When we trade on-chain, speculative traders can bribe miners by increasing miner fees to gain priority in transactions, getting ahead of our trades and seizing arbitrage opportunities, thus increasing our on-chain trading costs.

Summarizing the arguments for the necessity of Unichain: Unichain can help reduce the inefficiencies in value capture caused by transaction fees and MEV costs, and increase the value for $UNI holders. By operating its own chain, Uniswap can significantly lower transaction fees, especially benefiting small trades. Additionally, solutions like interval cryptography or batch exchanges can reduce traders' MEV costs.

The greatest advantage of Unichain is its ability to implement better incentive mechanisms among Uniswap participants. Currently, $UNI token holders have limited options for value capture, mainly confined to governance decisions, such as adjusting exchange fees. A dedicated chain will enable $UNI holders to benefit from transaction fees and internalized MEV, enhancing the value proposition of the token. This approach not only rewards $UNI holders but also creates a more efficient trading platform for users, potentially solidifying Uniswap's position as a leading decentralized exchange (DEX).

1.2 Unichain - Capturing More Value and Achieving Unity

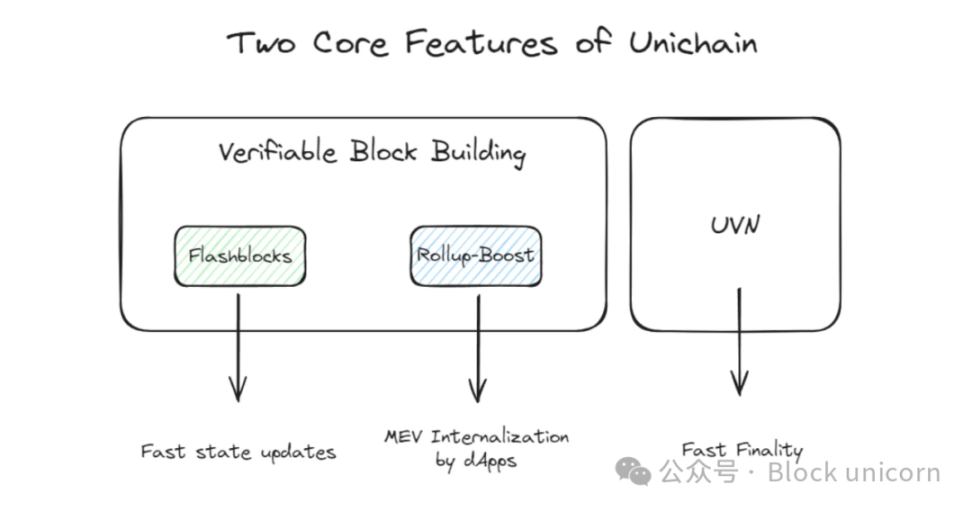

Unichain, as a super chain built on OP Stack, brings two innovations aimed at enhancing efficiency, user experience, and liquidity management across L2 blockchains:

The first key feature is Verifiable Block Building, developed in collaboration with Flashbots, which includes a mechanism called Flashblocks. It achieves an effective block time of 200-250 milliseconds by dividing each block into four sub-blocks. This system allows Unichain to update its state more quickly. Additionally, Unichain uses a Trusted Execution Environment (TEE) to separate the orderers and block builders, implementing Priority Ordering to tax MEV opportunities, enabling applications to directly extract and internalize MEV.

The second major feature is the Unichain Verification Network (UVN), a decentralized network composed of node operators that independently verify the blockchain state. UVN allows Unichain to provide fast finality and settle cross-chain transactions through economic security. When a new block is generated on Unichain, validators must prove that it is part of the authoritative chain, thereby reducing the security risks posed by a single orderer. To become a validator, one must stake $UNI, and if selected as part of the active node set based on staking weight, they will perform validation and receive corresponding rewards. This operational model allows $UNI holders to delegate their stakes to validation nodes and receive allocated rewards.

2. Key Points - The Development Direction Proposed by UniChain in DeFi

Decentralized finance (DeFi) is no longer limited to single applications but has chosen an increasingly complex development path. DeFi applications are actively internalizing the value they generate, operating their own application chains or L2s, and developing wallet services. Application-Specific Sequencing (ASS), which allows applications to directly extract MEV, is also gaining attention. Amid these trends, the launch of Unichain clearly demonstrates the future development direction of DeFi: DeFi with sufficient users and scale will ensure the independence of its own infrastructure.

2.1 DeFi is Becoming "Bulkier"

DeFi is choosing to internalize the value that should have been extracted externally through more complex development processes, improving user experience, or providing self-contained "money legos" through the interoperability of their own financial products.

This trend is reflected in applications that do not adopt L2 or L3 execution methods, using ASS designs to avoid exposure to MEV extraction during the ordering of transactions. For example, controlling the order of transactions that depend on external oracle data allows applications to directly capture MEV (i.e., Oracle Extractable Value, OEV), or they are avoiding MEV exposure through intent-based batch auctions using solver networks. Alternatively, they are enhancing user experience and preventing value leakage to external third-party infrastructures by developing auxiliary infrastructures (such as optimized application wallet infrastructures or mobile interfaces).

2.1.1 ASS (Application-Specific Sequencing): CoW AMM

CoW AMM protects liquidity providers (LPs) from MEV impacts by bundling trades into an offline batch and auctioning off the arbitrage portion. In CoW AMM, whenever there is an arbitrage opportunity, solvers compete for the right to rebalance the CoW AMM pool. The solver that provides the most favorable trading conditions and retains the most profit (surplus) in the liquidity pool will gain the right to rebalance the pool. Through this batch auction, CoW AMM can capture the MEV value that arbitrage bots would extract when rebalancing liquidity pools, eliminating the LVR (loss relative to rebalancing) risk faced by LPs.

2.1.2 Mobile / Wallet: Jupiter / Uniswap Wallet

From the current market share of user devices, mobile devices account for 63%, while desktop devices account for 37%, indicating significant growth in mobile device usage environments. Therefore, establishing a mobile environment has become increasingly important in crypto application development.

Recently, Jupiter launched a mobile application capable of handling all functions from swaps, slippage adjustments, priority fee adjustments to fiat channels in a mobile environment. Users can trade at optimal prices without fees through Jupiter routing, thus gaining a better DeFi experience.

Additionally, Uniswap has also developed and deployed its own wallet service. Through this wallet, users can conveniently swap from Uniswap's liquidity pools at routed transaction prices, while Uniswap Labs charges front-end fees for swaps conducted through the wallet to create sustainable cash flow.

Thus, it is evident that DeFi is no longer limited to the implementation of decentralized exchanges (DEXs), money markets, or options DeFi contracts, but is achieving increasingly complex DeFi through the introduction of ASS or the development of additional infrastructure. In this way, applications maximize internalization of value to redistribute it to participants or provide enhanced application experiences. However, Unichain has chosen its own L2, aiming to become the "home of DeFi and cross-chain liquidity," indicating that for DeFi to create greater potential, expanding to L2 is an important choice beyond a single application.

2.2 From Dapp to L2

With the launch of Unichain, the roadmap for applications expanding to L2 has become clearer. Many applications have chosen to improve their infrastructure and user experience by expanding to L2, starting from single DeFi products (such as stablecoins or liquid staking) and gradually broadening their vision. This L2 transformation can create significant value for applications in two main aspects:

First, based on L2 infrastructure, applications can create various values through unique mechanisms. For example, selling block space based on block demand has long been proven to be a profitable business in the crypto industry, while the income of orderers and MEV extraction creates significant cash flow for L2 operators. Unichain's L2 architecture proposes new possibilities for operating MEV in a differentiated manner through priority ordering. Unichain separates block builders and orderers through TEE, allowing applications to directly control MEV and operate the MEV obtained in agreement with users. In other words, Unichain provides a platform environment where MEV is controlled by applications and users, rather than orderers, and operates under consistent rules. This offers a meaningful methodology for specific applications' L2 to adopt this mechanism to control MEV.

Another value that can be enhanced through the transformation of applications to L2 is from the perspective of token economics. The demand for Uniswap's $UNI token has long been limited, with almost no other use besides governance functions. Therefore, the Fee Switch proposal was put forward early on, aiming to distribute Uniswap's revenue to $UNI holders, but this proposal was not actively advanced due to regulatory concerns.

In this context, the launch of Unichain gives $UNI practical utility. To become a validator in the UVN, one must stake $UNI to build a form of cryptoeconomic security, and $UNI holders can earn allocated rewards by delegating their stakes to validation nodes. Thus, the transformation of applications to L2 creates the potential for the native token to accumulate value, covering various means from orderer income to MEV and staking rewards.

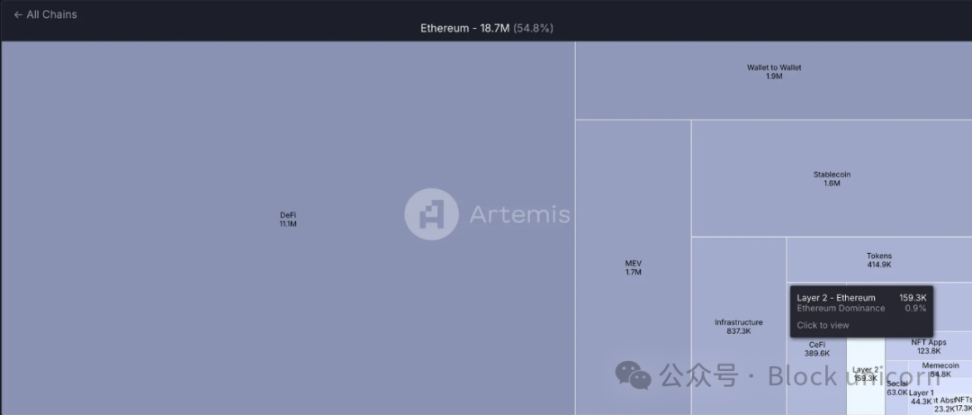

While the L2 transformation can significantly enhance value in these two aspects, is it the ideal development direction for the Ethereum ecosystem? Like all solutions, it brings dual outcomes. From the perspective of the entire Ethereum ecosystem, there are currently over 100 different L2s dispersing liquidity on the Ethereum chain. Additionally, relatively little value accumulation occurs on the Ethereum main chain compared to L2 activities, leading to a "parasitic" economic issue for Ethereum.

2.3 The Value Accumulation Problem of Ethereum

The current system through which Ethereum derives value from L2 solutions has issues. As more applications build their own L2s, these problems become more apparent. Currently, L2s only utilize about 0.9% of Ethereum's total gas fees, indicating a disconnect between L2 growth and mainnet appreciation. Recent updates, such as EIP-4844, further reduce the fees paid by L2s to Ethereum, potentially decreasing the demand for ETH as gas fees.

This situation raises concerns about L2 potentially being economically "parasitic" to Ethereum. Despite Ethereum having a large ecosystem and a strong developer community, its economic model is being questioned. The reduction in fees paid by L2s means a decrease in revenue for the Ethereum network, which could undermine the value of ETH. I believe that while L2 solutions benefit from Ethereum's existing framework, they may not sufficiently support the economic health of the main layer.

However, as the L2 ecosystem expands, it may attract more liquidity, potentially establishing ETH as the primary currency for economic activities within Ethereum. While this may maintain ETH's use as an asset, the question remains: can ETH continue to grow and become a more valuable asset within this system?

3. Other Perspectives

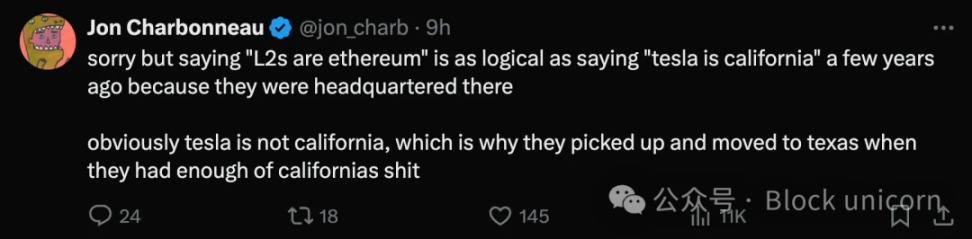

3.1 Jon Charboneau's View: "L2 is Ethereum, just as saying Tesla is California."

3.2 Mason Nystrom from Pantera's Perspective

Key insights on Unichain and its significance:

- Token value accumulation: $UNI evolves from a governance token to a fee accumulation token. Validators with the highest $UNI staked earn rewards by validating the network and collecting fees.

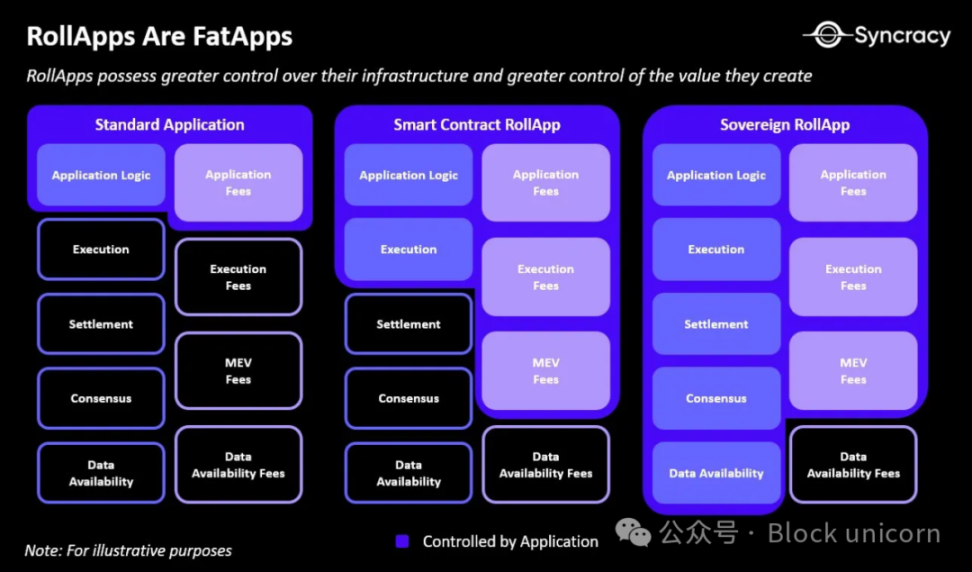

- Unichain supports the "fat application" theory: Applications create their own chains for economic control and block space management. Uniswap's chain will capture fees from various transactions, including swaps, lending, and perpetual contracts, going beyond traditional DEX activities.

- Internalizing MEV: Unichain's verifiable block building and "flash block" ordering demonstrate potential. Applications are exploring how to internalize MEV or redistribute it to users and stakeholders.

- Unichain and Ethereum: Unichain may have a significant impact on the Ethereum mainnet. DeFi activities may shift to Unichain, with the appeal lying in the orderer fees from $UNI staking and better user pricing.

- Vertical integration: Larger applications are motivated to control the entire tech stack—from applications (Uniswap wallet, frontend + Uniswap X) and protocols (Uniswap V4, V3, V2) to the blockchain (Unichain).

These perspectives emphasize the potential impact of Unichain on the DeFi ecosystem, particularly regarding token economics, MEV internalization, and the trend of applications controlling chains.

3.3 Ryan Watkins from Syncracy Capital

In this article, Ryan Watkins questions the notion that Bitcoin and stablecoins are the only valuable blockchain applications. He believes we have entered an era of diversification in blockchain applications. Platforms like Ethereum and Solana now host many applications generating substantial revenue and growing rapidly. Nevertheless, the valuations of these applications still lag behind their underlying blockchain infrastructures. Trends indicate that applications are earning increasingly more blockchain fees, often exceeding the infrastructure assets. This shift may mark a turning point in blockchain development.

The rise of "fat applications" in blockchain represents an enhancement of application autonomy. The drivers behind the development of "fat applications" include the demand for better scalability, improved user experience, and greater economic control relative to underlying infrastructure. As chain abstraction and smart wallet technologies evolve, this application-centric approach is expected to become smoother, potentially reshaping the way value distribution and control occur within the blockchain ecosystem.

Ryan Watkins' perspective highlights the growing importance of applications within the blockchain ecosystem and the implications of this trend for infrastructure and application value distribution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。