Memecoins are not a vampire attack on crypto technology, but a counterattack against traditional Crypto Tokens.

Author: MiX

TL;DR

The era of synchronized rises in crypto assets has ended;

The supercycle of Memecoins has begun, and it is now;

Any crypto asset that does not allocate cash flow to your wallet and cannot serve as a store of value is a Memecoin;

The cryptocurrency industry is not a technology-first industry, but an asset-first industry;

Memecoins are not a vampire attack on crypto technology, but a counterattack against traditional Crypto Tokens;

I only started to seriously ponder Memecoins in April 2024, when Casey, the father of Runes @rodarmor, defined Runes: "Runes were built for degens and memecoins," meaning Runes were born for Memecoins.

Later, I gave a presentation in Hong Kong titled "Runes|Bringing Memes Back to Bitcoin": on one hand, I believe the Runes protocol will become the first standard for issuing Memecoins in the entire Crypto world; on the other hand, I found that the connotation of Meme is expanding, growing, and evolving, from "speculation" to a "growth strategy," and becoming a vehicle for a "social movement."

In the future, things may proceed with Memecoins leading the way, attracting the public to do financial pricing based on consensus, solidifying the community through survival of the fittest, and then doing interesting and valuable things that can, in turn, empower Memecoins. This aligns with the saying "Memecoins are a business card for an ecosystem," implying that without Memecoins breaking out, it is highly likely that this ecosystem lacks even basic community consensus.

Vitalik has also extended and reflected on the value of Memecoins⬇️, and his perspective is quite high-level.

Yesterday, Vitalik was also discussing how Memecoins could bring positive utility to the world.

Today's main text "The Memecoin Supersycle" is Murad's speech at the recently concluded TOKEN 2049 conference in Singapore⬇️

Since the video was released, in just 10 days, it has garnered 26,000 views on YouTube and over 1.2 million impressions on X. With such momentum, Memecoins truly have the opportunity to become an important practice in exploring new economic models and promoting social progress.

Below is the full text of the speech, Enjoy~

Memecoins have sparked a frenzy in the cryptocurrency market, so the supercycle of Memecoins is not just a prediction for the future, but is already happening.

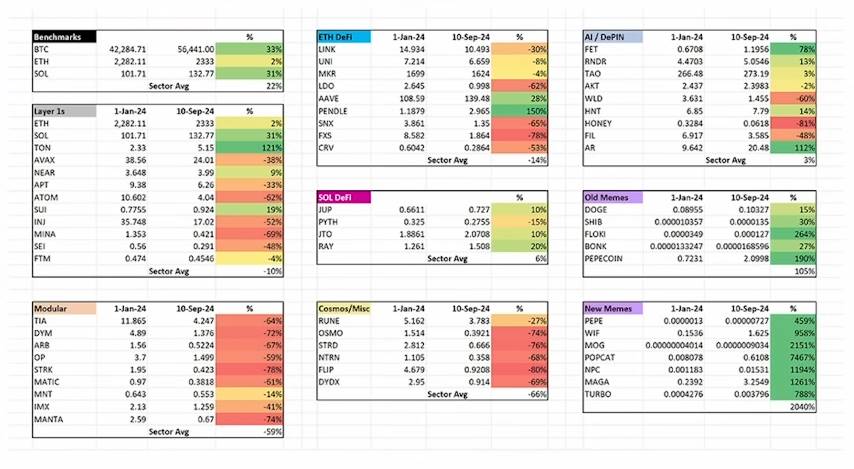

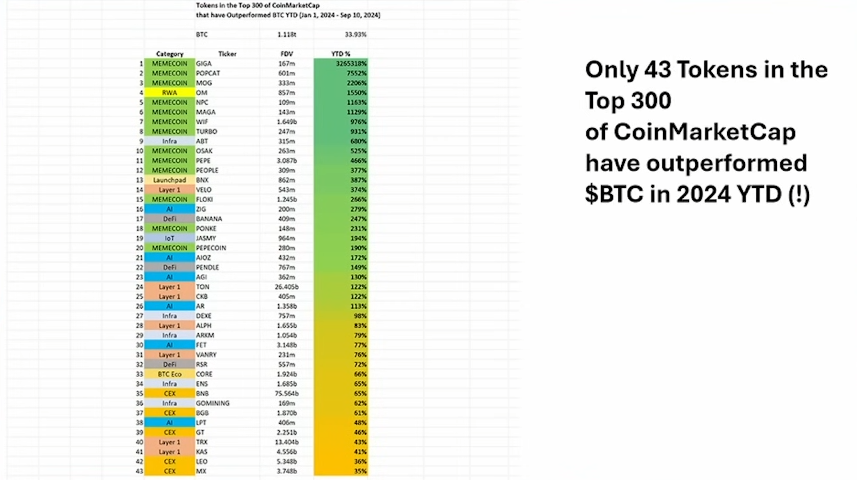

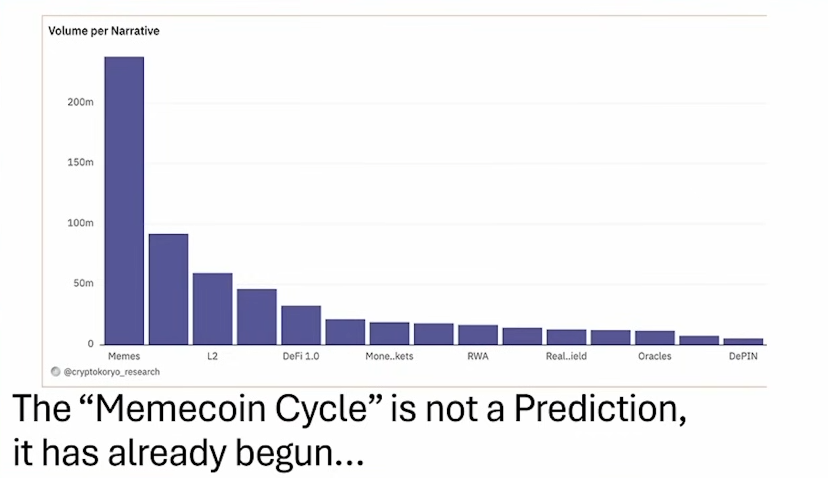

When we analyze the performance of all major cryptocurrency categories so far this year, you will find a mixed bag, with many disappointing tokens. However, as shown in the image above, Memecoins have performed exceptionally well.

Currently, old Memecoins are performing well, while new Memecoins are performing remarkably. The era of synchronized rises in all crypto assets has ended; the saying "we will succeed" is outdated, and this is a natural step in the development of the field.

As shown in the image above, you will find that so far this year, only 43 tokens have outperformed Bitcoin, and among the top 20 tokens, 13 are Memecoins.

# Why is there a Memecoin cycle?

There are two driving factors behind the Memecoin cycle: one is internal to the crypto space, and the other is external. First, let's look at the internal factors within the crypto space.

Token oversupply: By April 2024, 600,000 new tokens had already been launched in the market, with over 5,500 new tokens added daily. This oversupply has flooded the market with a large number of new tokens, leading to severe dilution of value for many projects.

Severe inflation of altcoin valuations: These tokens are artificially inflated in value when listed on centralized exchanges. Founders acquire tokens at almost no cost, while venture capitalists and angel investors buy large proportions of tokens at very low prices. Then, centralized exchanges, market makers, Twitter influencers, Telegram group callers, YouTubers, etc., promote projects by acquiring tokens or money. Ultimately, retail investors become the source of liquidity when these projects exit, and when you launch a project valued at $10 billion, retail investors are the ones being dumped on.

Price increases during the private placement phase: The vast majority of altcoin price increases occur during the private placement phase. By the time the tokens are actually launched, their valuations often reach levels of $500 million, $1 billion, or even $1.5 billion, leaving retail investors with almost no opportunity to profit. They are merely lured into the bubble at these high price points.

I firmly believe that these tokens are deliberately pushed to market with extremely high initial valuations at launch, so that even if the token price inevitably drops 90% in the early stages, seed investors can still achieve hundreds of times returns, while retail investors are misled into thinking these tokens are being sold at a "discount."

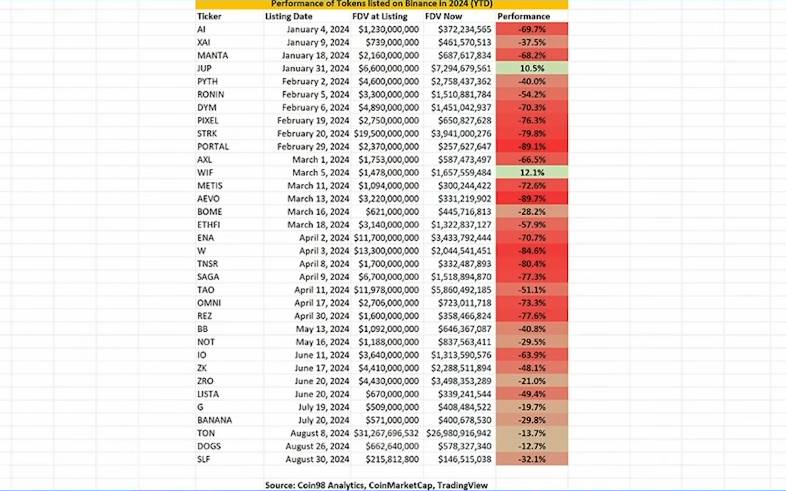

In 2024, all new tokens launched on Binance, with two exceptions, have declined. One exception is Whiff, which has seen almost no growth since its launch, and the other is Jupiter, which is closely related to the trading infrastructure of Memecoins. These facts send a strong signal: most newly issued altcoin projects are not performing well.

# Issues within the industry

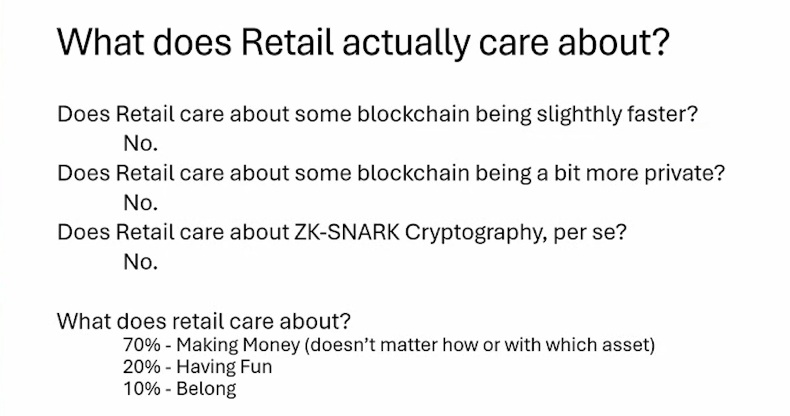

Without retail capital inflow, the entire token market cannot be sustained, but the vast majority of retail investors never care about technology.

Even though we have been using smart contract technology for over a decade, there are still very few non-speculative decentralized applications (dApps) that succeed in this industry. If you look at projects like Uniswap, dYdX, GMX, and Solana, these may be the projects with the highest product-market fit in cryptocurrency history, but they all rely heavily on speculative activity. 99% of altcoins are not worth their valuations, and many projects do not distribute dividends, often claiming it is due to regulatory reasons, but in reality, it does not align with their interests.

Some projects may only generate $500 in fee revenue daily, yet their valuations reach billions of dollars. This phenomenon is very common, and these infrastructure tokens clearly will not serve as a store of value for currency.

The value of these tokens often relies on narratives, mimetic effects, and market hype, and the market does not tend to evaluate these tokens based on actual revenue.

# Unique advantages of Memecoins

In contrast, Memecoins have their unique advantages. Memecoins do not need to rely on complex valuation models or actual revenue to support their market value like traditional tech tokens. Their advantage lies in simplicity and directness—the token itself is the product. Memecoins are not an attack on crypto technology, but a counterattack against crypto technology tokens. Memecoins and altcoins are essentially selling the same thing—the token itself, rather than the underlying technology.

Memecoins are the spiritual embodiment of the 2017 ICO wave, but they appear in a whole new form and are more pure. They represent a more direct community economy that does not rely on complex technological narratives but attracts the market through simple and understandable means.

Many venture-backed tech projects are overvalued and lack genuine community support. In contrast, Memecoins leverage community to build strong brands and loyalty, allowing projects to operate sustainably. In comparison, venture projects rely on private placements and high valuations to drive the market, while Memecoins harness the power of community cohesion, enabling participants to profit and become loyal advocates.

# External environmental drivers

In addition to internal industry factors, external environments are also driving the development of Memecoins. Today's global economy is vastly different from four years ago. Inflation is soaring, and the prices of everyday goods continue to rise. The rapid development of artificial intelligence even threatens job opportunities in traditional STEM fields, and wealth inequality has reached historic highs. The situation is particularly dire in regions outside of developed countries.

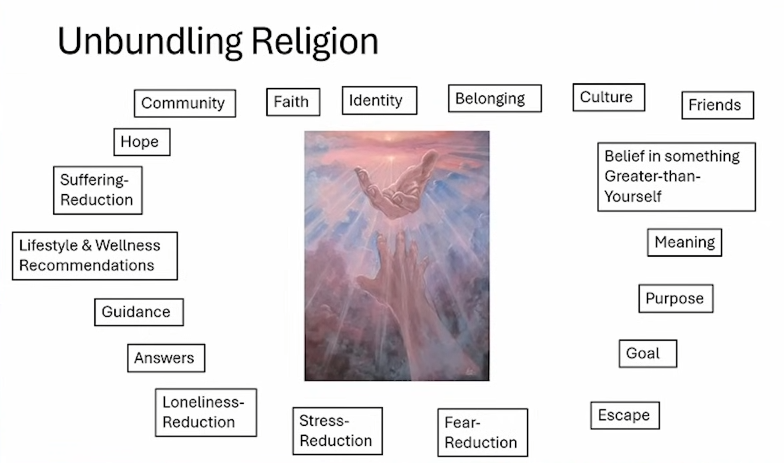

The intensification of loneliness, sexual repression, and mental health issues has led more and more people to turn to the virtual world in search of belonging and meaning. In this context, Memecoins have become their choice. People are not only seeking wealth in Memecoins but also fun, identity, and a sense of belonging.

# The Power of Narrative and Culture

Memecoins are essentially a Swiss Army knife, offering a range of products that provide identity, culture, escapism, reduced loneliness, community, hope, and much more. I believe that the influence of religion in the world is waning, while brands, experiences, and communities are filling that void. You can already see this in video games, music festivals, yoga, DMT retreats, CrossFit, SoulCycle, ketogenic diets, and of course, financial assets.

The formation of trends requires narratives to support them, and the success of Memecoins is backed by stories of people achieving massive gains in simple ways, stories that are continuously spread throughout the industry and on social media. For example, Pepe, Bonk, and Whiff have become several successful case studies in this cycle. These stories breathe new life into Memecoins and drive the continued development of the market.

History tells us that assets that perform well in the first half of a cryptocurrency cycle often continue to perform well in the second half. For instance, Ethereum surged in 2016 and then spiked again twice in 2017; Verge soared in 2016 and rose again in 2017; Solana surged in 2020 and rebounded strongly in 2021. Therefore, I believe that the Memecoin craze we experienced in March 2024 is just the first wave of three waves of increases, with two larger surges expected in 2025.

# Market Positioning of Memecoins

The success of Memecoins is not solely due to speculative behavior. They represent a more organic market model that allows ordinary investors to gain wealth through holding tokens. Memecoins have turned investors who previously found it difficult to profit in other markets into loyal advocates, driving the spread of the entire project.

The future of Memecoins lies in their potential to be more than just speculative tools; they represent a new economic form—a tokenized community. The best Memecoins will become long-lasting brands and cultural symbols, representing not just wealth but also a sense of identity.

# The Future of Memecoins

The supercycle of Memecoins has begun, and it will continue to develop. I predict that the market capitalization of Memecoins will reach $1 trillion, with a quarter of the top 20 on CoinMarketCap being Memecoins. Over time, utility tokens and venture-backed altcoins will continue to perform poorly, while Memecoins will dominate the market.

Memecoins are not just a market phenomenon; they represent a new community economic model. Their simplicity, understandability, and high level of participation make them some of the most vibrant and growth-potential assets in the cryptocurrency industry. If you want to seize the next big opportunity, Memecoins are undoubtedly a field worth your attention.

In summary, Memecoins are simpler than tech altcoins, more liquid than NFTs, and safer than DeFi. They have no inflation, no unlocks, and no venture capital firms dumping on you. Your odds are better than sports betting or casinos, with greater volatility (which means more excitement). It is a fresher narrative that gives retail investors a chance to win, and the community is more passionate than any other category of crypto assets. The best crypto products do not need tokens, and the best crypto tokens do not need products. Again, the Memecoin cycle is not a prediction; it is already happening, and Memecoins dominate every metric.

So, predictions: the market capitalization of Memecoins will reach $1 trillion; you will see 2 Memecoins with a market cap exceeding $100 billion; you will see 10 Memecoins with a market cap exceeding $10 billion; a quarter of the CoinMarketCap homepage will be Memecoins; Memecoins will hold a 10% dominance; utility and venture-backed altcoins will continue to perform poorly; the "fat protocol" theory will slowly fade away as establishing stores of value and casinos (ranked fourth and fifth) becomes increasingly difficult; venture capital firms will buy blue-chip Memecoins, and savvy venture capital firms have already started doing so; traditional finance will buy Memecoins, and savvy traditional finance has already begun doing so; you will see super Memecoinization before super Bitcoinization; many people are talking about faith economics, the tokenization and financialization of faith as a new religion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。