In the third quarter of 2024, the NFT market experienced a 50% decline in trading volume to $1.1 billion, yet it demonstrated resilience and recovery potential, with long-term growth expected driven by infrastructure expansion and application scenarios.

Author: NFTScan

Translation: Blockchain in Plain Language

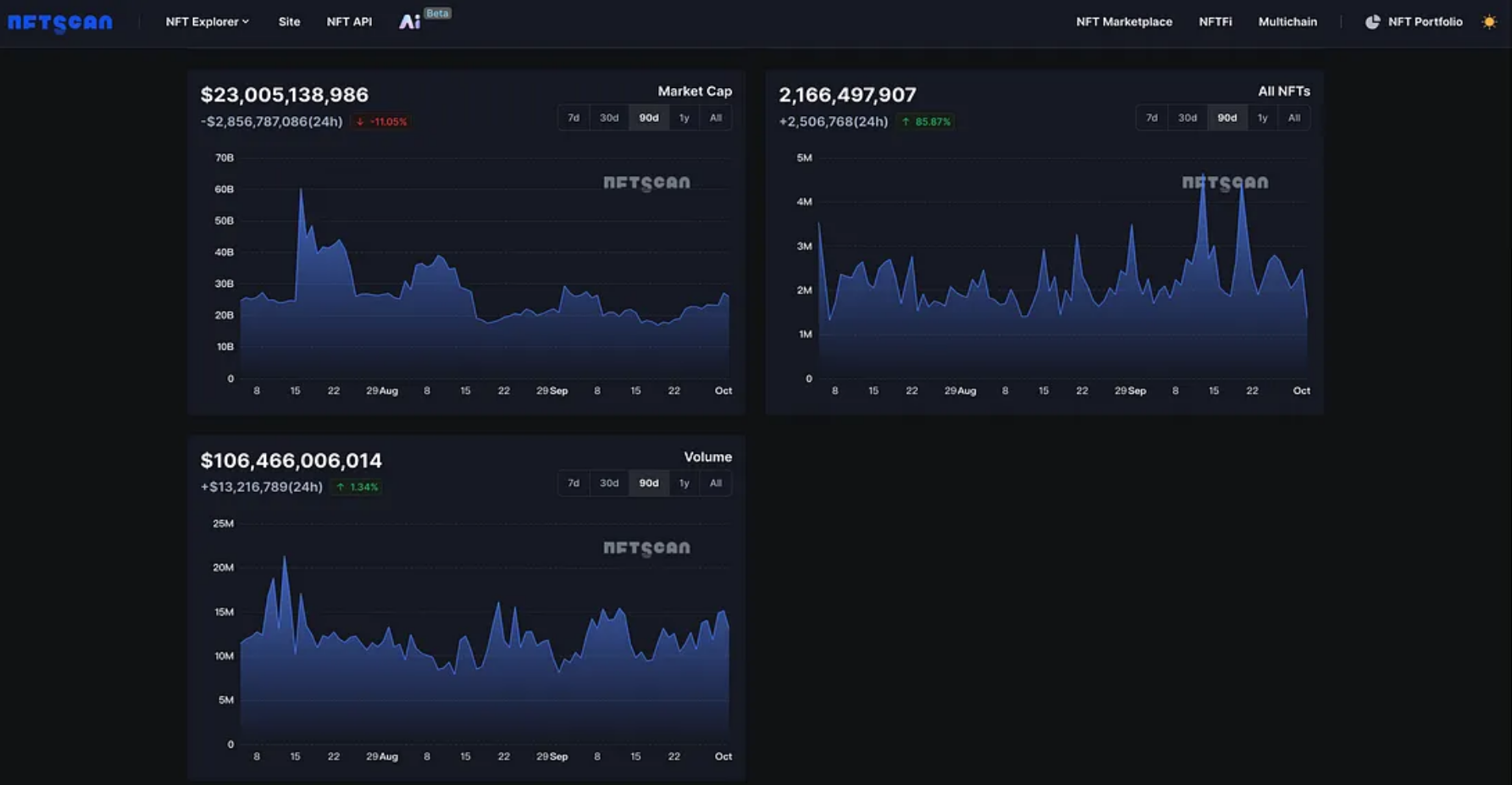

The non-fungible token (NFT) market in 2024 has been highly volatile, but the latest data indicates strong recovery potential. Despite a 50% drop in trading volume in the third quarter compared to the previous quarter, falling to $1.1 billion, this remains a remarkable figure considering the current market environment. The global NFT market kicked off the first quarter of 2024 with a record trading volume of $4.1 billion, showcasing significant initial enthusiasm. Although activity decreased to $2.25 billion in the second quarter as initial hype waned, meaningful demand persisted.

Most importantly, the $1.1 billion trading volume in the third quarter highlights the resilience of the NFT ecosystem and collectors' interest in this innovative asset class. As long as the market environment remains favorable, we have reason to believe that NFT trading will regain significant upward momentum in the coming quarters, driven by infrastructure and application case expansion. Despite recent volatility, the long-term prospects and transformative potential of NFT technology inspire confidence that the market will rebound from this low point and become stronger. To better understand the future trends of the NFT market, let’s delve into the key trends that emerged in the third quarter of 2024.

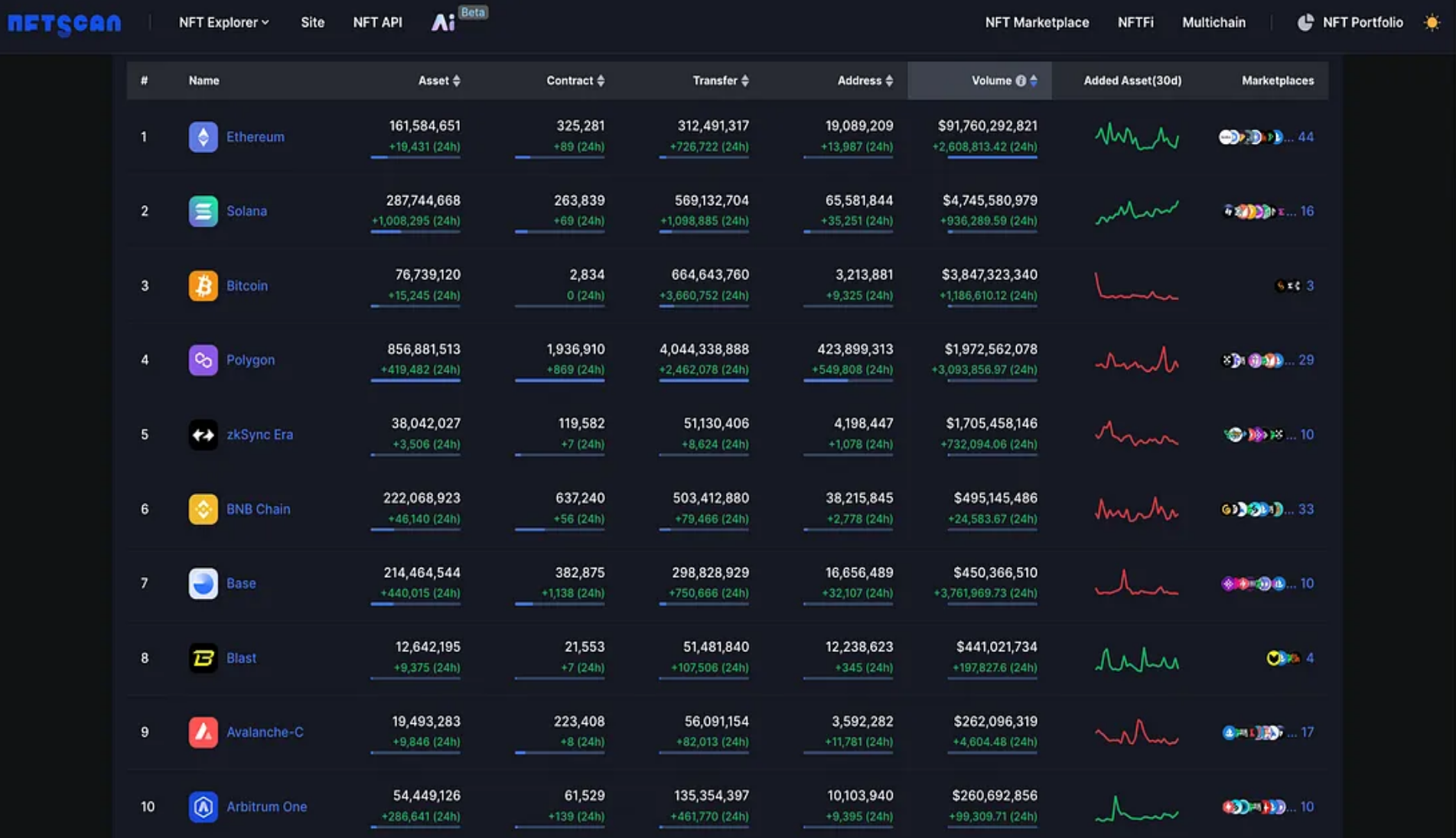

1. Leading Blockchains in Q3 2024

According to NFTScan data, Ethereum continues to dominate the NFT market, solidifying its industry-leading position with the highest trading volume among all blockchains.

Solana has secured its second position, with NFT trading activity significantly increasing on this high-throughput blockchain. The low transaction fees, scalability, and thriving ecosystem of gaming, metaverse projects, and DeFi applications on Solana have driven rapid growth in demand for Solana-based NFT collections and utilities.

Despite being relatively new, Bitcoin has already claimed the third position in cross-chain NFT trading volume.

Ethereum-compatible Layer 2 solution Polygon has risen to fourth place, benefiting from its low fees, fast transaction times, and seamless connection to the Ethereum mainnet. As a scalable platform extending Ethereum's influence, Polygon's NFT ecosystem has grown in parallel with its strong DeFi presence; zkSync Era has quickly ascended to fifth place.

According to NFTScan data, August 21 marked the peak of cross-chain NFT sales, with a staggering daily trading volume of 3,151.52 ETH.

On the other hand, July 7 was the lowest point for cross-chain NFT trading activity this quarter, with a daily trading volume of only 755.24 ETH. This slump is typically attributed to a decrease in high-profile NFT releases, reduced promotional efforts, and increased market uncertainty, which suppressed risk appetite.

The fourfold difference between the quarterly highs and lows underscores the early stage and accompanying volatility of the emerging multi-chain NFT market. Trading interest and volume fluctuations remain significantly influenced by new series releases, changes in market sentiment, and the pace of real-world events in this rapidly evolving field.

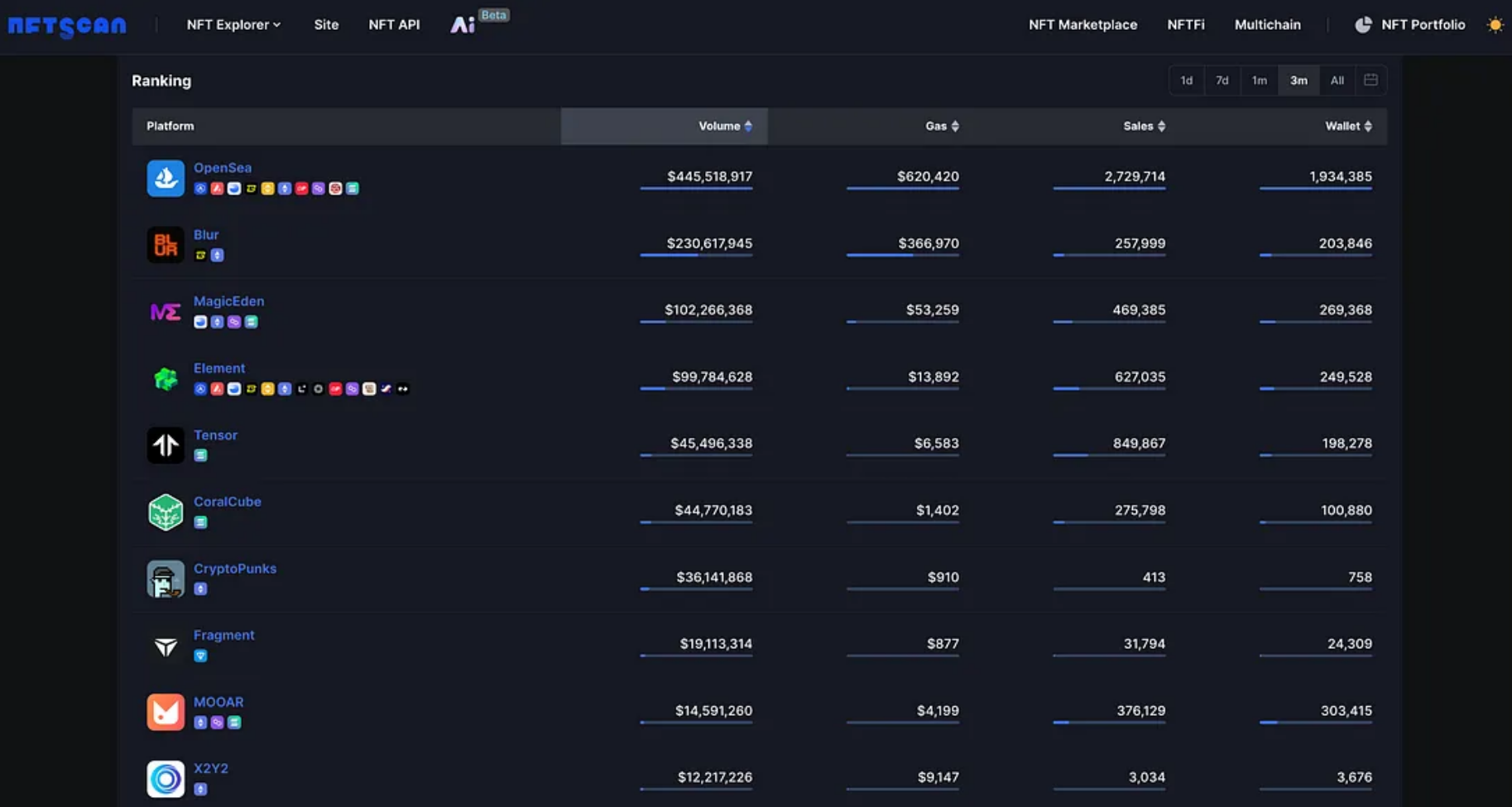

2. Top NFT Markets in Q3 2024

In the third quarter of 2024, OpenSea maintained its position as the largest NFT market, achieving an impressive trading volume of $445.52 million over the past 90 days, with a market share of 40.78%. Despite transaction fees reaching $620,000, OpenSea facilitated 2.72 million transactions involving 1.93 million wallets, showcasing its status as a top NFT trading hub.

Blur solidified its second position with a trading volume of $230.62 million, capturing 21.11% of the market share. Although fuel fees reached $366,000, the platform processed 258,000 transactions from 203,000 unique wallets. Advanced features like real-time pricing and portfolio tools may have enhanced its appeal among professional NFT traders and collectors.

MagicEden ranked third with a trading volume of $102.27 million and a market share of 9.36%. With fees of only $53,260, this multi-chain market facilitated 469,000 transactions across 269,000 wallets. Support for NFTs on Solana, Ethereum, Polygon, and Bitcoin may have expanded MagicEden's user base.

Element ranked fourth with a quarterly trading volume of $99.79 million and a market share of 9.14%. Its relatively low fees of $13,900 accompanied a sales volume of 627,000 transactions involving 250,000 wallets, demonstrating efficient infrastructure. The platform's unique offerings may have supported its momentum.

Ranking fifth, Tensor achieved a trading volume of $45.5 million, capturing 4.17% of the market share. Despite fees of only $6,590, it completed 850,000 transactions involving 198,000 wallets, showcasing its optimized seamless user experience for high trading throughput.

3. Top NFT Collections in Q3 2024

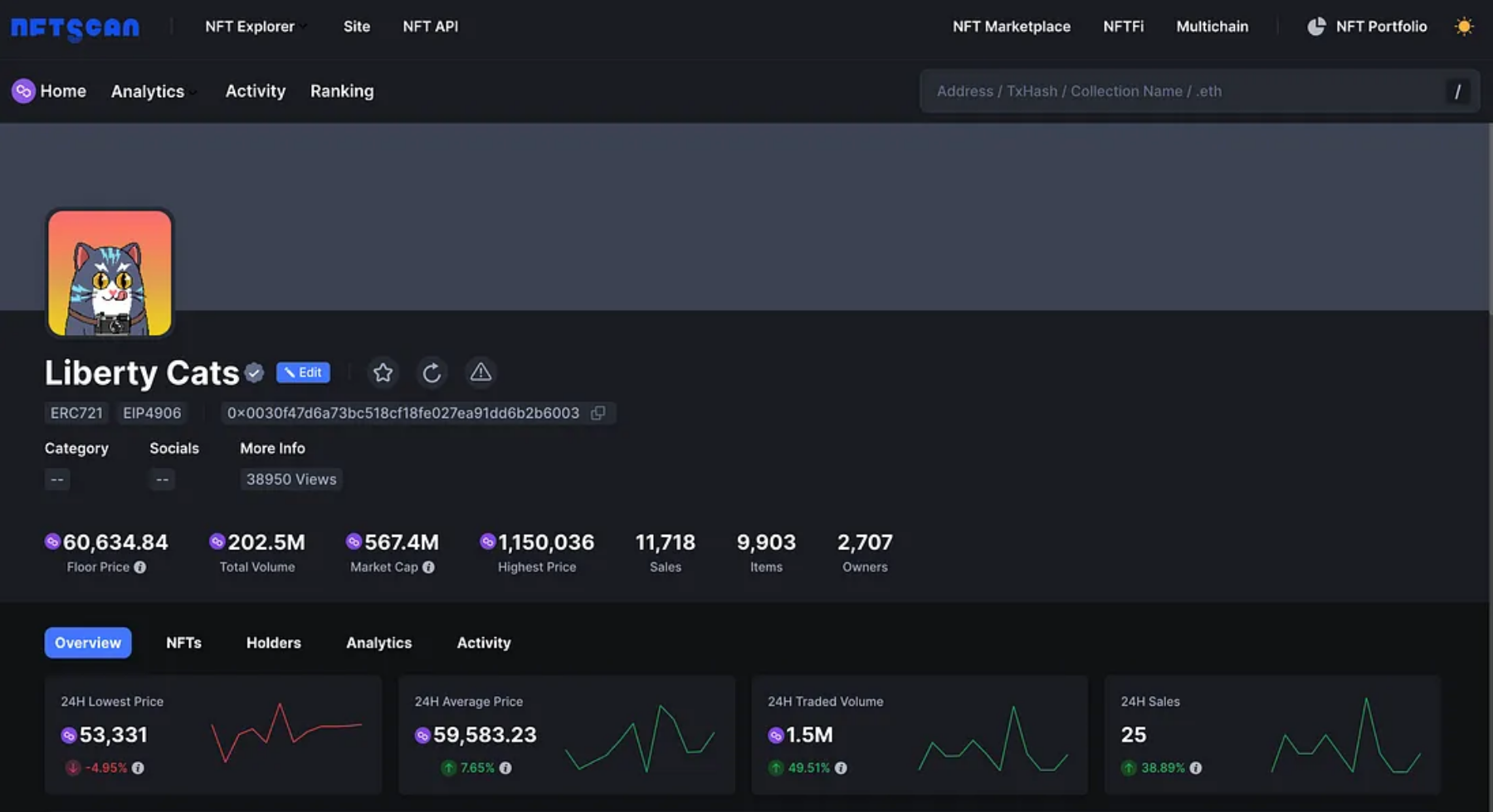

In the third quarter of 2024, Liberty Cats emerged as the standout NFT collection, a limited edition of 9,903 non-fungible tokens hosted on the Polygon blockchain network. Over the past 90 days, Liberty Cats demonstrated impressive trading performance, with a trading volume of $157.86 million in MATIC.

The strong performance of this collection is attributed to 3,010 transactions, reflecting significant demand from collectors and investors. Despite the limited supply, Liberty Cats maintained healthy liquidity, with a floor price stabilizing at a strong level of 60,634 MATIC.

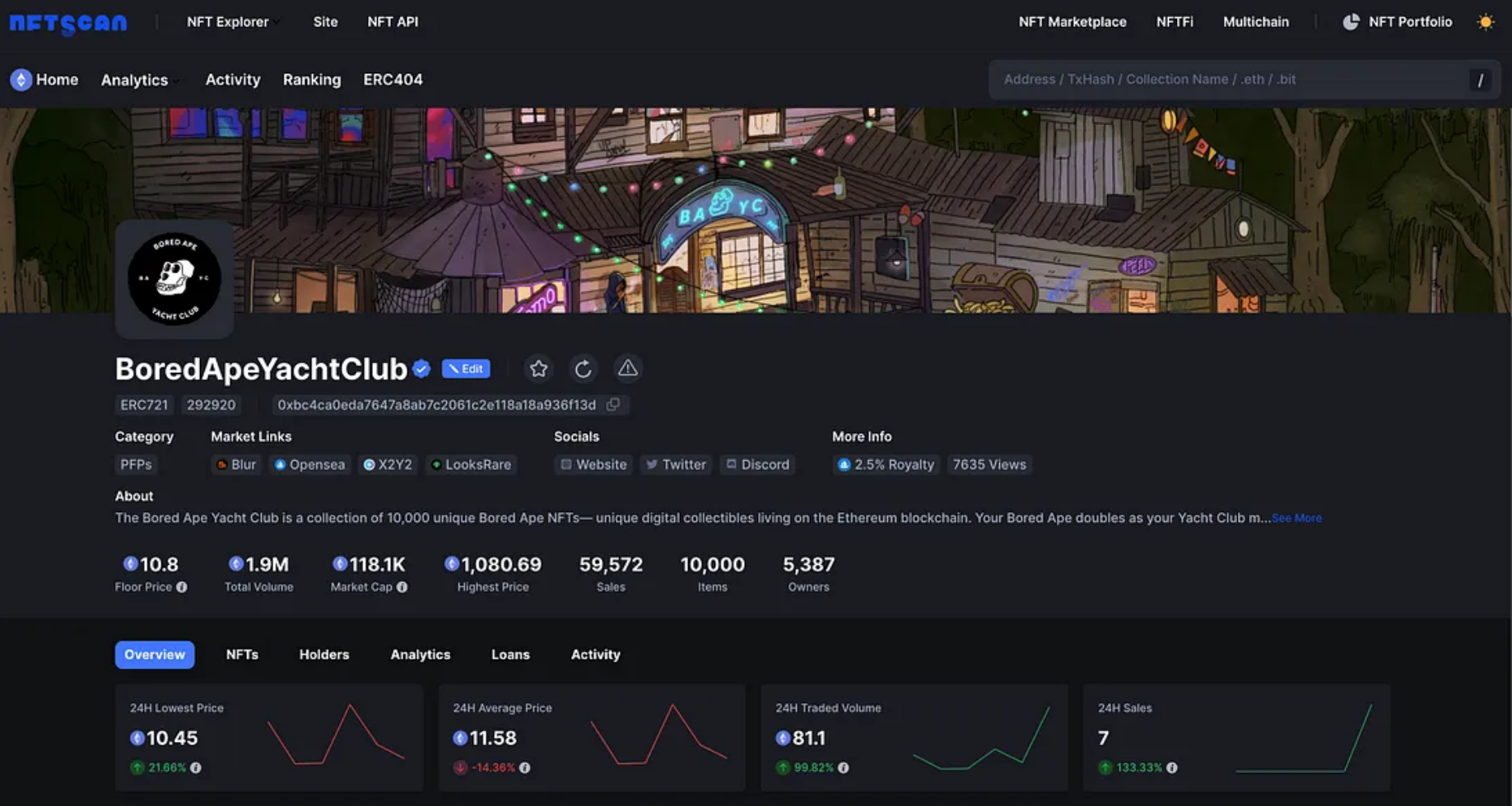

In the third quarter of 2024, the iconic Bored Ape Yacht Club (BAYC) collection from blue-chip NFT studio Yuga Labs continued to solidify its giant status in the industry. This set of 10,000 avatar NFTs minted on Ethereum achieved a trading volume of 15,100 ETH over the past 90 days, with 1,300 transactions.

BAYC's enduring dominance stems from its pioneering role in the emergence of the avatar NFT (PFP) phenomenon and its enthusiastic cultivation of the holder community. Its intellectual property and ambitious roadmap extending into gaming, merchandise, and the metaverse solidify BAYC's status as a blue-chip asset, possessing strong utility and cultural relevance beyond mere digital collectibles.

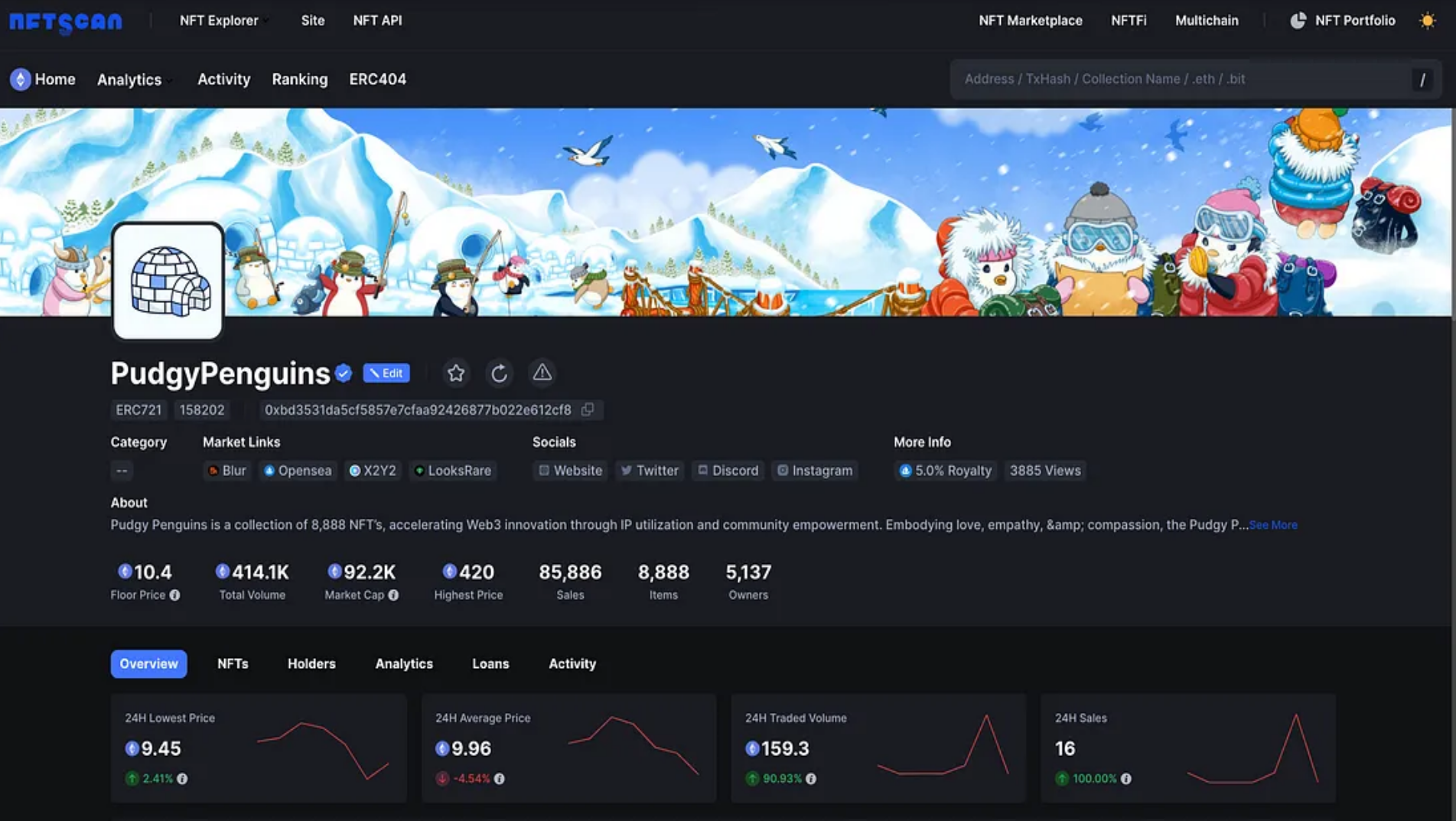

Following closely is Pudgy Penguins, a collection of 8,888 generated penguin avatars released on Ethereum by NFT studio Igloo. This collection attracted a trading volume of 14,670 ETH this quarter, with sales reaching 1,470 transactions, reinforcing its position as a strong PFP competitor.

Meanwhile, the millions of dollars in trading volume for these projects highlight the concentration of liquidity and wealth within the blue-chip NFT ecosystem. To attract mainstream users, the next generation of collectibles may need to creatively blend culture, utility, accessibility, and composability to appeal to a broader audience.

4. Conclusion

The Q3 2024 NFT market data provided by NFTScan offers valuable insights into the development landscape and key players of this innovative digital asset class. Although overall trading volume decreased by 50% from the previous quarter to $1.1 billion, this figure still reflects healthy demand and resilience within the market cycle.

Looking ahead, the NFT ecosystem shows tremendous recovery potential, driven by infrastructure expansion, application cases, and mainstream adoption. While volatility in this emerging market will likely persist, the underlying transformative technology inspires confidence, indicating that this market will become stronger in the long term.

To realize the full disruptive impact of NFTs, stakeholders need to prioritize utility, accessibility, composability, and sound incentive design to attract and empower as broad a user base as possible. The foundation for NFTs is being laid to spark a revolutionary new creator economy.

Article link: https://www.hellobtc.com/kp/du/10/5455.html

Source: https://medium.com/nftscan/q3-2024-nft-market-report-trading-volume-exceeds-1-1-billion-amid-shifting-landscape-a4c94af0a70a

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。