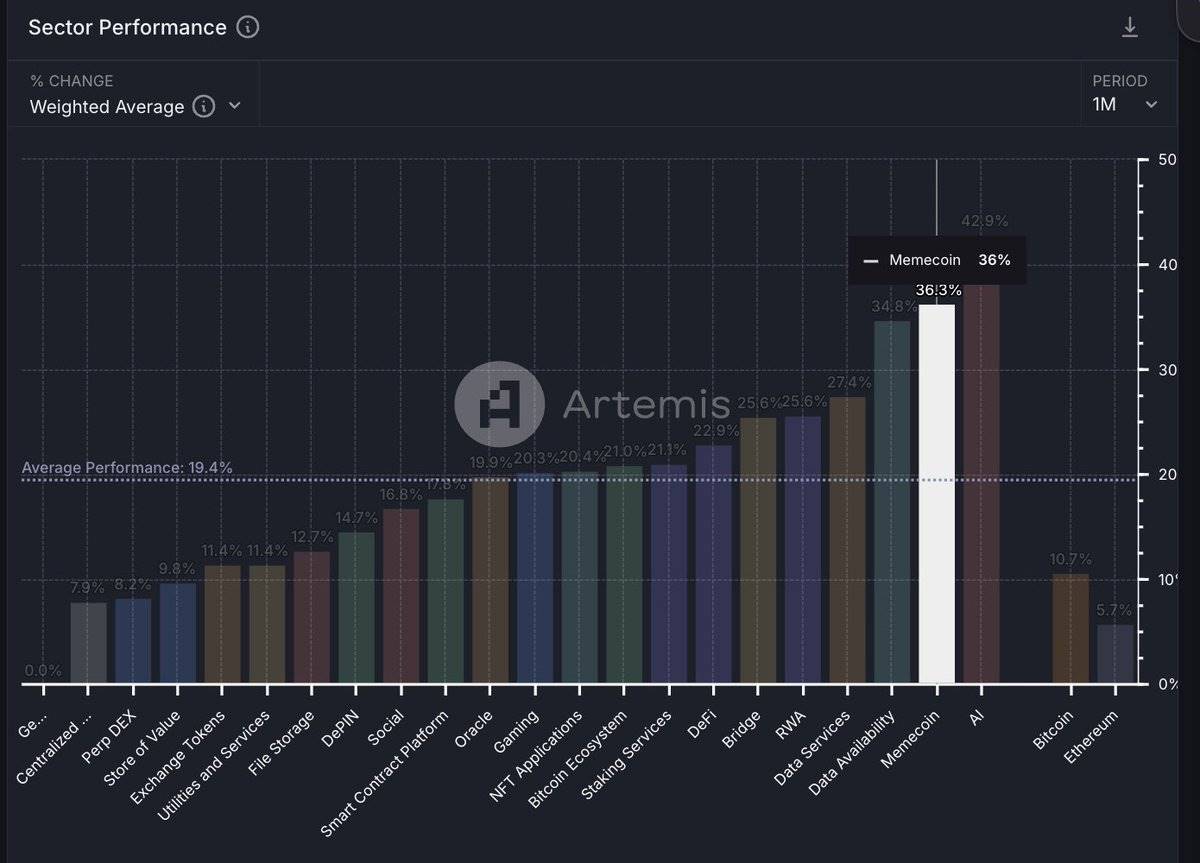

The current market is dominated by Memes, but this also presents a great opportunity to accumulate those undervalued utility tokens.

Author: arndxt

Compiled by: Deep Tide TechFlow

Here are some suggestions.

Recently, Memes have dominated trading volume in the crypto market. If you hold utility tokens, do not expect them to rise quickly—this indeed requires patience. Perhaps a better strategy is to first profit from Memes and then invest those gains into utility tokens.

I also noticed that the market is filled with hype and pump-and-dump phenomena. A few days ago, I found that some people started digging up those forgotten old Memes, trying to revive them. In my view, this is a large-scale fear of missing out phenomenon. When the market starts to slow down in the coming days, only high-quality Memes will be able to maintain their value.

I want to remind everyone to be cautious of those artificially hyped low-quality projects to avoid falling into traps. While we have seen a noticeable rebound in AI tokens, most investors remain relatively cautious.

I believe our current market is dominated by Memes, but this also presents a great opportunity to accumulate those undervalued utility tokens, which may receive attention in the future.

$RSS3 is an open information protocol that I am very much looking forward to, especially the part related to @followapp, which has become the top trending project on GitHub.

$BANANA - My favorite yield-generating token, its value is severely undervalued compared to the income of $AAVE over the past 30 days. I believe $BANANA has at least 100 times growth potential. Additionally, I am also very optimistic about $PENDLE, $EQB, and $LYNX. $CELO - Vitalik has mentioned this project, and its activity is also increasing.

$ALEO - I am currently closely monitoring the development of this project.

$FTM - The Sonic upgrade and its strong financial reserves will be an important selling point.

$APT - This token is attracting institutional investment, and tokens like $AVAX, $CHEX, and $IXS are my favorites when discussing RWA and institutional investment.

$SOL - This is a chain that has stood the test of time, capable of handling a large number of transactions, and is expected to be a strong investment this year.

$AZUR - Gamblefi will regain its glory, and the funding of @Polymarket may boost the market. Other tokens like $WINR, $RLB, and $CROWN are also worth paying attention to.

$W - A token that has long been overlooked is gradually being accumulated, while $STRK and $ENA have also experienced significant declines from their all-time highs (ATH).

$NEAR - This chain continues to innovate and has a strong focus on the AI field. I am also keeping an eye on other tokens like $ATH and $DEAI, while also watching $SPEC, $GURU, and $TARS.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。