Overall, it seems that multiple factors are converging to herald the revival of DeFi.

Author: flow

Translation: Deep Tide TechFlow

The summer of 2020, known as the "DeFi Summer," was an incredible period for the cryptocurrency industry. For the first time, DeFi was not just a theoretical concept, but a practical one. During this time, we witnessed a surge in multiple DeFi native protocols—including the decentralized exchange (DEX) of Uniswap, the lending protocol of aave, the algorithmic stablecoin of SkyEcosystem, and many other projects.

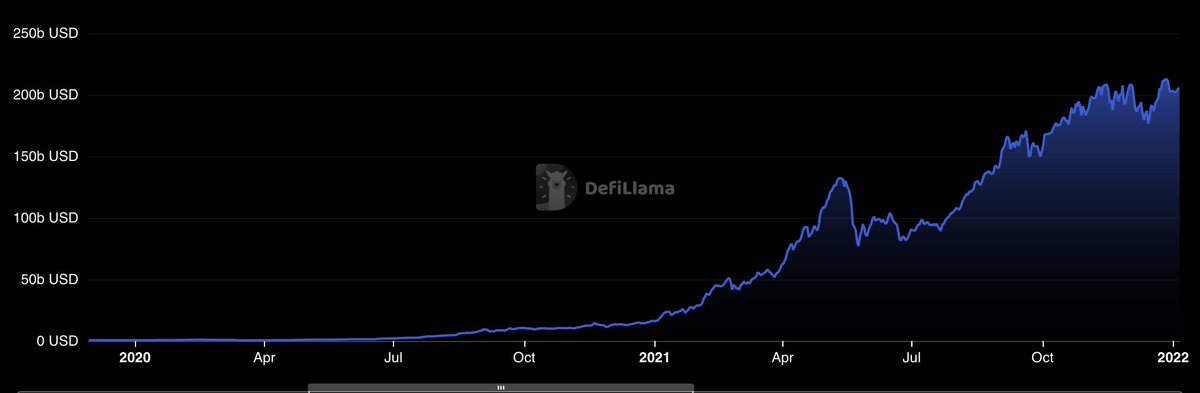

Subsequently, the total value locked (TVL) in decentralized finance (DeFi) applications saw a significant increase. From around $600 million in early 2020, the TVL rose to over $16 billion by the end of the year and reached a historic high of over $210 billion in December 2021. This growth was accompanied by a strong bull market in the DeFi space.

Cryptocurrency TVL chart from 2020 to the end of 2021

Source: DeFi Llama

We can attribute the main catalysts of the "DeFi Summer" to two aspects:

Breakthrough advancements in DeFi protocols, enabling scalability and providing clear use cases.

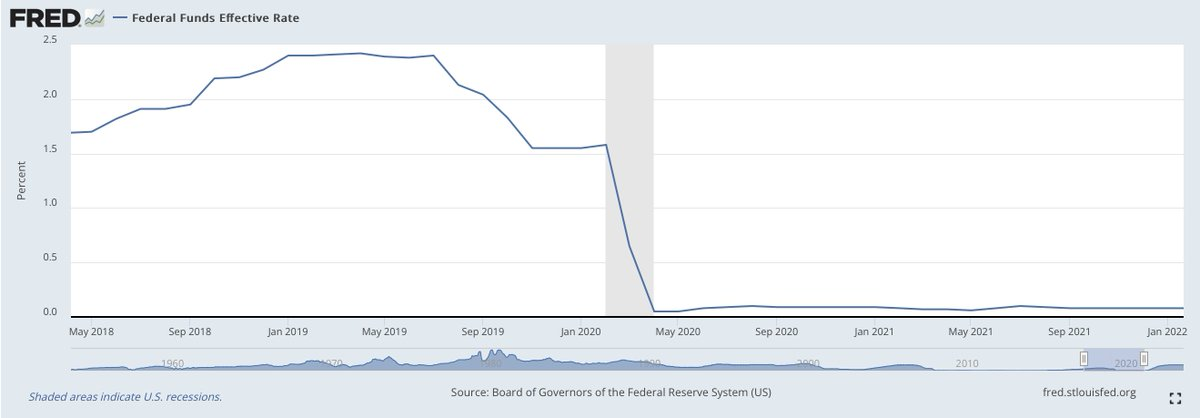

The start of a loose monetary policy cycle by the Federal Reserve, during which interest rates were significantly lowered to stimulate the economy. This led to ample liquidity in the system and incentivized people to seek more exotic yield opportunities, as traditional risk-free rates were very low. This created the perfect conditions for the flourishing of DeFi.

Chart of the Federal Funds Rate from May 2018 to January 2022

Source: Fred St Louis

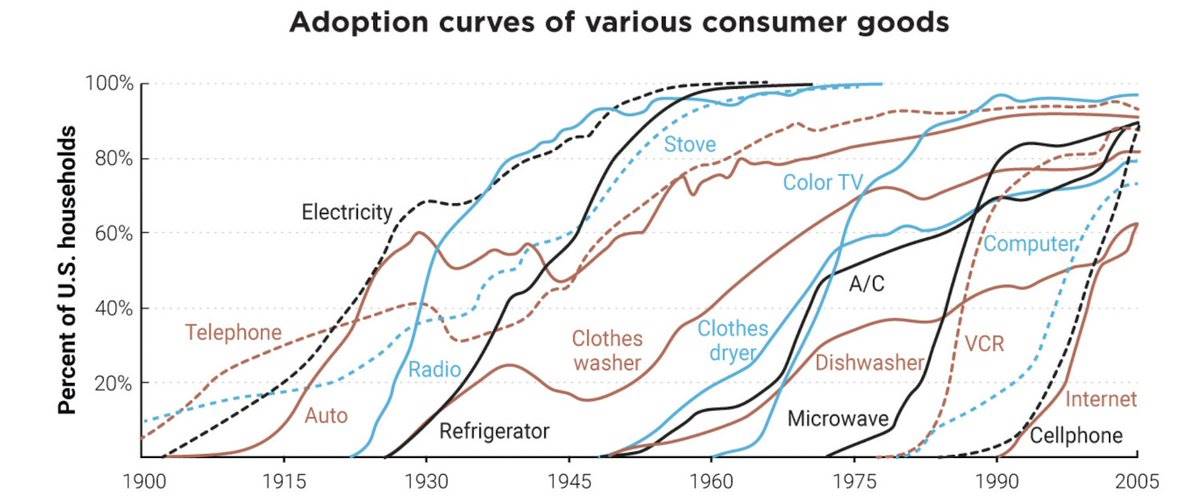

However, like many emerging disruptive technologies, the adoption of DeFi follows a common S-curve trend, often referred to as the Gartner hype cycle.

Chart showing the adoption of various consumer goods over time, reflecting this trend

Source: The Bullish Case for Bitcoin

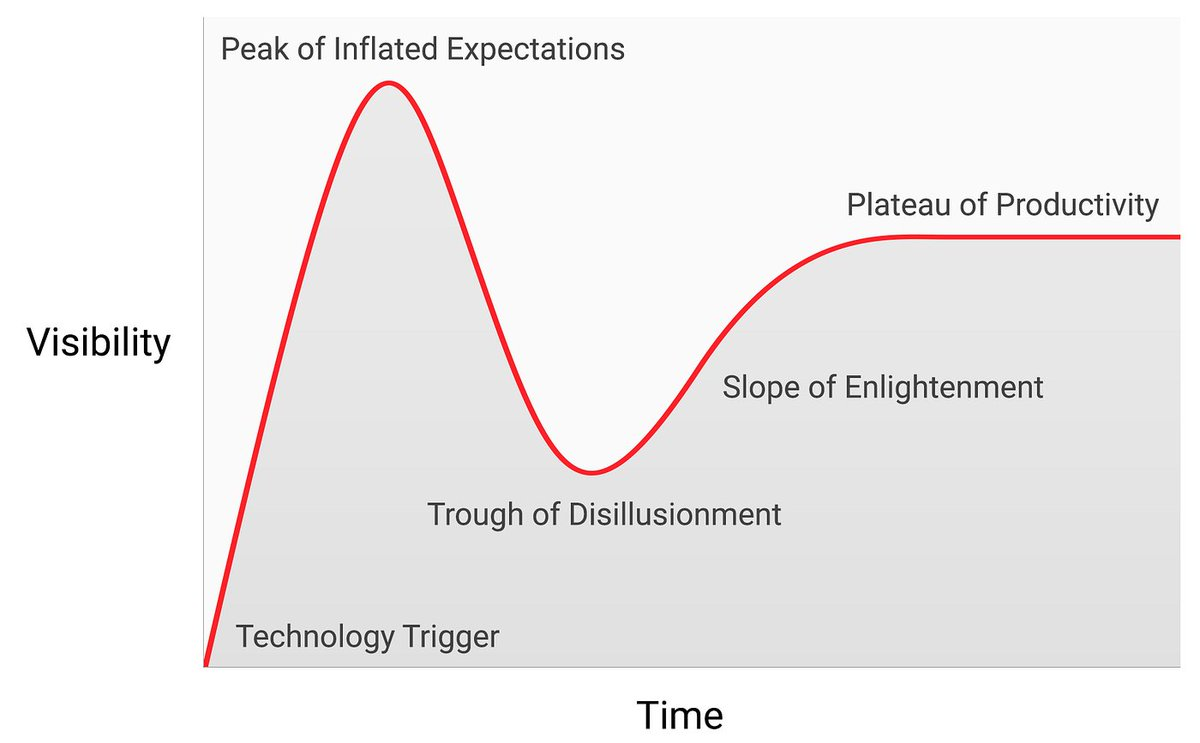

In general, its operation is as follows: in the early stages of the "DeFi Summer," early investors had strong confidence in the transformative nature of the technology they were investing in. For DeFi, this confidence stemmed from its potential to fundamentally change the current financial system. However, as more people entered the market, enthusiasm peaked, and buying behavior became increasingly driven by speculators whose interest in quick profits outweighed their focus on the underlying technology. After this peak of frenzy, prices declined, public interest in DeFi waned, and we faced a bear market, followed by a long period of stability.

Gartner hype cycle chart

Source: Speculative Bitcoin Adoption Price Theory

It can be clearly stated that this dull stable phase is not the end of DeFi, but the beginning of the true journey towards mass adoption. During this period, developers continue to build, and the number of staunch believers in DeFi is gradually increasing. This lays a solid foundation for the next iteration of the Gartner hype cycle, which may bring in a larger scale of users and potentially even larger scale.

DeFi Revival

At present, the prospects for the revival of DeFi seem very optimistic. Similar to the catalysts of the previous DeFi Summer, we currently have: the development of a new generation of more mature DeFi protocols; healthy and sustained growth of DeFi metrics; the arrival of institutional participants; and the ongoing loose monetary policy of the Federal Reserve. This provides a perfect environment for the flourishing of DeFi.

To gain a clearer understanding of this situation, let's analyze these components:

Towards DeFi 2.0

Over the years, DeFi protocols and applications have undergone significant evolution from the initial speculative wave of 2020. Many issues and limitations faced by first-generation protocols have been addressed, leading to the construction of a more mature ecosystem. This is the emergence of what we now call the DeFi 2.0 movement.

Some key improvements include:

Better user experience

Cross-chain interoperability

Improved financial architecture

Enhanced scalability

Strengthened on-chain governance

Improved security

Proper risk management

Furthermore, we have seen the emergence of multiple new use cases. DeFi is no longer limited to early-stage trading and lending. New trends such as restaking, liquid staking, native yield, new stablecoin solutions, and tokenization of real-world assets (RWA) have made the ecosystem more vibrant. Even more exciting is the ongoing development of new infrastructure. One that recently caught my attention is the on-chain credit default swaps (CDS) and fixed-rate/term loans built on existing lending infrastructure.

Healthy and Sustained Growth of DeFi Metrics

Since the end of 2023, there has been a revival of DeFi activity, and we have witnessed a wave of new DeFi protocols emerging.

First, looking at the total value locked (TVL) in the crypto ecosystem, we find that after a long period of stability, momentum has started to rise. From $41 billion in October 2023, the TVL almost tripled, reaching a local high of $118 billion in June 2024, before falling back to the current level of around $85 billion. Although this is still below the all-time high (ATH), it represents a significant upward trend. There is strong reason to believe that this may be the first wave of a long-term upward trend in TVL.

Chart showing the evolution of TVL in the crypto space

Source: DeFi Llama

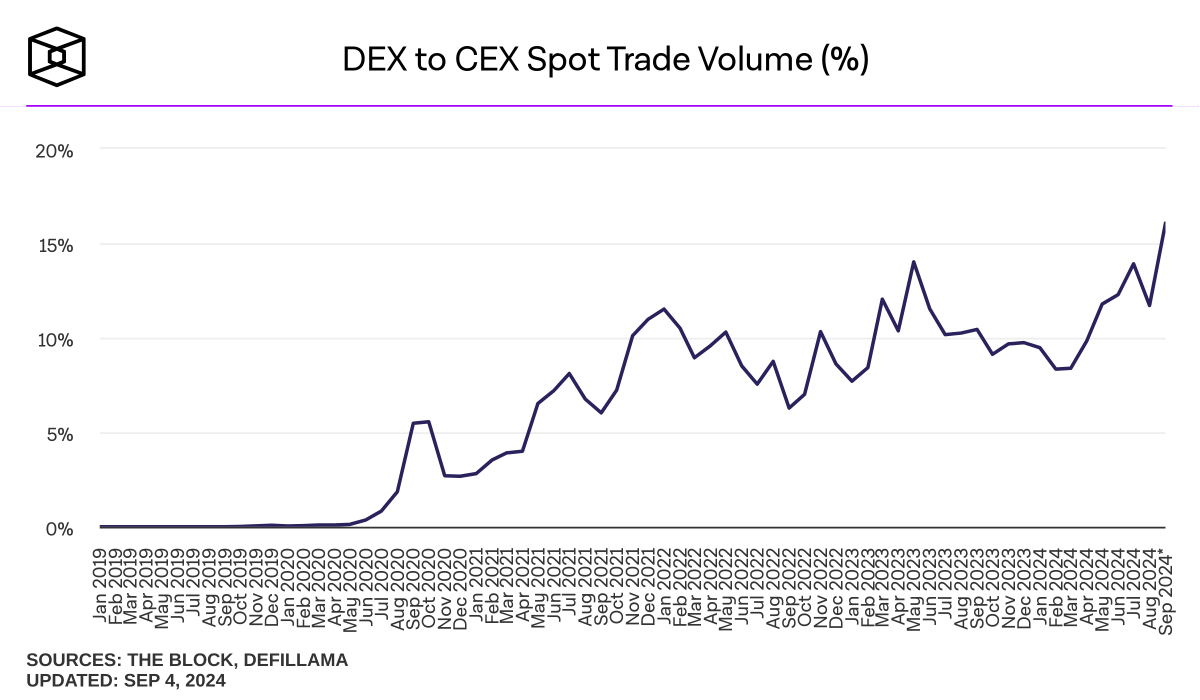

Another interesting metric is the spot trading volume between decentralized exchanges (DEX) and centralized exchanges (CEX), which measures the relative trading activity between the two. Similarly, we notice a positive long-term trend indicating that more and more trading volume is shifting to on-chain.

The chart shows the spot trading volume between DEX and CEX

Source: The Block

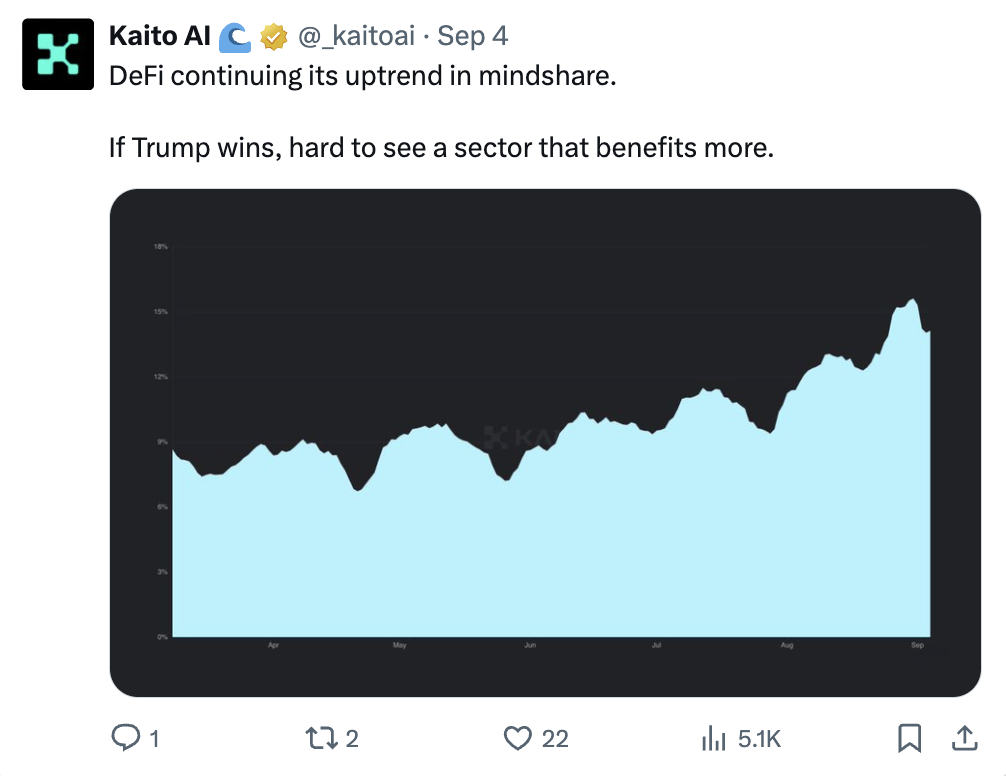

Lastly, but equally noteworthy, is the increased attention that the DeFi space has garnered within the broader crypto ecosystem in recent months. In a competitive market where everyone is vying for attention, DeFi is once again gaining traction.

Attention on DeFi continues to rise.

It's hard to imagine which industry would benefit the most if Trump wins.

Arrival of Institutional Participants

During the "DeFi Summer," the first wave of DeFi participants was primarily individuals trying to grasp this new technology, and a new wave of DeFi protocols is beginning to attract some large traditional financial institutions into the DeFi space.

In March of this year, the world's largest asset management firm, BlackRock, launched its first tokenized fund on the Ethereum blockchain—the BlackRock USD Institutional Digital Liquidity Fund (BUIDL Fund), allowing investors to earn U.S. Treasury yields directly on-chain. This is BlackRock's first DeFi initiative and has achieved significant success, with the fund's assets under management exceeding $500 million.

The BlackRock tokenized physical asset fund $BUIDL has surpassed the $500 million milestone within four months of its launch, as tokenized treasury markets continue to expand.

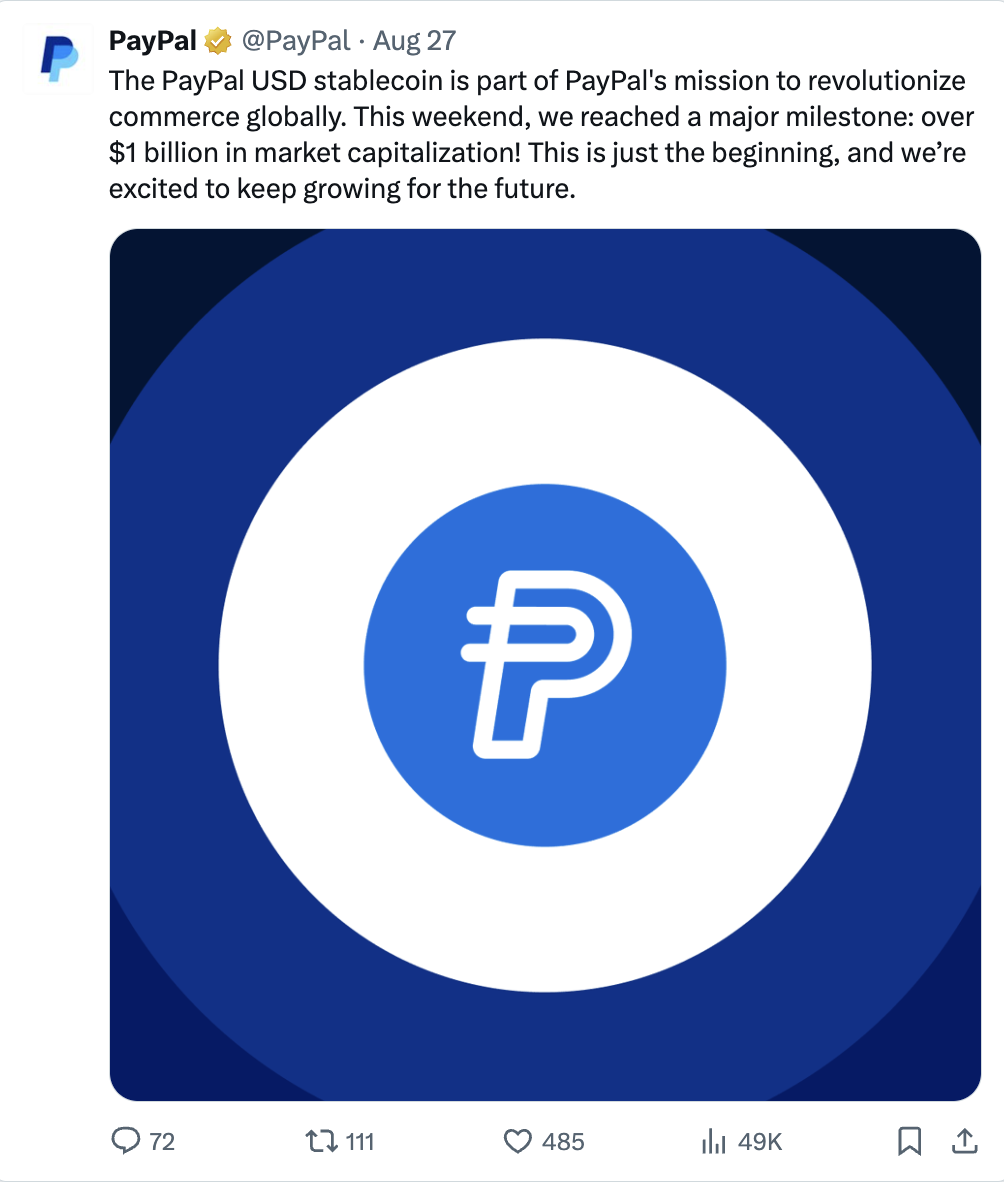

Another significant example of institutional interest growth is PayPal's PYUSD stablecoin, which recently reached a major milestone: its market cap exceeded $1 billion just one year after its launch.

The PayPal USD stablecoin is part of PayPal's global mission to innovate business. This weekend, we reached a significant milestone: a market cap of over $1 billion! This is just the beginning, and we are excited about the continued growth in the future.

These examples indicate that the broader financial industry is finally beginning to recognize the value proposition of building financial systems based on decentralized blockchain technology. In the words of PayPal's Chief Technology Officer, "If it can lower my overall costs and bring benefits, why not embrace it?" As more institutional participants begin to experiment with this technology, it can be expected to be a powerful catalyst for driving the development of the DeFi space.

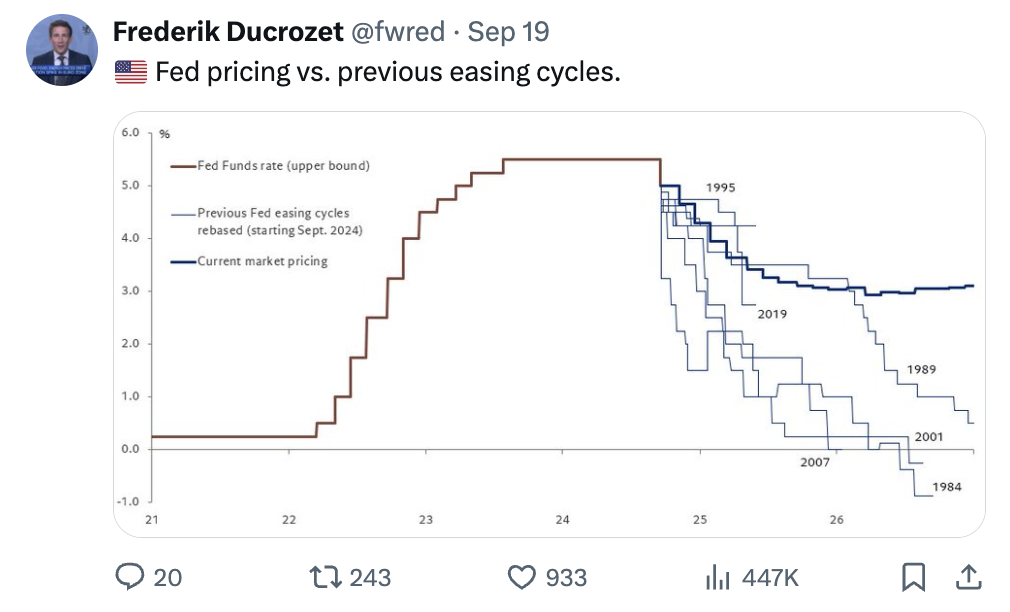

Federal Reserve Entering a Loose Monetary Policy Cycle

In addition to the points mentioned earlier, the current direction of U.S. monetary policy is another potential catalyst for DeFi. In fact, we have just crossed a significant turning point in the economy. This is the first 50 basis point rate cut at the recent September FOMC meeting since the Federal Reserve began combating inflation during the post-pandemic period, indicating a new loose monetary policy cycle is underway. This has been further evidenced by the expected trajectory of the Federal Funds Rate.

Frederik Ducrozet: Fed pricing in a new easing cycle.

The start of this new loose monetary policy cycle provides two key supports for the bull case of DeFi:

This loose cycle is expected to increase liquidity within the system. Liquidity is a key element of financial markets, and excess liquidity is favorable as it means more funds can enter the market. Therefore, DeFi and the broader crypto market are expected to benefit from this.

The decrease in the Federal Funds Rate will relatively increase the attractiveness of DeFi yields. Simply put, as traditional risk-free rates decrease, investors will start seeking other yield opportunities. This could lead to a rotation into DeFi as it offers an array of attractive yields in stablecoins and other more exotic strategies that are safer and more reliable compared to a few years ago.

Will History Repeat Itself?

Overall, it seems that multiple factors are converging to herald the revival of DeFi.

On one hand, we are witnessing the emergence of several new DeFi infrastructures that are safer, more scalable, and more mature than a few years ago. DeFi has proven its resilience and established itself as one of the few areas in the cryptocurrency space with mature use cases and real-world applications.

On the other hand, the current monetary environment is also driving the revival of DeFi. This is similar to the situation during the previous DeFi Summer, and the current DeFi metrics suggest that we may be in the early stages of a larger upward trend.

While history may not repeat itself entirely, similar circumstances often arise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。