Can historical election trends predict the next trend of Bitcoin?

By Matt Crosby, Bitcoin Magazine

Translated by Deng Tong, Golden Finance

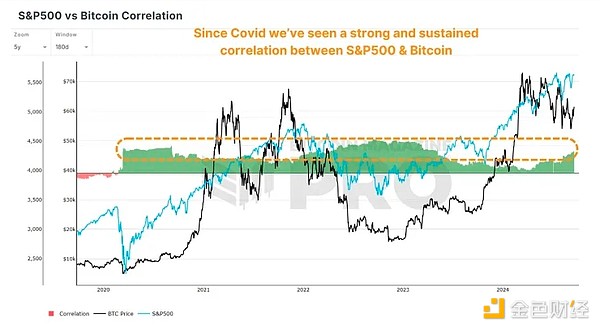

As the US presidential election approaches, it is worth studying how past elections have affected the price of Bitcoin. Historically, the US stock market has shown clear trends during elections. Given the strong correlation between Bitcoin and stocks, especially the S&P 500 index, these trends can provide reference for understanding what might happen next.

Correlation with S&P 500 Index

Bitcoin has always maintained a strong correlation with the S&P 500 index, especially during Bitcoin's bull market cycles and the overall traditional market risk appetite period. As Bitcoin gradually matures and "decouples" from stocks, and its narrative as a speculative asset, this phenomenon may come to an end. However, there is currently no evidence to suggest that this is indeed the case.

Figure 1: 180-day correlation between Bitcoin and the S&P 500 index over the past five years.

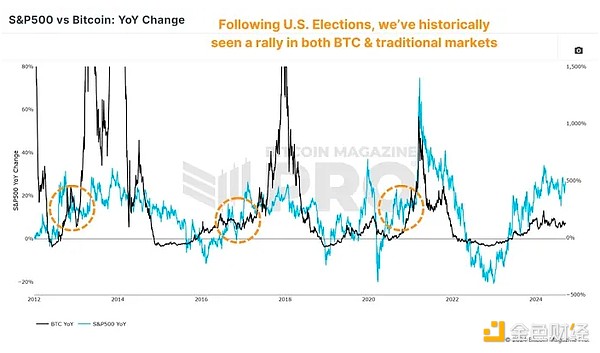

Post-election Performance

The S&P 500 index typically responds positively after the US presidential election. This pattern has remained consistent over the past few decades, with the stock market usually experiencing significant gains in the year following the election. In the comparison chart of the S&P 500 index and Bitcoin, we can see the timing of the election (orange circle) and the subsequent price trends of BTC (black line) and the S&P 500 index (blue line) over the following months.

Figure 2: Bitcoin and the S&P 500 index have achieved excess returns in the year following the election.

- 2012 Election: In November 2012, the S&P 500 index increased by 11% year-on-year. A year later, this increase soared to around 32%, reflecting a strong market rebound after the election.

- 2016 Election: In November 2016, the S&P 500 index increased by approximately 7% year-on-year. A year later, the index had increased by about 22%, once again showing significant growth after the election.

- 2020 Election: This pattern continued in 2020. In November 2020, the S&P 500 index increased by approximately 17-18%; by the following year, the index had climbed to nearly 29%.

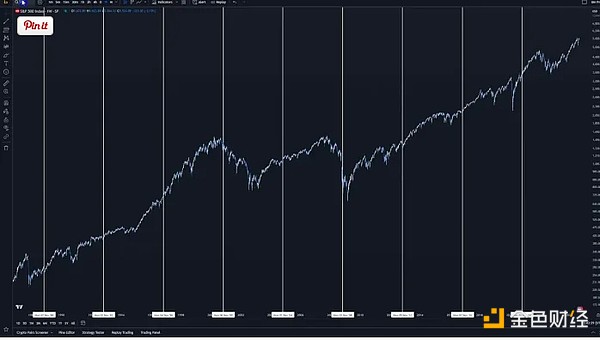

Recent Trends?

This is not limited to the three elections during Bitcoin's existence. To obtain a larger dataset, we can look at the S&P 500 index returns in the past forty years or ten elections. Only one year had a negative return in the twelve months following the election day (2000, during the bursting of the dot-com bubble).

Figure 3: The S&P 500 index has performed well in most of the time following the election day.

Historical data indicates that the victory of either the Republican or Democratic party does not have a significant impact on these positive market trends. Instead, the upward momentum is more about addressing uncertainty and boosting investor confidence.

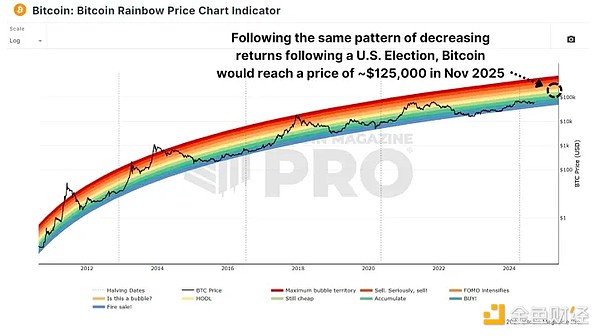

How will Bitcoin respond this time?

As the 2024 US presidential election approaches, it is easy to speculate on the potential performance of Bitcoin. If historical trends remain unchanged, we may see a significant price increase. For example:

If we experience the same percentage increase as in 2012 within 365 days after the election, the price of Bitcoin could rise to $1,000,000 or more. If we experience a situation similar to the 2016 election, we may climb to around $500,000, and a scenario similar to 2020 may see Bitcoin reaching $250,000.

It is worth noting that each occurrence has led to a subsequent decrease of approximately 50% in returns, so perhaps $125,000 is a realistic target for November 2025, especially when this price and data are consistent with the middle band of the rainbow price chart. It is also worth noting that in all of these periods, Bitcoin actually experienced higher peak cycle increases!

Figure 4: The rainbow price chart aligns with historical patterns and post-election price targets.

Conclusion

The data indicates that the period following the US presidential election is positive for both the stock market and Bitcoin. With less than two months until the next election, Bitcoin investors may have reason to be optimistic about the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。