The biggest problem with Ethereum at the moment is that its industry applications are encountering a bottleneck period, but the low transaction fees of L2 are brewing and promoting the outbreak of new applications. After the improvement of the capital market liquidity, the adoption rate of the cryptocurrency industry will accelerate, and the future of Ethereum is still worth looking forward to.

Author: Ebunker

Expenditure Disclosure by the Ethereum Foundation

Recently, the Ethereum Foundation's sale of ETH and its financial transparency has attracted widespread attention in the cryptocurrency community. In response, the Ethereum Foundation released its official expenditure details at the end of August.

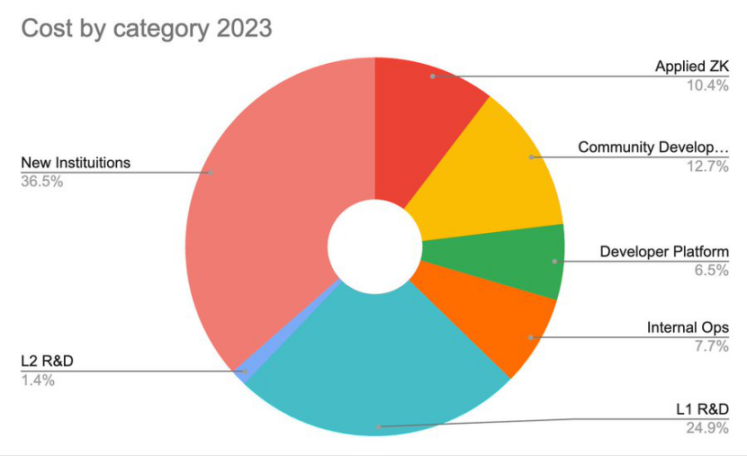

According to the chart, the "New Institutions" category accounts for the largest share of the foundation's expenditure, at 36.5%. Vitalik Buterin stated that this category includes funding provided to various organizations such as the Nomic Foundation, L2BEAT, Decentralized Research Center, and 0xPARC Foundation. The primary goal of establishing these new organizations is to strengthen the Ethereum community in the long term.

The second largest expenditure category of the foundation is L1 development, accounting for 24.9% of the total expenditure. This category includes funding for external client teams (62%) and internal foundation researchers (38%). Internal expenditures include teams such as Geth, Cryptography Research, Devcon, Solidity, and Next Billion, whose responsibilities are public and have relevant activity information on their websites, GitHub, and social channels.

Additionally, the foundation has released activity reports on external expenditures or funding over the past 4 years. Projects funded by the foundation in Q1 2024 include Xerxis, Ethereum Bogota, Motherless Africa, and ETHKL. The remaining expenditures of the foundation also include community development (12.7%), zero-knowledge applications (10.4%), internal operations (7.7%), developer platforms (6.5%), and L2 development (1.4%).

In addition to disclosing the Ethereum Foundation's expenditures, Vitalik also revealed that his annual salary at the organization is approximately $139,500. This is not high considering his net worth, which Forbes estimated to be around $1.5 billion in 2022.

Regarding the foundation's fund management plan, Vitalik mentioned that the foundation will spend 15% of the remaining funds each year, which means the foundation will exist indefinitely, but its influence in the ecosystem will diminish over time. Foundation member Justin Drake estimates that the foundation still has about 10 years of operating funds, but this will fluctuate with the price of ETH.

Vitalik Selling ETH Again?

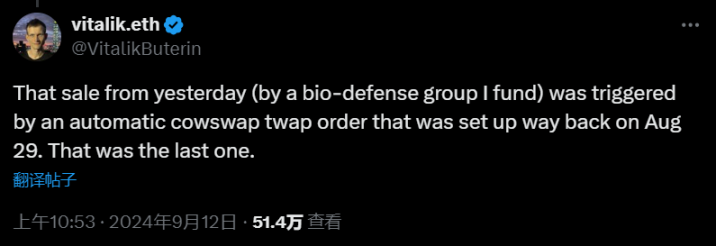

After selling $441,000 worth of ETH on September 12, Vitalik faced criticism once again, but he explained that the order was placed in August and stated that this was the last sale (used to fund ecological defense projects), and similar transactions are not expected to occur again. It is reported that this transaction was triggered by an automatic order from Cowswap twap, which was set as early as August 29 (twap strategy can execute large orders by spreading them into smaller parts over a certain period).

According to LookOnChain's data, wallets associated with Vitalik sold a total of 190 ETH on September 12, and have sold ETH worth $2.28 million since August 30. Vitalik firmly claims that he has never profited from selling ETH, as all proceeds are used to fund projects, which can be considered a silent contribution.

How Does Vitalik and the Ethereum Foundation View DeFi?

Kain Warwick, who has been involved in DeFi development for a long time, recently accused Vitalik and the Ethereum Foundation of "opposing DeFi." This developer claimed that the foundation only allocates a small portion of its budget each year to promote the development of decentralized finance and wastes the majority of its annual budget on other unimportant areas.

Vitalik responded by emphasizing his long-term commitment to decentralized exchanges and sustainable projects, but he is not interested in investing in short-term projects with unsustainable prospects, such as liquidity mining or temporary projects that rely on issuing new tokens and then selling them on the market.

Dankrad Feist, a member of the Ethereum Foundation team, stated that the foundation does not have a unified view on DeFi. He personally likes DeFi, but DeFi alone cannot solve all of Ethereum's problems. The financial market itself does not create value, but it can create more value for society by providing services such as liquidity and insurance. The most valuable contribution of DeFi on Ethereum is decentralized stablecoins. He hopes that these stablecoins can become "pure" cryptocurrency exchange media, but they have serious scalability limitations, so custodial solutions are currently more popular. Nevertheless, he believes that having decentralized and uncensored alternatives is very valuable.

Recent Main Research Directions of the Ethereum Foundation

Despite the controversy surrounding its expenditures, the Ethereum Foundation is actively researching technological advancements in multiple areas.

Regarding zero-knowledge proofs (ZK), George Kadianakis stated that research is being conducted on STARKs and SNARKs, such as recursive signature aggregation and achieving post-quantum security. Justin Drake mentioned that the introduction of SNARKs significantly reduces the cost of proofs and emphasized the formal verification work of zkEVM.

Regarding verifiable delay functions (VDF), Antonio Sanso stated that while it has not been implemented in Ethereum yet, the team is researching its potential applications, but further improvements and evaluations are needed.

Regarding maximum extractable value (MEV), Barnabé Monnot and s0isp0ke discussed the research progress of solutions such as ePBS, Execution Tickets, and Inclusion Lists to reduce the impact of MEV and enhance network resistance to censorship.

Vitalik Buterin and Justin Drake believe that in the future, binary hash trees may be used instead of Verkle trees to adapt to technological upgrades. In addition, formal verification and verifiable computation are seen as key technologies to ensure code correctness and promote interoperability between different programs.

How Does the Foundation View the Issue of ETH Value Accumulation?

As is well known, according to the roadmap, rollups will form a diversified ecosystem on Ethereum L1, with a large number of DApps on L2, and users will pay extremely low fees. However, this raises the issue of the lack of value accumulation for ETH assets. Regarding this issue, the Ethereum Foundation members believe that the accumulation of value for ETH is crucial to the success of Ethereum. ETH supports decentralized stablecoins as a currency and provides economic security for the network.

Foundation member Justin Drake believes that Ethereum must become the programmable currency of the internet, and the accumulation of value for ETH will be achieved through total fees and currency premium. The total fees are important, not the fees for each transaction. Even if the fee for each transaction is less than one cent, it can still generate billions of dollars in revenue through millions of transactions per second.

Another important aspect he mentioned is the proportion of ETH used as collateral, such as to support DeFi. Different financial activities on Ethereum will bring value capture to ETH.

Additionally, he also believes that in the Rollup roadmap, the Ethereum mainnet will be the convergence point of high-value activities, and L1 expansion is necessary.

If Ethereum is designed to promote sustainable economic activities, the accumulation of value for ETH will also follow. The growth in value of ETH will support the security and economic activities of the Ethereum ecosystem, thereby driving Ethereum to become a global financial platform.

How to Address the Centralization Issue of Layer2?

Currently, over 80% of Ethereum's transactions occur on Layer 2 solutions, including Arbitrum, Optimism, Base, and zkSync. Recently, L2 networks have faced some criticism due to centralization. Last month, Justin Bons of Cyber Capital expressed concerns, stating that these networks pose risks due to centralization. In response, Vitalik explained that highly decentralized L2 solutions fundamentally cannot take users' funds without strong consensus.

On September 12, Vitalik stated that regardless of his investment, he will only publicly acknowledge L2 that has reached Stage 1 or higher in decentralized work. Vitalik reiterated the importance of L2 and emphasized the importance of security, suggesting not to remove initial protection until the proof system is thoroughly verified. Starting next year, he plans to only publicly mention (such as in blogs, speeches, etc.) L2 at Stage 1 or higher and provide a "possibly temporary grace period" for truly interesting new projects.

Vitalik outlined the standards for Stage 1+ rollup, stating that the network needs 75% consensus of the council to overturn the proof system, and at least 26% of the council members must be independent of the rollup team. He believes "this requirement is reasonable and necessary for the security of the network. The era of rollup being glorified as 'multisig' is coming to an end, and the era of cryptographic trust has arrived." It is reported that several zero-knowledge (ZK) rollup teams plan to achieve this milestone by the end of this year.

Summary

In conclusion, despite facing some FUD, the Ethereum team is actively addressing and resolving issues. As the largest application public chain, the fundamentals of Ethereum have not been shaken, and there is no need to be overly pessimistic.

The biggest problem with Ethereum at the moment is that its industry applications are encountering a bottleneck period, but the low transaction fees of L2 are brewing and promoting the outbreak of new applications. After the improvement of the capital market liquidity, the adoption rate of the cryptocurrency industry will accelerate, and the future of Ethereum is still worth looking forward to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。