Has everything come to an end?

Author: Ignas | DeFi

Translated by: DeepTechFlow

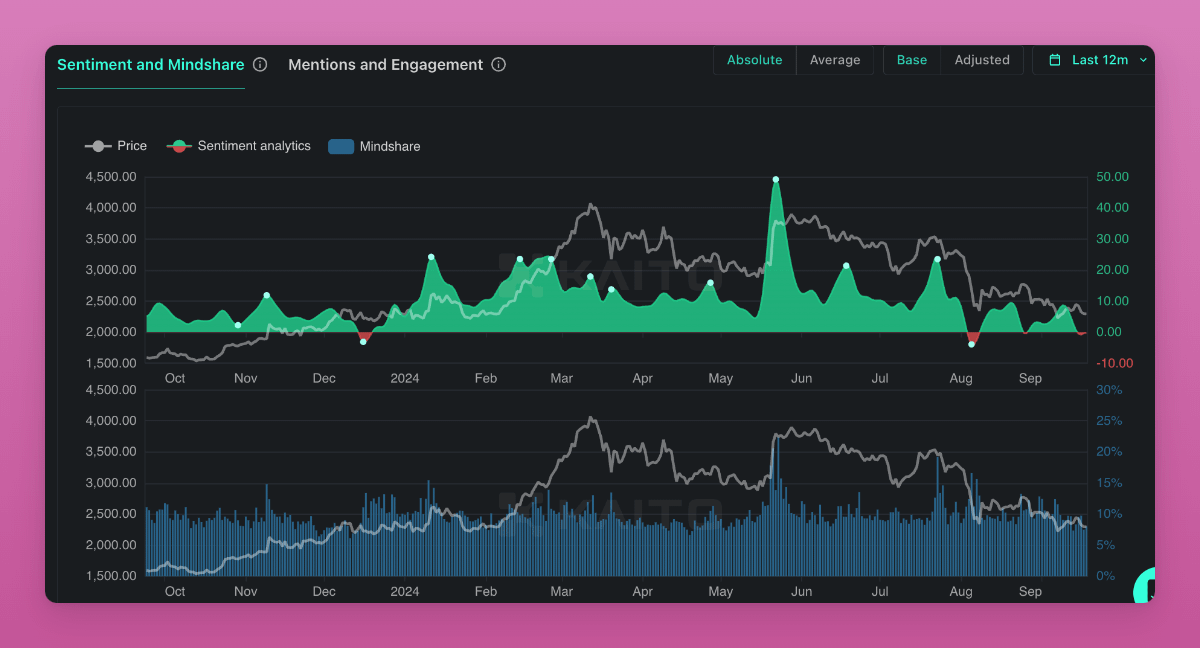

The market sentiment of Ethereum has turned extremely bearish for the fourth time this year.

People are gradually realizing that the concept of "ultrasound money" no longer applies, as both the revenue and destruction of Ethereum (ETH) are declining.

While activity on L1 needs to increase, these activities are actually being shifted to L2, and the community believes this does not bring significant benefits to ETH.

@iamDCinvestor hopes to re-emphasize the value of Ethereum (ETH) as programmable money, which he believes is the only important narrative.

This viewpoint is based on treating ETH as high-quality collateral, so metrics such as revenue and destruction seem less important.

On the other hand, @ChainLinkGod argues that stablecoins have been proven to be a more effective and widely applicable form of programmable money compared to ETH.

The notion of Ethereum (ETH) as "digital oil" is also weakening, as more and more Layer 2 solutions are starting to use their own native tokens to pay gas fees.

Even developers are feeling concerned.

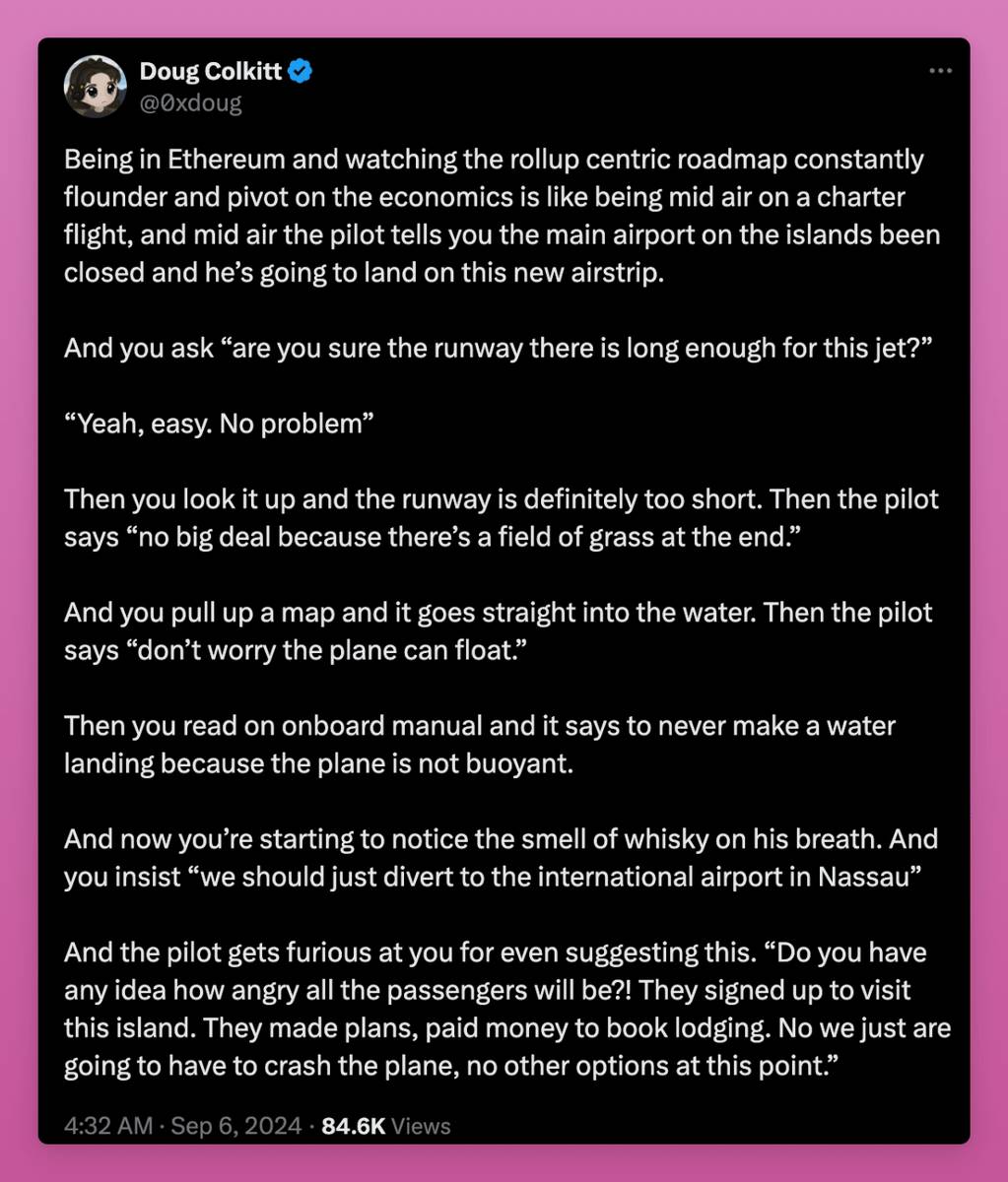

@ambient_finance founder @0xdoug humorously, but accurately, compares Ethereum's aggregation-centric roadmap to a pilot discovering that the runway is too short during flight, yet still insisting that everything is fine—despite all evidence indicating otherwise.

To make matters worse, the pilot is also drunk.

In the development of Ethereum, seeing the aggregation-centric roadmap constantly wavering and adjusting economically is like sitting on a charter plane and the pilot suddenly telling you that the main airport on the target island is closed, and he plans to land on a newly built runway.

You ask, "Are you sure the runway is long enough?"

He replies, "Of course, no problem."

However, upon checking, you find that the runway is indeed too short. The pilot then says, "It's okay, there's a patch of grass at the end of the runway."

But after looking at the map, you realize that the patch of grass leads directly to water. The pilot continues to reassure, "Don't worry, the plane can float."

However, as you flip through the onboard manual, you discover that it explicitly states that landing on water is not possible because the plane is not equipped to float.

At this point, you start to smell whiskey on the pilot's breath. You insist, "We should divert to the international airport in Nassau."

The pilot is very angry at this suggestion: "Do you know how angry the passengers will be?! They signed up to go to that island. They've already planned everything, paid for accommodations. Now we can only crash the plane, there's no other choice."

Has everything come to an end?

@llamaonthebrink believes that to evaluate the value of Ethereum (ETH), one needs to have social awareness, understand the mission of the blockchain industry, appreciate network effects, be skeptical of fiat currency, and believe in the innovative native internet society.

ETH is different from traditional assets, so it's difficult to define it with traditional narratives like "digital oil" or "tech stock."

Its value lies in being able to build an internet-native sovereign economy that does not rely on intermediaries or traditional systems.

This requires foresight, understanding of network effects, and seeing the possibilities that have not yet been realized.

Some may find this difficult to understand for the baby boomer generation and traditional institutions.

@mikeneuder provides a visionary example.

His reason for being optimistic about Ethereum is that it provides a decentralized, self-custodial, and permissionless system for global value transfer, which is not easily seized or censored.

This is the core of his long-term value proposition.

Decentralization is not just an optional feature, but crucial.

In a world where governments and companies can control centralized systems, Ethereum, with its neutrality and resistance to censorship, becomes a unique digital property system.

While Bitcoin (BTC) also has censorship resistance, as block rewards gradually decrease, Bitcoin will rely on transaction fees to incentivize miners, which may not guarantee its long-term security.

This is a viewpoint previously mentioned by well-known researchers at the Ethereum Foundation, such as @drakefjustin.

Ethereum

31 million ETH has been staked

Each ETH is worth $3400

-> Total economic security value reaches $105 billion

Bitcoin

Hash rate reaches 600 million terahashes per second

Each hash is worth $17.5

-> Total economic security value is $10.5 billion

Furthermore, compared to Bitcoin's inflexible scalability roadmap, Based Rollups, in the short term, can fundamentally change the incentive structure, directly impacting the monetization process of ETH, according to @adamscochran.

This change could potentially increase the long-term demand for ETH by 100 times.

After completing the transition to PoS and introducing the ETH burning mechanism, ETH was once considered to be developing smoothly.

However, due to the prolonged low price of ETH, the narrative of Ethereum is currently at a standstill.

For me personally, observing how the community discusses and attempts to redefine the narrative of Ethereum is very interesting.

I agree with @llamaonthebrink's viewpoint, that truly understanding the value of Ethereum requires more social awareness and a deeper understanding of the industry's mission.

However, when greed and speculation cloud our judgment, the entire industry often deviates from its mission. It's only when things become difficult that everyone refocuses on their original intentions.

We also notice that discussions between the Ethereum Foundation and Layer 2 developers are becoming more active, and even Vitalik is increasing interaction with the community.

This clearly indicates that there is an increasing urgency for everyone to return to the right development track.

However, as @0xdoug asked, "Are you sure this plane has a long enough runway?"

Even so, I remain optimistic about the future (if you will, you can call it holder's bias).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。