At 2:00 am on September 19th, Beijing time, the Federal Reserve announced a 50 basis point rate cut, lowering the target range for the federal funds rate from 5.25% - 5.50% to 4.75% - 5.0%, officially starting a new round of interest rate cuts. This 50bp rate cut is in line with the expectations of CME interest rate futures, but it exceeds the predictions of many Wall Street investment banks. Historically, the first 50bp rate cut has only occurred in times of economic or market emergencies, such as the technology bubble in January 2001, the financial crisis in September 2007, and the COVID-19 pandemic in March 2020. As a 50bp rate cut may raise greater concerns about economic "recession" in the market, Powell emphasized in his speech that he has not seen any signs of a recession, as always using this method to hedge market concerns about a recession.

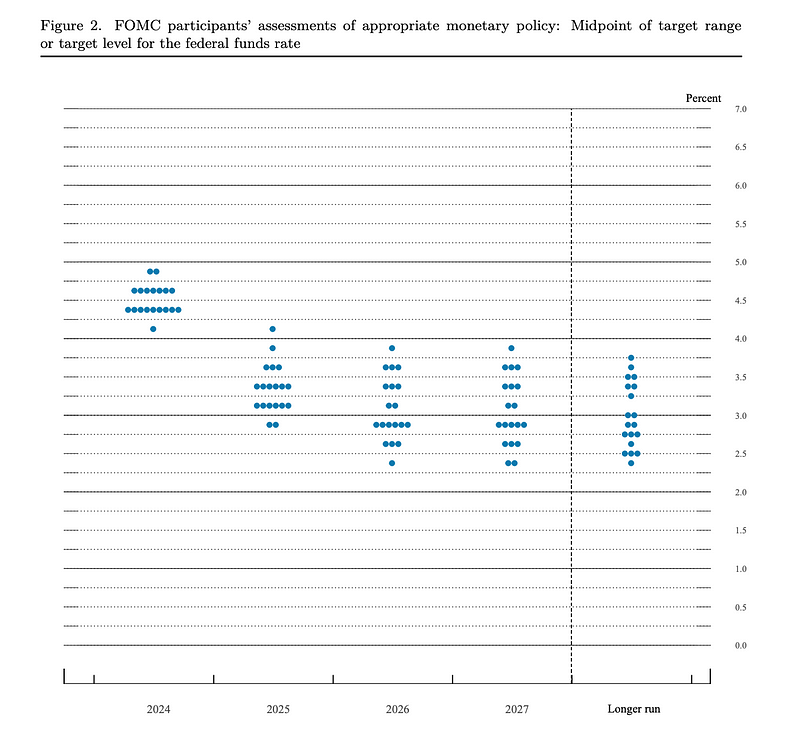

The Federal Reserve also provided a more hawkish dot plot, expecting two more rate cuts totaling 50bp by the end of the year, 4 cuts totaling 100bp in 2025, and 2 cuts totaling 50bp in 2026, with an overall rate cut of 250bp and an endpoint interest rate of 2.75–3%. The pace of rate cuts provided by the dot plot is slower than the CME interest rate futures trading, which predicts reaching the 2.75–3% level in September 2025. At the same time, Powell emphasized that this 50bp rate cut cannot be used as a new benchmark for linear extrapolation, and no fixed interest rate path has been set. The rate cuts can be accelerated, slowed down, or even paused, depending on the situation at each meeting, which to some extent explains the surge in U.S. bond yields after the market close.

In terms of economic forecasts, the Federal Reserve lowered its GDP growth forecast for this year from 2.1% to 2.0%, significantly raised the unemployment rate forecast from 4.0% to 4.4%, and lowered the PCE inflation forecast from 2.6 to 2.3%. The Federal Reserve's data and statements both show increased confidence in curbing inflation, while also paying more attention to employment. Overall, with a significantly large initial rate cut and a more hawkish rate cut pace, the Federal Reserve has once again played with expectations management.

1. A Loose Cycle Reopened after Four Years

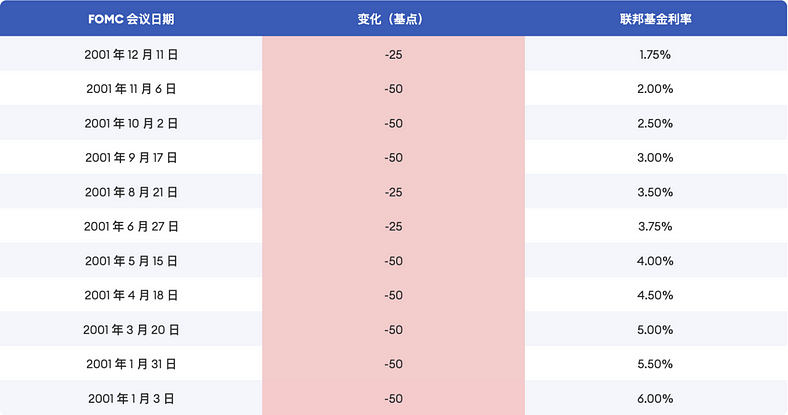

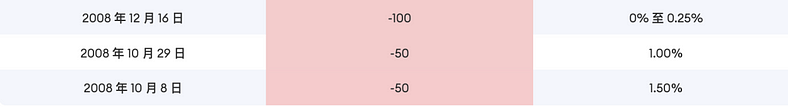

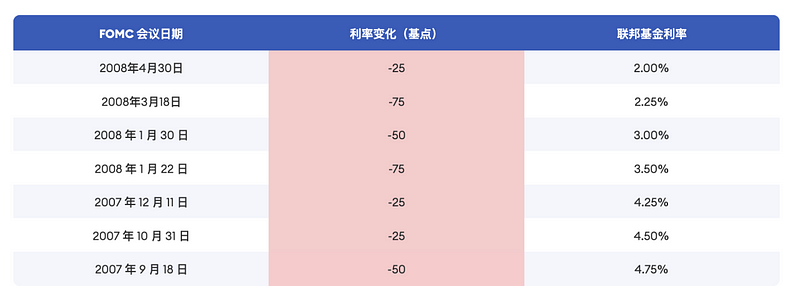

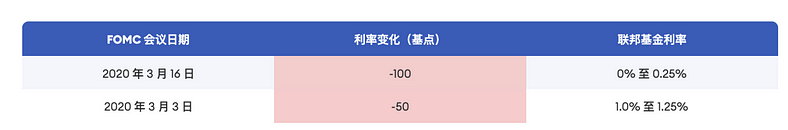

At 2:00 am on September 19th, Beijing time, the Federal Reserve announced a 50 basis point rate cut, lowering the target range for the federal funds rate from 5.25% - 5.50% to 4.75% - 5.0%, officially starting a new round of interest rate cuts. This 50bp rate cut is in line with the expectations of CME interest rate futures, but it exceeds the predictions of many Wall Street investment banks. Historically, the first 50bp rate cut has only occurred in times of economic or market emergencies, such as the technology bubble in January 2001, the financial crisis in September 2007, and the COVID-19 pandemic in March 2020. As a 50bp rate cut may raise greater concerns about economic "recession" in the market, Powell emphasized in his speech that he has not seen any signs of a recession, as always using this method to hedge market concerns about a recession.

The Federal Reserve also provided a more hawkish dot plot, expecting two more rate cuts totaling 50bp by the end of the year, 4 cuts totaling 100bp in 2025, and 2 cuts totaling 50bp in 2026, with an overall rate cut of 250bp and an endpoint interest rate of 2.75–3%. The pace of rate cuts provided by the dot plot is slower than the CME interest rate futures trading, which predicts reaching the 2.75–3% level in September 2025. At the same time, Powell emphasized that this 50bp rate cut cannot be used as a new benchmark for linear extrapolation, and no fixed interest rate path has been set. The rate cuts can be accelerated, slowed down, or even paused, depending on the situation at each meeting, which to some extent explains the surge in U.S. bond yields after the market close.

In terms of economic forecasts, the Federal Reserve lowered its GDP growth forecast for this year from 2.1% to 2.0%, significantly raised the unemployment rate forecast from 4.0% to 4.4%, and lowered the PCE inflation forecast from 2.6 to 2.3%. The Federal Reserve's data and statements both show increased confidence in curbing inflation, while also paying more attention to employment. Overall, with a significantly large initial rate cut and a more hawkish rate cut pace, the Federal Reserve has once again played with expectations management.

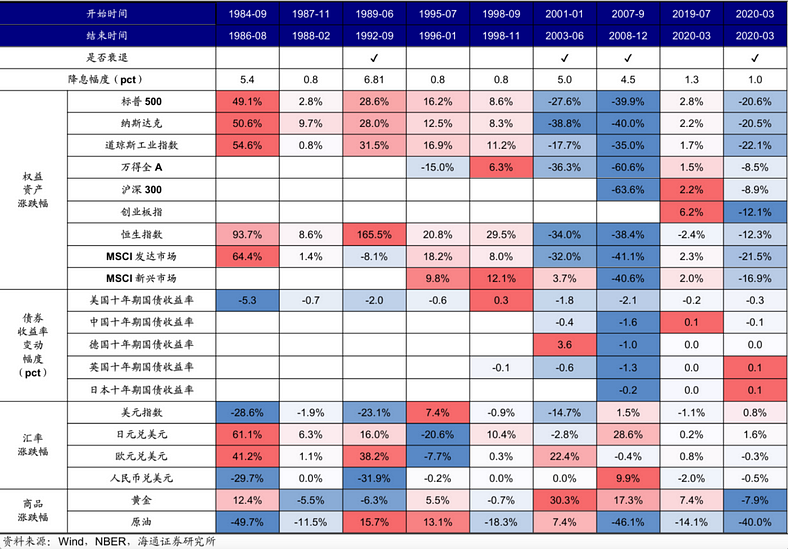

2. Interest Rate Cycles Since the 1990s

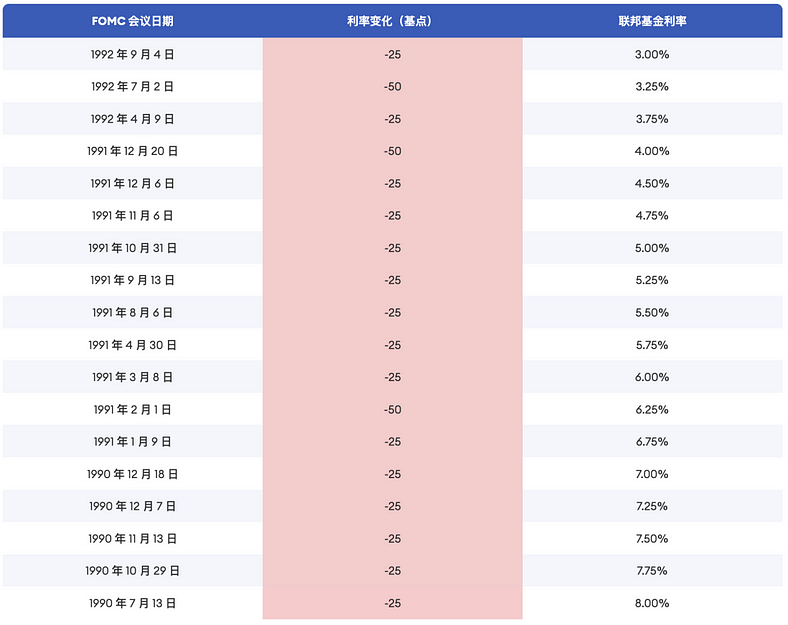

June 1989 to September 1992 (Recessionary Rate Cuts)

At the end of the 1980s, U.S. interest rates rose rapidly, leading to a situation where short-term deposit rates were higher than long-term fixed loan rates, and U.S. bond yields inverted. The U.S. financial industry experienced a "savings and loan crisis," with a large number of banks and savings institutions going bankrupt. Combined with the external impact of the Gulf War, the U.S. economy fell into a recession period defined by the National Bureau of Economic Research (NBER) from August 1990 to March 1991, lasting 8 months. The Federal Reserve began a rate cut cycle in June 1989, cutting rates by a total of 681.25BP over more than three years, with the upper limit of the policy rate dropping from 9.8125% to 3%.

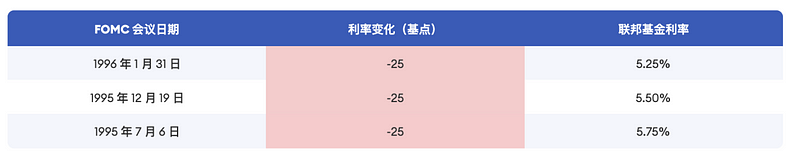

July 1995 to January 1996 (Preventive Rate Cuts)

In 1995, the U.S. economy showed signs of slowing growth and weak employment. The Federal Reserve believed that although the economy had not yet entered a recession, some economic indicators' decline or implied future economic downturn risks, and decided to cut rates to stimulate the economy as a preventive measure. This rate cut began in July 1995, lasted for 7 months, with a total of three rate cuts, totaling 75BP, and the upper limit of the policy rate dropped from 6% to 5.25%. Later, the U.S. economy achieved a "soft landing," with weak employment and manufacturing PMI indicators rebounding before the rate cut. This rate cycle is also considered a typical case of a "soft landing." On the other hand, the Federal Reserve's operations successfully prevented inflation from "taking off," with the PCE inflation rate hardly exceeding 2.3% during the rate cut process, maintaining relative stability.

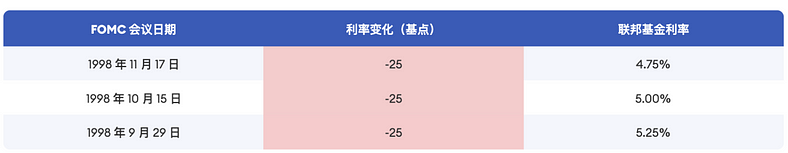

September 1998 to November 1998 (Preventive Rate Cuts)

In the second half of 1997, the "Asian financial crisis" broke out, and the recession in the Asian economy weakened external demand, affecting U.S. commodity trade. While the overall U.S. economy remained stable, the turmoil in the external environment and the weakness in commodity trade pressured the U.S. manufacturing sector, leading to a stock market correction. In August 1998, the S&P 500 index experienced a nearly two-month correction, with the deepest decline approaching 20%, and the giant hedge fund Long-Term Capital Management (LTCM) was on the verge of bankruptcy. To prevent the crisis from further affecting the U.S. economy, the Federal Reserve began rate cuts in September 1998, with three rate cuts by November, totaling 75BP, and the upper limit of the policy rate dropped from 5.5% to 4.75%.

January 2001 to June 2003 (Recessionary Rate Cuts)

At the end of the 1990s, the rapid development and popularization of internet technology led to excessive speculation and irrational prosperity, with a large amount of capital flowing into internet investments. From October 1999 to March 2000, the Nasdaq index rose by 88% in five months. From June 1999 to May 2000, the Federal Reserve raised interest rates six times, totaling 275BP, to counteract the overheated economy. In March 2000, after reaching its peak, the Nasdaq index quickly declined, the internet bubble gradually burst, and a large number of internet companies went bankrupt, leading to an economic recession. On January 3, 2001, the Federal Reserve announced a 50BP rate cut, followed by a total of 13 rate cuts, totaling 550BP, with the upper limit of the policy rate dropping from 6.5% to 1.0%.

September 2007 to December 2008 (Recessionary Rate Cuts)

In 2007, the subprime mortgage crisis broke out in the United States and further spread to other markets such as bonds and stocks, leading to a rapid change in the U.S. economic situation. On September 18, the Federal Reserve cut the federal funds target rate by 50 basis points to 4.75%, and then continued to cut interest rates 10 times, lowering the rate by 550 basis points to 0.25% by the end of 2008. The rate cuts were still insufficient to address the severe economic situation, so the Federal Reserve introduced quantitative easing (QE) for the first time, using unconventional monetary policy tools such as large-scale purchases of U.S. Treasury bonds and mortgage-backed securities to lower long-term interest rates, stimulate the economy, and inject liquidity into the market.

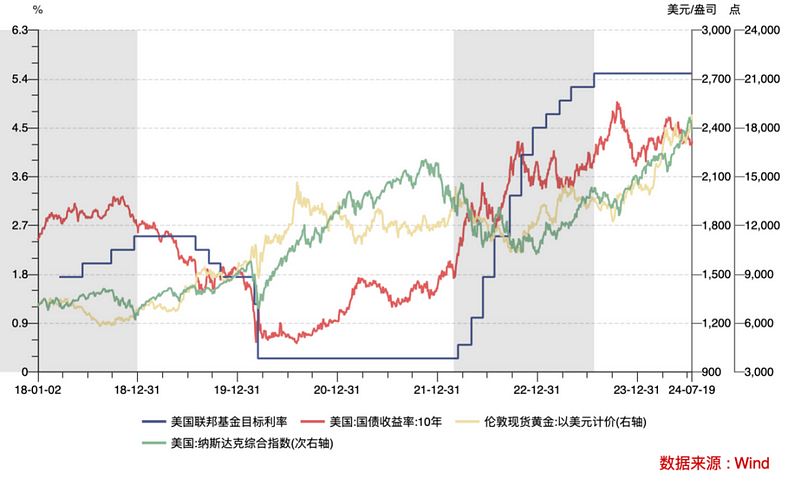

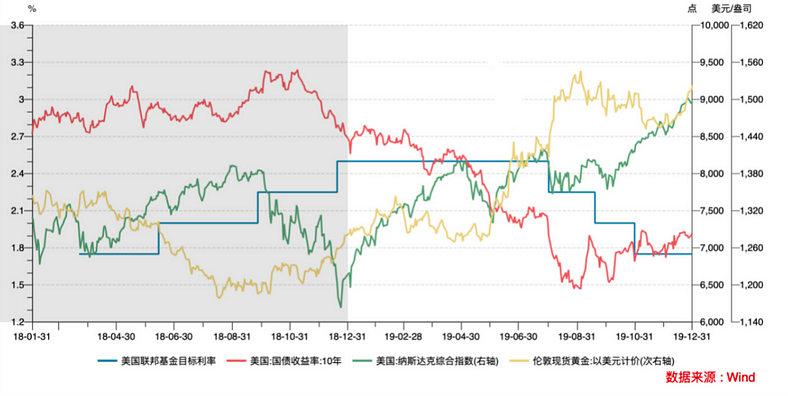

August to October 2019 (Preventive Rate Cuts)

In 2019, the overall U.S. economy and job market were stable, but factors such as geopolitical conflicts and U.S.-China trade tensions weakened U.S. external demand, while domestic demand also showed a slowing trend, with inflation rates below 2%. In the first half of 2019, the PCE inflation rate remained at 1.4–1.6%, and the core PCE inflation rate dropped from 1.9% at the beginning of the year to 1.6% from March to May.

On July 31, 2019, the Federal Reserve announced a 25 basis point rate cut to 2.25%, stating that the U.S. economy was growing moderately, the job market was strong, but overall and core inflation rates were both below 2%, aiming to guard against economic slowdown, especially considering the tense trade situation and global growth slowdown. Until the global pandemic outbreak in 2020, the overall U.S. economy was stable, with indicators such as manufacturing PMI and core PCE showing a rebound. From August to October 2019, the Federal Reserve made three consecutive rate cuts, totaling 75 basis points, with the upper limit of the policy rate dropping from 2.5% to 1.75%.

March 2020 (Recessionary Rate Cuts)

In 2020, the global spread of the COVID-19 pandemic led to the Federal Open Market Committee holding two emergency meetings and making significant rate cuts, restoring the federal funds target rate range to 0 to 0.25%.

Asset Prices during Rate Cycles

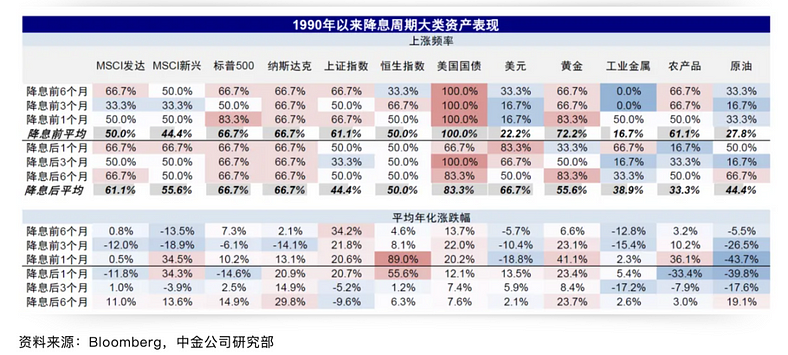

The changes in asset prices after rate cuts are closely related to whether the macroeconomic environment is in recession. It is believed that the current U.S. economic data does not support the conclusion of a recession. Under the premise of a soft landing for the U.S. economy, more attention should be paid to the asset price trends during the rate cuts in the 19-20 period, which are closer to the present time.

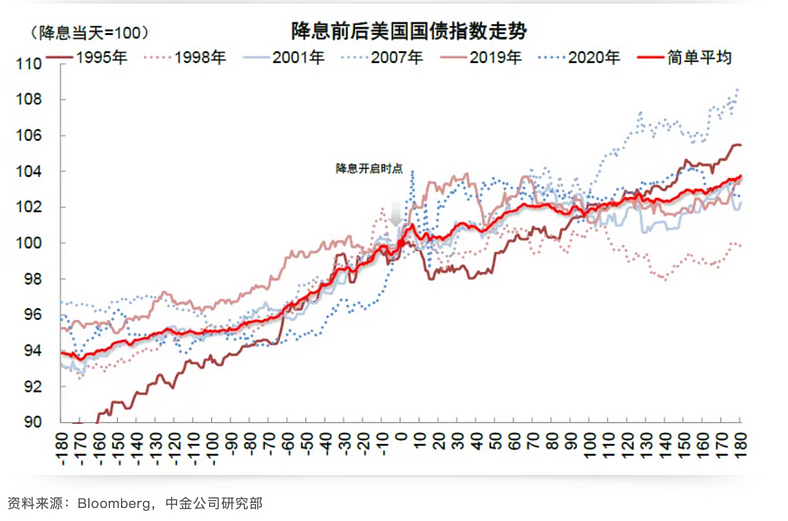

U.S. Treasury Bonds

Overall, U.S. Treasury bonds were on an upward trend before and after the rate cuts, with a more certain and larger increase before the rate cuts. The average upward frequency in the 1, 3, and 6 months before the rate cuts was 100%, while it decreased after the rate cuts. The average upward amplitude in the 1, 3, and 6 months before the rate cuts was 13.7%, 22%, and 20.2%, respectively, compared to 12.2%, 7.1%, and 4.6% after the rate cuts. It is evident that the market behavior was priced in advance. The volatility increased around one month before and after the rate cuts. In the later stage of the rate cuts, the interest rate trends showed differentiation due to different economic recovery situations.

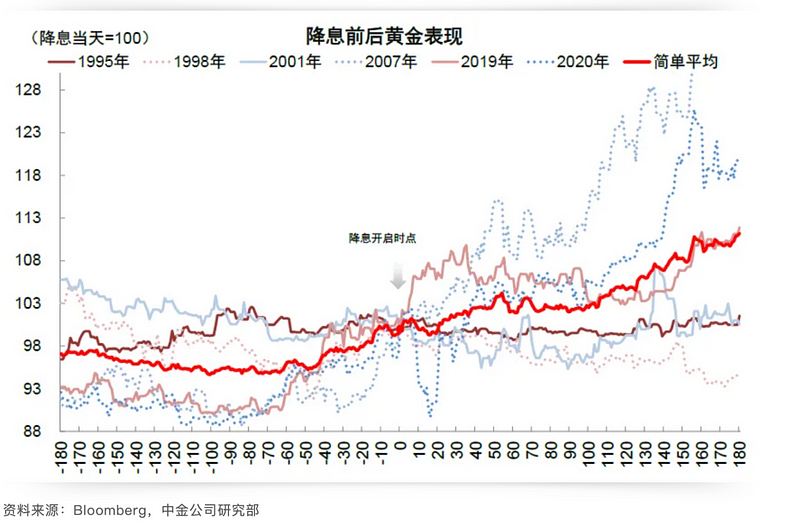

Gold

Similar to U.S. Treasury bonds, gold had a higher probability and amplitude of increase before the rate cuts. Benefiting from the safe-haven demand in critical situations, the relationship between the trend of gold and a "soft landing" is relatively unclear. From a trading perspective, the best time to trade gold as the denominator asset is before the rate cuts, as the expectations are fully priced in and the rate cuts are limited. After the rate cuts, more attention can be given to the assets on the numerator side that benefit from the rate cuts.

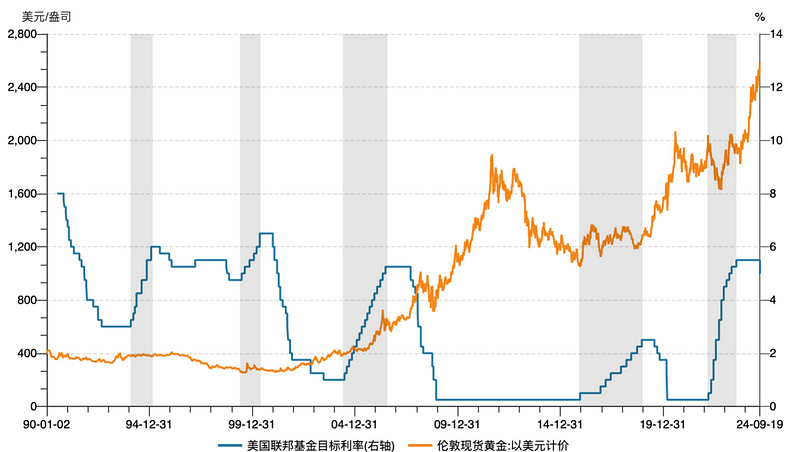

Before the approval of the first globally traded gold ETF by the U.S. SEC in 2004, the correlation between gold prices and rate cuts was not clear. The rise of gold ETFs led to a surge in gold investment demand, attracting a large number of retail and institutional investors, and the continuous inflow of funds provided strong momentum for the rise in gold prices. This upward cycle lasted for 7 years until it peaked in 2011, experiencing significant interest rate hikes from 2004 to 2006 and substantial rate cuts from 2007 to 2008 by the Federal Reserve, maintaining an overall upward trend. Excluding the impact of gold ETFs, the only meaningful rate cut cycle to refer to at present is in 2019. In the short term, during the rate cuts from August to October 2019, gold rose significantly after the first rate cut, followed by a volatile pullback in the next two months. In the longer term, gold continued to show an upward trend after the rate cuts.

Federal Reserve Rate Cycle and Gold Prices

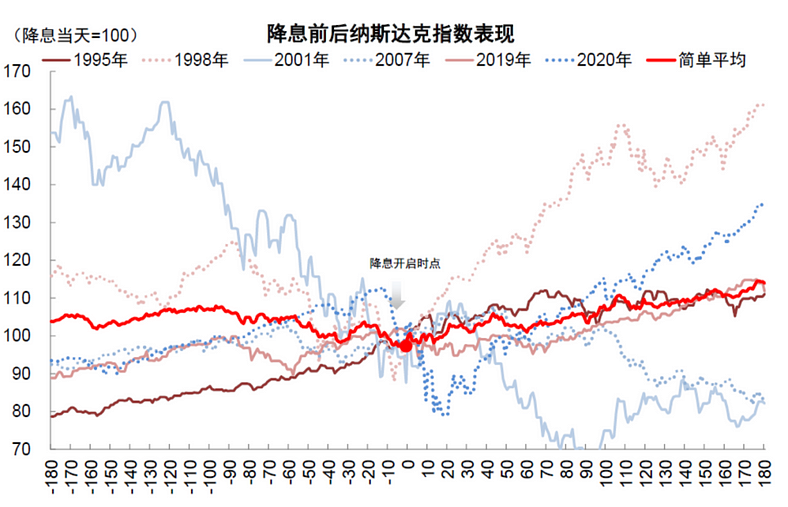

Nasdaq

The performance of the Nasdaq during recessionary rate cuts depends on the situation of fundamental repairs. Overall, the Nasdaq mostly showed a decline during recessionary rate cut cycles, except for a 28% increase during the extended rate cut cycle in 1989. In the rate cut cycles of 2001, 2007, and 2020, the Nasdaq fell by 38.8%, 40%, and 20.5% respectively. After the first preventive rate cut by the Federal Reserve, the short-term performance in different years varied, but the long-term trend was upward, indicating that preventive rate cuts often have a positive effect on the economy, reversing signs of weakness and driving the stock market up. Therefore, the key to judging the trend of the Nasdaq index lies in understanding the possibility of a recession. During the rate cuts in 2019, the Nasdaq experienced a pullback after the first and second rate cuts, showing a volatile trend over the three months of rate cuts, and began a major upward trend after the third rate cut.

BTC

During the rate cut cycle in 2019, BTC briefly rose in price after the first rate cut, but then overall entered a downward channel. The overall retracement from the top lasted 175 days, with a retracement of approximately 50% (excluding the subsequent impact of the pandemic). The difference from the previous rate cut cycle is that due to the fluctuating rate cut expectations, the retracement of BTC came earlier this year. Since reaching its peak in March 2020, BTC has been in a volatile retracement for a total of 189 days, with a maximum retracement of approximately 33%. Based on historical experience, the long-term outlook is bullish, with the possibility of short-term volatility or retracement, but the magnitude and duration of the retracement will be smaller and shorter compared to 2019.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。