Author: YBB Capital Researcher Zeke

Preface

The law of halving is beginning to fail, and the various altcoins are also in a slump. Speculators are exiting, and believers are beginning to doubt themselves. The industry's despair comes not only from the low prices in the secondary market, but also from the confusion about the future direction. Criticism has become the main theme within the industry, from the lack of applications to the detailed analysis of the financial reports of major public chains. Now, the focus has turned to the internal dilemma of the former king of altcoins, Ethereum. So, what exactly is the internal dilemma of the king of altcoins?

I. Horizontal Expansion of the Main Chain, Vertical Development of Multiple Layers

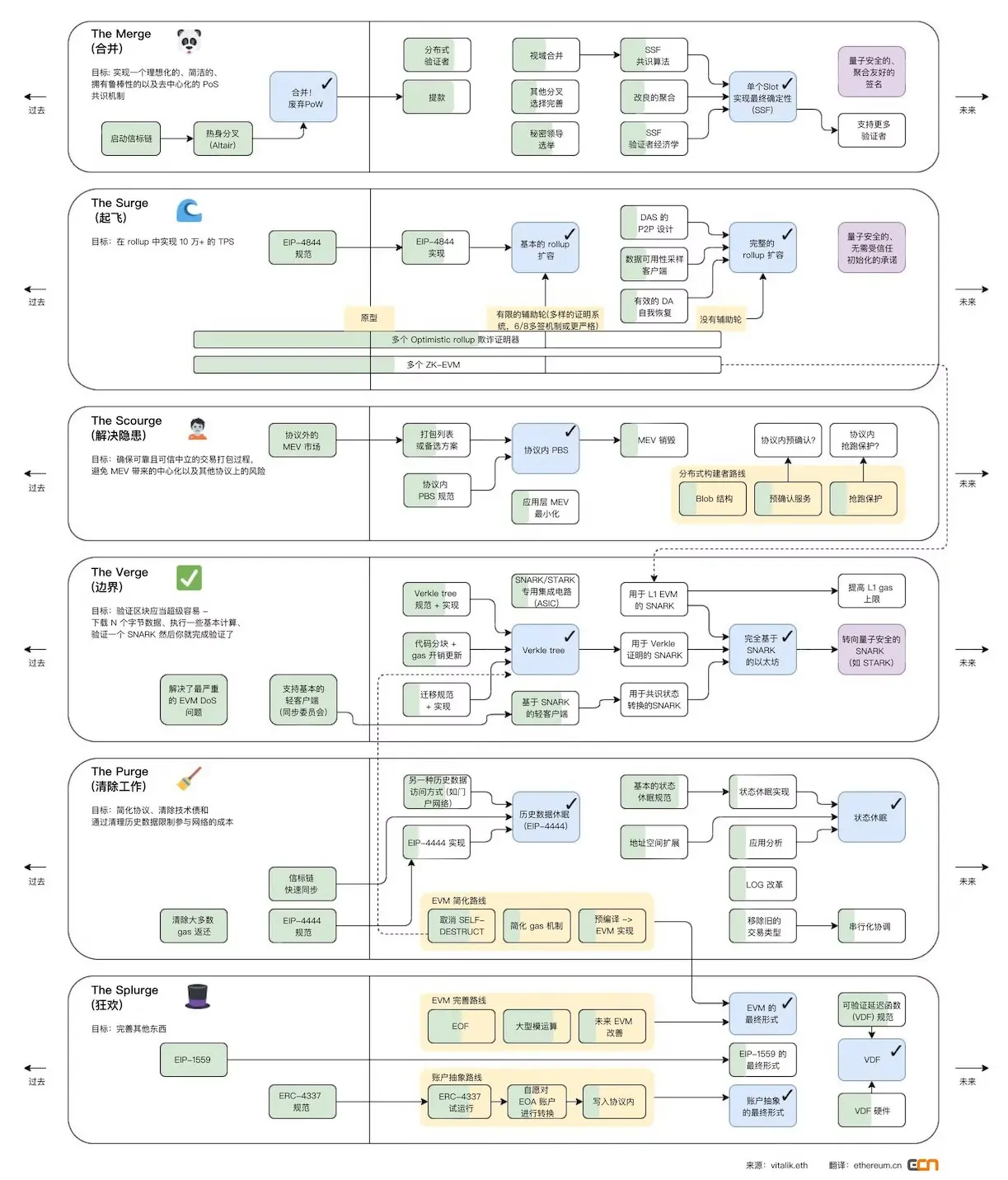

The move towards fully modularized expansion was a vision for Ethereum's endgame that Vitalik had in 2018 and 2019. The bottom layer was optimized around Data Availability, and the upper layer was infinitely scalable, breaking free from the blockchain trilemma, with Ethereum becoming the settlement layer for thousands of chains, ultimately achieving the end game of blockchain scalability.

After confirming the feasibility of this idea, Ethereum's roadmap for both horizontal and vertical expansion began to progress rapidly. In 2023, with the successful merger of the main chain and the Beacon Chain in Shanghai, the modularization theme began to cover the Ethereum ecosystem. Now, with the first step towards EIP4844 after the Cancun upgrade, the main chain itself has come infinitely close to Vitalik's early vision. The upper layer is also flourishing, with Gas, TPS, and diversity gradually surpassing its former competitors.

It can be said that, except for the drawback of fragmentation, all narratives about Ethereum Killers from various heterogeneous chains should be declared over. However, the cruel reality is the continuous rise of TON and Solana, and many infra projects that imitate modularization narratives even outperform the "modularization protagonist" backed by ETFs in the secondary market. What is the cause of this situation?

The recent criticism of Ethereum's multiple "crimes," from transitioning to POS to developing Layer2, is the main focus. But in my opinion, Ethereum developers and Vitalik are not wrong in advancing the modularization process. If there is any fault, it may be that the process was pushed too quickly and was overly idealistic. I once wrote in an article earlier this year, roughly meaning: if blockchain has a lot of value outside the financial sector and mass adoption will eventually come, then Ethereum's shift to modularization makes sense.

Obviously, Ethereum is overly idealistic in this regard, and there is currently no evidence to prove that these two points are true. This is also the case with the current state of Layer2; the anticipated explosion of the application layer has not arrived. Furthermore, a large number of general-purpose chains are basically only ARB, OP, and Base, which are still active. It is completely impossible for Ethereum to sustain a positive cycle solely based on DA income. There are many other remaining issues, such as the significant reduction in Gas consumption, where tasks that used to require 0.1 ETH to complete can now be done with just 0.001 ETH, but user activity has not increased by tens or hundreds of times, resulting in market supply far exceeding demand.

However, it seems that there is nothing wrong with promoting the development of public chains for large-scale adoption while maximizing decentralization and security. Ethereum has gradually turned the "pie" it has drawn over the past eight years into reality, which is commendable in the crypto world. Unfortunately, reality is always utilitarian, and the market will not pay for ideals. In the current situation of application and liquidity scarcity, the contradiction between technical idealists and investors will continue to deepen.

II. Human Nature

The idealism of Ethereum is not only reflected in its judgment of the future of the application layer, but also in its judgment of human nature. The two most discussed issues with Layer2 from a technical perspective are: 1. Centralized Sequencer; 2. Token. From a technical perspective, Layer2 can be decentralized. But from the perspective of human nature, it is impossible for the leading Layer2 projects to give up the huge profits brought by the sequencer. Unless the three words "decentralization" can activate the token and achieve greater benefits.

For example, the aforementioned leading Layer2 projects are certainly capable of decentralizing the sequencer, but they will not do so. Because they are all top-down projects that have been created through massive financing, their birth is very Web2, and their operational logic is the same. The relationship between community members and Layer2 is more like that of consumers and cloud server operators. For example, those who frequently use Amazon's AWS servers may receive some coupons and cashback, and Layer2 is the same (airdrop).

However, the income from the sequencer is the lifeblood of Layer2 from the perspective of the project side. Design, financing, development, operation, hardware procurement—all of these do not require community support. In their logic, users do not contribute much (which is why many Layer2 projects always have a bad attitude towards users), let alone the community wanting to decentralize the sequencer. Only moral constraints cannot bind Layer2. To make the sequencer as decentralized as possible, a new sequencer scheme needs to be designed from the perspective of the interests of the Layer2 project side. However, this controversial scheme would be highly controversial. A better approach is to erase the part of the roadmap that decentralizes the sequencer, or hide it in an unseen part of the roadmap.

The current form of Layer2 is completely contradictory to the original intention of Ethereum's embrace of modularization. Most Layer2 projects are just changing concepts and dividing everything valuable in Ethereum.

Let's talk about tokens again. From the perspective of Ethereum, Layer2 should not have tokens.

Layer2 is just a "high-performance scaling server" that needs to be used for cross-chain transactions, and it only charges user service fees. For both parties, this is healthy. To maintain the value and status of ETH to the maximum extent, it is necessary to stabilize the business in the long run. To put it more concretely, if the entire second-layer ecosystem is compared to the European Union, then maintaining the stability of the euro is necessary.

If a large number of member countries weaken the euro by issuing their own currency, then the EU and the euro will eventually cease to exist. Interestingly, Ethereum does not restrict Layer2 from issuing tokens, nor does it restrict whether Layer2 should use ETH as Gas fees. This open attitude to the rules is indeed very "crypto." However, with the continuous weakening of ETH, the "EU members" are already eager to move. In the issuance tools of leading Layer2 projects, it is clearly stated that projects can use any token as Gas, and projects can choose any integrated DA solution. In addition, one-click issuance will also lead to the formation of second-layer alliances.

On the other hand, from the perspective of Layer2 and the community, even if ETH rebounds strongly in the future, the situation of tokens is still awkward. For token issuance, the leading Layer2 projects were actually very hesitant in the early stages. In addition to the aforementioned issues of being at odds with ETH, there are several other points: regulatory risks, not needing to maintain development through tokens if there is no shortage of money, difficulty in scaling token empowerment, using ETH directly can quickly promote TVL and ecosystem growth, issuing tokens oneself may contradict this, and liquidity cannot be stronger than ETH.

It is still a problem of human nature; no one can resist printing billions of dollars out of thin air.

Furthermore, from the perspective of community members and ecosystem development, tokens seem to be necessary. In addition to collecting fixed service fees, there is also a treasury that can be cashed out at any time. Why not? However, the design of tokens needs to minimize empowerment in combination with the above issues.

From Air Tokens to Real Value

A bunch of air tokens that do not require staking through POS or mining through POW have been born, and their only function is voting. Each time they are linearly released, they also need to divide a large amount of liquidity from the market. As time goes on, these tokens without any driving force will continue to decline after a one-time airdrop, and neither the community nor the investors can come up with a good explanation. So, should they be empowered? Any valuable empowerment will be contradictory to the above issues, ultimately leading to a dilemma. The situation of the four major tokens can also well illustrate the above problems.

Base, which does not issue tokens, is now far more prosperous than Zks and Starknet. Its sequencer income has even surpassed that of Superchain's creator, OP. This was mentioned in a previous article about the attention economy. Using social media influence, operations, and hype to create the wealth effect of MEME and multiple projects in the ecosystem is actually a kind of indirect multiple small airdrops, which is much healthier than directly issuing tokens and a one-time airdrop. In addition to creating sustained appeal, it can also avoid a lot of problems. Setting aside a portion of the sequencer income every month can sustain activity and build a healthy ecosystem. Furthermore, the current Web3's point system is just scratching the surface of Pionex. Coinbase's long-term operational approach far surpasses the nouveau riche like Iron Shun.

III. Inferior Competition

The first layer and the second layer are homogenized, and the second layer and the second layer are also homogenized. This situation stems from a very crucial problem: in this round, there are not many independent applications that can support an application chain, and the few that can have "run away" (DYDX).

From the current perspective, it can be said that the target users of all Layer2 are the same, even with the main chain. An extremely bad phenomenon has also arisen from this: the second layer is constantly eroding Ethereum, and there is also vicious competition for TVL between the second layers. No one understands the difference between these chains, and users can only judge where to deposit money and where to trade based on point activities. Homogenization, fragmentation, and liquidity scarcity—Ethereum is currently the only one that can simultaneously occupy these three points in the Web3 public chain ecosystem. These problems also stem from the drawbacks of Ethereum's open spirit. We may soon see a large number of Layer2 projects being naturally eliminated, and the centralization issue will also lead to various chaos.

IV. The Leader Does Not Understand Web3

Whether it's the former Vitalik or the "Little V" in the mouths of KOLs, Vitalik's contributions to infrastructure have indeed promoted the prosperity of the entire industry since the era of Satoshi Nakamoto, and this is obvious to all. However, the reason Vitalik is now called "Little V," in addition to issues in his personal life, there is also an interesting argument: the Ethereum leader does not understand DApps, let alone DeFi. I somewhat agree with this statement, but before discussing this issue further, I want to clarify one thing first: Vitalik is just Vitalik.

He is not an all-powerful deity, nor is he a useless dictator. In my eyes, Vitalik is actually a relatively humble and actively learning public chain leader. If you have read his blog, you should have no trouble noticing that he updates discussions on philosophy, politics, Infra, and DApps one to three times every month. He also enjoys sharing on Twitter. Compared to some public chain leaders who like to occasionally criticize Ethereum, Vitalik is much more pragmatic.

Having said the good things, let's talk about the negative aspects. In my opinion, Vitalik has three problems:

His influence on the industry is too great, from retail investors to VCs. Everyone is influenced by his every word and action, and entrepreneurship is also a pathological trend of Web3 projects following Vitalik's lead.

He is quite persistent in the technical direction he believes in, and sometimes he even goes to bat for it.

He may really not understand what encrypted users need.

Let's start with Ethereum's scalability. The argument that Ethereum urgently needs to scale is often supported by the super high on-chain access brought about by the overflowing external liquidity from 2021 to 2022. But every time Vitalik talks about this, it seems like he really doesn't understand. This is clearly a short-term phenomenon, and why users come to the chain is not clear. Another point is that he has repeatedly emphasized the technical superiority of ZK on Layer2, but ZK is clearly not user-friendly in terms of user experience and ecosystem development. Now, a large number of startups following Vitalik's lead in ZK Rollup are not even in the T2 or T3 ranks, and even the two giants at the top are on the verge of collapse. The performance of the three giants of Optimistic Rollup is also better than the sum of dozens of ZK Rollups. There are several other issues like this, such as the mid-2021 criticism of MPC wallets, which was a case of generalizing from a specific case, and directly supporting AA wallets.

He also proposed SBT earlier, but it was very lackluster when it came to applications, to the point that no one mentioned it later. It can be said that the technical solutions supported by Vitalik in recent years have not performed well in the market. Finally, his recent statements about DeFi are also confusing. Looking at it from various perspectives, we can only say that Vitalik is not perfect. He is an excellent and idealistic developer, but at the same time, he lacks an understanding of user groups and occasionally expresses subjective opinions about things he does not fully understand. The industry needs to dispel the charm of him and also distinguish right from wrong about the controversies surrounding him.

V. From Virtual to Real

From the ICO frenzy in 2016 to the P2E bubble in 2022. In the history of infrastructure being limited by performance and constantly developing, each era will bring about matching Ponzi schemes and emerging narratives, driving the industry towards a bigger bubble. And now we are experiencing the era of the bursting bubble, with massively financed projects self-destructing, high-profile narratives repeatedly failing, and a value gap between Bitcoin and altcoins. Doing valuable things is the main point I will continue to emphasize in multiple articles this year. Moving from the virtual to the real is also the current main trend. As Ethereum embraces modularization, many people say that the narrative of Ethereum killers should be turned over.

But the most popular ecosystems now are TON and Solana. Do they bring any innovation to Crypto? Are they more decentralized or secure than Ethereum? No, and there is no new narrative in their story. They just make things that sound mysterious more like applications and integrate the advantages of the chain into a more Web2-friendly standard.

In the context of geometric growth internally and a lack of external liquidity, striving for new narratives also fails to fill the block space of Ethereum's Layer2. As the leader of the industry, Ethereum should first solve the fragmentation and internal corruption of Layer2.

Especially, the Ethereum Foundation (EF), which was not mentioned earlier, why has it not played a role that matches its massive spending? In the case of extreme oversupply of Layer2 infrastructure, why is the priority of infrastructure funding still listed as the highest? Even the leader of Cex is putting down its pride and seeking change. The EF, as a key organization for accelerating ecosystem growth, is going in the opposite direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。