The trading volume of the October federal funds futures, which bet on the Fed's interest rate decision this week, has risen to a record high, with most contracts betting on a 50 basis point rate cut, and one-third of the positions were newly established this week.

Author: Li Xiaoyin

Source: Wall Street News

On the eve of the Fed's September interest rate decision, the market's expectation of a 50 basis point rate cut has become increasingly strong.

According to Bloomberg compiled data, the trading volume of the October federal funds futures, which bet on the Fed's interest rate decision this week, has risen to the highest level since 1988, with most new contracts betting that the Fed will cut interest rates by 50 basis points, and one-third of the positions were newly established this week.

After last Thursday's repeated preheating of mainstream financial media opinion articles such as "Fed Communication Society," the market's expectation of the magnitude of the Fed's first rate cut suddenly changed from 25 basis points to "more likely to be a substantial rate cut."

Currently, the market's implied odds show that the likelihood of a 50 basis point rate cut is slightly higher than 50% before the Fed makes a decision. At the same time, U.S. bond yields have fallen sharply this week, with the 2-year U.S. bond yield touching a two-year low of 3.52%.

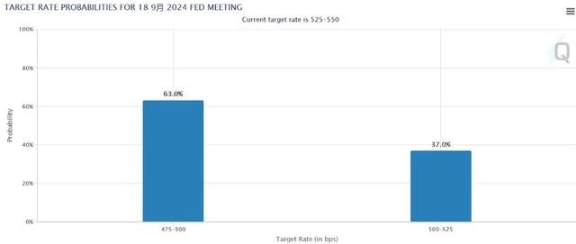

As of Wednesday, the Chicago Mercantile Exchange's Fed Watch Tool priced the probability of a substantial 50 basis point rate cut at 63%, far exceeding the 30% from a week ago, and the likelihood of a "conventional" 25 basis point rate cut is only 37%.

Data from the U.S. Commodity Futures Trading Commission (CFTC) shows that as of the week ending September 10, hedge funds increased their net short positions in long and ultra-long bonds, adding approximately $6.4 million for each basis point; and as of the week ending September 16, JPMorgan client surveys also showed that despite the closure of long positions that week, investor sentiment remained bullish.

Bank of America strategists stated in a report:

"The global rise in interest rates is leading people to believe that interest rate long positions are the most crowded trade, surpassing long positions in stocks for the first time."

Sue Subadra Rajappa, head of interest rate strategy at Natixis, warned that if the Fed's rate cut is small and Powell hints at a gradual approach to rate cuts, the market may face significant selling pressure.

"If the Fed cuts rates by 25 basis points instead of 50 basis points, the market reaction will be much stronger. The current market positioning, optimism, and loose financial conditions may be tested."

Kathy Jones, chief fixed income strategist at Charles Schwab, expects that short-term U.S. bonds, which are more sensitive to Fed policy, may be most affected, especially considering that they are "already priced quite aggressively."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。