1. Introduction to AEVO

Aevo is a decentralized exchange specializing in derivative trading, including options and perpetual contracts. Aevo utilizes a customized Layer 2 solution, using Celestia to achieve data availability, combining Ethereum's strong security with off-chain order matching and on-chain settlement speed. One of Aevo's most innovative products is the pre-launch token futures, allowing traders to speculate on tokens before their official release.

2. Project Features of AEVO

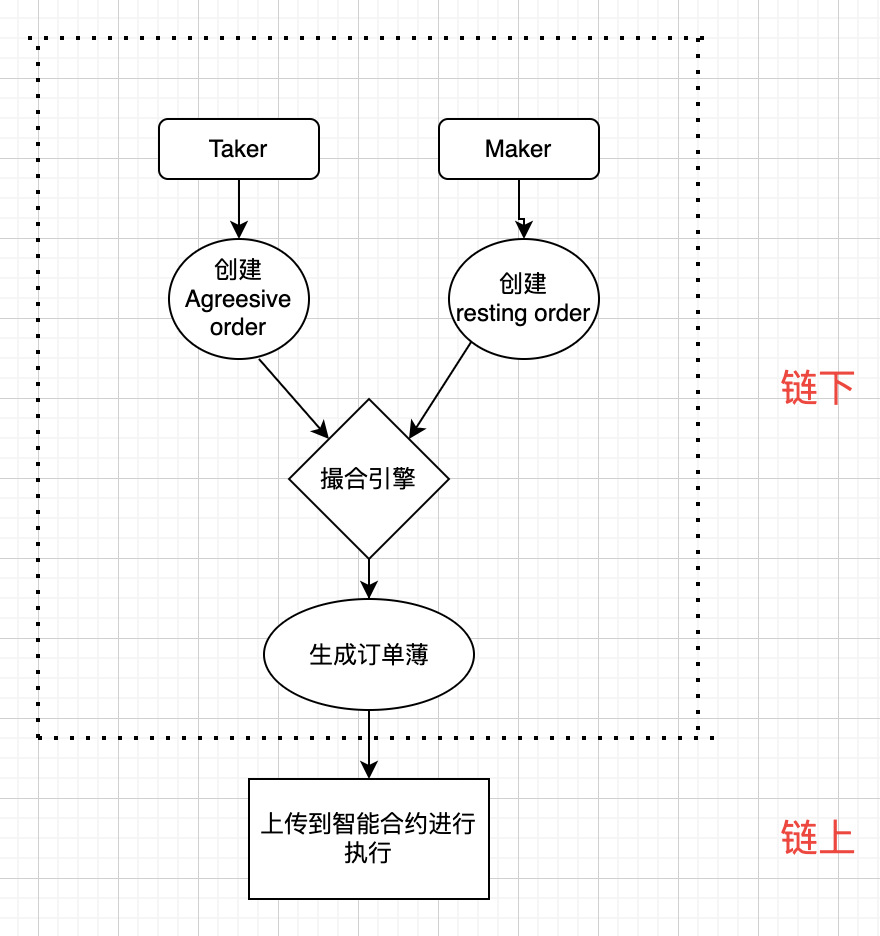

(1) Off-chain Order Book

Aevo adopts off-chain order book technology, where relevant information is only published to Aevo's smart contracts after the order creator and recipient are successfully matched. This design improves trading efficiency and ensures trading security through off-chain risk system assessment.

Off-chain Order Book

(2) Aevo Architecture

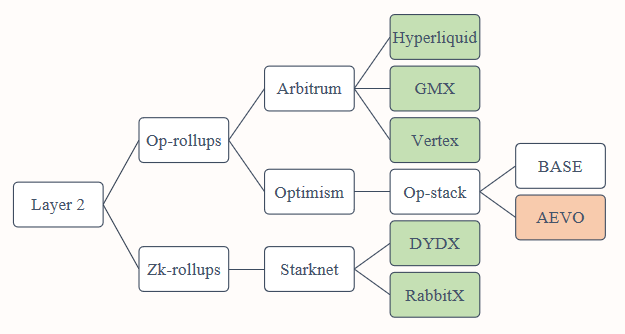

Aevo is built on the Ethereum platform and constructed on OpStack, known as AevoL2Rollup. This architecture allows smart contracts to process transactions and settle on the Ethereum mainnet every hour through Conduit's sequencer, ensuring efficient and secure transactions.

Designating Celestia as the Data Availability Provider

(3) Unique "Pre-Launch Token" Futures Contract

This product allows traders to speculate on tokens that have not yet been launched, providing early exposure to potential market movers through specific leveraged options. Users can trade with contracts for tokens not yet listed, and after the tokens are listed on centralized exchanges, these futures contracts will convert to regular perpetual contracts.

"Pre-Launch Token" Futures Contract

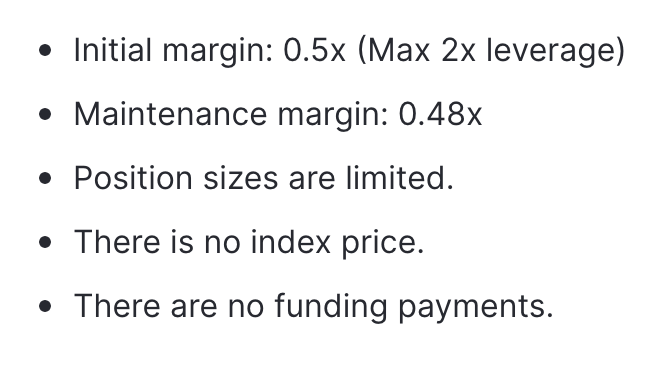

(4) Unique Theta Vault Feature

Theta Vault automatically issues out-of-the-money options to users who deposit funds weekly, allowing them to earn premiums. As out-of-the-money options cannot be exercised, they can be used as fixed income instruments.

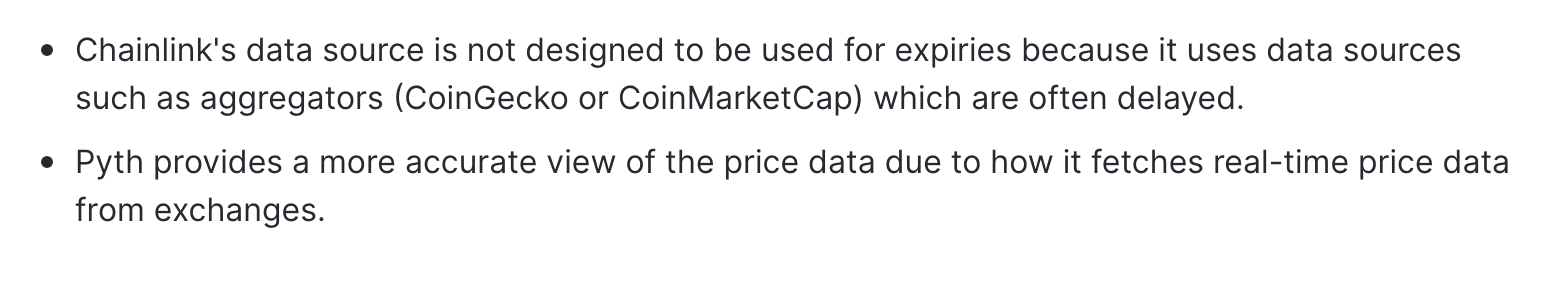

Using Pyth Network as the vault's oracle, Pyth's oracle program is an aggregation algorithm that combines data submitted by providers to generate aggregated prices and confidence intervals during computation, making Pyth prices more accurate.

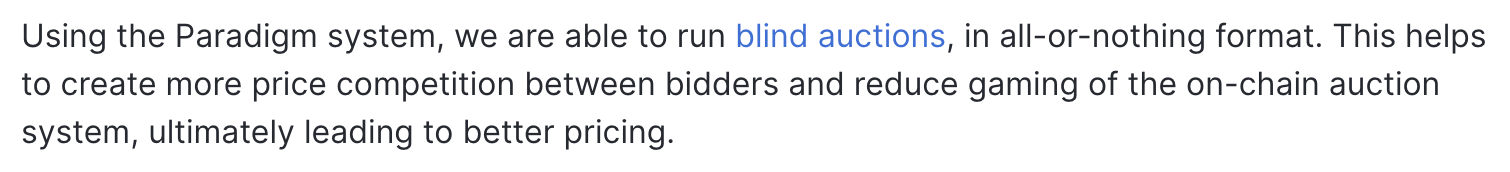

Utilizing Paradigm to conduct auctions for options in the vault.

Pyth prices are more accurate, while Chainlink often experiences delays

Utilizing Paradigm to conduct auctions for options in the vault

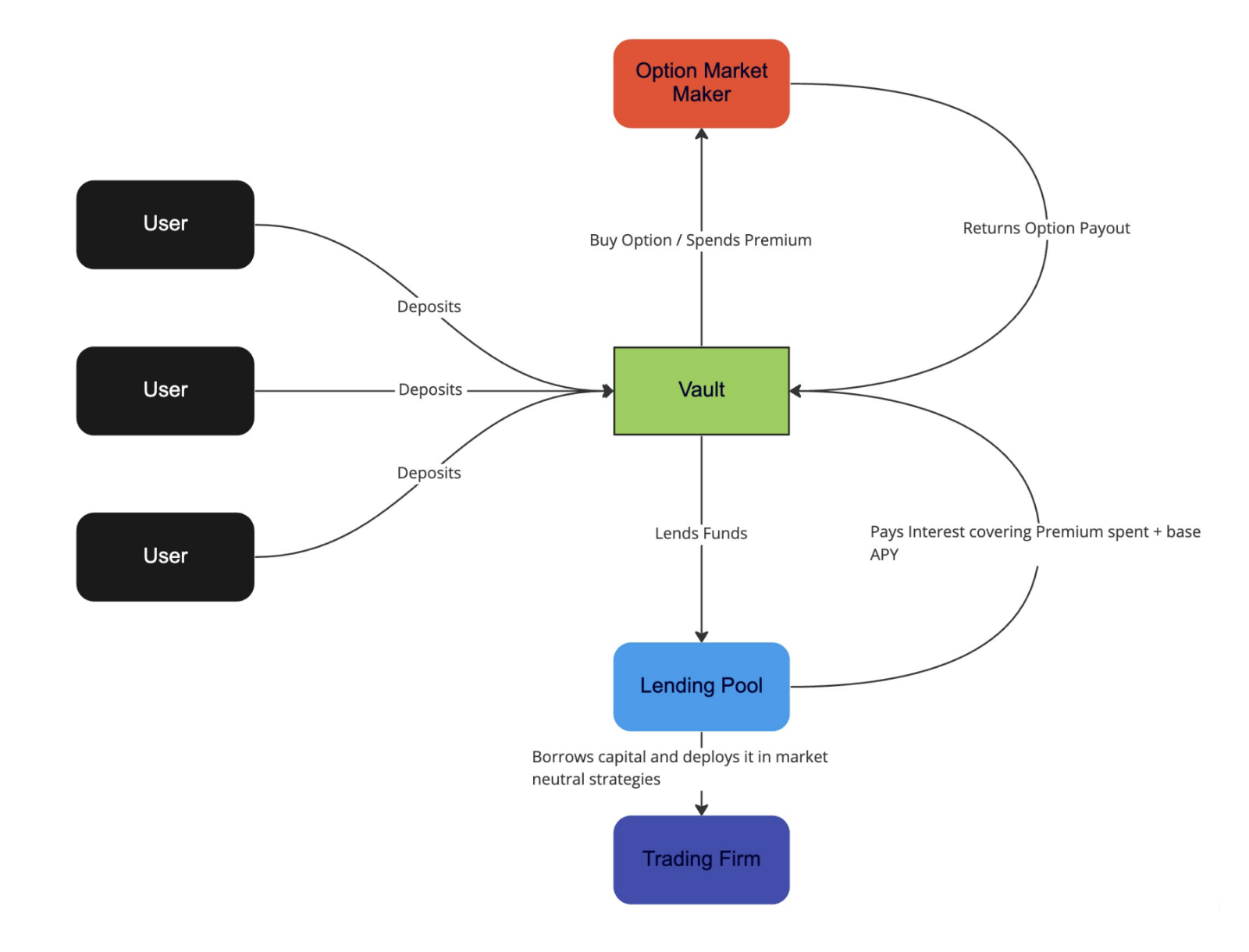

(5) Earn Vault - New Yield Insurance Vault

Earn Vaults are a series of new yield insurance vaults designed to complement Theta Vaults' risk allocation. Earn Vaults employ a fully funded strategy, allowing depositors to take advantage of Ethereum's intra-week volatility while ensuring the protection of their capital.

Earn Vault Introduction

3. Market Performance of Aevo

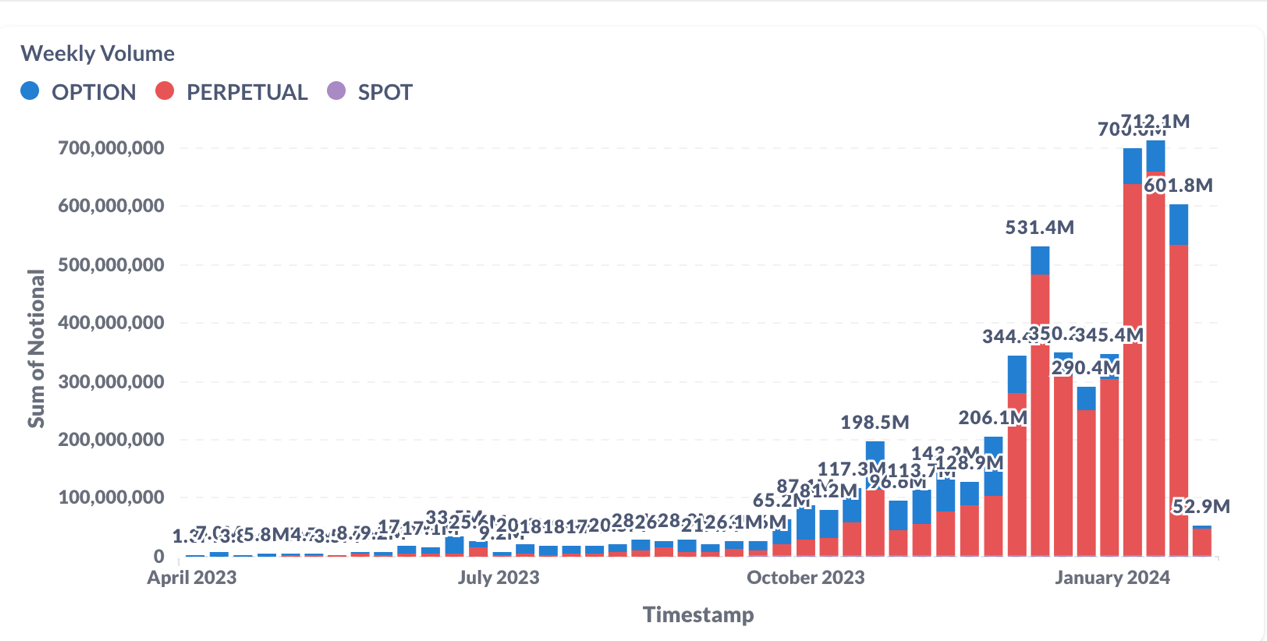

(1) From the Perspective of Trading Volume

The weekly trading volume on the AEVO platform has significantly increased since October 2023. The proportion of perpetual contract trading volume has consistently remained around 90% since October, while the proportion of options trading volume has been maintained at around 9.75%, with spot trading volume being extremely low, usually less than 0.25%.

Trading volume data

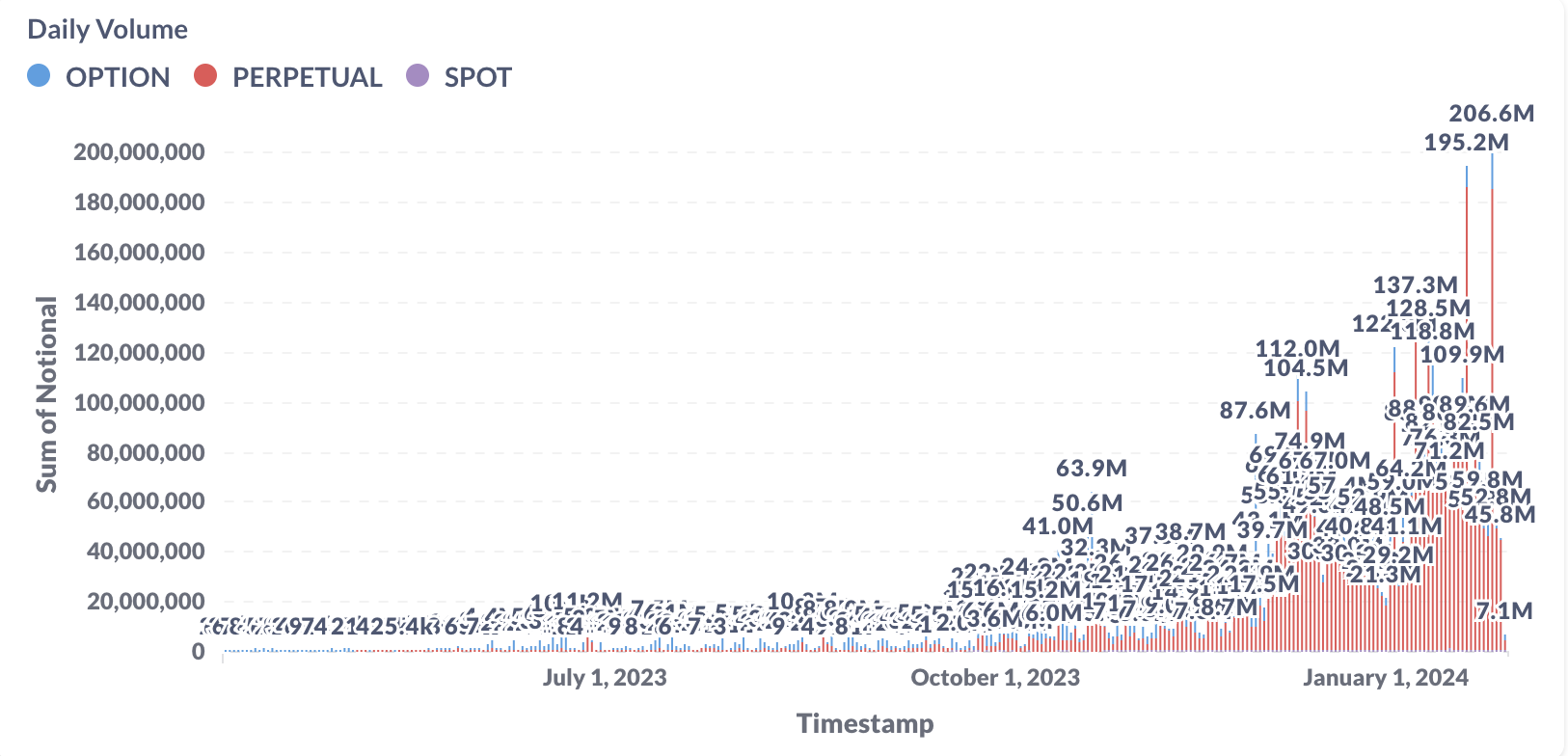

Looking at the daily data, the two days with a significant surge in trading volume were January 20, 2024, and January 26, 2024, which were also the days when Aevo launched the "Pre-Launch" futures contracts for $ALT and $JUP, respectively.

Daily trading volume data

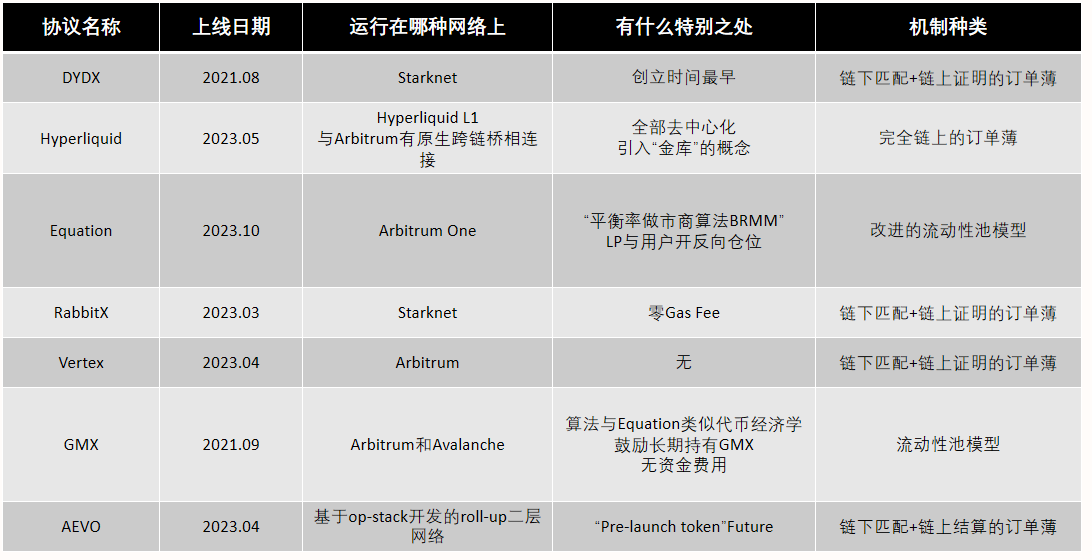

(2) Comparative Analysis with Similar Platforms

Comparative analysis with other competitors

4. Comprehensive Analysis of Aevo

(1) Advantages

New listing mechanism and speed, Pre-Launch + contracts create a paradise for speculative clients.

Not yet launched. As one of the few DEXs that have not yet launched, there are expectations of airdrops, which can attract people to interact.

Currently the only derivative DEX built on OP-Stack.

Luxurious VC lineup for investment - Paradigm and Coinbase.

(2) Disadvantages

- In the DEX derivatives field, there is a winner-takes-all effect.

Based on the data on the fifth page, even including inflated volume data (those with excessively large Volume/TVL ratios), the tenth-ranked platform is only 1/7 of the first-ranked platform. Therefore, to survive, there needs to be technological innovation, unique mechanisms (such as Equation), unique token economics (such as GMX), or a long-standing reputation (like DYDX). Unfortunately, Aevo does not have a striking technological innovation.

- The flow of investor funds into Aevo is contrary to expectations.

Aevo focuses on options, operates an options vault, and offers fixed income from premiums, but recent trading volume shows that contract trading accounts for 90% of the total trading volume. This indicates that the vast majority of individual investors currently do not favor options; they prefer "Pre-Launch." This also indicates that Aevo's management has made misjudgments in strategic planning and market assessment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。