Stablecoins have been established as a meaningful settlement medium, comparable to established transfer networks, and are no longer used solely for cryptocurrency speculation.

Byline: Deep Tide TechFlow

This business of stablecoins is attracting more and more traditional enterprises. For example, Visa, a giant in settlement and payment in the Web2 world, is gradually extending its business into the stablecoin field. Leveraging its existing business network, Visa currently supports 50+ wallet partners to facilitate rapid and easy issuance of Visa credentials, enabling stablecoin users to make payments quickly and securely at over 130 million merchants worldwide.

At the same time, Visa is also experimenting with the use of stablecoins such as USDC to expand the settlement capabilities of global issuing and acquiring banks, providing greater flexibility for modern sovereign debt.

How do industry giants view today's stablecoin market?

Recently, Visa, in collaboration with Castle Island (venture capital), Brevan Howard Digital (asset management), and Artemis (on-chain data analysis), jointly released a research report on the stablecoin market, investigating the macro market, supply and demand relationships, and adoption of stablecoins.

It is worth mentioning that the report focuses on five emerging countries: Brazil, Turkey, Nigeria, India, and Indonesia. By combining user survey results with on-chain estimates and qualitative insights from companies operating in these markets, the report provides a comprehensive understanding of the global use of stablecoins.

Deep Tide TechFlow has interpreted and summarized the report, selecting key points as follows.

Key Conclusions

- On-chain data proves that the usage of stablecoins is growing, whether in monthly active addresses, total supply, or settlement value.

- Stablecoins have been established as a meaningful settlement medium, comparable to established transfer networks.

- Stablecoins are no longer used solely for cryptocurrency speculation. 47% of surveyed cryptocurrency users list saving in USD as their stablecoin goal, 43% mention efficient currency exchange, and 39% indicate generating income.

- When asked about non-cryptocurrency stablecoin activities, the most popular uses are currency substitution (69%), followed by payment for goods and services (39%) and cross-border payments (39%).

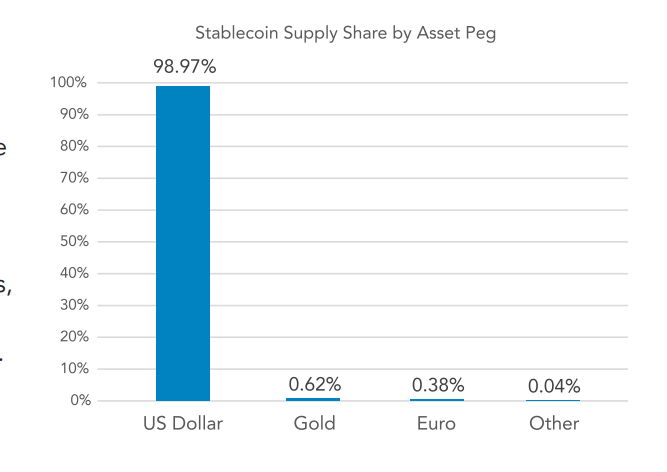

- The vast majority (about 99%) of stablecoins are pegged to the US dollar. When discussing US stablecoin regulation, one cannot ignore the fact that a large number of individuals and companies in emerging markets rely on these networks for savings, cross-border payments, remittances, and corporate cash management.

- When discussing the advantages of stablecoins, it is necessary to consider the potential benefits for billions of users in emerging markets to effectively access alternative hard currencies.

Stablecoin Market Situation: More Than Just Speculation, A New "Savior" in Emerging Countries

Key Points

- Stablecoins are the "killer app" of cryptocurrencies.

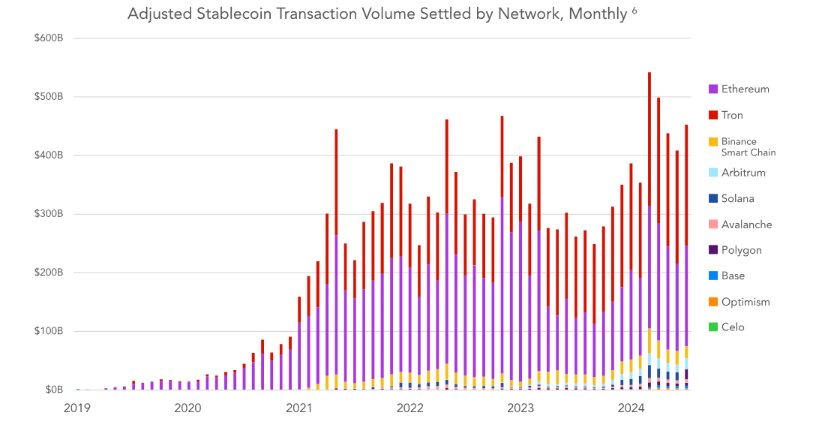

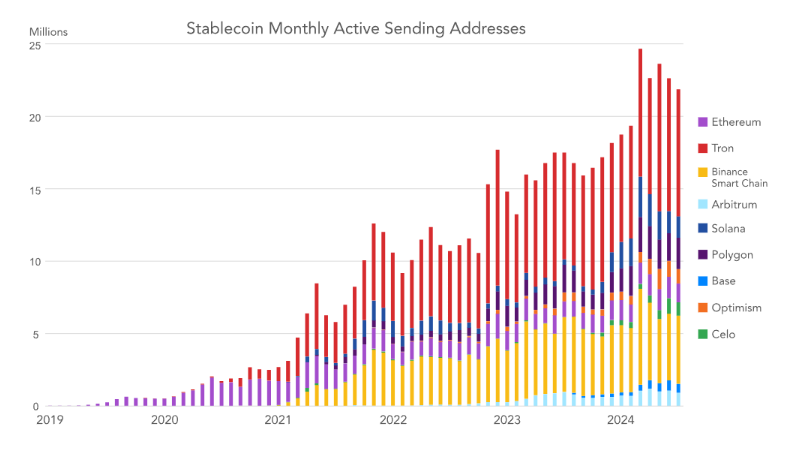

- The current circulating value of stablecoins exceeds 160 billion USD, higher than the tens of billions in 2020. Over 20 million addresses conduct stablecoin transactions on public blockchains every month. In the first half of 2024, the settlement value of stablecoins exceeded 26 trillion USD.

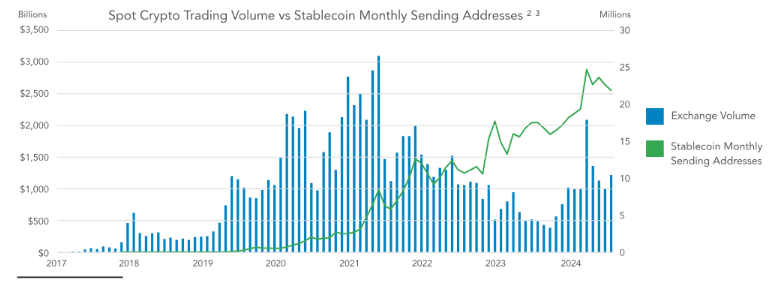

- Due to the divergence between stablecoin activity and the cryptocurrency market cycle, it is evident that the adoption of stablecoins has surpassed serving only cryptocurrency users and use cases.

Especially in emerging markets, they are used for currency substitution (escaping local currency volatility or depreciation), as alternatives to USD-based bank accounts, B2B and consumer payments, obtaining various forms of income, and trade settlements. Stablecoins are particularly attractive in countries with high inflation, or where access to USD banking services is difficult or costly.

Macro Data Overview: Strong Rise of Stablecoins, Gradual "Dollarization" of Blockchain

Key Points

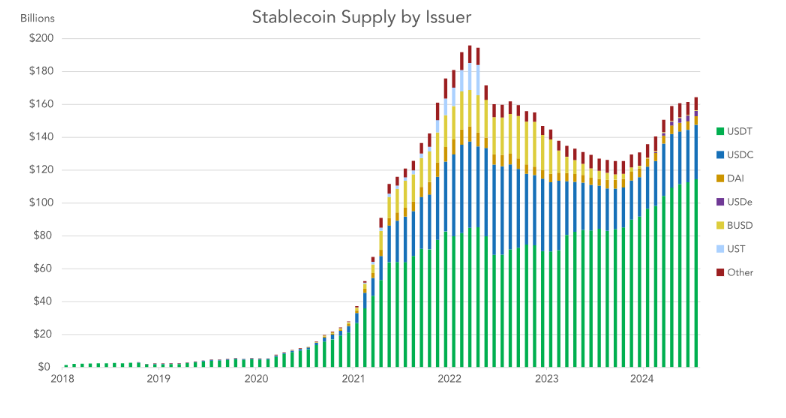

- Since 2017, the total supply of stablecoins has grown rapidly, reaching a peak of about 192 billion USD in March 2022.

- Terra's UST dissolution and credit tightening suppressed native cryptocurrency rates, reducing cryptocurrency trading volume. After the credit crisis was essentially over, stablecoin supply began to recover in December 2023, as major cryptocurrencies rebounded before the approval of the Bitcoin ETF in the United States.

- With the rise in native cryptocurrency rates and sovereign rates, some stablecoin issuers have begun to attempt to pass on earnings to holders, either programmatically on-chain or through third-party profit-sharing arrangements.

- Notably, Ethena's USDe is a synthetic USD token, with earnings derived from arbitrage between Bitcoin and Ethereum futures and spot markets, ranking fourth with a supply of over 30 billion USD.

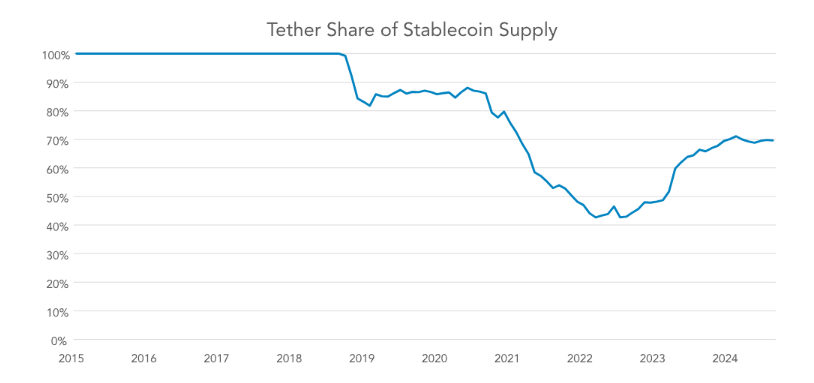

- USDT (initially issued on the Bitcoin Omni protocol) was the first stablecoin to achieve breakthrough success, and Tether has always been the largest and most widely used stablecoin.

- With significant growth in Circle's USDC, Tether's dominant position fell below 50% in 2022. Since then, Tether's supply market share has recovered and stabilized at around 70%.

- In 2023, transactions worth a total of 3.7 trillion USD were conducted using these stablecoins.

- By mid-2024, transactions worth 2.62 trillion USD had already been conducted using them. If this momentum continues in the second half of the year, the total for the year could reach 5.28 trillion USD.

- Although the entire cryptocurrency market was not very prosperous in 2022 and 2023 (with many cryptocurrency prices falling and trading volume on exchanges decreasing), the usage of these stablecoins has been steadily growing.

- As of June 2024, the most popular blockchains for settling value are Ethereum, Tron, Arbitrum, Coinbase's Base, Binance Smart Chain, and Solana.

- The most popular blockchains for sending stablecoins are Tron, Binance Smart Chain, Polygon, Solana, and Ethereum. Ethereum's fees are usually higher, meaning there are fewer addresses and transactions compared to Tron or Binance Smart Chain, but Ethereum still leads in settlement value.

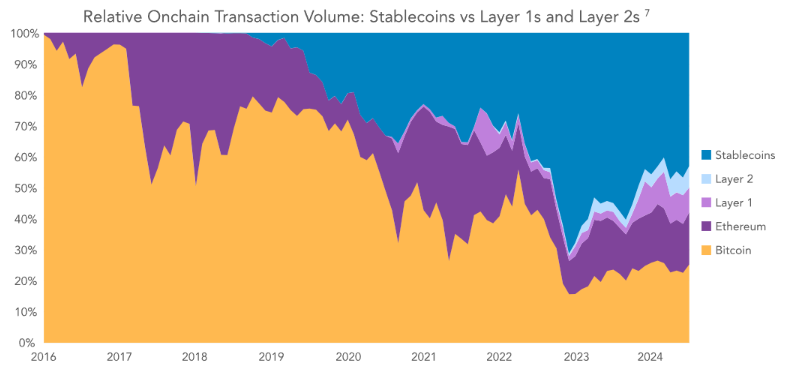

- The "Dollarization" Story of Blockchain Emerges --- Historically, Bitcoin and Ethereum have been the primary means of exchange on public blockchains, but stablecoins—especially those pegged almost entirely to the US dollar—have steadily gained market share.

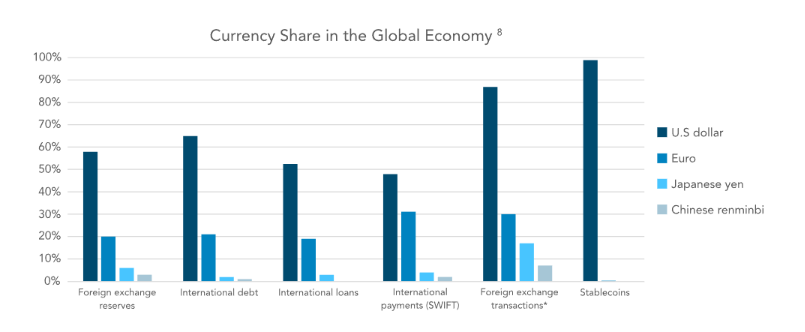

- Among the fiat-pegged options for stablecoins, the overwhelming favorite is the US dollar, followed by the euro. As of June 2024, its supply is 617 million USD, accounting for 0.38% of the entire stablecoin market.

- The dollar is the global reserve currency, but it does not dominate any other use case category as stablecoins do.

The idea of using alternative currencies as stablecoins has been around for years but has not gained attention. The overwhelming dominance of the dollar in the stablecoin space likely reflects the fact that most jurisdictions have not set any local barriers to using dollar-pegged stablecoins, and users simply prefer the most liquid tokens, such as USDT and USDC.

Micro-Adoption Survey: Nearly Half of Users' Primary Goal for Stablecoins is "Saving in USD"

Survey Method

Approximately 500 people from Nigeria, Indonesia, Turkey, Brazil, and India were surveyed, with a total sample of 2541 adults.

The sample was limited to existing cryptocurrency users to gain a better understanding of how these individuals interact with stablecoins.

Key Findings

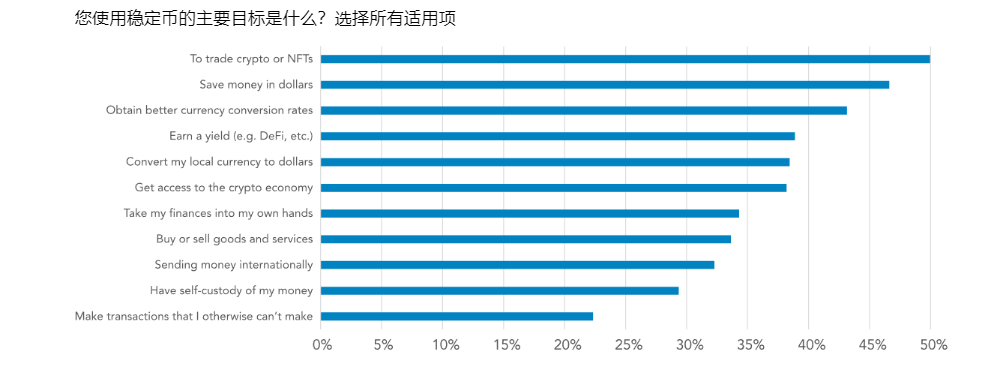

- While the most common motivation for using stablecoins is to acquire cryptocurrencies (50%), non-cryptocurrency uses such as acquiring USD (47%), generating income (39%), and trading purposes are also popular.

- Stablecoins are more popular than USD bank accounts due to their lower interest rates, efficiency, and lower likelihood of government intervention.

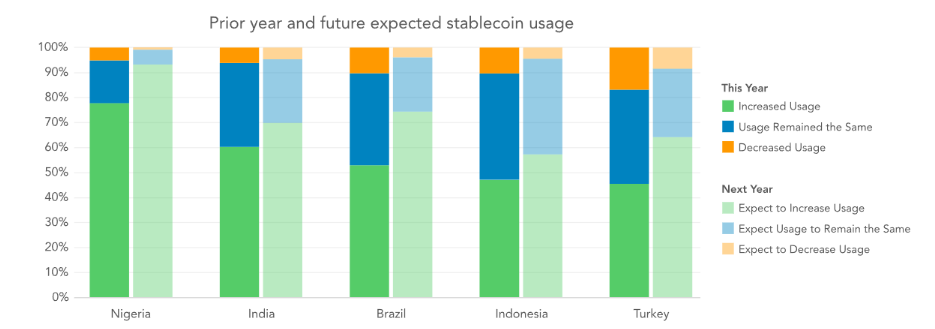

- 57% of users reported an increase in stablecoin usage over the past year, and 72% believe they will increase their usage in the future.

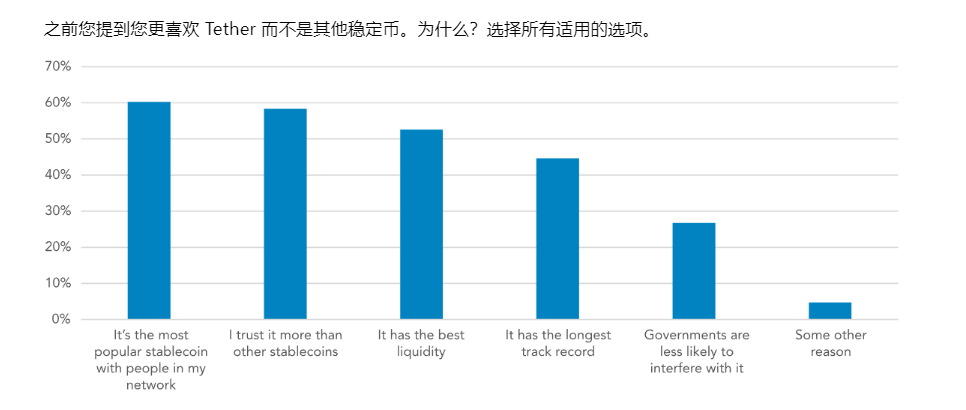

- The primary reason for preferring Tether is its network effect, followed by user trust, liquidity, and its record relative to other stablecoins.

- In non-trading use cases, currency exchange (to USD) is the most frequent activity reported in the survey, followed by paying for goods, cross-border payments, and paying or receiving wages.

- Ethereum is the preferred blockchain among sampled users, followed by Binance Smart Chain, Solana, and Tron.

- The most popular wallet among respondents is Binance (exchange), followed by Trust Wallet, Metamask, Coinbase Wallet, crypto.com, and Phantom Wallet. The wallet usage survey shows a clear long-tail effect.

Survey Details

- The most popular goal for stablecoin users in the sample is trading cryptocurrencies or NFTs, but other non-cryptocurrency uses are not far behind.

- Overall, 47% of respondents stated that one of their primary goals is saving in USD, 43% mentioned better currency exchange rates, and 39% indicated earning income.

- The research results are clear: in the surveyed countries/regions, non-cryptocurrency usage holds a significant share in stablecoin usage patterns.

The most popular use case is currency exchange, followed by shopping and cross-border transactions. It is noteworthy that the majority of respondents from all countries/regions stated that they have used stablecoins for non-cryptocurrency transaction use cases.

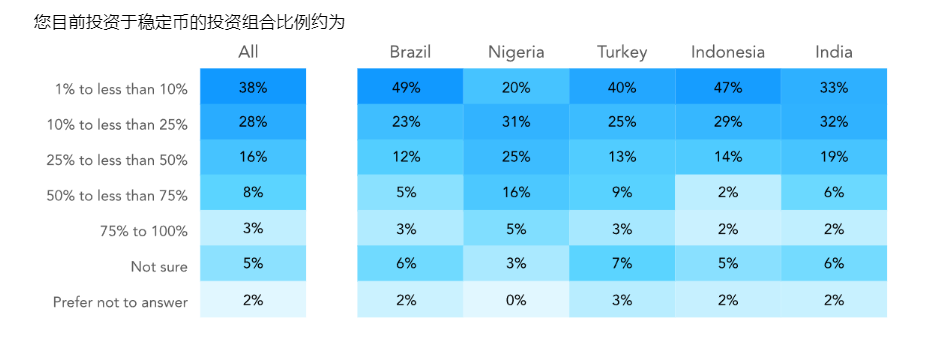

- At the national level, the penetration of stablecoins in users' investment portfolios varies by country.

- Nigerians have a much higher penetration than the rest of the sample, followed by Turkey and India. In the Indian sample, the wealthiest respondents also reported holding a larger share of stablecoins in their financial investment portfolios.

- Nigerians have the highest affinity for stablecoins among the surveyed countries. Nigerians trade most frequently, hold the largest share of stablecoins in their investment portfolios, report the highest share of non-cryptocurrency use cases for stablecoins, and have the highest self-reported understanding of stablecoins.

- In Turkey, the most common goal is to earn income, followed by trading cryptocurrencies. For Indonesians, better currency exchange rates are the primary goal, followed by trading cryptocurrencies and saving in USD. For Nigerians, saving in USD is the primary goal, followed by trading cryptocurrencies and obtaining better currency exchange rates.

- The income results for India are very clear: wealthier respondents have a higher penetration of stablecoins in their investment portfolios, they are more inclined to use stablecoins for a wider range of use cases, including non-cryptocurrency use cases, and they are more likely to trust stablecoins over bank accounts.

Age Factor: Young People's New Favorite

- Young people have a higher usage rate of stablecoins. They are more likely to try various stablecoins and maintain a higher share of stablecoins in their overall financial investment portfolios.

- In terms of frequency of fiat conversion, 34% of young people (18-24 years old) do it weekly, 38% do it monthly, while the oldest respondents (55+) do it weekly at a rate of 15% and monthly at a rate of 46%.

- Stablecoin usage rates are higher among young age groups for all non-cryptocurrency use cases: paying for goods/services, remittances, and receiving wages in stablecoins.

Tether More Popular, But Not Unchangeable

- Many people report sticking with USDT out of habit, but they would switch stablecoins if there was consensus around alternative stablecoins in their network.

- Some users also report that they would switch from Tether if it were banned or faced government intervention. Additionally, the lack of earnings is a potential reason for switching to alternative stablecoins.

Wallet Usage: Ethereum is Expensive but Popular

- Ethereum is the most popular blockchain network in all regions, followed by Binance Chain, Solana, and Tron.

- The results are surprising, as Ethereum fees have always been too high for smaller retail payments.

- The most popular non-custodial wallet is Trust Wallet, followed by Metamask and Coinbase Wallet.

- Half of the respondents stated using Binance exchange as a wallet, more than any other non-custodial wallet. It is noteworthy that 39% of surveyed Nigerians admitted to using Phantom Wallet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。