Given the volatility of the crypto market, the opportunity for cryptocurrencies to skyrocket in value comes with an equally significant risk of them plummeting. This reality forces investors and users to identify tokens that are less likely to lose their value suddenly. According to Statista, as of August 2024, there were over 10,000 active cryptocurrencies, raising the question as to how to determine the staying power of each token from this enormous digital assets’ pool.

The key distinction that separates valuable crypto assets from so-called shitcoins lies in the token’s intrinsic value and functional utility. Looking at GOMINING, it appears to be a token that offers more than just surface-level speculative appeal. Let’s examine whether this assumption is true and if genuine utility and value are indeed integrated into the token’s ecosystem. Beyond fundamental factors, we’ll look into the token’s technicals to see the current market forces behind it.

GoMining is a Bitcoin mining company easing access to BTC mining that introduced a concept called Liquid Bitcoin Hashrate (LBH), which involves hashrate tokenization, allowing average users to own NFTs backed by real computing power. Unlike conventional mining, which requires significant upfront investment in hardware and ongoing maintenance, GoMining NFTs, or digital miners, eliminates these hassles. Users gain real ownership of terahashes (TH/s) through these NFTs, allowing them to mine Bitcoin with minimal setup, where the entry barrier is notably low, starting from just 1 TH/s.

The company handles infrastructure setup and maintenance and secures a steady electricity supply—relieving mining enthusiasts from these significant burdens. With over seven years of blockchain development expertise, GoMining currently operates nine data centers across different countries, with a current power capacity of 350 MW and a reported uptime of over 99% for its mining equipment. GoMining has partnered with major industry players such as Binance Pool, Bitmain and Bitcoin Mining Council, with its mining operations distributed across multiple pools.

Additionally, GoMining offers daily Bitcoin rewards, convenient upgrades through a user-friendly application, and various other features that make Bitcoin mining more attractive and accessible.

The GOMINING token (GOMINING) plays a central role in the GoMining ecosystem, beyond serving as a medium of exchange. GOMINING enables users to utilize GoMining’s data centers’ mining hardware, integrating seamlessly with the platform’s infrastructure.

One of the primary utilities of GOMINING involves paying for digital miners and upgrades. With GOMINING, users can purchase additional computing power or upgrade their existing miners. Moreover, GOMINING can be used to pay for electricity costs with an additional discount of up to 20%, incentivizing its use over Bitcoin for operational expenses. As user-owned hashrate power at GoMining continues to grow and with 67.5% of all electricity expenses paid in tokens, the demand for the token is projected to increase.

Moreover, GOMINING offers staking options ranging from one week to 4 years, with approximately 30% of the total token supply locked for an average period of two years, allowing holders to earn up to ~22% APR. It demonstrates strong community support and long-term commitment to the project.

With the number of unique digital miner holders surpassing 87K and the community having mined almost 2,500 bitcoins, GoMining continues to expand the utility and benefits of the GOMINING token for its growing user base.

The token is available for purchase across multiple channels: users can buy GOMINING directly through a GoMining account, via the Trust Wallet app, or on various exchanges such as MEXC, Bitget, Gate, Phemex, HTX, LBank, Bitfinex, Bitmart, PancakeSwap V3, and BingX. GOMINING supports a trio of prominent blockchain standards: ERC-20, BEP-20, and TON, thus opening doors to a broader user community.

The GOMINING token’s value proposition is further strengthened by its well-thought-out tokenomics, which includes a deflationary model designed to reduce supply over time while increasing demand.

A key aspect of GOMINING’s tokenomics is its burn and mint cycle. Users are encouraged to pay for electricity expenses using GOMINING rather than Bitcoin, not only because of the 10% discount but also due to the potential for value appreciation. Every time GOMINING is used for such payments, a certain percentage of the tokens is permanently burned. In July 2024, for example, 17% of the tokens received for electricity payments were burned. This continuous reduction in supply helps support the token’s price by creating scarcity.

The initial supply of GOMINING tokens was set at 436,915,240, but thanks to the deflationary mechanics, over 15,000,000 tokens have already been permanently burned. The ultimate goal is to reach a target supply of 100,000,000 tokens. This reduction in supply, combined with the growing demand driven by the platform’s expanding user base and utility, creates a robust economic model that supports long-term value appreciation.

Moreover, around 350,000 GOMINING tokens are used daily to cover electricity costs, translating to over $100,000 per day or approximately $3 million per month. This high level of daily usage underscores the token’s utility and the strong demand it generates within the GoMining ecosystem.

Beyond the internal mechanics and community support, GoMining also benefits from substantial backing by major industry leaders. For instance, top VC fund Bitscale Capital recently invested $3 million in GoMining, highlighting the platform’s potential for long-term growth and sustainability. This kind of industry support not only validates GoMining’s business model but also provides additional resources for further development and expansion.

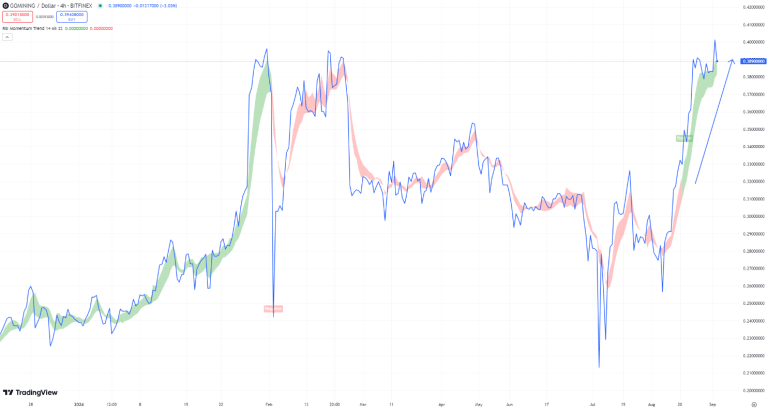

To complement the fundamentals of the GOMINING token, a technical analysis provides further insight into its performance and potential future price movements.

The GOMINING token has seen a 63% increase in its value year-to-date. It’s the first indication of growing confidence among short- to medium-term investors. A year-to-day increase of this magnitude clearly shows the token’s ability to withstand market turbulence. It’s also worth mentioning that because the token can be used for electricity payments, which ensures a steadily increasing demand, it may be less susceptible to declines driven by speculative trading activity.

Looking into a larger time-frame, over the past year, the GOMINING token has shown a significant raise in value, with an impressive 470% increase. It’s no wonder long-term investors are bullish on the token too – it has maintained a steady upward trajectory over such an extended period.

With a market capitalization of $162.25 million, GOMINING has established a solid market presence, making it less prone to volatility compared to tokens with smaller market caps. Higher market capitalization usually translates to a higher number of investors participating in the market, resulting in increased liquidity and stability, and eventually, a more secure investment.

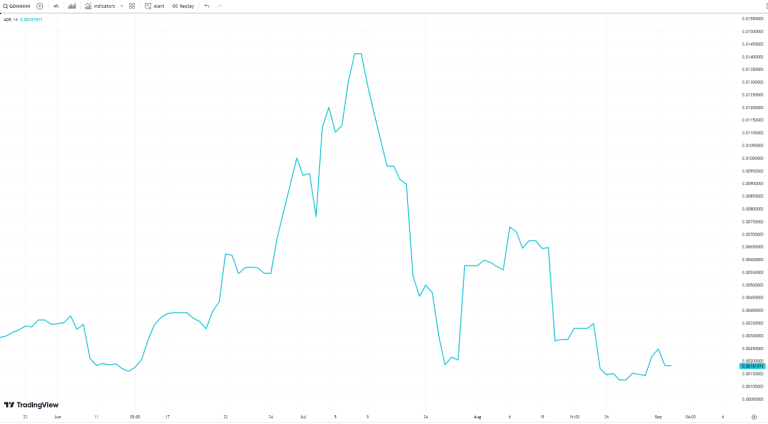

The Average Day Range (ADR) technical indicator measures the average volatility of an asset over a specified period, helping to assess potential price fluctuations and the associated risk level of an investment. For GOMINING, the ADR (14), which reflects a 14-day period, indicates a decrease in volatility over recent weeks. The chart shows peaks in volatility during early to mid-July, most likely driven by overall market volatility at the time rather than any issues specific to the GOMINING token. Following these peaks, there has been a noticeable decline in the ADR value. The current value comes in at 0.0018, suggesting a period of low volatility. This reduced volatility benefits traders and investors who prefer a balanced risk-reward profile. This stability makes the token particularly appealing to those seeking to minimize risk while maintaining exposure to potential gains.

The 24-hour trading volume of $12.74 million suggests high liquidity, meaning GOMINING is actively bought and sold. With the token available on multiple platforms, traders can execute positions seamlessly without major price swings, thus increasing the token’s attractiveness and flexibility.

The current pivot point at $0.34 is a key level to watch. If the price remains above this point, it signals bullish market sentiment, potentially driving traders to buy. Breaking through the first resistance level at $0.43 could lead to further growth toward $0.47 and $0.61, suggesting a strong upward trend. Conversely, if the price falls below the pivot mark, traders will watch for support levels at $0.29 and $0.20, which could act as strong barriers against further price declines. However, a bearish scenario is likely if there is a broader market plunge, which could lead to these support levels being tested or broken.

The current token price is above both the 20-day SMA ($0.3355) and the 100-day SMA ($0.3149), indicating a strong bullish trend in both the short-term and long-term and bolstering the argument for sustained momentum.

The Bull and Bear Power indicator shows a dominance of green bars, indicating positive momentum and the potential for further price growth. The decreasing number and size of red bars suggest a weakening of bearish pressure, previously affecting the market.

Meanwhile, the Relative Strength (RSI) Momentum Trend Index, which considers the previous RSI value, current RSI value, and positive change in the 5-period exponential moving average (EMA) of the closing price, also shows a strong upward trend for the GOMINING token, gaining strength and entering a phase of confident growth.

Backed by strong fundamentals and fueled by dynamic market forces, the GOMINING token appears to offer investors a truly compelling case. Fundamentally, the token benefits from its intrinsic utility within the GoMining ecosystem, allowing users to pay for electricity costs with a discount and offering the ability to purchase additional mining power or upgrades. Its deflationary tokenomics model, where token burns reduce supply and enhance scarcity over time fuel a sustained demand that gathers momentum as scarcity intensifies. With GOMINING accessible on multiple platforms, it eliminates liquidity concerns and provides trading opportunities that are less influenced by broader market fluctuations.

The GOMINING value has increased dramatically over the past year and with strong trading activity, it is obvious why investors are placing their trust in this token. Reduced volatility, as evidenced by the Average Day Range (ADR) indicator, suggests a more stable trading environment, while momentum indicators such as the Simple Moving Average (SMA) and RSI Momentum Trend point towards a sustained bullish trend.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

This is a sponsored brand spotlight content post. Learn how to reach our audience here. Read disclaimer below.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。