Original Title: BLOCKCHAINLATAM REPORT 2024

Author: Sherlock Communications

Translation: ChainCatcher

Table of Contents

I. Preface

II. Analysis of Some Countries/Regions (Ecosystem, Regulation, Key Participants)

- Brazil

- Argentina

- Mexico

- Colombia

- Peru

- Venezuela

- Chile

- Ecuador

- Dominican Republic

- El Salvador

- Costa Rica

- Panama

III. Current Status of Cryptocurrency and Blockchain in Latin America

Preface

In 2024, we officially welcome institutional investors to join the crypto community. Over the past two years, significant efforts have been made, particularly in regulation, to conduct extensive testing, experiments, and establish regulatory pathways for cryptocurrencies in Latin America and around the world.

In the upcoming bull market, we will see frequent news coverage of Bitcoin, consecutive new historical highs, celebrities endorsing cryptocurrencies, and the emergence of new meme coins, making crypto enthusiasts wealthy. A large number of crypto projects will emerge, with possibly 90% of them failing. I recommend reading Travis Kling's paper on financial nihilism to understand the macro principles we face entering this bull market.

The last crypto winter was not easy. The crypto community suffered significant losses, but we managed to hold some responsible parties accountable for their actions. Following the FTX and Luna fraud incidents, we have seen significant regulatory progress and imprisonment rulings globally. FTX founder SBF has been convicted and is serving time in prison. Terraform Labs (Luna) from Montenegro and the United States and South Korea are seeking his extradition due to his role in a terrorist bombing incident. Zhao Changpeng, known as CZ, the founder and CEO of Binance, was convicted of money laundering and agreed to step down from the world's largest cryptocurrency exchange as part of a settlement with U.S. law enforcement and financial regulatory agencies.

Holding influential and powerful individuals accountable for their actions is a good thing for the industry. Governments around the world have learned from these cases and accelerated their plans to establish regulatory frameworks. As a result, the path has been paved for the approval of a Bitcoin spot ETF in the United States, and an Ethereum ETF was approved in 2024. Countries worldwide are approving crypto-friendly regulations, and the macroeconomic environment is becoming more favorable for cryptocurrencies.

After two years of rapid rate hikes, the Federal Reserve is expected to maintain or lower interest rates in 2024. Other central banks controlling inflation should follow this trend. Brazil has already begun. This is very positive for crypto investments, as investors are willing to allocate more funds to higher-risk investments.

All of this sets the stage for the upcoming Bitcoin halving, where the mining reward will decrease from 6.25 BTC per block to 3.125 BTC, and the daily supply of Bitcoin will decrease from 900 BTC to 450 BTC.

One conclusion from our research is that Latin America is ready to embrace the crypto wave.

Latin American countries like Brazil and El Salvador are leading in cryptocurrency regulatory frameworks. Brazil has established friendly regulations, has enormous potential to develop Real World Assets (RWA), a diverse and vibrant community, and is in the pilot phase of a CBDC (called DREX). In El Salvador, Bitcoin is legal tender, encouraged by the government, and incentivizes crypto tourism, but I believe we should keep a close eye on Bitcoin bonds. This project has the potential to disrupt the bond market and become a use case for other countries.

In terms of the ecosystem, Argentina recently elected a president with a crypto-friendly attitude, and adoption is high at the grassroots level due to currency devaluation. Mexico is witnessing growth in crypto adoption, benefiting from low-cost and fast remittances. Meanwhile, Ecuador and Guatemala are using blockchain technology to provide transparency and credibility for their national elections.

Inspired by El Salvador's Bitcoin Beach, multiple grassroots projects are emerging on the continent: Bitcoin Jungle in Costa Rica, Bitcoin Lake in Guatemala, and Bitcoin Beach in Brazil, among others.

In the bull market, we will see institutional funds nurturing grassroots crypto ecosystems for the first time. All the inflow of funds from institutional investor demand and the potential rise in BTC prices will also benefit small crypto holders worldwide, especially in Latin America, where grassroots adoption is significantly higher, with scenarios of "adoption out of necessity" to protect assets from the impact of inflation or reduce remittance costs.

Observing the development and maturation of the Latin American ecosystem in this new context will be very interesting. There is still a long way to go, with many challenges ahead—the biggest challenge remains education to increase user adoption. I hope we can focus resources and increase adoption across the continent. I hope cryptocurrency brings hope to many people in Latin America and around the world. I hope it brings decentralized prosperity and wealth.

This report focuses on key aspects of the blockchain ecosystems in 21 Latin American countries, with a focus on their cryptocurrency ecosystems, regulations, and key participants. Our goal is to provide valuable insights for organizations aiming to enter this region. (*To ensure a smooth reading experience, ChainCatcher has removed some content related to less influential countries/regions during the translation process. Interested readers can check the original link to read the full content)

Brazil

Ecosystem:

Brazil is the largest cryptocurrency market in Latin America, ranking 9th globally in the 2023 Global Cryptocurrency Adoption Index, down from 7th in 2022.

Even during the bear market period from 2022 to 2023, cryptocurrency adoption in Brazil continued to grow. By 2023, the number of registered investors exceeded 4.1 million individuals and 92,000 companies. With ETFs facilitating the inflow of funds from ordinary investors into the cryptocurrency market, and global major exchanges such as Binance, Coinbase, and Crypto.com targeting the Brazilian market, these numbers continue to increase.

Cryptocurrency-related ETFs made their debut in Brazil in 2021, initially associated with Bitcoin and Ethereum. They have been hugely successful, allowing investors to enter the cryptocurrency market in a simple, secure, and regulated manner.

The first crypto ETF, HASH 11, launched by Hashdex, became the second-largest futures traded on the Brazilian stock exchange after just 9 months, with over 150,000 investors currently.

Other ETFs have also been listed on the Brazilian stock exchange, offering investment options ranging from carbon-neutral Bitcoin to DeFi, metaverse, and Web3.

Traditional financial (TradFi) participants have entered the market, and Brazil has now established clear regulations, especially with the upcoming digital transformation of the Brazilian financial services sector. If the Brazilian economy can be tokenized, what is the potential of this opportunity? Major participants have been experimenting and have achieved promising initial results.

Brazilian bank Itaú Unibanco offers cryptocurrency trading services to its clients as part of its investment platform. Itaú is the largest asset manager in Brazil and one of the leading lending institutions in Latin America, and it has introduced cryptocurrency trading for Bitcoin and Ethereum, with plans to add other cryptocurrencies soon.

Itaú participated in the Central Bank of Brazil's Lift Challenge, collaborating with R3 Corda and B3 to use the PvP (Payment versus Payment) method in an application in Colombia for international payments. This is an effort to improve cross-border payments, with a large market size in Latin America, especially in international trade.

Santander plans to launch cryptocurrency trading functionality in Brazil and participated in the Central Bank of Brazil's Lift Challenge, launching a DvP (Delivery versus Payment) project, in which used cars and real estate ownership will be tokenized and delivered upon payment.

Bradesco, the third-largest bank in Latin America, entered the cryptocurrency world through its first tokenized credit note issued in 2023. This pilot operation was conducted in partnership with Bolsa OTC, tokenizing nearly $2 million in bank credit notes, distributed by the bank.

Visa and Microsoft created a project in the Lift Challenge to provide financing for small and medium-sized enterprises (SMEs) in Brazil using blockchain. Enabled by smart contracts, programmable currencies make it easier for these enterprises to be accepted by global investors and capital.

Mercado Livre, one of Brazil's largest online marketplaces, invested in 2TM, the holding company of Mercado Bitcoin. Through its subsidiary Mercado Pago, a major payment company with over 20 million active users and 1 million cryptocurrency customers in Brazil, it enables Brazilian residents to buy, sell, and hold major cryptocurrencies like BTC and ETH.

Nubank, Brazil's largest digital bank, has been offering Bitcoin and Ethereum to its customers since 2022, expanding to 10 other tokens and starting to accept USDC stablecoin. The bank announced a partnership with Polygon to create Nucoin, their own crypto asset, as part of a loyalty rewards program.

BTG Pactual, one of Brazil's leading investment banks, has offered several crypto ETFs to its user base. The bank created its own crypto exchange, Mynt, to provide cryptocurrencies to its clients and launched the first stablecoin supported by a traditional bank, BTG Dol. BTG announced a strategic partnership with Crypto.com and invested in blockchain development company Lumx.

Meanwhile, XP Investimentos and Picpay exited the cryptocurrency market due to regulatory uncertainty.

In terms of development, Cryptum is enabling Web2 enterprises to enter the Web3 universe through blockchain-as-a-service solutions, making the transition to Web3 smoother and more accessible in the short term.

Brazil's cryptocurrency community is nurturing a fertile ReFi (Regenerative Finance) ecosystem. Social currencies like Muda Outras Economias, as well as projects like Ambify, Ekonavi, Agroforest DAO, Surfguru DAO, and One.percent, are organically growing and gaining momentum in the community.

Builders are making a positive impact using Web3, including platforms like Moss, a carbon credit platform, Ribon DAO, which incentivizes donations, and Play4Change, a DAO that promotes education, financial inclusion, and social change. Thousands of Brazilians are using Web3 tools.

Brazil hosted several cryptocurrency events in 2023, including highlights such as Ethereum Rio 2023, Eth Samba 2023, NFT Brasil 2023, and Blockchain Rio Festival. A grassroots Rio Crypto Hub community holds monthly events, bringing together the city's Web3 community.

Additionally, Rio Onchain Week, Eth Samba, and Blockchain Festival are confirmed Web3 events to be held in Brazil in 2024.

Even during the bear market in 2023, Brazil's NFT community continued to grow. Cryptorastas, a Brazilian project supporting reggae culture, has been globally adopted and is a successful "Made in Brazil" story. Nouns, one of the most famous NFT projects, has a Nouns Brasil community, and its sub-DAO Gnars provides support for extreme sports athletes, holding a 20% share of Brazilian Discord members.

Surfjunkies, a membership club using NFTs as membership cards, was launched in 2023 and successfully combined surfing and NFT. These projects were born in the crypto bear market and are expected to thrive in the bull market.

Nouns hosted several community events in Rio de Janeiro, including a live prop-making event—Precious Noggles, made from recycled plastic sunglasses created in collaboration with Nouns and Precious Plastic, funded by Nouns DAO and designed by Brazilian designer Mariana Salles.

Extreme sports athletes like Bob Burnquist (skateboarding), Carlos Burle, and Bruno Santos (surfing) are getting involved in NFT projects and leveraging their audience to engage with communities like Gnars DAO and Surf Junkieclub. Gnars is promoting gatherings, renovating skate parks and beach park entrances, while Surf Junkie is promoting VIP passes for music festivals and other experiences.

Football NFTs lost appeal during the 2021-2023 crypto bear market. However, promising use cases are still ongoing. Coritiba shared the sale of football player Domilson Cordeiro dos Santos (aka Dodô) for $100,000, one of the first real-world asset (RWA) tokenization use cases promoted by Brazilian startup Liqi.

Regulation:

In 2023, Brazil approved a bill to establish rules for daily cryptocurrency use and a regulatory framework for "virtual assets" and their service providers. It also treats digital assets as securities, defines crimes and fines related to fraudulent use of digital assets, with the overall goal of increasing investor protection. The topic of making Bitcoin a legal tender is not currently on the agenda in Congress.

An executive order was issued stipulating that cryptocurrencies will be regulated by the Brazilian Securities and Exchange Commission (CVM) and the Central Bank of Brazil (BCB). The main focus in 2024 is to finalize the cryptocurrency regulatory framework, which is still under further development.

Another significant step is the testing and launch of the Central Bank of Brazil's digital currency (CBDC), the Digital Real (DREX). Pilot testing has been conducted in the LIFT Challenge since March 2023. The official DREX website states that the launch date has not yet been estimated.

CVM issued Notice CVM/SSE 04/2023 in 2023, providing guidance on accounts receivable tokens or fixed income tokens (TR) and qualifying them as securities, intended for exchanges and virtual asset service providers. These tokens are subject to securities laws and must comply with this regulatory framework. It is currently unclear whether CVM has banned staking tokens, but at the time of writing, most exchanges are offering staking services to users.

In a unanimous vote by service providers consulting CVM, there is support for allowing and regulating staking services in Brazil.

Regarding taxation, a recent update is the imposition of a new 15% income tax on cryptocurrencies held on foreign exchanges. This provision takes effect from 2024.

Cryptocurrency holders on Brazilian exchanges must adhere to the same rules: if the value exceeds 5,000 reais, they must declare it for income tax. Any sale of cryptocurrency is subject to capital gains tax. In May 2022, the Brazilian Revenue Service (RFB) clarified the requirement for investors to pay capital gains tax when converting one cryptocurrency to another, regardless of whether there is an intermediate conversion to Brazilian reais. Trading cryptocurrency pairs incurs tax liability.

Key Participants:

Brazil: Central Bank of Brazil, Mercado Bitcoin, Nubank, Mercado Pago, Foxbit, BTG Pactual, Santander, Bradesco Bank, Lumx, Hashdex, BLP Crypto, Stratum Blockchain, MOSS, OnePercent, QR Capital, Play4 Change, Muda Outras Economias, Binance, Crypto Rastas, NounsBR, Pods Finance, RibonDAO, Surf Junkies, CELO, Mynt, Cryptum

Argentina

Ecosystem:

It is estimated that around 5 million Argentinians hold cryptocurrencies, and one thing is certain: cryptocurrency adoption is growing in the country. It is the second-largest cryptocurrency market in Latin America and ranks 15th in Chainalysis' 2023 Global Cryptocurrency Adoption Index, down from 13th in 2022.

Despite being in a bear market, Argentina's growth is related to inflation. The annual inflation rate in 2023 reached 211%, the highest since the early 1990s. This, coupled with strict capital controls and other factors, explains why Argentinians are turning to cryptocurrencies—especially stablecoins—to protect their savings.

Each Argentine citizen has a monthly personal limit of $200 to purchase US dollars at the official exchange rate, although demand is higher due to the devaluation of the peso. This has led to the informal dollar market, such as Dollar Blue and stablecoins known as "cryptodolares."

The election of President Javier Milei is changing this landscape. Milei, guided by liberal principles, is leading cryptocurrency-friendly economic reforms, such as integrating Bitcoin and other cryptocurrencies into the economic framework and legalizing their acceptance as a means of payment. Milei has also proposed a bill to regulate undeclared crypto assets and potentially dollarize the Argentine economy.

The ease of access to dollars may slow down the adoption of stablecoins, but the bull market in 2024 will bring many different listing tools, allowing Argentina's vibrant and creative cryptocurrency ecosystem more freedom to build, adopt, and create blockchain-based applications.

The cryptocurrency community in Argentina is expected to continue growing.

Here are some interesting developments in the country's ecosystem:

Ripio, an Argentine exchange with over 8 million users and over $200 million in transactions, helped launch the Layer 1 blockchain LaChain and introduced UXD, a new stablecoin pegged to the US dollar for LaChain users in Argentina and Brazil.

Lemon Cash, founded in 2019, is a cryptocurrency wallet with 1.8 million users. In 2021, they started offering Lemon Card, allowing users to pay in Argentine pesos with their crypto assets and receive up to 2% cashback in BTC. In 2023, Lemon Cash launched the first nationwide peer-to-peer (P2P) cryptocurrency trading market.

Blockchain infrastructure company SenseiNode raised $3.6 million in seed funding and will use these resources to expand its node operations in Latin America, where less than 1% of nodes are deployed. The company recently announced a milestone of managing assets worth $1 billion.

Open Vino is an open-source initiative aimed at providing more transparency and ethical business practices in the wine industry, using blockchain technology and new ownership and valuation models. A proof of concept is being developed at the Costaflores boutique winery in Mendoza.

Approximately 500,000 freelancers in Argentina need to receive funds from abroad. They have several ways to do this, one of which is the Bitwage platform, which saw a sharp increase in demand in 2023: the number of Argentinians working and receiving wages in cryptocurrency on the platform grew by 300%.

Due to contract breaches, Binance's sponsorship of the Argentine Football Association (AFA) was canceled due to lack of compliance.

Low energy prices and a cool climate are encouraging the country's mining operations—Canadian company Bitfarms began its large-scale Bitcoin farm operations in 2022 and expanded production in 2023, securing prepaid contracts at $21 per megawatt-hour, improving the cost efficiency of their mining operations in Argentina.

Regulation:

After Javier Milei's election, the government's regulatory stance on cryptocurrencies seems to be more friendly.

Milei's first step is to propose an asset regularization initiative, allowing Argentine taxpayers to legalize their crypto assets without additional documentation about their source. Regularization involves a unified tax rate for declared assets: 5% in March 2024, 10% from April to June, and 15% from July to September.

An executive order to regulate cryptocurrency exchanges to comply with KYC and AML rules is expected to be issued in early March. Milei's regulatory efforts aim to prevent Argentina from re-entering the Financial Action Task Force (FATF) gray list.

The Central Bank of Argentina (BCRA) has pushed several anti-cryptocurrency rules, which the Fintech Association claims should be reviewed.

Currently, Argentina has three cryptocurrency taxes, two of which were created in 2021:

Income tax: Cryptocurrencies are taxed as any other intangible asset. Income from the sale of digital currencies is taxed at a rate of 15%. This was the only cryptocurrency tax until 2021.

Provincial tax: In 2021, regulations were passed in provinces like Cordoba to tax gross income at a rate of 4 - 6.5%. Individuals and businesses exchanging goods or services with cryptocurrencies will be subject to a 0.25% tax rate.

Other provinces, such as Tucuman, Entre Rios, and Catamarca, have started levying additional taxes on gross income generated through cryptocurrency trading.

Check tax: In November 2021, the Argentine government updated its "check tax" rules to include cryptocurrency exchanges. This means that buying and selling cryptocurrencies will be subject to a bank debit and credit tax of up to 0.6%.

Key Participants:

Mercado Libre, Bitfarms, Moneda Par, Lemon Cash, RSK, Ripio, Sensei Node, Attic Lab, Bitwage, Binance, EOS Argentina

Mexico

Ecosystem:

Mexico has a growing cryptocurrency industry, with over 3.1 million cryptocurrency owners, representing 2.5% of the total population. It ranks 16th in the 2023 Global Cryptocurrency Adoption Index and 3rd in Latin America, up from 28th in 2022.

Remittances are a major driver of adoption in the country. Mexico is the world's second-largest recipient of remittances, reaching a record $63 billion in 2023. These figures represent a huge opportunity for the cryptocurrency ecosystem, and many participants are trying to enter this market.

In 2023, Bitso processed $43 billion in the US-Mexico corridor, surpassing $33 billion in 2022. The Mexican exchange saw a 60% growth in its Bitso Business division, with a global annualized trading volume of $8 billion.

Another significant player entering the Mexican market is Coinbase. The US-based exchange provider recently launched a remittance pilot in Mexico aimed at facilitating cryptocurrency cash withdrawals and offering services up to 50% cheaper than traditional cross-border payment methods. They recently launched the Coinbase Wallet, allowing users to send money with zero fees.

Ripple is also targeting the Mexican market, as the Central Bank of Mexico is analyzing the use of xRapid as a bridge mechanism between the US dollar and the Mexican peso.

Mexico's government plans to launch its own central bank digital currency (CBDC) by the end of 2024, following in the footsteps of Brazil and Peru.

Predictions for the Mexican cryptocurrency ecosystem have been ongoing since 2020. A study by the Ponemon Institute indicates that about 40% of Mexican companies are eager to implement blockchain technology in some form, with 71% of companies focusing on the use of cryptocurrencies.

In 2023, Grupo Salinas announced that it would accept Bitcoin payments via the Lightning Network. This announcement came from the country's third-largest conglomerate, with businesses ranging from banking to retail, football clubs to television channels—all owned by Bitcoin enthusiast and billionaire Ricardo Salinas.

Telecommunications companies are also adopting cryptocurrencies: Telefónica (Movistar) and Nova Labs are launching blockchain-based mobile infrastructure in Mexico, and Telefónica is also expanding its existing coverage in Mexico City and Oaxaca using Helium hotspots.

In October 2023, Etherfuse, a platform aimed at improving decentralized blockchain infrastructure, announced "Stablebond," a tokenized bond product for retail investors in Mexico.

Regulation:

The main regulation currently in place is the "Fintech Law," aimed at providing guidelines for electronic payments, crowdfunding, and digital assets in the country. Cryptocurrencies are recognized as digital assets and are therefore a legal means of payment and transaction. Regulatory sandboxes have been established for innovative projects.

The Central Bank of Mexico (Banxico) is the central authority overseeing cryptocurrencies. The institution is currently analyzing cryptocurrency regulation to protect digital asset users. Banxico Governor Victoria Rodriguez Ceja stated that the "use of cryptocurrencies" is "not backed by Mexican banks," but acknowledged that citizens have "freedom to operate with digital assets," and companies in the industry must comply with "certain anti-money laundering obligations."

Key figures in the Mexican Congress interested in cryptocurrencies include Senator Kempis Martinez, who, after visiting El Salvador, stated that "adopting Bitcoin as legal tender is an opportunity for national growth."

Key Participants:

Bitso, Volabit, Coinbase, Ripple, Banco Azteca, Banxico, Telefonica, Helium, Etherfuse, investment firms Exponent Capital, Lvna Capital, and GBM, ConsenSys Academy, and BIVA.

Colombia

Ecosystem:

Colombia ranks 32nd in the Chainalysis 2023 Global Cryptocurrency Adoption Index, down from 15th in 2022 and 11th in 2021. It currently ranks 4th in Latin America, behind Brazil (9th globally), Argentina (15th), and Mexico (16th).

Colombia has the fastest grassroots adoption growth of any country in Latin America. The decline in the cryptocurrency adoption index can be attributed to a decrease in decentralized finance (DeFi) activity, with Colombia ranking 46th in this area.

Over 5.6 million Colombians are actively involved in cryptocurrencies. The country added 5 Bitcoin ATMs between 2022 and 2023, bringing the total to 45 in operation.

As in typical Latin American cases, the main drivers of adoption are high inflation rates and cross-border payments. Colombia's inflation rate reached 13.12% in 2022 and 9.28% in 2023, with a total inflation rate of 22.4% over the two years, motivating the adoption of cryptocurrencies to hedge against currency devaluation.

Remittances also play a significant role in the Colombian economy, with $9.4 billion received in 2022, mainly from the United States. The World Bank's 2022 report stated that the average cost of remittances to Latin American countries for $200 was 5.8%. Using cryptocurrencies for transfers from abroad is faster and cheaper. Following a successful pilot in Mexico, Bitso also launched its remittance service in Colombia.

Education and events play an important role in growing the crypto community. The Crypto Latin Fest was held in 2023, and two major Ethereum ecosystem events, VI Devcon and Eth Medellin, were held in 2022.

The Colombian government is becoming increasingly friendly towards blockchain technology. In 2022, it released a guide for implementing blockchain in public projects; collaborated with Ripple Labs as part of a land distribution correction effort; and is considering introducing a central bank digital currency (CBDC) to facilitate transactions and reduce tax evasion.

The Central Bank of Colombia is collaborating with Ripple (XRP) to explore blockchain use cases, such as Ripple's CBDC platform, to improve its high-value payment system. The initiative is being conducted by the Colombian Ministry of Information and Communication Technologies (MinTIC) and is still in the experimental stage.

Under the country's regulatory sandbox, banks are partnering with cryptocurrency exchange companies to conduct cryptocurrency activities. Buda.com is partnering with Banco de Bogotá, Binance with Davivienda, and Gemini with Bancolombia.

Notable local initiatives in Colombia include Tropykus, a decentralized finance platform based on Bitcoin and built using RSK, focusing on the Latin American market; Populart, an NFT project highlighting Spanish-speaking talent; and Hash House, a Web3 hub based in Medellin.

Regulation:

The Colombian government has taken a friendly regulatory approach to cryptocurrencies, issuing a regulatory sandbox in 2021. The government also released cryptocurrency tax guidelines and anti-money laundering (AML) regulations.

A bill aimed at regulating crypto assets was submitted to Congress at the end of 2023. It seeks to establish a regulatory framework to define operations conducted on digital platforms in Colombia, following similar legislation recently passed in Brazil.

Key Participants:

Buda.com Colombia, Panda Exchange, RSK, ViveLab Bogotá, Cajero.co, Inti Colombia, Paxful, Binance, Bitso, Gemini, Obsidiam.com, Banexcoin, Tropykus, Ripple, LACChain, Populart, Hash House

Peru

Ecosystem:

Peru ranks 49th in the global 2023 cryptocurrency adoption index, 6th in Latin America, down from 35th globally in 2022.

The country has a total cryptocurrency value of over $20 billion, with approximately 30% coming from P2P transactions, and 51 registered cryptocurrency-friendly businesses on Coin map (down from 91 in 2022) and 5 cryptocurrency ATMs (down from 7 in 2022), according to Coin ATM Radar data.

As in many other Latin American countries, inflation and currency instability have led to the growth of blockchain initiatives and cryptocurrency adoption. With the annual inflation rate dropping from 8.45% in 2022 to 3.24% in 2023, and a bear market from 2022 to 2023, the adoption rate has slowed down.

While interest and adoption are growing among the tech-savvy population, there is still a considerable portion of the population either unaware or skeptical of cryptocurrencies, highlighting the need for comprehensive awareness and education efforts.

The Peruvian Blockchain Association (ABPE) was established in October 2021 and currently has 1,044 cryptocurrency enthusiasts on its meetup page. The association is dedicated to promoting the adoption of blockchain and interacts with the government, private sector, and academic entities to regulate the correct use of blockchain technology in the country.

ABPE also promotes multiple blockchain initiatives, use cases, and solutions for application by other public or private institutions.

Inspired by El Salvador's Bitcoin Beach initiative, the Peruvian non-governmental organization Motiv is establishing a Bitcoin-based circular economy in 16 towns in the country—three of which are in the capital Lima, and the others are in remote areas. The organization accepts cryptocurrency donations to support their work and has won multiple awards in 2023.

By teaching participants how to create and use digital wallets, encouraging businesses to pay employees in Bitcoin, incentivizing wholesalers to accept Bitcoin as a payment method, and teaching entrepreneurship to locals, the non-governmental organization has stimulated the use and adoption of Bitcoin in the community, reducing reliance on traditional banks.

Regulation:

Bill No. 1042/2021-CR, also known as the "Core Law for the Commercialization of Crypto Assets," proposes to regulate companies that provide services related to the use and exchange of digital assets and cryptocurrencies through technological platforms.

The bill was introduced by legislator José Elías Ávalos in December 2022 and is currently under review. The bill grants Bitcoin the status of "assets with accounting value" and stipulates that investors have primary responsibility when using digital assets. Additionally, the bill proposes the creation of a public registry of cryptocurrency service providers and a default mandatory commitment to report "suspicious transactions" to the financial intelligence unit. Unlike El Salvador, cryptocurrencies will not be recognized as legal tender.

The Central Reserve Bank of Peru (BCRP) is developing its own digital currency plan. After releasing their CBDC whitepaper, BCRP is now receiving assistance from the International Monetary Fund. The next phase involves engaging with stakeholders from the financial services, fintech, and technology industries to gather feedback and enter the pilot phase.

Compared to some neighboring countries, Peru is taking a more cautious approach. While open to the potential of cryptocurrencies, the government emphasizes consumer protection and is keen on establishing a robust regulatory framework before fully embracing the crypto industry.

Key Participants:

Agente BTC, Buda.com, Buenbit, Peruvian Crypto Bank, Binance, Kraken, Pachacuy, Qolkrex, Kaytrust Criptovision, Kindly, Unisuam, Fireblocks, Cryptometales, Algorand, CoinCaex, Sumara Hub Legal, Adolfo Ibáñez University, Metary, Buenbit.com, EY, Sura Gaming, Axie Infinity

Venezuela

Ecosystem:

Venezuela is a prime example of a country where cryptocurrency adoption has been strong among users out of necessity, despite the central authority and government's failure to adopt cryptocurrencies. In the 2023 Global Cryptocurrency Adoption Index, Venezuela ranks 40th, the fourth highest cryptocurrency adoption rate of any country in Latin America.

The failure to adopt cryptocurrencies in a centralized manner can be attributed to corruption and lack of trust. The Venezuelan government shut down the state-backed cryptocurrency Petro (PTR), which was intended to circumvent U.S. financial sanctions on Venezuela. Petro, launched six years ago, was never adopted by the people and became part of a corruption scandal involving the head of the cryptocurrency regulatory agency SUNACRIP and the Minister of Energy.

So why is grassroots adoption so strong? The main reason is currency devaluation, a result of the government's inability to control inflation. Since 2014, the annual inflation rate has never been below 100%, reaching 190% in 2023. Despite the significant devaluation of the bolívar, Venezuela remains a growing cryptocurrency market priced in U.S. dollars. Venezuelans received $28.3 billion in cryptocurrency in 2021. In 2022, the country received $37.4 billion, a 32% increase. With the bull market continuing into 2024, this trend seems likely to persist.

Due to high inflation, Venezuelans are keen on using stablecoins, with stablecoin transactions accounting for 34% of all small retail transaction volume in the country—the largest in Latin America.

The adoption of stablecoins is due to the failure of the national currency (bolívar) and the need to establish new means of exchange value (i.e., stablecoins/cryptocurrencies). The use of low-fee blockchains like Polygon, Tron, and Solana for stablecoins makes it easier and more accessible to store wealth, protect it from inflation, and receive funds from abroad.

Venezuelans are finding sources of income through cryptocurrencies and are the largest community on the decentralized social media platform Hive and the second-largest community on the play-to-earn game Axie Infinity.

Cryptocurrency projects are attempting to establish their presence in Venezuela, as the adoption soil is fertile there. Many Venezuelans work in the cryptocurrency field, serving as community managers, translators, and designers. Due to political instability, cryptocurrency projects operate from abroad, and some influential members of the ecosystem currently reside in other countries.

In October 2023, the Caracas Blockchain Week event brought together industry leaders.

Public government officials have received part of their salaries in Petro in the past, and most people have at least some basic knowledge of cryptocurrencies.

The country has various communities and major projects using Bitcoin, Bitcoin Cash, Ethereum, DASH, EOS, Polkadot, and Litecoin, as well as exchanges like Libertex, Surbitcoin, and Paxful. Shapeshift is a DeFi platform operating in the country.

Regulation:

In 2019, Venezuela created SUNACRIP, a government office specifically for regulating cryptocurrencies in the country. The agency was closed in March 2023 due to a corruption scandal and is planned to be reorganized and reopened in March 2024.

The clearest legal framework relates to mining: if users intend to mine in Venezuela, they need to apply for a license, and the same applies to exchanges. Legislation has previously revolved around Petro, which has now been abandoned, so it remains to be seen how the ecosystem will adapt.

In 2022, Venezuela passed a law taxing any non-government-supported currency, with tax rates ranging from 2% to 20%.

Key Participants:

Amberes and CrytoLago (government-supported exchanges), Cryptobuyer, Locha Mesh, SUNACRIP, Paxful, Dash, Axie Infinity, Tether, Hive, CryptoMiner, Shapeshift, Libertex

Chile

Ecosystem:

Chile ranks 68th in the 2023 Global Cryptocurrency Adoption Index, a 12-place drop from the previous year. Currently, 410,149 people, or 2.01% of the population, own cryptocurrencies in Chile.

Blockchain conferences are not unfamiliar to Chile, including the Bitcoin Chile meetup in Santiago in November 2023 and the Ethereum Santiago event in September 2022, where over 40 experts spoke and discussed topics such as DeFi, NFTs, CBDCs, and DAOs. Chile will host the International Blockchain and Cryptocurrency Conference (ICBC) in September 2024.

According to Statista, 15% of respondents in Chile in 2023 stated that they own or have used cryptocurrencies, compared to 14% in 2022 and 12% in 2020.

In 2022, Chile's economic growth slowed due to inflation/interest rate hikes and increasing political uncertainty (including the rejection of a new constitutional amendment proposal in a national referendum). However, in 2023, inflation significantly decreased from 12.8% in 2022 to 3.94% in 2023, indicating a relief in Chile's economic situation. By 2024, Chile had reduced its interest rates to 7.25%, with an expected inflation rate of 3% in 2024.

One of the most prominent cryptocurrency initiatives in Chile is Mercado Libre, the largest e-commerce company in Latin America. Mercado Libre recently enabled cryptocurrency transactions and payments in its digital wallet Mercado Pago through a partnership with Ripio.

In 2023, Bitfinex invested in the Chilean cryptocurrency exchange OrionX and plans to expand to Peru, Colombia, and Mexico, aiming to reach over 1 million users in the region by the end of 2024.

Cryptocurrencies are currently the third most popular investment asset among Chileans. Stablecoin trading on national cryptocurrency exchanges grew by up to 50% in 2022 as residents sought to protect their assets from the effects of inflation and the depreciation of the Chilean peso.

Two blockchain projects that gained attention in Chile showcased their use cases in Santiago in 2023: Endangered Tokens and Wbuild. The former is a regenerative finance initiative claiming to create incentives for nature conservation using cryptographic tools, while the latter is a platform allowing tokenization and borderless real estate investment starting from $50. Wbuild grew by 46% in the six months leading up to February 2024, and their growth prospects continue to look promising.

Another successful foreign project in Chile is Worldcoin. In a press conference in September 2023, the company announced that the World ID registrations exceeded 1% of the Chilean population.

The Central Bank of Chile disclosed initial blockchain experiments at the end of 2019 and is still in the early stages of developing its central bank digital currency (CBDC), with a single report released in May 2022. Nevertheless, the entity has shown interest in accepting digital payments. The bank will also hold a series of workshops, speeches, and meetings with various partners to find the ideal design for the Chilean peso CBDC.

Regulation:

In January 2023, Chile implemented the so-called "Fintech Law" aimed at promoting financial inclusion and competition in financial services through innovation and technology, although the regulatory implementation is still in the drafting stage.

Cryptocurrencies: While the law regulates cryptocurrency trading and custody, subjects such as lending or staking (yield) are not yet included in the proposal. Chilean fintech companies must register with the Financial Market Commission (CMF) to obtain operational authorization to provide these services. Currently, there are no banks in Chile offering cryptocurrency-related services.

Although the legal issuance process is ongoing, many different institutions in Chile have already issued official statements on cryptocurrency regulation. In June 2016, the CMF stated that crypto assets are not subject to stock market securities regulations but can be used as a means of exchange as long as both parties agree, although they must comply with anti-money laundering/counter-terrorism financing regulatory frameworks.

Regarding anti-money laundering/counter-terrorism financing, the Financial Analysis Unit (UAF) disclosed guidance for institutions on the characteristics and behaviors of potentially suspicious transactions or individuals in the 2021 alert signal guide. In 2019, the Central Bank of Chile stated that crypto assets can be used as a means of exchange and investment, although they are not considered legal tender.

Key Participants:

ONG Bitcoin Chile, Mercado Pago, OrionX, Buda.com, CryptoMKT, Colledge, Worldcoin, Bitfinex, Endangered Tokens, Wbuild, Eth Chile

Ecuador

Ecosystem:

Ecuador ranks 43rd in the 2023 Global Cryptocurrency Adoption Index, 5th in Latin America, a drop from 18th globally in 2022. According to Triple A, the country currently has 695,148 cryptocurrency owners, equivalent to 3.82% of the total population.

Since adopting the US dollar as its national currency in 2000, Ecuador's economy has been relatively stable. The country is one of the most significant cryptocurrency adoption cases in Latin America as of January 2024.

As one of the world's largest banana producers, Ecuador ranked fifth in cryptocurrency value received among Latin American countries from June 2022 to July 2023, with billions of dollars flowing into the Ecuadorian economy during that period, according to the 2023 Cryptocurrency Geographic Report.

The traditional fish and shrimp market in the country has seen significant growth with the help of this technology, heavily relying on two factors: traceability and awareness of product origin. The use of blockchain technology has facilitated significant market growth over the past decade, as emphasized by Sustainable Shrimp Partnership (SSP) and its five-year collaboration with IBM Food Trust.

As of March 2024, there is only one cryptocurrency ATM operating in Ecuador, located in Cuenca. According to Coin ATM Radar, it currently allows people to purchase various cryptocurrencies, although according to Coinmap, 36 locations accept cryptocurrency as a payment method. Ernst & Young Global Limited released a case study on the implementation of blockchain by an Ecuadorian energy production company, which implemented blockchain throughout its production and transmission chain, focusing on operational carbon footprint. After implementing DEEP (Digital Energy Enablement Platform), the company's internal systems were promptly upgraded. This enables the company to track the carbon footprint at every stage of the production chain and obtain more data to improve transparency, security, and the quality and capacity of data processing, while reducing costs.

In February 2023, Ecuador became the first country in Latin America to apply blockchain technology to its electoral process, particularly for transparency records and audit systems. This was the result of a collaboration between the Ecuadorian company Eminkatech and the Chilean company ZEYO, which has a presence in the country. The same service provider collaborated with the National Electoral Council (CNE) during the presidential elections in October 2023.

One of the largest companies in Ecuador using cryptocurrencies is Despegar, a Peruvian company and one of the main travel service providers in Ecuador. This is particularly significant in a country where almost 30% of the banked population has engaged in some form of cryptocurrency-related transactions, according to Minsait Payments data.

Ecuador has hosted several cryptocurrency and blockchain-related events, with the most notable being the "Road to Blockchain Week" held in May 2023, hosted by ETH Tricolor/ETH Ecuador, the largest blockchain and cryptocurrency community in Ecuador, which recently announced its transition to a DAO.

Regulation:

The Ecuadorian government's legal stance on cryptocurrencies, particularly Bitcoin, is characterized by cautious pragmatism. The Central Bank of Ecuador first announced in 2018 that cryptocurrencies are not authorized as a means of payment, but banks recognize the legality of buying and selling cryptocurrencies online. This position was further reinforced in Article 94 of the Monetary and Financial Law, which explicitly denies Bitcoin and similar digital currencies legal tender status.

This legal framework defines the limits between allowed cryptocurrency transactions and their restricted use as traditional exchange media, exposing the external perception of cryptocurrencies by the Ecuadorian people, primarily as an alternative investment choice rather than a daily payment method. Nevertheless, the country's widespread adoption of cryptocurrencies is driving the Ecuadorian government to find a balance between promoting innovation in the financial sector and protecting national financial interests.

Ultimately, on August 21, 2023, the Monetary Policy and Regulatory Committee issued a resolution regarding digital wallets, outlining a series of requirements for companies offering such products in the market. It emphasizes that only entities with specific licenses can provide digital wallet services and underscores the necessity of continuous immediate availability of holder funds.

The resolution also involves auxiliary payment systems for clearing payments between different participants in the financial sector, channels for remittances, coverage and powers of deposit and digital payment companies, in addition to creating a sandbox with the private sector and providing temporary licenses to selected companies to operate and test technology.

Key Participants:

ZEYO, Ethereum Ecuador, Road to Blockchain Week, Ernst & Young, eToro, Deribit, IBM Food Trust

Dominican Republic

Ecosystem:

Despite the restrictive (but unenforced) regulations released in September 2021, the country's cryptocurrency market has steadily developed over the past few years, with continued growth in adoption. The Dominican Republic ranks 71st in the 2023 Global Cryptocurrency Adoption Index, a drop of 28 places from the 2022 index.

Over 30% of the banked population in the Dominican Republic has purchased some form of cryptocurrency. According to research by Minsait Payments (page 86), the majority (72%) of use cases to date are for investment, 21% for daily use/payment, and NFT transactions account for an additional 9.8%. The report specifically notes that the Dominican Republic has the highest proportion of willingness to use cryptocurrency for payments among banked populations in Latin American countries: 25.1% of respondents stated they would definitely use cryptocurrency, while 12% indicated they might use it as a payment method.

In 2023, the "Running with Bitcoin" event took place in the Dominican Republic, during which Paco de La India shared his experiences of traveling to over 40 countries (15 in Latin America) using Bitcoin and spreading the ideals of Bitcoin.

Educational initiatives are becoming increasingly prevalent in the island nation, with one notable project being "My First Bitcoin" developed by Bitcoin Dominicana, aiming to democratize access to digital finance by teaching cryptocurrency basics and advanced applications.

Cryptocurrency services are becoming increasingly popular. Companies like BitcoinRD (established in 2015) provide cryptocurrency exchange services and operate twelve BTC ATMs across the island.

Athena Pay offers businesses a way to accept cryptocurrency, while Paxful, as the largest Bitcoin P2P in the country, provides exchange and education services. These two companies are consolidating their positions in the Dominican Republic's economy by offering innovative services that promote financial inclusion, one of the six strategic objectives of the Dominican Republic's Banking Regulator.

Regulation:

In September 2021, the Central Bank of the Dominican Republic issued a statement regarding cryptocurrencies and virtual currencies, emphasizing that crypto assets do not have the "support or authorization of the Monetary Board for any type of transaction nationwide as a means of payment; this means they do not have the force of legal tender or release from public or private obligations."

The statement also reiterated text from 2017, stating that "regulated entities of the national financial system are not authorized to use or operate (crypto assets) in the payment systems of the Dominican Republic. Anyone acquiring such virtual assets as an investment, or interested in using them as a means of payment, and anyone accepting them as a form of payment in commercial transactions, does so at their own risk."

In contrast, the Governor of the Central Bank of the Dominican Republic, Héctor Valdez Albizú, has shown significant interest in CBDC in 2021. He stated that the central bank is conducting studies and exploration of the monetary impact and functions of CBDC. In the same year, Albizú stated that the Dominican Republic is maintaining a digital agenda and proposed the creation of a Digital Currency Financial Innovation Center to address issues such as instant payments, cross-border payments, and improving the digital identity of the national economy.

While the central bank has a restrictive attitude towards the cryptocurrency market, enforcement in this area has been lenient. Companies and individuals complying with anti-money laundering and international standards have begun using/accepting cryptocurrencies, shaping and developing the market over the past few years.

However, in some notable cases, government scrutiny has been strict, such as the bankruptcy of Harvest Trading Cap, a popular company in the Dominican Republic, whose stock price plummeted in early 2022 due to capital flight from Bitcoin, leading to the company's inability to repay customer funds.

Key Participants:

Bitcoin Dominicana, Bitcoin RD, Paxful, Athena Pay, LACChain

El Salvador

Ecosystem:

Since 2021, El Salvador has been actively creating incentives to promote cryptocurrency adoption, successfully attracting businesses and tourists to the country. However, the country has faced challenges in promoting adoption among its citizens.

It will be interesting to see how the Bitcoin Law of 2021 will be affected by the bull market of 2024 and how it will impact the ecosystem. El Salvador ranks 95th in the Global Cryptocurrency Adoption Index, a drop from 55th in 2022. This is due to overall low adoption rates, and the Global Cryptocurrency Adoption Index incorporating DeFi as an evaluation criterion.

In 2023, El Salvador's inflation rate was 1.23%, with remittances totaling $8.18 billion, an increase of 4.63% from the previous year, accounting for almost 30% of the country's GDP.

Despite cryptocurrency-friendly regulations, El Salvador is experiencing a paradox, as evidenced by the remittance landscape. While remittances through traditional financial channels are growing, cryptocurrency remittances have declined. The Central Bank of El Salvador reported that cryptocurrency remittances decreased to $82.93 million in 2023, compared to $116.4 million in 2022, while overall remittances reached a historical high of $8.18 billion.

El Salvador's cryptocurrency venture, led by President Nayib Bukele, has experienced a dynamic trajectory. Initially investing $100 million in Bitcoin and $275 million in launching the Chivo wallet, while accepting Bitcoin as legal tender, demonstrates a strong push to integrate cryptocurrency into the national economy. Despite initial setbacks with the wallet, low adoption rates, and criticism of governance practices, the profitability of the Bitcoin investment, growth in the tourism industry, and the anticipated bull market indicate a potential turnaround in 2024 and 2025.

President Nayib Bukele was successfully reelected on February 4, 2024, and will continue to serve as president for the next five years. He will face many economic challenges and has bet on cryptocurrency, hoping to bring prosperity to his country by becoming a financial center in Latin America.

Bukele's investment in Bitcoin has now become profitable, accumulating approximately 2,464 BTC. According to the "Nayib Tracker" website, the current value of the Bitcoin investment is approximately $122.01 million. The overall return on investment at the time of writing (March 6, 2024) is approximately 57.28%, equivalent to approximately $69.576138 million. The average cost per share (DCA) of the Bitcoin investment in El Salvador is $42,548.37.

In December 2023, the Salvadoran Congress approved all regulatory infrastructure for volcano bonds, which will purchase $500 million in Bitcoin, fund renewable energy-based mining, and provide investors with a 6.5% annual return.

A notable aspect of El Salvador's cryptocurrency strategy is the introduction of an investor visa program. The Free Visa program aims to attract cryptocurrency entrepreneurs by offering permanent residency in exchange for a $1 million investment in Bitcoin or USDT, and to provide a favorable environment for blockchain innovation and cryptocurrency-related businesses. Investors in volcano bonds with a $100,000 investment are eligible for citizenship after residing for 5 years.

Overall, despite facing financial challenges including debt negotiations and market uncertainty, El Salvador's commitment to promoting a cryptocurrency-friendly environment may set a precedent for exploring similar initiatives in other countries.

If volcano bonds succeed, they will pave the way for other countries with similar characteristics to implement alternative fundraising measures—from establishing cryptocurrency-friendly regulatory frameworks to entering capital markets and developing public policies that incentivize web3 development.

Due to El Salvador's cryptocurrency-friendly regulations, many companies are investing in the country: the Central Bank stated that there are currently 59 cryptocurrency and blockchain companies with registered offices in the country. Examples include Bitfinex Securities, Strike, and cryptocurrency exchange platform Paxful, which has opened a "Bitcoin House" in El Salvador, a Bitcoin education center offering free learning opportunities related to Bitcoin. However, several companies and investors left the country last year, complaining about poor enforcement and "lack of motivation".

In addition to attracting businesses, the tourism industry is also growing.

Regulation:

In 2021, the government passed the Bitcoin Law, making El Salvador the first country in the world to formally adopt Bitcoin as legal tender. The most cryptocurrency-friendly ecosystem in Latin America will continue to be committed to the cryptocurrency movement after Bukele's reelection. The legislation came into effect on September 7, 2021, and Bitcoin has been legal tender since then. Due to its legal tender status, Bitcoin is not subject to capital gains tax.

In December 2023, the Congress approved a comprehensive cryptocurrency adoption law aimed at making El Salvador a center for cryptocurrency innovation. The legal framework established the National Digital Assets Council and the Bitcoin Fund Management Agency, which will manage, protect, and invest funds from public digital asset issuances conducted by the government.

As stated in the legislation, "The purpose of this law is to establish a legal framework to provide legal certainty for transfer operations using any digital asset used in public issuances." The law provides a legal basis for volcano bonds.

On April 19, 2023, the National Assembly passed the "Promotion of Innovation and Technological Manufacturing Act". The law provides 15 years of income tax and capital gains tax exemption for investments in new technology, municipal taxes on net assets of companies, and duty-free imports of raw materials, machinery, equipment, and tools.

The regulatory and ecosystem development in El Salvador is worth close attention. The regulatory environment is in place, meaning the country should be able to attract significant capital inflows during the next bull market (2024-2025).

Key Participants:

Government of El Salvador, Chivo Wallet, Bitcoin Beach, Strike, Blockstream, AlphaPoint, Paxful, Algorand, Bitso, BitGo, Koibanx, Bitfinex Securities, Athena Bitcoin.

Costa Rica

Ecosystem:

Costa Rica ranks 92nd in the 2023 Global Cryptocurrency Adoption Index, a drop of 27 places from 65th in 2022.

Costa Rica widely adopts cryptocurrencies, with many businesses accepting them as a means of payment—workers can receive a portion of their wages in cryptocurrency, and Costa Rica has 6 Bitcoin ATMs, with a population of only 5 million.

This country, known as the "pure life," has rapidly embraced blockchain technology and cryptocurrencies, thus having an active ecosystem. Costa Rica has become a cryptocurrency hub, as there is high demand from businesses to integrate the technology into their systems and accept it as a means of payment.

The active cryptocurrency ecosystem has given rise to an active blockchain association: Asos Blockchain promotes activities and regularly gathers the country's leading web3 builders at events such as The Tico Blockchain Conference and community-led events like Crypto Cantina.

Costa Rica has stable and reliable internet connectivity and one of the largest renewable energy outputs in the world—98% of its energy is renewable, making it one of the "greenest" countries on earth, attractive for cryptocurrency mining projects.

Grassroots adoption is underway: the Bitcoin Jungle community has expanded from the Dominican Beach to the Golden Triangle of Costa Rica (Dominical, Uvita, Ojochal, Playa Hermosa, Tinamastes).

The community actively promotes gatherings and educational work, with initiatives like El Zonte Bitcoin Beach, initiated by cryptocurrency enthusiasts, inspiring this experiment by helping sellers save credit card fees (up to 8%) while incentivizing Bitcoin enthusiasts to visit this surfing town. The successful El Zonte Bitcoin Beach has inspired this experiment.

The Blockchain Jungle conference aims to position Costa Rica as a global center for sustainable blockchain technology. Speakers such as Nick Szabo and Costa Rican Minister of Technology Paula Bogantes attended the event in November 2023.

Costa Rica has launched its own ReFi Node, aiming to incubate regenerative finance projects and promote collaborative enterprises in the region. Another notable project is Cambiatus, a blockchain-based platform for creating complementary currencies. The thriving Monte Verde community uses the platform to raise awareness of green initiatives and reward volunteer work, driving local economic growth after the adverse effects of the pandemic on the tourism industry, the main economic activity in the region. Since its launch in December 2020, the Verde community currently has over 2,800 members and is still growing. Cambiatus also facilitated the creation of CoFi Blocks in 2022, a collaborative enterprise led by coffee producers.

In the private sector, Edenia is an initiative led by builders of the web3 ecosystem, assisting bare-metal infrastructure servers, serving as a development lab, providing validator services for multiple blockchains such as Bitcoin, Ethereum, Polygon, Dash, EOS, TELOS, Libre, LACChain, and more.

Cryptocurrency mining is also an interesting area. In early 2022, a hydroelectric plant that had been operating for 30 years changed its business model to start mining Bitcoin. In 2023, Evergreen Sustainable Enterprises launched a hydroelectric Bitcoin mining facility in Costa Rica. The sustainable facility's electricity costs are as low as $0.02 per megawatt-hour, lowering the breakeven point for BTC market prices to $10,145.

Regulation:

Costa Rica aspires to be a cryptocurrency-friendly country with very low taxation on cryptocurrencies. Congresswoman Johana Obando proposed a Cryptocurrency Market (MECA) bill to regulate the cryptocurrency market, providing clarity and protection for individuals and companies investing in cryptocurrencies, while fostering an ecosystem to attract investment.

The proposed bill would prevent the government from taxing cryptocurrencies used to purchase goods, exempt profits from cryptocurrencies held in cold storage, and profits from the mining industry. However, profits from cryptocurrency trading would be subject to income tax.

Legislators hope that the Costa Rican government recognizes what cryptocurrencies are and allows people to hold and use them freely. The goal is to eventually attract foreign investors, fintech companies, and tourists, and create job opportunities for Costa Ricans in the technology and tourism sectors. Costa Rica's regulations are different from El Salvador's—it will not force anyone to accept Bitcoin, but it will make it possible if both parties agree.

Currently, the Central Bank of Costa Rica does not regulate cryptocurrencies, but they are legal and recognized as a legitimate means of payment.

A government statement from 2017 explains that state institutions are not responsible for and do not manage cryptocurrency operations, advising users to "use them at their own risk."

The Central Bank of Costa Rica (BCCR) does not regulate or enforce the use of cryptocurrencies, as they are not issued or supported by the central bank. According to The Tico Times, "Article 166 of the Labor Code allows the use of assets that are generally accepted as a means of payment." Therefore, employees can accept a portion of their wages in cryptocurrency. Salaries must be paid in legal tender (government-issued currency) up to the minimum wage, and the excess can be paid in cryptocurrency.

In November 2021, the Costa Rican tax authority proposed taxing cryptocurrency assets, proposing a 13% value-added tax on the purchase of cryptocurrency, in addition to a 15% capital gains tax. This proposal is not expected to pass, as it would hinder Costa Rica's cryptocurrency ecosystem and impede innovation.

Key Participants:

Aso Blockchain, Blockchain Costa Rica, Edenia, EOS Costa Rica, Cambiatus, Genesis Blockchain Technologies, Data Center CR, LACC Chain, Cryptoreds, Bitcoin Jungle, Blockchain Jungle

Panama

Ecosystem:

Panama experienced a severe economic downturn in the early stages of the pandemic, mainly due to its service-based economy, with its GDP contracting by 17.7% in 2020. However, it saw a strong rebound in the following years, with a growth rate of 15.8% in 2021 and 10.8% in 2022.

Panama ranks 97th in the 2023 Global Cryptocurrency Adoption Index, a 7-place increase from 2022, and is currently one of the Latin American countries with the most cryptocurrency ATMs (32), according to CoinATMRadar data.

Panama faces challenges of poverty, unemployment, and a highly unbanked population, yet it has a very high internet penetration rate—providing a potentially fertile environment for blockchain initiatives. Approximately 41 merchants in the country accept cryptocurrencies as a means of payment, with 34 located in Panama City, according to CoinMap data.

Since October 2022, large-scale protests against the government and a Canadian copper mining company operating in the country and reaching an agreement with the government, at least for another twenty years, have further raised interest in financial alternatives such as Bitcoin, leading to the shutdown of some Bitcoin ATMs in Panama.

An important participant embracing the cryptocurrency/blockchain space in Panama is Towerbank. This cryptocurrency-friendly financial institution held a Bankathon in 2023, where participants could showcase their groundbreaking solutions and have the opportunity to collaborate with the bank.

Towerbank was also a major sponsor of the Blockchain Summit Latam held in Colombia in 2023, where the company announced the launch of a Bitcoin wallet called Ikigii: customers will have the option to trade cryptocurrencies and convert them to US dollars through their cryptocurrency-friendly bank accounts. The bank has an independent cryptocurrency department and promotes multiple educational activities in Panama.

In March 2024, Panama will host Eth Canal, the country's first Ethereum-based event, with several international speakers scheduled to attend.

While Panama's cryptocurrency field has not yet diversified in terms of local initiatives or public adoption, the environment is conducive to increased adoption. Firstly, the US dollar is the country's official currency, similar to El Salvador. One way to hedge against the devaluation of the dollar due to inflation is by purchasing Bitcoin, as the Salvadoran government has done.

The approval of pending regulations could lead to high adoption and usage of cryptocurrencies in the Panamanian economy, potentially making it one of the most important cryptocurrency centers in Latin America.

Regulation:

The "Ley Cripto" or cryptocurrency bill in Panama was initially proposed by Congressman Gabriel Silva in September 2021. However, President Laurentino Cortizo objected to the bill during the second debate in June 2022. He requested adjustments to specific clauses, such as compliance with international anti-money laundering regulations; expanding the definitions of terms such as collateral, DAO, and consensus; increasing tax obligations; and designating a single entity (Banking Supervision) to regulate the market and exchanges within the country.

According to the legislation, Panamanians "may freely agree to use cryptographic assets, including Bitcoin and Ethereum, as an alternative means of payment for any civil or commercial operation." The bill also regulates the tokenization of precious metals and the issuance of digital value. Additionally, the government's innovation agency will explore the digitization of identity using blockchain or distributed ledger technology.

The bill was approved after the third debate. However, Congressman Silva expressed dissatisfaction with many of the amendments and stated on Twitter that the modified bill would set the country back in terms of competitiveness.

On October 28, 2022, the bill was sent to the President's office, who had 30 working days to veto or approve it. On January 26, 2023, he subsequently sent the bill to the Supreme Court of Panama for review, claiming that the legislation violated core principles of the constitution and was unenforceable.

In a ruling in July 2023, the Supreme Court found the bill to be unconstitutional in form and procedure, as the National Assembly failed to comply with the procedural rules regarding vetoed bills. The court did not make any decision on the actual content of the bill, stating that its procedural and formal unconstitutionality rendered the entire bill unconstitutional, meaning no further analysis was necessary.

Key Participants:

Towerbank, Ikigii, Eth Canal, Eth Kipu, We Dao Latam, CAPATEC, Enterprise Ethereum Alliance, Colledge.

III. Current Status of Cryptocurrency and Blockchain in Latin America

Sherlock Communications conducted a survey of 3,438 people in six Latin American countries to explore public opinions and knowledge related to blockchain and cryptocurrency. This exclusive survey was conducted in February 2024 through online groups, including participants from Argentina (474), Chile (460), Colombia (407), Brazil (827), Mexico (820), and Peru (450).

One of the main objectives of the survey was to understand the reasons behind cryptocurrency investment and explore the main challenges preventing wider cryptocurrency usage in the region.

Cryptocurrency Investors in Latin America

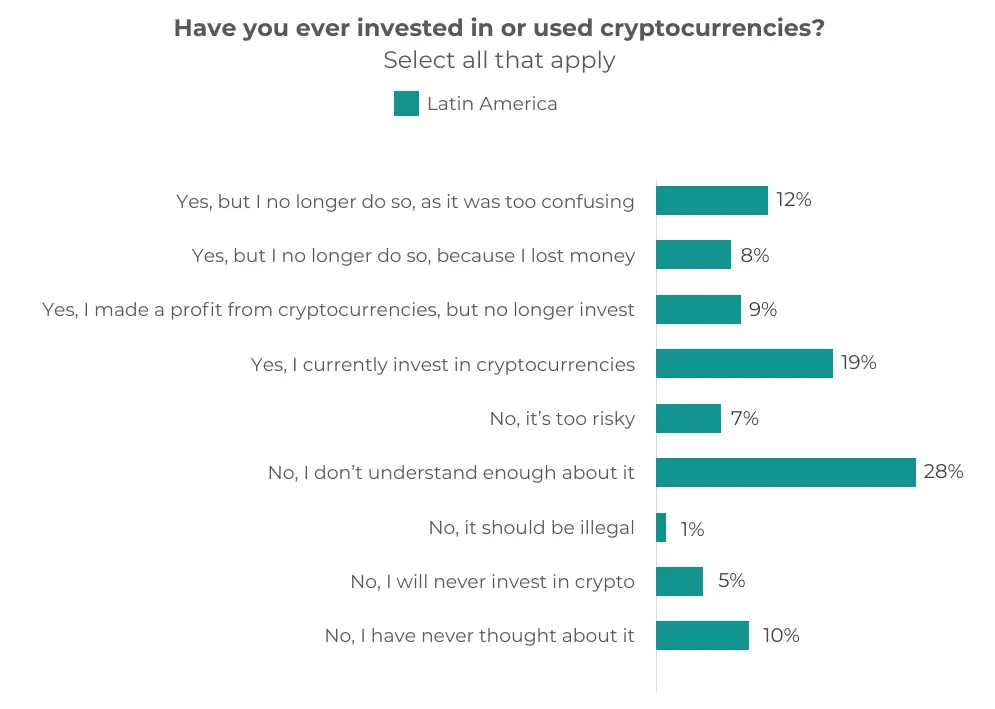

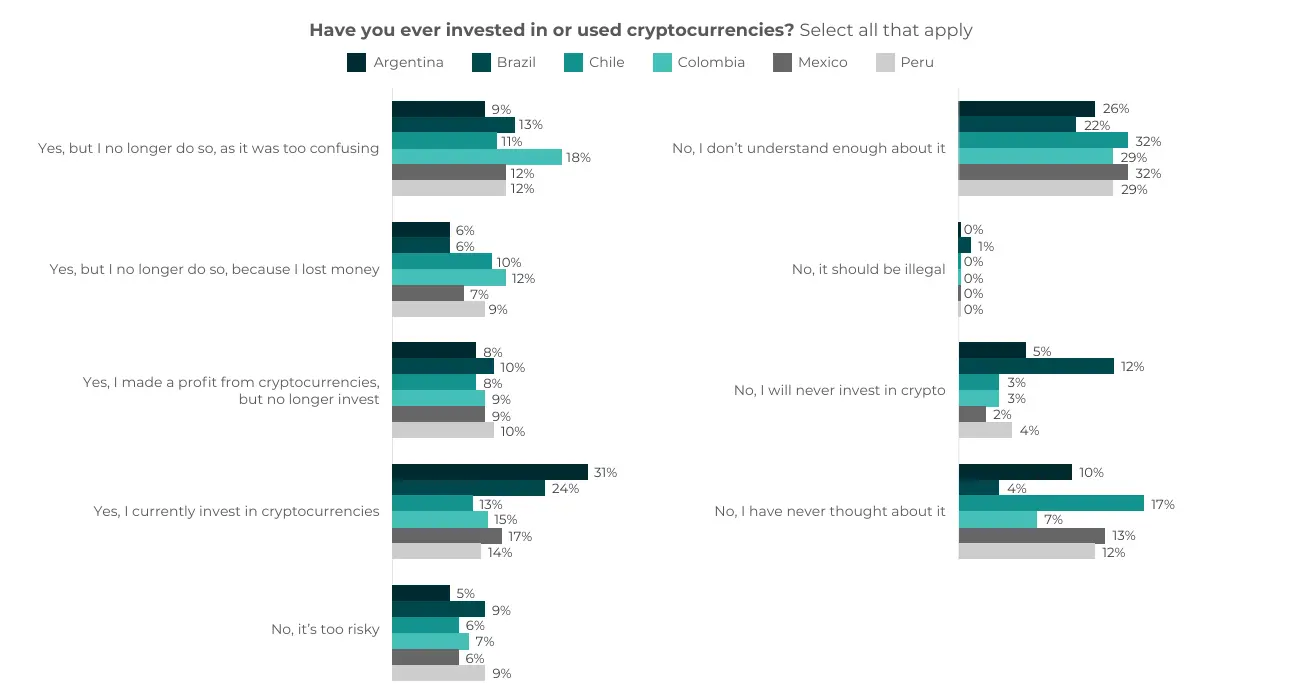

Half of the survey respondents (48%) in Latin America reported having experience investing in cryptocurrencies, although 60% of them have stopped trading for various reasons. Some found it too complex, others lost money, and another group no longer invests despite making money through cryptocurrencies.

One-fifth of the Latin American survey respondents (19%) reported currently investing in cryptocurrencies, with the highest proportions of cryptocurrency investors in Argentina (31%) and Brazil (24%). The lowest current cryptocurrency investor proportion was in Chile, with 13% of survey participants.

Reasons for Investing in Cryptocurrencies

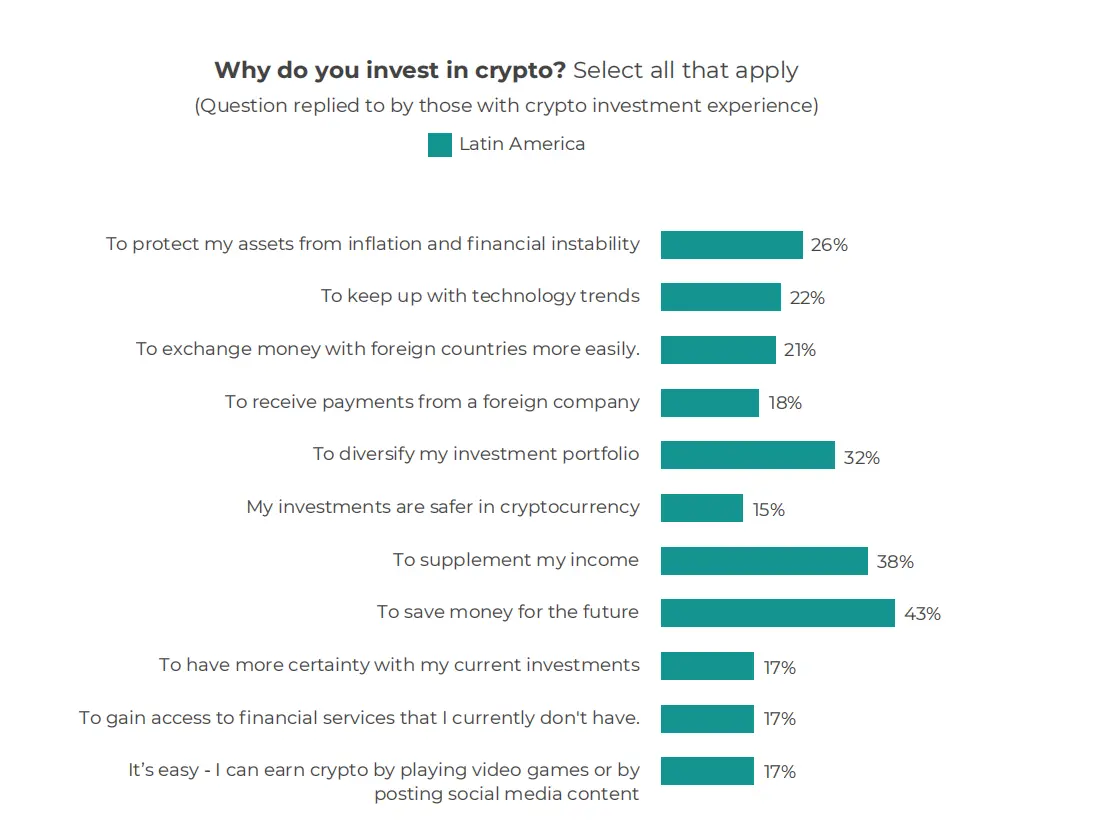

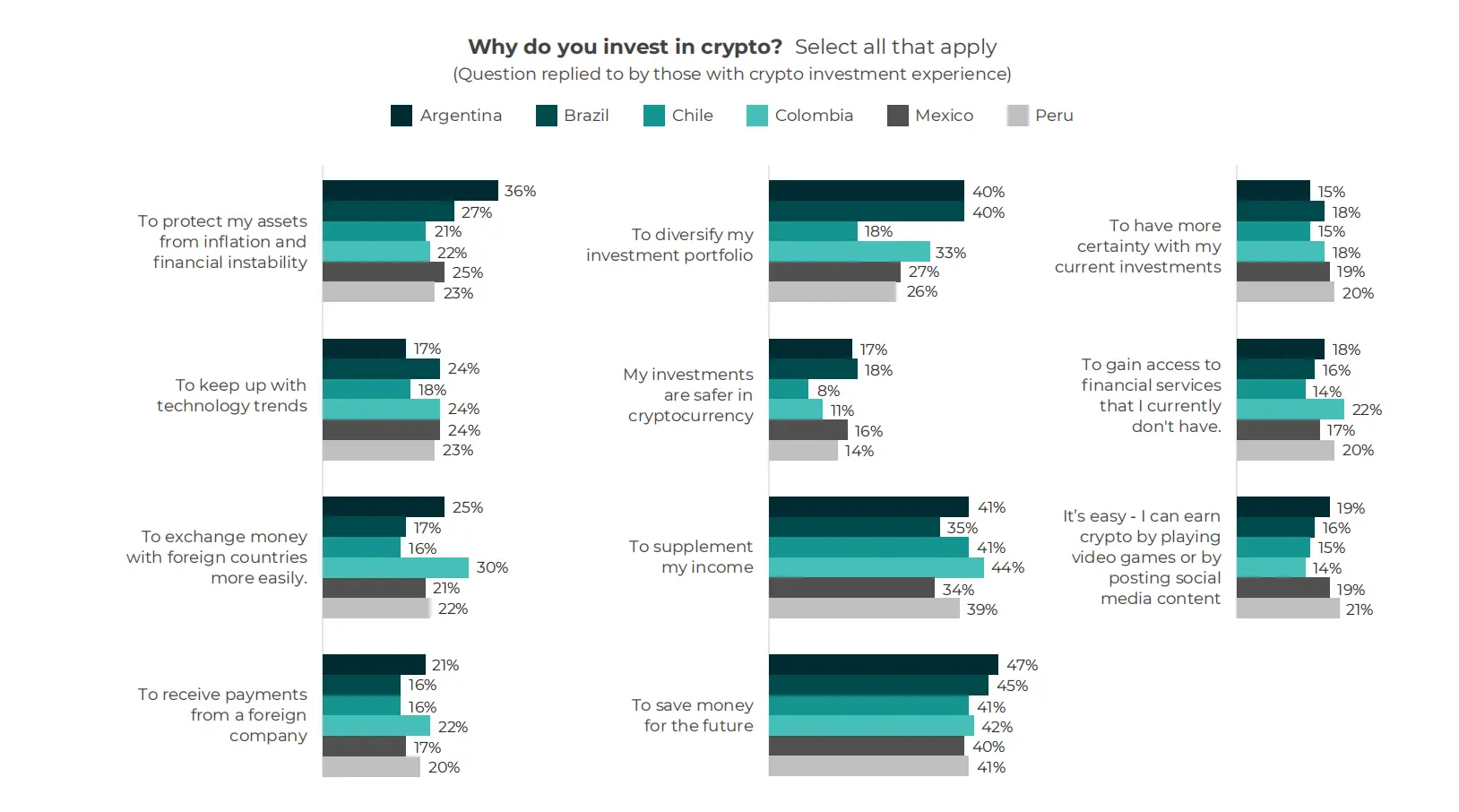

There are many reasons why Latin Americans choose to invest in cryptocurrencies. 43% of respondents with cryptocurrency investment experience believe "saving for the future" is the most common reason. Among cryptocurrency investors, 38% stated that it provides them with the possibility of additional income. In a region with fluctuating inflation rates, a quarter (26%) of cryptocurrency investors in Latin America are motivated to "protect my assets from inflation and financial instability," a motivation particularly strong in Argentina, where 36% of cryptocurrency investors cited this reason. Portfolio diversification is a motivating factor for 40% of cryptocurrency investors in Argentina and Brazil, while 18% of cryptocurrency investors in Chile also cited this reason, higher than the Latin American median of 32%.

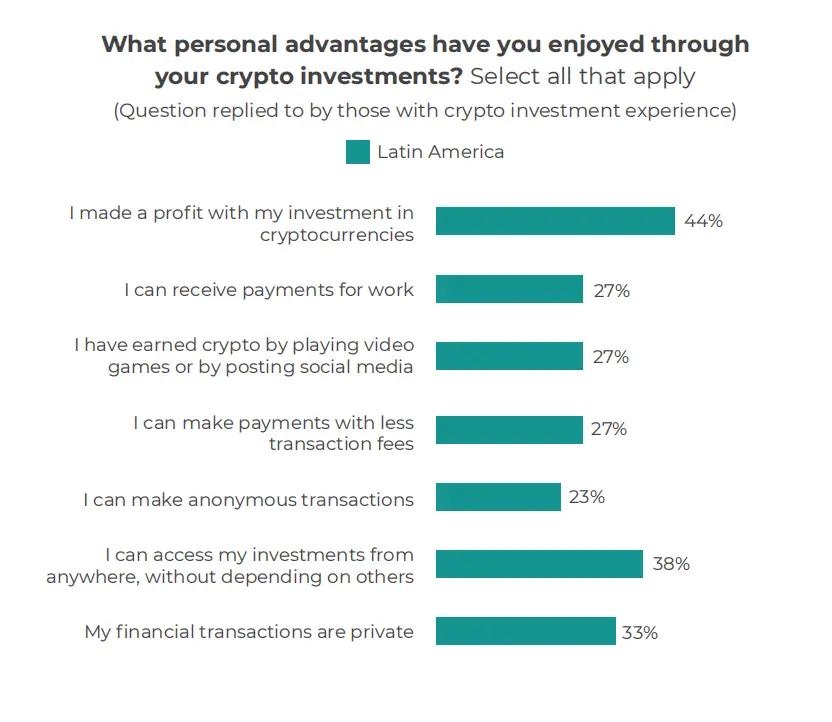

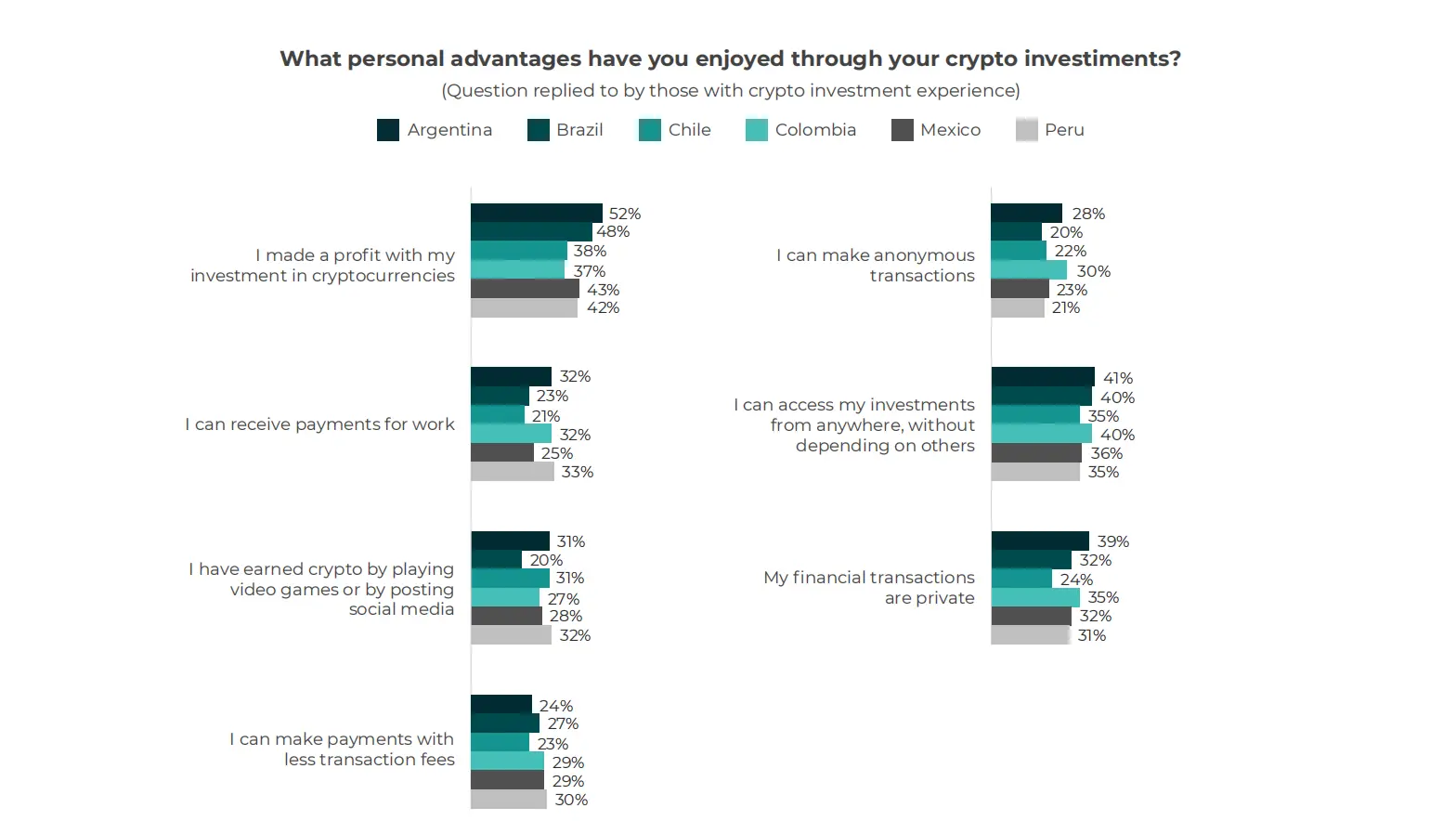

Less than half (44%) of investors with cryptocurrency investment experience reported making a profit from their investments, including over half (52%) of cryptocurrency investors in Argentina. Meanwhile, 38% of respondents with cryptocurrency usage experience stated that they can "access my investments from anywhere without relying on others," which is an advantage. Privacy in cryptocurrency transactions was listed as a personal advantage for one-third (33%) of the cryptocurrency investment sample.

What Hinders the Adoption of Cryptocurrency in Latin America?

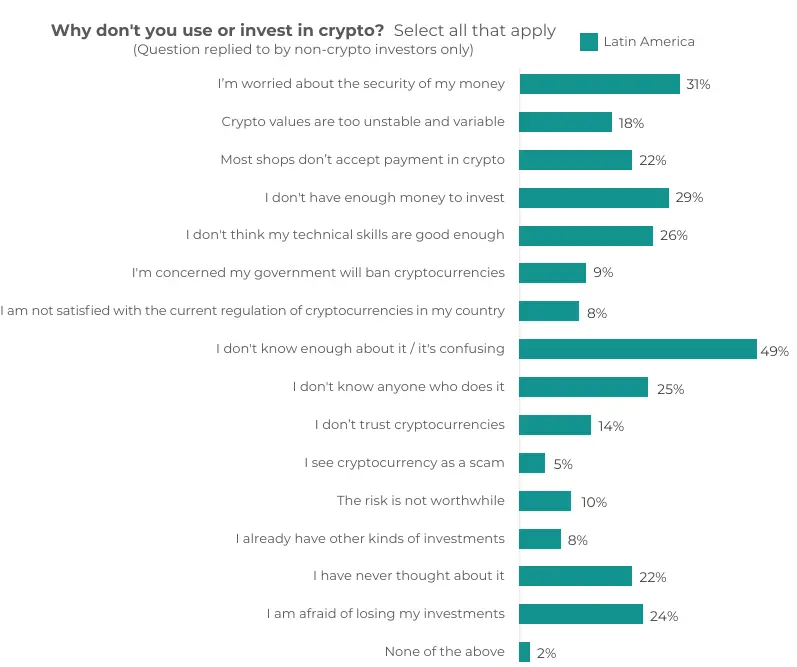

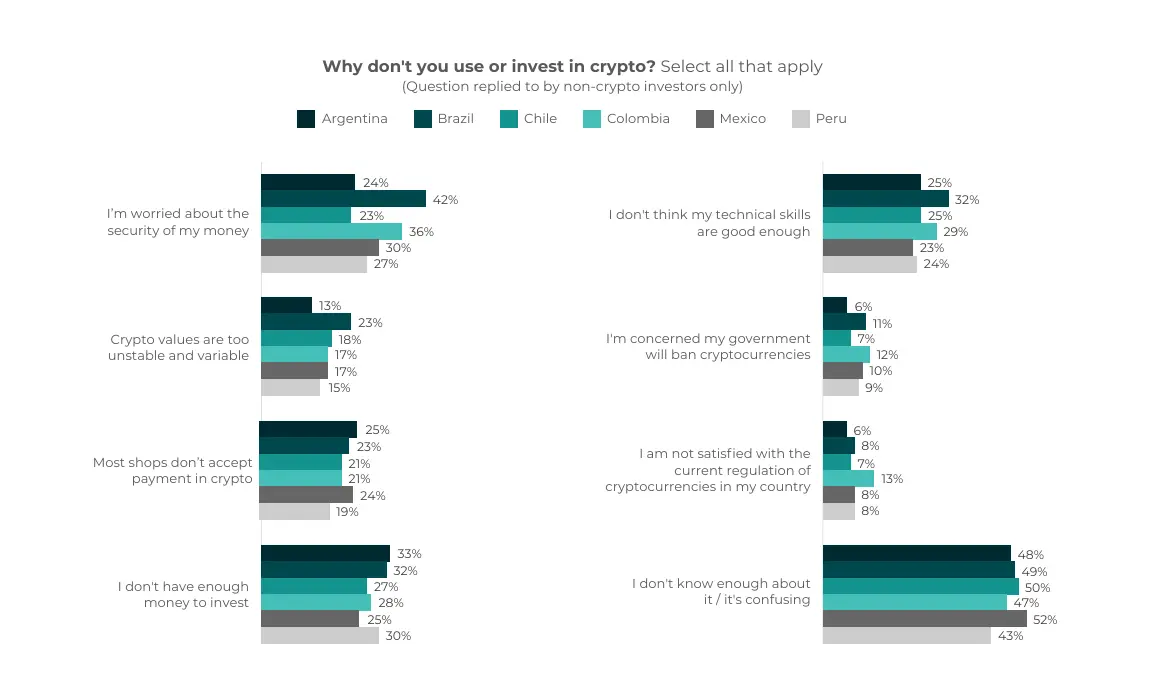

Information and security concerns are the primary worries preventing the adoption of cryptocurrencies in Latin America. In our survey sample, half (49%) of non-cryptocurrency users stated that they did not invest in cryptocurrencies due to a lack of knowledge and confusion on the subject. Mexicans are most likely to avoid due to lack of information, with 52% of non-cryptocurrency users citing this reason, while 43% in Peru hold the same view.

Concerns about the security of their funds are a worry for 31% of non-cryptocurrency users in not investing in cryptocurrencies, with this number rising to 42% in Brazil, while only 24% of non-cryptocurrency investors in Argentina expressed the same concern. One in ten (9%) non-cryptocurrency investors in our Latin American sample expressed concern about the government banning cryptocurrencies, with 12% of non-cryptocurrency investors in Colombia expressing this concern. Similarly, 20% of Colombians stated "I don't trust cryptocurrencies," higher than the Latin American average of 14%.

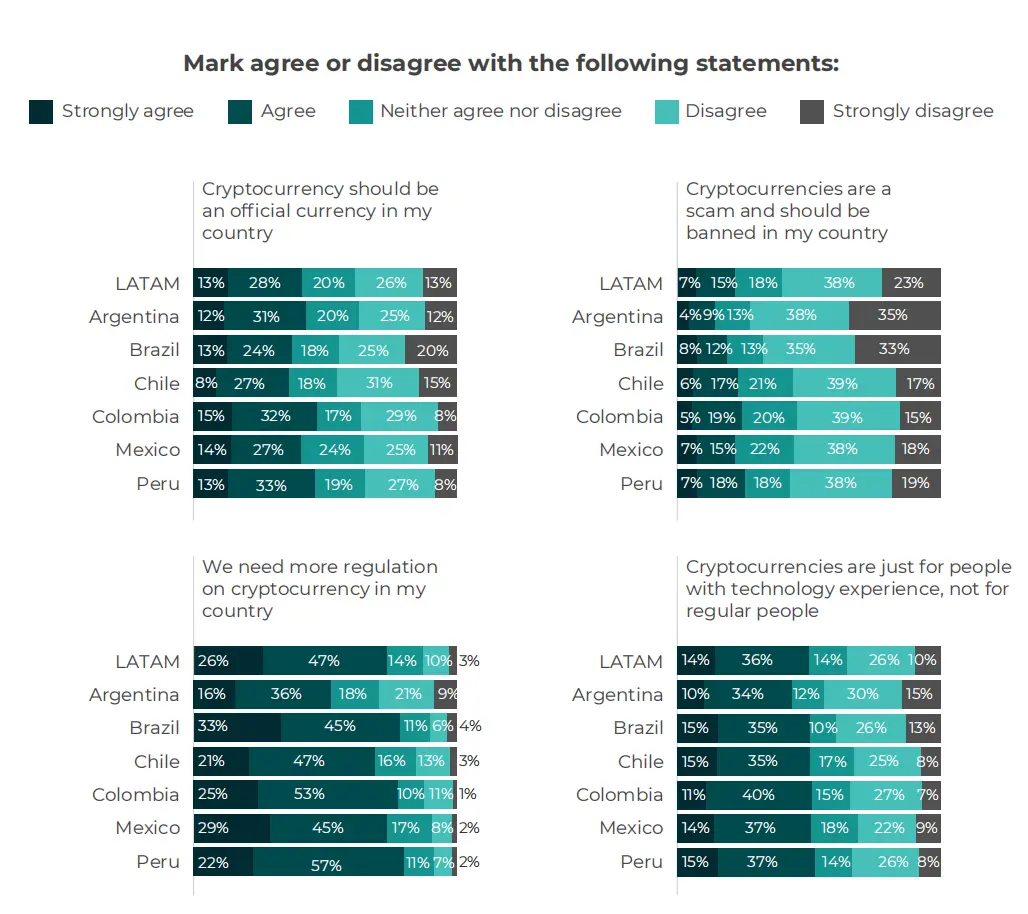

Regulatory Demands

In our sample, the vast majority (83%) of Latin Americans stated that they want the government to provide more official information about the use of cryptocurrencies, with 90% in Colombia seeking further official information from the government, and 86% in Brazil and Peru. Meanwhile, four out of five (80%) Peruvians said, "We need more regulation of cryptocurrencies." In Argentina, only slightly over half (52%) of respondents hold the same view, compared to the regional average of 73%. When it comes to the idea of formally adopting cryptocurrencies at the national level, there is an interesting divergence of opinions. While 41% of respondents in Latin America agree that "cryptocurrencies should be the official currency of my country," slightly over half (51%) of respondents in the region claim, "My country should protect traditional currency instead of considering cryptocurrencies."

FOMO (Fear of Missing Out)

The feedback from this consumer survey is clear—Latin Americans want more information about cryptocurrencies provided in their own language, with 85% agreeing. As cryptocurrencies become an increasingly popular buzzword, many Latin Americans fear missing out. In fact, 55% of the region's respondents believe "I am being left behind because I don't understand cryptocurrencies," with this sentiment strongest in Peru and least of a concern in Brazil, with only 47% agreeing. This lack of understanding translates into fear, with 65% of respondents in our Latin American survey unanimously agreeing, "Investing in cryptocurrencies is risky because I don't understand enough." At the same time, 65% of people in our Latin American survey stated that widespread adoption of cryptocurrencies will increase exclusion of those who do not understand cryptocurrencies. This sentiment is strongest in Colombia, with 64% of people expressing this concern, and 63% in Peru.

The Importance of CBDCs

Latin Americans firmly believe that Central Bank Digital Currencies (CBDCs) can help combat corruption, as 67% of respondents (two-thirds) agree. The country with the most support in this direction is Peru, with 78% of respondents agreeing. Sixty-eight percent of respondents believe that CBDCs will "speed up payments, reduce bureaucracy." However, many believe that this digital currency provides a means for the government to observe their actions. Over half (56%) of the sample believe that CBDCs are "a way for the government to monitor my spending habits," with 64% of Colombians agreeing with this view, while Argentina is at 48%. One-third (34%) of the region unanimously believes, "Digital currencies are an invasion of my privacy." Overall, it is clear that Central Bank Digital Currencies have relatively high ambiguity, with 62% of the region stating that they do not understand digital currencies enough. This sentiment is highest in Brazil and Chile, at 65% each.

Overall Perception of Blockchain

According to our survey results, blockchain has a good reputation in Latin America. Respondents in Latin America believe that the technology has a positive impact in areas beyond business and finance. In the region, 61% of the survey sample agree that blockchain technology can fundamentally change the way governments maintain health records, 59% believe blockchain is a tool for positive impact on underdeveloped communities, and 60% believe blockchain is a secure way to donate to non-governmental organizations. Additionally, in Latin America, only slightly over half (54%) of respondents believe that using blockchain can make elections more reliable through electronic voting records. This sentiment is strongest in Peru, with 65% of people agreeing, while only 47% in Chile agree.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。