Binance's lending scheme is relatively favorable for borrowers, as collateral can still earn interest; OKX has strong flexibility and versatility, relatively favoring depositors.

Authored by: Nan Zhi, Odaily Star Daily

Since last year, several centralized exchanges have faced controversies regarding their lending products, with some claiming to have suffered "significant losses" due to unclear terms. In reality, the lending products of major centralized exchanges are not simply about depositing collateral and borrowing, but involve various "special" provisions.

In this article, Odaily Star Daily will summarize and explain the lending rules of Binance, OKX, and Bybit in detail to help readers understand the product details.

Binance's Flexible Borrowing

Collateral

Users can only pledge assets from the purchase of Binance's principal-protected earning products as collateral, including 137 cryptocurrencies such as USDT. If the collateral from the principal-protected earning products is insufficient to cover the required borrowing amount, users can also use digital assets in their spot accounts to purchase the principal-protected earning products and then use them as collateral.

Borrowing Details

Individual positions: Users can borrow from a total of 218 assets, and each "collateral - borrowing pair" can open a separate borrowing position. For example, one position could be "USDT collateral + ETH borrowing," while another could be "USDT collateral + BTC borrowing." Each "collateral - borrowing pair" is independent and calculates its own collateral ratio, additional margin, and forced liquidation collateral ratio separately.

No active liquidation for borrowing: Binance's flexible borrowing is an indefinite product. As long as the product supports the borrowing asset and the collateral digital asset, and does not exceed the corresponding collateral ratio, users can hold the position indefinitely.

Collateral ratio: Depending on the collateral cryptocurrency, the initial collateral ratio varies, with most being 78% (meaning that collateral worth $100 can borrow up to $78 in assets).

Forced Liquidation Rules

If any cryptocurrency reaches a 90% maximum forced liquidation collateral ratio, or the unpaid borrowing value falls below $200, a complete forced liquidation will occur. All borrowing will be repaid through the equivalent collateral of the borrowing position. If forced liquidation occurs, the platform will charge 2% of the borrowing amount as a forced liquidation fee.

Borrowing Interest

Borrowing interest can be checked on Binance's lending page and is updated every minute. It is worth noting that Binance has not disclosed the calculation method for the borrowing interest of each cryptocurrency, but overall, the higher the overall collateral ratio of a token, the higher the interest. When borrowing reaches a certain limit, depositors will be unable to redeem, but the interest will also increase to a certain extent to encourage borrowers to repay early.

(Odaily note: This clause was also the fundamental reason for the previous CYBER controversy. Binance emphasized in the "Binance Principal-Protected Earning Products Beginner's Guide" that "if there are too many redemption requests for a certain token, it may still lead to temporarily insufficient available balance. In this case, when the borrower makes a repayment or other users provide additional liquidity, redemptions will return to normal.")

After a successful borrowing order, interest accrues every minute, and the interest generated per minute accumulates into the total unpaid borrowing amount.

Special Provisions

Due to the impact of the EU's cryptocurrency market regulation, the European Economic Area (EEA) cannot lend unregulated stablecoins such as USDT and FDUSD. For details, refer to the English version of the lending rules.

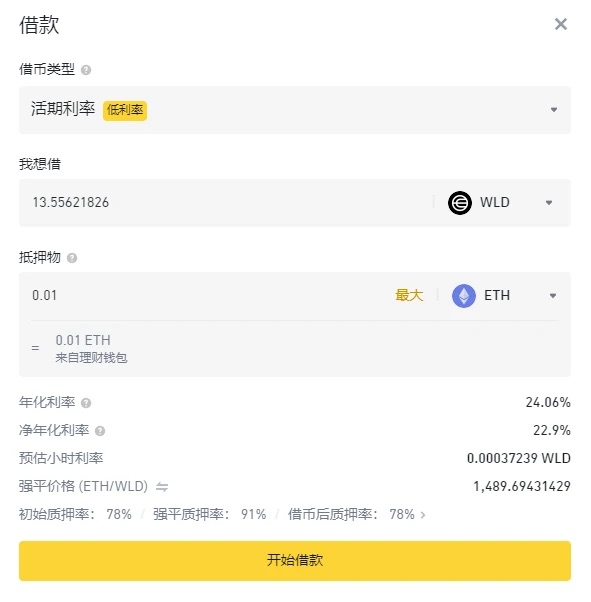

After digital assets used to purchase Binance's principal-protected earning products are pledged for Binance's flexible borrowing, they will continue to receive real-time annualized returns and tiered annualized returns from the principal-protected earning products, but BNB will no longer enjoy Launchpool returns. As shown in the figure below, the original lending rate for WLD is 24.06%. After deducting ETH's flexible returns, borrowing at a 78% collateral ratio results in a net borrowing rate of 22.9%.

(Odaily note: The displayed net annualized interest rate is calculated based on the initial collateral ratio and does not change with different borrowing amounts. Users who do not borrow the full amount need to calculate the annualized interest rate separately.)

OKX Flexible Borrowing

Collateral

Includes 149 cryptocurrencies, including USDT, and collateral is purely for pledging without other earnings or requirements.

Borrowing Details

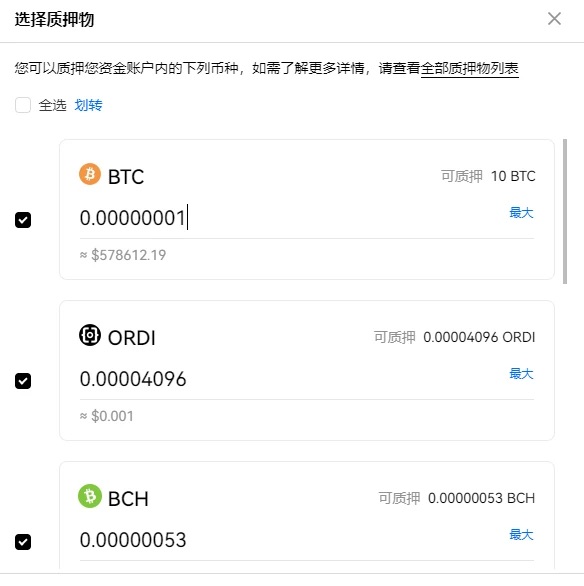

Selectable mode: Users can borrow from a total of 127 assets and can freely combine to establish "multi-collateral - borrowing pairs." For example, the image below uses BTC+ORDI+BCH as collateral, while the borrower selects from 127 tokens. When there are lending positions, collateral can be adjusted freely within the safety line.

Collateral ratio: OKX's initial collateral ratio is relatively low, mostly at 70%.

Forced Liquidation Rules

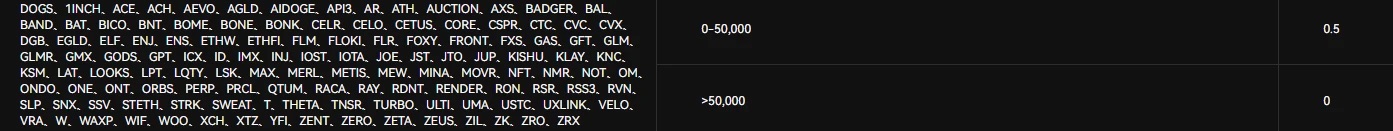

OKX's forced liquidation collateral ratio calculation is=(collateral value × currency discount rate - borrowing value × maintenance margin rate - forced liquidation cost) / collateral value. The forced liquidation collateral ratio is mostly 98.5%, but the discount rate for each token varies greatly. The highest is for BTC, ETH, USDT, USDC, with discount rates ranging from 0.9 to 1 depending on the amount, while a series of altcoins such as NOT, 1INCH, ACE have the lowest discount rate, with a rate of 0.5 for amounts under $50,000 and 0 for amounts over $50,000, meaning that the borrowing limit is only half for currencies like BTC and the maximum borrowing is $50,000.

Additionally, it is important to note that after forced liquidation, the remaining funds from flexible borrowing will enter the platform's risk reserve fund to cover potential losses from undercollateralization and will not be returned.

Borrowing Interest

The interest rate for OKX's flexible borrowing is refreshed hourly and interest is deducted hourly. The interest rate mechanism is relatively unique, as it matches market rates based on the rates set by users in the platform's "Yubi" and the borrowing amount. For example:

User A deposits 1000 USDT, sets the minimum lending rate at 1%, and User B deposits 1000 USDT, setting the minimum lending rate at 10%. If a user borrows 1500 USDT on the platform, User A's entire amount matches, and User B's 500 USDT is lent at a 10% rate, with no interest on the remaining amount. Therefore, there is a possibility of "explosive" returns on borrowing on the OKX platform.

Special Provisions

In addition to the user's own borrowing health ratio, OKX also has an automatic coin exchange mechanism for borrowing. When the platform's borrowing amount / deposit amount reaches 100%, in order to quickly reduce the risk of all platform borrowers, the system will perform a gradient classification based on the borrowing amount from large to small, and the group of users with the highest borrowing amount will be prioritized for automatic coin exchange. In short, whether a user's borrowing will be liquidated also depends on the overall market borrowing rate.

(Odaily note: The official document related to this is the "Automatic Coin Exchange Rules.")

The rules above correspond to OKX's ability for depositors to withdraw at any time, which is completely different from Binance's model of "triggering the upper limit and using high interest rates to encourage borrowers to repay."

Therefore, for borrowers, in addition to their own healthy position ratio, they also need to pay attention to the overall market borrowing rate. However, to prevent attackers from maliciously attacking based on this data, the overall market borrowing rate will not be made public, and users will receive risk warnings and liquidation queues via email.

Bybit Collateral Borrowing (Simple Version of Lending)

Collateral

Includes 153 cryptocurrencies, including USDT, and collateral is purely for pledging without other earnings or requirements.

Borrowing Details

Individual positions: Users can borrow from a total of 157 assets, and each "collateral - borrowing pair" can open a separate borrowing position, which is basically similar to Binance's model.

Collateral ratio: Bybit's initial collateral ratio is 80%, and the forced liquidation collateral ratio is 95% (a few are 93%), much higher than other platforms.

Forced Liquidation Rules

The user's collateral will be used for full automatic repayment and a 2% forced liquidation fee will be charged. The forced liquidation fee will be deducted from the collateral amount, and any remaining collateral after full repayment will be returned to the user's previously selected collateral deduction account.

Borrowing Interest

Flexible borrowing has no fixed repayment date, and the interest rate is not fixed. It fluctuates hourly based on market conditions, and interest accrues hourly until the borrowing is fully repaid or forced liquidation is triggered.

Conclusion

Most DEXs adopt the method of earning interest on deposits and making it difficult to withdraw and significantly increasing interest rates after reaching the limit to encourage borrowers to repay, which is similar to Binance's approach.

Binance and OKX have introduced relatively complex lending rules compared to other exchanges. In the event of extreme surges and the platform being fully borrowed, Binance's depositors cannot withdraw and sell, which is relatively favorable for borrowers. OKX has strong flexibility and versatility, and is relatively favorable for depositors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。