Uniswap Layer, as the latecomer of liquidity aggregation, is expected to integrate the fragmented BTC liquidity and bring users a smoother full-chain liquidity interoperability experience, similar to the BTC DeFi ecosystem leader WBTC.

I. Bitcoin DeFi Ecosystem: From WBTC to BTC Restaking

1.1 WBTC Pioneers the BTC DeFi Ecosystem

Bitcoin is like a dormant dragon that will shake the world once awakened.

As the earliest blockchain project with the highest consensus, Bitcoin has an undisputed position in value storage and exchange. However, due to its lack of Turing completeness, it has long been unable to participate in the thriving DeFi ecosystem. Compared to the thriving ecosystem of Ethereum, the total market value of the Bitcoin ecosystem is less than 1% of its market value.

Before the outbreak of the mainnet ecosystem driven by asset issuance protocol upgrades, the BTC ecosystem mainly relied on external consensus to participate in various DeFi ecosystems through anchored coins. Anchored coins map BTC to other blockchains and are rigidly redeemed 1:1 with the mainnet. This mechanism unleashes the financial value of BTC, allowing it to participate in scenarios such as collateralized borrowing, liquidity mining, and supports various ecosystem use cases. For BTC long-term believers, using BTC anchored coins is the optimal solution to earn DeFi ecosystem income while holding Bitcoin.

The mapping mechanism of BTC anchored coins is divided into two categories: centralized and decentralized.

The centralized anchoring mechanism relies on trusted third-party custodians to manage the mainnet BTC assets and mint anchored coins. This model is based on off-chain social consensus and carries trust and security risks.

The decentralized anchoring mechanism uses MPC and BFT algorithms to custody BTC in multi-signature addresses, reducing the risk of single point of failure and enabling permissionless minting, but with higher complexity in minting and redemption.

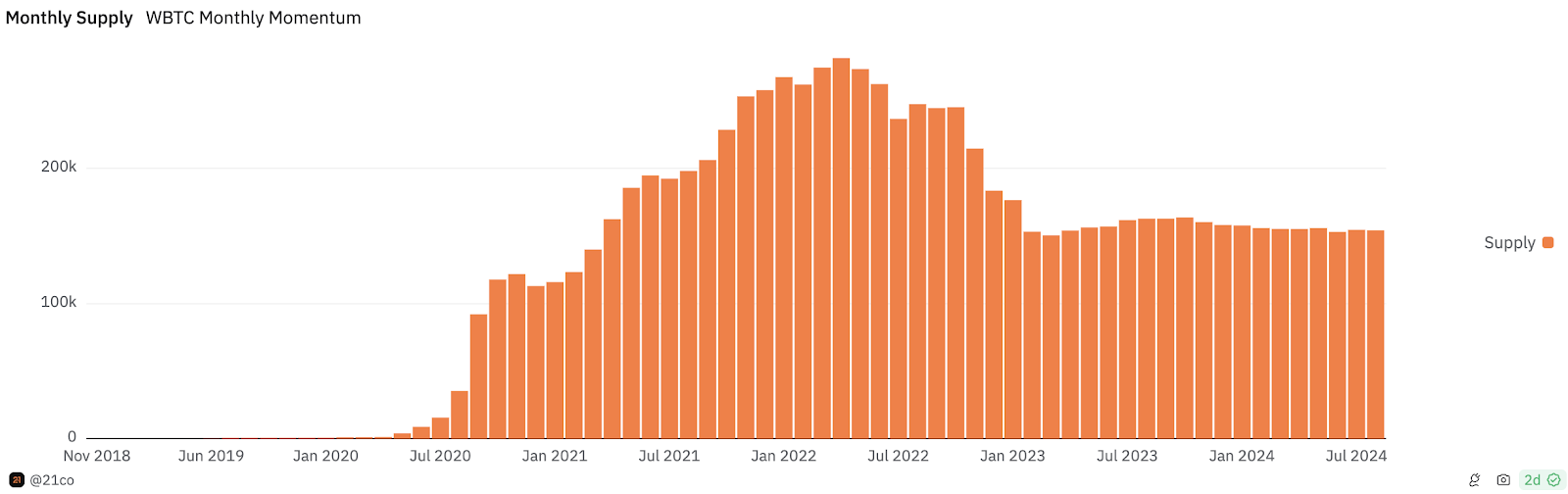

WBTC is currently the most widely used BTC anchored coin, jointly launched by multiple institutions including BitGo in 2018. After being listed as collateral assets by MakerDAO, WBTC quickly gained a dominant position in the market, with its supply increasing tenfold within three months. During the DeFi Summer in 2020, demand for WBTC on Ethereum peaked, with the supply reaching 281,000 and has now stabilized at 154,000, mainly used for borrowing (40%) and other DeFi use cases.

WBTC began to grow rapidly in 2022 and stabilized after the end of 2022

Although numerous alternative projects have emerged subsequently, such as decentralized anchoring projects represented by RenBTC and tBTC, and various chain-specific BTC represented by BTCB, WBTC has maintained its dominant market position due to its first-mover advantage, network effects, and user trust, with a market dominance on the Ethereum mainnet as high as 94.6%.

This to some extent reflects the higher demand for liquidity aggregation compared to security by users. WBTC's seamless integration with various DeFi protocols is incomparable to other newcomers.

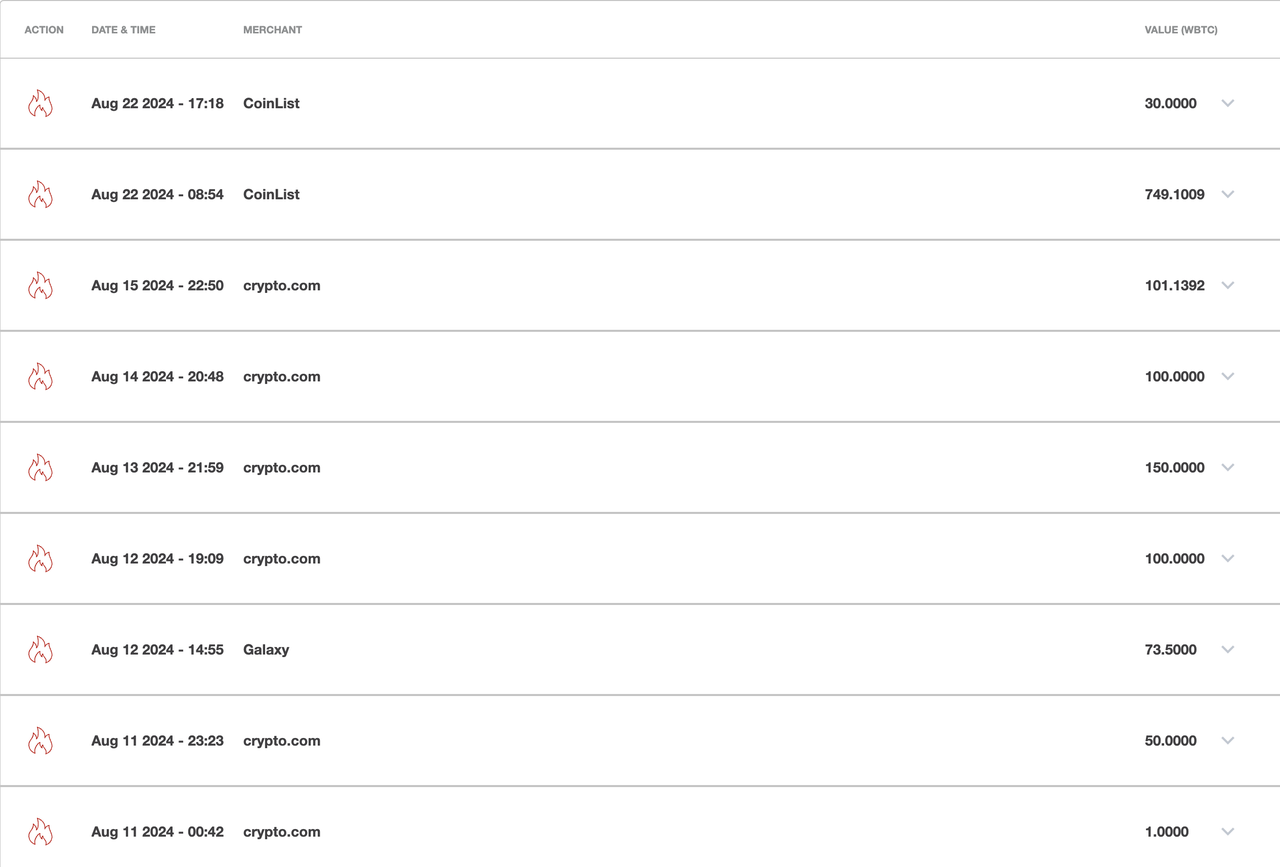

The extremely high market dominance cannot conceal the centralization risks of WBTC itself. In August 2024, BitGo and BiTGlobal established a joint venture, with Justin Sun becoming the actual controlling person. This raised concerns in the market about the centralization risks of WBTC, leading to large redemptions by institutions such as Crypto.com.

After BitGo's announcement, nearly 1,380 BTC were collectively redeemed through various channels, and no WBTC minting has occurred

In addition, the fees and non-yield attributes of WBTC also limit its attractiveness. Each time BTC is custodied to a custodian to mint WBTC, or when merchants destroy WBTC to redeem BTC, a 0.2% fee is charged. If users cannot earn stable high income after minting WBTC and also bear the risk of centralization trust, they have no incentive to bridge more mainnet BTC into on-chain financial scenarios.

Despite nearly six years of development, WBTC's market value accounts for only 1% of the total market value of BTC and its growth has stagnated.

How to introduce secure and stable income for BTC has become the key proposition for the development of the BTC DeFi ecosystem.

1.2 Babylon Rings the First Bell for BTC Native Income

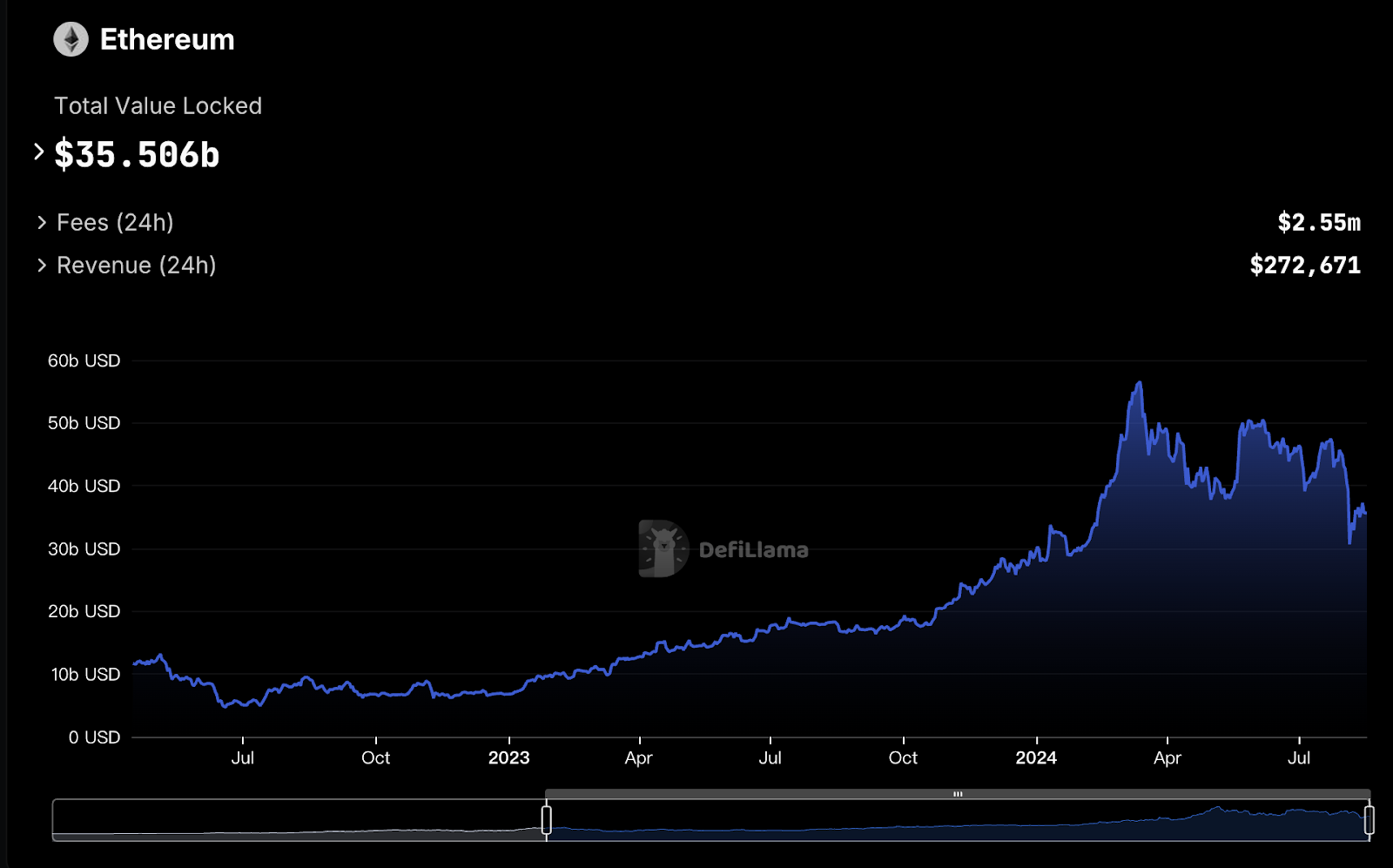

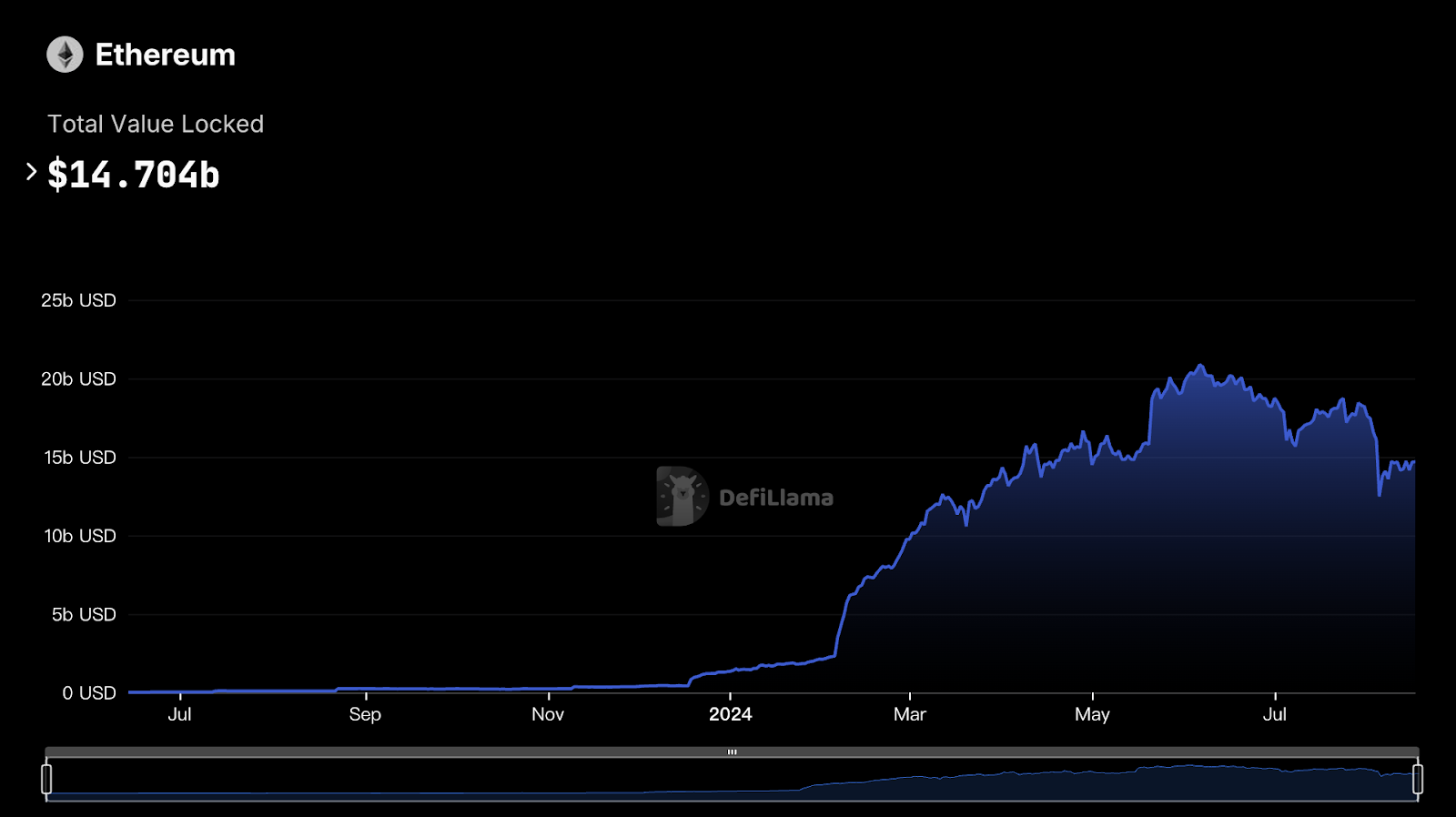

Compared to the stagnation of the total market value of the Bitcoin ecosystem, Ethereum completed The Merge upgrade at the end of 2022, successfully transitioning to proof of stake (PoS), introducing native risk-free income for Ethereum, and driving the explosion of the ETH Staking ecosystem. As of August 28, 28.11% of ETH has been staked, creating a staking market with a market value of $35.5 billion and a restaking market of $14.7 billion. DeFi products based on liquidity staking certificates (LST) have taken the lead in the financial ecosystem of Ethereum and have grown rapidly.

The left image shows the staking market, and the right image shows the restaking market

Compared to Ether, Bitcoin, as the largest cryptocurrency by market value, known for its decentralization, price stability, and resistance to price manipulation, should be more suitable for the staking and restaking market. The security of proof of stake (PoS) highly depends on capital stability, and Bitcoin's characteristics naturally suit the security of PoS.

With the approval of Bitcoin ETFs, the channels for compliant allocation of Bitcoin have opened up. In particular, long-term investment institutions such as family offices, private banks, and pension funds incorporating Bitcoin ETFs into their asset allocations will further enhance the stability of Bitcoin prices and its position as global digital gold.

Introducing the most needed native income for tokens suitable for AVS services, Babylon has become the destined figure in this round of the Bitcoin ecosystem.

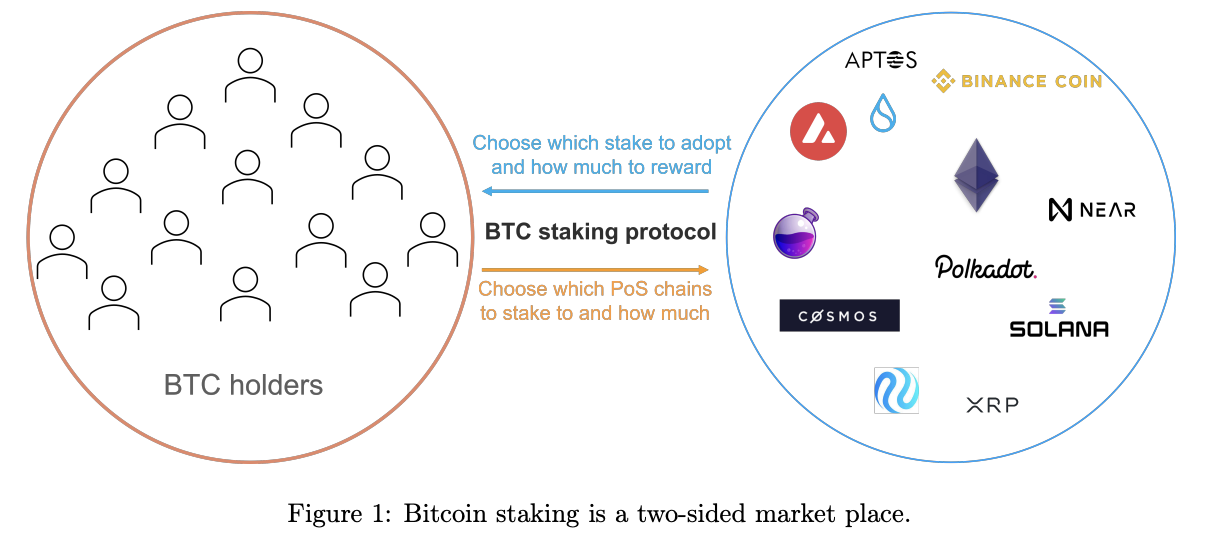

Babylon, while maximizing the security of Bitcoin assets, awakens the dormant Bitcoin ecosystem using appropriate economic incentives. By using Bitcoin's existing script language to implement staking and slashing mechanisms, Babylon's staking contract allows users to self-custody assets while safeguarding the economic security of the PoS consumption chain, introducing permissionless PoS risk-free income for the Bitcoin ecosystem (with an early hard cap of 1,000 BTC TVL).

Bitcoin staking is a bilateral market that connects the demand for income with the economic security guarantee needs of PoS chains

Babylon eliminates the reliance on third-party custody through a self-custody protocol and unleashes the potential of restaking using a remote staking scheme. Projects in the Bitcoin ecosystem can build Babylon's PoS income as the cornerstone of their protocols, overlaying CeDeFi income to maximize economic incentives.

The launch of Babylon marks the beginning of native income for BTC, bringing the BTC DeFi ecosystem into a new stage and addressing the core pain points that have constrained the development of the BTC DeFi ecosystem in the past two years.

1.3 Warlords' BTC Layer2

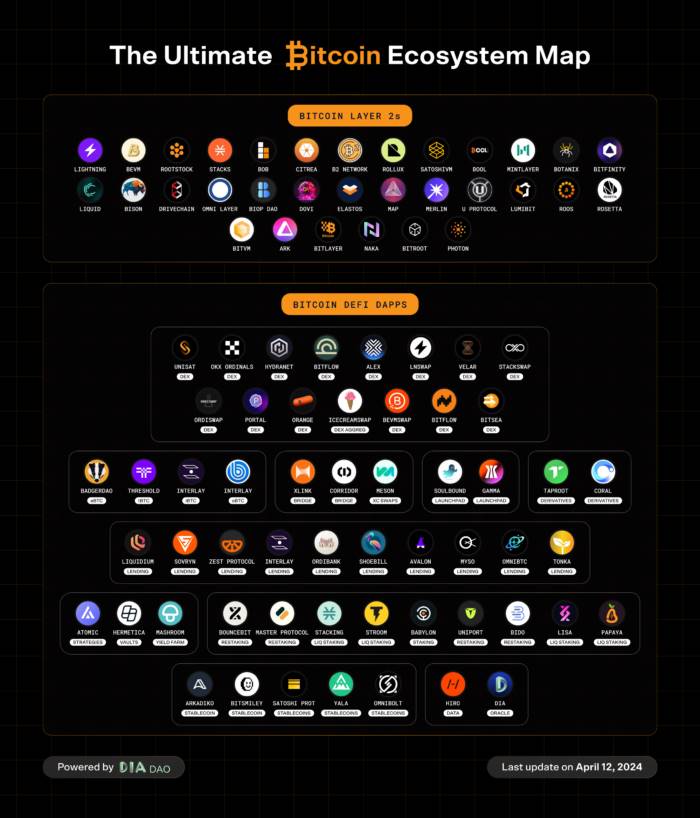

In addition to native income, the rapid rise of the programmable ecosystem of BTC has introduced a more secure source of DeFi income for Bitcoin.

It took Ethereum 9 years from November 2015, when Ethereum developer Fabian Vogelsteller proposed the ERC-20 standard, to April 2024 when EigenLayer went live on the Ethereum mainnet. However, the Bitcoin ecosystem caught up with this achievement in just a year and a half.

At the end of 2022, Casey Rodarmor proposed the Inscriptions protocol, making asset issuance on the Bitcoin mainnet possible. In March 2023, Domo introduced the experimental BRC-20 standard, enabling token deployment, transfer, and minting on the Bitcoin mainnet. By the end of 2023, the Ordinals ecosystem rapidly rose, demonstrating the significant demand for Bitcoin asset issuance and the importance of DeFi applications. However, due to the limited block space on the Bitcoin mainnet, the development of complex financial scenarios was restricted, leading to increased user costs and decreased user experience. In particular, when the block height reached 840,000 during the halving, the activation of the Rune protocol triggered market FOMO, causing mainnet transaction fees to soar to 2000 satoshis/byte.

The Rune protocol went live on April 20, 2024, causing a surge in Bitcoin mainnet transaction fees

Some researchers proposed Bitcoin Improvement Proposals (BIPs), attempting to enhance the mainnet's smart contract capabilities by reintroducing the OP_CAT opcode. Another group of developers explored scaling solutions without changing the existing technical framework of Bitcoin, driving the development of Bitcoin Layer2.

Bitcoin Layer2, represented by Botanix and BitLayer, placed Bitcoin Finality at the core of their designs. They compressed transaction data and packed it into the Bitcoin mainnet, building trustless bridges to ensure equivalent security with the Bitcoin mainnet.

Compared to the challenges of bridging to Ethereum, bridging to Bitcoin Layer2 offers higher security and legitimacy, gaining widespread consensus and support from the Bitcoin community. As a result, a large amount of dormant Bitcoin liquidity was activated, injected into the Bitcoin ecosystem, and sought after in high-yield financial scenarios. Since most Bitcoin Layer2 solutions are fully compatible with the EVM, many DeFi applications on Ethereum began to build on Bitcoin Layer2, gradually forming a rich DeFi ecosystem.

Bitcoin ecosystem map as of April 2024

1.4 Intense Competition in BTC Restaking

The introduction of native income solutions, combined with the improved programmability of the Bitcoin ecosystem, has made Restaking an important DeFi use case in the Bitcoin ecosystem. Similar to Ethereum's EigenLayer restaking ecosystem, Bitcoin has also formed a preliminary restaking ecosystem around the Babylon Staking protocol. Users can choose to self-custody BTC on the Bitcoin mainnet to enjoy shared security income from Babylon, or custody Bitcoin to the LRT protocol to participate in the DeFi ecosystem on Bitcoin L2 using liquidity staking certificates (LST) to earn additional income. Alternatively, when participating in staking activities on Layer2 such as Merlin Seal, users can stake M-BTC to the Solv Protocol, exchange it for the SolvBTC liquidity income certificate, and participate in liquidity mining or arbitrage of CeFi funding rates.

Restaking ecosystem projects collaborate with Babylon to introduce underlying income for BTC anchored coins, and the prosperity of ecosystem projects also benefits Babylon, enhancing the security of its PoS AVS service.

However, the development of the BTC Restaking track has brought new challenges:

Unsustainable underlying income: Many protocols rely on high inflation tokens as rewards, which cannot sustain high yield rates in the long term. If these protocols cannot achieve sustainable development, users may face the risk of a decline in token market value after the TGE.

Fragmentation of liquidity and user experience: Competition among Restaking projects has led to the dispersion of liquidity in the BTC ecosystem, reducing overall utility. The complexity of switching between different Layer2 and wrapped tokens has increased the usage threshold, limiting the potential for large-scale financial operations and cross-chain integration. Over time, this may lead to a situation where the past winners are the losers, and WBTC dominates the market.

High educational threshold: The rapid development and intense competition in the Bitcoin ecosystem have led to a high educational threshold. Users find it difficult to keep up with the changes in new protocols and understand various income strategies to choose the optimal one.

Inability to guarantee security: Many projects have rushed to launch without thorough security validation, increasing the risk to user assets.

These new problems require new solutions. The Restaking era needs new aggregated liquidity tokens, similar to the previous dominance of WBTC, to become a bridge seamlessly connecting various DeFi protocols.

Uniquid Layer has emerged.

II. Uniquid Layer - A Liquidity Layer Designed for a Wider Community

2.1 What is Uniquid Layer?

The Uniquid Layer protocol, fully named Unified Liquidity Layer, aims to seamlessly and efficiently connect the fragmented Bitcoin ecosystem, similar to Cycle Network and AggLayer, which are based on chain abstraction for full-chain liquidity aggregation networks. Uniquid focuses on unified liquidity management, helping users avoid cumbersome income calculations and comparisons, maximizing Bitcoin investment returns. In a figurative sense, traditional BTC Restaking protocols are more like individual phone manufacturers, delivering complete devices with slight comparative advantages under specific parameters and striving to lock users into their own ecosystems. Uniquid, on the other hand, is more like a computer assembly butler. It can select the most suitable components according to the specific needs of users under different parameters. Even if a specific component encounters a risk failure or undergoes an upgrade, this butler can respond and replace it at the fastest speed.

Uniquid Layer, known as the "People's Liquidity Layer," effectively addresses many of the previously mentioned issues from a user experience perspective.

Provide security guarantees. Uniquid Layer adopts ADV technology to maximize the security of liquidity aggregation. In addition, for underlying Restaking protocols, Uniquid Layer conducts detailed research on the risks of various protocols to select the safest and most sustainable ecological projects for users.

Maximize Bitcoin returns. Uniquid Layer integrates various Restaking projects to calculate and compare the real returns of underlying Bitcoin ecosystem projects, maximizing liquidity returns.

Provide a unified and user-friendly liquidity management platform for Bitcoin holders. Uniquid Layer integrates and manages users' cross-chain BTC liquidity, ensuring seamless connectivity between different Layer1 and Layer2.

Lower the entry barrier for Bitcoin DeFi ecosystem participation. Users no longer need to understand the usage methods of various Restaking protocols. They only need to pledge assets on Uniquid Layer to enjoy the optimal returns from various Restaking projects and receive liquidity certificates to participate in a larger DeFi ecosystem.

2.2 Simplifying the Participation Barrier for BTC Restaking, Unified BTC Anchored Coin Liquidity

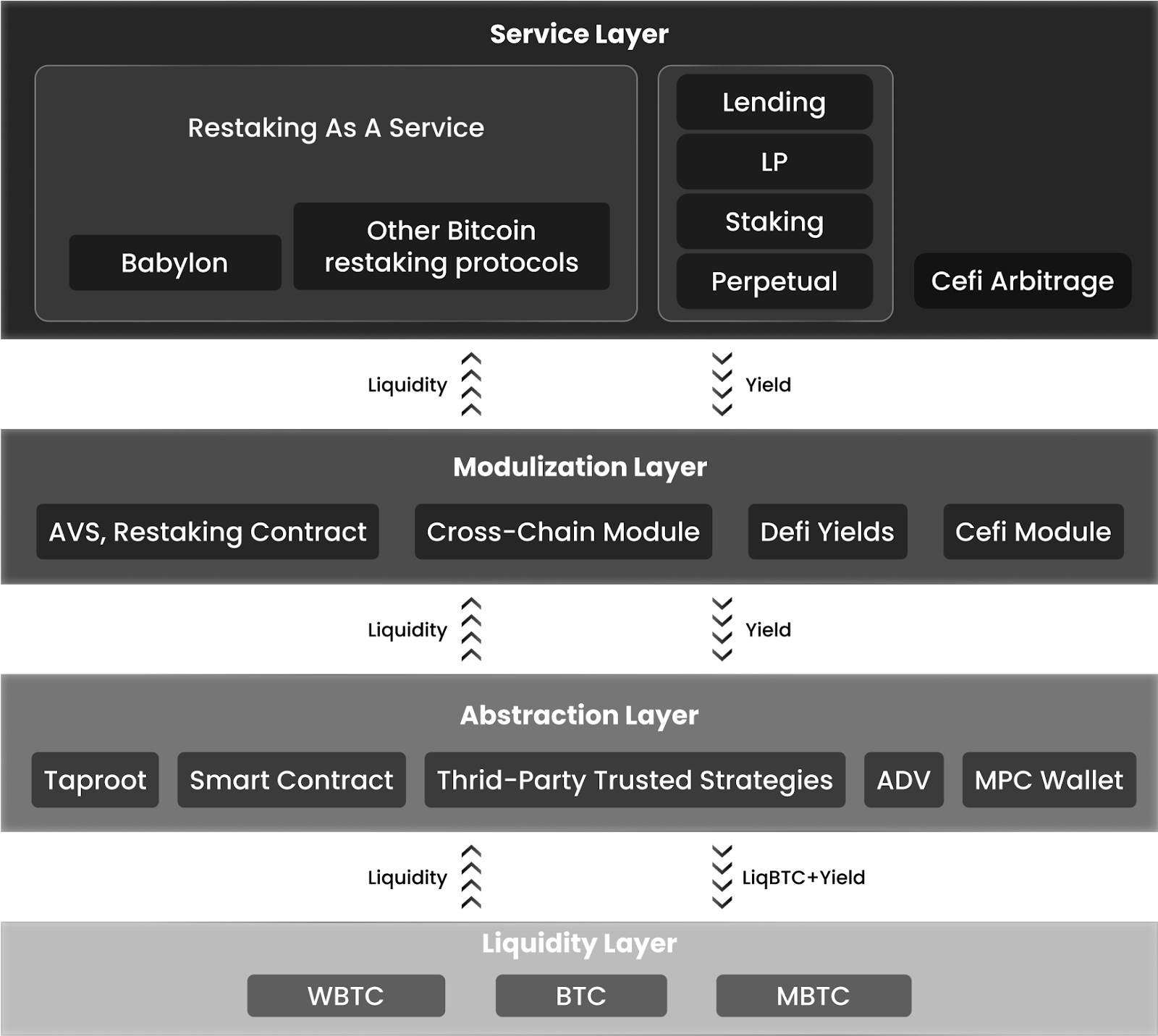

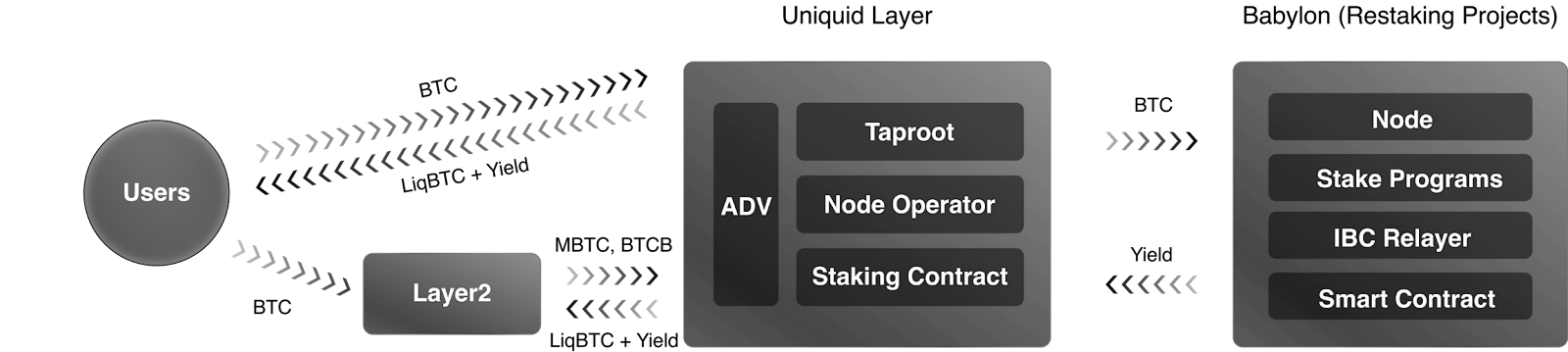

Uniquid Layer provides a unified framework to aggregate and manage Bitcoin liquidity on different blockchains and centralized exchange platforms, abstracting the entire Restaking ecosystem into four layers: service layer, modular layer, abstract layer, and liquidity layer. The first three layers are encapsulated in the underlying protocol, and users only need to pledge various forms of BTC anchored coins in the liquidity layer to reap the optimal annualized returns managed by Uniquid Layer.

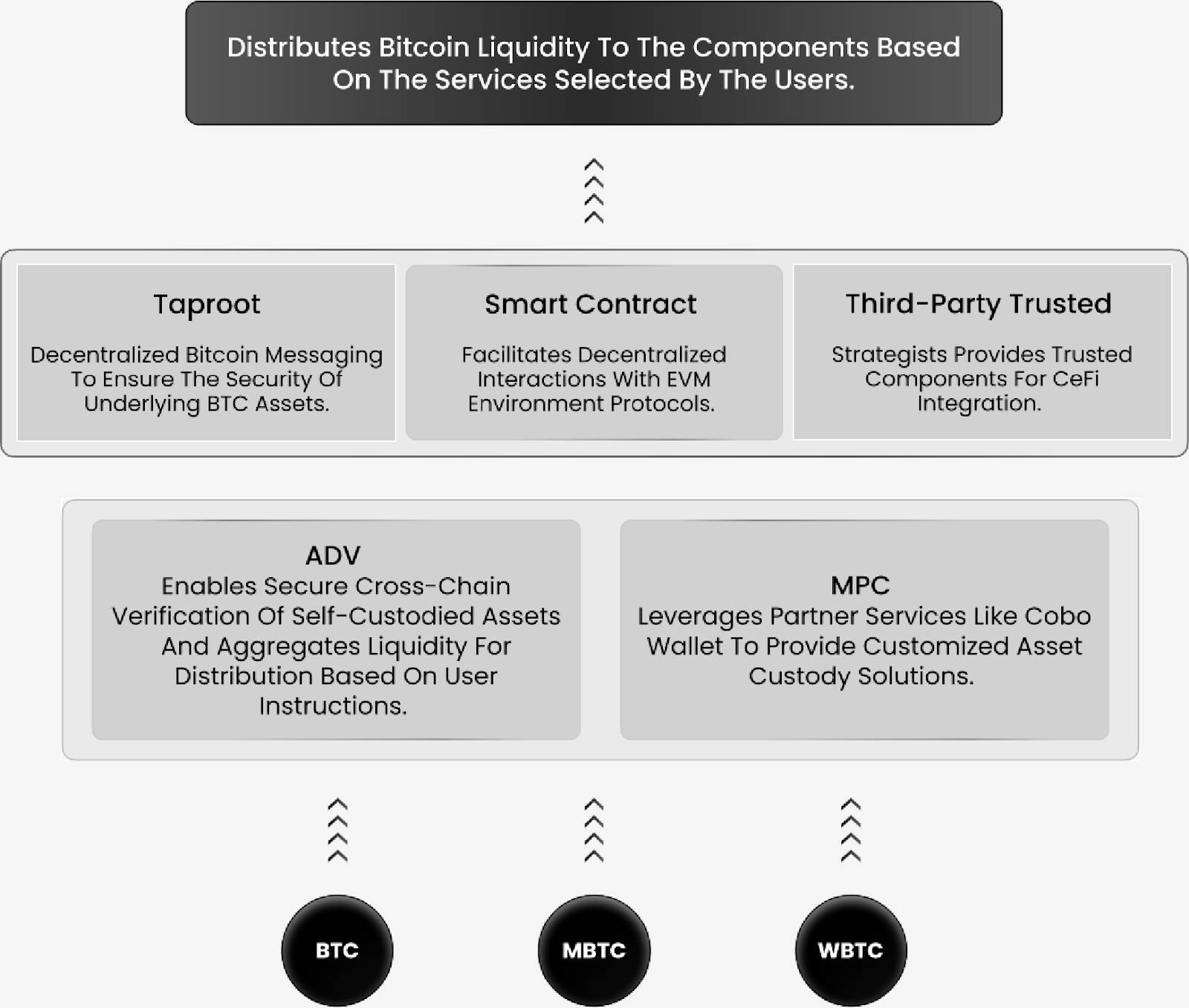

For Bitcoin ecosystem projects, asset security should always take precedence over economic incentives. For a liquidity aggregation platform, aggregating Bitcoin dispersed in various chains and protocols in a trust-minimized manner is the core technological pillar of Uniquid Layer. Uniquid Layer uses Anonymous Decentralized Validation (ADV) technology to aggregate full-chain BTC liquidity. For different BTC use cases, Uniquid Layer designs decentralized privacy technologies tailored to ensure the security of the aggregation process and provide secure income access:

For the Bitcoin mainnet, it effectively hides the information transmission of Bitcoin scripts through Taproot.

For the EVM environment, it uses decentralized signatures to interact with smart contracts.

For centralized exchanges, it integrates trusted third-party strategies.

It collaborates with MPC custody service providers to provide customized asset custody solutions.

ADV

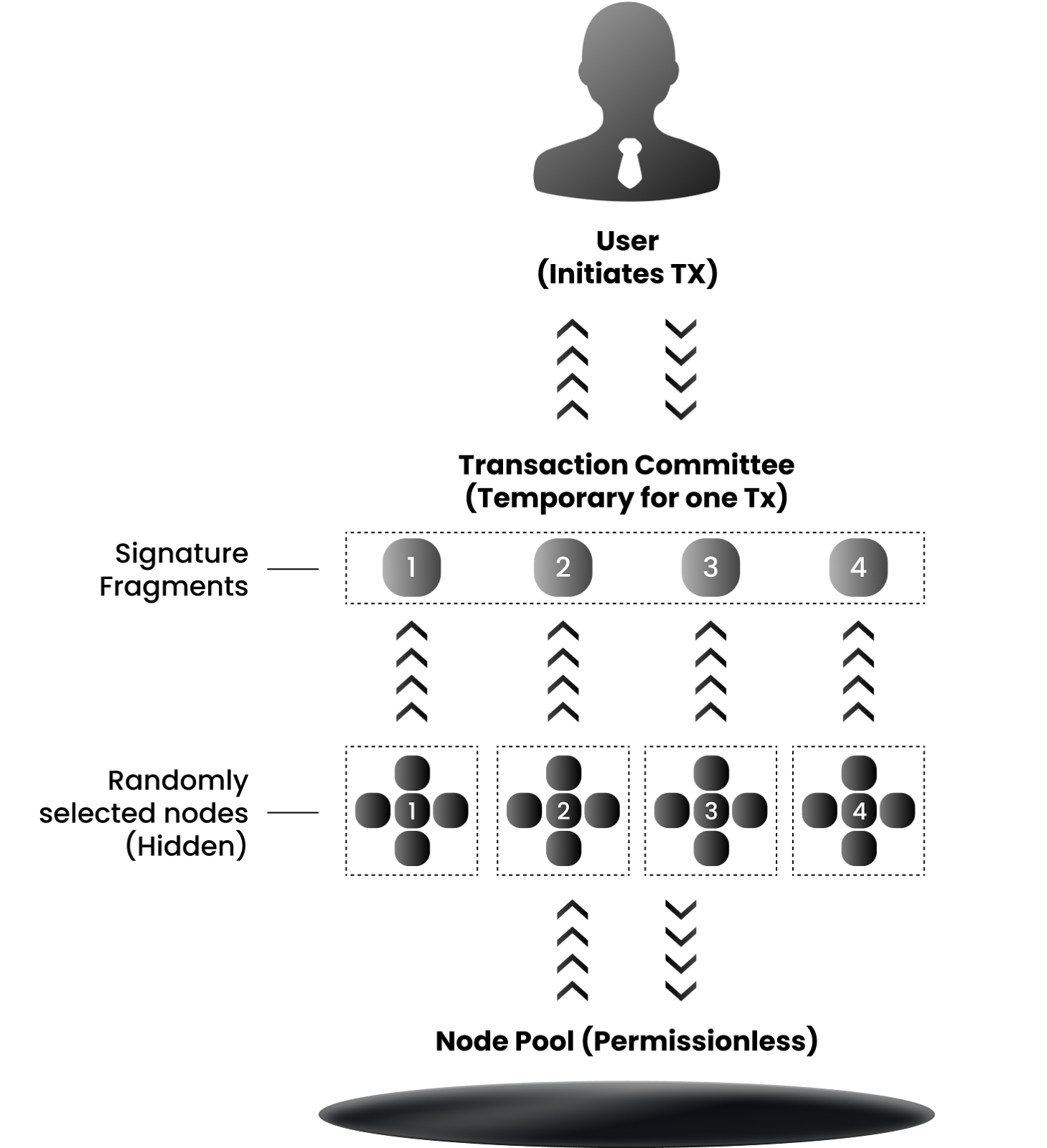

Uniquid Layer uses ADV technology to protect and abstract liquidity, aggregating it securely into the highest annualized return Restaking protocols. Similar to threshold signature technology, the signing private keys for cross-chain transactions are no longer controlled by a single node but are split among a permissionless anonymous node pool. After a user initiates a cross-chain transaction, the protocol randomly selects a group of nodes from the node pool. Only by aggregating the signature fragments generated by this group of nodes can the signing be completed.

Since the signing members are randomly selected from the permissionless anonymous node pool, the mechanism of ADV effectively prevents single-point failure of signers, significantly increases the cost of malicious node attacks, and ensures the flexibility, anonymity, and scalability of the cross-chain ecosystem.

2.3 Modularization of Restaking Components, Integration of Various Protocol Providers

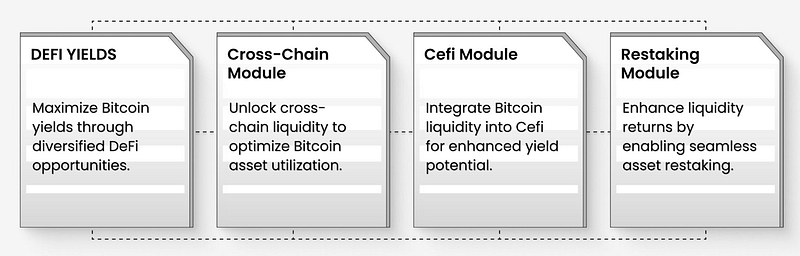

Uniquid Layer unifies existing Restaking ecosystem projects under a powerful and adaptive modular framework, linking various project returns and enhancing liquidity management solutions. The modular framework is divided into four modules: Active Validation Service (AVS) and Restaking Module, Cross-Chain Liquidity Module, DeFi Income Module, and CeFi Income Module. All Restaking project providers are abstractly integrated into this layer for easy selection and scheduling.

AVS & Restaking Module. AVS income is the cornerstone of Restaking. Uniquid Layer maximizes liquidity returns by actively integrating advanced validation systems while maintaining high security standards for underlying assets.

Cross-Chain Module. This module facilitates secure and free liquidity flow between different blockchains, optimizing the utilization of Bitcoin assets, allowing users to explore diverse sources of benefits in multiple blockchain ecosystems.

DeFi Income. This module aims to increase the returns of decentralized and centralized finance, integrating Bitcoin liquidity into various DeFi platforms to maximize the potential for returns through diversified DeFi opportunities.

CeFi Module. This module integrates Bitcoin liquidity into centralized financial systems, providing users with more arbitrage-based income opportunities.

2.4 Restaking as a Service, Maximizing User Returns

By participating in Uniquid Layer's restaking service, users can obtain the best returns for their staked assets. Uniquid Layer aggregates all liquidity income sources into the Restaking service layer, calculating the expected returns of various income sources through dynamic algorithms and analysts to maximize user asset investment returns. In addition, pledging assets to the liquidity layer of Uniquid Layer also earns users Uniquid points rewards.

2.5 LiqBTC, the WBTC of the Restaking Era

By pledging assets in Uniquid Layer, users can not only maximize their investment returns but also receive the liquidity staking certificate LiqBTC. The design goal of LiqBTC is not just a liquidity staking certificate (LST) but to set the standard for full-chain income BTC anchored coins. By integrating with DeFi ecosystems on more than 10 chains, LiqBTC, like WBTC, connects the vast BTC financial ecosystem beyond the Bitcoin mainnet, avoiding centralization risks and having the highest underlying income in the Restaking era.

2.6 Roadmap and Future Plans

Uniquid Layer is expected to complete the construction of the underlying protocol framework in 2024. In the third quarter, it will introduce the Restaking as a Service function and launch an early supporter incentive program. In the fourth quarter, it will integrate the liquidity module and develop the liquidity abstraction layer protocol. The testnet is expected to officially launch in the first quarter of 2025 and deploy validation nodes. The mainnet will be launched in the second to fourth quarters and gradually integrate LiqBTC into various chain DeFi ecosystem protocols, building a full-chain liquidity market.

2.7 Financing Situation

Uniquid Layer has a strong investment lineup and has received financing from well-known domestic and foreign investment funds such as Amber Group, DWF Labs, and ArkStream Capital.

III. Conclusion

The introduction of Babylon's native income has ushered the BTC financial ecosystem into a new era of great navigation. As a trillion-dollar blue ocean market, whoever can bring higher security, higher actual returns, and lower usage barriers to BTC users will stabilize the throne of BTC liquidity finance. In the competition in this race, Uniquid Layer, as a latecomer in liquidity aggregation, is expected to integrate the fragmented BTC liquidity and, like the BTC DeFi ecosystem leader WBTC, provide users with a smoother full-chain liquidity interoperability experience.

References

https://www.odaily.news/post/5150988

https://foresightnews.pro/article/detail/66576

https://blog.bitgo.com/bitgo-to-move-wbtc-to-multi-jurisdictional-custody-to-accelerate-global-expansion-plan-2ea0623fa2c8

https://www.btcstudy.org/2021/12/13/schnorr-applications-blind-signatures/

https://dune.com/21co/wbtc

https://wbtc.network/dashboard/order-book

https://dune.com/sankin/bitcoin-on-ethereum

https://www.diadata.org/blog/post/bitcoin-ecosystem-map/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。