Market Overview

Assets that have performed well since the third quarter include: RUT (Russell 2000 Index), XAUUSD (gold price), SPF (financial stocks), and US bonds. Assets that have performed poorly include: Ethereum, crude oil, and the US dollar. The Nasdaq 100 has remained relatively flat.

For the US stock market, the current market is still in a bull market, with the main trend still upward. However, in the last few months of the year, the trading environment is expected to lack performance themes, and both the upward and downward potential of the market will be limited. The market has continuously revised down Q3 earnings expectations.

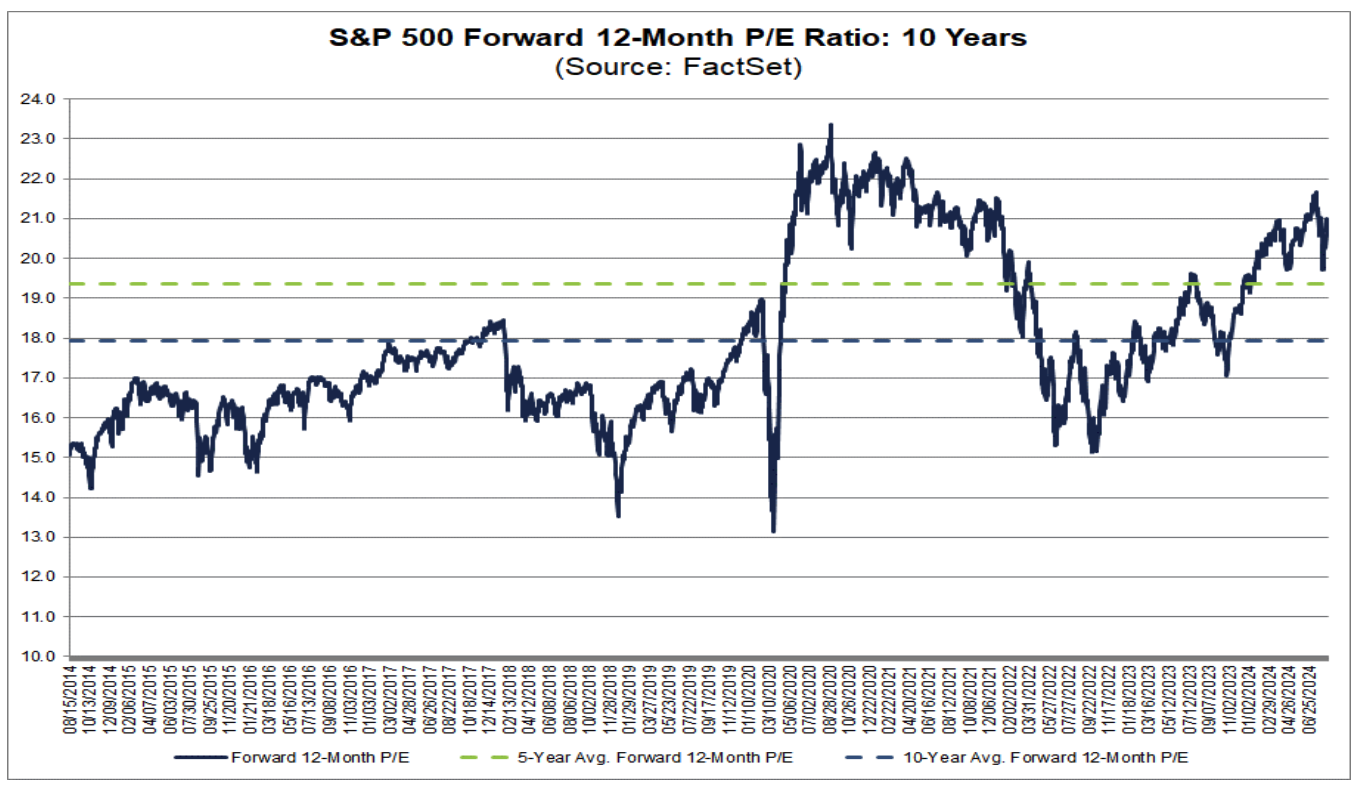

Valuations have recently pulled back, but the rebound has been quick, with a PE ratio of 21 still far above the 5-year average:

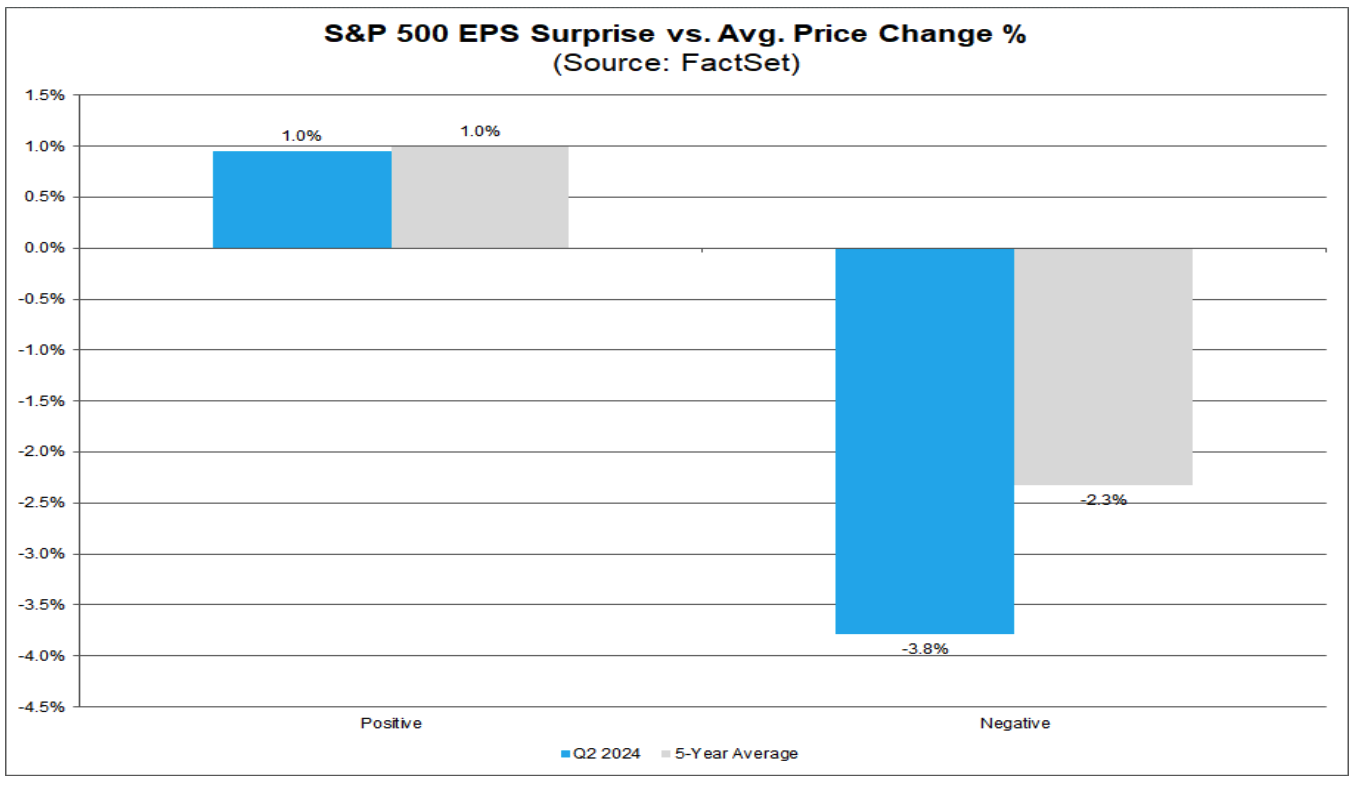

93% of S&P 500 companies have reported actual results, with 79% of companies exceeding EPS expectations and 60% of companies exceeding revenue expectations. The stock price performance of companies that exceeded expectations is basically in line with historical averages, but the performance of companies that fell short of expectations is worse than historical averages:

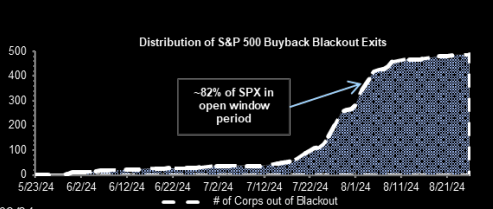

Buybacks are currently the strongest technical support for the US stock market, with corporate buyback activity reaching twice the normal level in the past few weeks, at approximately $5 billion per day ($1 trillion annually). This buying pressure may continue until mid-September before gradually fading.

Large-cap tech stocks have shown some weakening in mid-summer, mainly due to lower earnings expectations and waning market enthusiasm for AI themes. However, the long-term growth potential of these stocks remains, and their prices may not decline.

There was indeed a very bullish period in the market for some time, for example, from October last year to June this year, experiencing some of the best risk-adjusted returns of this generation (NDX Sharpe ratio reached 4). Today, with higher stock market PE ratios, slower economic and financial growth expectations, and higher market expectations for the Fed, it is difficult to expect the same performance in the stock market as in the previous 3 quarters. We also see signs of large funds gradually shifting towards defensive themes (for example, both subjective and passive strategy funds have increased their holdings in the healthcare sector, which provides defensive and non-AI-related growth). It is expected that this trend will not reverse quickly, so it is more prudent to hold a neutral attitude towards the stock market in the coming months.

At Friday's Jackson Hole meeting, Fed Chairman Powell made the clearest statement to date about rate cuts, with a rate cut in September now a certainty. He also expressed his desire not to further cool the labor market and his confidence in the path to 2% inflation. However, he still insists that the pace of policy easing will depend on future data performance.

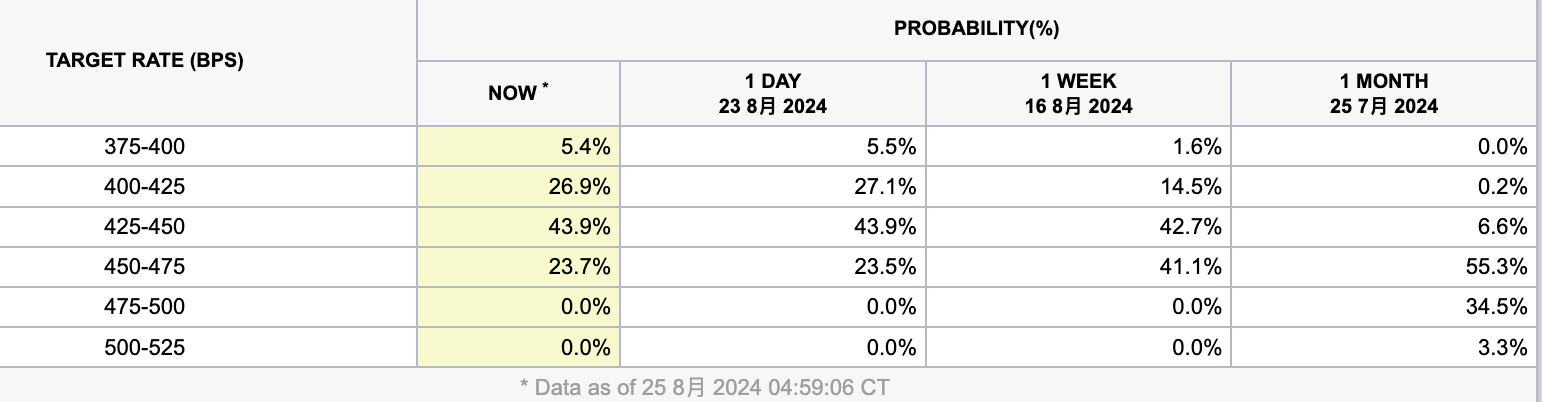

So personally, I don't think Powell's statement this time is more dovish than expected, so it didn't cause much of a stir in the traditional financial markets. The most important thing for everyone is whether there is a chance of a 50bp rate cut this year, which Powell did not hint at. So there has been almost no change in the expectations for rate cuts this year compared to before:

So if future economic data improves, there is even a possibility of a downward adjustment to the current priced-in 100bp rate cut expectation.

However, the crypto market has reacted very strongly, which may be due to a squeeze caused by excessive short positions (for example, the recent rapid increase in open interest but frequent occurrence of negative funding rates for contracts), and the fact that the understanding and dissemination of macro news in the crypto community is not as unified as in traditional markets, meaning that there is a greater damping effect on the transmission of news. Many people may not even know that Powell was going to speak at the JH meeting this week. But whether the current market environment supports a new high for the crypto market is questionable. Generally, in addition to a supportive macro environment and increasing risk appetite, native crypto themes are also necessary. NFTs, DeFi, spot ETFs, and meme frenzy all count. Currently, the only strong theme seems to be the growth of the Tele ecosystem. Whether it has the potential to become the next theme depends on the performance of the latest token projects and the quality of the incremental users they bring.

The sharp rise in the crypto market is also related to the significant downward revision of last year's non-farm payroll numbers in the US this week. However, as we have analyzed in detail in previous videos, this revision is excessive, ignoring the contribution of illegal immigrants to employment, and including these people in the initial count of employed individuals. Therefore, this correction is not significant, and the traditional market's reaction to it has been muted, while the crypto market sees it as a sign of a significant rate cut.

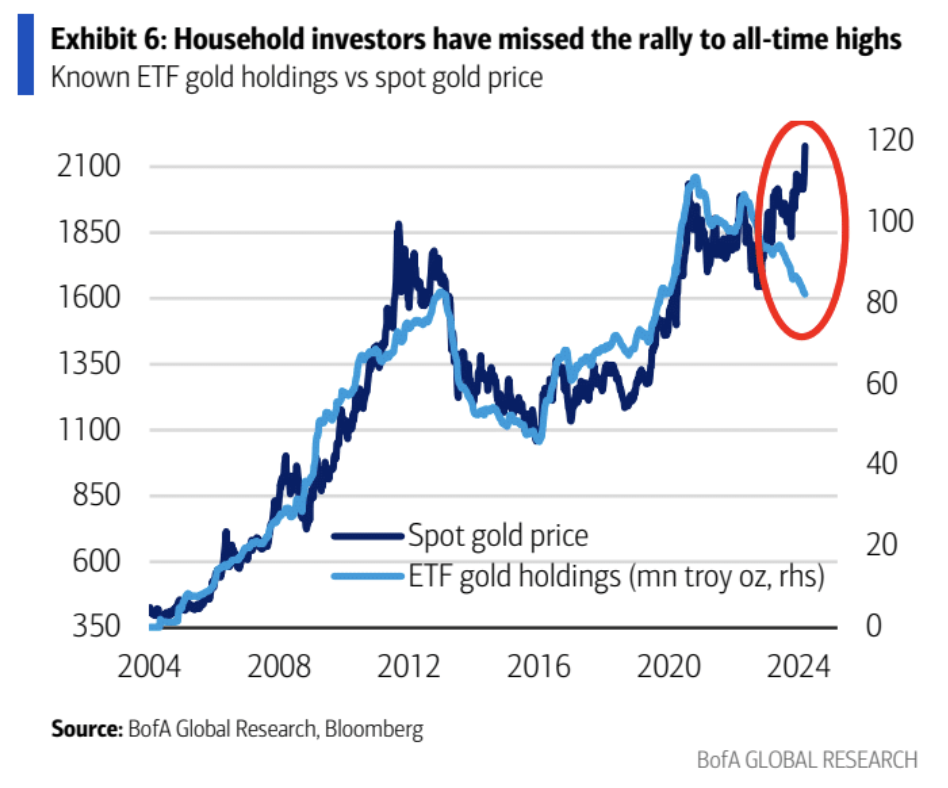

From the experience of the gold market, most of the time, prices are positively correlated with ETF holdings. However, in the past two years, the market structure has changed, and most retail and even institutional investors have missed out on the rise in gold prices, with the main buying power shifting to central banks:

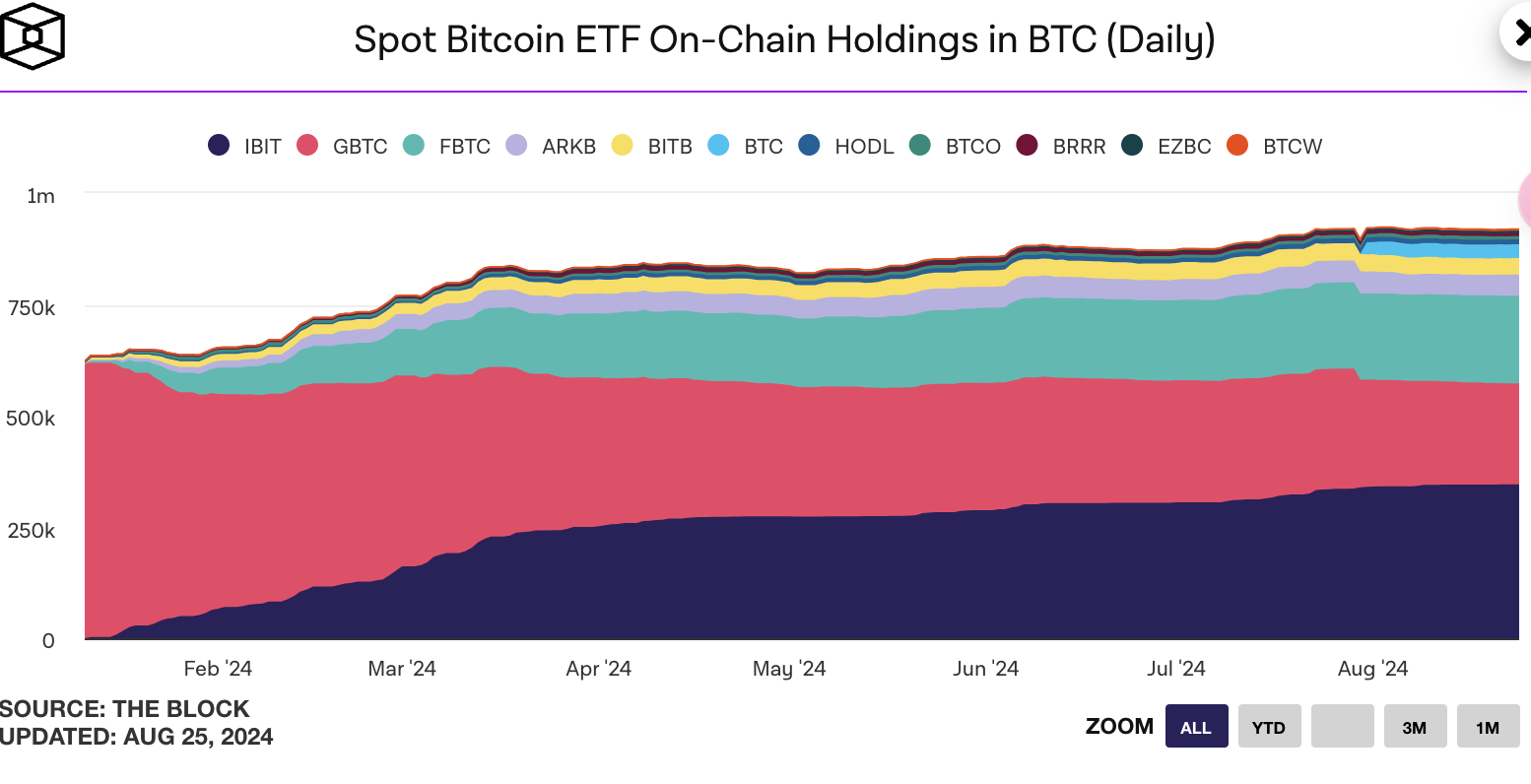

From the chart below, it can be seen that the inflow rate of Bitcoin ETFs has significantly slowed down since April, with a total increase of only 10% in the past 5 months, which matches its peak in March. If risk-free returns decline, it may attract more investors to enter the gold and Bitcoin markets, which is very likely.

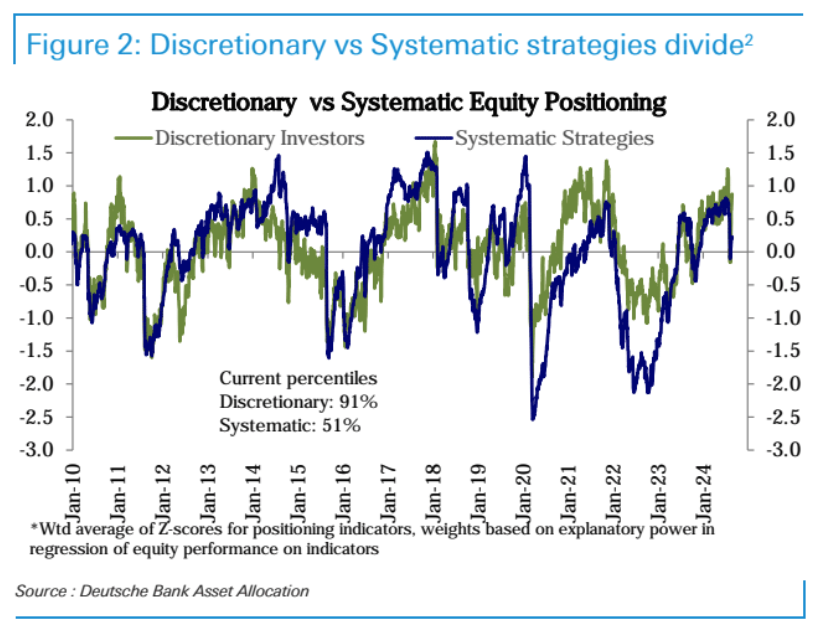

In terms of stock positions, subjective strategy funds performed quite well earlier in the summer, timely reducing positions, and had an opportunity to attack in August. The chart below shows that the green line representing subjective strategy funds has recently increased positions very quickly, with positions returning to the historical 91st percentile. However, systematic strategy funds have responded more slowly and are currently only at the 51st percentile:

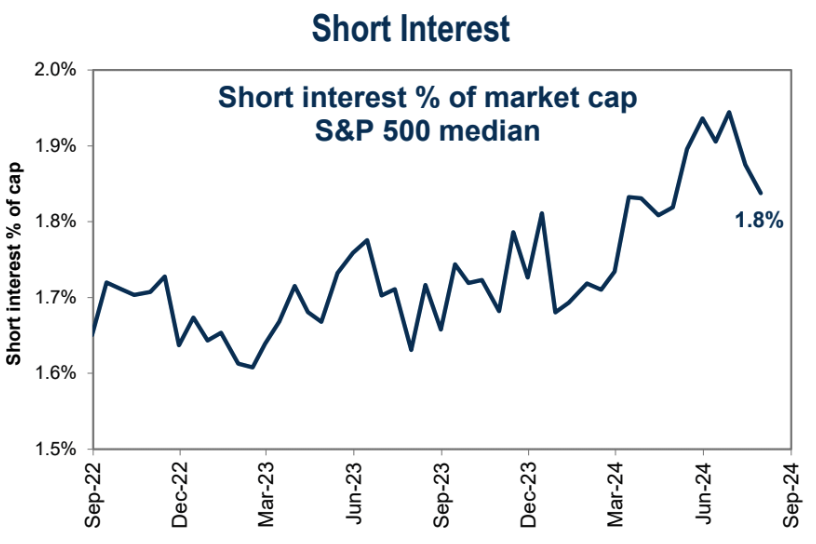

Short positions in the stock market were closed during the decline:

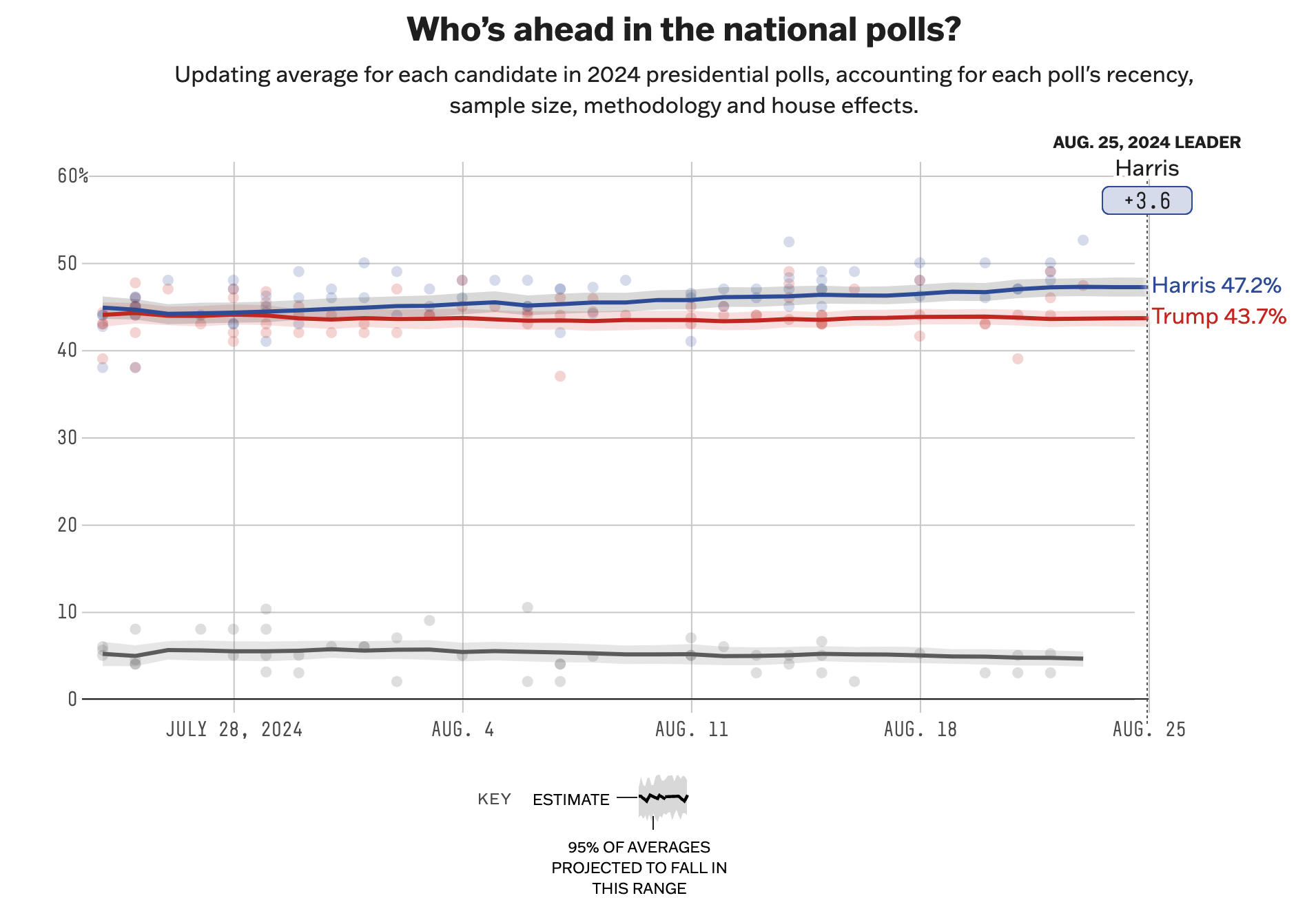

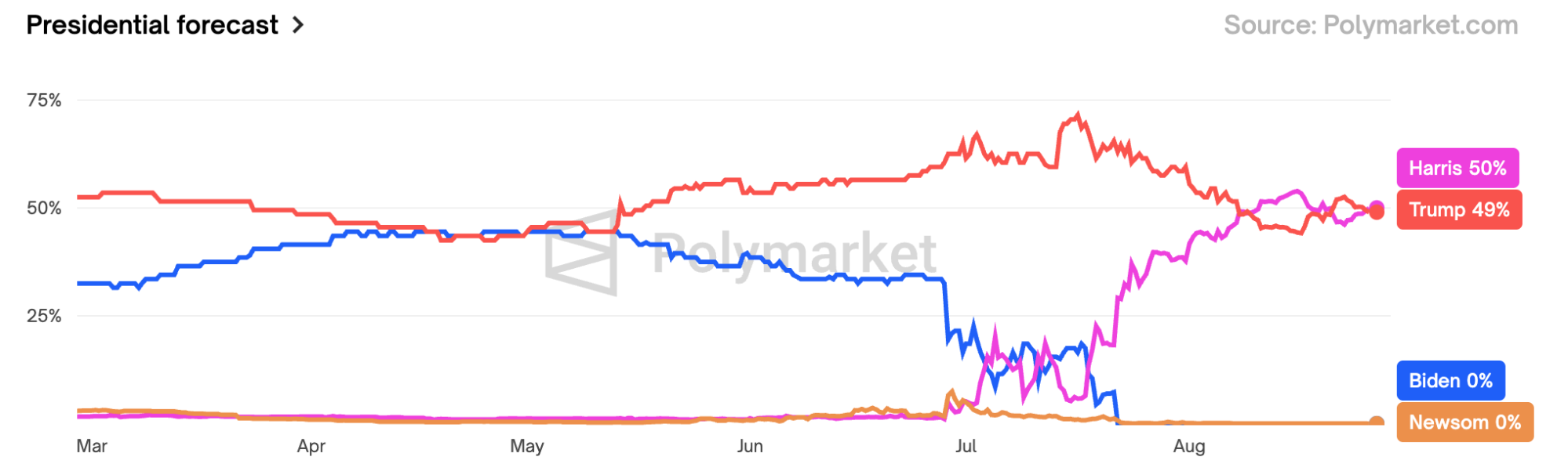

On the political front, Trump's approval rating has stopped falling, and betting support has increased. Trump also received support from Little Kennedy over the weekend, which could reignite trading around Trump, which is generally good for the stock market or the crypto market.

Fund Flow

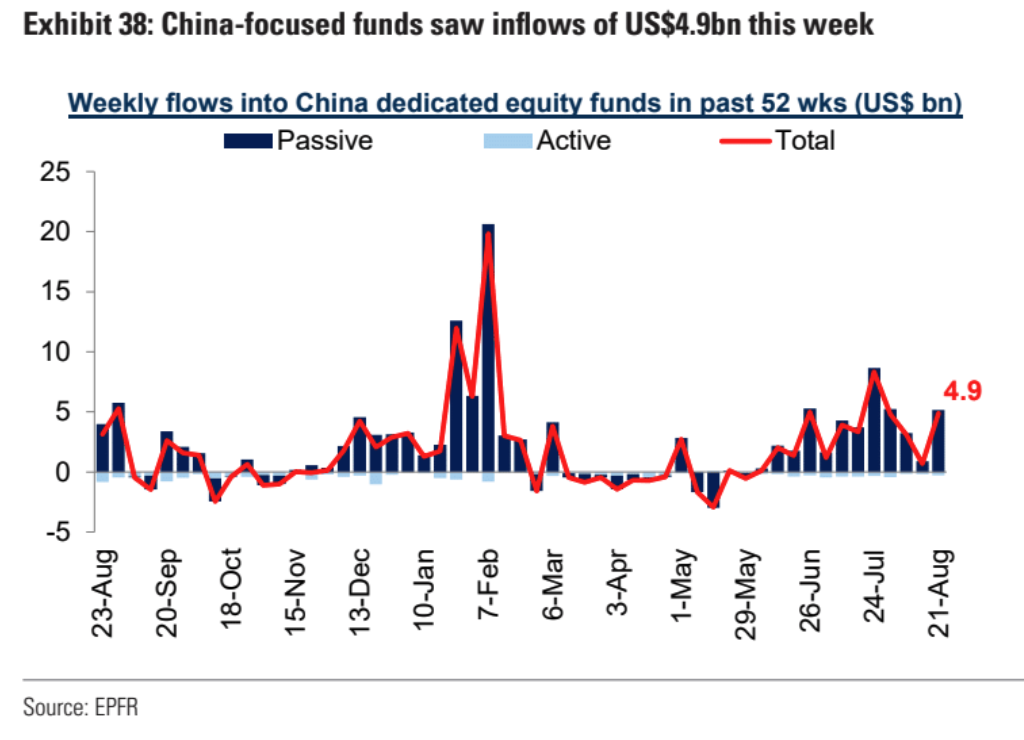

The Chinese stock market has been declining, but funds related to Chinese concepts have been consistently flowing in. This week, there was a net inflow of $4.9 billion, reaching a new high in five weeks and marking the 12th consecutive week of net inflows. Compared to other emerging market countries, China has seen the most inflows. Those who dare to counter-cyclically increase their positions in the current market downturn are either national teams or long-term funds. Bet that as long as the stock market doesn't shut down, it will eventually rise back.

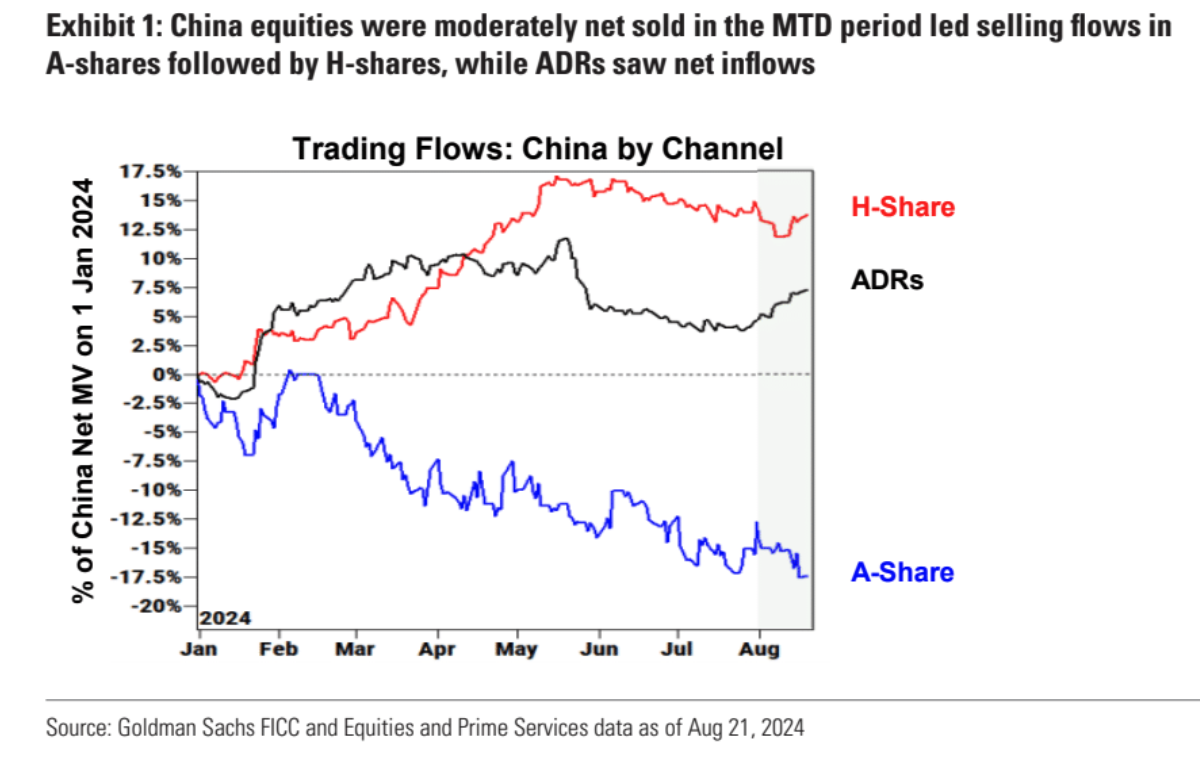

However, structurally, from the perspective of Goldman Sachs clients, after February, they have basically been reducing their holdings of A-shares. The recent increase in holdings has mainly been in H-shares and Chinese concept stocks:

Despite the global stock market rebound and fund inflows, the low-risk preference for money market funds has seen four consecutive weeks of inflows, with the total scale rising to $6.24 trillion, reaching a historical high, indicating that market liquidity is still very abundant:

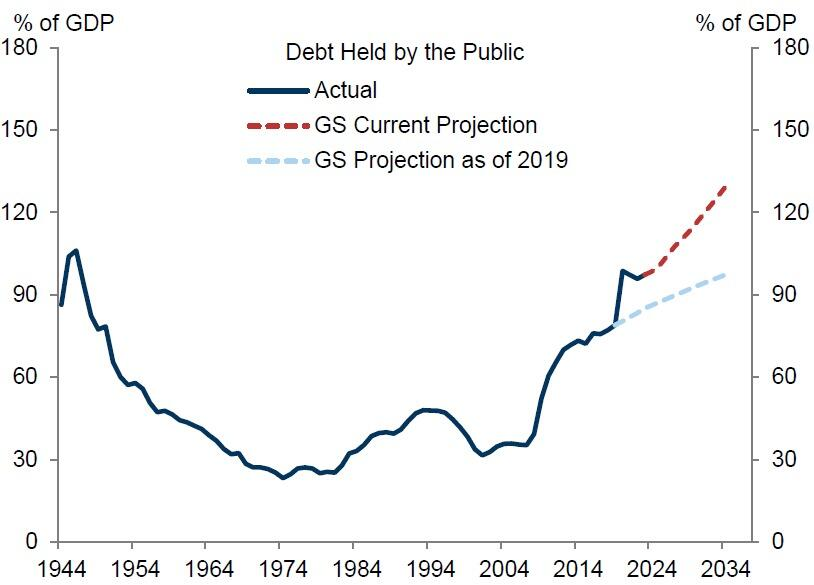

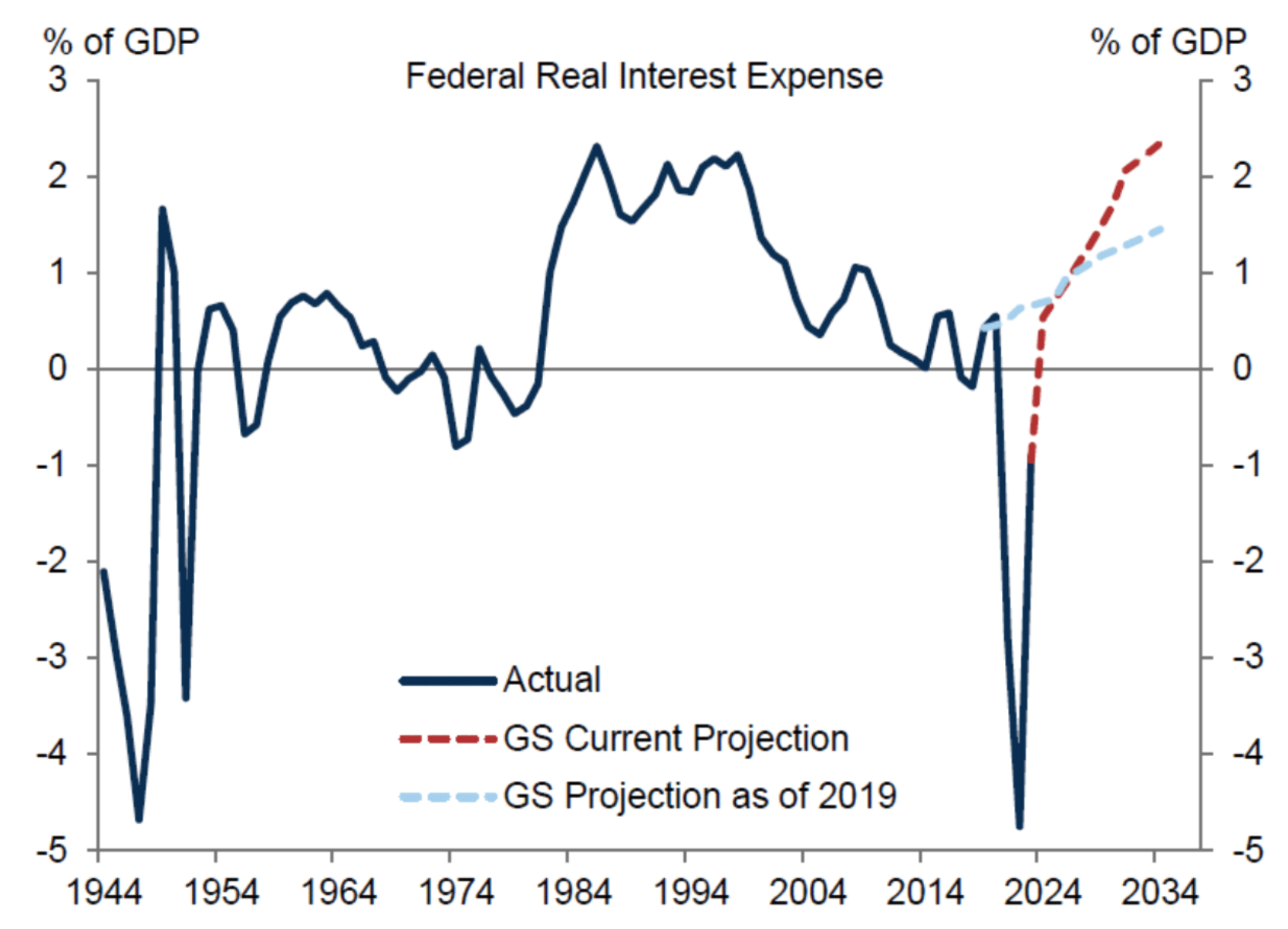

Continued attention to the fiscal situation in the United States, which is basically a theme for speculation every year. As shown in the chart below, the US government's debt could reach 130% of GDP within ten years, and interest payments alone will reach 2.4% of GDP, while maintaining the military spending that sustains US global hegemony is only 3.5%, which is clearly unsustainable.

Weakening US Dollar

Over the past month, the US Dollar Index (DXY) has fallen by 3.5%, the fastest decline since the end of 2022, which is related to the market's increased expectations of a Fed rate cut.

Looking back to the beginning of 2022, the Fed adopted an aggressive rate hike policy to combat inflation, which led to a strengthening of the US dollar. However, by October 2022, the market began to anticipate the end of the Fed's rate hike cycle, and even the possibility of a rate cut. This expectation has led to a decrease in demand for the US dollar, causing it to weaken.

The current market situation seems to be a replay of that year, except that the speculation at that time was too advanced, and today the rate cut is about to land. If the US dollar falls too much, the release of long-term arbitrage trades may re-emerge, thereby suppressing the stock market.

Two Major Themes Next Week: Inflation and Nvidia

Key price data includes the US PCE (Personal Consumption Expenditures) inflation rate, the preliminary CPI (Consumer Price Index) for August in Europe, and the CPI in Tokyo. Major economies will also release consumer confidence indices and economic activity indicators. In terms of corporate earnings, the focus will be on Nvidia's earnings after the US stock market closes on Wednesday.

The PCE released on Friday is the last PCE price data before the Fed's decision on September 18. Economists expect the month-on-month growth in core PCE inflation to remain at +0.2%, with personal income and spending both increasing by +0.2% and +0.3% respectively, in line with June, indicating that the market expects inflation to continue to grow moderately without further decline, leaving room for possible downside surprises.

Preview of Nvidia's Earnings Report - Clouds Disperse, Expected to Inject Confidence into the Market

Nvidia's performance not only affects AI and tech stocks, but even serves as a barometer for the sentiment of the entire financial market. On the Nvidia side, demand is not currently a problem, and the most critical issue is the impact of the delay in the Blackwell architecture. After reading several institutional analysis reports, it is found that the mainstream view on Wall Street believes that this impact is not significant. Analysts generally maintain optimistic expectations for this earnings report, and Nvidia's actual results have exceeded market expectations in the past four quarters.

The most critical market expectations indicators are:

- Revenue of $28.6 billion, year-on-year +110%, quarter-on-quarter +10%

- EPS of $0.63, year-on-year +133.3%, quarter-on-quarter +5%

- Data center revenue of $24.5 billion, year-on-year +137%, quarter-on-quarter +8%

- Profit margin of 75.5%, flat compared to Q1

The most concerning questions are:

1. Has the Blackwell architecture been delayed?

UBS analysis believes that the first batch of Nvidia's Blackwell chips may be delayed by about 4-6 weeks for shipment, with the delay expected to be until the end of January 2025. Many customers have switched to purchasing the H200, which has extremely short delivery times. TSMC has started production of the Blackwell chips, but due to the complex CoWoS-L packaging technology used by B100 and B200, there are yield challenges, and initial production is lower than planned, while H100 and H200 use CoWoS-S technology.

However, this new product was not included in recent performance forecasts:

Since Blackwell is not expected to enter sales expectations until Q4 2024 (Q1 2025), and Nvidia only provides single-quarter performance guidance, the delay is not expected to have a significant impact on the performance of Q2 and Q3 2024. At the recent SIGGRAPH conference, Nvidia did not mention the impact of the delay of the Blackwell GPU, indicating that the impact of the delay may not be significant.

2. Has the demand for existing products increased?

Secondly, the decline of B100/B200 can be compensated for by the growth of H200/H20 in the second half of 2024.

According to HSBC's forecast, the production of B100/B200 substrates (UBB) has been revised by 44%, although deliveries may be partially delayed until the first half of 2025, resulting in reduced shipments in the second half of 2024. However, H200 UBB orders have significantly increased, with an expected growth of 57% from the third quarter of 2024 to the first quarter of 2025.

Based on this forecast, the revenue of H200 in the second half of 2024 is expected to be $23.5 billion, which should be enough to offset the potential $19.5 billion loss in revenue from B100 and GB200, equivalent to 500,000 B100 GPUs or $15 billion in implied revenue loss, as well as an additional $4.5 billion in lost NVL 36 revenue. We also see potential upside from the strong momentum of the H20 GPU, mainly targeting the Chinese market, with potential shipments of 700,000 units or implied revenue of $6.3 billion in the second half of 2024.

In addition, the step increase in TSMC's CoWoS capacity could also support revenue growth from the supply side.

On the client side, the ultra-large-scale tech companies in the United States account for more than 50% of Nvidia's data center revenue, and their recent comments indicate that the demand outlook for Nvidia will continue to increase. Goldman Sachs' forecasting model shows that the year-on-year growth in global cloud computing capital expenditure will reach 60% and 12% in 2024 and 2025, respectively, higher than previous forecasts (48% and 9%, respectively). However, it can also be seen that this year is a year of significant growth, and it is not possible to maintain the same level of growth next year:

3. Degree of slowing momentum

In addition to the fact that the expenditure growth of large enterprises will slow down next year, the growth rate of Nvidia's performance will also further slow down.

The market consensus expects revenue for the 2025 fiscal year to be $105.6 billion, compared to $60.9 billion last year, with the growth rate slowing from 126% last year to 73%. The official guidance for Q2 revenue is $28 billion, and the market is expected to be more optimistic, but the growth rate for this quarter is expected to further slow down from the 2x% range to the 1x% range:

It should be noted that there are more and more participants in the AI market: AMD's MI300X chip is reportedly superior to Nvidia in some aspects. Cerebras has launched a chip with a whole wafer architecture, significantly reducing interconnection and network costs as well as power consumption. In addition, major tech companies including Google, Amazon, and Microsoft are developing their own AI chips. These could reduce the dependence on Nvidia products in the future, but this concern currently does not have enough cases to support its fermentation, and Wall Street still expects Nvidia to maintain its dominant position in data center chips:

4. Focus on China

In the upcoming earnings outlook, the demand trend for Nvidia in China will also be a focus, especially in the case of increased demand for H20. Key points to focus on in the earnings conference call include:

- Changes in customer interest since the launch of H20.

- The company's competitiveness in the face of domestic competitors (mainly Huawei).

- The timing of the launch of B20 (Blackwell Lite) in 2025.

5. Changes in product line

Due to unprecedented production complexity in TSMC chip packaging (CoWoS-L vs. traditional CoWoS-S) and ARM-based Grace CPU (compared to traditional x86 CPUs), reducing the number of high-bandwidth memory stacks to reduce packaging complexity (allowing the use of traditional CoWoS-S instead of CoWoS-L) is possible. For example, the new Nvidia products B200A and GB200A Ultra may use the old CoWoS-S packaging, and the changes in technical specifications and cooling methods for new products make it difficult for NVDA to maintain its previous high pricing power in the market:

Technical Specifications: The new A-series GPUs have slightly lower performance compared to the standard B100 and B200 GPUs. The lower performance means that the market's price expectations for these new products will also decrease. Therefore, the average selling price (ASP) of the B200A is expected to be between $25,000 and $30,000, while the ASP of the previous B100 and B200 GPUs was between $35,000 and $40,000. This decrease in specifications and performance directly leads to a decrease in pricing power.

Cooling Method: The upcoming GB200A Ultra NVL36 rack solution is expected to use air cooling instead of a complex liquid cooling system. This change, compared to the previous GB200 NVL36 and NVL72 racks, may result in lower overall revenue.

This may have an uncertain impact on performance, as it could be positive for revenue on one hand, but on the other hand, it may reduce NVDA's pricing power as it essentially competes with its own product line.

6. Stock Price Volatility

Due to the delay of Blackwell, challenges in the AI narrative, and overall market correction, Nvidia's stock price initially dropped by 30% from its peak, but investors bought aggressively at the low, leading to a 30% rebound. Currently, its market value of $3.18 trillion ranks second globally, with only a 7% difference from its all-time high.

NVDA's current valuation level is basically at the median level of the past three years, neither high nor low.

In comparison to its competitors, NVDA's price-earnings ratio is relatively high at 47.6 times, but due to the continued high growth expectations, its PEG ratio, which is the price-earnings ratio divided by the growth rate, is still among the lowest in the industry:

7. Bull and Bear Scenarios

The AI narrative has faced some challenges in the past two months, mainly from the perspective of the potential contribution to enterprise revenue. If based on this pessimistic assumption, that is, the AI investment frenzy is a one-time event, then Nvidia's data center business may quickly return to the trend level before 2023.

For example, assuming that data center revenue declines to $69 billion in 2025, which is 38% lower than the current level and 55% lower than the baseline expectation, as a "most pessimistic" scenario. Then, the most optimistic assumption is for data center revenue to grow by 100% in 2025.

Goldman Sachs' stock price change forecast in this bull and bear scenario is as follows:

Based on the current stock price of $124.58, the baseline expected stock price is $135. Bull #1 and Bull #2 would increase by 41% and 89% respectively, while Bear #1 and Bear #2 would decrease by 61% and 26% respectively. This means that at the current price level, the potential return on NVDA is still smaller than the risk.

8. Summary: Trend Slowing, but Maintaining Optimism

NVDA's valuation is currently in the neutral range, and its performance is still satisfactory. However, the peak of market FOMO has passed, and the growth rate has entered a downward channel. It is clear that NVDA's price is unlikely to replicate the 10-100% increases seen in previous years.

The biggest risk is the potential falsification of the AI narrative, but as long as this issue does not continue to ferment, the bearish news about NVDA's performance is more of an emotional fluctuation. Other bearish factors are more related to macro-level uncertainties such as interest rates and geopolitical uncertainties. For example, the U.S. Department of Commerce will conduct an annual review of semiconductor export restrictions in October, which may prohibit the export of the "special edition" H20 chips that have already weakened performance, and may even affect the difficulty of obtaining the "crippled version" B20.

Market uncertainties may bring some stock price volatility, and there is a possibility of contraction in valuation multiples. However, at this stage, it is still possible to maintain optimism because the problems are mainly concentrated in the supply chain, rather than in demand. These supply chain issues can be resolved and will not fundamentally undermine Nvidia's long-term growth momentum. The company remains attractive in the coming years, as evidenced by a 30% rebound in just a few days, indicating the market's enthusiasm for bottom fishing.

In particular, the outlook for AI demand may still be in its early stages, for example, Meta's next-generation Llama 4 large language models are expected to have 10 times the computational volume of Llama 3.1, indicating that the long-term demand outlook for AI computing chips may exceed our expectations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。