The sudden emergence of Story is a true benchmark or just "capital accumulation"?

Author: Yangz, Techub News

On August 21, L1 Story, focusing on intellectual property (IP), announced the completion of an $80 million Series B financing, led by a16z, with participating investors including Polychain Capital. Individual investors include Scott Trowbridge, Senior Vice President of Stability AI and board member, K11 founder and billionaire Adrian Cheng, and digital art collector Cozomo de' Medici. In addition to the $29.3 million seed round financing led by a16z last year and the $25 million Series A financing, Story's total financing reached $140 million.

Such a huge amount of financing has shocked many practitioners. At the same time, there have been many doubts within the industry. As user X @wsjack_eth pointed out, "Is there really such an exaggerated narrative space for an ERC-6551 protocol?" In the current extremely difficult primary market, is Story's sudden emergence a true benchmark or just "capital accumulation"?

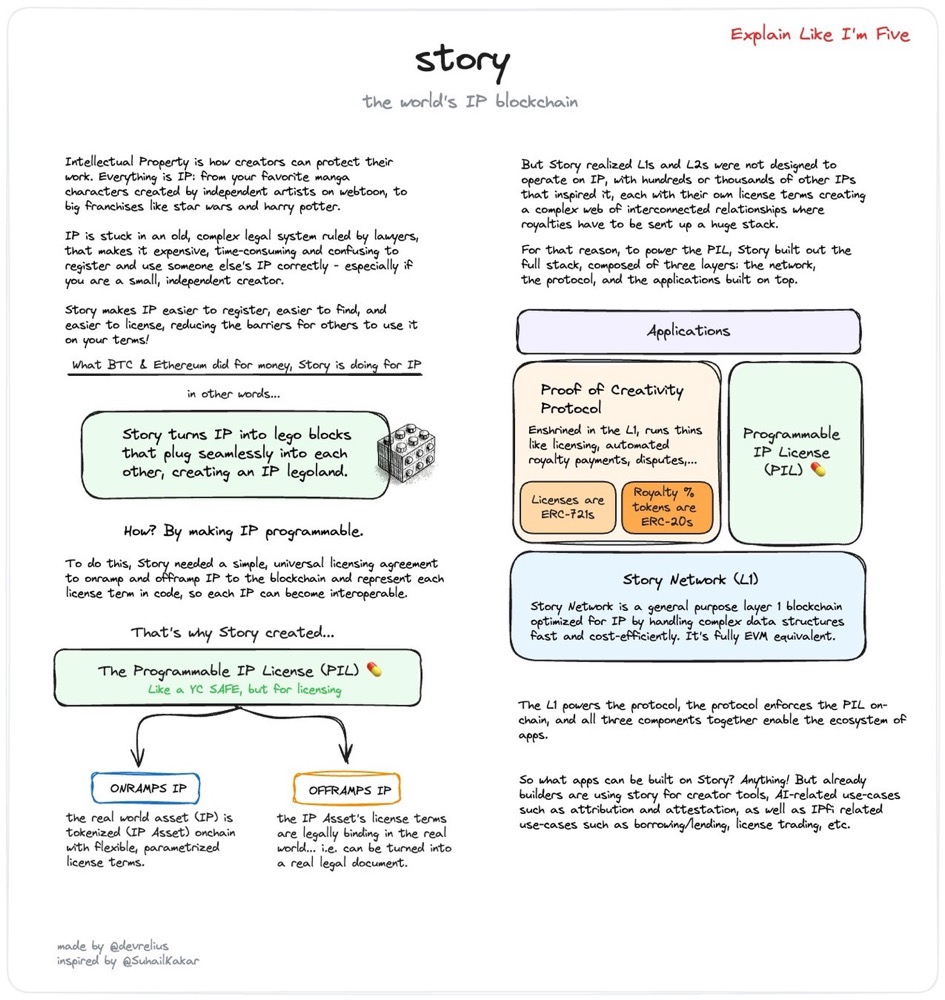

Story's Technology Stack

With doubts in mind, the author consulted Story's technical documents. In summary, Story plans to improve the situation where IP in the Web2 world relies on traditional legal "time-consuming and costly" processes through the Story Network (L1), Proof-of-Creativity Protocol (smart contracts), and Programmable IP Licensing (PIL) to achieve its ultimate goal of "IP Lego."

Specifically, the Story Network is an EVM-compatible L1 designed to process complex data structures such as IP quickly and cost-effectively. Its specific logic uses precompiled primitives to traverse complex data structures in seconds at marginal cost, and then, based on the mature CometBFT protocol stack, ensures fast termination and low-cost transactions.

The Proof-of-Creativity Protocol consists of various smart contracts, including "modules" for handling IP licensing, royalties, disputes, and more. The Proof-of-Creativity Protocol is natively deployed on the Story Network, allowing creators to register their IP as "IP Assets." Each IPA consists of on-chain NFTs and associated IP accounts. IP accounts are based on ERC-6551 (token-bound accounts) implementation.

In addition, Programmable IP Licensing (PIL) aims to establish a mapping between on-chain contracts and real legal terms, allowing creators to migrate tokenized IP to off-chain legal systems and write specific terms, such as how creators can mix, monetize, and create derivative works with their IP.

As many industry professionals have pointed out, Story's technology stack is not complex and does not propose any new concepts. So, what is the basis for Story to raise such a huge amount of capital? Through an investment article written by a16z partner Chris Dixon, we may discover some potential factors.

Investing in People

First is the background of Story's team. According to Chris Dixon, the Story founding team "has deep expertise in both technology and creativity." The a16z team was impressed by CEO and co-founder Seung Yoon Lee's "foresight and world-class tactical execution" when they first met him three years ago. According to information from the Berggruen Institute, Seung Yoon Lee graduated from the University of Oxford and was elected as the first Asian chairman of the Oxford University Alliance. In addition, his creation of the mobile novel app Radish Fiction received support from SoftBank, UTA, and Bertelsmann, and was acquired by Korean technology giant Kakao for $440 million in 2021. Lee also served as Kakao's global chief strategy officer, responsible for global investment and M&A activities. Furthermore, Lee is also a venture partner at Hashed, Korea's largest blockchain fund, and a researcher at the Asia 21 Young Leaders and Trilateral Commission. In 2016, Lee was selected as the inaugural member of Forbes Asia Under 30 and later named an outstanding alumni.

In addition, according to @jason_chen998, Seung Yoon Lee has also worked in the Korean National Assembly and the U.S. House of Representatives, and has worked for two newspapers, "holding the cards of government + media + capital at the same time."

As for Jason Zhao, another co-founder currently leading Story's technical development, although his resume is not as impressive as Seung Yoon Lee's, it is still remarkable. Jason Zhao graduated from Stanford University with a major in computer science and later worked at DeepMind.

The saying "investing in people" is probably just that. Of course, in addition to the excellent background of the founding team, a16z's choice to invest in Story, its own investment philosophy is also worth considering.

Story Values Ownership, as Does a16z

As a leader in Web3 narratives, a16z has published many profound insights about Web3. From Chris Dixon's description of Web3's "readable, writable, and ownable" characteristics, it is clear that he highly values the concept of ownership. Chris Dixon pointed out in the investment article, "For decades, the internet has reached an implicit economic agreement between creators and platforms, where creators provide supply and platforms provide demand," however, "the development of generative AI is likely to break this agreement," greatly harming the interests of creators. Story, aimed at protecting creator ownership, may have struck a chord with Chris Dixon. Just as Jason Zhao explained when outlining why Story was built as L1, "the next generation of blockchain infrastructure needs to be 'purpose-built,'" a16z values Story's philosophy, not just its technology.

Other Possible Factors

In addition to factors related to the technology stack, founding team, and investment philosophy, other possibilities have been mentioned by investors. @akiaeki pointed out that the Story team probably has strong resources in the Korean entertainment industry. Considering the global influence of "Hallyu" (Korean Wave) (manually dogeza, Hallyu is the most awesome), if Story can bring various KPOP IPs into the cryptocurrency industry, its influence is indeed considerable.

In addition, as @jason_chen998 once envisioned when Story completed its Series A financing, the historically enthusiastic Korean cryptocurrency community may rise to new heights after Do Kwon "enters."

The Power of IP

As a common phenomenon in the cryptocurrency industry, it is impossible to verify whether Story's $140 million financing involves "water injection." However, considering the vast IP industry, a valuation of $22.5 billion for Story might be quite normal, after all, "one Iron Man can save the entire Marvel." Data compiled by Wiki&Mili shows that among the 50 most profitable IPs globally in 2023, the "Pokemon" IP brought in revenue of up to $88 billion for the Pokemon Company and Nintendo.

However, in an interview with Fortune, Jason Zhao stated that Story is unlikely to attract IP giants like Disney. The platform is established to attract "secondary IP" creators. Zhao stated, "This generation of creators using AI tools is like previous internet celebrities and is not valued by traditional brands." "Similar to the situation with YouTube, YouTube does not rely on big directors like Spielberg, but on YouTubers who upload videos with their phones. 15 years later, YouTube became 'MrBeast'."

Whether Story can become the "YouTube" in Jason's words remains to be seen. It is worth noting that after the financing news was announced, the floor price of the NFTs released by Story to commemorate ETHDenver 2024 skyrocketed several times. In an interview with The Block, Jason Zhao introduced that the Story mainnet is expected to be launched later this year. When asked if the token will be launched simultaneously with the mainnet, Jason Zhao declined to comment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。