When the competition within the BTC ecosystem becomes intense, projects that seek liquidity and returns from outside are more worthy of attention.

Cryptocurrency investment is an art that closely follows the flow of funds, and alpha clues are often hidden in the financing dynamics of the primary market.

According to a research report, the most concentrated financing projects in the first quarter of this year were within the BTC ecosystem. For example, the Bitcoin collateral protocol Babylon secured a $70 million financing, reflecting the optimism of VCs towards this market hotspot.

However, within the BTC ecosystem, the scalability and capital efficiency of Bitcoin need to be improved. For example, BTC's share in DeFi has always been very low, especially considering its huge market value.

But if you change your perspective and consider how other ecosystems can benefit from the hot BTC ecosystem and how to make the value of BTC overflow, the situation will be quite different.

Capital is always fluid. In the current BTC ecosystem, BTC indeed attracts liquidity inflows, and assets seem to flow out very little.

There are still a large number of active users in the ecosystems of other chains. Is there a way to extend the asset returns and capital efficiency of BTC to other ecosystems? In addition, everyone has a long-term bullish expectation for BTC, and miners are also holding coins for a rise.

However, there is always an opportunity cost for holding funds, and everyone is eager for more profitable destinations.

So, when the competition within the BTC ecosystem becomes intense, those projects that "seek" liquidity and returns from outside are more worthy of attention.

The recently launched FBTC is such a project. It allows your assets to participate in various Bitcoin revenue sources in the DeFi space, regardless of which chain they are on, through 1:1 anchoring of FBTC to BTC.

This has also given rise to a new concept - Ominichain BTC.

With the continuous growth of Bitcoin value and the addition of various innovative Bitcoin revenue sources, this new concept contains more opportunities.

At the same time, the project is jointly created by top infrastructure and asset management institutions in the industry such as Mantle and Antalpha Prime, and its financial strength and resource linkage capabilities should not be underestimated.

Is a product like FBTC, which represents a full-chain Bitcoin asset, competitive in the market? What potential returns are worth our attention?

wBTC, the largest solution but not the best solution

Why do we need to pay attention to synthetic assets like FBTC? First, let's take a look at the situation of BTC assets outside the Bitcoin ecosystem.

Starting from the core logic of "assets need to flow out," you will find that the most representative example of BTC flowing out is wBTC (Wrapped BTC), a 1:1 anchored ERC-20 token on the Ethereum blockchain.

However, recently, wBTC has been at the center of attention and has experienced a crisis of trust - due to a recent announcement by BitGO, the entity behind wBTC, about relinquishing control of wBTC, which has sparked discussions in the market about the security of future wBTC control.

Beyond this turmoil, in fact, wBTC's performance in the Ethereum ecosystem, which has a rich variety of assets and mature DeFi use cases, is also unsatisfactory.

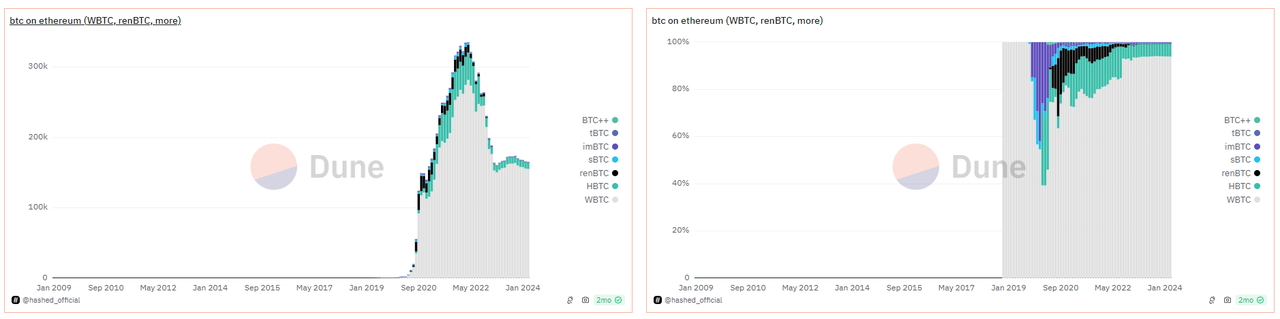

Public data shows that on Ethereum, wBTC is far ahead in terms of the absolute amount and market share of assets compared to similar synthetic BTC assets.

However, this does not mean that in terms of experience, mechanism, and returns, wBTC is also far ahead.

First, wBTC has poor on-chain liquidity, and the trading volume and depth on centralized exchanges are relatively low. Secondly, beyond the change of ownership, what everyone cares most about is actually the issue of wBTC's low asset yield, such as the inability to support Bitcoin revenue scenarios in the Babylon ecosystem and CeDeFi products.

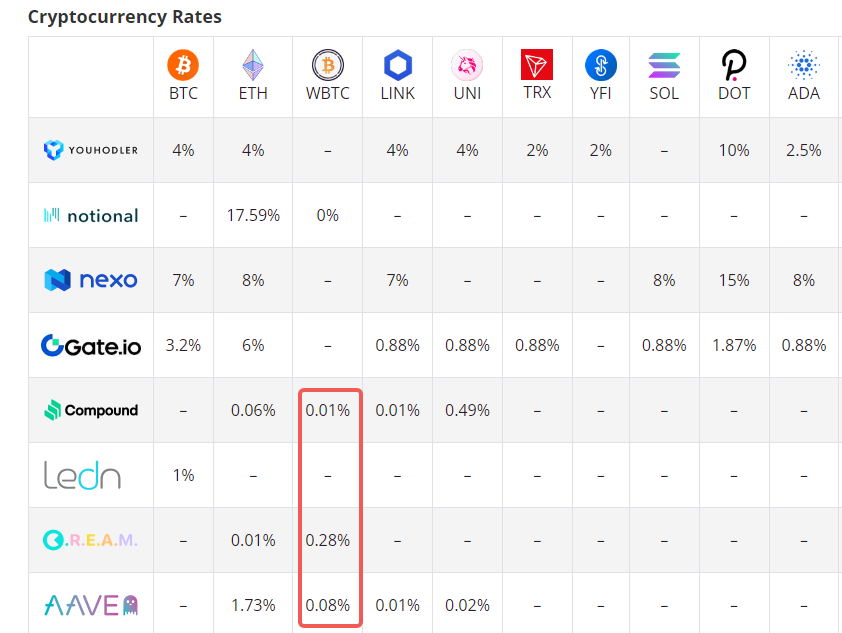

As shown in the figure below, wBTC lags significantly behind in terms of returns on various types of crypto assets.

For example, on Compound and AAVE, wBTC only has a return of 0.01% - 0.08%.

Obviously, for synthetic BTC assets, wBTC is currently the largest solution, but not the best solution.

Whether for Ethereum or other ecosystems, the use of funds never sleeps. The market always needs one challenge after another to wBTC's better solution, and this better solution needs to be reflected in:

Better asset returns, providing more opportunities for income;

Better capital efficiency and liquidity, with less friction when synthetic BTC flows, ideally establishing connections with more chains;

More decentralization, ensuring greater security when minting synthetic BTC.

In addition, the total locked value (TVL) in the BTC-related ecosystem accounts for only 4% of the BTC token market size, much lower than the 75% TVL in the ETH ecosystem.

More ERC20 synthetic BTC assets face greater opportunities.

This is also the basic logic behind the existence of the FBTC product.

FBTC, the pioneer of full-chain BTC synthetic assets

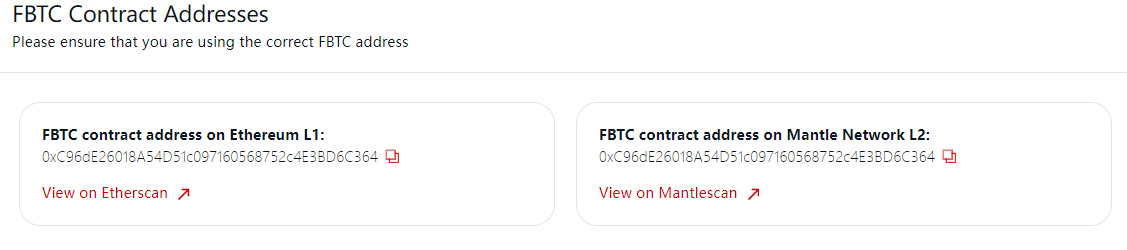

If we were to define FBTC, it is a new type of synthetic asset that is 1:1 anchored to BTC; more importantly, it supports full-chain BTC circulation (Ominichain).

Currently, FBTC will initially run on the ETH and BNB chains, and will subsequently expand to more networks.

So, what does it mean to be 1:1 anchored to BTC?

In simple terms, if you deposit BTC into a fixed address, FBTC will be generated at a 1:1 ratio on your preferred chain (e.g., in ERC20 format). You can then use FBTC to seek returns in more DeFi scenarios.

In summary, the key advantages of FBTC are:

Multi-party custody: FBTC will use multiple MPC (multi-party computation) custody providers. Initially, FBTC will choose Cobo because it is the first and only provider to support Babylon staking. The custody of FBTC is jointly signed by a security committee, including AntAlpha, Mantle, and custody providers.

Joint guarantee of technology and organization: The minting, burning, and cross-chain bridge of FBTC are managed by a TSS (threshold signature scheme) network operated by the FBTC security committee and security companies (the first to join is Phalcon).

Transparent reserves: The reserve proof of FBTC can be queried in real-time and monitored and verified by external security companies.

Locked FBTC can release underlying BTC as collateral. With this feature, lending can be based on BTC liquidity rather than on-chain liquidity of FBTC.

Trusted by the audience: Built by well-known parties in the blockchain ecosystem and Bitcoin financial institutions, it is trusted by a large number of miners and builders.

Governance tokens as incentives.

However, if we delve deeper, we can take a closer look at the specific product design of FBTC and quickly understand its operational mechanism.

For most ordinary crypto players, you do not need to understand complex technical details. You only need to ask yourself three questions to understand the essence of FBTC:

Where to deposit BTC? Where does BTC go? Who guarantees the deposit and withdrawal process?

Corresponding to these three questions, the design of FBTC is - BTC chain custody address + target chain smart contract + off-chain module.

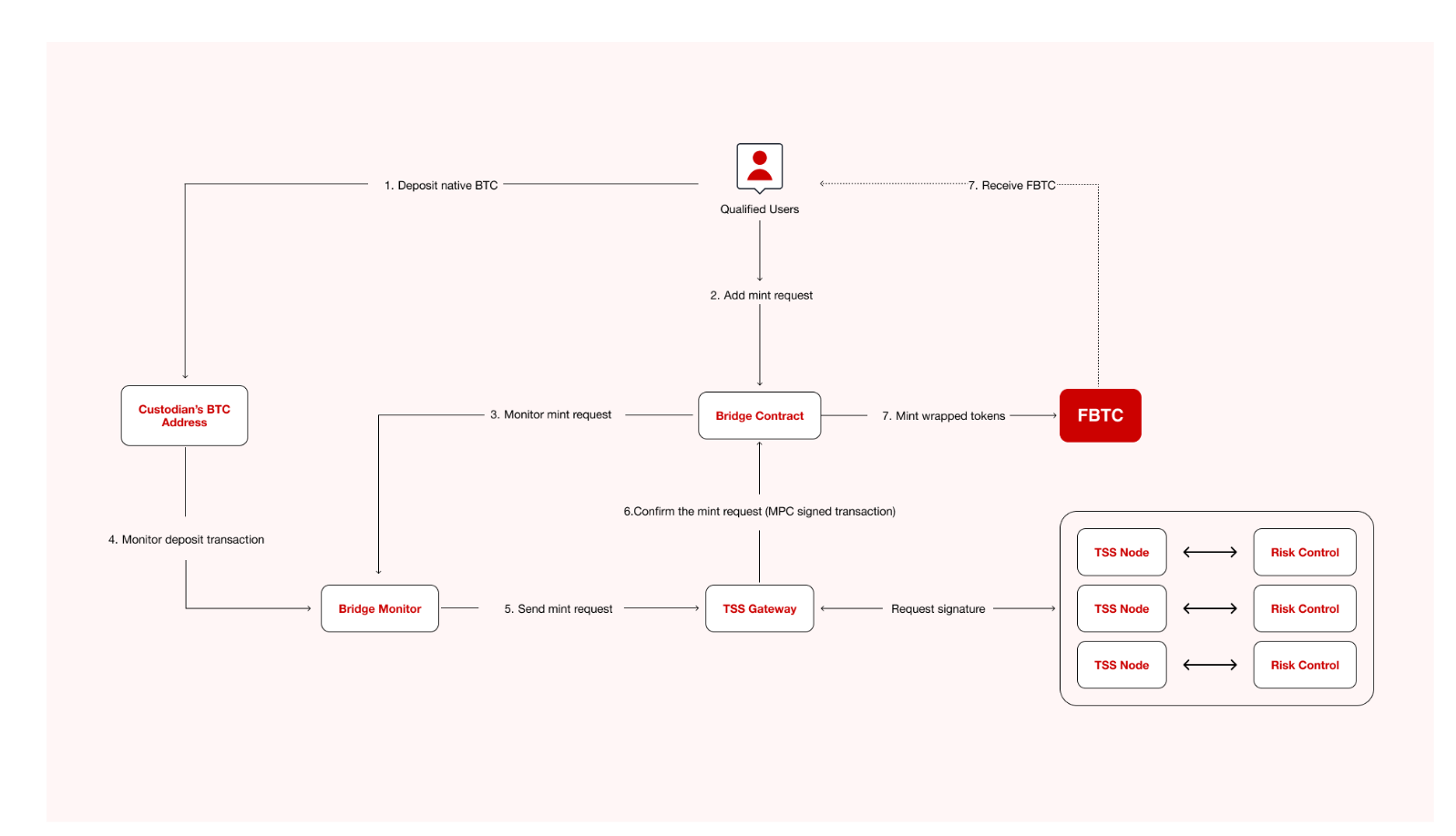

To use FBTC, the system will first generate a Bitcoin network deposit address for each eligible user, and these addresses will be controlled by MPC multi-signature nodes (the specific security design of the nodes will be discussed below).

After eligible users deposit Bitcoin into their respective addresses, FBTC will be issued to the corresponding eligible users on the target chain.

Therefore, the total amount of Bitcoin locked on the addresses controlled by the MPC wallet will be consistent with the total supply of FBTC on the target chain; in other words, one is deposited, one is locked, and one is generated.

- Target Chain Smart Contract: Implementing the generation and mapping of BTC in more ecosystems

How are the BTC deposited in the deposit addresses distributed to the target chain?

This will inevitably involve a bridging smart contract that manages assets for eligible users and completes related operations such as cross-chain issuance of FBTC. Therefore, you can understand it as a smart contract that is pre-written for the supply and transfer of synthetic asset tokens.

- Off-chain Module: Ensuring the normal operation of the deposit and generation process

With the entry and generation of synthetic assets on the target chain, the roles of various other parties are also indispensable.

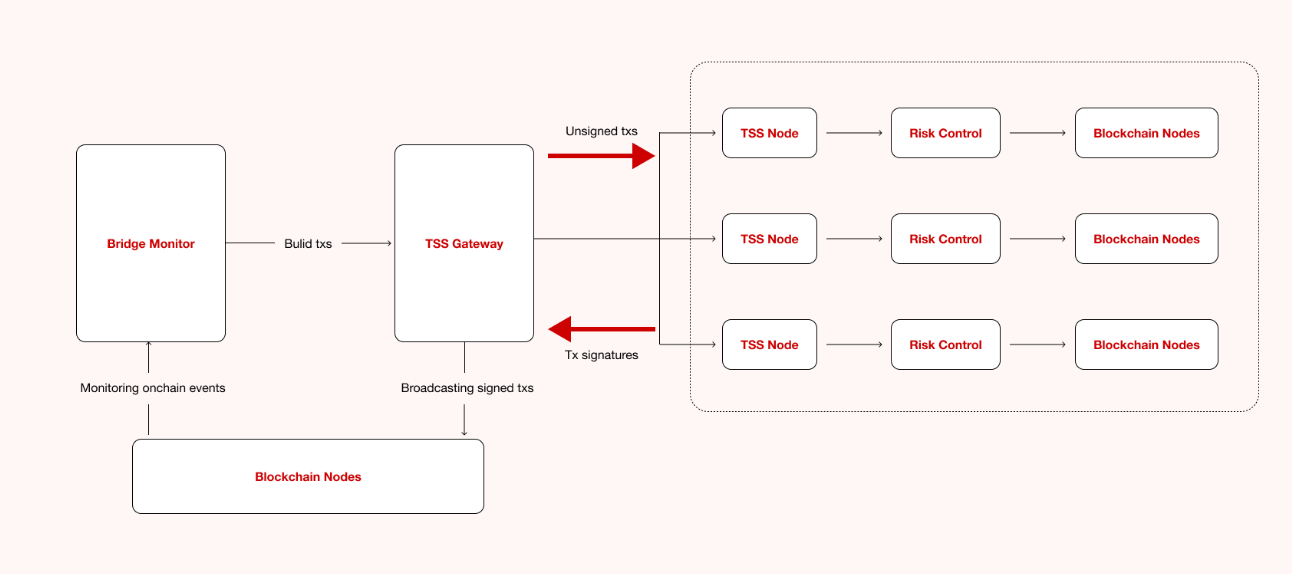

In the FBTC system, bridge monitors, TSS gateways, TSS nodes, and risk control modules all play their respective roles, collectively ensuring the entire process of assets from BTC to FBTC (and vice versa).

For example, the bridge monitor monitors on-chain events in real-time, such as new minting, burning, and cross-chain requests; the TSS gateway coordinates the signing process to ensure the smooth completion of transactions; and the TSS nodes, through a distributed signature mechanism, each run independent risk control modules to disperse the overall risk of the assets.

But more important than the technology is the design and arrangement of the various roles.

In the above process, the assets deposited into the MPC address by users are actually managed by the custodians, with key shares held by multiple trusted institutions. This is done in a decentralized manner under limited risk control to issue FBTC.

In addition, not all users have the right to mint FBTC. The significance of the "eligible users" mentioned earlier lies in this - only entities, institutions, and merchants that meet the conditions have the right to mint FBTC. This is more like a delegated agency mechanism, where when a merchant mints FBTC, users can subscribe to it rather than mint it directly.

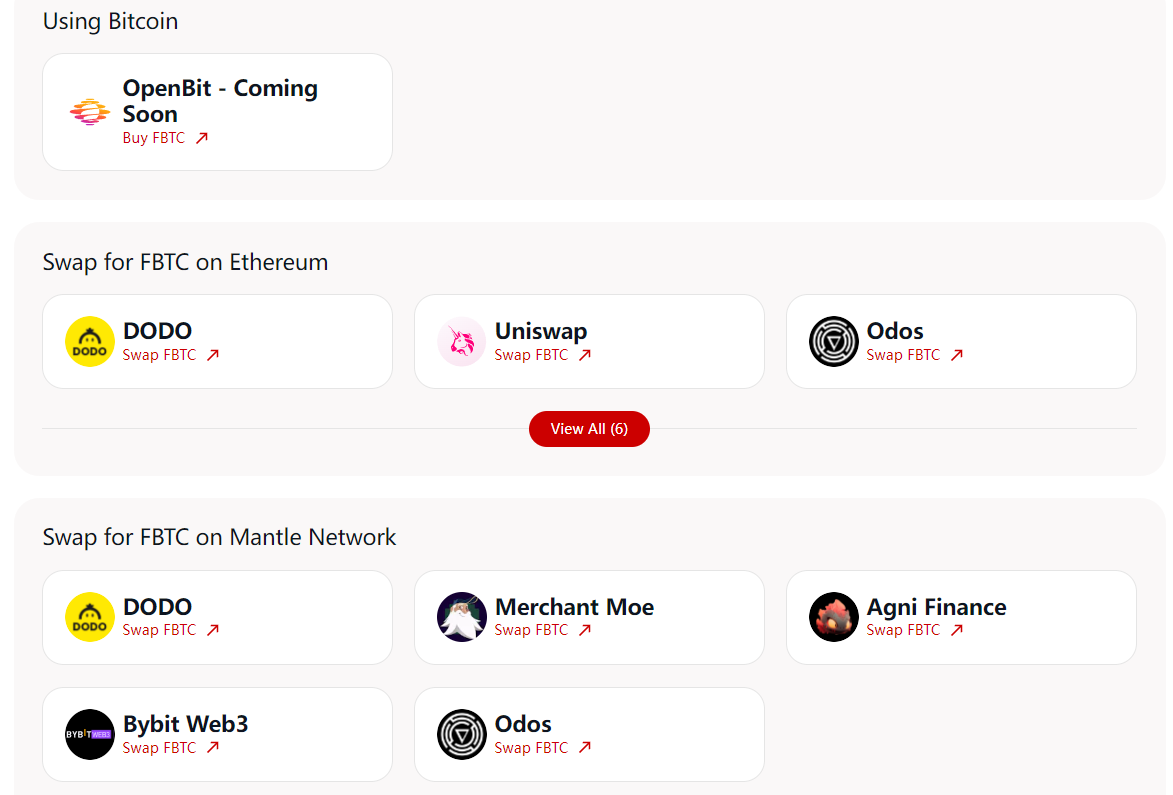

Currently, the FBTC website provides an entry point, and users can swap FBTC through different DeFi protocols, but the circulation of FBTC behind the scenes depends on the minting of the eligible users mentioned above.

Finally, FBTC has also established a security council to oversee the operation of the BTC custodian MPC multi-signature and the bridge TSS nodes. Currently, Mantle, Antalpha Prime, and Cobo serve as the initial members of the council, with plans to gradually introduce more trusted council members.

This is more like a practical alliance, where highly trusted institutions first form an initial alliance to ensure the smooth operation and security of the product in the early stages, and then gradually expand to achieve complete decentralization.

An Example: Understanding FBTC Minting and Burning Quickly

If you find the above roles and technical design too abstract, let's use a specific example to see how FBTC is minted and burned.

Suppose Alice wants to mint her 1 BTC into 1 FBTC on the Ethereum network, then:

Initiation of transfer: Alice transfers 1 BTC to the MPC custodian address provided by the FBTC system.

Minting request: Alice interacts with the FBTC bridging contract on Ethereum to initiate a request to mint 1 FBTC.

Request monitoring: The bridge monitor monitors and detects Alice's minting request and the 1 BTC deposit transaction.

Request transmission: The bridge monitor sends Alice's minting request to the TSS gateway.

Transaction signing: The TSS gateway coordinates multiple TSS nodes to sign the transaction. These nodes jointly generate transaction signatures through the MPC algorithm to ensure the legitimacy of the deposit transaction and minting request.

FBTC minting: Once confirmed, the FBTC tokens are minted and sent to Alice's wallet address on Ethereum.

In the example above, the technology and governance ensure the smooth and secure operation of the process, and users do not need to be aware of:

When eligible users (such as Alice) transfer BTC to the custodian address, it is an MPC address managed jointly by multiple custodians. This means that any withdrawal of BTC requires a joint signature from multiple custodians, and a single custodian cannot independently access the BTC, preventing asset theft.

The bridge monitor ensures real-time monitoring, ensuring that each step is carried out under strict monitoring.

The TSS gateway coordinates multiple TSS nodes for signing. These nodes jointly sign transactions through a threshold signature scheme (TSS) to ensure that FBTC is minted or BTC is withdrawn only when all security and verification conditions are met.

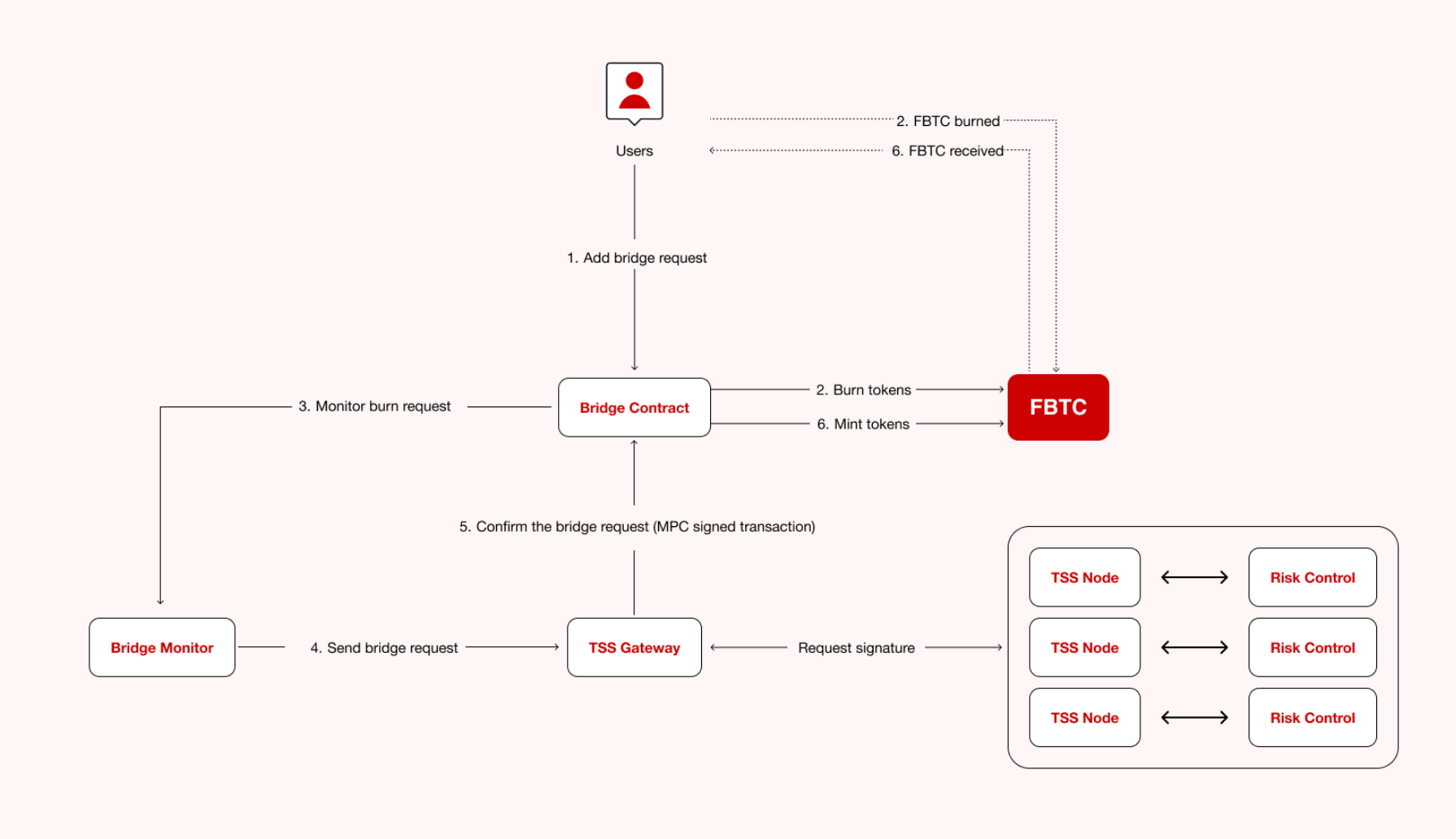

Another benefit is that using the above mint and burn mechanism makes it easier to transfer FBTC across chains.

In the same way, if Bob initiates a request to transfer 1 FBTC from Ethereum to BSC:

At this point, the bridging contract on Ethereum burns Bob's 1 FBTC, reducing the supply of FBTC on Ethereum. Similarly, the bridge monitor also monitors this event and sends it to the TSS gateway.

Finally, the TSS gateway calls the bridging contract on BSC to confirm the cross-chain operation. After the transaction is confirmed, Bob receives 1 FBTC on BSC.

The same set of processes and the same level of security ensure that each cross-chain operation is jointly confirmed by multiple validation nodes, avoiding the risk of single point of failure and malicious operations, while achieving seamless transfer of BTC synthetic assets between different blockchain networks.

Better Resources Create Better Assets

From the above design, the technical design of FBTC is not complex, and the principle of input and output is clear.

For such cross-chain synthetic assets, technology and security are the lower limit, and the ability to cover resources is actually the upper limit.

I believe that better resources create better assets: in simple terms, pooling resources and integrating various forces to establish a wide cooperation network is the key to the success of FBTC or similar projects.

After all, FBTC needs people to adopt it, use it, promote it, and have the ability to mobilize these people and related resources for the business to run smoothly.

So, let's think a little deeper, what exactly are these "resources"?

The FBTC asset itself cannot flow on its own; you must be able to attract and integrate multiple partners and participants, including decentralized finance (DeFi) protocols, cross-chain bridges, exchanges, and custodial service providers.

The participation and support of these partners can increase the credibility and use cases of the project, thereby promoting the circulation and acceptance of FBTC assets.

So the question becomes, has FBTC been able to attract and acquire these resources?

Don't forget, FBTC is jointly created by Mantle and Antalpha Prime, both of which are in different positions in the crypto ecosystem and naturally have their own advantages.

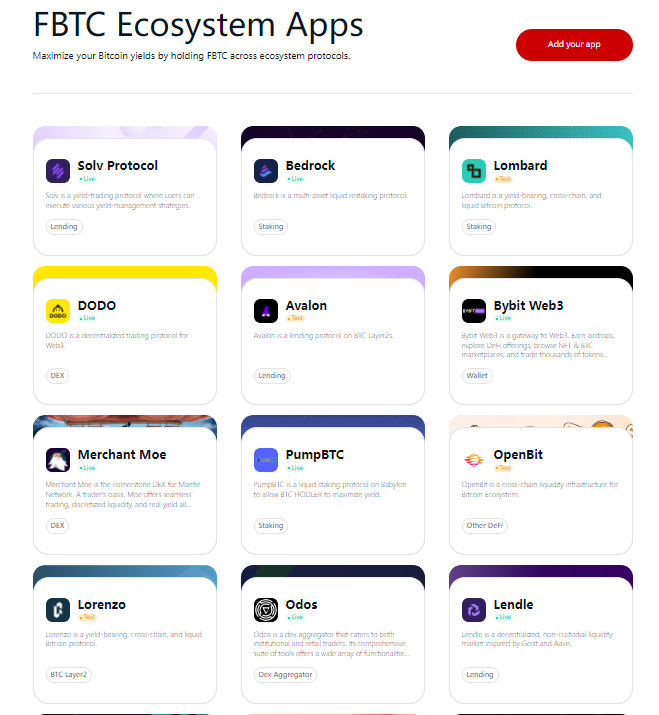

For Mantle, as an L2 solution, it can naturally integrate with various DeFi protocols such as lending, liquidity mining, decentralized exchanges (DEX), etc., which are already part of its own chain ecosystem.

This not only provides more earning opportunities for FBTC holders but also enhances the usage scenarios and market demand for FBTC.

Currently, FBTC has already gained 24 various project partners, which is the best proof of this connectivity:

Babylon Ecosystem: solv, pumpbtc, bedrock, pell network, lombard, satlayer, etc.

On-chain DeFi: merchant moe, agni, dodo, Init, etc.

CeDeFi: avalon finance, bouncebit, etc.

New chain projects as liquidity assets: fuel, mezo, bob, botanix, etc.

For cross-chain synthetic assets, these seed partners will play a crucial role in the initial liquidity of FBTC, injecting a scale of liquidity into the market.

At the same time, Mantle's treasury holds billions of dollars in assets, and it is also a well-known L2 with a strong financial background; I speculate that a portion of these funds will inevitably be used for cooperation, establishment, and promotion, which should not be underestimated.

However, the official team has not yet released more incentive activities, and we can also wait and see if there are more opportunities for participation.

As for Antalpha Prime, as a digital asset financial service provider, its business scope includes asset management, crypto lending, crypto mining financing, trading, and venture capital. In addition to providing investment services to high-net-worth individuals, it is also a long-term trading partner for institutional clients.

This also means that it has rich financial resources and a deep industry background, which can provide necessary financial support and market promotion resources for FBTC, reaching more potential users and market participants, and enhancing the project's market acceptance and liquidity.

Finally, Cobo is also an early infrastructure provider for the project. Cobo has a solid business in digital asset custody and management services, with strong security custody technology and multi-party computation (MPC) capabilities. They can ensure the security and reliability of FBTC in custody and cross-chain operations, enhancing the trust and transparency of the FBTC project.

At the same time, Cobo is also one of the first custodians to provide staking for Babylon.

Leave professional matters to professional teams, utilize the resources and capabilities of different organizations to complement each other, and create a new situation for the growth of BTC synthetic assets.

Recently, the FBTC product was officially launched on July 12th, and public data shows that its on-chain circulation has rapidly grown to $70 million within a month. It is expected that we will see a new option for earning more in Q3:

Based on Ethereum and Mantle, in addition to the earnings from staking/restaking assets on these two main chains, storing FBTC in earning partner protocols can also earn APY through lending and staking mechanisms.

Currently, FBTC has been launched on BSC, and will continue to be launched on various mainstream and new public chain ecosystems.

In addition, to encourage users to hold FBTC, the project's point-based gameplay, Ignition Sparkle Campaign, will also be launched at the end of August, laying the foundation for the airdrop expectations. Interested players can visit the project's official website for details.

Conclusion

Cryptocurrency assets never sleep, and the search for more earnings and liquidity is an ongoing pulse.

Those who can provide better services for asset liquidity will benefit from the flow of assets. This is similar to the people coming and going at gas stations next to highways and express lanes.

From the product design and initial planning, FBTC seems to be like a gas station for BTC assets, revitalizing and connecting the earnings from the BTC ecosystem through full-chain synthesis.

But Rome wasn't built in a day, and whether FBTC can become the first choice for discerning crypto players also depends on more market strategies and operations in the future.

Build a foundation on security, connect with the full chain, and maximize earnings; the future looks promising for FBTC's business.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。