Nothing is smarter than the market, and no information system is more efficient than a free market.

Author: Trustless Labs

Prediction markets are open markets that predict specific outcomes through financial incentive mechanisms. These markets are established for trading bets on various event outcomes. Market prices can reflect the public's perception of the probability of an event occurring.

The typical trading range of a prediction market contract is between 0% and 100%. The most common form of prediction market is binary options markets, with prices at expiration being 0% or 100%. Users can also sell options before the event occurs and exit according to market prices.

Through prediction markets, we can extract the value of the public's future expectations of an event from the betting community's performance on the event's outcome. Traders with different beliefs will use trading contracts to reflect their confidence in possible outcomes, and the market prices of these contracts are considered to be aggregated beliefs.

The history of prediction markets is long, almost as long as the history of human gambling, and the combination of prediction markets and politics seems to have existed since ancient times: in the Middle Ages, people were keen on betting on the prediction of the election of the Catholic Pope.

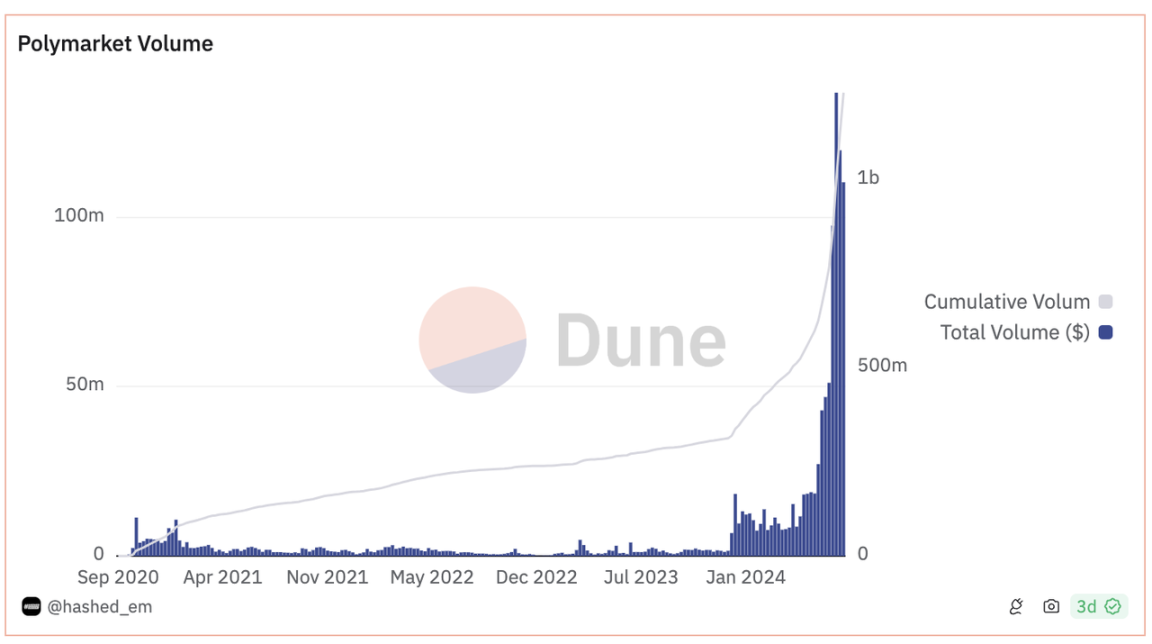

With the approaching US presidential election, the interest in betting on the political sector reached a new peak in July with events such as Trump's assassination, Biden's withdrawal, and the Democratic Party replacing Harris as an elector, and prediction markets represented by Polymarket have attracted widespread attention.

Polymarket: Order book tradable prediction market

Polymarket is a decentralized prediction market project born in 2020, founded by Shayne Coplan, and supported by well-known institutions and angel investors such as Polychain Capital, Founders Fund, and Vitalik.

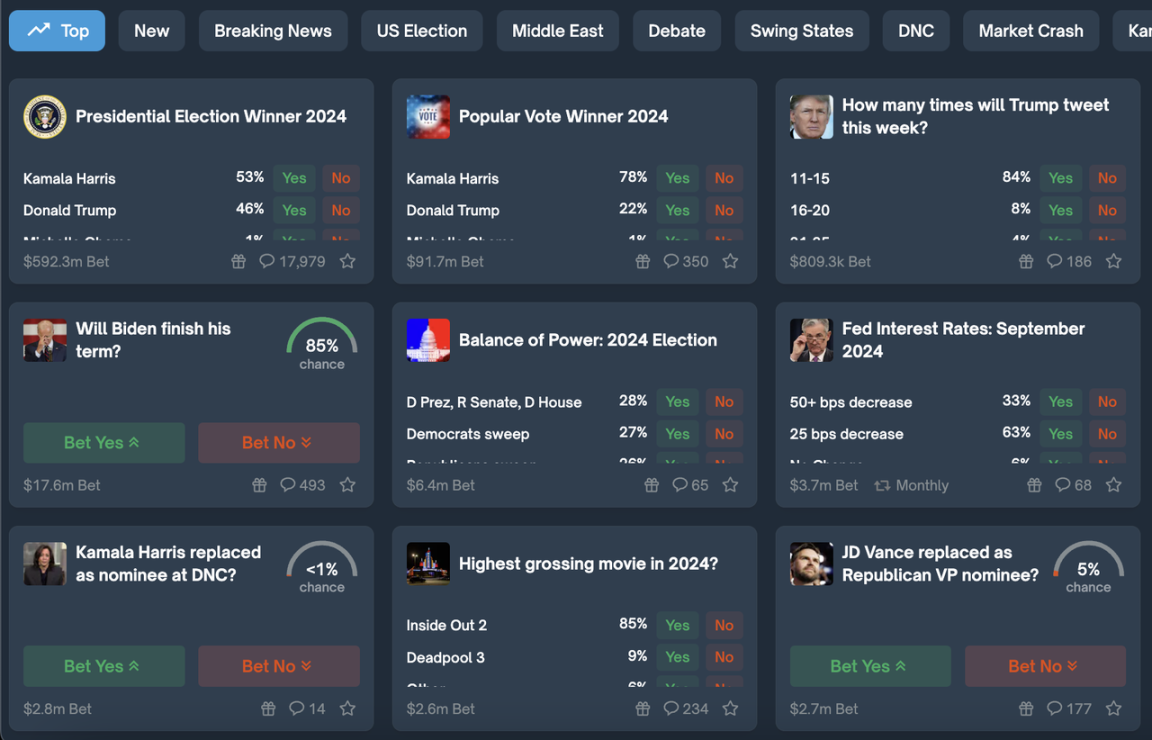

Polymarket allows users to trade on controversial topics in the world (such as politics, sports, popular culture, etc.), and users build investment portfolios based on their predictions.

Unlike traditional sports betting, Polymarket allows users to freely trade shares in the market before the topic is settled, and speculators can flexibly participate in probability games.

Real-time hot markets in Polymarket

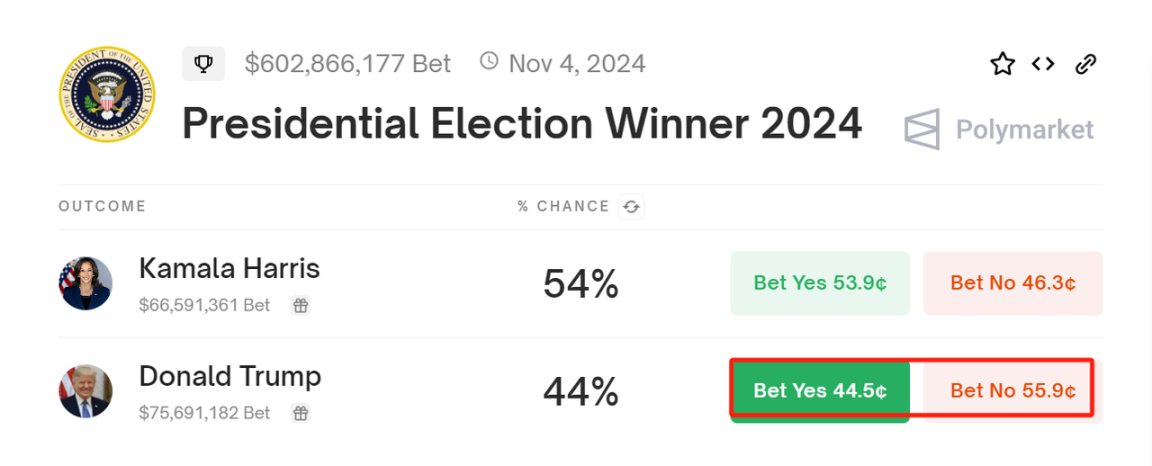

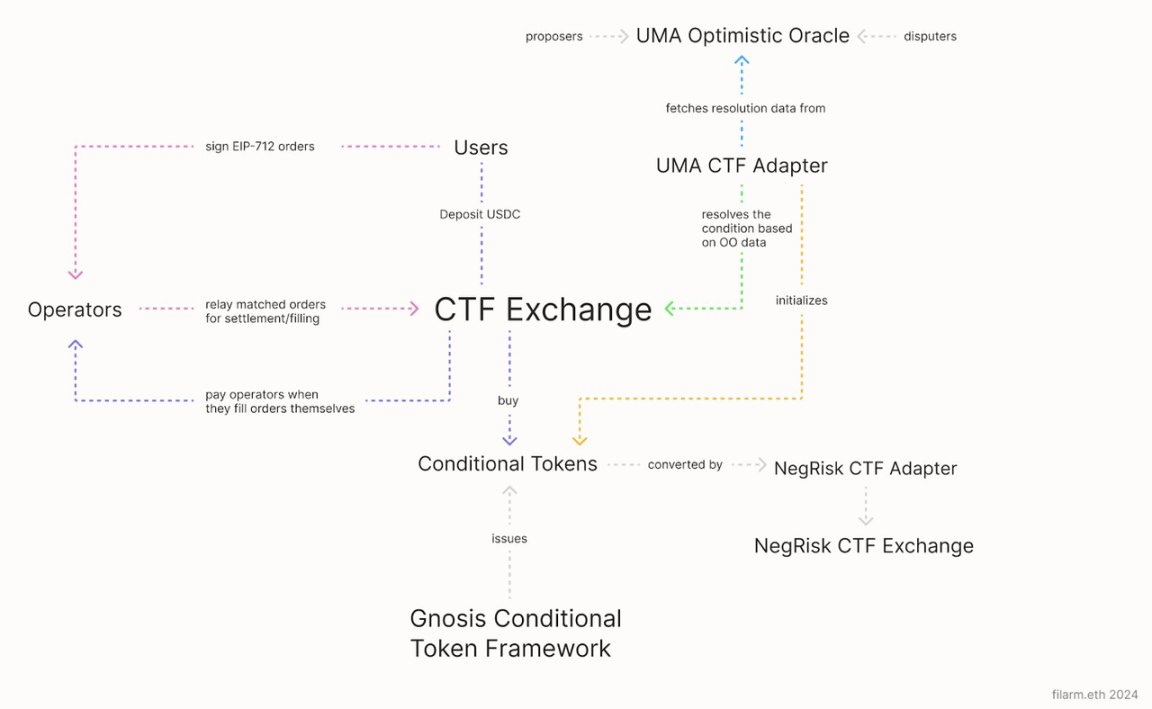

Polymarket uses the conditional token framework (CTF) based on Gnosis. For every $1 of ERC20 tokens such as USDC pledged, two conditional tokens representing the positive and negative outcomes of the event are generated. The market for multiple outcome markets is a comprehensive statistic of multiple binary outcome markets.

The conditional tokens fluctuate in the market due to trading demand, and users can buy and sell through the order book at any time. Alternatively, they can wait until an event has a result, and those holding the correct tokens will receive the full $1 profit.

Because the two tokens trade independently in a market similar to a centralized exchange, it is possible for the sum of the two token prices to not equal $1. Therefore, market makers need to be involved to balance the difference. Therefore, before the event ends, it is also possible to use one positive and one negative token to exchange back the $1 pledge in the contract at any time.

The prediction market in Polymarket consists of the following main parts:

Market theme - Each prediction in Polymarket focuses on a specific theme or event. Although users can submit new market creation proposals through Polymarket's Discord, Polymarket has discretionary power over which markets will be created due to the complexity of the wording.

Oracle - The determination of the event's outcome usually requires human input from an oracle. Polymarket uses the UMA optimistic oracle, which allows anyone to submit a solution. If no one challenges the solution within a certain period, the solution will be considered as fact. In rare cases, when there is a dispute, the oracle's decision is made by UMA token holders.

Conditional tokens - As mentioned above, by locking $1, users obtain two conditional tokens representing "yes" and "no" in the market settlement. Those holding the winning result will receive the full $1. The "yes" and "no" tokens are freely traded in the market, and their prices indicate the probability. Polymarket uses the conditional token framework (CTF) developed by the Gnosis protocol, which is built on the ERC1155 token standard.

Order book market - Polymarket's market is a hybrid on-chain order book trading mechanism, similar to dYdX v3, where users authorize through signatures, and the operator matches off-chain, ultimately interacting with the contract on-chain. Settlement is done in a non-custodial manner by the contract, with atomic exchanges between binary outcome tokens and collateral assets, so the operator does not hold the pledged $1.

Liquidity providers - Unlike sports betting, Polymarket allows the free trading of conditional tokens before the results are known, and pricing is determined by supply and demand rather than by a mechanism. Token prices may deviate (the sum of the two token prices may not equal $1). Therefore, anyone can earn fees by placing limit orders and trading the price difference, and Polymarket also provides additional USDC incentives.

Polymarket system architecture

Source: https://dune.com/blog/polymarkets-rise-a-new-era-in-prediction-markets

Polymarket currently has no token issuance plan and does not actively incentivize user points. Nevertheless, Polymarket has distributed over $3 million in USDC through its liquidity reward program this year to incentivize market-making activities, with the aim of increasing the overall liquidity depth of the platform. The highest trading volume market currently pays approximately 600 USDC in rewards to liquidity providers each day.

SX Bet: Single bet prediction platform

SX Bet is a sports betting platform based on Ethereum founded in 2019, and the project is currently based on the SX Chain established by Arbitrum Orbit Rollup.

Currently, the betting markets supported by SX Bet mainly focus on sports topics, such as betting on the winners of major events in tennis, football, baseball, and basketball. Recently, new betting topics have been added to the betting section, including Crypto, Degen Crypto, and politics, focusing on the price trends of mainstream crypto assets and on-chain meme coins, as well as the winner of the US election.

Unlike Polymarket, SX Bet only supports single bets in accordance with the traditional sports betting model, and bets cannot be freely traded before the outcome of the prediction event is determined.

SX Bet's innovation lies in the first implementation of a system for combination betting, where users make predictions on a series of events and can only receive winnings if all predictions are correct. The potential winnings from combination betting are often huge, which can be seen as leverage in the prediction market. SX Bet's market-making will become the counterparty for trading.

This type of combination betting is more like a lottery and can often bring in huge profits, sometimes up to thousands of times the original bet. The success stories of such bets can easily go viral, making it one of the most interesting aspects of traditional sports prediction markets.

Obviously, Polymarket and all prediction markets based on the "dual token" conditional framework cannot implement combination betting because the contract cannot mint a conditional token for every possible combination of results and ensure that it can be freely traded with sufficient liquidity. The odds for prediction markets with only two outcomes may be limited and may not be attractive to users.

Pred X: AI-driven topic-based prediction market

Pred X is an initial prediction market based on the Sei blockchain, covering various topics such as politics, cryptocurrency price predictions, and popular events. Currently, the platform supports betting with USDC on multiple blockchains such as Base, Linea, Sei, and Bitlayer, and has launched a corresponding Telegram bot. Pred X's Telegram bot is called PredXFun (@PredxFantasyBot), which provides users with two modes: one is a game mode where users predict the probability of hot events and earn points, and the other is a real mode where users can participate in real bets on similar topics through wallet connection on the official website.

Unlike Polymarket, where users mainly propose and generate prediction market topics in Discord, most of Pred X's prediction topics are generated by the Aimelia AI by scraping popular news and market sentiment indices from the internet and then pushing the generated prediction topics to the Pred X website, where users form the trading market spontaneously. Although Pred X supports multiple blockchains, it is not a fully decentralized prediction market application. The prices for different outcomes of various prediction topics are determined by the platform's centralized order book, and the ordering process and the market for each prediction topic are implemented according to smart contract rules.

Objectively speaking, Pred X is still an immature platform compared to other prediction markets. The order book depth and betting volume for topics on the website are much lower than those of Polymarket and SX Bet. As a prediction market, it should support users to freely trade tokens for different outcomes before the event is revealed. However, unfortunately, Pred X's order book does not support users to place orders themselves. In most markets where there is a lack of market makers, users actually cannot freely trade result tokens. Additionally, the documentation does not detail how to ensure the consistency of market contracts for different topics on multiple chains when implementing multi-chain betting support, and how to ensure that all probability result tokens have sufficient liquidity on each chain. There are differences in the betting prices for the same topic between the prediction market on the Telegram bot's "real mode" and the official website when trading with connected wallets.

All these factors raise doubts about the practicality and reliability of Pred X. Overall, the product currently seems more like an unfinished product.

Azuro: Betting protocol supported by liquidity pools

Azuro is not a prediction market itself, but a basic protocol for creating on-chain prediction markets. This comprehensive permissionless infrastructure includes on-chain smart contracts and web components, and multiple prediction market applications can be built based on Azuro. All betting platforms based on Azuro can be found on its website.

Azuro only allows single bets and does not support free trading of "yes" and "no" tokens like Polymarket. Users can only receive profits after the results are announced.

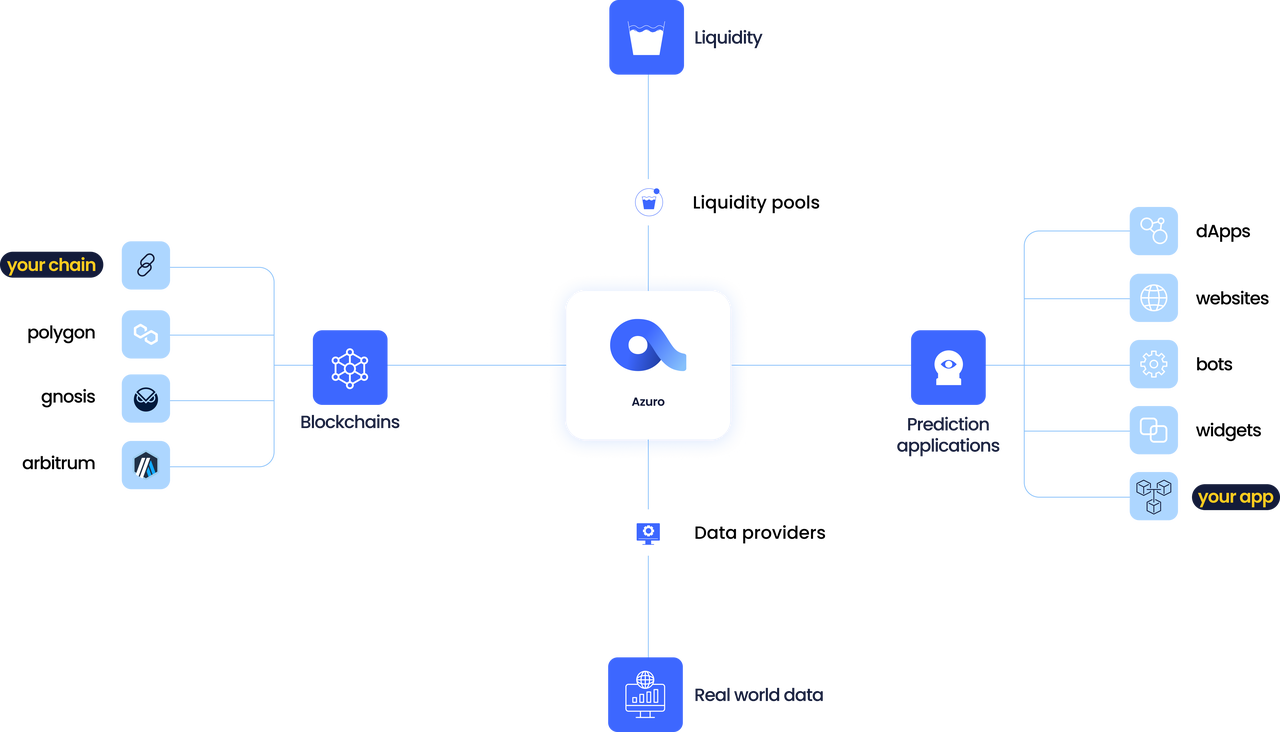

Role of Azuro in the ecosystem

Source: https://gem.azuro.org/hub

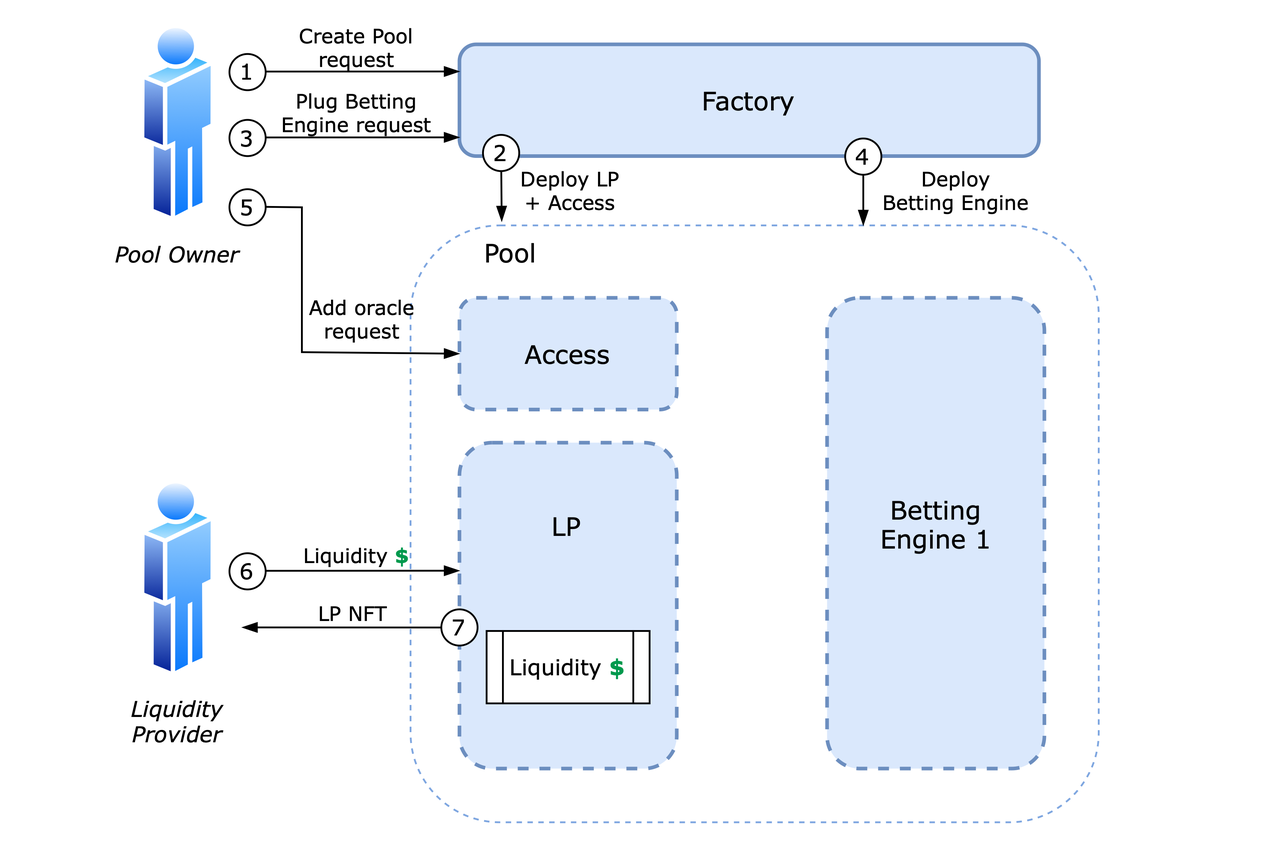

The Azuro system is built around liquidity pools, and anyone can deploy their own liquidity pool by interacting with the Azuro factory contract. Multiple betting platforms can be created under a liquidity pool, and multiple possible events can be established for each betting platform.

In the binary split model of prediction markets like Polymarket, liquidity is isolated and divided among multiple different prediction events. Azuro proposes a concept called liquidity tree, where multiple events under a prediction topic, and even multiple topics and betting platforms, can share the same liquidity pool.

The liquidity tree provides a hierarchical structure, with different possible events defining the liquidity range, such as the various possible scores for a football match.

This liquidity ensures that the platform has the ability to act as the counterparty for bettors in any situation, to pay potential winnings (resulting in losses for LPs). If bettors generally lose, LPs can earn profits. A liquidity tree provides liquidity for multiple prediction topics and generates profits or losses as the counterparty.

The odds for each event under Azuro are calculated based on the funds bet on each event and the proportion of the total liquidity range for the entire prediction topic. The initial odds are set by specific data providers and correspondingly add initial liquidity. Data providers can also adjust the odds during the betting process, and the ability to pay these odds is guaranteed by the initial liquidity.

Azuro liquidity factory system design

Source: https://gem.azuro.org/contracts/factory

Azuro also supports the implementation of multiple dapp platforms, where betting platforms can set their own fee sharing, which bettors can freely choose. The creator of the liquidity pool can also set the fee sharing ratio for the pool. A certain percentage of the profits from all pools will enter Azuro's own DAO, and Azuro has also issued its native token $AZUR.

Conclusion

The philosophy behind prediction markets is interesting, as participants aim to profit and view the free market as the most effective information gathering system for predicting real-world events. These results often turn out to be surprisingly accurate. In a contemporary society dominated by recommendation algorithms monopolizing information, prediction markets seem to effectively reveal the truth and reflect viewpoints, as evidenced by the political event predictions on Polymarket.

For many cryptocurrency users, their first encounter with prediction markets may have been during the last presidential election when FTX launched the Trump and Biden indices, where, with the strong market-making ability of SBF, users could even engage in high-leverage trading. Although centralized, it was indeed a very interesting experience.

Of course, cryptocurrencies have greatly reduced the trading friction in prediction markets, providing a better and more efficient market mechanism. Based on the ideas of smart contracts and AMMs, prediction markets have also been given better market mechanisms - permissionless access and better liquidity. Many AI AgentFi projects also see prediction markets as a battleground for harnessing collective intelligence and honing their capabilities.

However, the shortcomings are also very apparent: although Polymarket has opened up the free trading of conditional tokens, it is difficult to implement a flexible betting mechanism, and the lack of high leverage returns may also detract from the enjoyment of ordinary players. The solutions like liquidity pools in Azuro are still somewhat complex and lack trading capabilities after betting.

Rather than calling it a mechanism and technological innovation, the current popularity of prediction markets should be seen as another mass adoption of crypto culture, a victory for the free market culture behind it, which is particularly valuable in a contemporary society where algorithmic authoritarianism is gradually monopolizing information. After all, nothing is smarter than the market, and no information system is more efficient than a free market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。