Bitcoin has established a baseline level of trust and this trust continues to grow.

Authors: NOTDEGENAMY, RAM & JOMO

Translation: DeepTechFlow

Introduction

In 2009, an anonymous figure named Satoshi Nakamoto released Bitcoin, the world's first decentralized cryptocurrency. It enables peer-to-peer currency transfers without intermediaries such as banks.

Due to its early origins, anonymous founding team, extensive miner network, and lack of traditional financing methods, Bitcoin has become the most decentralized cryptocurrency. Due to the absence of a single controller, malicious actors find it extremely difficult to rewrite transactions on the Bitcoin network. Even coordinated attacks among multiple individuals to compromise the network's accuracy are challenging due to its decentralization. To understand the degree of decentralization of Bitcoin, one can consider the Nakamoto coefficient, which represents the degree of decentralization with a single number. This coefficient represents the number of participants/node operators controlling more than one-third of the entire network. The Nakamoto coefficient for Bitcoin is estimated to be around 7000. At the time of writing, the second most decentralized network is the Mina protocol, with a coefficient of 151. Other notable networks include Solana with a coefficient of 18 and BNB with 7. The unique aspect of Bitcoin is its exceptional decentralization.

In addition to decentralization, Bitcoin is also unique due to its fundamental characteristics. Bitcoin's supply is limited to 21 million BTC, making it an attractive hedge against inflation and economic instability. Therefore, Bitcoin is often referred to as "digital gold."

In summary, Bitcoin:

Is functionally simple—it enables peer-to-peer currency transfer

Is decentralized—it is far ahead of all other cryptocurrencies

Is secure—it is resistant to attacks and has been secure for over 15 years

These factors have given Bitcoin the highest level of regulatory transparency. It is classified as a commodity, indicating institutional recognition of its decentralized nature. Its ETF was also approved in January 2024, which will bring Bitcoin into traditional financial markets.

In essence, Bitcoin has established a baseline level of trust and this trust continues to grow. If we can build applications on top of Bitcoin, they will benefit from network effects.

However, this is not easy. Bitcoin was not initially designed to be the foundational layer for other applications.

First, transactions on Bitcoin are expensive and slow

If I send you 5 BTC, this transaction must be recorded on the Bitcoin network. More specifically, this transaction must (1) be included in the ledger, and (2) the updated ledger must be distributed to thousands of computers. Including transactions in the ledger requires numerous miners to compete to solve cryptographic puzzles to verify and confirm transactions—this is a resource-intensive and expensive process. Ensuring ledger distribution also slows down the number of transactions we can process per second. Computers run by ordinary people do not have unlimited storage capacity. Here, we observe that Bitcoin's focus on decentralization has led to a trade-off between cost and speed.

Second, Bitcoin is not friendly to smart contracts

Suppose we want to do something more complex than peer-to-peer currency transfers on the Bitcoin network. For example: we want to program an automatic vending machine on the Bitcoin network. Based on the input value, the vending machine dispenses a product, and the remaining quantity of products in the vending machine is continuously tracked by the Bitcoin network. This vending machine is similar to a smart contract: a set of rules that automatically execute based on specific trigger conditions.

Bitcoin does not directly support smart contracts, and this limitation stems from two deliberate design choices.

Bitcoin adopts a restricted stack-based scripting language intentionally lacking Turing completeness, which lacks advanced features such as loops and complex conditions. In other words, writing complex logic on Bitcoin is difficult. It only supports simple operations such as digital signatures and time locks.

Bitcoin uses the Unspent Transaction Output (UTXO) model to track state—i.e., the current state of all information on the blockchain—efficient for tracking wallet balances but inefficient for tracking the state of other types of transactions.

These architectural decisions sacrifice programmability for security and predictability. Therefore, while Bitcoin excels in secure value transfer, it is very unfriendly to the complex state-dependent logic required to support smart contract applications. Networks like Ethereum later emerged as solutions to these limitations.

Early attempts to overcome these limitations—Segwit, Lightning Network, and Taproot

Bitcoin's first major upgrade, called Segwit, was released in 2017. It allowed Bitcoin transactions to be processed faster while allowing modification of transaction IDs before blockchain confirmation. This made it possible to securely batch process multiple transactions. Ultimately, multiple transactions occurring off-chain could be combined into one transaction and then stored on-chain.

This brought about the first Bitcoin Layer 2 (L2), known as the Lightning Network, which was launched in 2018. L2 is a protocol for settling transactions on top of the base layer L1 (in this case, Bitcoin is L1).

Here's a brief explanation of what happens in the Lightning Network:

If I send you 10 BTC and you send me 5 BTC, there would typically be 2 transaction records. The Lightning Network creates a new mini-ledger between the two parties. It settles the net result after a period of time (e.g., A sent 5 BTC to B), reducing the transaction records from 2 to 1 on the main ledger.

The Lightning Network batches multiple transactions into one and records that single transaction on the Bitcoin blockchain. While there are certain trade-offs in decentralization, the Lightning Network provides significant flexibility. For small transactions, users benefit from its speed and lower transaction costs. Bitcoin transaction fees are around $1, while Lightning Network fees are only $0.001 per transaction.

The Lightning Network improves speed but does not support programmability or other interesting use cases. Using the Lightning Network, I still cannot send you stablecoins and have that transaction secured by the Bitcoin network, let alone program smart contracts on Bitcoin.

The Taproot upgrade, activated in 2021, laid the foundation for smart contract programming on Bitcoin. Essentially, it relaxed the restrictions on the amount of arbitrary data that can be included in Bitcoin transactions.

Introducing Ordinals

Thanks to Taproot, users can now directly engrave data on a single satoshi (100,000,000 satoshis equal 1 bitcoin). More specifically, a satoshi can be (1) assigned a specific ordinal for future reference and (2) engraved with data such as text, images, or complex files. This effectively turns fungible satoshis into non-fungible satoshis, creating what is commonly referred to as non-fungible tokens (NFTs).

Ordinals have sparked mixed opinions.

On one hand, Bitcoin Ordinals can be considered superior to NFTs stored on other blockchains.

The reasons are as follows: When NFTs are stored by engraving on the Bitcoin network, the actual data—such as images, videos, etc.—is stored on the blockchain. In contrast, non-Ordinal NFTs typically store metadata/URL pointers on the blockchain rather than actual data. Therefore, Ordinals are more resistant to censorship, link rot, and data loss.

On the other hand, many in the Bitcoin community believe that forcing Bitcoin nodes to download and store images wastes resources. Below is a famous Ordinals collection, the Taproot Wizards collection.

Some NFTs from the Taproot Wizards collection

In fact, the attention drawn to Ordinals has decreased compared to a few months ago. The chart below shows a reduction in the resources consumed to create Ordinals, and overall, the number of Ordinals created is also decreasing.

The efforts to create Bitcoin Ordinals have decreased over time (Source: Dune Analytics)

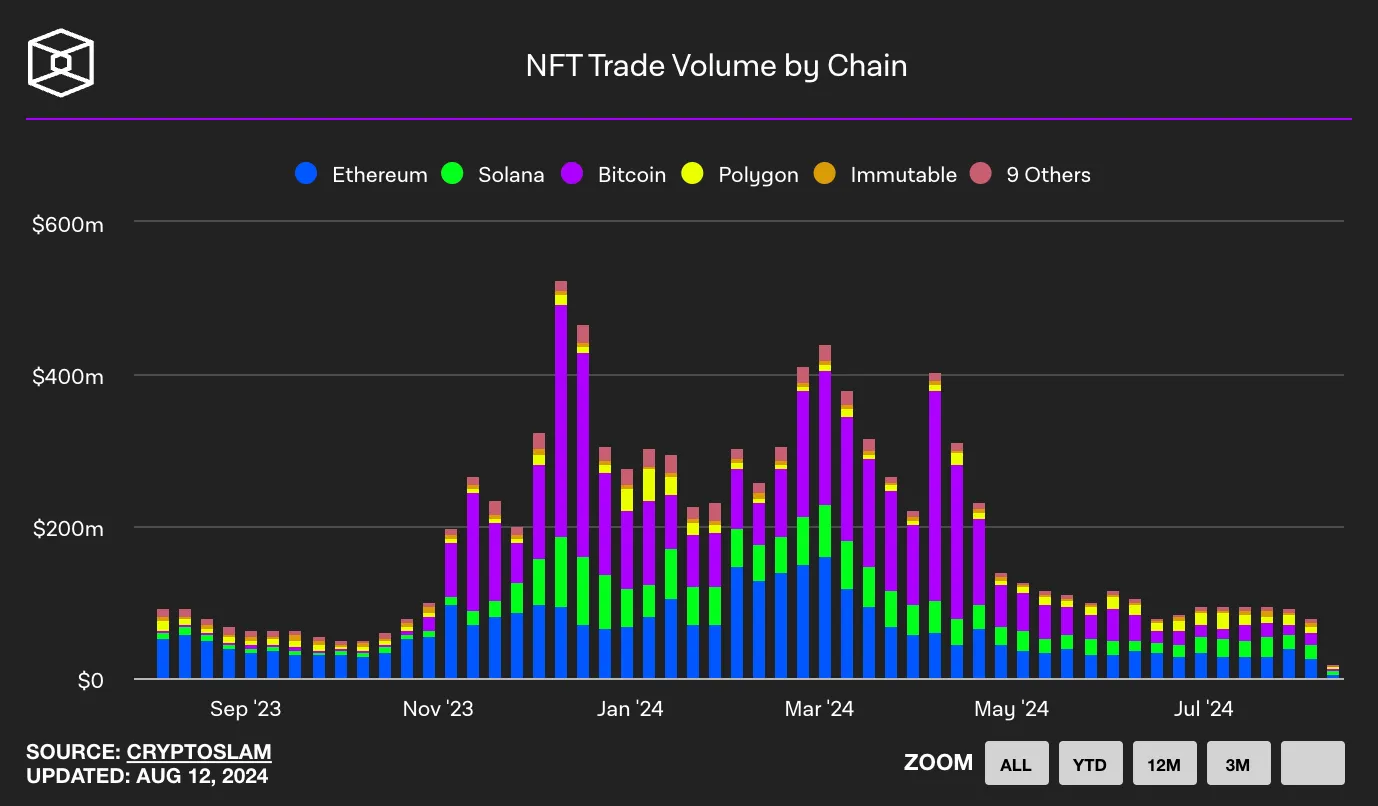

Concerns about whether Ordinals should occupy space in the Bitcoin network blocks are the main driving factor behind this slowdown, but it is worth noting that this is not a phenomenon limited to Ordinals alone. Interest in NFTs may have decreased due to market oversaturation.

This decline in popularity is not specific to Bitcoin Ordinals—it is a general downturn in the entire NFT space (Source: The Block)

Throughout this article, the emphasis has been on Bitcoin's prioritization of security and decentralization, which reduces its scalability. This is the reason why Ordinals have faced criticism—many believe that images are not worth adding additional congestion to the Bitcoin network. This leads us to Bitcoin's L2.

Entering Layer 2 (L2s)

Understanding L2s

Before delving into Bitcoin-related content, it is crucial to understand the basic concepts of L2s. L2s can be confusing because different people have different definitions. In this article, we categorize L2s into two main types: sidechains and rollups. At Ocular, we consider rollups to be true representations of L2.

Sidechains

Sidechains are independent blockchains that do not settle their transactions on the main chain. In other words, not every transaction on L2 can be directly verified on L1.

The Liquid Network is a good example of a Bitcoin sidechain. You can transfer BTC from the Bitcoin network to the Liquid Network through a bridge. This involves sending BTC to an address managed by "watchers"—a pool of about 65 trusted members selected by the community, including representatives from exchanges, financial institutions, and Bitcoin-related companies. In return for each BTC transferred to this watchman-managed address, users receive a synthetic BTC called LBTC. This is a two-way peg mechanism.

The security of the Liquid Network depends on these watchers and their ongoing reputation; the Liquid Network does not inherit security from Bitcoin L1. If the majority of watchers collude or are attacked, the security of the sidechain may be compromised. The main benefit of the Liquid Network is that it helps parties in need of fast and private transactions without completely leaving the Bitcoin environment—transactions are faster, and users can also trade stablecoins and other tokens as well as LBTC on the network.

Rollups

We consider rollups to be true L2s because each transaction has a proof submitted to L1 as support; this proof can be directly verified on L1. In rollups, several transactions are rolled up into one transaction. This transaction, along with the proof of validity, is then submitted to L1. The proof of validity states, "Hey, I've checked these transactions and can confirm they follow all the rules. You can check me and get cumulative certainty. You don't need to individually check each transaction!"

Each transaction is protected by a verifiable proof, so rollups inherit high security from the Bitcoin blockchain, making them true L2s. Rollups that help make Bitcoin more programmable include MerlinChain, BOB, BEVM, Bitlayer, and Botanix.

Other Approaches

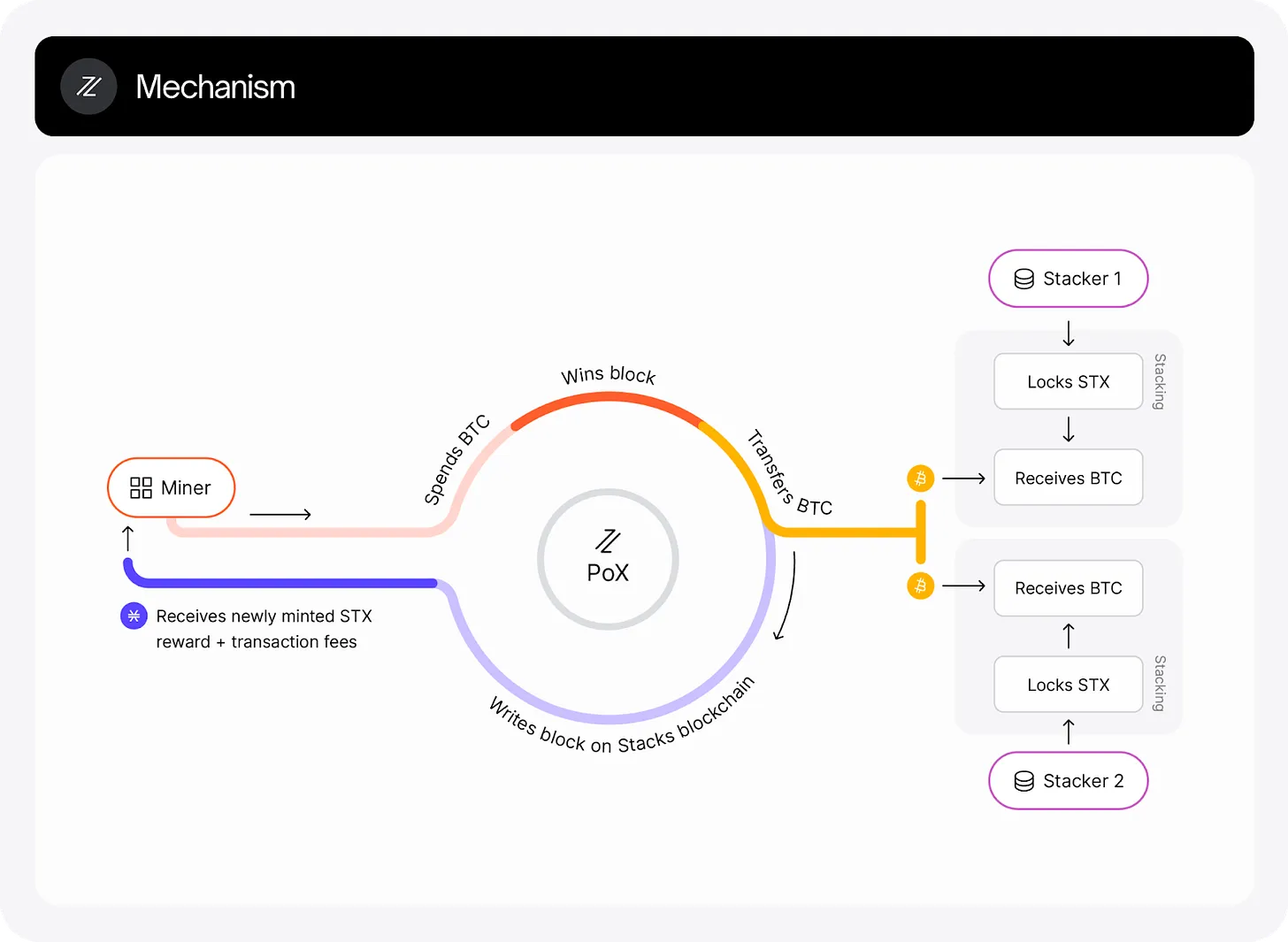

Stacks presents a non-rollups, non-sidechain approach that still inherits a degree of security from Bitcoin L1.

How Stacks intertwines with Bitcoin: Stackers receive BTC, and Bitcoin miners receive STX, intertwining the two blockchains (Source: Stacks Documentation)

Stacks is essentially an independent blockchain that calls on Bitcoin miners to validate its blocks in exchange for rewards. However, Stacks does not publish any proof or hash on the Bitcoin blockchain, so it is not directly related to Bitcoin like rollups.

Other Exciting Programming Attempts on Bitcoin

B² Network

The B² Network is a true L2 example that allows us to delve into rollups. Transactions on B² are batched and a verifiable proof is generated to demonstrate the correctness of the batch. This proof is subsequently recorded on the L1 Bitcoin blockchain.

The proof adopted by B² is called zero-knowledge (zk) proof, which is generally considered the best implementation as it allows for on-chain verification of batch validity without revealing the content. In simple terms, zk proofs ensure privacy. B² Network is also compatible with the Ethereum Virtual Machine (EVM), meaning code written for Ethereum can run the same applications on B². This makes B² attractive to developers.

L2s like B² expand the Bitcoin ecosystem by supporting user-facing platforms such as the Master Protocol.

Master Protocol

The Master Protocol is a financial platform within the Bitcoin ecosystem designed to facilitate interest rate swaps and yield farming of Liquid Stacking Tokens (LSTs) and other yield-generating assets.

The Master Protocol improves liquidity in the Bitcoin ecosystem in several key ways:

Asset Aggregation: Master Protocol serves as an aggregator of users and assets, deeply integrated into the Bitcoin ecosystem. It integrates various LSTs and yield-generating assets from different protocols and L2 solutions, creating a centralized liquidity hub.

Yield Market Platform: Master Protocol's core product, Master Yield Market, packages Bitcoin ecosystem assets into Master Yield Tokens (MSY), which are then split into Master Principal Tokens (MPT) and Master Yield Tokens (MYT). This allows users to trade these tokens, create yield markets, and improve overall liquidity.

Simplified Access: Aggregating multiple assets and protocols simplifies interactions for users within the Bitcoin ecosystem. Users can access yield opportunities from different protocols without constantly switching, increasing ecosystem participation and liquidity.

Liquidity Staking and Restaking: Master Protocol allows users to stake Bitcoin on various L2 networks and receive LST as staking collateral. These LSTs can be reinvested or further staked to earn Liquidity Restaking Tokens (LRT), enhancing investment capabilities and asset liquidity without affecting the original stake.

Interest Rate Swaps: As an interest rate swap market, Master Protocol facilitates the trading of yield assets, helping manage liquidity risk and optimize capital efficiency.

Ecosystem Synergy: As an all-in-one Bitcoin ecosystem yield trading center, Master Protocol not only improves its adoption but also channels traffic and users to multiple Bitcoin ecosystem protocols, promoting overall liquidity.

Fragmentation Resolution: Master Protocol helps address the fragmentation issue caused by the growth of Bitcoin L2 solutions, improving composability and operability within the Bitcoin ecosystem. The integration of various DeFi protocols and L2 solutions enhances overall liquidity flow.

Master Protocol serves as a central hub connecting Bitcoin enthusiasts with various applications, supporting the development of new applications and enhancing the overall utility of the Bitcoin infrastructure. Additionally, it addresses the fragmentation issue caused by the growth of Bitcoin L2 solutions by improving composability and operability.

Babylon

Babylon is an innovative project aimed at extending Bitcoin's unparalleled security to various Proof of Stake (PoS) chains, especially those within the Cosmos network.

By leveraging Bitcoin's powerful Proof of Work (PoW) consensus mechanism, Babylon enhances the security of PoS chains through a process called "restaking." This involves locking Bitcoin on its network and using it to secure other PoS chains, providing economic security and allowing Bitcoin holders to earn staking rewards. The protocol uses advanced encryption technology and consensus innovations to facilitate this process without the need for complex smart contracts.

Babylon's architecture is based on the Cosmos SDK and is compatible with Inter-Blockchain Communication (IBC), allowing seamless aggregation and communication between the Bitcoin chain and other Cosmos application chains. By combining Bitcoin's security features with the flexibility of PoS networks, the Babylon protocol is poised to play a crucial role in the future of the Bitcoin ecosystem, driving a more secure, scalable, and interconnected blockchain ecosystem.

The Next Frontier of Bitcoin Programming and Areas of Interest for Ocular

The Ocular team closely monitors applications built on Bitcoin and has identified the following areas as focal points for innovative development:

More L2 Solutions: Improved L2 solutions are needed to increase transaction speed and reduce costs while maintaining Bitcoin's security.

Smart Contract Platforms (remorachains): Initiatives like RSK (Rootstock) are making Ethereum-style smart contract functionality on Bitcoin increasingly relevant. These platforms allow for the development of decentralized applications (dApps) and DeFi services on Bitcoin.

Cross-Chain Compatibility: Platforms that allow applications from other blockchains (e.g., Solana) to run on Bitcoin represent an exciting investment opportunity in the field of blockchain interoperability.

DeFi on Bitcoin: With increased programmability, the potential of a robust DeFi ecosystem on Bitcoin is growing. Projects focusing on lending, decentralized exchanges, and stablecoins built natively on Bitcoin may be interesting investment areas.

Bitcoin Native Application Platforms: These platforms aim to enhance Bitcoin's programmability while maintaining its security and decentralized core principles.

Zero-Knowledge Proof Technology (ZK-Proof Technology): Bitcoin projects implementing zero-knowledge proofs may offer enhanced privacy and scalability features, making them attractive investment prospects.

Custodial Solutions: With increased programmability, there will be a growing demand for secure custodial solutions to meet the expanding functionality of Bitcoin while maintaining the principle of "not your keys, not your coins."

Developer Tools and Infrastructure: With increased focus on Bitcoin programmability, there may be a surge in demand for developer tools, SDKs, and infrastructure to support this new wave of Bitcoin applications.

Conclusion

These areas represent the frontier of Bitcoin's evolution from a simple store of value to a more universal and programmable platform. As the ecosystem develops, it may attract more developers, users, and investors, driving the next phase of growth for Bitcoin and the broader crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。