Highlights of this Issue

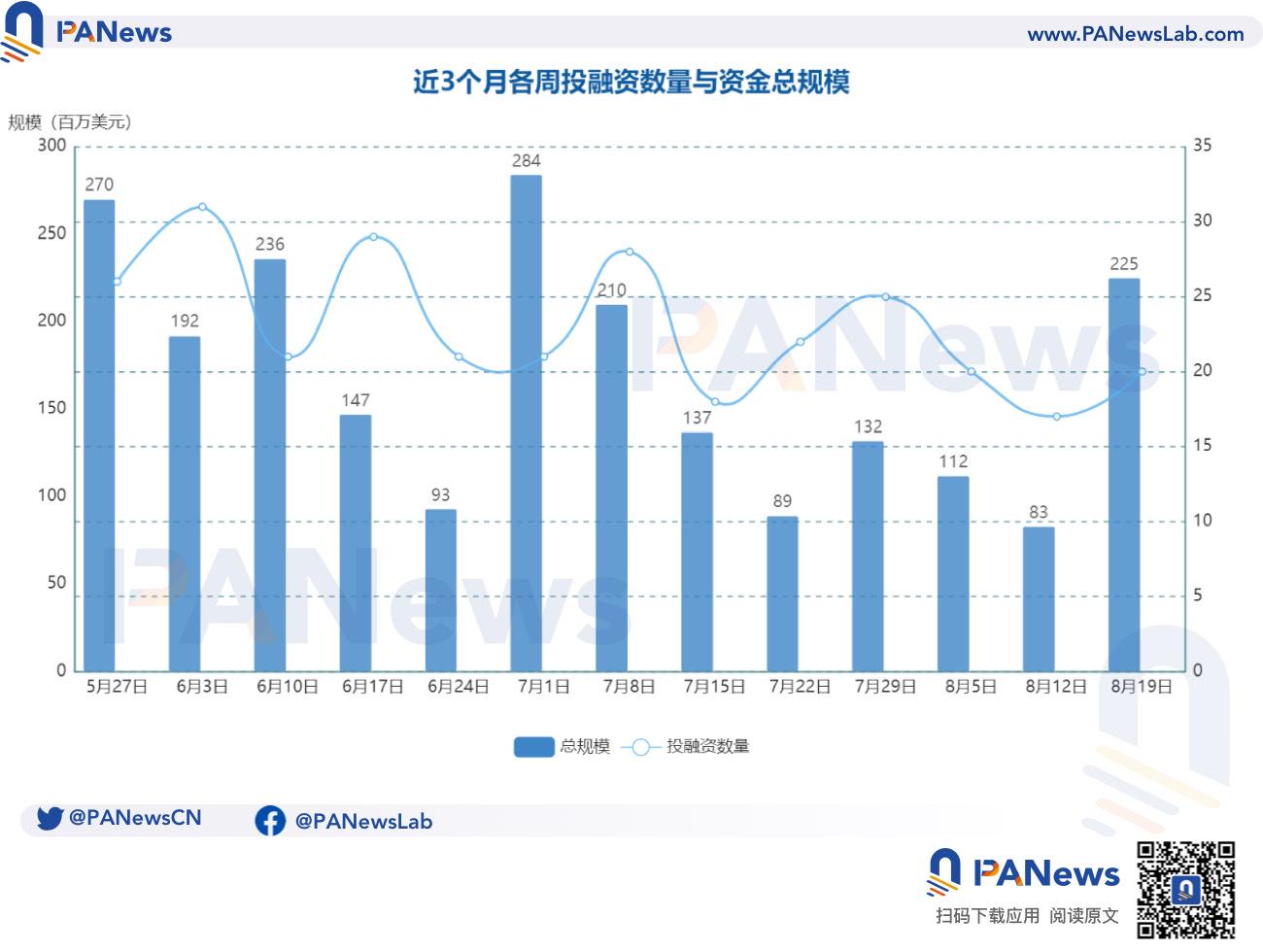

According to PANews incomplete statistics, there were 20 blockchain investment and financing events globally last week (8.12-8.18), with a total funding scale exceeding $225 million, a significant increase in funding scale. An overview is as follows:

- DeFi announced 5 investment and financing events, among which Chaos Labs completed a $55 million Series A financing. This round of financing was led by Haun Ventures.

- Web3 Games revealed 2 investment and financing events, including Autoverse Studios, a Web3 game development studio, completing an $8 million financing round, led by White Star Capital.

- AI field announced 3 investment and financing events, including decentralized AI blockchain platform Sahara AI completing a $43 million financing round, with Binance Labs leading the investment.

- Infrastructure and Tools track announced 6 financings, including Essential completing an $11 million Series A financing led by Archetype, and launching Essential Devnet.

- Other Blockchain/Crypto Applications announced 3 financings, including Crunch Lab completing a $3.5 million seed round financing, with Multicoin Capital leading the investment.

- Centralized Finance field announced 1 financing, with stablecoin payment platform Sling Money completing a $15 million Series A financing, led by Union Square Ventures.

DeFi

Chaos Labs completes a $55 million Series A financing, led by Haun Ventures

Chaos Labs, a New York-based crypto startup focusing on on-chain risk management tools, completed a $55 million Series A financing. This round of financing was led by Haun Ventures, with participation from well-known investment institutions such as F-Prime Capital, Slow Ventures, Spartan Capital, as well as major investors including Lightspeed Venture Partners, Galaxy Ventures, and PayPal Ventures. Chaos Labs also received support from angel investors such as Anatoly Yakovenko from Solana and Francesco Agosti from Phantom. Founded in 2021, Chaos Labs plans to expand its platform as the demand for automated risk management in DeFi grows, and has already helped manage risks for over 20 protocols including Aave and GMX.

Stablecoin 2.0 infrastructure company WSPN completed a $30 million seed round financing, led by Foresight Ventures and Folius Ventures, with participation from Hash Global, Generative Ventures, Yunqi Partners, and RedPoint China. WSPN is a new generation stablecoin infrastructure company aiming to provide users with a more secure, efficient, and transparent payment solution through building a global compliance system and a new payment ecosystem. WSPN includes core members from CTH, Paxos, and Visa, with over 10 years of experience in payment and stablecoin operations. Currently, WSPN has obtained regulatory licenses in multiple major countries and regions, and has received support from over 30 exchanges, more than 10 mainstream wallets, dozens of major payment institutions, and market makers.

Orderly Network completes a $5 million strategic financing, with participation from OKX Ventures

Web3 liquidity provider Orderly Network raised $5 million in its latest strategic financing. This round of financing was participated by OKX Ventures, Manifold Trading, Presto Labs, LTP, Nomad Capital, and Origin Protocol. Orderly Network integrates orders from multiple blockchains to solve DeFi liquidity issues, supporting Ethereum mainnet, Polygon, Optimism, Base, Arbitrum, and Mantle. The platform plans to use this funding to develop new products, strengthen its on-chain liquidity, and prepare for its token generation event, where token holders will receive 60% of the trading fees.

Ion Protocol, a protocol for releasing liquidity for stakers, announced the completion of a $4.8 million financing, with participation from Gumi Capital Cryptos, Robot Ventures, BanklessVC, NGC Ventures, Finality Capital, and SevenX Ventures, with a total financing amount of approximately $7 million. The new capital will be used to support and develop a native revenue primitive called Nucleus, aimed at helping solve the monetization problem for rollups and application chains, potentially nurturing new decentralized application use cases in its ecosystem.

Decentralized investment platform BasedVC completes a $2 million seed round financing

The decentralized investment platform BasedVC completed a $2 million seed round financing at a valuation of $15 million, with participation from Neo Tokyo, Kongz Capital, as well as angel investors such as Mario Nawfal, Crypto Banter, Ashcrypto, and Kmanu. According to the team, "In the past year, BasedVC platform has generated over $65 million in revenue and invested in over 50 cryptocurrency projects. BasedVC allows the community and retail users to participate in seed rounds and private rounds, avoiding the high risks of public rounds, and raising funds from strategic communities such as Neo Tokyo."

Web3 Games

Web3 Games

Autoverse Studios Completes $8 Million Financing, Led by White Star Capital

Web3 game development studio Autoverse Studios announced the completion of an $8 million financing round, led by White Star Capital, with participation from Sfermion, RockawayX, Ocular, Sidedoor Ventures, MCE Group, Saison Capital, and LiquidX. According to reports, Autoverse Studios is an innovative PC and mobile game developer and publisher. Founded in 2022, Autoverse is headquartered near Los Angeles, California. Auto Legends will be a free game available on PC, Mac, iOS, and Android platforms. However, players can choose to utilize Web3 features for a deeper experience. The game is currently in closed alpha testing on PC and Mac at the Epic Games Store.

Web3 Game Platform GAMEE Completes New Round of Financing, with TON Ventures Participating

Web3 game platform GAMEE, a subsidiary of Animoca Brands, announced the completion of a new round of financing, with participation from TON Ventures. The new funding will support GAMEE's WATCoin ecosystem, including the WatBird Mini App project. GAMEE will further integrate TON-based digital assets (such as tokens and NFTs supported by TON) into GAMEE's Telegram Mini App to enhance user engagement.

AI

Decentralized AI Blockchain Platform Sahara AI Completes $43 Million Financing, Led by Binance Labs

Decentralized AI blockchain platform Sahara AI announced the successful completion of a $43 million financing round, led by Binance Labs, Pantera Capital, and Polychain Capital, with participation from Samsung, WeWork, and Thailand's Kasikornbank, among other top global investment institutions. Additionally, several leaders in the AI industry and academia have also joined forces, including Laksh Vaaman Sehgal, Vice Chairman of Motherson Group, and Rohan Taori, a scientist at Anthropic. Founded by Sean Ren, an AI professor at the University of Southern California, and Tyler Zhou, former Investment Director at Binance Labs, Sahara AI has established partnerships with 35 leading enterprises and research institutions such as Microsoft, Amazon, and MIT since April 2023. This financing will be used to expand the team, enhance AI blockchain performance, and accelerate developer ecosystem development.

Decentralized AI infrastructure project Rivalz Network raised $9 million in recent rounds of financing, with major investors including Delphi Ventures, D1 Ventures, Gate.io, Magnus Capital, and Cogitent Ventures. Other investors include Zee Prime, Caballeros, Formless Capital, Dweb3, Mask.io, BitsCrunch, SL2, Momentum6, 4RC, Stakewithus, NewTribe, as well as angel investors from 0g Labs, Clique, Metaking Studios (Blocklords), and Vader Research. Rivalz is addressing a key bottleneck in AI development— the demand for AI-ready, validated, and private data.

KIP Protocol announced the completion of a new $5 million private placement financing round, led by Animoca Ventures and Tribe Capital. This brings KIP's total financing to $10 million, further advancing its mission as the Web3 foundational layer for AI. Other participants in this round of financing include GBV Capital, DWF Ventures, and Morningstar Ventures. KIP Protocol is dedicated to breaking industry monopolies through decentralized AI (DeAI) innovation and helping AI developers deploy and monetize assets through its D/RAG (Decentralized Retrieval Augmented Generation) framework.

Infrastructure & Tools

Essential Completes $11 Million Series A Financing Led by Archetype, and Launches Essential Devnet

"Intent-based" blockchain infrastructure Essential announced the completion of an $11 million Series A financing round, led by Archetype, with participation from IOSG, Spartan, Mirana, Amber Group, Maven 11, Bodhi Ventures, Big Brain Holdings, Heartcore Capital, Selini, DCLM, and PropellerHeads, as well as founders and angel investors from companies such as Celestia, Hashflow, Enso, Barter, LI.FI, Astaria, GlueX, Bebop, and Sorella. Essential introduces intent-driven blockchain infrastructure and Essential Devnet, aimed at making blockchain technology more intuitive through declarative architecture. The newly developed Pint language provides constraints for programmable intent, optimizing user and developer experiences. Essential plans to drive the next paradigm shift in blockchain by reducing on-chain computation, improving scalability, and connecting with the DeFi world through its public chain.

Ethereum L2 Developer Parfin Completes $10 Million Financing, Led by ParaFi Capital

Cryptocurrency infrastructure company Parfin, focused on enterprise-level blockchain development, raised $10 million in its first round of Series A financing. This financing was led by ParaFi Capital, with participation from Framework Ventures, L4 Venture Builder, and Núclea. Parfin plans to raise an additional $16 million in its second round of Series A financing, bringing its total financing to $38 million. Founded in 2019, Parfin will use this funding to continue developing its custom Rayls network and expand into global markets, particularly in Latin America. Rayls is a permissioned EVM blockchain designed for enterprise applications such as tokenization, central bank digital currencies (CBDCs), and inter-institutional transactions. All accounts must comply with KYC requirements while maintaining user privacy, and connect with the DeFi world through the Rayls public chain. The blockchain is currently involved in the CBDC pilot of the Central Bank of Brazil and was selected for the Mastercard Start Path program in May. Additionally, Parfin offers stablecoin, fiat on/off-ramp, and crypto brokerage services.

Bitcoin network infrastructure developer Satflow announced the completion of a $7.6 million seed round financing, with Variant Fund leading the round and participation from Nascent, Coinbase Ventures, UTXO Management, Hash3, CMS, Asymmetric, Robot Ventures, Bitcoin Frontier Fund, Sora Ventures, and MEME LAND. Angel investors include Nick Hansen from Luxor, Udi Wertheimer from Taproot Wizards, FarmerJoeDomo, Udi Wertheimer from Taproot Wizards, and Danny Diekroeger from Deezy. Satflow will focus on providing infrastructure for market makers and bulk traders, elevating Bitcoin L1 to institutional-grade quality and enhancing decentralization.

Digital Identity Project Holonym Foundation Completes $5.5 Million Seed Round Financing, Led by Finality Capital and Paper Ventures

Decentralized network digital identity security development organization Holonym Foundation announced the completion of a $5.5 million seed round financing, led by Finality Capital and Paper Ventures, with participation from Draper Dragon, Arrington Capital, Lightshift, Zero Knowledge Ventures, and Zero DAO. Holonym Foundation is building critical middleware and applications to empower Web3 users with ownership, management, and selective sharing of data, providing privacy and security guarantees to enhance the digital identity capabilities of every citizen.

Rhinestone Completes $5 Million Seed Round Financing, Led by 1kx

Modular intelligent account development company Rhinestone raised $5 million in a seed round financing led by 1kx, with support from CoinFund, Lattice, Heartcore, Circle Ventures, and others. Rhinestone is dedicated to building intelligent account infrastructure with enhanced interoperability, security, and functionality. Rhinestone provides tools for developers through self-contained modules aimed at improving the interoperability and security of smart contracts. The company is also developing a platform to enable developers to distribute and monetize their modules, which can be installed by end users and dapp developers. This financing will be used to expand the team and intelligent account infrastructure, as well as to expand the developer incentive program.

Parallel EVM L2 Network Reddio Completes Seed Round Financing, Led by Paradigm and Arena Holdings

High-performance parallel Ethereum Layer2 network Reddio announced the completion of seed round financing, led by Paradigm and Arena Holdings. Founded by Neil, a graduate of Stanford Graduate School of Business and the National University of Singapore, who has previously worked at companies such as Twilio and PingCAP. The team's high-performance distributed database has been used long-term by Bybit, OKX, and Square. The Reddio project has launched staking and task systems and will soon announce the results of a new Series A financing round, with participation from several well-known institutions.

Other

DAO

Crunch Lab Completes $3.5 Million Seed Round Financing, Led by Multicoin Capital

Cryptocurrency investment company Multicoin Capital led a $3.5 million seed round financing for Crunch Lab. Factor Capital, Fabric VC, and Elixir Capital also participated in this financing, bringing Crunch Lab's total financing to $5.3 million. Crunch Lab is a core contributor to CrunchDAO, a platform that provides distributed machine learning competitions for AI researchers. Participants can earn CRNCH tokens and enjoy governance rights through competitions. Crunch Lab's founder and CEO, Jean Herelle, revealed that the company has entered the prototype testing phase with two financial institutions and is expected to bring in $2 million in annual recurring revenue (ARR) for Crunch Lab this year.

Goldilocks DAO Completes $1.5 Million Seed Round Financing, Led by Hack VC and Shima Capital

Decentralized autonomous organization network Goldilocks DAO, based on Berachain, announced the completion of a $1.5 million seed round financing, led by Hack VC and Shima Capital, with participation from AtkaBlockchain, Rana, and Public Works. Specific valuation information has not been disclosed. Currently, GoldilocksDAO allows users to trade tokens, provide liquidity, and participate in NFT-based loans.

Cryptocurrency Mining

Bitcoin Mining Company Digihost Completes $4 Million Private Placement Financing

Bitcoin mining company Digihost announced the completion of a $4 million private placement financing, including the sale of 3,636,363 shares of the company at a price of $1.1 per unit. The net proceeds will be used for infrastructure expansion-related acquisitions and general operating purposes.

Centralized Finance

Stablecoin payment platform Sling Money announced the completion of a $15 million Series A financing, led by Union Square Ventures, with participation from Ribbit Capital and Slow Ventures. This financing round will help Sling Money advance its mission of making global payments instant, convenient, and low-cost, using Pax Dollar (USDP) for transfers. USDP is a USD-backed stablecoin issued by Paxos Trust Company, and its reserves are subject to strict regulation by the New York State Department of Financial Services. Sling Money enables users to make instant transfers with almost zero fees in over 50 countries, using stablecoin technology and a user-friendly interface. The company previously raised a $5 million seed round financing led by Ribbit Capital.

Venture Capital

Former TON Foundation Members Establish TON Ventures, with an Initial Fund Size of $40 Million

Former TON Foundation members Ian Wittkopp and Inal Kardan have established TON Ventures and launched the first fund worth $40 million. The fund aims to support projects based on the TON blockchain. Wittkopp and Kardan previously served as Director of TON Accelerator and Game Director, respectively. TON Ventures primarily invests in early-stage projects within the TON ecosystem, focusing on decentralized finance, gaming, advertising/marketing, and regulated financial products. Wittkopp stated that TON Ventures has supported over ten startups, including Catizen, Tradoor, and Evaa Protocol. The average investment size of the fund is $500,000 or less, but it also participates in larger "strategic" transactions in later stages. The fund is expected to be fully deployed within a year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。