Author: Luccy, BlockBeats

Since the beginning of this year, the market has been extremely lacking in new narratives. The brief bull market brought by ETFs did not truly inject new vitality into the cryptocurrency market. Meme has become the most profitable field, while VC coins have been repeatedly criticized. Especially in the DeFi projects, there have been almost no waves in several rounds of fund rotation, and they are still living in a difficult situation.

In order to bring value back, value coins are all seeking their breakthrough. "Community consensus" is the unified answer they have given, and community activity has also become the indicator for judging the strength of consensus. Jupiter is one of "them".

Jupiter's co-founder, meow, has been hiding in the cryptocurrency developer community, previously serving as the chief advisor for Instadapp, Kyber, and Blockfolio. He is also one of the co-founders of the largest wrapped token wBTC and a founding contributor to the Handshake project. However, meow has never publicly revealed his identity, until two days before the JUP airdrop, when he made a public appearance and accepted an exclusive interview with Luke Belmar, the founder of Capital Club.

In the interview, meow emphasized the importance of community consensus multiple times. He criticized the overuse of the word "community" in the current cryptocurrency world, believing that only strong consensus can truly be called a "community", and it is consensus that shapes currency.

To this end, Jupiter has invested a lot of effort in building and maintaining the community. In addition to the PPP experimental cooperation partner Irene Zhao's exposure, and the JLP contract platform holding up in the market downturn to become the "best dollar-cost averaging target", Jupiter has attracted enough attention for the community. However, this attention does not seem to have brought much value increment to JUP.

Hottest DEX Community

At the Solana Breakpoint hackathon a year ago, meow's speech was hailed as one of the most popular. Feeling that consensus had already accumulated amidst the cheers, he decided to take the first step and convert these Jupiter enthusiasts into a community.

Jupiter hopes to build the most vibrant, forward-looking, and non-professional community in the cryptocurrency field. To achieve this, Jupiter has established dedicated working groups for media channels such as Twitter, DC, website, YouTube, and Reddit, and is jointly operated by team members and community members.

Under careful operation and maintenance, Jupiter has created a thriving and lively community. According to similarweb data, Twitter accounts for 66.25% of all of Jupiter's social media traffic. Overall, Jupiter's social media traffic accounts for 3.49% of website traffic. Compared to Raydium, which is also known as the new leader of Solana, Jupiter is better at converting social media influence into traffic, mainly relying on Twitter for dissemination. This also indirectly indicates that Jupiter has a closer interaction with the community.

The upper image is Jupiter, and the lower image is Raydium.

"Thousand-Person Meeting" is Daily

Just like fan circles use different abbreviations to filter their small groups, Jupiter is also using its own language to create a core circle.

Meow has always been creating different abbreviations, and in most cases, he does not provide textual explanations for these abbreviations. Only by watching Jupiter's Planetary Call can one understand the meaning of the abbreviations. The audience also seems to be willing to maintain a sense of "only I understand" pride, using abbreviations to chat in the comments section, and bystanders who want to integrate into the circle also have to learn new vocabulary.

The Planetary Call is broadcast live on YouTube and Twitter at the same time every Wednesday. Meow and Uplink leader Kash participate in hosting every episode, and other team members share the project's recent developments in detail, allowing the community to gain a deeper understanding of the Jupiter ecosystem. Almost every episode on YouTube has been viewed over 4,000 times, and the number of views on Twitter can reach tens of thousands.

The left image is the Jupiter YouTube live section, and the right image is the Twitter live broadcast of the 20th episode of the Jupiter Planetary Call.

Looking at the entire cryptocurrency ecosystem, it seems that only Ethereum can complete this amount of work. Ethereum holds core developer calls every week, hosted by the Ethereum Foundation. As a live meeting that has been held for hundreds of episodes, the average number of views on YouTube mostly does not exceed 500. When searching on Twitter with keywords, the first tweet on the homepage is still from 2022.

The left image is the Ethereum YouTube live section, and the right image is the Twitter search results for "ETH" and "ACD".

From the interaction perspective, the comments section during Jupiter's live broadcast is always active, even flooding, but the comments section for Ethereum's meetings is mostly blank. Every Jupiter video has comments below, while Ethereum's meetings have fewer comments, and there may even be robot advertisements.

The left image is the Jupiter Planetary Call, and the right image is the Ethereum core developer meeting.

In terms of community proposals, DAO members can decide on the allocation of tokens for various working groups in Jupiter. The Uplink working group has the fewest votes for the budget, about 178 million. But even with the current JUP staking amount, the voting rate four months ago still exceeded 50%. In addition, the proportion of votes in favor of most proposals exceeds 70%, and the abstention votes are all maintained at below 15%.

From left to right are the core working group, website working group, Catdet (DC) working group, Reddit working group, and Uplink working group budget proposal.

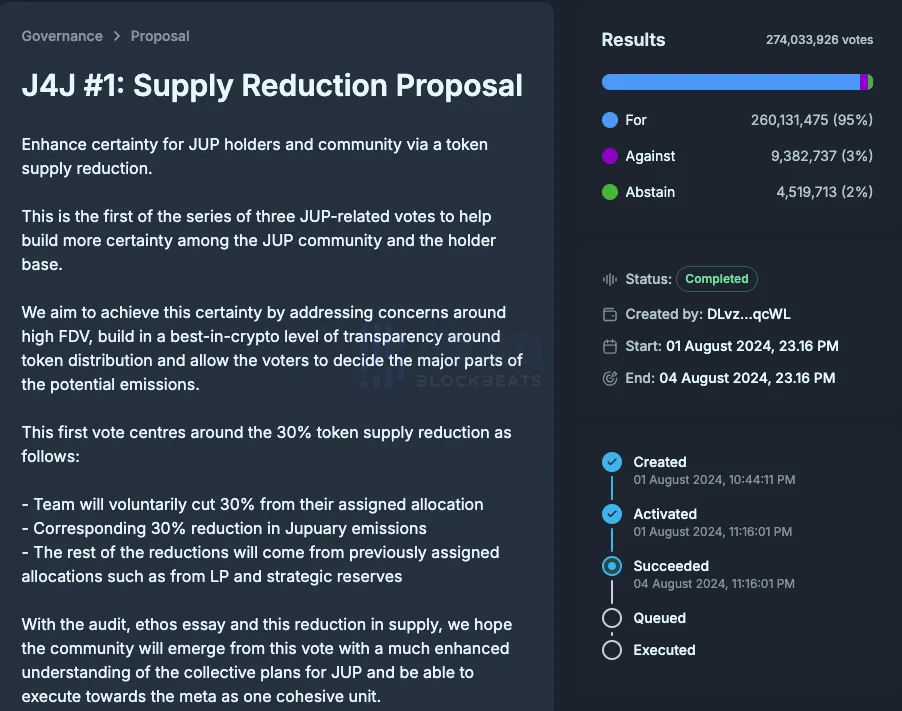

In addition, to further "get closer to the people", Jupiter proposed in mid-June to reduce token supply, and the team voluntarily cut 30% from the allocated tokens, corresponding to a 30% reduction in token emissions. The remaining reduction will come from previously allocated allocations, such as limited partnerships and strategic reserves. The proposal was voted on August 1st and collected over 160 million votes in just half a day. It ultimately received 95% support from the voters, with 274 million votes, setting a record for DAO voting rates.

Perhaps Jupiter believes that voting to determine token allocation is not enough. On July 31, they announced a protocol draft, which includes a public review of JUP's distribution every 6 months; 100% disclosure of token sales if any tokens are released; and careful management of any tokens released from reserves for strategic reasons, ensuring proportionality with market liquidity and at least 3 months' advance notice.

All wallets will have clear labels for easy tracking of JUP usage. It is worth noting that all community-distributed tokens will be allocated through DAO voting to achieve complete visibility.

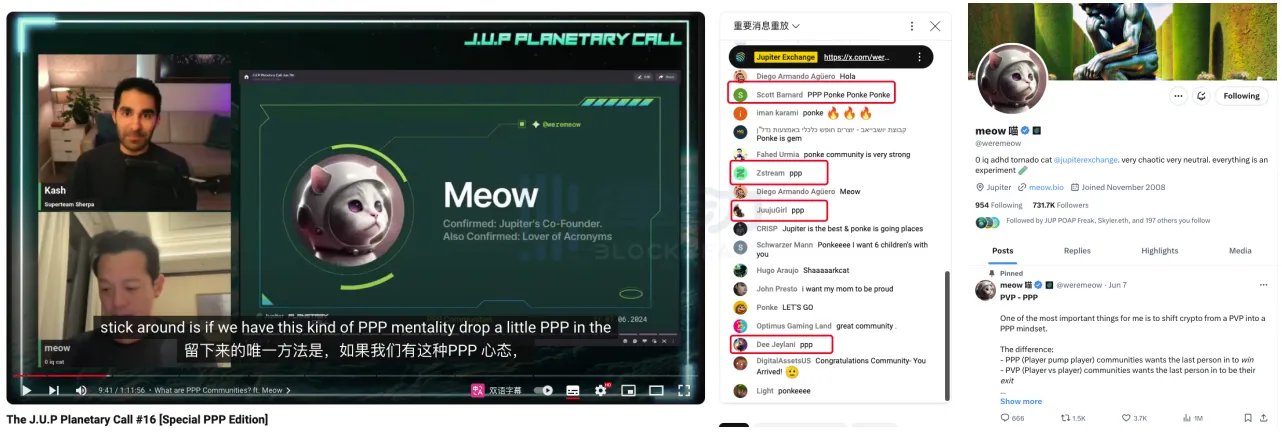

In addition, to address the chaos of meme coins, Jupiter has implemented PPP. According to meow's explanation, the core focus of the PPP community should not be to attract others and hope to abandon them, but to have more allies and jointly build a common long-term future.

To achieve PPP, Jupiter first preached the concept of PPP, and even held a Planetary Call specifically on the theme of PPP. During the 1.5-hour live broadcast, meow and Kash had conversations with 6 meme players. The retail investors participating in the meeting are not well-known KOLs, and the recommended memes are not gold dogs, but still attracted thousands of viewers and flooded the PPP in the comments section.

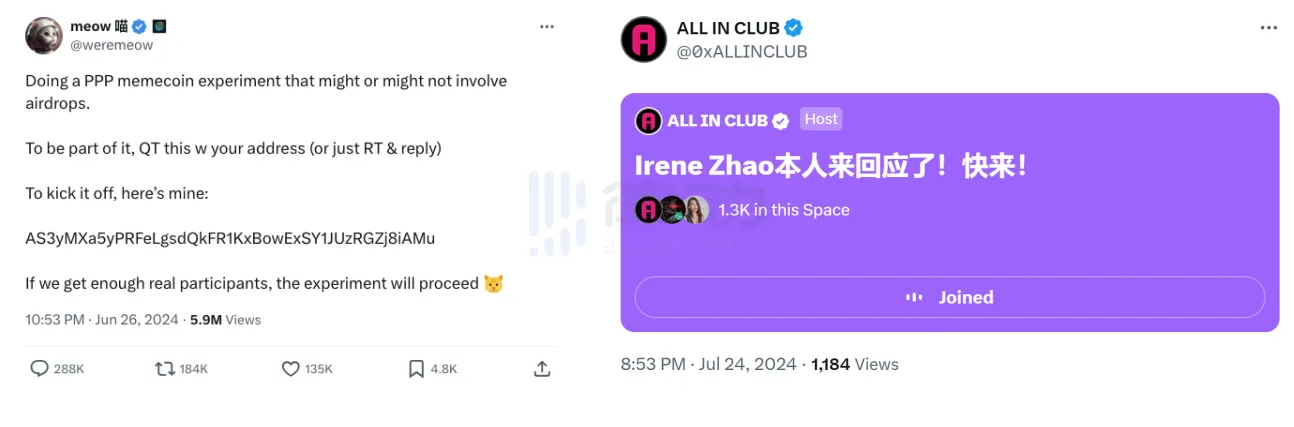

Subsequently, meow explained the PPP concept in a post and conducted a PPP experiment, calling on the community to leave their Solana addresses in the comments section. In an information asymmetry situation, the PPP experiment attracted hundreds of thousands of participants within a month.

"Let's Fucking Go"

In the process of continuous clarification, Jupiter realized that it is not enough to let the community be mere spectators to truly be "active". They should be involved and become part of the builders.

So Jupiter launched the Launchpad and handed the selection of launch projects to the community, and Jupiter DAO was born for this purpose. In February, Jupiter launched DAO, requiring a staking of 50 JUP to participate in voting. As of now, the total staked JUP exceeds 350 million, with over 550,000 unique addresses.

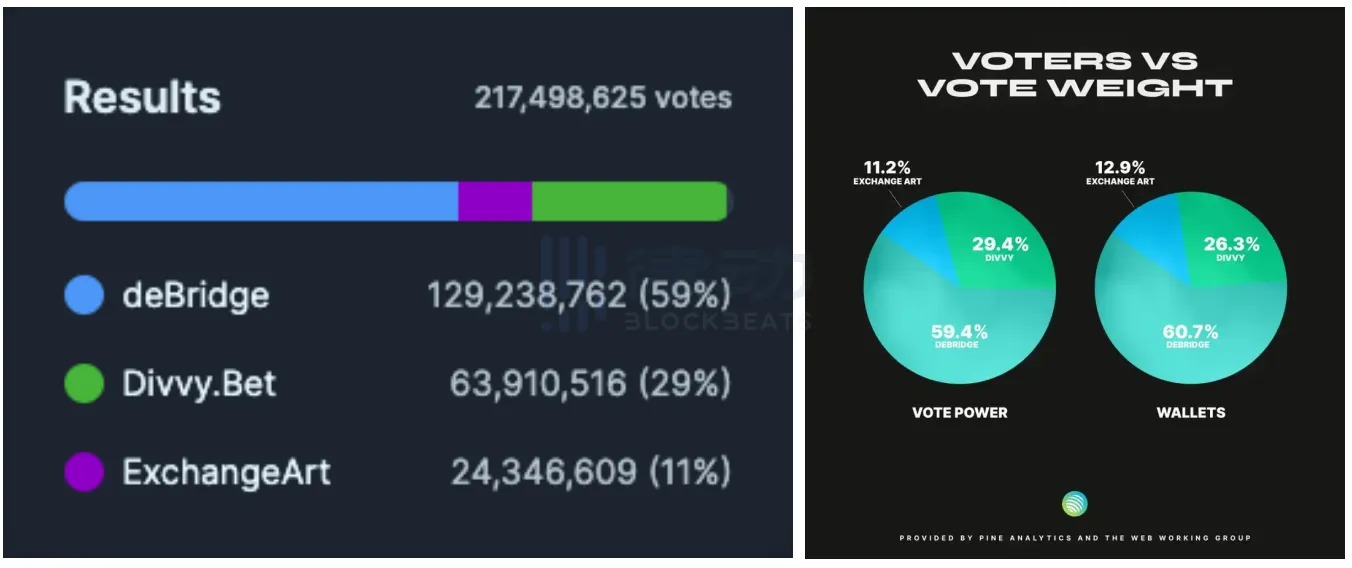

After the first test proposal was approved, Jupiter immediately held the first LFG Launchpad vote, attracting over 200 million JUP votes. It is worth noting that in Jupiter DAO, the voting power held by the public is almost equal to that of the whales. According to Jupiter's data for the 3rd phase of LFG, the voting power data and the number of independent voting wallets are quite consistent, with the winning projects receiving 59.4% voting power and 60.7% support from independent voting wallets, respectively, which is close.

Not only does Jupiter allow the community to participate in voting, but it also allows DAO members to participate in the entire process of the Launchpad. Jupiter LFG Launchpad is divided into four steps: application, preaching, voting, and launch.

Project applications need to be posted on the Jupiter forum, so not only the Jupiter team, but the entire Jupiter community can be the project's reviewers. The level of interaction between the project and the community is considered "community sentiment" and is a major factor in influencing Jupiter's candidate selection. To become a candidate, participating projects will have to constantly pay attention to Jupiter community dynamics, answer questions for members, and this positive feedback has won enough traffic and attention for the entire ecosystem.

Candidate projects will have a dedicated channel in the Jupiter official DC group and will conduct AMA meetings with Jupiter, increasing the opportunities for community communication and review. After the live broadcast, these AMA segments will be edited and re-released, with almost all segments receiving thousands of views. The final winning project and the launch time of the Jupiter protocol token.

During the public vote, a large number of users participated in the Launchpad like investing in Shiba Inu, and LFG was jokingly referred to as the abbreviation for "Let's Fucking Go". According to similarweb data, during the Launchpad period, the LFG official website received over 3.23 million visits. During the same period, the DAO conducted two LFG votes, with the page visits exceeding 3.4 million, and the data is basically consistent.

As a platform that has been officially launched for less than six months, Jupiter Launchpad's traffic is outstanding compared to other Launchpad platforms. The four major on-chain Launchpad platforms that were once popular at the end of last year—Bounce Brand, BakerySwap, Analysoor, and TurtSat—had a total visit count of only 355,000, about one-tenth of Jupiter's.

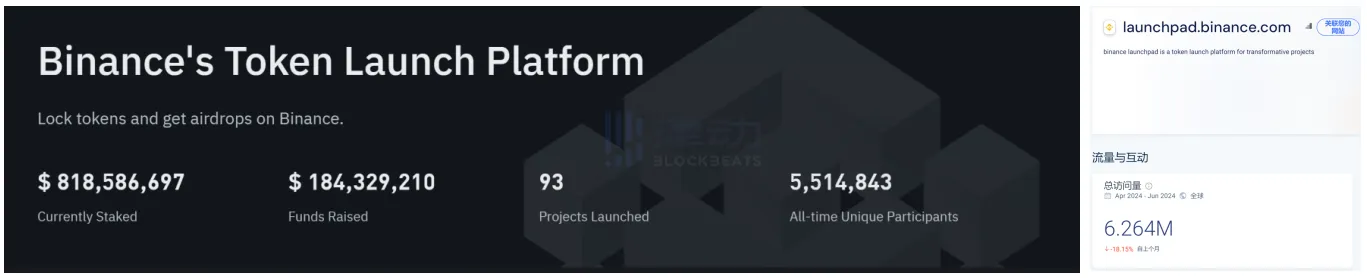

In comparison to off-chain platforms, the most active Binance Launchpad has launched 93 projects, with over 5.5 million unique participants, which is 10 times the number of projects and unique addresses of Jupiter. In the past three months, Binance has launched a total of 6 projects, with the Launchpad website receiving 6.26 million visits, while LFG, with the background of launching 3 projects, has even slightly exceeded half of Binance's visits.

Misaligned Consensus

The effort and effect that Jupiter has put into community building can be said to be equivalent. The team has proven its willingness and ability to attract enough collaborators.

After announcing the LFG rules for the first time, Jupiter received 20 project applications to participate in the first round of LFG elections on the Jupiter forum, and new project applications continued to emerge. Countless meme community members shouted PPP and viewed Jupiter as "revolutionaries". Whether it's from social media interactions to DAO voting, participating in LFG, or preaching PPP, Jupiter has attracted countless active users to participate in almost every move, but does high popularity really mean strong consensus?

Why Are You Voting?

The winning project Zeus Network was officially listed on the Jupiter LFG Launchpad on April 4, with a total supply of 50 million ZEUS tokens, ending at a price of $0.776. OKX immediately listed ZEUS, and the trading volume exceeded $100 million within 20 minutes of opening. However, the good times did not last long. Just a week later, ZEUS could not withstand the market pressure and plummeted to $0.185, losing 10 times its opening price.

The day after the sharp drop of ZEUS, the second round of voting for LFG began. The market did not give retail investors much time to react, and they continued to rush into the next project, throwing all their enthusiasm into the second round of voting.

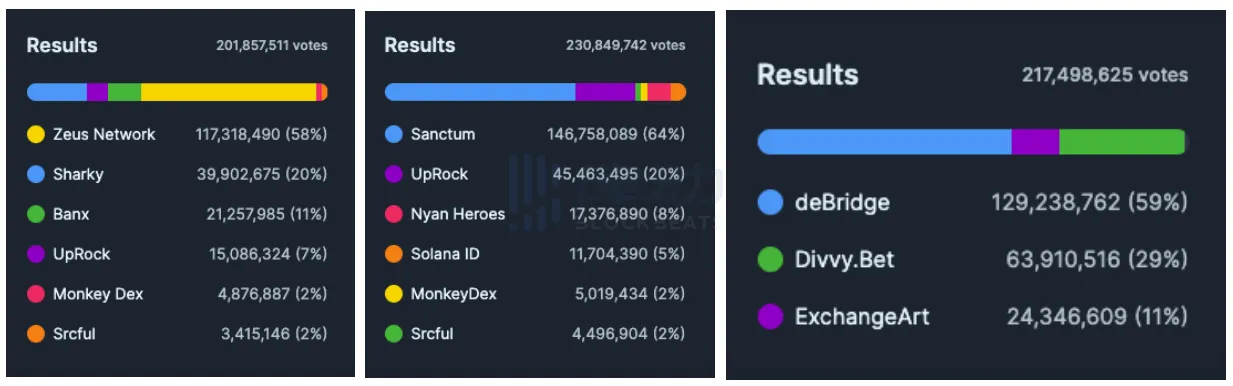

The second-phase winning project, Sanctum, had multiple interactions with the Jupiter team in the early stages of the campaign. Its related videos uploaded to the official Jupiter YouTube channel have been viewed thousands of times and received a lot of support from KOLs. Not only did it attract over 230 million votes in the voting, becoming the proposal with the most votes in the LFG, but Sanctum also received 64% of the votes in this proposal, while the support rate for the first and third phase LFG first-place candidates did not exceed 60%.

Results of the first, second, and third phase LFG proposals from left to right

However, Sanctum fell into an airdrop public relations crisis as a result. On July 16, Sanctum officially opened the airdrop application query window. According to its airdrop rules, the team selected 2,000 "sincere contributors" to distribute 50 million tokens through active review. These so-called "sincere contributors" refer to users who promoted Sanctum on social media, which inevitably made the "loyal players" who had invested a lot of money feel dissatisfied.

The project was chosen by the community, but it ultimately had a bad outcome, which seems to indicate that consensus was not reached. The original intention of Jupiter's Launchpad was for projects to work in synergy with the Jupiter ecosystem and Solana, which should not only be the direction of the project's development but also one of the decision factors for community members to choose to launch a project.

LFG project application format, image source: Jupiter Forum

However, for community members, participating in LFG voting is like participating in an investment. Once a project performs poorly, it means investment failure, so the tendency when voting is to favor projects that are unique and have good advantages.

Informed sources told BlockBeats that winning LFG projects have high participation, meaning that a large number of users are using their protocols. "Personally, I vote for projects that can maximize my benefits." For him, projects that he has used before or wants to use will be more likely to get his attention, "because launching through LFG has a good impact on the project itself (and valuation), and I also get airdrops from the project."

In addition, compared to projects running at the same time, the winning projects Zeus and Sanctum both have strong financing backgrounds. Crypto Wei explained to BlockBeats, "Retail investors' voting logic is influenced by VCs and CEXs, believing that only narratives endorsed by VCs have a chance to be listed on major exchanges."

Zeus announced in early April that it had completed an $8 million financing at a valuation of $100 million, with investors including Mechanism Capital, OKX Ventures, Animoca Ventures, and The Spartan Group, among other well-known VCs. Angel investors such as Solana co-founder Anatoly Yakovenko, Stacks co-founder Muneeb Ali, and Mechanism Capital founder Andrew Kang also participated in this round of financing.

Similarly, as a winner, on April 4, Sanctum announced the completion of a seed round extension financing, led by Dragonfly, with participation from THE CMS, DeFiance Capital, GenblockCapital, Jump Crypto, Solana Ventures, and many other VCs. In addition, angel investors from projects such as LayerZero Labs and Drift Protocol also participated in this round of financing, with a total financing amount of $6.1 million.

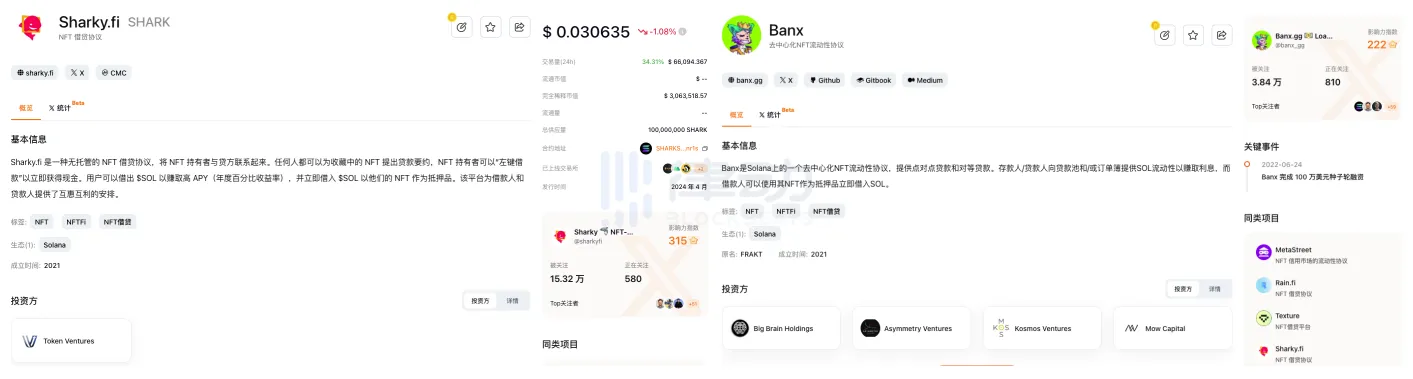

Compared to their projects running at the same time, the top-ranking NFT lending protocol Sharky.fi and NFT liquidity protocol Banx also have financing backgrounds, but the investment parties and financing amounts are far less than Zeus. Sharky.fi only has Token Ventures investment, and the financing amount and date are unknown, while Banx completed a $1 million seed round financing in 2022, and infrastructure projects Uprock, clean energy network Srcful, and MonkeyDEX have no relevant financing records.

Image source: rootdata

So, if all the candidate projects are not endorsed by VCs, what criteria will retail investors use to make their choices? Crypto Wei used the logic of meme coin investment to explain this issue. Meme coins themselves are unendorsed cryptocurrencies, with much larger trading volumes than VC coins, but when they are voted on in Launchpad alongside VC coins, it becomes difficult for people to make judgments.

"This is the paradox of the Launchpad model," Crypto Wei believes that not only Jupiter, but also Launchpad platforms including DaoMaker and Seedify, fundamentally have no difference, as they all cancel on-chain indicators without reducing risk exposure.

In addition, due to Jupiter's emphasis on fairness and deliberate downplaying of vote-buying factors, all users staking JUP (at least 50) can participate in voting, with each wallet being able to select only one project, and 1 JUP representing one voting right. Wind No commented, "This makes voting a formality."

There's trust

At the end of July, Jupiter launched a new meme launch—CAT Launch Mechanisms, announcing the first launch project ASIANMOM.

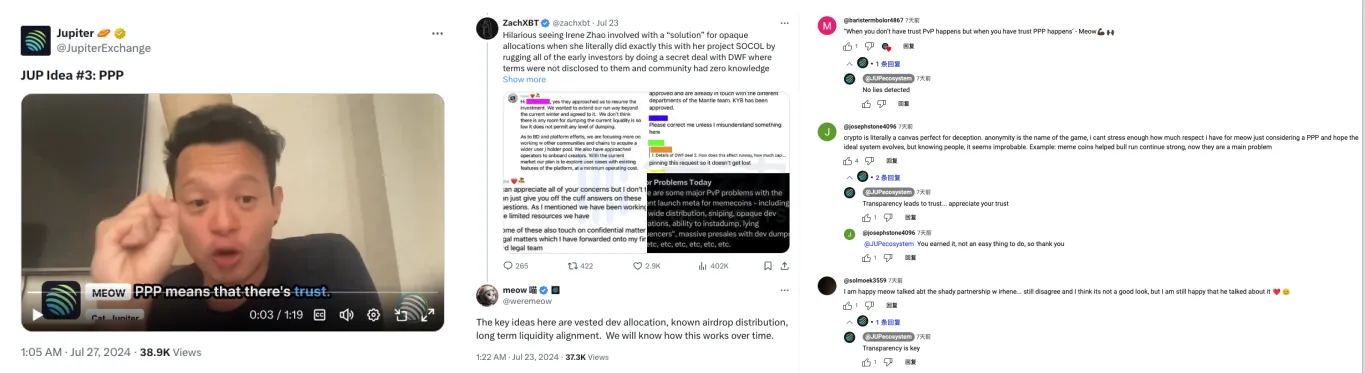

When ZachXBT pointed out that the partner Irene Zhao had been involved in multiple fraudulent projects, Jupiter unquestionably became the center of public opinion, and the topic of Irene and Jupiter's partnership only gained more attention. ALL IN CLUB promptly held a space, attracting over 1,300 online listeners at one point, and even Irene appeared to explain, but it seems that the community consensus did not strengthen because of the attention.

Not only did the Chinese community criticize Irene, but the English community also eagerly demanded an explanation from Jupiter.

On the night of the space, Jupiter's response in the 22nd Planetary Call was "trust," with meow stating, "When you don't have trust, PVP happens, but when you have trust, PPP happens." Irene also explained to BlockBeats that the meme launch mechanism is very complex and requires long-term commitment, such as long-term lock-ups, so it requires a lot of time, effort, and community interaction. It can be seen that Jupiter still considers "faith" as the main means of promoting PPP.

If the community's trust in PPP previously came from Jupiter's leading position in Solana, then the trust guarantee for ASIANMOM can only rely on transparency. Just as Jupiter responded to ZachXBT's doubts in the community, Irene also repeatedly stated in the space, "All token supply allocations will be very open and transparent."

Jupiter's transparency in the community is evident, but the flow of funds in projects that Irene has been involved in over the past 3 years is unknown, and this experience seems to have nothing to do with "transparency." Although Irene stated that there will be an 18-month token lock-up period in the ASIANMOM project, and it will be completely transparent and traceable, the seeds of doubt have already been planted, and the community finds it hard to pretend not to care.

In fact, Jupiter has never hidden its desire to bring memes to the Launchpad, as long as the meme is good enough, it can still apply to start LFG. However, all projects submitted for LFG applications are based on old concepts such as GameFi, NFT, DeFi, and infrastructure. Therefore, Jupiter personally stepped in, launching the meme Launch and promoting the PPP experiment. Irene also stated in the space that the collaboration with Jupiter had been confirmed long ago, and the content of the PPP experiment previously released was the result of joint discussions between the two parties.

LFG Launchpad guidelines, image source: Jupiter Forum

The day after the ASIANMOM incident, meow connected with MOTHER founder Iggy for a live broadcast that lasted over 2 hours. During this conversation, meow emphasized the importance of building trust and recognition in the Web 2 world. Perhaps what Jupiter values is Irene's combined experience in both Web2 and Web3 before entering the Web3 industry.

Before entering the Web3 industry, Irene had been a popular figure on Instagram for a long time, and after crossing over to Konomi, she shaped her brand image as CMO, accumulating enough Web3 popularity and fans in just six months. Irene explained to BlockBeats, "The Telegram sticker pack based on IreneDAO had over 1,000 downloads in 3 days, all from native Web3 Telegram users, and many industry bigwigs are paying attention."

The left image shows meow and Iggy's YouTube live broadcast, and the right image shows the IreneDAO sticker pack on Telegram

In the space, Irene emphasized that the main reason for this collaboration was that meow liked the Asian mom narrative. Upon seeing MOTHER, as a Chinese person, meow hoped that Asia could also have its own "mom." In meow's eyes, the "mom" narrative is not just a meme, but also symbolizes a continuously spreading cultural unit.

meow also mentioned that in popular culture, memes with the "mom" narrative increase the attractiveness and memorability of the meme in visual representation, and believes that this narrative symbolizes a perfect storm of emotional connection, polarization, and cultural understanding, making it an efficient and enduring meme. Therefore, Irene, with a community base for ASIANMOM, naturally became the target of Jupiter's collaboration.

But regardless of the reason, this collaboration was like a sudden attack on the community. Due to the lack of strong consensus, the trust and faith accumulated by the community seemed to collapse the moment ZachXBT released evidence.

Although Irene told BlockBeats that in order to make ASIANMOM successful, she and Jupiter's Launchpad, Uplink, and airdrop teams have been discussing how to implement the Launch, and most of the teams have been involved in designing the Launch mechanism, Irene's previous experience inevitably made community members doubt her strength and ability to lead.

In addition, Jupiter has not made any substantial progress other than promoting "trust." Therefore, when asked if he sees a bright future for PPP, Wind No commented, "meme is PVP, meow is not a savior, and can't change anything."

The best alternative

"Like JUP, avoid Launch disasters," this may be the highest praise from the community for Jupiter after frequent Launch failures. It also indirectly indicates that although high community enthusiasm has not brought strong consensus to Jupiter, it does not mean that capturing attention economics is a wrong decision.

The overall performance of DeFi in this cycle has been poor. According to Dune data, the daily trading volume of DEX reached $42.6 billion, with Uniswap accounting for half of it. However, according to DeFiLlama data, Uniswap's trading volume has been in a long-term stagnation since the beginning of this year, with no clear signs of growth. Therefore, DEX has to focus on attention markets, and LFG Launchpad and meme Launch are indispensable steps. An openly transparent LFG Launchpad can attract native Web3 traffic, while the meme Launch in collaboration with Irene can capture the market potential of Web2.

The left image shows the market share of DEX trading volume, and the right image shows the TVL and trading volume changes of Uniswap in 2024

The stagnation of DeFi development will be reflected in the altcoin market. According to Binance Research, the MC/FDV of altcoins in 2024 is only 12.3%, the lowest in nearly three years. Therefore, when asked about the poor performance of Launchpad, Wind No explained to BlockBeats, "Apart from the worrying nature of the projects themselves, this may also be related to the altcoin market."

Wind No believes that "the previous bull market saw new narratives such as metaverse, NFT, and GameFi, and most altcoin projects could rise as long as their concepts matched the hotspots. However, in this cycle, 99% of altcoin projects peaked at the opening, except for memes on Solana, there are no projects that have truly taken off."

It is also because the meme trend is becoming more frequent that TGBot, which provides functions such as copy trading, data analysis, and cross-chain assets, further suppresses the DEX market. According to Dune data, Banana Gun achieved a trading volume of $5 billion during the meme trend, and the current trading volume has exceeded $5.6 billion, with an average daily trading volume of over $23 million.

In just one year, the protocol revenue of Banana Gun has surpassed MetaMask, Curve Finance, and Raydium. Its ability to attract millions of dollars even caught the attention of Binance, which launched BANANA on its seventh anniversary as the first HODLer Airdrops project.

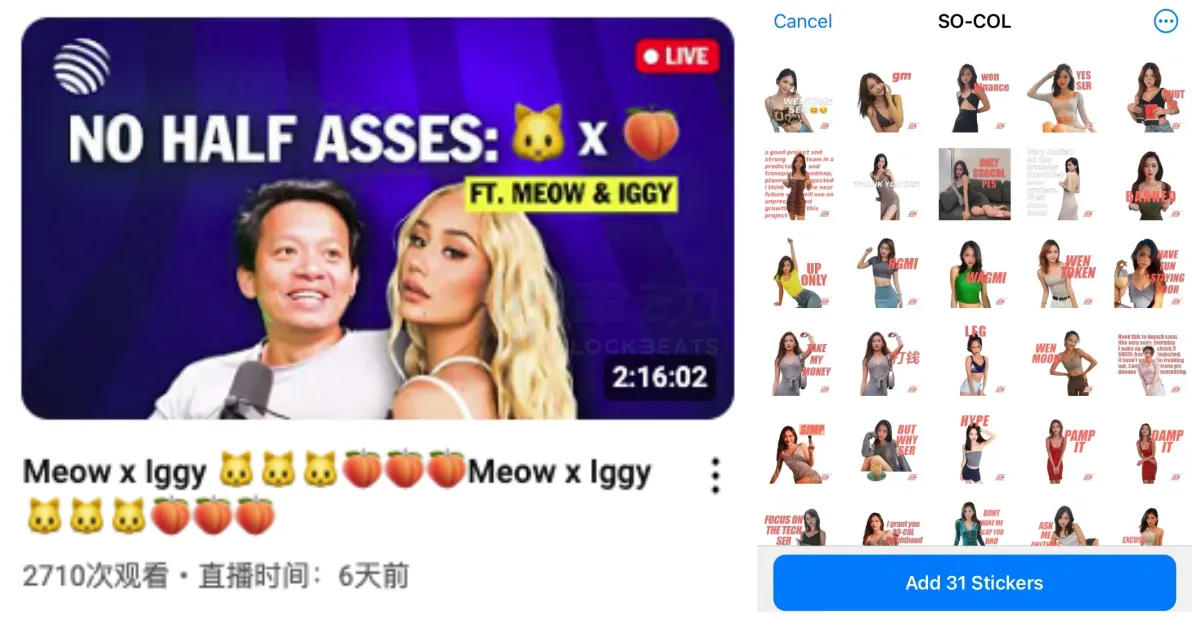

When comparing the DEX track, Solana DEX seems to have a slight edge. According to Defillama data, the DEX trading volume on Solana reached $55.876 billion in July, while the DEX trading volume on Ethereum during the same period was $53.867 billion, meaning that the monthly DEX trading volume on Solana surpassed Ethereum for the first time in history.

However, despite being a leader in Solana, Jupiter has long been in a state of being drained by Raydium. Dune data shows that most of Solana's DeFi players are distributed in Raydium. Although pump.fun has been trying to capture the user market on Solana since its inception, it has had a smaller impact compared to Raydium, another project of the Jupiter team.

The left image shows the ranking of public chains by DEX trading volume, and the right image shows the total number of users of different DeFi protocols on Solana

Moreover, according to Messari's report on Solana's ecosystem in the second quarter, Raydium became the main beneficiary of pump.fun, leading to a 77% month-on-month increase in its average daily trading volume to $8.67 billion and a TVL of $9.91 billion, making it the project with the highest TVL among Solana's DeFi protocols. In comparison, although Jupiter still accounts for 51% of the DEX trading volume on Solana, its market share was surpassed by Raydium at the end of the quarter.

With TGBot grabbing the spotlight and DEX competition, Jupiter is willing to "sacrifice feathers" to attract long-term players and funds, and going public is also a methodology.

From the legendary story of pizza and Bitcoin to the emergence of Ethereum and Musk promoting Dogecoin, each cycle has a unique narrative of going public. This round, there is the Bitcoin bull market brought by ETFs from outside the circle, and the meme bull market led by Solon within the circle. Celebrities entering the meme market may be the opportunity that Jupiter is seizing.

In the exchange with Iggy, meow firmly expressed the desire to be the first true Alpha. In his view, only becoming the first celebrity project to prove itself and succeed in the long term is truly Alpha. Introducing celebrities, creating release platforms, and brand collaborations are very important for increasing visibility and revenue. Jupiter hopes to create a roadmap that guides and increases awareness of specific tokens through collaboration and product creation.

This is essentially a competition for attention in the market. However, Irene does not believe that now is a good time for Web2 celebrities to enter. She explained to BlockBeats, "Currently, Web3 is mainly for on-chain players, and they are not very willing to pay for Web2 celebrities."

Furthermore, for Web2 celebrities to succeed in launching projects, they need to have a certain level of visibility in Web3. "It's not just anyone taking a selfie NFT that can become popular," Irene added. "They wanted to replicate IreneDAO at the time but failed because they didn't understand the play of memes and Web3."

When asked if PPP will be promoted in the Web2 community, Irene said, "The Web2 community doesn't even know what PVP is, so it's a bit early to talk about PPP." In addition, "Most Web2 celebrities are still only driven by the money-making effect and are not really interested in this industry."

But Jupiter's focus on attention economics will not change because of this. They will still greedily seek out every opportunity and grab every potential "follower." As meow said, "Most of the best entrepreneurs, politicians, and influential people are masters of hype, because you need enough attention to take action."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。