Author: Luccy, BlockBeats

There is no gambler who always makes money, but there is a casino that always makes money. So, can one also make money on the chain by "investing in a casino"? After the launch of JLP, Jupiter seems to have provided an answer.

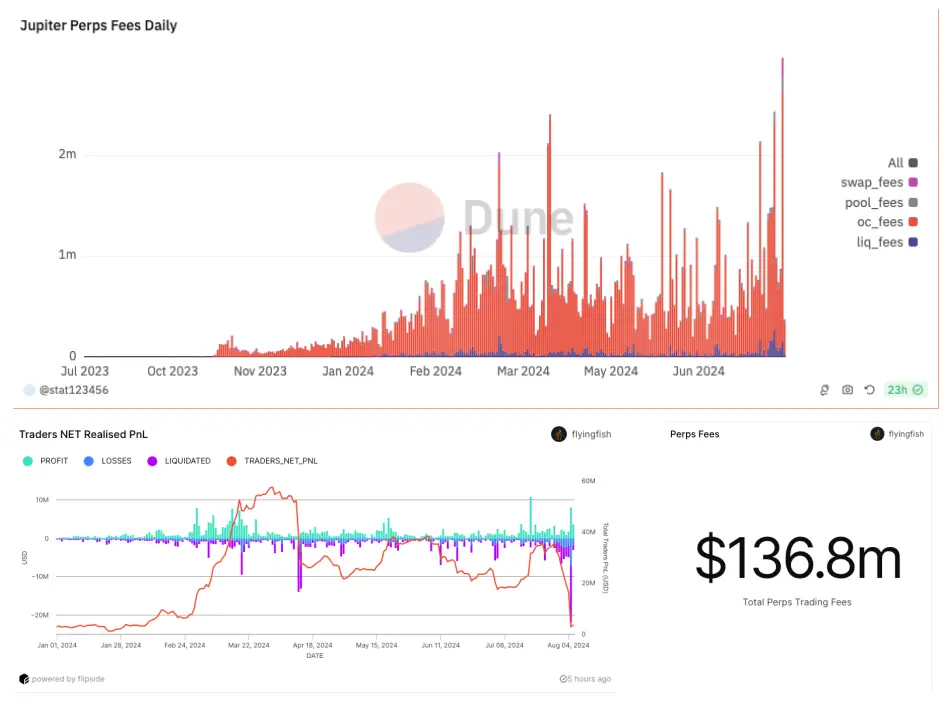

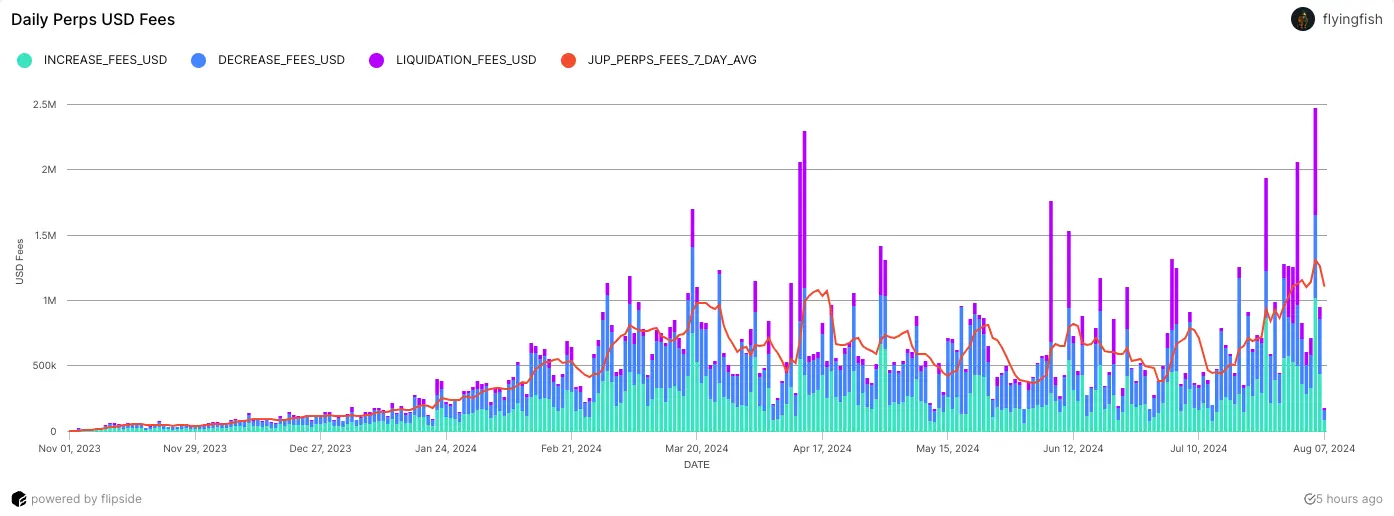

Since the beginning of this year, Jupiter's perpetual contract platform JLP (Jupiter liquidity provider) has become one of the best-performing and highest-yielding casinos. According to Dune data, the opening fee alone reached 2.475 million US dollars on August 5th, with an opening fee of only 0.0006 US dollars per transaction. However, according to flyingfish data, from the beginning of this year to the present, players playing contracts on Jupiter have only made a total of 3.7 million US dollars, while they have contributed 136.8 million US dollars in fees to JLP.

On August 5th, the overall market plummeted, and cryptocurrencies collapsed across the board, with Ethereum wiping out its year-to-date gains, and SOL also falling all the way to 110 US dollars. However, in the case of underlying assets being Bitcoin, Ethereum, and SOL, the decline of JLP was smaller than that of the underlying assets, leading many to wonder why JLP is so resistant to declines.

Contract Players: In Debt from the Moment of Opening

On JLP, the counterparty of the user is the platform itself. When traders seek leveraged positions, they borrow tokens from the pool, with the price being directly fed by the oracle. This model is also known as "partnering to open a casino", where users make money and the platform loses money.

The JLP pool supports five assets: SOL, ETH, WBTC, USDC, and USDT, and the contract supports leverage multiples of 1.1x-100x. Traders borrow relevant liquidity from the JLP pool, and after closing the position, they either profit or settle the loss, returning the remaining tokens to the JLP pool.

Taking a long position in SOL as an example, assuming the price of SOL is 150 US dollars and opening a 5x leverage, the trader borrows 5 SOL from the pool, worth 750 US dollars. If the price of SOL rises to 160 US dollars, the position increases to 800 US dollars, and the trader profits from closing the position. After closing the position, the trader needs to return the initial 750 US dollars in principal, with a total profit of 50 US dollars. However, for the platform, as the price of SOL has risen, the principal value is not enough for 5 SOL, so the platform's U-based funds remain unchanged, while the coin-based funds are in a loss state.

If the price of SOL falls to 140 US dollars, leaving the position at only 700 US dollars, the trader closes the position due to stop loss, and thus the trader needs to return the remaining 700 US dollars in assets to the platform and pay an additional 50 US dollars. Due to the fall in SOL, the amount of SOL corresponding to 50 US dollars increases, and the platform's coin-based funds are in a profit state, while the U-based funds remain unchanged. Similarly, taking a short position in SOL requires borrowing stablecoins.

The biggest difference between JLP and general perpetual contracts may be that the latter may have a negative fee rate. In order to make the price of perpetual contracts close to the spot price, the platform will subsidize the interest rate, but in the case of JLP, there is no platform subsidy.

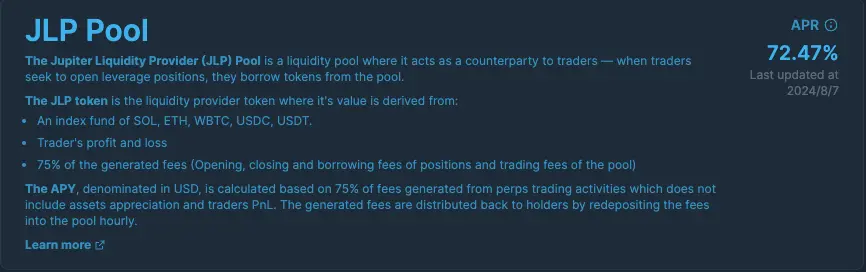

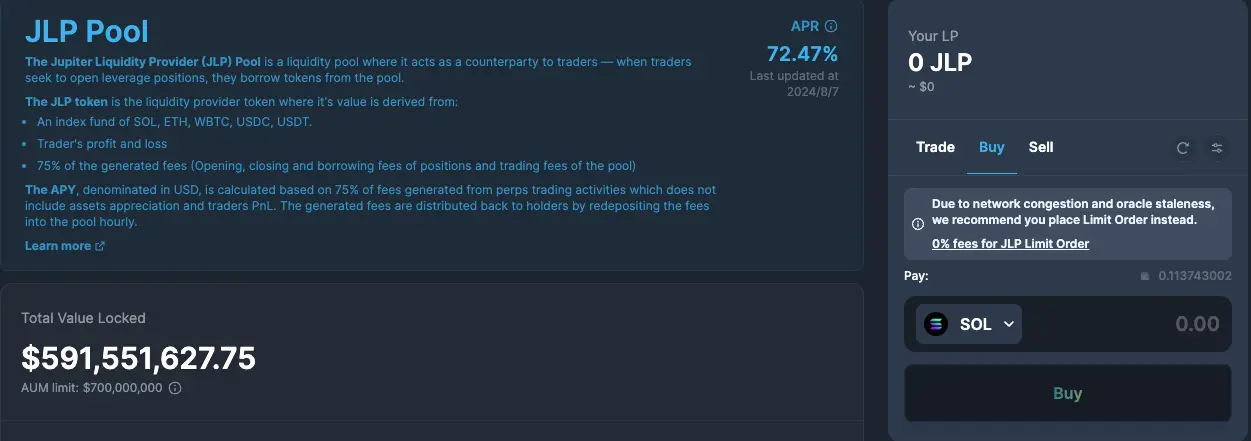

Regardless of profit or loss, the opening capital comes from the JLP platform, so from the moment of opening, traders are in debt to the platform. According to the JLP Pool page, the current APR of JLP is 72.47%, but this data is updated weekly and may differ from actual earnings.

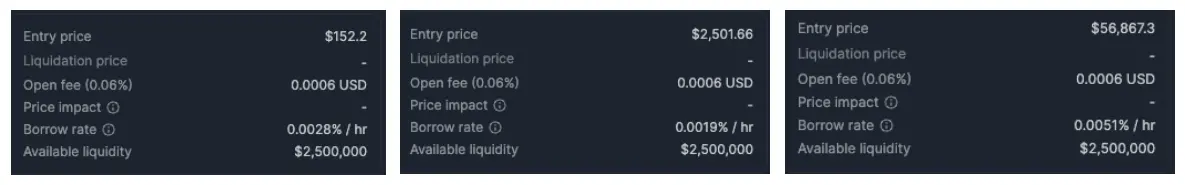

The borrowing rate for different pools can be manually calculated on the contract trading page, with different rates for different pools, as shown in the figure below. If calculated based on the SOL rate, it is 0.0028% per hour (x24 hours x365 days), with an annualized rate of 24.53%. Similarly, the annualized rates for Ethereum and Bitcoin are 16.64% and 44.68% respectively, resulting in a total annualized rate of 85.58%.

From left to right are the contract-related fees for SOL, ETH, and wBTC.

JLP Investors: Returns and Losses Smaller Than Underlying Assets

The fees generated by trading will be reflected in the platform token JLP. According to the official introduction, the value of JLP comes from three aspects.

First, 75% comes from the opening, closing, borrowing fees, and pool trading fees. As they can receive a share of the platform's fees, the net value of this part of JLP is basically on the rise.

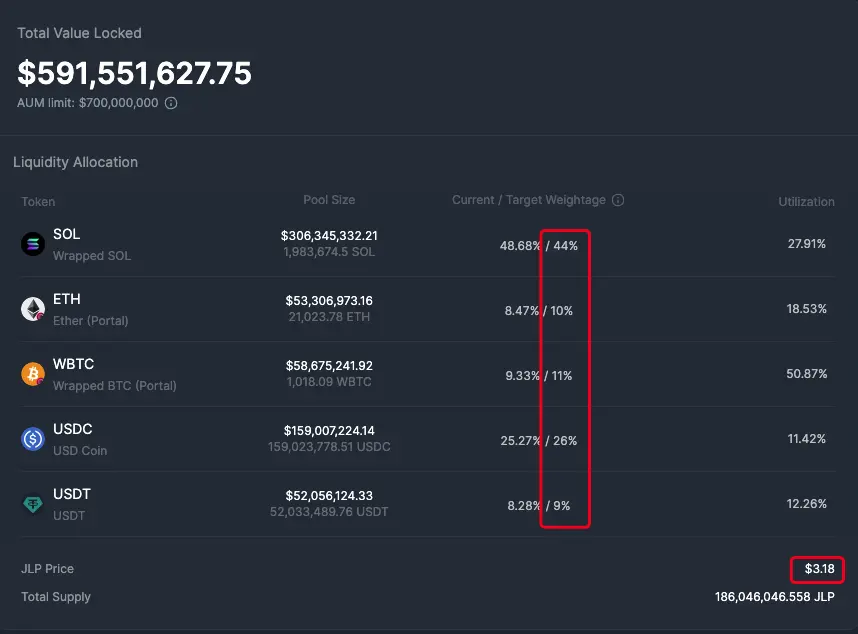

Second, it comes from the 5 underlying assets, theoretically (as shown in the figure below), a JLP price is composed of 44% SOL, 10% ETH, 11% WBTC, 26% USDC, and 9% USDT. The net value of JLP is also calculated based on these factors on the official platform page, currently at 3.18 US dollars.

The rise and fall of SOL, Ethereum, and Bitcoin will also cause JLP to change accordingly. Therefore, some community members believe that buying the dip in JLP is a good choice, as it not only captures the rise of underlying assets but also captures platform fees.

However, a careful comparison of the fluctuations of JLP and other assets reveals that the fluctuations of JLP are smaller. The main reason is that 35% of the value composition of JLP comes from stablecoins (USDT and USDC), and the prices of stablecoins do not experience drastic fluctuations.

To specifically compare the increase in JLP, DeFi researcher @22333D calculated the price changes of JLP and an equal amount of SOL, Ethereum, and Bitcoin from May 7th to May 19th, and found that the increase in JLP was the smallest, with a 5.3% increase, while the total increase in SOL, Ethereum, and Bitcoin was 6.8%.

@22333D explained that the shortfall may come from the coin-based losses of the JLP platform. This is also the third source of JLP value, namely the profit and loss of traders, which is negatively correlated with the price of JLP. If a trader makes a lot of money, the net value of JLP will decrease, as if the asset composition of JLP has been taken away by contract players, and vice versa.

Although in the short term, the platform may be in a loss state, according to flyingfish data, JLP's overall profits have exceeded losses since the beginning of this year.

Treating JLP as a Financial Product?

Currently, JLP can be purchased directly on the JLP official website through Jupiter's spot price order, with zero fees. Part of the purchased JLP comes from LP provision, and the rest is newly minted JLP. When JLP reaches the TVL limit (700 million US dollars), minting will stop, and the current TVL is 5.91 billion US dollars.

@22333D pointed out that if JLP is purchased with SOL, it is equivalent to exchanging 56% of SOL for stablecoins, Ethereum, and Bitcoin. Then, by taking a long position in SOL with the funds accounting for 35% of the total JLP position, it is possible to hedge and realize the financial management of SOL.

If JLP is purchased with USDT or USDC, it is possible to take a short position in SOL with the funds accounting for 44% of the total JLP position, 10% in Ethereum, and 11% in Bitcoin, effectively turning JLP into a stablecoin-based financial product.

In addition, there are other arbitrage strategies for JLP, such as depositing JLP in the Solana lending platform Kamino, borrowing stablecoins, and then buying JLP to achieve leveraged mining. However, due to the gambling factor of JLP, its price carries uncontrollable risks. Whether as a contract player or a token investor, caution is required, and DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。