Hash(SHA1): a543a5b2582006c8b503b1182274b528c108388a

Number: Chain Source Hotspot Insights Broadcast No.002

Trump comments on the sharp drop in US stocks: This is called "Kamala Crash"

The US stock market opened sharply lower on Monday, and Republican presidential candidate Donald Trump referred to this phenomenon as "Kamala Crash," pointing the finger at Kamala Harris, the 2024 Democratic presidential nominee. On the social media platform Truth Social, Trump wrote in capital letters, "TRUMP CASH VS KAMALA CRASH," and insisted that he would not cause such an impact. At a rally in Atlanta, Georgia, he claimed that if Harris were elected president, she would "destroy" the US economy, and mentioned the recent rise in the unemployment rate to 4.3%.

The Fed's Tightening Policy and Market Reaction

Chicago Fed President Guersbey stated that the Fed has been in a tightening mode, and such strict measures are only necessary when there is concern about the economy overheating. Current data does not show signs of economic overheating, with employment data lower than expected but not showing signs of economic recession. Guersbey emphasized the need for forward-looking decision-making by the Fed.

Investment tycoon Warren Buffett holds a record $277 billion in cash and sold 50% of his Apple stock earlier, preparing to buy back at a discount in the event of a market crash. Monday's market crash led to a $1.4 trillion evaporation of US stock market value, while $1.2 billion in cryptocurrency leveraged positions were liquidated within 24 hours.

Synchronized Global Market Decline

The rise in US unemployment rate in July has raised concerns about economic recession, leading to a sharp decline in global capital markets on Monday. The Nikkei index in Japan fell by 4451 points, marking the largest drop in the Japanese stock market. The Kospi and Kosdaq indices in South Korea fell by over 8%, triggering a circuit breaker. Nasdaq 100 index futures widened their decline to over 5%, and the Euro Stoxx 50 index fell by over 3%.

The cryptocurrency market was not spared either. After falling below $60,000, Bitcoin did not find support and dropped to below $50,000, reaching a low of below $49,000, with a intraday decline of over 15%. Ethereum saw a decline of over 20% within 24 hours, briefly falling below $2,200. According to CMC market data, the total market value of cryptocurrencies plummeted to as low as $1.76 trillion, with a nearly 20% decline within 24 hours.

Historic Market Linkage

Zhu Haokang, Director of Digital Asset Management at Huaxia Fund (Hong Kong), analyzed that the sharp drop in Bitcoin prices often occurs almost simultaneously with the decline of the Nasdaq 100 index, especially when the market faces widespread systemic risks, such as the market crash triggered by the COVID-19 pandemic in March 2020 and the market adjustment in 2022.

Chart data shows a significant time relationship between the sharp drop in Bitcoin prices and the decline of the Nasdaq 100 index over the past 16 years. For example, in March 2020, the price of Bitcoin dropped from around $10,000 to around $4,000, a decline of about 60%; during the same period, the Nasdaq 100 index fell by about 30%.

Investor Reaction and Market Expectations

Hayden Hughes, Cryptocurrency Investment Director at Evergreen Growth, pointed out that cryptocurrency assets have become part of the victims of yen arbitrage trading closures. Investors are adapting to higher interest rates in Japan, and the impact of the sharp increase in hedging costs due to fluctuations in the USD/JPY exchange rate on cryptocurrency assets.

Portfolio manager Daniel Tan expects that it is more reasonable for the Fed to cut interest rates twice by the end of 2024, once in September and once in November, with a total rate cut of 75 basis points, indicating potential opportunities to increase bond holdings in the coming months.

George Bourbouras, Research Director at K2 Asset Management, believes that the market has clearly overreacted to recent soft economic data. The recent momentum of the US economy has slowed, with improved core inflation data, and the market expects a 25 basis point rate cut in September.

Turmoil in the Cryptocurrency Market

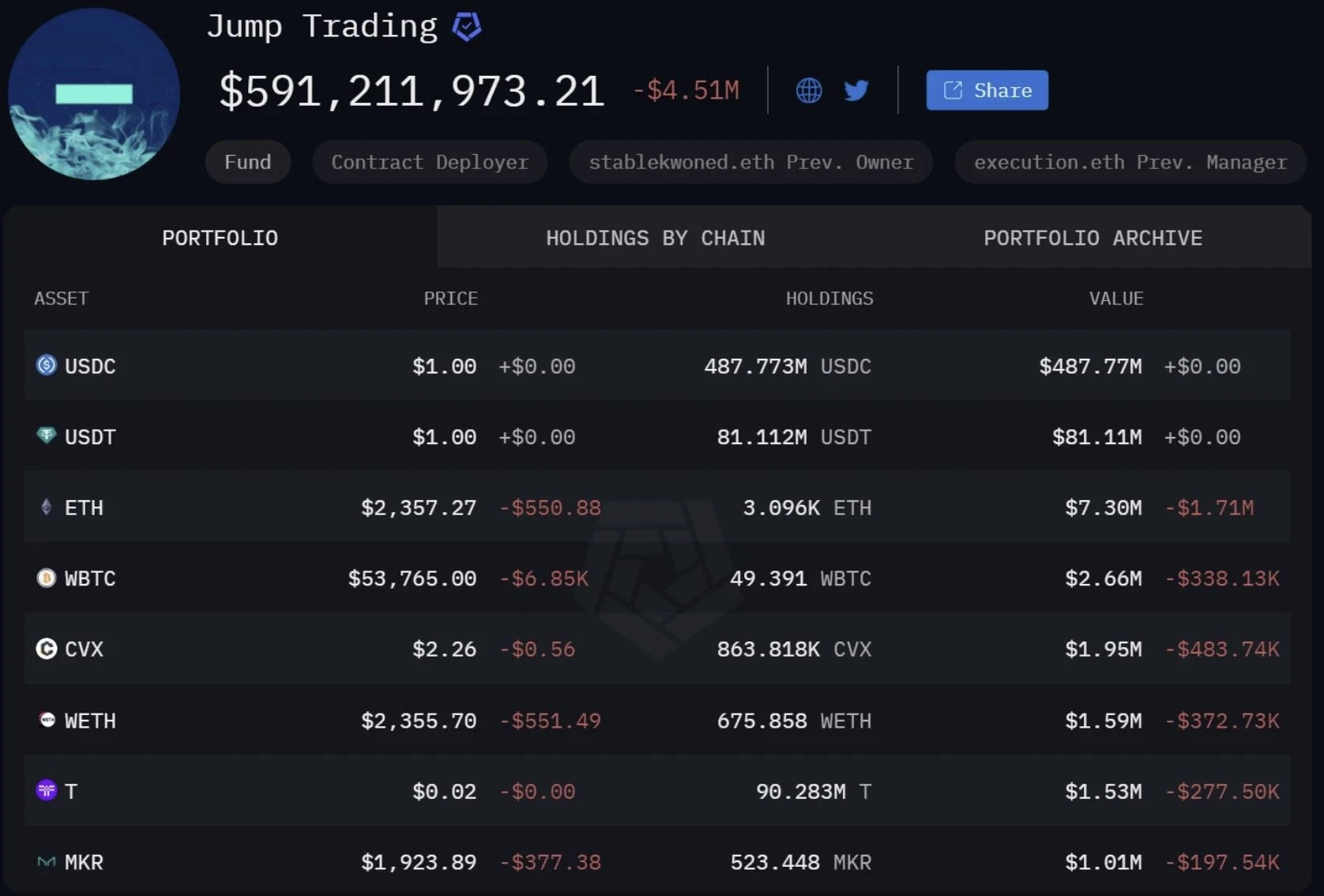

Presto Research analyst Min Jung pointed out that factors such as lower-than-expected employment data, concerns about economic recession, and large transfers by Jump Crypto have led to the decline in the cryptocurrency market. The decline in Bitcoin and Ethereum can be attributed to several factors, including lower-than-expected employment data, Buffett's sale of Apple stock, and Jump Trading's transfer of a large amount of cryptocurrency assets.

Cryptocurrency analyst Lark Davis stated that despite the current market turmoil, there are still investment opportunities in the long term. Justin d'Anethan, Head of Business Development for Keyrock Asia Pacific, pointed out that the current market is not led by Bitcoin, but by market sentiment, especially with the trading of Ethereum spot ETFs and large investors unwinding their positions in the Grayscale ETH fund.

10x Research predicts that Bitcoin may fall to $42,000 and Ethereum may drop below $2,000. Although this may seem extreme to some, market structure, on-chain data, and cycle analysis indicate further pressure in the future.

Binance CEO: The sharp decline in cryptocurrency assets seems to be mainly attributed to the impact of the macroeconomy

In the past few days, the sharp decline in cryptocurrency and stock prices can be attributed to the dual impact of the macroeconomy and specific factors of cryptocurrency assets, with the former currently appearing to be the main reason. The CEO of Binance stated that the impact of the macroeconomy on the cryptocurrency market is particularly significant.

From a macroeconomic perspective, Wall Street has experienced significant volatility over the past week. Major stock indices and stock market futures saw sharp declines over the weekend, as concerns about economic recession intensified. The US employment report released on Friday has heightened these concerns, triggering worries about the extent of economic growth. In addition, ongoing geopolitical tensions have also exacerbated market uncertainty and instability.

Specifically for cryptocurrency assets, concerns about economic recession have led to widespread market sell-offs, prompting capital to be reallocated from high-risk assets, with cryptocurrency assets still largely seen as high-risk assets. Recent dynamics in the US presidential election have made this trend more complex, with some market participants believing that this may not be favorable for cryptocurrency assets as an asset class. Finally, in the cryptocurrency market, the summer has historically been flat compared to other months of the year, with lower returns. These seasonal factors may also be at play at this time.

Despite these challenges, we do not believe that this indicates a long-term negative trend in the cryptocurrency market. The Fed is expected to cut interest rates in September, which should improve the outlook for the US economy. In addition, with some time remaining until the presidential election, the possibility of market volatility remains high. As the election approaches and candidates clarify their positions on cryptocurrency assets, we may see a two-way impact on the market.

Impact of Yen Arbitrage Trading

The Yen Carry Trade refers to a financial operation where market participants borrow low-interest Japanese yen and invest in high-interest or high-yield assets. As Japan's interest rates have been at extremely low levels for many years, market participants finance borrowing at low rates in Japan, then convert the funds into US dollars or other currencies to invest in assets in high-interest rate countries. In recent years, this arbitrage trade has supported the bull market in global stock markets, allowing cheap currency funds to be invested elsewhere.

However, the reversal of yen carry trades often triggers financial market turmoil. Unwinding yen carry trades leads to the withdrawal of funds from high-yield risky assets, which typically causes a decline in asset prices. Financial institutions need to reduce leverage by selling assets and repaying debts when unwinding yen carry trades, leading to reduced liquidity in the credit market and further tightening of credit conditions. In addition, changes in market risk preferences lead to increased market volatility.

Conclusion

Despite the many challenges the market currently faces, the cryptocurrency market still has potential in the long term. The Fed is expected to cut interest rates in September, which will improve the outlook for the US economy and may have a positive impact on the cryptocurrency market. As the US presidential election approaches, market volatility will continue to exist, and the candidates' stance on cryptocurrency assets will be a focus of market attention.

The volatility of the blockchain market is significant, and the Chain Source Security Team advises investors to carefully navigate this high-risk environment. At the same time, technical security is crucial for ensuring the security of blockchain systems and transactions. Effective security measures not only prevent hacking and data leaks but also enhance user trust and drive the widespread application of blockchain technology. Stable markets and solid technical foundations together promote the healthy development of the blockchain ecosystem.

Chain Source Technology is a company focused on blockchain security. Our core work includes blockchain security research, on-chain data analysis, and asset and contract vulnerability rescue, and we have successfully recovered multiple cases of stolen digital assets for individuals and institutions. At the same time, we are committed to providing project security analysis reports, on-chain tracing, and technical consulting/support services for industry institutions.

Thank you for reading, and we will continue to focus on and share blockchain security content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。