原创 | Odaily星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web3)

RWA板块市场表现

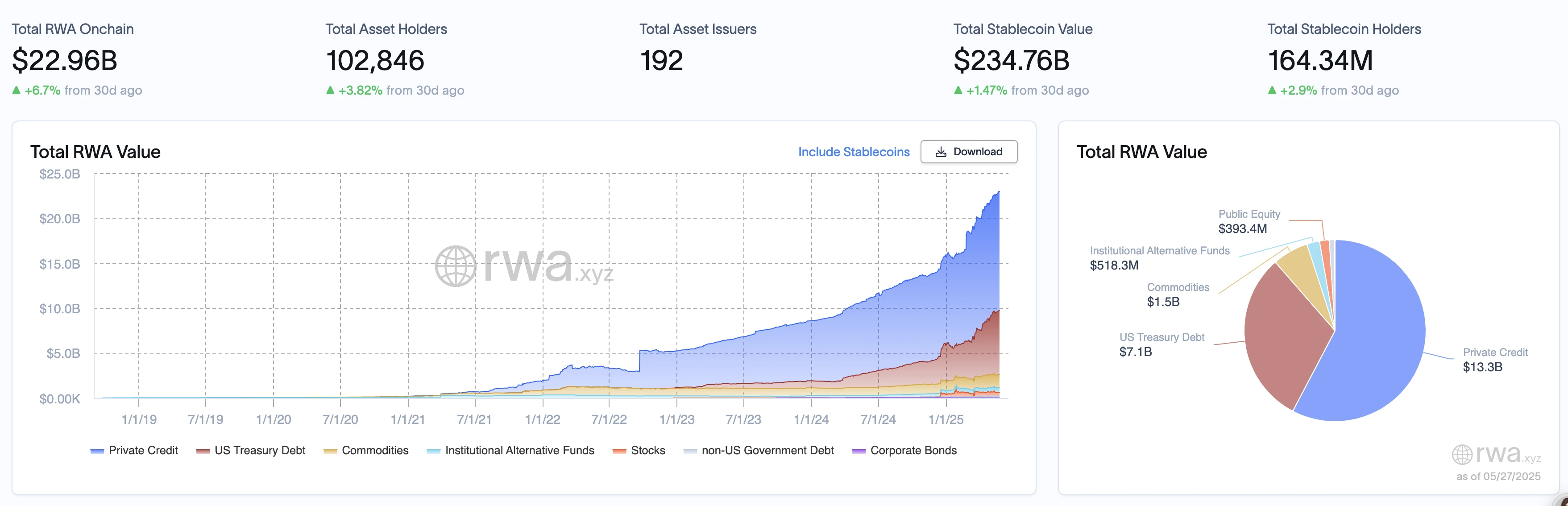

根据 RWA.xyz 数据,截至 2025 年 5 月 27 日,RWA 链上总价值达到 229.6 亿美元,较 5 月 20 日的 226 亿美元增长 1.59%。链上资产持有者总数由 101,854 人增至 102,846 人,增长 0.97%;资产发行数量从 191 个增加至 192 个。稳定币总价值由 2321.7 亿美元上升至 2347.6 亿美元,增长 1.11%;稳定币持有者数量由 1.6302 亿人增加至 1.6434 亿人,增长 0.81%。

从资产类别来看,私人信贷从 131 亿美元增长至 133 亿美元,占比则由 57.96% 小幅下降至 57.92%,在总资产中的主导地位略有稀释;美国国债由 70 亿美元增加至 71 亿美元,占比从 30.97% 降至 30.92%,尽管金额增加,但占比略微回落,反映出市场仍对其保持配置但未显著加仓。

值得注意的是,商品类资产从 14 亿美元增长至 15 亿美元,占比从 6.19% 上升至 6.53%,表现出一定的配置热度回升,可能受到宏观通胀或大宗行情驱动。机构另类基金从 5.118 亿美元上升至 5.183 亿美元,占比维持在 2.26% 不变,显示其仍作为小规模稳健补充存在。股票、非美国政府债务和公司债券等类别依旧占比较小,未显著扩张。

从上周数据对比来看,本周资产类别分布变化较为微小,但呈现出一些值得关注的趋势:

私人信贷虽继续增长,但增速放缓,占比略有下滑,反映出市场对该类资产的边际偏好可能进入调整期;美国国债依然获得稳健资金青睐,配置比例虽微降但总值持续上升;商品类资产的增长较为明显,或表明市场开始加强对通胀对冲类资产的关注;而另类基金等小众资产维持稳定,显示出其在机构投资组合中仍具稳健配置价值。

整体而言,RWA 链上资产仍以高收益与低波动资产为主导。建议投资者在继续把握私人信贷机会的同时,关注商品类资产的潜在机会,并适度增加国债等低风险资产配置,以优化整体组合的风险收益比。同时,股票和公司债券等仍处于低配状态,可根据市场环境动态调整投资策略。

重点事件回看

美参议员拟修改GENIUS法案,限制特朗普家族从稳定币中获利

部分民主党参议员计划提出修正案,调整正在推进的《美国稳定币国家创新指导法案(GENIUS Act)》,以应对前总统特朗普及其家族与加密货币平台有关的潜在利益冲突。据 Axios 报道,参议院少数党领袖 Chuck Schumer 与参议员 Elizabeth Warren 和 Jeff Merkley 将提案禁止美国总统通过稳定币牟利。

此前,特朗普家族涉足加密平台 World Liberty Financial,并在 3 月推出 USD1 稳定币。阿布扎比一家投资机构宣布将使用 USD1 完成 20 亿美元的 Binance 投资,引发民主党人对潜在利益输送的担忧。

此外,Merkley 和 Warren 还批评特朗普于 5 月 22 日举办私人晚宴,接待大量购买其个人“Meme币”的人士,称其为“最严重的腐败之一”。目前该事件已引发进步组织抗议,民主党议员要求公布晚宴宾客名单。

稳定币发行商 Circle 否认了将其公司出售给旧金山加密公司 Ripple Labs 或 Coinbase 的传闻。Circle 的一位发言人在最近给 PYMNTS 的一份声明中驳斥了这一说法,此前有报道称 Circle 正在进行非正式讨论,寻求以 50 亿美元的估值出售公司,这与其首次公开募股(IPO)的目标估值一致。尽管存在这些报道,Circle 发言人强调否认了出售给包括 Coinbase 和 Ripple 在内的任何实体的计划,并表示 Circle 致力于实现其长期目标。

Robinhood向美SEC提案拟为代币化RWA创建联邦框架

Robinhood 已向美国证券交易委员会提交了一份长达 42 页的提案,旨在为代币化的现实世界资产创建一个联邦框架,以实现美国证券市场的现代化。据悉,该计划可能包括将债券、股票等传统资产进行代币化,以实现更高的流动性和透明度。此举被视为推动华尔街资产上链化的重要一步,可能对传统金融和加密市场产生深远影响。

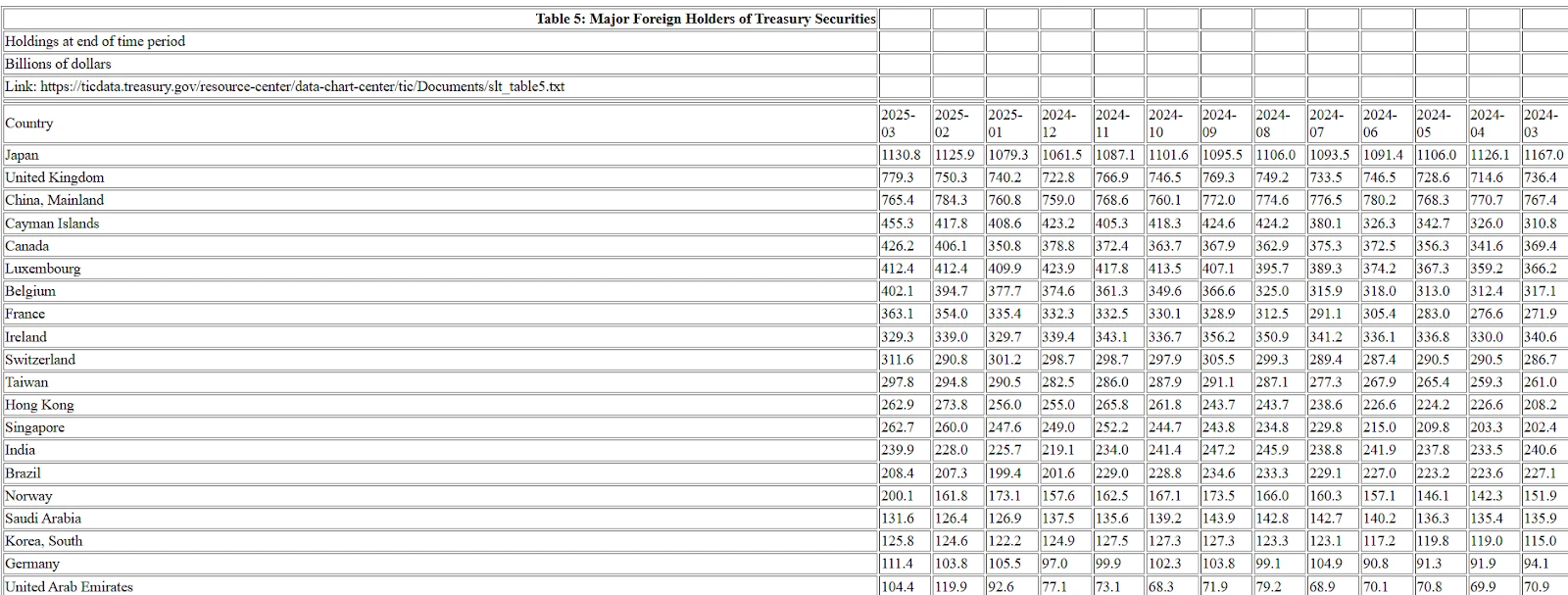

据美国财政部数据显示,稳定币发行商 Tether 持有的美国国债规模已超过德国的1114亿美元,达到1200亿美元,位居全球主要持有方之列。

作为市值超1510亿美元的稳定币发行巨头,Tether依靠以美债为核心的多元化储备策略,在应对加密市场波动中展现出更强的稳定性。此次突破也凸显了其在全球金融体系中的资产配置规模日益提升。

5 月 21 日傍晚,中国香港特区政府于 2024 年底提交的《稳定币条例草案》经香港立法会三读通过。此举意味着中国香港特区开始设立法币稳定币发行人的发牌制度,对完善虚拟资产活动在当地的监管框架亦迈出重要一步。今年年底前,合规的香港稳定币有望正式落地。

热点项目动态

Ondo Finance (ONDO)

介绍:Ondo Finance 是一个去中心化金融协议,专注于结构化金融产品和现实世界资产的代币化。它的目标是通过区块链技术为用户提供固定收益类产品,如代币化的美国国债或其他金融工具。Ondo Finance 允许用户投资于低风险、高流动性的资产,同时保持去中心化的透明性和安全性。其代币 ONDO 用于协议治理和激励机制,平台还支持跨链操作,以扩大其在 DeFi 生态中的应用范围。

最近动态:5月21日,Ondo 宣布链上代币化美国国债的TVL首次超过 70 亿美元,Ondo 的 USDY 和 OUSG 是其主要推动力。另Ondo表示,稳定币用了五年达到这一规模,而代币化国债不到三年,足以显示出 RWA 增长速度远超预期;5 月 23 日,Ondo 宣布推出"Ondo Global Markets"平台,该平台将支持在 Solana 区块链上进行公开证券(包括股票)的链上交易。

Plume Network

介绍:Plume Network 是一个专注于现实世界资产(RWA)代币化的模块化 Layer 1 区块链平台。它旨在通过区块链技术将传统资产(如房地产、艺术品、股权等)转化为数字资产,降低投资门槛并提高资产流动性。Plume 提供了一个可定制的框架,支持开发者构建 RWA 相关的去中心化应用(dApp),并通过其生态系统整合 DeFi 和传统金融。Plume Network 强调合规性和安全性,致力于为机构和零售投资者提供桥接传统金融与加密经济的解决方案。

最新动态:5月 21 日,Plume与 Espresso Systems 合作,推出 Composables NFT(跨链的 Web3 头像 NFT);5月22 日,Plume 宣布原定的 Plume Room 直播(与@Cultured_RWA、@truflation和@stevenmai_)因故推迟至 5 月 26 日 14:00 UTC。直播将讨论 RWAfi 和收益策略;5月23日,Plume与 Skate Chain 合作,解锁跨链 RWA 流动性,允许用户在不同区块链生态中无缝访问 Plume 的真实收益资产。

相关文章推荐

《RWA周报|GENIUS稳定币法案进入正式审议阶段;美SEC发布加密货币经纪商监管新指南(5.14-5.20)》

RWA上周周报:梳理行业最新洞察及市场数据。

5月16日,热门的RWA公链Pharos宣布上线公共测试网,引起了市场的广泛关注。Pharos同时上线一系列的测试网任务,用户参与热情极高,根据官方披露的数据,测试网发布仅24小时就涌入了超11万名真实用户。本文手把手教用户如何零撸交互Pharos测试网。

《继美国GENIUS之后,香港通过的稳定币法案有何新看点?》

本文作者基于香港稳定币法案《条例》原文(宪报编号C3116-C3684),解构其核心内容,对比美国稳定币法案《GENIUS Act》,并汇集行业观点,探讨两大监管框架的异同与影响。

《美元霸权2.0:《GENIUS法案》如何重塑稳定币全球格局?》

文章基于被视为美国稳定币监管里程碑的法案《GENIUS Act》进入修订阶段,加密行业的情绪也随之升温的背景下汇集了各方主要阐述观点。

本文盘点了最近7个活跃于RWA叙事下的链上新势力,涵盖Base、BNB Chain和Solana生态,大多项目向着应用落地、合规实践和生态联动等多个维度全面进化,兼顾叙事想象力和现实落地性。

《现实世界资产(RWA)代币化:市场动态、全球实践与中国探索》

由The Web3Dao撰写的,涵盖多角度的关于现阶段RWA发展的深度研报。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。