The cryptocurrency market has encountered a catastrophic blow today, with the gloom of "Black Monday" hanging heavily over it.

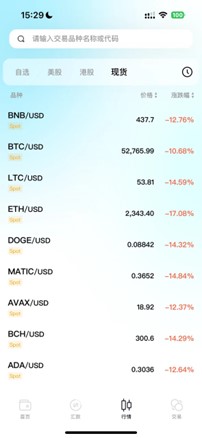

Bitcoin plummeted by 15% in just 24 hours, breaking through the important support level of $53,000; Ethereum fared even worse, with a staggering 30% drop, approaching $2,100, almost erasing all the gains accumulated since 2024. Meanwhile, other altcoins were not spared, all suffering from a brutal decline, plunging the entire cryptocurrency market into panic and chaos.

Analysis of Recent Market Sell-offs and Reasons

(1) Significant Market Turbulence

In the past week, the cryptocurrency market has experienced the most turbulent sell-off in nearly a year. The price of Bitcoin plummeted from a remarkable $70,000 to just over $52,000, while the price of Ethereum fell sharply from $3,300 to $2,100. The market value of the entire cryptocurrency market seemed to burst like a dam, rapidly decreasing by nearly $500 billion. This intense market turbulence has left investors in a state of panic, prompting them to seek the underlying reasons.

(2) Interweaving Impact of Multiple Factors

- Bank of Japan's Interest Rate Hike and Yen Appreciation

On July 31, the Bank of Japan decisively raised its policy interest rate from the original 0-0.1% to 0.25% and announced a gradual reduction in monthly bond purchases, far exceeding market expectations. This drastic tightening measure caused a rapid appreciation of the yen, with the USD/JPY exchange rate soaring from 160 to 145.

This significant exchange rate fluctuation directly led to a cliff-like decline in the Japanese stock market. The Nikkei index plummeted by approximately 15% over the past three trading days, reaching a staggering 20% drop compared to its mid-July peak, inevitably falling into the abyss of a technical bear market. The stock price of Mitsubishi UFJ Financial Group hit a historic low, and the TOPIX index was not spared, with a decline of over 9%, triggering a circuit breaker and causing a temporary halt in market trading.

The market's extremely rapid and highly emotional response to these sudden changes quickly spread panic, triggering a global wave of risk aversion. Nick Ferres, Chief Investment Officer of Vantage Point Asset Management, bluntly stated that the sell-off in the Japanese stock market was "large-scale, rapid, and emotional," with far-reaching effects beyond most people's expectations. Mike Novogratz, CEO of Galaxy Digital, also clearly stated that the Bank of Japan's interest rate hike undoubtedly ignited a global wave of risk aversion sentiment.

More importantly, the Bank of Japan's interest rate hike and yen appreciation had a significant and lasting negative impact on the U.S. stock market. For a long time, the low-interest yen has been commonly used for arbitrage trading in the international financial market. Now, the sharp appreciation of the yen has forced these arbitrage funds to hastily sell off their U.S. stock assets to recoup funds, causing a severe impact on the U.S. stock market. This series of chain reactions has posed a serious challenge to the stability of the global financial market.

- Weak U.S. Economy

The decline in the Japanese stock market, like a heavy bomb, quickly spread its shockwaves to multiple global capital markets, with the U.S. market particularly affected. The Nasdaq index plummeted by over 5% in the last two trading days of the previous week, and Nasdaq futures suffered a heavy blow on Sunday night, with a decline of 2.5%.

In this context, major tech companies such as Microsoft and Intel reported financial results that fell below market expectations, undoubtedly casting a shadow over investors' confidence. Meanwhile, Nvidia suffered a severe blow as market expectations for interest rate cuts were dashed, leading to a sharp drop in its stock price. These negative news items prompted capital to flee from large tech companies and flow back to smaller, underperforming companies.

UBS Group closely monitored market dynamics and explicitly pointed out that the unexpected increase in the U.S. unemployment rate to 4.3%, far higher than the Federal Reserve's expectations, further sparked deep concerns about the U.S. economy potentially entering a recession. Goldman Sachs subsequently reassessed the future economic situation, significantly raising the probability of a U.S. economic recession within the next year from 10% to 25%. However, Goldman Sachs still insisted that although the risk of a recession had increased, it remained within a manageable range.

It is worth noting that the legendary figure in the investment world, Warren Buffett, made a remarkable decision through his Berkshire Hathaway company. He significantly reduced his holdings in Apple Inc., significantly increasing cash reserves. This move undoubtedly demonstrates Buffett's keen anticipation of a major market adjustment and further exacerbates market anxiety.

- Jump Trading's ETH Sell-off

In the midst of the cryptocurrency market turmoil, on-chain analyst Yu Jin, with his keen insight, observed that Jump Trading was systematically and massively selling off ETH in batches. Recently, they decisively redeemed wstETH worth as much as $4.1 billion for ETH and swiftly transferred some ETH to exchanges. In the eyes of market commentators, this aggressive operation is seen as a key factor exacerbating the market sell-off pressure.

Due to Jump Trading's significant position and influence in the market, its large-scale sell-off behavior has sparked investor panic, further driving down the price of ETH and causing a chain reaction affecting the stability of the entire cryptocurrency market. Many investors have followed suit in selling off their ETH and other cryptocurrency assets, exacerbating the market's downward trend.

- Escalation of Iran-Israel Geopolitical Conflict

The ever-changing geopolitical situation has brought undeniable impact to the cryptocurrency market. According to authoritative reports from AXIOS, U.S. Secretary of State Blinken issued a serious warning, stating that Iran and Hezbollah are highly likely to launch a military attack on Israel. This escalation of tension undoubtedly cast a shadow over the global financial market sentiment.

In the cryptocurrency field, investors are highly sensitive to geopolitical risks. Due to concerns that potential military conflicts may cause global economic instability, thereby affecting the market demand and prices of cryptocurrencies, investor panic quickly spread. This uncertainty further intensified the volatility of the cryptocurrency market, making investors more cautious and significantly reducing market trading activity.

- Seasonal Market Decline

Coinbase analysts pointed out through in-depth analysis of historical data that August is typically a relatively weak month for the cryptocurrency market. Historical trading data clearly shows that the average decline of Bitcoin in August is 2.8%. During this period, the activity of market participants often decreases, leading to a significant reduction in liquidity and trading volume.

Future Market Outlook

(1) Short-term Market Uncertainty

In the short term, the cryptocurrency market is likely to continue to be affected by policy fluctuations and macroeconomic factors. Based on his extensive market experience and keen insight, Mike Novogratz, CEO of Galaxy, believes that the global risk aversion sentiment triggered by Japan's interest rate hike may continue to exert sustained pressure on the market in the near future.

In addition, governments' regulatory policies on cryptocurrencies are still in a phase of continuous adjustment and improvement, bringing many uncertainties to the market. For example, some countries may strengthen the regulation of cryptocurrency trading or introduce new tax policies, all of which may directly affect the confidence and behavior of market participants.

At the same time, global macroeconomic changes, such as the level of inflation, interest rate adjustments, and the economic growth of major economies, will continue to play an important role in the short-term trends of the cryptocurrency market. In this context, investors need to remain highly vigilant, closely monitor the release of various policies and economic data, in order to make timely investment decisions accordingly.

(2) Potential Opportunities in the Long-term Market

However, from a long-term perspective, with the development of the global economic situation and the evolution of the financial market, the cryptocurrency market still presents many potential opportunities. Despite the current market facing numerous challenges and uncertainties, the value and application prospects of cryptocurrencies are still worth looking forward to, with continuous technological innovation and the expansion of application scenarios.

On the one hand, the direction of the Federal Reserve's monetary policy plays an important guiding role in the global financial market. If the Federal Reserve begins to cut interest rates in the future as expected by the market, a loose monetary policy environment will provide more abundant liquidity support for various assets, including the cryptocurrency market. This will help improve the market's funding conditions, enhance investors' risk appetite, and create favorable conditions for the recovery and development of the cryptocurrency market.

On the other hand, Jeremy Allaire, co-founder of Circle, has consistently maintained an optimistic attitude towards the long-term prospects of the cryptocurrency industry based on his in-depth understanding of the industry and long-term observations. He believes that investors should focus more on technological development and market adoption, rather than just short-term price fluctuations. With the continuous improvement and popularization of blockchain technology, cryptocurrencies are expected to make breakthrough progress in areas such as cross-border payments, digital asset trading, and supply chain finance.

What Should Investors Do?

In the long run, the cryptocurrency market still has optimistic prospects, although the market is currently in a downtrend. Investors can adopt a short-selling and long-buying investment strategy. When the market reverses, gradually increase long positions as the bull market arrives, and gradually benefit from the landing of ETFs, Bitcoin halving, and a series of favorable factors such as the Federal Reserve's interest rate cuts and the U.S. presidential election.

So, cryptocurrency investors have a headache: their deposits and withdrawals are often frozen. How should they deal with this?

Everyone in the cryptocurrency world has encountered withdrawal issues to some extent! Imagine in the future, if one day you achieve financial freedom through cryptocurrency trading, how can you safely cash out your digital assets?

Here, we recommend BiyaPay—from withdrawing USDT from exchanges to BiyaPay, this is an app with a legal license in the United States. In BiyaPay, you can exchange USDT for an equivalent amount of US dollars, and then withdraw the dollars to Wise or OCBC bank. Although there will be fees and exchange rate losses, these funds are all legal!

Secure solutions from BiyaPay:

• From Wise, you can transfer the dollars back to Alipay, WeChat, or a bank account, but there is an annual limit;

• The OCBC Bank's 360 account allows direct cash withdrawals without the $50,000 limit.

Conclusion

In summary, the short-term trend of the cryptocurrency market is influenced by a complex interweaving of factors, including frequent policy changes, market sentiment fluctuations, geopolitical uncertainties, and seasonal market patterns. Although the current market is in a severe state of turbulence and investor confidence has been greatly impacted, in the long run, the cryptocurrency market still has the potential to usher in new development opportunities under the drive of positive factors such as global monetary policy easing, technological innovation, and the expansion of application scenarios.

For investors, in such a market environment full of variables and challenges, closely monitoring the dynamic changes in the market, conducting in-depth research on various influencing factors, and flexibly and timely adjusting investment strategies will be the key to steady progress and asset preservation and appreciation in the cryptocurrency market. At the same time, investors also need to maintain rationality and calmness, avoid blindly following the crowd and excessive speculation, in order to reduce investment risks and achieve long-term investment goals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。