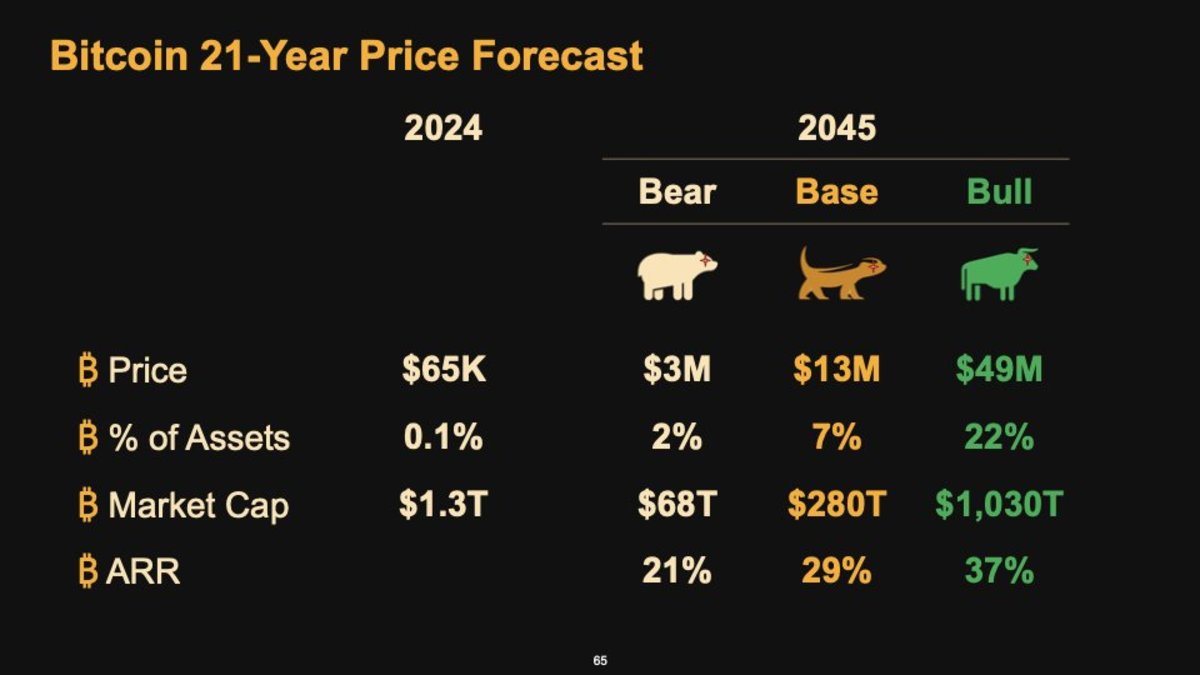

Michael Saylor predicts that by 2045, the price of Bitcoin will reach 13 million US dollars. Perhaps, you have to remind yourself every day that you may not be bold enough or optimistic enough.

Written by: Guillaume, Assistant Manager of UTXO Management Venture Capital

Translated by: Yangz, Techub News

If you are looking for a more substantial recap of the "Bitcoin 2024" key points than the TLDR thread on X, then this article is tailored for you. Most of the following content is the result of discussions with Tradfi investors, cryptocurrency investors, founders of Bitcoin ecosystem projects, analysts, and mining executives.

Macro: Bitcoin has crossed the "Rubicon"

Donald Trump and the Point of No Return

The concept of "Bitcoin strategic reserve" has been a dream for many Bitcoiners for many years, and it actually happened last week. It can be said that Bitcoin crossed its own "Rubicon" last Saturday, and behind this is actually a game between major powers. From now on, countries around the world must take the concept of Bitcoin reserves seriously, otherwise they may face the possibility of being left behind by other countries. If this concept is ultimately put into action, the United States will have about 1% of the total Bitcoin supply.

Note: The Rubicon is a shallow river in northeastern Italy. In 49 BC, Caesar crossed the river to Rome. When crossing the river, Caesar said "alea iacta est," meaning the die is cast, similar to the Chinese phrase "木已成舟," indicating that the situation is determined and irreversible.

From the perspective of other countries, it will be very difficult to replicate this strategy because the United States basically obtained these bitcoins for free. In contrast, many countries would find it very difficult to accumulate hundreds of thousands of bitcoins without paying a huge premium. This is also why Bitcoin mining has become a national security issue. After Trump announced this news, Michael Saylor presented a framework for the country to adopt Bitcoin as a national treasury asset in front of more than 10 senators (how to adopt Bitcoin reasonably and why to do so). When a good idea meets a good time, it will be unstoppable.

Institutions are flocking in

Game theory also applies to institutions. If nation-states are accumulating Bitcoin, then companies must do the same. The accumulation by nation-states basically guarantees the long-term rise in the price of Bitcoin, which also means that the financials of companies priced in US dollars will be relatively damaged. This has become a clear line that distinguishes winners from losers. Converting some assets into Bitcoin may not necessarily make you a winner, but it will become a basic requirement for institutional competition. As the old saying goes, "It makes sense to buy some just in case."

Retail investors are still absent

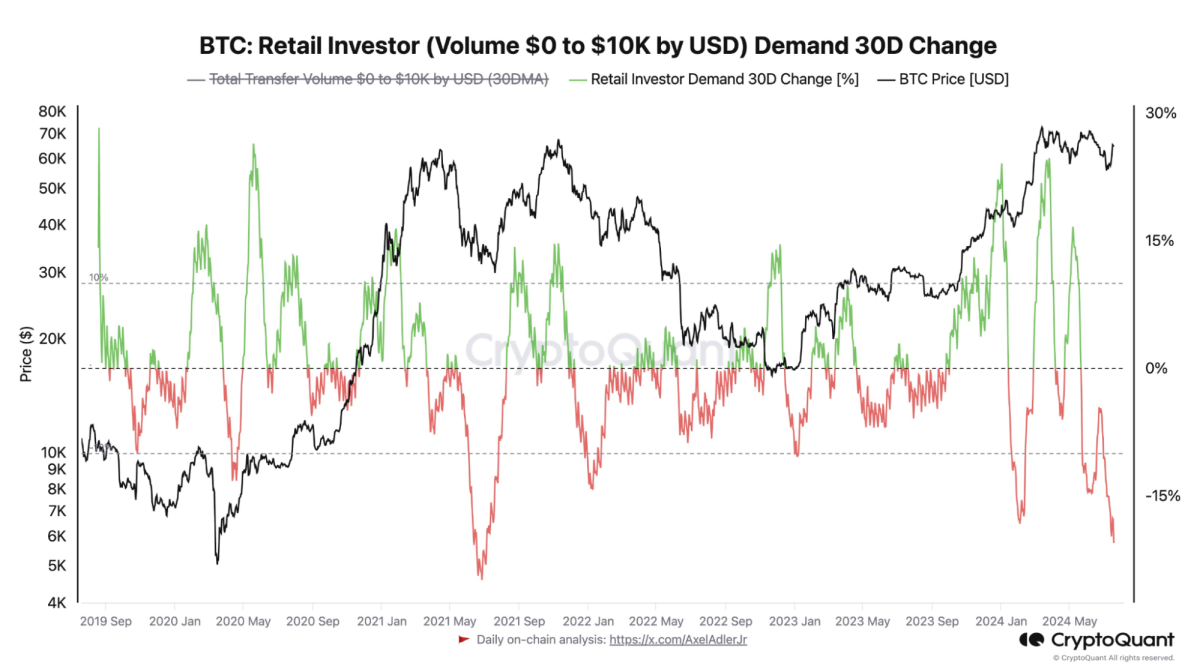

Although Bitcoin is less than 10% away from its all-time high, as shown in the chart below, the flow of retail investors measured by the total transfer volume in the last 30 days with a total transaction value of less than $10,000 is at its lowest point in 3 years.

From the perspective of retail investor participation, this meeting was successful, but retail buyers seem to be tired, either already all in, or unwilling to buy more Bitcoin at the current price. Another possible explanation is that the feeling conveyed throughout the meeting is that people are "waiting for the next catalyst."

VC and the Bitcoin Ecosystem

Supporting the Best Bitcoin Talent

UTXO Management held the first Investor Day, UTXO Alpha Day, at this conference. We gathered hundreds of capital allocators, entrepreneurs, institutional investors, and angel investors to discuss income assets in Bitcoin, the layout of the new Bitcoin layer, and the concept of Bitcoin as the ultimate financial asset. The event was successful and it reminded us that venture capital should first focus on outstanding individuals, as they are competing to bring new utility to Bitcoin. After participating in the exchange meeting held by BTC Startup Lab, I deeply realized the value of the founders of Bitcoin ecosystem projects, and the United States must welcome them with open arms. Their focus is to prepare for the bull market, and when Bitcoin decisively breaks the previous high, everything will follow.

One of the main takeaways from this conference is that the demand for Bitcoin-native income strategies by investors is growing beyond our initial expectations. When we talk about idle capital, most people tend to think of Bitcoin in their wallets. However, the situation last week showed that the opportunity for Bitcoin-native income is equally attractive to cryptocurrency investors currently allocating capital on different chains. In the current environment, TVL follows the interest. We have discussed with many investors who either want to cross-chain from Bridged BTC (such as WBTC) to Bitcoin L2, or want to find more attractive opportunities for altcoins on Ethereum or Solana. In addition to the general income return, the incentive activities of Bitcoin ecosystem projects also provide unequal upward potential.

VC's understanding of Bitcoin is still limited

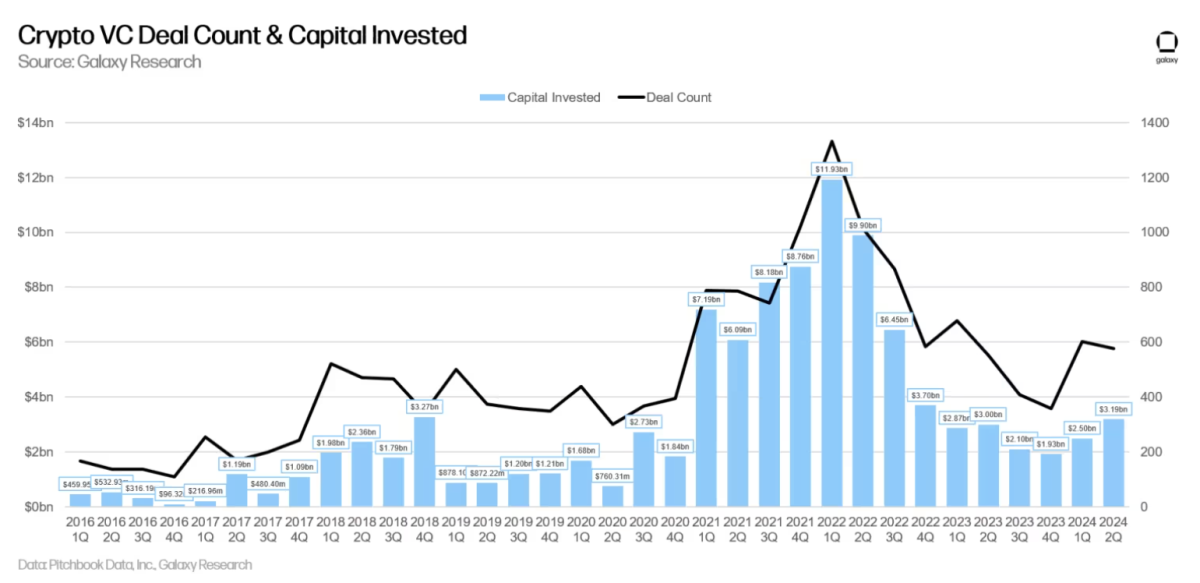

As emphasized in Galaxy's latest report on blockchain venture capital, interest in cryptocurrency investments has steadily increased this year, but it has not yet reached the peak of the first quarter of 2022. The report states that "in the second quarter of 2024, venture capitalists invested $3.194 billion (a 28% increase from the previous quarter) in cryptocurrency and blockchain companies, involving 577 transactions (a 4% decrease from the previous quarter)."

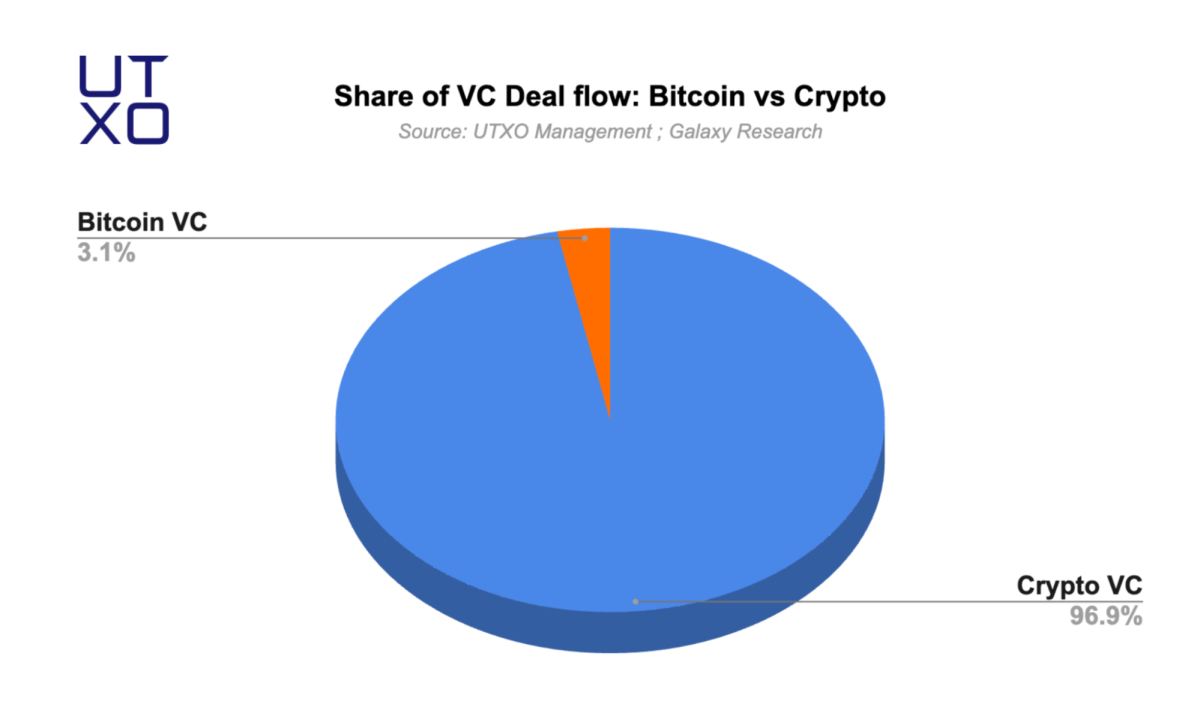

Although this is a good sign for the entire cryptocurrency industry, in the second quarter of 2024, venture capital investment in the Bitcoin ecosystem accounted for only 3.1% of the total transaction volume, which is $96.4 million, while the market value of Bitcoin accounted for over 55% of the entire cryptocurrency market.

We believe that as the Bitcoin DeFi/infrastructure matures, this trend will soon reverse, and the venture capital opportunities in the Bitcoin ecosystem will become impossible to ignore. One possible reason for the current lag in Bitcoin venture financing is that venture capitalists have less understanding of Bitcoin ecosystem technology compared to other cryptocurrencies. There are very few Bitcoin analysts, and the lack of programmability, which has always affected its attractiveness to VCs. We expect this situation to change soon, as understanding the ins and outs of Bitcoin in a less crowded market will bring more technical talent (including developers) to the Bitcoin ecosystem.

Alpha in the Bitcoin Ecosystem

Henry Elder from UTXO emphasized all the ways traditional investors should consider when deploying Bitcoin capital on-chain at Alpha Day. Here are some key points:

BTCFi is in its early stages and can be roughly divided into three categories: sidechains, L2, and meta-protocols.

Relying on the experience of Ethereum sidechains and related tools in the past few years, Bitcoin sidechains are easier to launch than true Bitcoin L2, so sidechains are currently the most developed and mature BTCfi ecosystem. In addition, the Bitcoin sidechain ecosystem also benefits from the highly developed security audit infrastructure that already exists in Ethereum and its related L2.

L2: Apart from the Lightning Network, the Bitcoin ecosystem's L2 is still largely in the development stage, with each product implementing unique and novel technical solutions that link security to Bitcoin.

Bitcoin meta-protocols that directly use the Bitcoin chain are the most native Bitcoin protocols. They use Bitcoin-native assets, and the operational details are directly encoded into Bitcoin blocks, but decoding requires custom indexers. Arch Network is an example of a meta-protocol that supports BTCfi applications, and Ordinals, BRC-20s, and Runes also belong to meta-protocols that support BTCfi assets.

In the past, the only Layer 1 options that could truly be used for building were Ethereum and some other blockchains. Now, Bitcoin offers an alternative that is not only economically more secure and neutral, but also potentially provides superior technical security due to a smaller attack surface compared to Ethereum. Traditional projects can eliminate billions of dollars in annual expenses and/or inflation by switching to a proof-of-stake model using BTC or Bitcoin L2, while gaining better security and maintaining a high level of technical and cultural independence.

Bitcoin L2: The Coolest Kid on the Block

L2 Takes Center Stage

Unsurprisingly, L2 became the focal point of this conference. BitcoinOS (Grail) announced the launch of a new Rollup protocol that can directly verify proofs on Bitcoin (similar actions were also taken by BitVMX on the testnet a few days ago). In addition, Bitlayer and many other L2-related companies were major sponsors of this conference and hosted numerous L2 afterparties. In summary, the momentum of L2 development is undoubtedly strong (mainly sidechains, as Janusz from Bitcoin Layers insists, which seems wise). I predict that as these L2s continue to onboard more projects, this trend will intensify. Different Bitcoin L2s will compete to build strong community moats to resist fierce competition in this field. Over 80 projects have already joined this race, and we have also found that this hype is clearly temporary for many people. Most people are aware of the major participants in Asia and the United States, and other participants will remain shrouded in the fog of war unless they bring new innovations. A significant moment during the conference was Cathie Wood discussing Bitcoin L2 with Alyse Killeen on the main stage, which may signal that larger institutional participants are considering entering this field (Franklin D. Development Research Institute also held a private event with several venture capital companies, including UTXO).

Rollup Teams at the Forefront of Bitcoin Research

After meeting with the teams from Alpen, Bitlayer, and Citrea, we clearly recognized the level of technical research in the Bitcoin field. The paradigm shift of BitVM has prompted some of the smartest people in this field to explore the cutting-edge areas of Bitcoin script and zero-knowledge proofs, and the work completed now is likely to bring the next million users into the Bitcoin ecosystem, with trust assumptions that can meet the needs of most users.

However, despite the excitement about Bitcoin Rollups, this track still faces many challenges. The first is the cost of providing data availability to Bitcoin. While this is good for miners, the challenge is how to provide the least amount of trust in the process while providing the best solution (trust-minimized solutions). Another point is that these teams are preparing to release new technical papers to the public, aiming to bring new understanding of how to design bridges for these Rollups.

The Forgotten Lightning Network

Amidst all the attention focused on Trump and the new, shinier object (sidechains), the Lightning Network was forgotten during the conference. Alex B from Bitcoin Magazine raised this issue at Alpha Day: "I don't think I've heard anyone mention the Lightning Network."

Perhaps forgotten for a few days, but the Lightning Network is not dead. Once fees soar again (it's not a question of if, but when), I am sure the Lightning Network will once again become the focus of discussion.

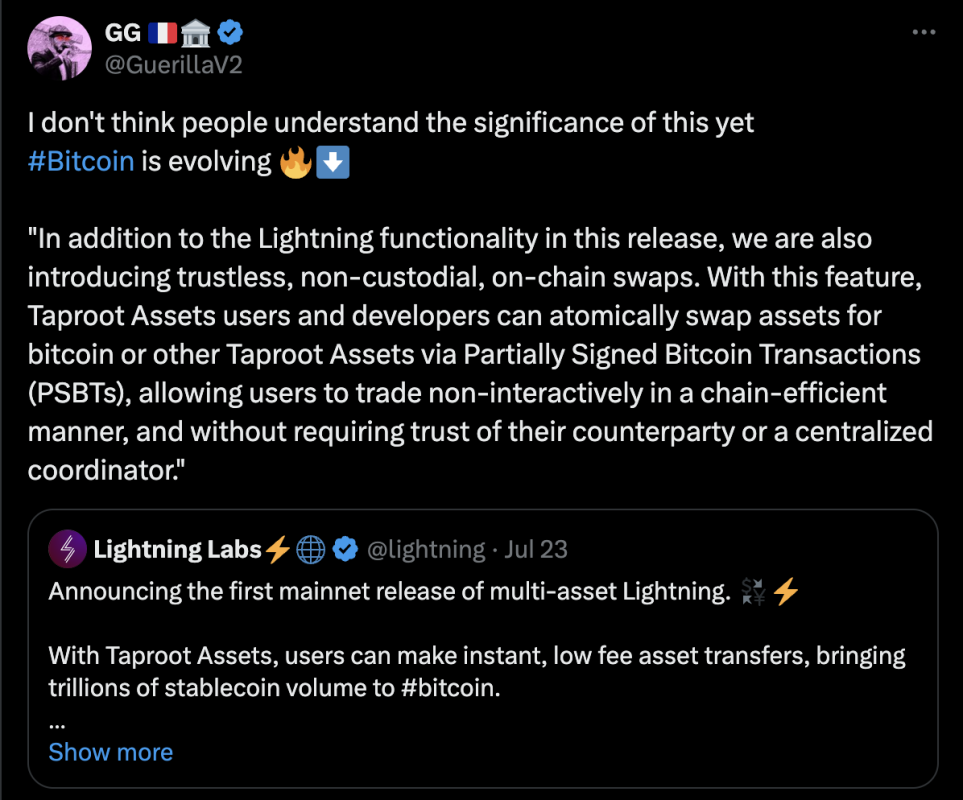

Regardless, the Lightning Network track will continue to grow slowly and steadily. Just as Lightning Labs announced (finally) the release of Taproot Assets on the Lightning Network before the conference, my reaction to this news was, "I don't think people understand the significance of this, Bitcoin is evolving."

Lightning-fast, trustless, and native to Bitcoin (earning for nodes) transactions. People always say that sometimes it's wrong to be too early, but in the case of Lightning, I believe this is the best outcome for capital allocators. Yes, there are no degens on the Lightning Network, and no so-called culture, but it has excellent token standards and network effects. Many people I spoke to at the conference tend to oppose the application of Runes/BRC-20s to Taproot Assets, but I believe they are complementary, one with a community, and the other with means to save the community a lot of costs and speed up transaction settlements (in a fully trustless manner).

I believe that investment opportunities at the intersection of Runes/Bitcoin native assets and Lightning infrastructure will be crucial, as the demand in this area will naturally flow to these projects (Joltz and LnFi are good examples that come to mind).

Can We Still Mine Now?

Unit hash rate price is no longer the key for profitable miners, but "we are building an AI pilot project"

In my discussions with miners and analysts, it is clear that the only catalyst supporting miners at the moment is not related to mining, but to capital allocation. Miners are choosing to allocate resources to artificial intelligence and high-performance computing, while investors are choosing to allocate resources to miners involved in these relatively new verticals the most. This shift has several reasons:

First, after the Bitcoin block reward halving, miners are finding it difficult to maintain substantial profits, and the transaction fees collected from Ordinals and Runes (so far) have been disappointing. This has led many miners to consider other sources of income, preferably those that are highly profitable, predictable in time, and compatible with existing infrastructure, and artificial intelligence is the most suitable choice.

Second, the marginal effects of hash rate announcements have forced miners and analysts to rethink how to value publicly traded companies, and the market is generously rewarding mining companies with exposure to artificial intelligence risk.

Although this trend is largely attributed to Core Scientific and Iris, it seems to be weakening and returning to rationality, with many representatives at the conference betting on selling their available capacity to AI/HPC companies at a premium.

Nevertheless, other factors driving mining growth last week are still very apparent, including unexpected advancements in ASIC design efficiency (especially Bitdeer's goal to reach 5J/TH by 2025), and the return of mining institutional financing led by Cantor Fitzgerald, which announced a $2 billion financing deal, with the expected growth rate far exceeding this level. This is important because unlike the 2021 mining cycle, when mining companies mainly relied on ASIC-backed loans to raise funds, since then, the capital markets have been closed to mining companies, forcing them to rely on highly diluted ATM issuances. This statement may be a turning point in mining financing in the 2025 cycle.

The Commoditization of Block Space is Becoming a Reality

I had the privilege of attending the Alkymia launch event hosted by Blockspace Media. For those unfamiliar with Alkymia, its new platform allows users to place directional bets on Bitcoin transaction fees. This is a new tool that allows miners to stabilize income while allowing exchanges, protocols, and traders to hedge against transaction fee volatility. As block space becomes increasingly valuable, the complexity of on-chain transactions will also increase, providing an advantage to professionals who understand the nuances of the Bitcoin mempool.

Mempools were also an important topic of discussion last week, as the additional programmability of Bitcoin and the introduction of Rollups may introduce some form of MEV or MEVil into protocols. Understanding the potential impact of MEV on Bitcoin is very important, and our investment in Rebar Labs has never been more meaningful. Although we are still in the early stages of these discussions, the people I have spoken to generally believe that MEV on Bitcoin will be different from Ethereum, with less centralization risk and easier opportunities for all miners.

The Overlooked Speech by Matt Corallo

Speaking in front of a potential future President of the United States is no easy task. However, Bitcoin core developer Matt Corallo made a very insightful statement about the fundamental principles of Bitcoin development, which deserves more attention. In particular, his accurate description of the block size debate in front of thousands of listeners. The history of Bitcoin is more of a governance issue than a block size issue, that is, who decides when and how to modify the code?

After 2017, we found the embryonic answer, that is, miners and companies do not have the decision-making power. And after the BTC++ conference earlier this year, we found that developers/technical commentators also do not have the decision-making power. The only remaining stakeholders in the Bitcoin governance triumvirate are the users, although users ultimately have to work with miners and developers to solidify code changes into the blockchain, they are still the "gatekeepers" preventing unnecessary protocol changes. Bitcoin is not just code, not just a blockchain, and not even just a currency, it is consensus among users.

So, after over 22,000 people came to Nashville to learn about Bitcoin, what did we learn from them?

In conversations with some locals and international visitors in Nashville, I gathered the following information:

Change is exciting, and most people are in favor of the recent proposals to bring more functionality to Bitcoin. However, most people do not understand what they can change or how they work, and there is a lack of related educational content.

After promoting Bitcoin to Uber drivers and restaurant/bar staff, I found that user experience is still the most concerning issue for people. Most people know about Bitcoin, have heard of it, or have bought some. But the most common situation is that people put Bitcoin on mobile platforms like Cash App, but do not know how to store Bitcoin in their own address. Most importantly, I believe that the next upgrade of Bitcoin should make it easier for people to store their Bitcoin, which is exactly what they will need when interacting with L2 and applications in the future. I believe that focusing on infrastructure investment will be crucial in this cycle.

Finally, I would like to end this article with Michael Saylor's optimistic prediction for Bitcoin. Michael Saylor predicts that by 2045, the price of Bitcoin will reach $13 million. Perhaps, you have to remind yourself every day that you may not be bold enough or optimistic enough.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。