Writing by: LINDABELL

In March 2024, Ethereum completed the Cancun upgrade, bringing the focus back to the Layer2 field. At the same time, in the first half of the year, Starknet and zkSync completed airdrop plans one after another, and the four major mainstream Layer2 projects have issued tokens. In addition, some emerging Layer2 projects also performed very well in 2024. For example, Base achieved significant traffic growth in the first half of 2024, surpassing Optimism to become the second largest Layer2.

Despite the strong growth trend in the Layer2 field, there are still doubts about the authenticity of its data in the market. Previously, the daily transaction volume and active address count of zkSync had been questioned. So, does this apparent prosperity truly reflect the actual usage of the network?

TL;DR:

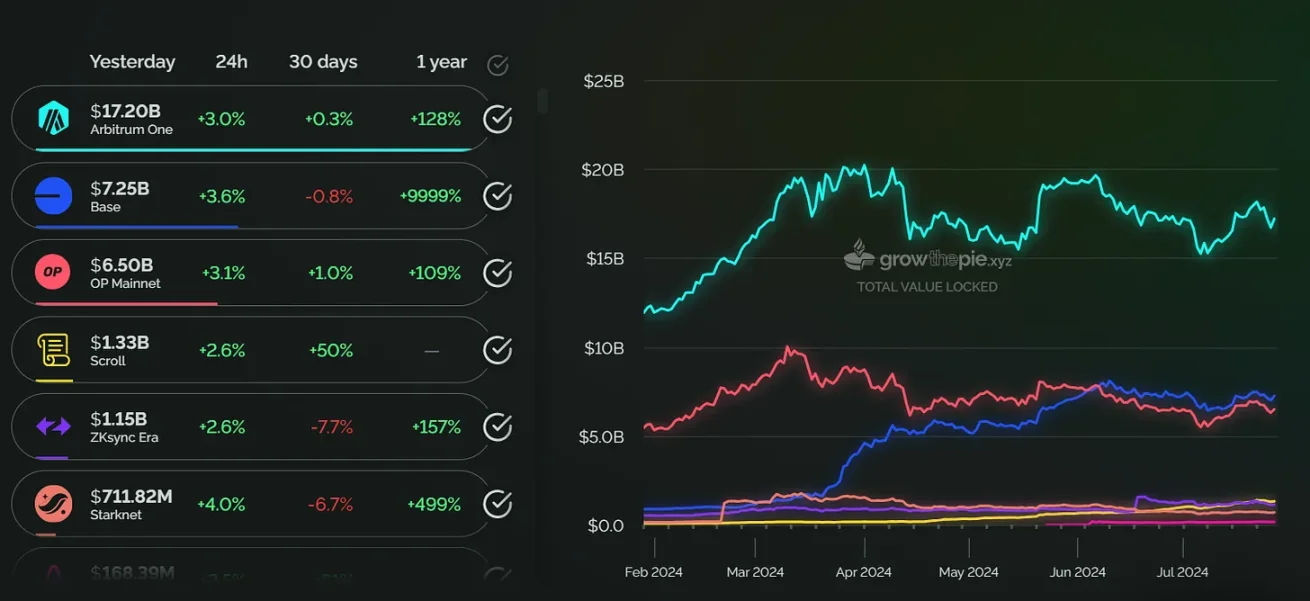

- In the first half of 2024, Arbitrum continued to lead, with a total locked value of $17.15 billion, accounting for 40% of the market share, firmly in first place.

- Base surpassed Optimism with a TVL of $7 billion, becoming the second largest Layer2 platform. As of July 28, Base's daily transaction volume reached 4 million transactions, almost double that of Arbitrum, and the number of active addresses also exceeded Arbitrum, reaching over 600,000.

- zkSync's TVL reached $1.12 billion in the first half of 2024, an increase of about 99% from the beginning of the year, but the number of active addresses decreased by 83.5% after the airdrop, and the daily transaction volume also decreased by 86%. Similarly, Starknet's TVL reached a peak of $1.776 billion in March 2024, but fell to $685 million, with a 92% decrease in the number of active addresses and a 64.2% decrease in daily transaction volume.

- Taiko launched its mainnet in May 2024, and its TVL reached a historical high of $190 million on June 5, but then fell to $163.45 million. The number of active addresses decreased by 78.3% after reaching its peak in June.

- Scroll's TVL saw a year-on-year increase of 1544%, but the increase in the number of active addresses and daily transaction volume was relatively small. The number of active addresses increased by 13.4% compared to the beginning of the year, and the daily transaction volume increased by 27.7%.

Total Locked Value

Arbitrum Leads, Base Surpasses Optimism to Become the Second Largest Layer2

In the first half of 2024, the total locked value of the Layer2 ecosystem increased from approximately $22.8 billion at the end of January to $42.97 billion, an increase of about 88%. Arbitrum, Optimism, and Base were the main contributors.

Since the beginning of 2024, Arbitrum's total locked value has been consistently leading. As of July 28, Arbitrum's TVL reached approximately $17.15 billion, firmly in first place, accounting for about 40% of the market share, more than 2.4 times that of the second-ranked Base. According to DeFiLlama data, the projects with the highest total locked value on Arbitrum are AAVE with a locked value of $8.1262 billion, followed by GMX and Uniswap with $5.1389 billion and $3.2543 billion, respectively.

In addition, from the chart below, it can be seen that Arbitrum's total locked value showed a downward trend from March to May, which may be mainly due to the large unlocking of ARB tokens by the Arbitrum team and investors in March. According to Token Unlocks data, as of July 28, the unlocking progress of ARB is currently at 34%.

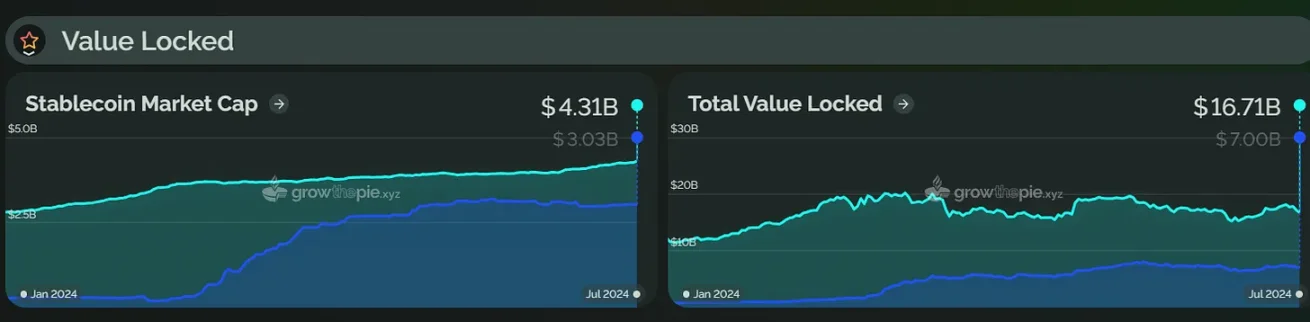

As a rising star, Base has maintained an upward trend since the beginning of 2024 and surpassed Optimism in June to become the second largest Layer2. Currently, Base's total locked value is approximately $7 billion, an increase of about 716% from the beginning of the year. From the chart below, it can be seen that Base experienced a significant TVL growth in March, possibly due to the continuous growth of Farcaster, the reduction in gas fees after the Cancun upgrade, and the popularity of the MEME token, which significantly increased on-chain liquidity and drove the growth of TVL. However, Base's TVL has slightly declined from June, by about 6.6%.

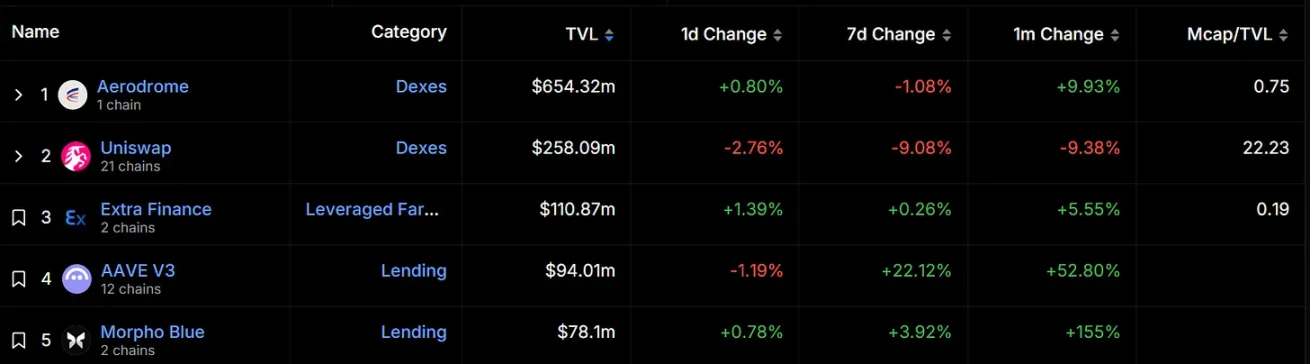

According to DeFiLlama data, the current DeFi TVL on Base is $1.67 billion, with native DeFi projects taking the lead, including Aerodrome ($654 million) and Extra Finance ($110 million). Aerodrome is the dApp with the highest total locked value on Base, leading by more than double the second-ranked Uniswap.

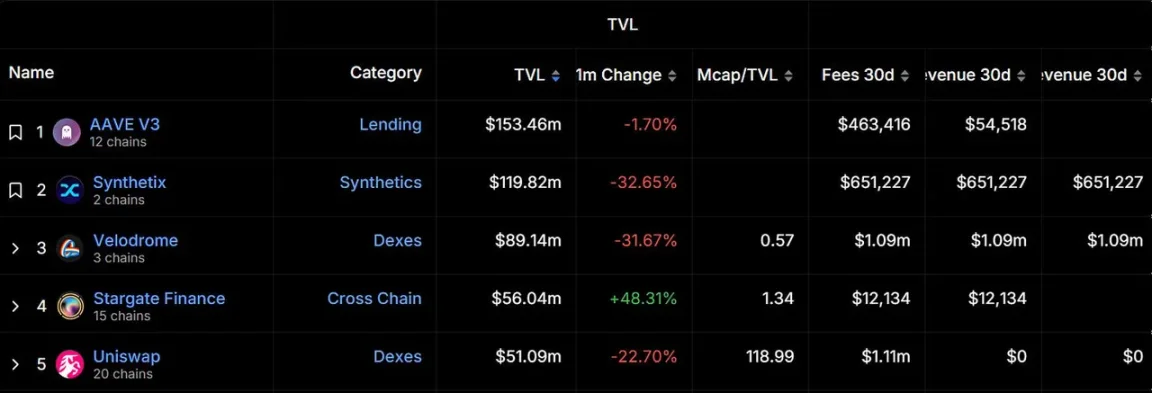

Optimism currently ranks third in total locked value, reaching a peak in the first half of 2024 on March 10, and then slightly declining, but overall remaining relatively stable, and was eventually surpassed by Base in June. According to DeFiLlama data, the top three projects in the Optimism ecosystem by TVL are AAVE v3, Synthetix, and Velodrome. However, these projects have shown a downward trend in TVL in the past month.

Scroll Repeatedly Hits New Highs, Taiko TVL Reaches Historical High and Then Declines

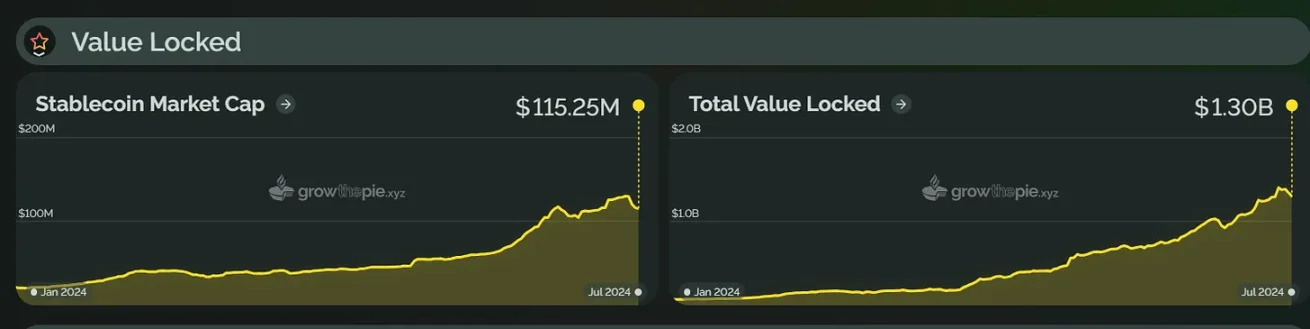

On the other hand, Scroll's total locked value in 2024 has repeatedly hit new highs, reaching $1.3 billion, ranking fourth among the Layer2 projects selected in this article, with an astonishing increase of 1544%. This growth may be attributed to a series of activities launched by Scroll at the user and developer levels. Scroll launched Scroll Sessions in April and started Session One on June 21, aiming to reward DeFi users providing liquidity in DEX. In addition, Scroll also launched the "Level Up with Scroll" platform, allowing developers to apply for ecosystem funding.

According to DeFiLlama data, the project with the highest total locked value on Scroll is its native ecosystem project Pencils Protocol, with a locked value of $310.87 million, showing a 317% increase in the past month. It is worth noting that the total locked value of DeFi on Scroll is $769.02 million, and the total locked value of the top three projects in its ecosystem accounts for over 95% of the market share.

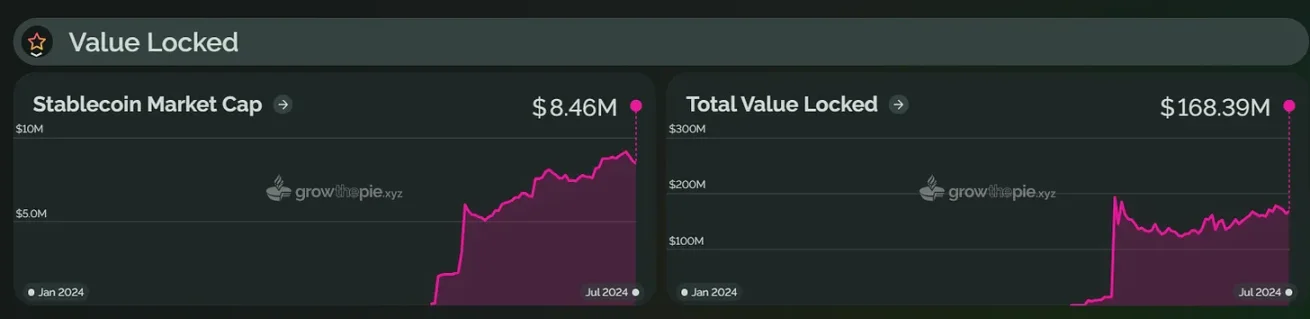

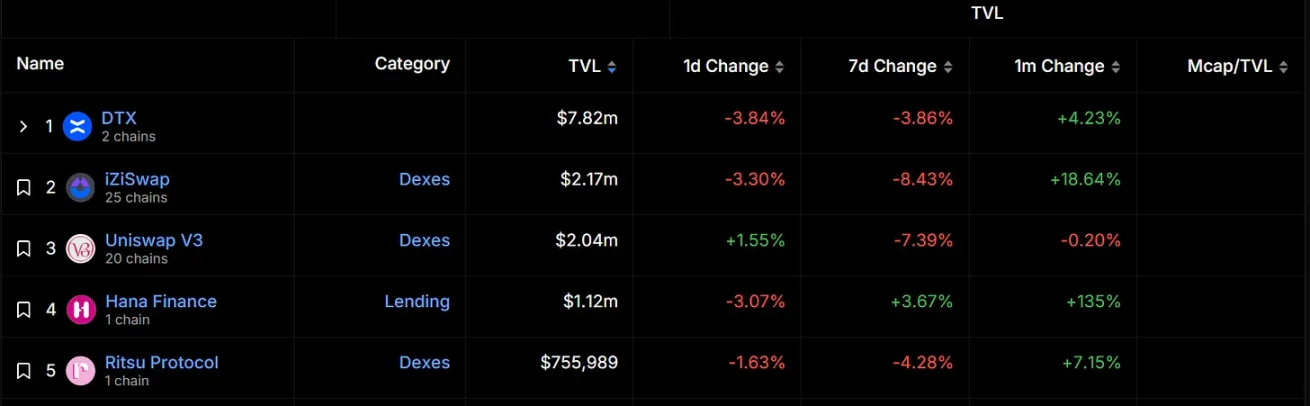

Taiko launched its mainnet on May 27, 2024. From the chart below, it can be seen that Taiko's TVL reached a historical high of approximately $190 million on June 5 and has now fallen to $163.45 million. As a newly launched Layer2 mainnet, Taiko's TVL is relatively low compared to other well-known Layer2 platforms, but it is actively expanding its ecosystem. For example, in terms of DeFi applications, Taiko has integrated over 80 projects including LayerZero, Stargate, and Oku Trade.

According to DeFiLlama data, the top three projects in terms of total locked value on Taiko are the decentralized perpetual trading platform DTX, the multi-chain DEX platform iZiSwap under iZUMi Finance, and Uniswap V3. Overall, the TVL of projects in the Taiko ecosystem is not high, and DTX occupies a significant market share.

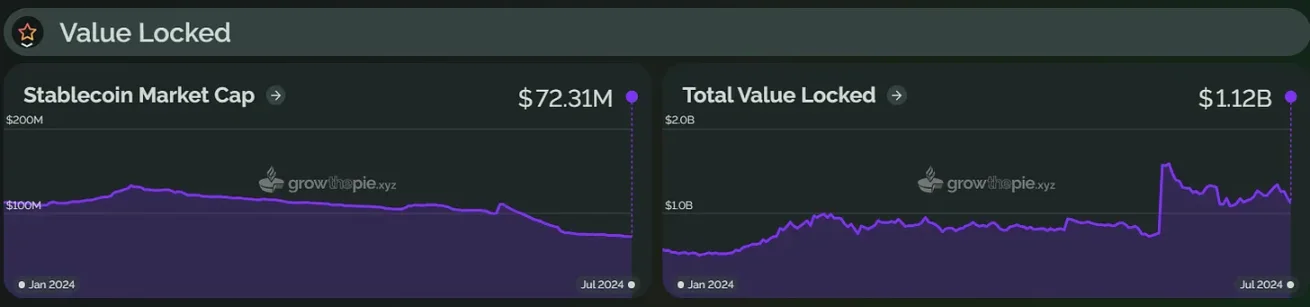

zkSync and Starknet Facing Ecosystem Challenges, Decrease in TVL After Airdrop

As of now, zkSync's total locked value is $1.12 billion, an increase of about 99% from the beginning of the year. From the chart below, it can be seen that zkSync's TVL showed significant growth in June, mainly attributed to its airdrop plan announced on June 11. According to the plan, zkSync airdropped 3.6 billion tokens to community members on June 17, with a total of 695,232 eligible wallet addresses. However, Nansen data shows that after the zkSync airdrop, over 40% of the main recipients sold all allocated tokens, and 41.4% sold some of the allocated tokens. Currently, only 17.9% still hold the tokens.

In addition, despite zkSync's ecosystem integrating over 200 projects, data shows that only 2 projects have a TVL exceeding $10 million. The project with the highest TVL is SyncSwap, with a TVL of $35.17 million, taking the lead. Furthermore, the top three projects, SyncSwap, Koi Finance, and zkSwap Finance, all experienced a decrease in TVL in the past month. Overall, for zkSync, the effects of the airdrop are just beginning, and ecosystem issues and sustainable development are the key areas that need attention.

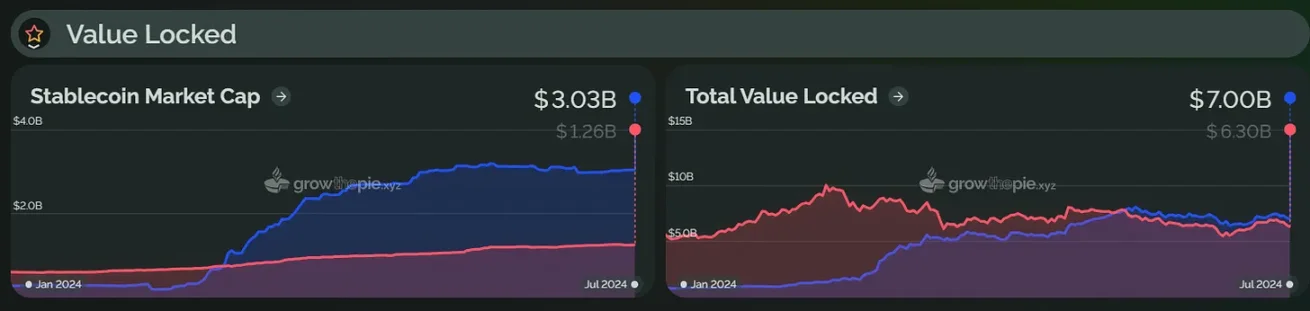

Similarly, in the first half of 2024, Starknet's total locked value started to significantly increase on February 20 and reached a historical high of $1.776 billion on March 14. This growth was mainly driven by the STRK token airdrop plan and the "Starknet Spring DeFi Incentive Plan" launched by the Starknet Foundation. However, as of now, Starknet's TVL has fallen to approximately $685 million, a decrease of about 61% from its peak.

In terms of ecosystem progress, the Starknet ecosystem has integrated over 100 applications. The top five projects in terms of total locked value on Starknet are all native projects of Starknet. The top project is the lending protocol Nostra, with a locked value of $164.6 million; the second-ranked project is the decentralized exchange Ekubo, which saw a 61.95% increase in TVL in the past month, reaching $77.98 million; and the third-ranked project is the lending protocol zkLend, with a TVL of $26.7 million. However, there are only four projects with a TVL exceeding $10 million in the Starknet ecosystem, and the fifth-ranked lending protocol Vesu has a TVL of only $3.77 million.

Active Addresses and Transaction Volume

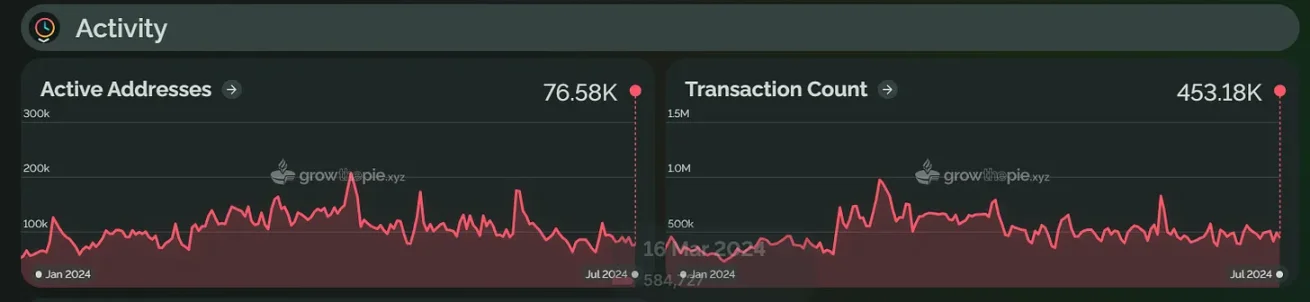

In addition to TVL, the number of active addresses and daily transaction volume of the network can reflect the actual usage and user participation in the network. In the first half of 2024, Arbitrum and Base had high user activity, while zkSync and Starknet showed a significant downward trend. Optimism and Scroll showed steady growth, although the increase was relatively small.

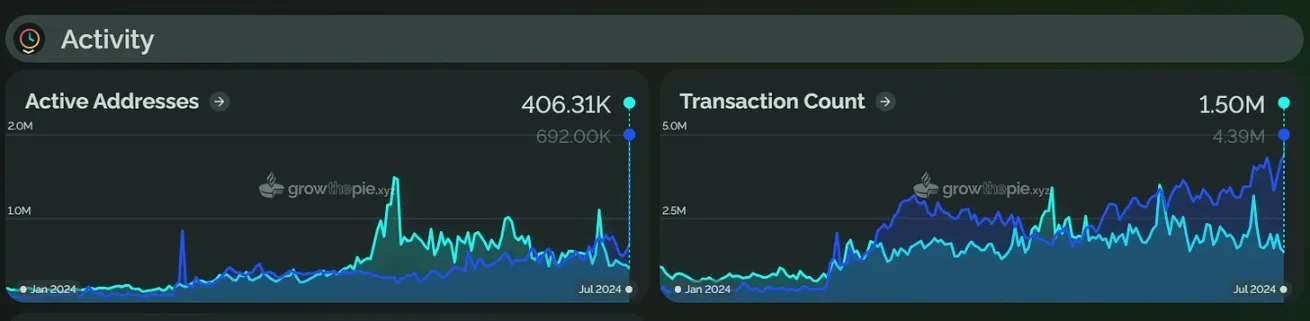

Arbitrum Sees a 140.7% Surge in Active Addresses, Base's Daily Transaction Volume Exceeds 4 Million Transactions

Since the beginning of 2024, the number of active addresses on Arbitrum has increased by 140.7%. This growth is attributed to the large-scale subsidy and funding support strategies implemented by Arbitrum. For example, the Arbitrum community passed a proposal in June to provide support for Arbitrum ecosystem games with a total of 200 million ARB tokens over a period of three years, and allocated $25 million for project management and operations. In addition, the Arbitrum Foundation provided funding support to 13 projects including DODO and Double in May. However, Arbitrum's daily transaction volume has only increased by 43.7% since the beginning of the year, a smaller increase compared to the increase in the number of active addresses. This may be due to the fact that although a large number of new users created addresses, they did not engage in frequent trading, or mainly engaged in low-frequency trading activities.

Currently, the daily transaction volume and active address count of Base are higher than Arbitrum. From the chart below, it can be seen that at the beginning of 2024, Base's daily transaction volume was only 330,000 transactions, while Arbitrum was around 1 million transactions. Since March 2024, Base's daily transaction volume has started to significantly increase and reached a new high on June 27. As of July 22, the daily transaction volume of Base has reached over 4 million transactions, almost double that of Arbitrum. At the same time, the active address count of Base is also increasing and has now surpassed Arbitrum, reaching over 600,000. Apart from the influence of meme coins and SocialFi, the smart wallet launched by Coinbase has also played an important role in improving user experience and transaction volume. This smart wallet provides a simplified, gas-free on-chain experience, allowing users to create a free, secure, self-custodial wallet in seconds, significantly improving the convenience of user transactions.

Significant Decline in Active Addresses and Daily Transaction Volume for zkSync and Starknet

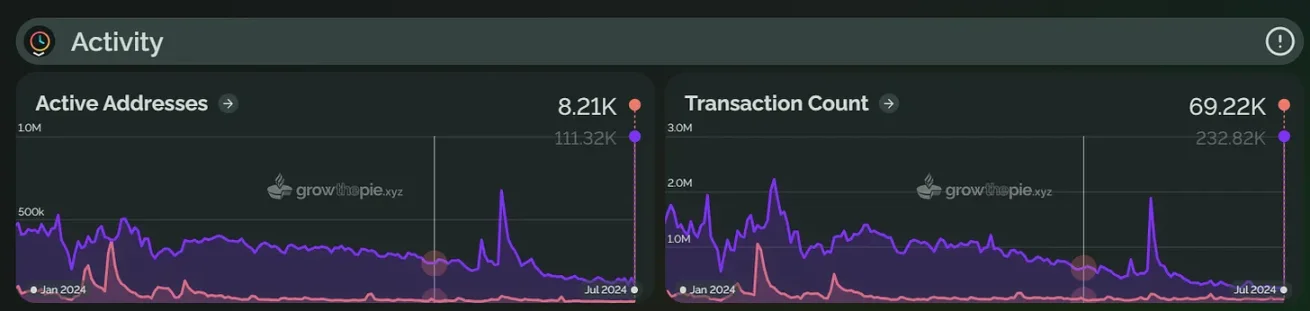

In the first half of 2024, both the active address count and daily transaction volume in the zkSync ecosystem showed significant declines. At the beginning of the year, zkSync had the highest number of active addresses, but it gradually decreased. From the chart, it can be seen that within a month after the zkSync airdrop on June 17, the number of active addresses on the network decreased by about 83.5%. This indicates that most users participated only to receive the airdrop. In addition, zkSync's daily transaction volume has also been declining since the beginning of the year, currently down by about 86% from the beginning of the year. Similar to the active address count, the daily transaction volume showed a significant decline within a month after the airdrop.

On July 2, zkSync announced the launch of zkSync 3.0 Elastic Chain, which is an infinitely scalable ZK Rollup network. zkSync stated that this solution achieves native, trustless, low-cost interoperability between ZK chains. However, whether it can capture market share from Optimism's Superchain and Polygon's AggLayer still needs to be verified over time.

Similarly, in the first half of 2024, both the daily transaction volume and active address count for Starknet also declined. As of now, Starknet's daily transaction volume has decreased by about 64.2% from the beginning of the year, and the active address count has decreased by about 92%. Among the selected Layer2 solutions in this article, Starknet's daily transaction volume and active address count are at the bottom. From the chart, it can be seen that there was a small wave of increase in the active address count and daily transaction volume for Starknet at the beginning of the year, mainly due to the airdrop plan in February, but after the airdrop, the active address count and daily transaction volume gradually declined. In the future, Starknet also plans to airdrop approximately $400 million worth of STRK tokens.

However, Starknet has several update plans scheduled for the second half of the year. The Starknet community has released v0.13.2 and a summer roadmap update, with v0.13.2 expected to be released in August and v0.13.3 expected to be released between October and November. At the recent Brussels ETHCC summit, Eli Ben-Sasson also announced that Starknet will open staking at the end of 2024.

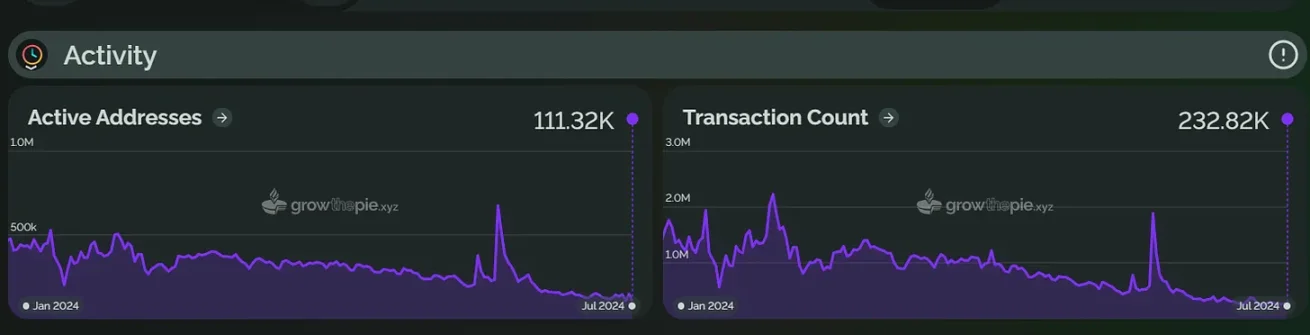

Steady Growth for Optimism and Scroll, with 35% and 13.4% Increase in Active Addresses

Optimism's development in the first half of 2024 has been relatively stable. The daily transaction volume and active address count have seen a slight increase since the beginning of the year, with the active address count increasing by 35% and the daily transaction volume increasing by 14%. From the chart, it can be seen that there have been small peak fluctuations in the active address count and daily transaction volume for Optimism, which may be related to specific developments or market activities. For example, in May, Optimism announced the availability of L3 built with OP Stack, which is eligible for retro funding, airdrops, and growth activities. In addition, the Retro Funding by Optimism has been distributed in four rounds starting from May, with a total allocation of 850 million OP to fund projects or individuals in the ecosystem. These activities and incentives may have contributed to the increase in the active address count.

In the first half of 2024, the active address count for Scroll increased by 13.4% since the beginning of the year, and the daily transaction volume increased by 27.7%. Unlike the significant increase in TVL for Scroll, the increase in active address count and daily transaction volume is not substantial.

After the Mainnet Launch, Taiko's Active Address Count Decreased by 78.3% from its Peak

From the chart, it can be seen that the active address count for Taiko sharply increased on June 4-5, then began to decline, possibly due to the TAIKO token being listed on the Bitget exchange on June 5. Subsequently, the active address count decreased, with a small increase after June 11, currently at about 40,000, a decrease of 78.3% from the peak. In addition, Taiko's daily transaction volume reached a historical high on June 30, currently at 1.35 million transactions, a decrease of about 38.4% from the peak.

Furthermore, after the mainnet launch, some community members have stated that Taiko has higher fees compared to other L2 protocols on Ethereum. In response, Taiko stated that this is mainly due to its involvement in more logic and storage. The current implementation uses multiple upgradable proxies, adding additional delegation call costs. Additionally, Taiko's blocks are not batched or proven, and proposers need to interact more frequently with Ethereum to compete for block space and ensure on-chain activity. As the on-chain circular buffer has not been exhausted, storage write costs are also high. Taiko stated that this situation will be improved in approximately 40 to 60 days. It is worth noting that Taiko's mainnet successfully upgraded to version 1.7.0 on July 2, which is expected to significantly reduce the Gas consumption of the Rollup protocol on Ethereum.

Conclusion

Overall, both established Layer2 projects and new entrants have shown diverse development trends in the first half of 2024. However, there are also some issues in this field, such as the decline in user participation for zkSync and Starknet after the airdrop, reflecting an overreliance on short-term incentives. While Scroll and Taiko have shown significant growth in TVL, they are facing challenges in maintaining user activity, requiring more comprehensive ecosystem development. This also means that as the market continues to evolve, major Layer2 projects will need to continue innovating and expanding to ensure sustainable growth and user participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。