Author: Frank, PANews

After experiencing a sharp decline in the cryptocurrency market on October 11, the market seems to have entered a prolonged "calm period." For most investors, understanding how the current market liquidity has recovered after the heavy blow on October 11 may be more important than predicting price fluctuations. Additionally, how do the dominant funds in the market view the future direction?

In this regard, PANews attempts to analyze the current capital structure of the market through several data points, including order book depth, options market, and stablecoins. The final conclusion is that the market does not seem to have welcomed a true recovery but is instead trapped in a state of continuous liquidity decline and accelerated defensive measures by institutional funds, leading to a structural split.

Micro Liquidity: Fragile Balance and Disappearing Support

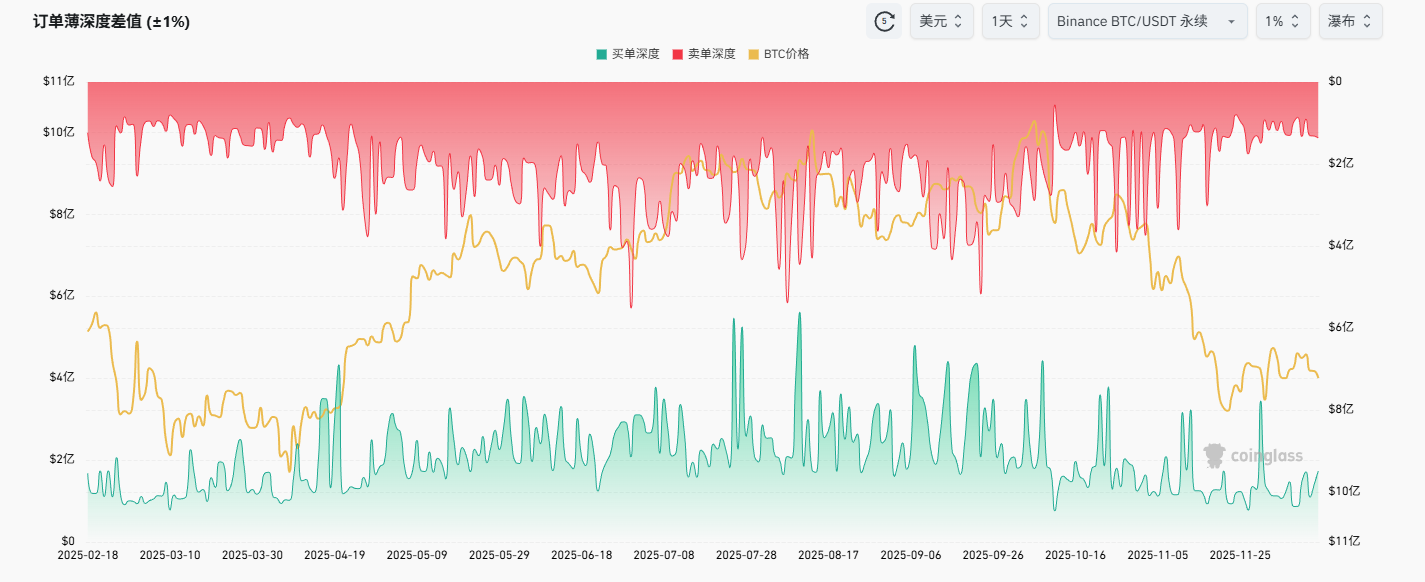

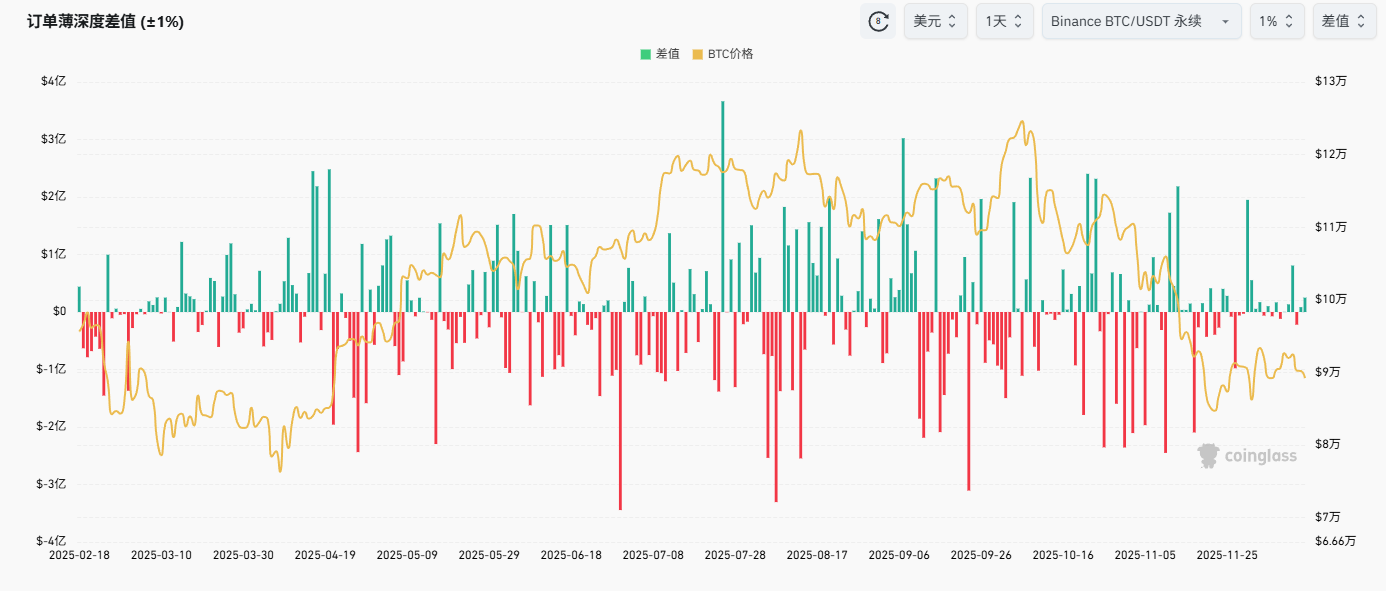

To understand the current liquidity situation, the order depth difference is one of the most direct indicators.

Taking the depth chart of the Binance BTC/USDT perpetual trading pair as an example, it is evident that since October, the depth of the buy order book has decreased significantly, dropping from a previous level generally above $200 million to a range of $100 million to $200 million. The depth of buy orders has also shown a clear decline, remaining below $200 million.

In terms of the difference, the depth difference between long and short orders has also become noticeably more balanced recently, with the order difference only around $10 million for several days since November. This data indicates that the entire market is currently in a relatively balanced state between long and short positions, but liquidity continues to decline.

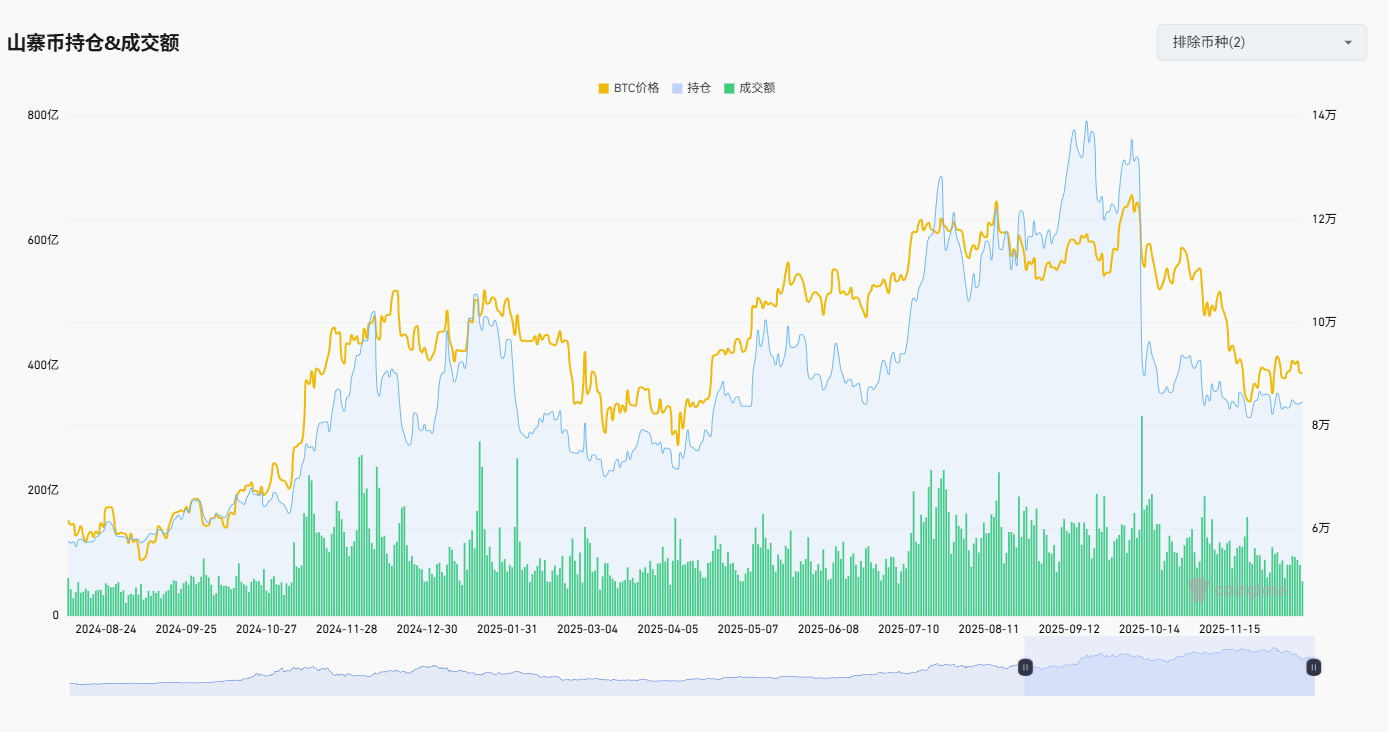

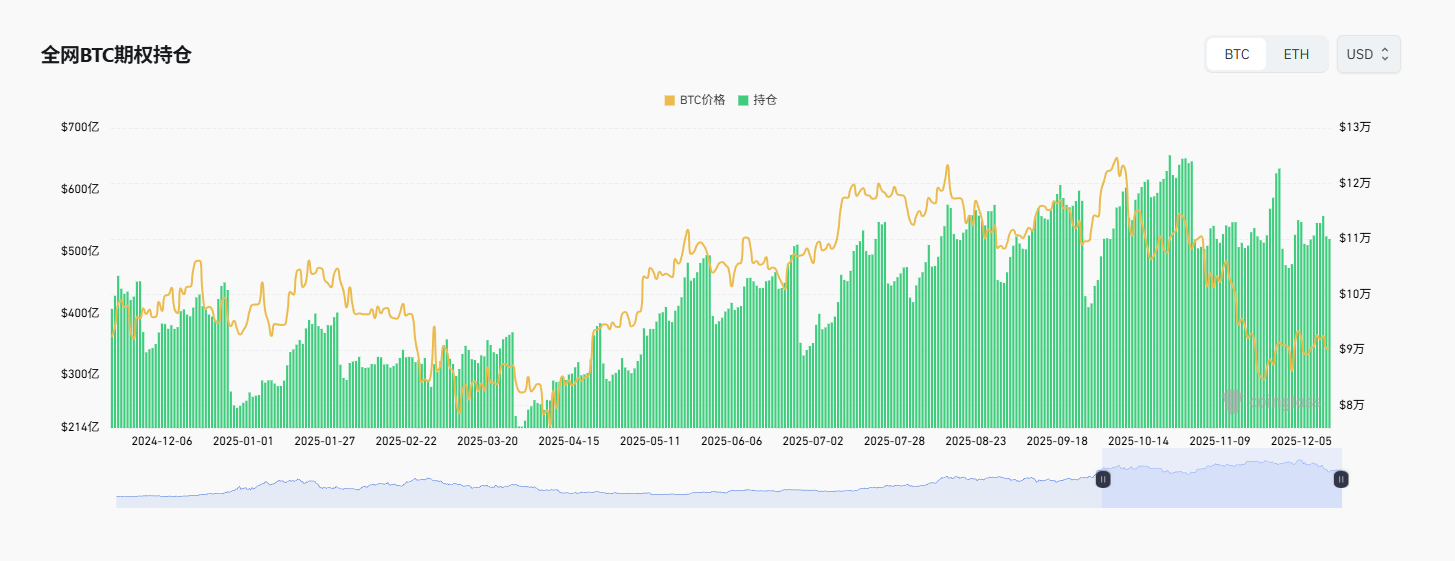

Regarding open interest, the overall open interest in altcoins (excluding BTC and ETH) has not shown growth as prices hit lows; instead, it is also in a state of decline. In comparison, the entire market experienced a significant rebound in open interest after a deep correction in April, even before prices reached their lowest point.

At the same time, the trading volume in the altcoin futures market is also shrinking, with no significant increase in volume triggered by bottom-fishing. From this data, it appears that the altcoin market has entered a state of neglect.

Options Market: Retail Investors Buying Lottery Tickets, Institutions Bearish

Another interesting data point is the ratio of crypto options to crypto contracts. The data shows that the proportion of BTC options has skyrocketed since the beginning of this year, even exceeding 100% at its peak, and currently maintains around 90%. Previously, the proportion of BTC options had long been around 60%. This means that the current BTC market has completely shifted from being dominated by futures contracts to being dominated by options contracts. However, the crypto options to crypto contracts ratio for ETH has dropped to a very low level this year, around 30%.

This data confirms two issues. One is that the dominance of the BTC market has been completely taken over by institutions and hedge funds, while ETH and other altcoins seem no longer to be trading options for these institutions and hedge funds. Another key point is that in predicting the BTC market, options market data has become more important. We can also see this trend in the total open interest of BTC options, which remains high even as prices decline.

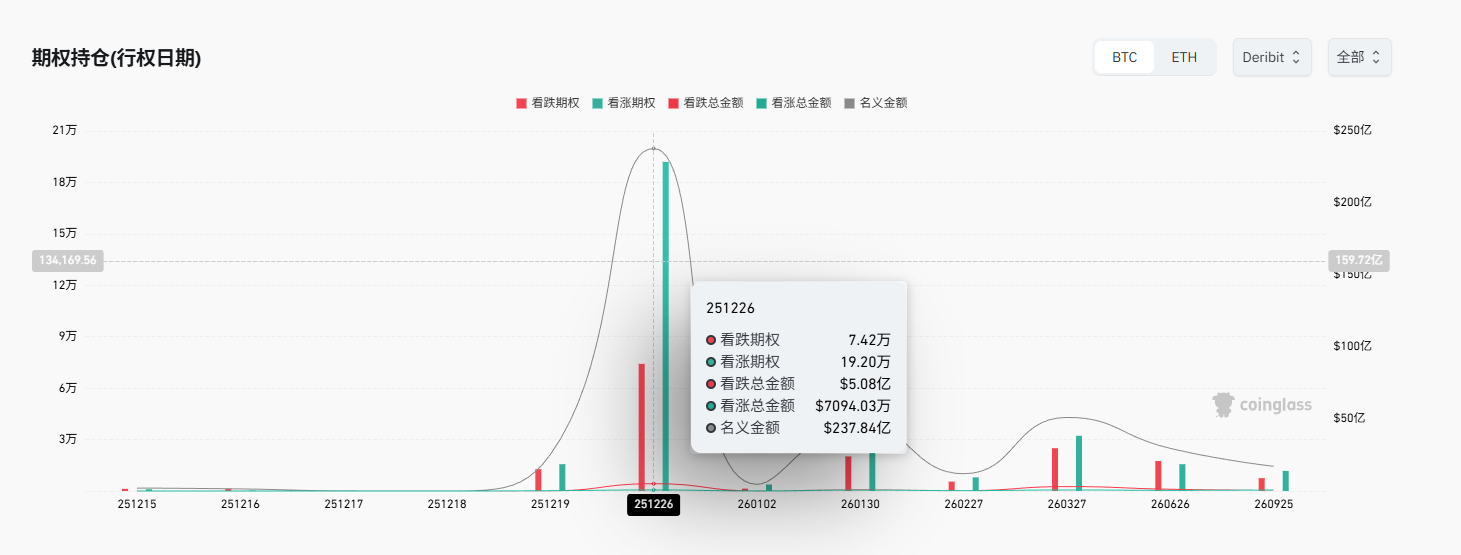

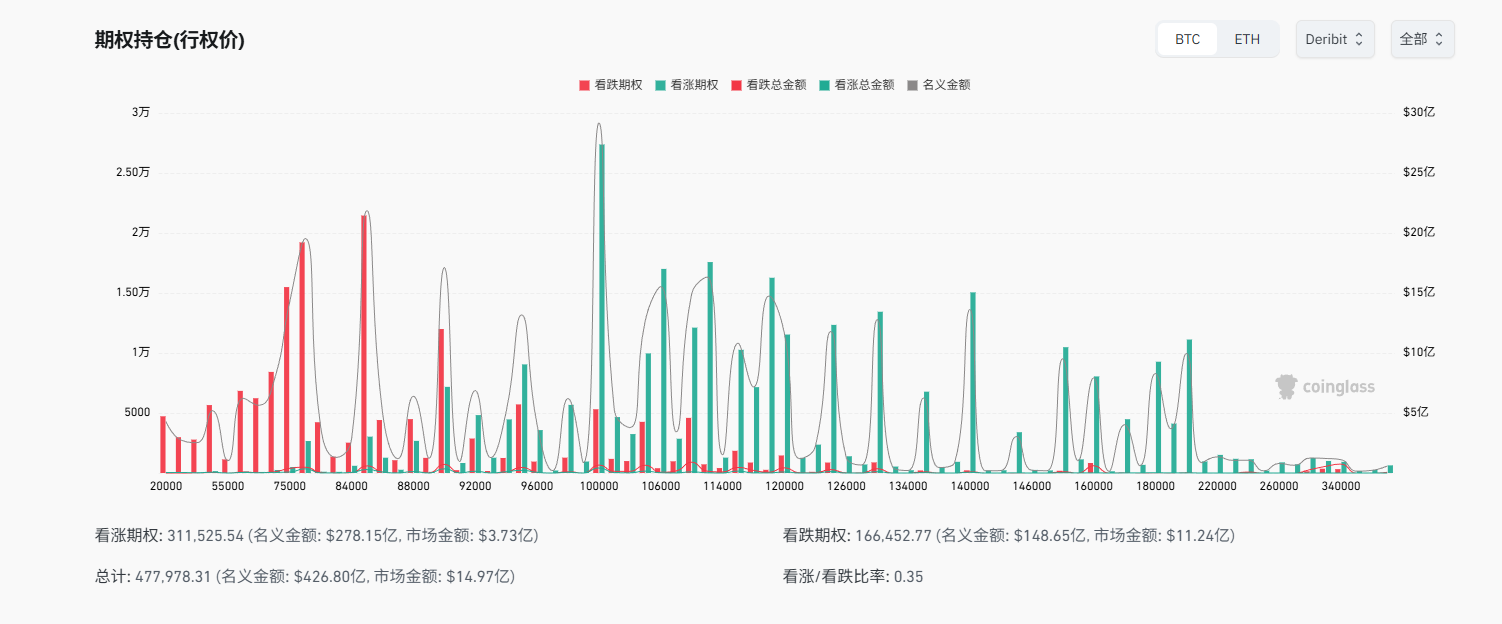

Therefore, the options expiration date and maximum pain point have become important reference indicators for the current BTC market. According to the latest data, the next important options expiration date is December 26, where the total amount of call options reaches 192,000, while the total amount of put options is only 74,200. However, the total value of these put options is as high as $508 million, while the total value of call options is only $71.25 million. This inverted data indicates that the current call options are very cheap (around $370), while put options are very expensive (reaching $6,800).

Combining the distribution of options strike prices, we can see that most call options are distributed above the $100,000 price level, which also makes it very unlikely for these options to be exercised on December 26. Therefore, although there are a large number of call options, they are more inclined towards speculative targets akin to "buying lottery tickets." Meanwhile, a large number of put options have strike prices concentrated at $85,000 and below. Additionally, the market value of put options has reached $1.124 billion, while the market value of call options is only $373 million (the premium paid by investors to purchase options). In summary, although there are more people bullish, in reality, more funds (about 75%) are betting on a decline or defending against a decline.

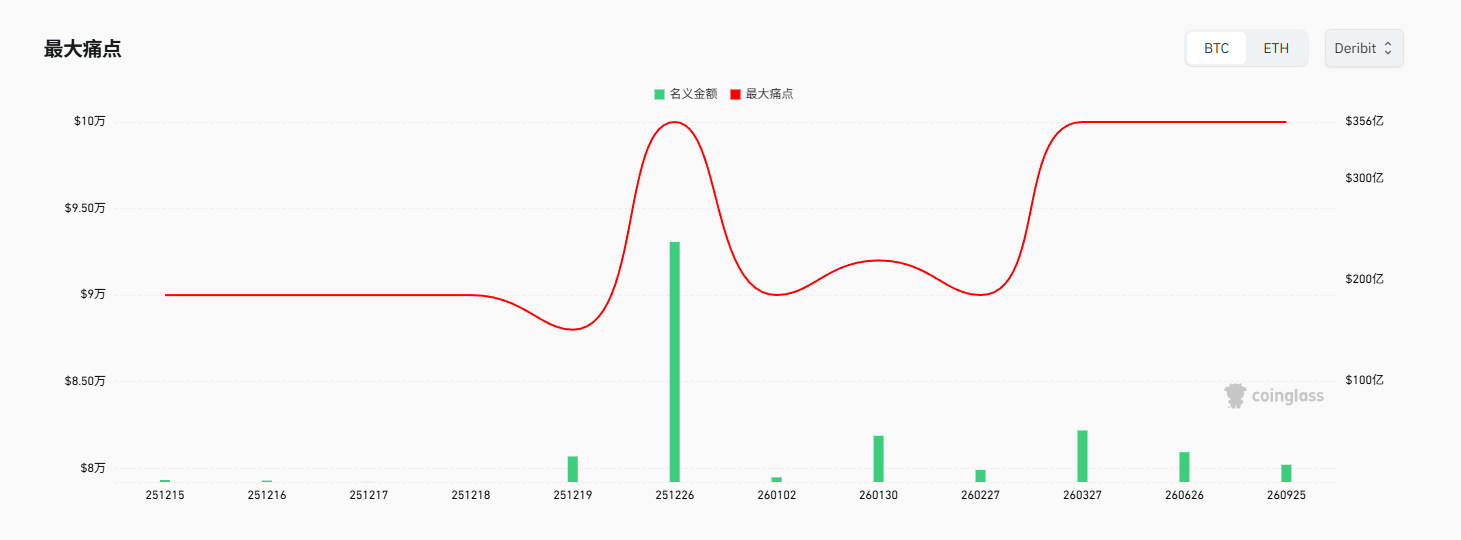

Furthermore, the current maximum pain point is at the $100,000 mark. This indicates that the $100,000 price may become the focal point of competition between options sellers and buyers this month. For market makers (options sellers), they may be the main bulls in the current market; as long as the price can be pushed to around $100,000, they will become the biggest winners.

However, for institutions that have invested heavily in put options, most of them may be using options to hedge against the risk of spot declines. Although they are primarily bearish out of defensive choices, the fact that they still allocate funds to put options despite the high costs indicates a significant pessimistic sentiment regarding future market trends.

Stablecoins: Regulatory Retreat, Speculative Capital Observing

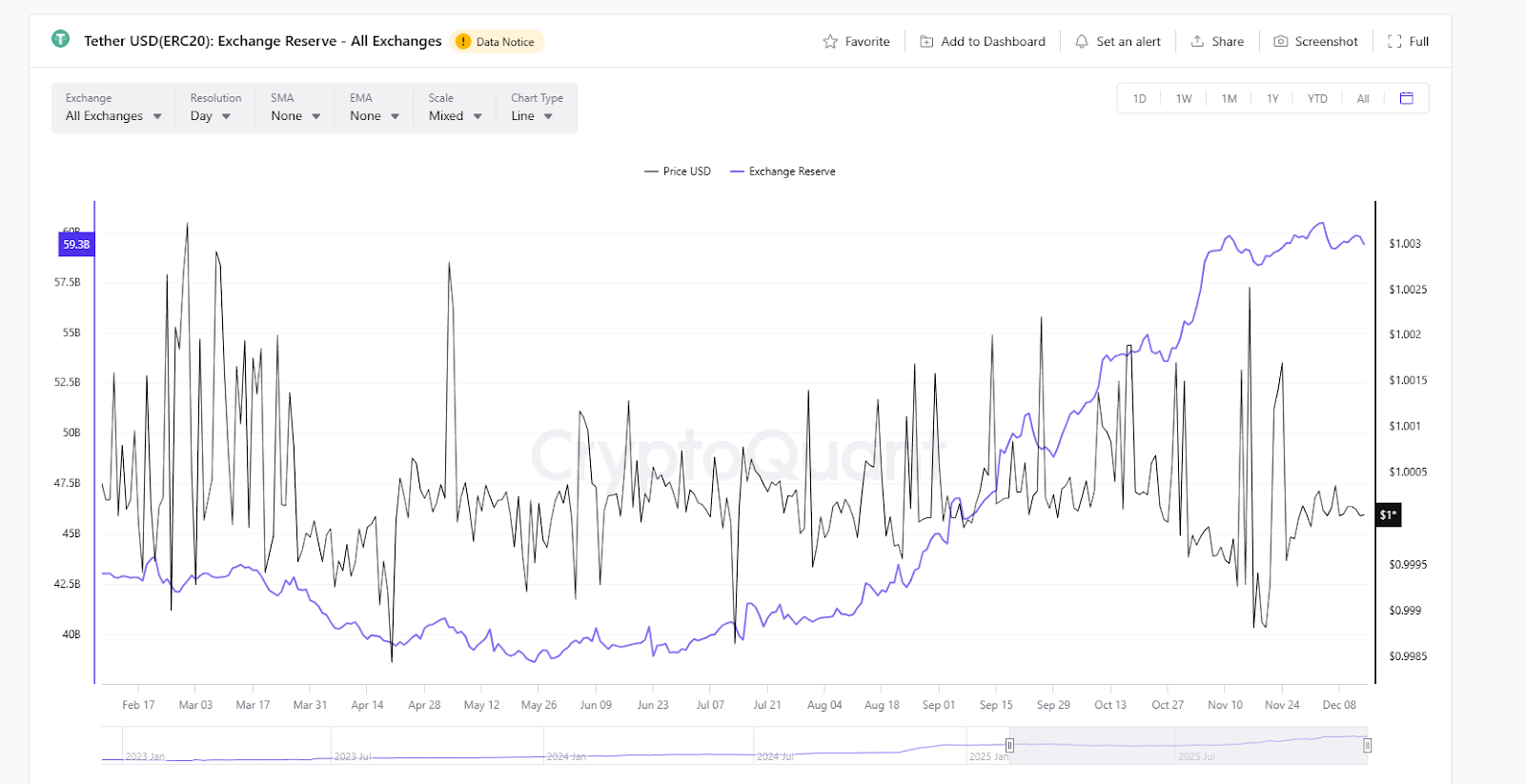

In addition to options data and order book data, stablecoin data is also an important indicator for assessing current market liquidity and direction, especially the flow of stablecoins on exchanges. However, this data also reveals a clear divergence in the market.

According to data from CryptoQuant, the exchange reserves of USDT have been on an upward trend this year and have maintained this momentum recently. On December 4, USDT reserves on exchanges reached a historical peak of $60.4 billion and currently remain at a high point of $60 billion. As the main pricing target for non-compliant exchanges in the market, the continuous growth of USDT reserves indicates that a large amount of speculative capital is still maintaining a betting or bottom-fishing state. Combined with the current decline in open interest, it can be felt that a significant amount of speculative capital is in a wait-and-see state.

In contrast, USDC shows a completely different picture. Since the end of November, a large amount of USDC has been withdrawn from exchanges, with exchange reserves dropping sharply from $15 billion to around $9 billion, a decrease of 40%. As the leading compliant stablecoin, USDC's main users come from U.S. institutions, compliant funds, etc. They represent the institutional faction in the market. Currently, it is evident that this group is accelerating their exit.

From the changes in the inflow and outflow of these two stablecoins, it seems that the market is waiting for retail and speculative capital to bottom out, while compliant institutions are retreating. This aligns with the earlier observations regarding changes in the BTC options market. Of course, another possibility is that under the downward risk of the market, a large amount of capital is converting their crypto asset holdings into stablecoins for hedging.

In reality, the data and indicators for assessing the market go far beyond these, but overall, they almost all draw similar conclusions. That is, the market has not truly recovered after the sharp drop on October 11; what we see is a market with scarce liquidity and significant divergence between institutions and retail investors. Retail and speculative capital are holding onto their chips and observing in the market, while compliant institutions or major funds are accelerating their exit from the spot market and paying high premiums in the options market to build a short defense line.

The current market does not seem to be a poised bottom but rather resembles a defensive battle of "institutional exit and speculative capital gaming." At this moment, paying attention to whether the institutional defense line at $85,000 is breached is far more pragmatic than expecting a breakthrough at $100,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。