Authored by: Tia, Techub News

MakerDAO is one of the important cornerstones of the Ethereum DeFi ecosystem. By collateralizing Ethereum with MakerDAO, users can obtain liquidity without selling their assets. Bitcoin is the most valuable asset in the crypto space, but due to its Turing incompleteness, it has not been effectively utilized. However, with the development of the Bitcoin ecosystem and the proliferation of various Bitcoin Layer2 solutions, there seems to be a possibility for the financialization of Bitcoin.

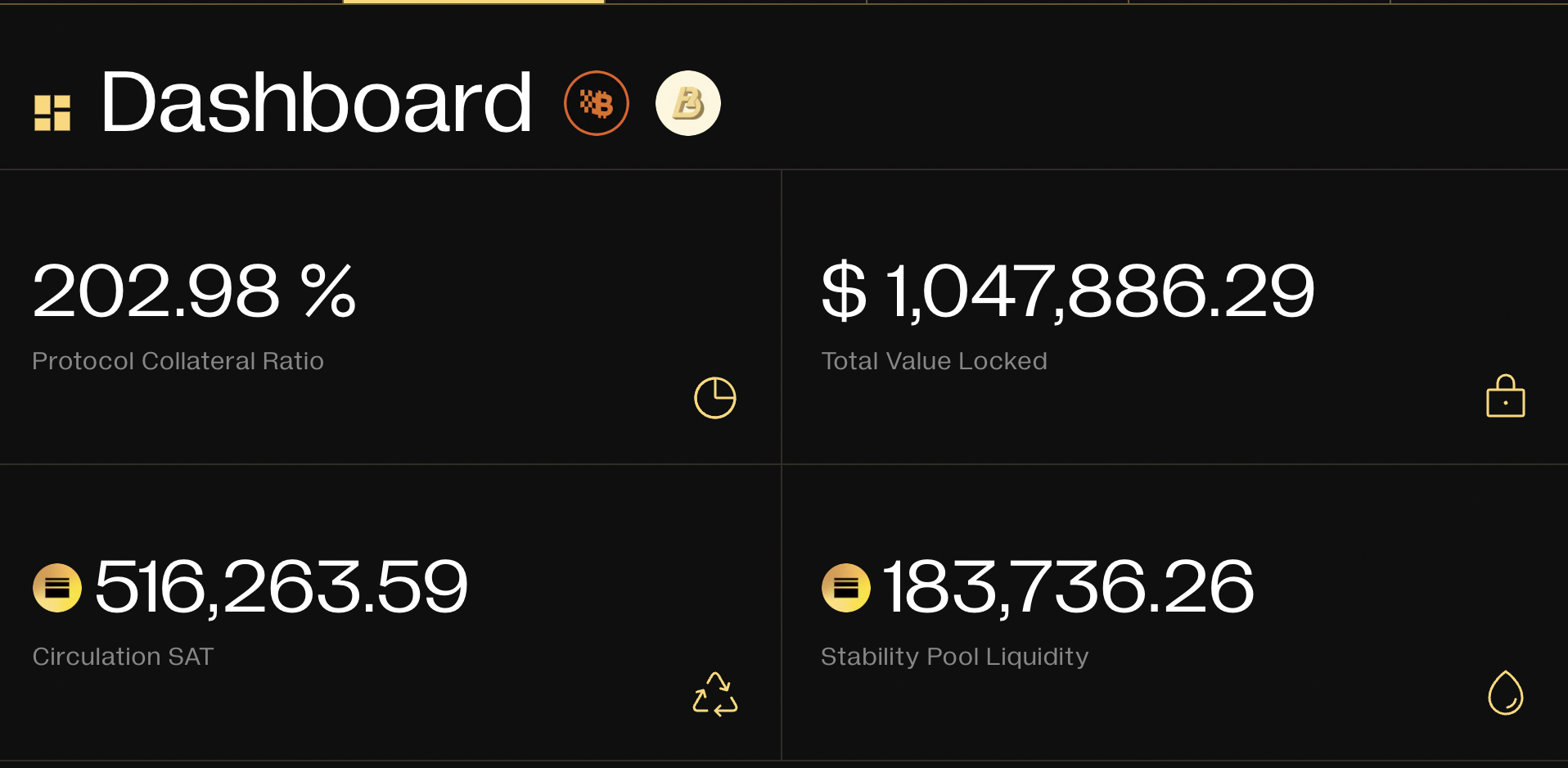

Satoshi Protocol is a stablecoin protocol built on the Bitcoin Layer2 BEVM. It announced on July 9th that it had completed a $2 million financing round, led by CMS Holdings and RockTree Capital. Currently, it has a locked amount of $1,047,886. Although the scale is not large, there is still potential for Bitcoin over-collateralized stablecoins in terms of narrative.

How to Mint Stablecoins? And How to Maintain "Stability"?

The stablecoin issued by Satoshi Protocol pegged to the US dollar is SAT. Users can deposit collateral to borrow SAT stablecoins, with a minimum collateralization ratio of 110%. Currently supported collateral includes Bitcoin Layer2 Bitlayer, Bitcoin on BEVM, and Lorenzo stBTC (Lorenzo is a Bitcoin liquidity financial layer based on Babylon, and Lorenzo stBTC is a liquidity collateral token generated by pledging Bitcoin).

When users mint SAT by borrowing against collateral, the Satoshi Protocol charges a minting fee and a fixed annual interest fee. Additionally, users need to deposit an extra 2 SAT as a reserve for gas fees during liquidation. If the position is not liquidated, this fee will be refunded to the user upon closing the position.

The minting fee is a one-time payment at a rate of the base rate + 0.5%. The base rate is determined by the proportion of redeemed SAT to the total stablecoin supply, and it is dynamic but not less than 0.5% and not more than 5%.

Stability Mechanism: Nexus Yield Module

The Nexus Yield Module (NYM) aims to manage and optimize the use of stablecoin assets within the ecosystem. NYM allows users to exchange stablecoins such as USDT and USDC for Satoshi Protocol's stablecoin SAT. When the module receives stablecoins from users (USDT, USDC), it mints an equivalent amount of SAT and sends it to the users. When there is a price difference for SAT, external users can arbitrage through this module to help maintain the peg of SAT to the US dollar.

Additionally, the Nexus Yield Module generates additional income through participating in DeFi mining, leveraging CeFi platforms for interest rate arbitrage and market-neutral trading. Users can also deposit SAT into this module to receive income distribution. After depositing SAT, users will receive a certificate sSAT representing their collateral assets, which can be used to claim rewards generated by NYM activities.

Risk Control

Risk control mainly relies on the liquidation mechanism, which automatically initiates liquidation and repays the debt of the liquidated position when the collateral falls below the minimum over-collateralization ratio. The liquidation mechanism of Satoshi Protocol is more refined, implementing different liquidation parameter standards for different assets to isolate risks. It customizes borrowing rates, loan-to-value ratios (LTV), and other risk parameters for different asset types to ensure the protocol remains safe and adaptable to different market conditions. By distinguishing these parameters, the protocol can better manage risks associated with volatile assets and provide users with a more stable and secure environment. Additionally, the protocol continuously monitors the performance and volatility of each asset type and can adjust the parameters for each asset type in response to changes in market conditions.

Satoshi Protocol also differs in its liquidation mechanism. In the crypto space, the common liquidation mechanism is auction-based. In times of extreme price volatility, inefficient auction models can lead to delayed liquidation and increased losses. However, Satoshi Protocol's more open liquidation mechanism can effectively avoid this issue. At Satoshi Protocol, user participation in liquidation does not require permission. When the collateralization ratio falls below the minimum standard, any user can trigger the liquidation process, making liquidation more immediate. Furthermore, to incentivize liquidation, Satoshi Protocol provides incentives to liquidators, who can receive a certain percentage of collateral rewards and gas compensation.

Stability Pool

In addition, Satoshi Protocol has created a dedicated asset pool called the Stability Pool (SP) for liquidation. Users can deposit their SAT into this pool to earn rewards from liquidation events and Satoshi Protocol's native token OSHI. When liquidation is triggered, the Stability Pool can use SAT to settle debts. In return, the Stability Pool can receive collateral from the liquidated position. The earnings from liquidation will also be distributed to users who have deposited SAT into the Stability Pool. Satoshi Protocol also has a flash loan module to support liquidation, ensuring that the protocol can process liquidation quickly even when the Stability Pool funds are insufficient.

Recovery Mode

Satoshi Protocol also has a recovery mode. When the total collateralization ratio (TCR) falls below 150%, this mode is triggered. In recovery mode, specific measures are taken to prevent further decline in TCR, including liquidating positions with collateral ratios below 150%, restricting lending activities that could further harm TCR, and waiving lending fees to improve TCR.

Token Economics

The native token of the Satoshi Protocol is OSHI, with a total supply cap of 100,000,000 tokens. Investors hold 15%, advisors hold 2%, the team holds 15%, ecosystem incentives hold 45%, the public sale ratio is 2%, and the remaining 21% is reserved.

The ecosystem incentives will be used for position creation incentives, Stability Pool (SP) incentives, and providing liquidity incentives to liquidity pools. 20% of the total supply is allocated to position creation incentives, 10% to Stability Pool (SP) incentives, and 15% to providing liquidity incentives to liquidity pools.

Additionally, the protocol has lock-up periods for holders. Investors can unlock 10% after the public sale (TGE) and the remaining 90% after waiting for another 6 months post-TGE, followed by linear unlocking over 24 months. Advisors have a cliff period of 12 months post-TGE, followed by linear unlocking over 24 months. The team also has a cliff period of 12 months post-TGE, followed by linear unlocking over 24 months. The reserves and ecosystem incentives will be linearly unlocked over 60 months.

sOSHI

Pledging OSHI can earn sOSHI, and the longer the pledging lock-up period, the higher the conversion rate of sOSHI received. sOSHI holders have the right to share all the protocol's earnings.

The above constitutes the complete introduction to Satoshi Protocol. While Satoshi Protocol has made some improvements to over-collateralized stablecoins in certain details, enhancing its risk resistance, overall, the mechanism is still quite similar to traditional CDPs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。