Authors: Gage, Mat, Darl, WolfDAO

Preface

Pendle Finance is an innovative interest rate derivative protocol. In simple terms, it achieves the separation of principal and interest by splitting interest-bearing tokens (i.e., tokens that generate income when held) into principal tokens (PT) and yield tokens (YT). This mechanism allows users to choose different risk and return exposures according to their own needs, and manage their investments more flexibly.

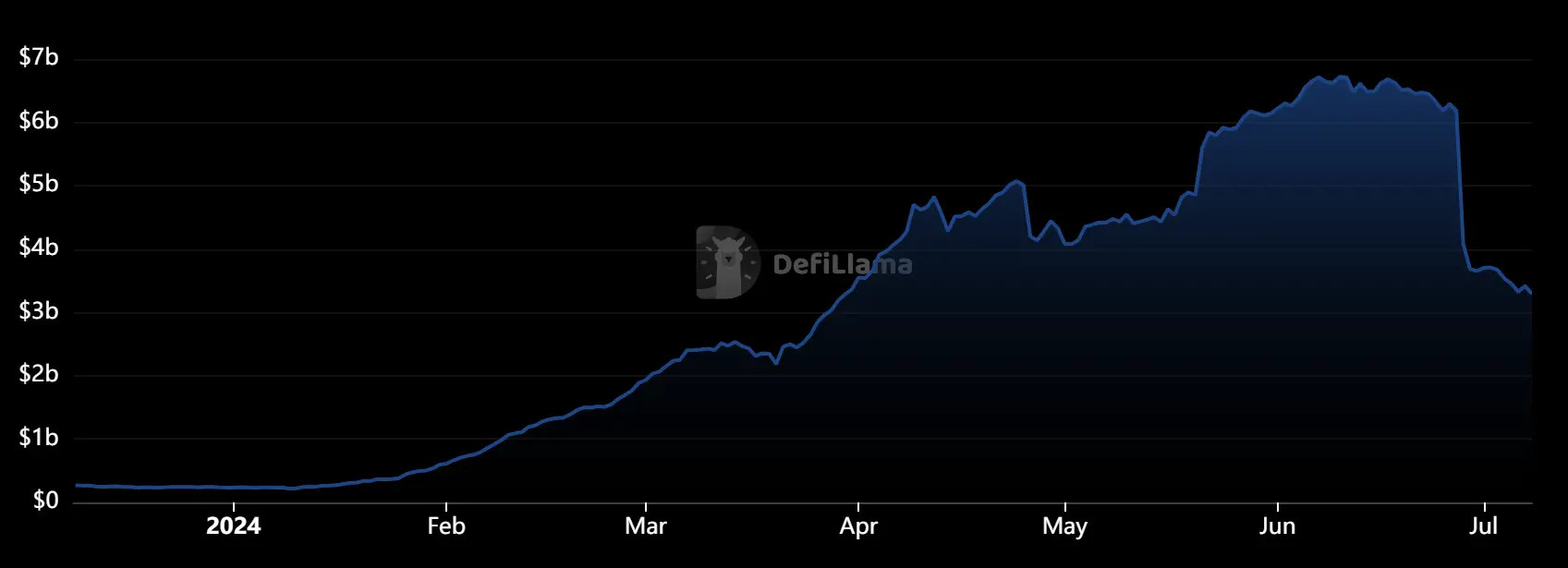

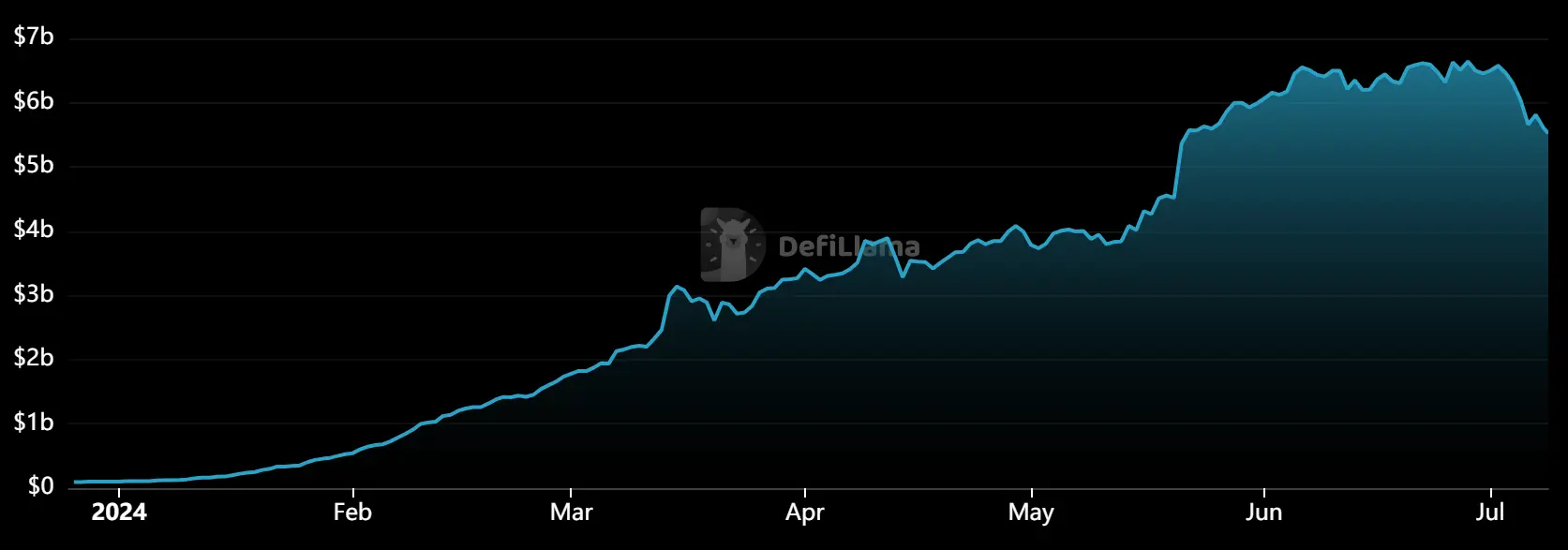

Over the past two years, Pendle has stood out in fierce market competition and has successfully become a well-deserved leading protocol in the LSDFi/Yield field. However, recently, Pendle's Total Value Locked (TVL) has plummeted from nearly $7 billion to $3.4 billion, and the token price has also nearly halved.

This phenomenon has attracted widespread attention. Therefore, this article will analyze in detail the reasons for the decline in TVL, observe the impact on the PENDLE token, and attempt to summarize the future expectations of the PENDLE token for readers' reference.

Event Overview

According to the latest Defilama data, on June 10th, Pendle's Total Value Locked (TVL) reached a peak of $6.7 billion. However, in the following two weeks, the TVL sharply dropped by 40%, with approximately $3 billion being withdrawn from Pendle. The main reason for this significant decline is that multiple financial products on the Pendle platform expired, leading users to choose to stop staking and withdraw their funds.

Detailed Analysis

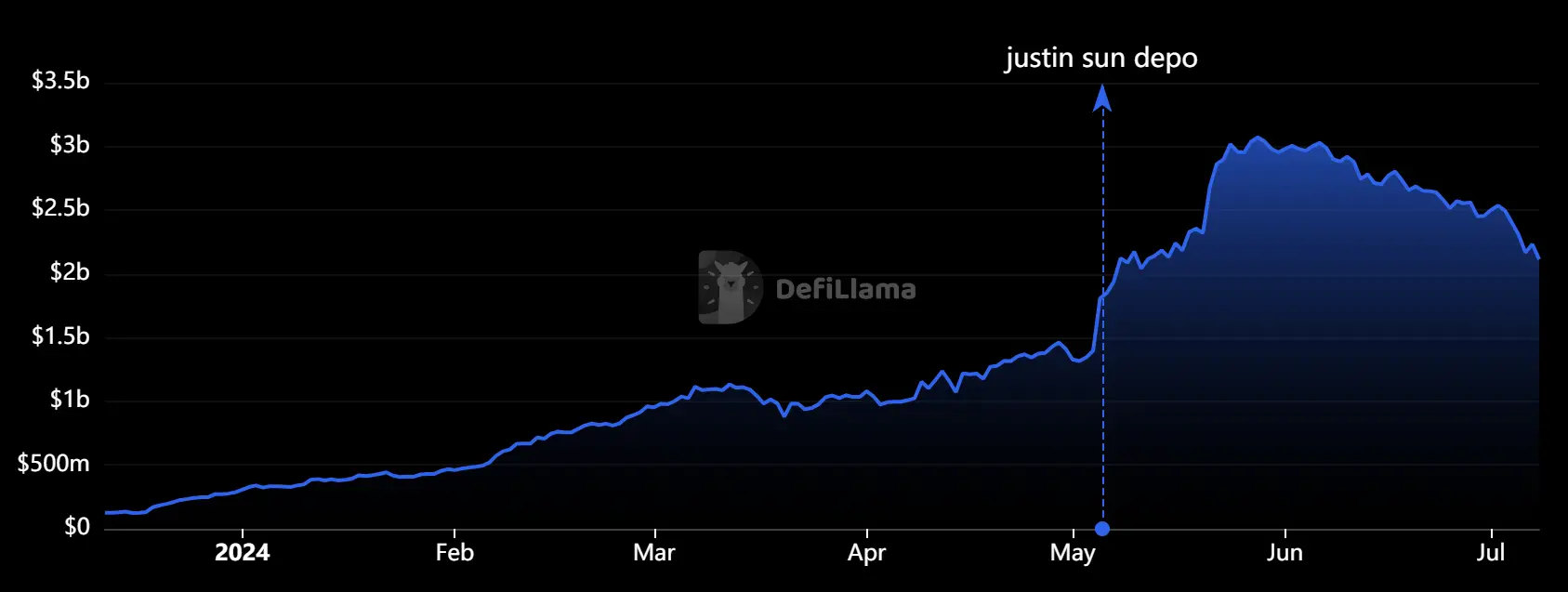

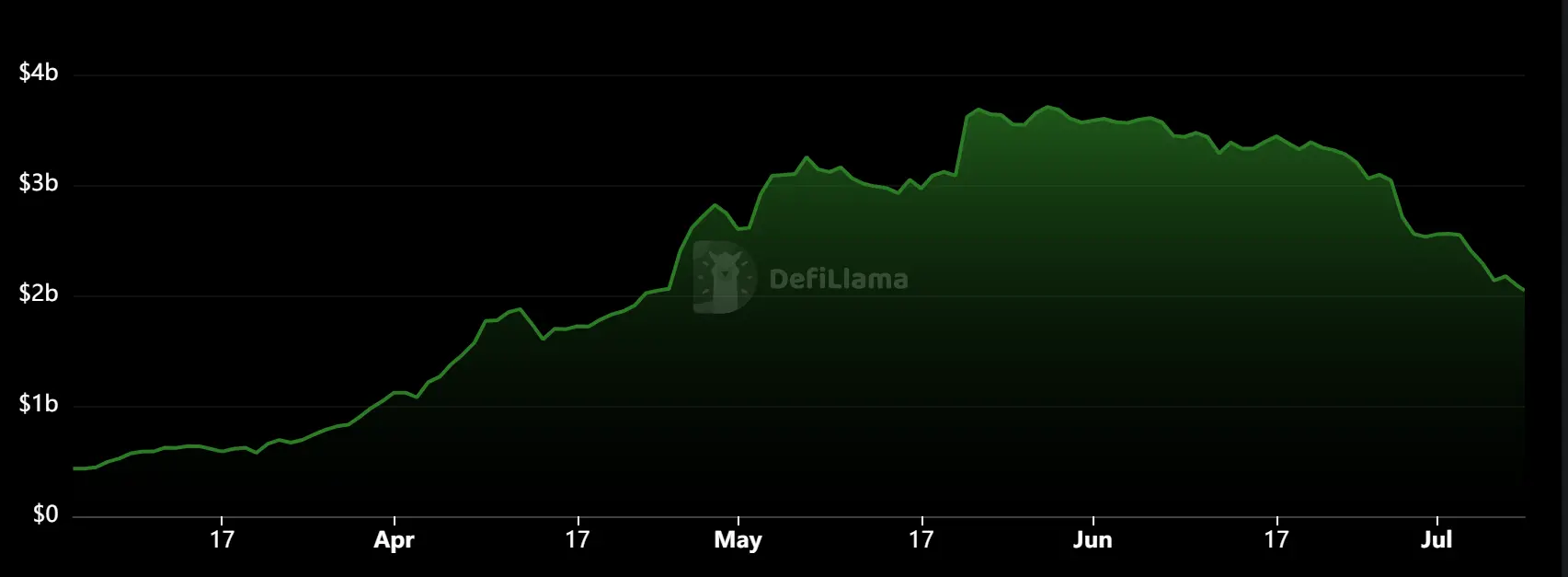

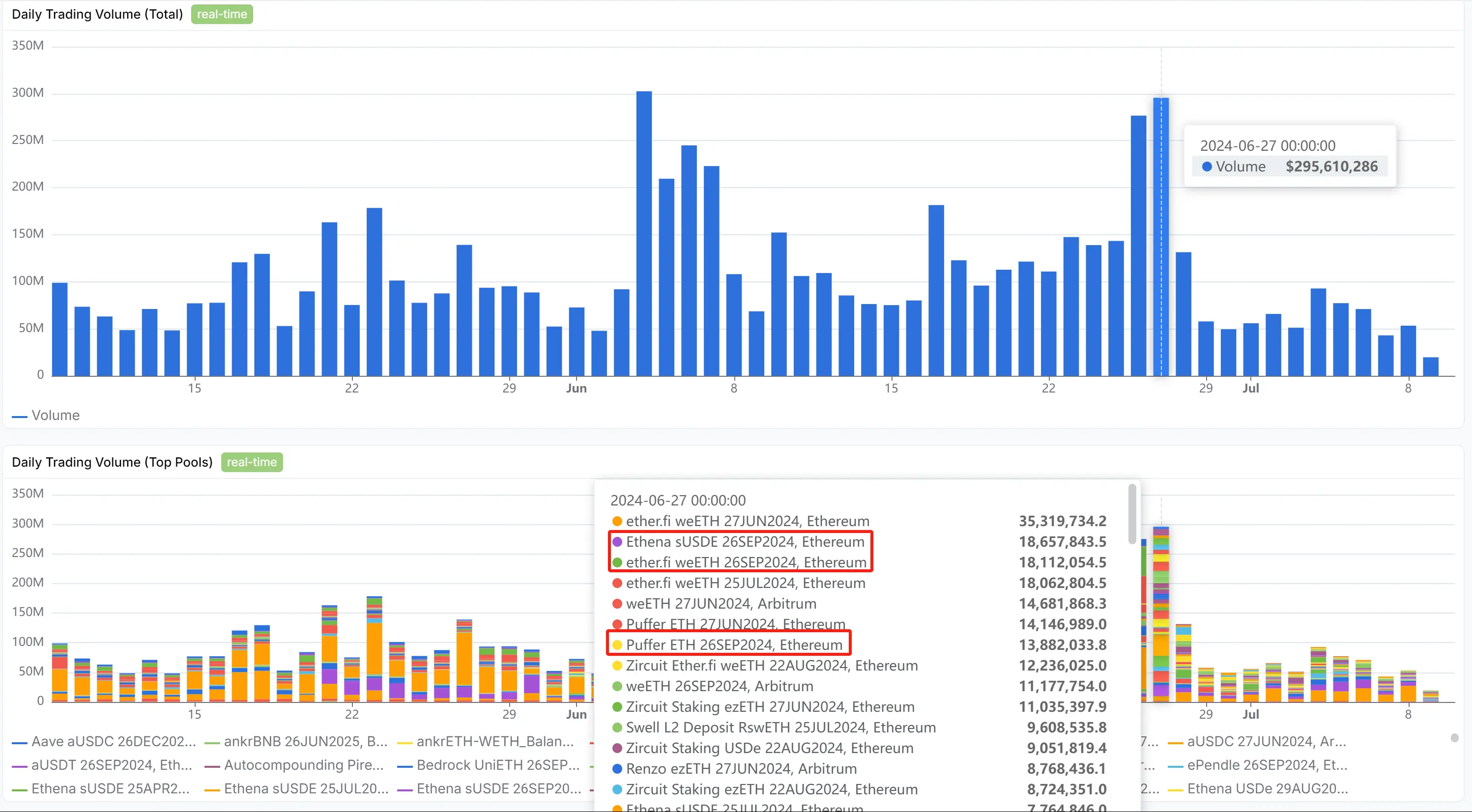

Since June 26th, Pendle users have withdrawn over $3 billion in deposits, mainly from the withdrawal of liquidity re-staking tokens (LRT). By comparing the decline in the Total Value Locked (TVL) of these re-staking protocols and the trend of Pendle's TVL from June to July, it can be observed that they all peaked and gradually declined between June and July.

The significant withdrawal of LRT liquidity on the Pendle platform was mainly influenced by the following two factors:

- Expiration of products in the Pendle on-chain market and Automated Market Maker (AMM)

- Reduced expectations or implementation of re-staking project airdrops (such as Ether.fi, Puffer, Renzo, etc.)

- For example, Ether.fi is about to launch Season 2 airdrop.

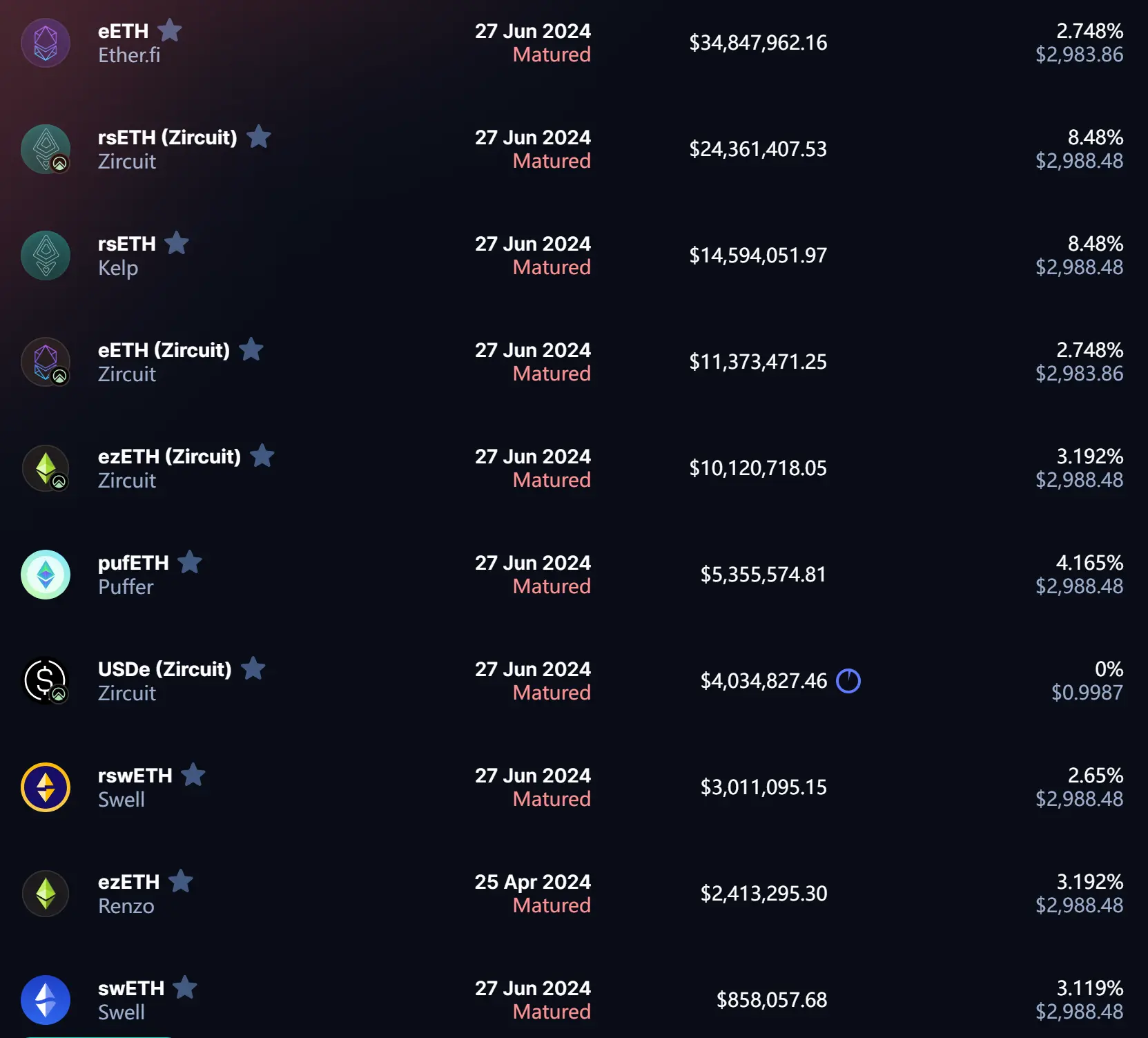

Since June 10th, Pendle's Total Value Locked (TVL) reached its peak, and by July 8th, the TVL had decreased by approximately $3 billion. This sharp decrease mainly involved the withdrawal of some particularly important market assets, including weETH from Ether.fi, sUSDE from Ethena, ezETH from Zircuit, and assets from Renzo, among others. The withdrawal of these assets was not only influenced by a single factor, but was the result of the combined effect of multiple factors.

Major Asset Withdrawals

Possible reasons for the withdrawal of major assets from the market include:

1. Withdrawal of weETH from Ether.fi

Ether.fi recently announced the upcoming Season 2 airdrop, which may have prompted investors to cash in their earnings and withdraw their funds early. In addition, reduced market expectations for the airdrop may have caused some investors to adopt a wait-and-see attitude and choose to temporarily exit the market.

2. Withdrawal of sUSDE from Ethena and ezETH from Zircuit

The expiration of deposits in these projects also led investors to choose to withdraw their stakes and recover their funds. In addition, the platforms where these assets are located may face liquidity pressure, prompting investors to withdraw as soon as possible to avoid risks.

Why Withdraw Early?

In addition to the withdrawal of expired assets, many assets scheduled to expire in July, August, and September were also withdrawn early, possibly for the following reasons:

- Market sentiment fluctuations: In the cryptocurrency market, investor sentiment fluctuates greatly. Once unfavorable news spreads in the market, it can trigger panic, leading to a large-scale withdrawal of assets.

- Liquidity needs: Some investors may choose to withdraw their funds early before the expiration due to their own liquidity needs.

- Adjustment of market expectations: Investors adjust their investment strategies based on market and policy changes, and risk aversion sentiment increases.

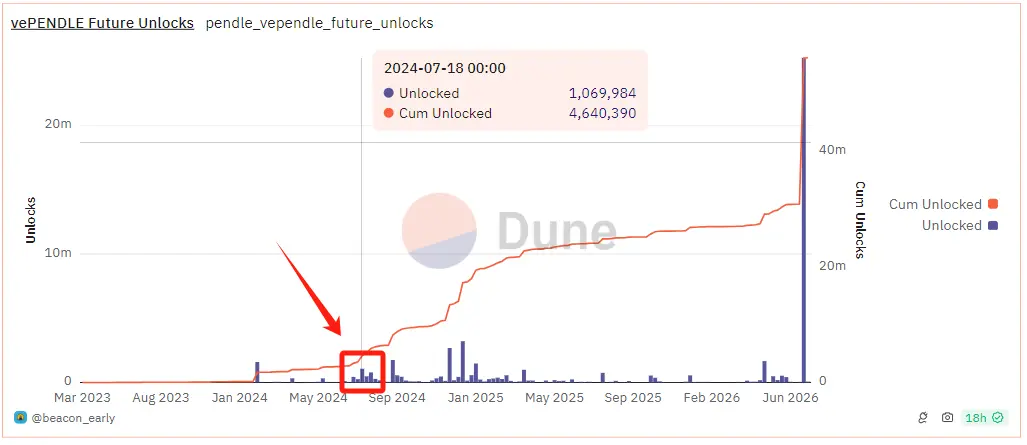

According to the situation in the figure below, the amount of vePendle unlocked reached a significant peak in June and July 2024. It can be seen that the withdrawal time of Pendle TVL is also somewhat related to the unlocking time of vePENDLE. A large amount of unlocked tokens often brings market selling pressure, and investors may sell in advance due to expected price declines, leading to price declines. This may then lead to anticipated selling pressure on the PENDLE token itself. Additionally, a large amount of unlocking leads to an increase in the circulating supply of PENDLE tokens in the market, and in a situation of oversupply, the price may decline.

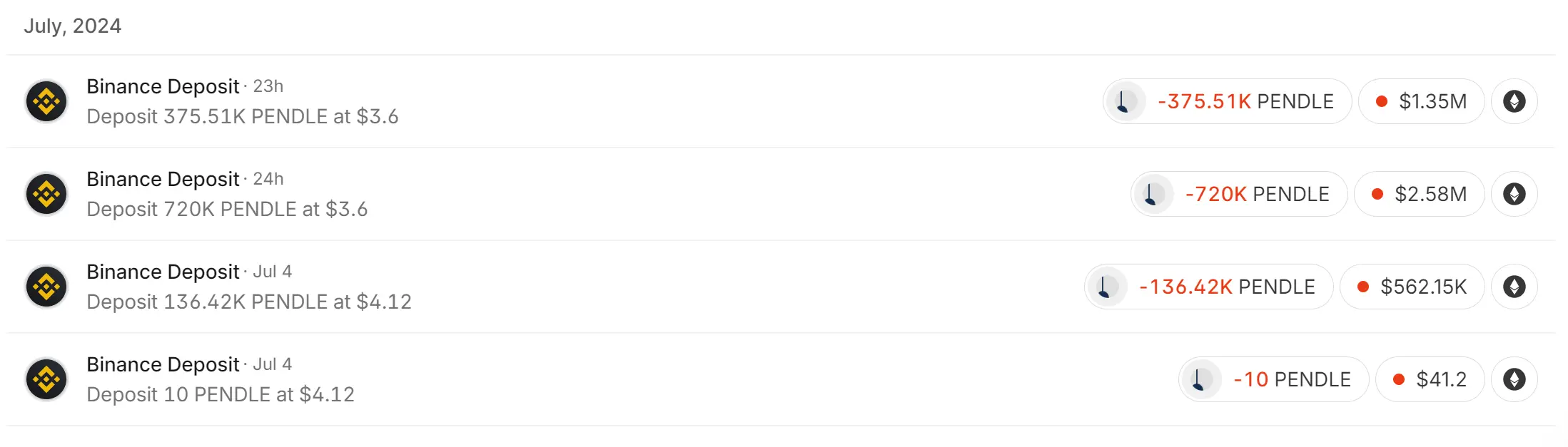

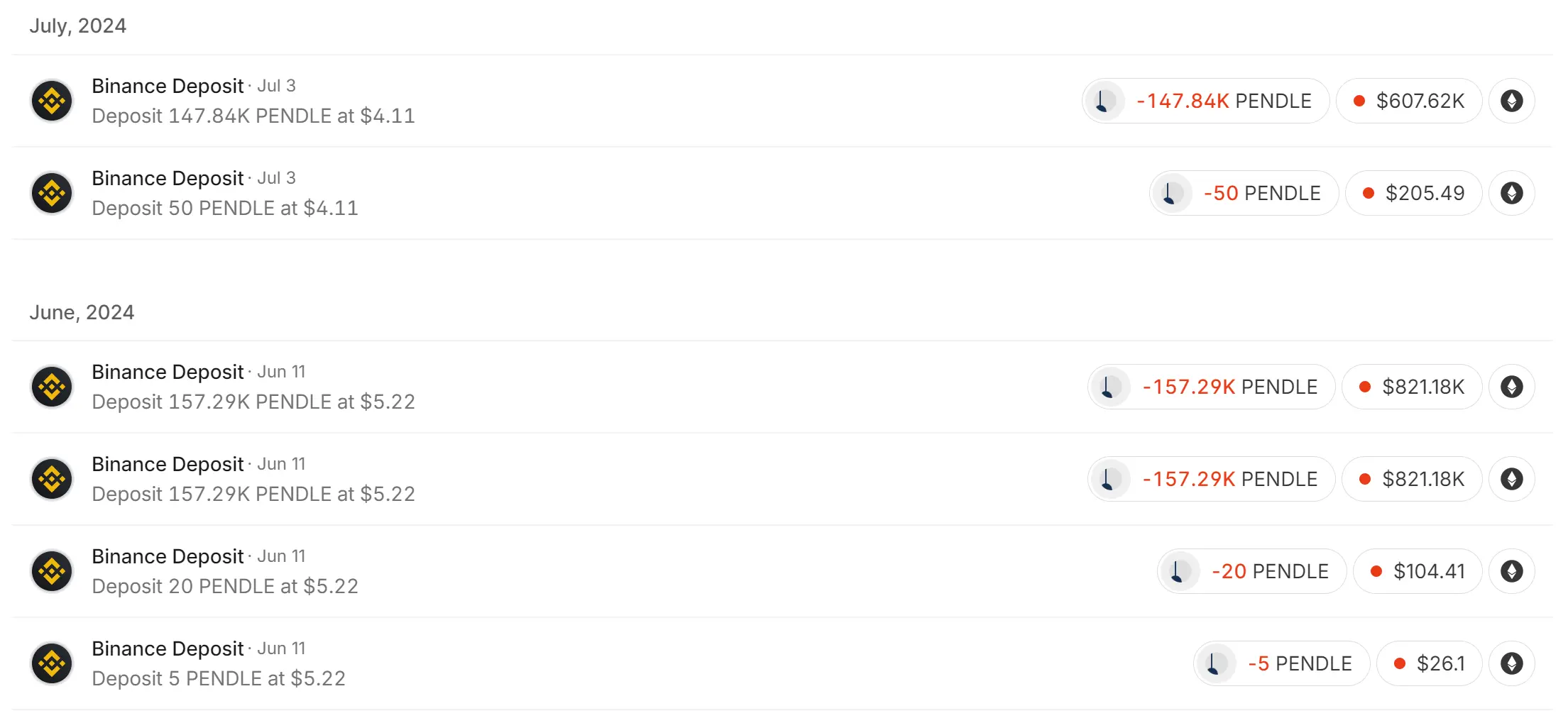

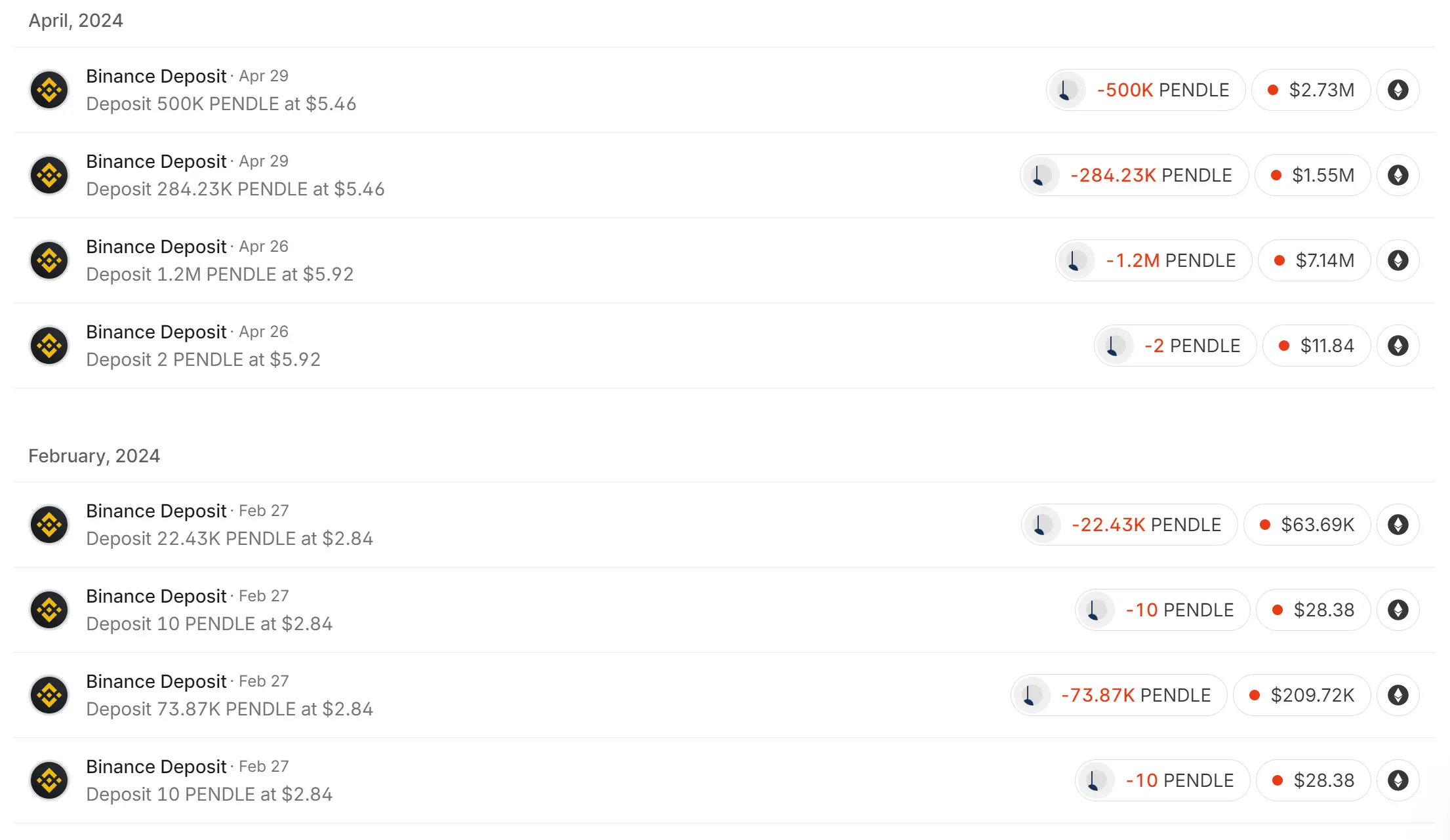

On the other hand, the second largest whale holder of PENDLE tokens, 0xb262F75dbBff55F14E2a50e2d9d751E213C81ED0, deposited over 1 million PENDLE tokens worth over $3 million into Binance on July 8th (left side shows the deposit quantity and price point, and the right side shows the token change quantity and value).

Whale Address Selling Operation 2024.7 (Source: Mest.io)

According to on-chain data, it can be found that this address has been continuously depositing and selling multiple high-value PENDLE tokens to Binance since February this year, totaling $19 million, with sales reaching as high as $11 million in April.

Historical Selling Situation of Whales (Source: Mest.io)

Reflected in the token itself, the price has shown abnormal movements since before the unlocking on June 27th. Recently, it has dropped by 44% from the previous high of $6.17 on June 23rd to $3.45 on July 8th.

PENDLE Price Trend (Source: Coingecko)

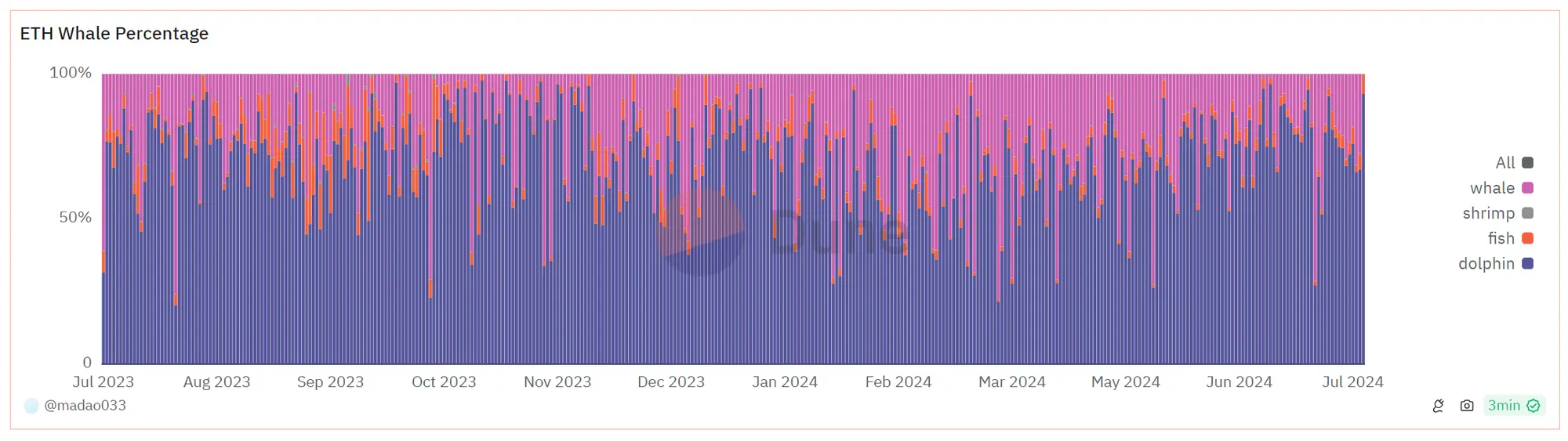

Analysis of Chip Structure

On June 25th, the proportion of on-chain whale users' holdings reached 71.2%, but by June 28th, the proportion of whale users plummeted to 4.7%, almost reaching a historical low. During the same period, the proportion of retail holders increased from 27.1% to 92.4%. This indicates that the selling behavior of whales has had a significant impact on retail holders, and there has been a huge change in the chip structure in the market.

PENDLE Chip Structure (Source: Dune)

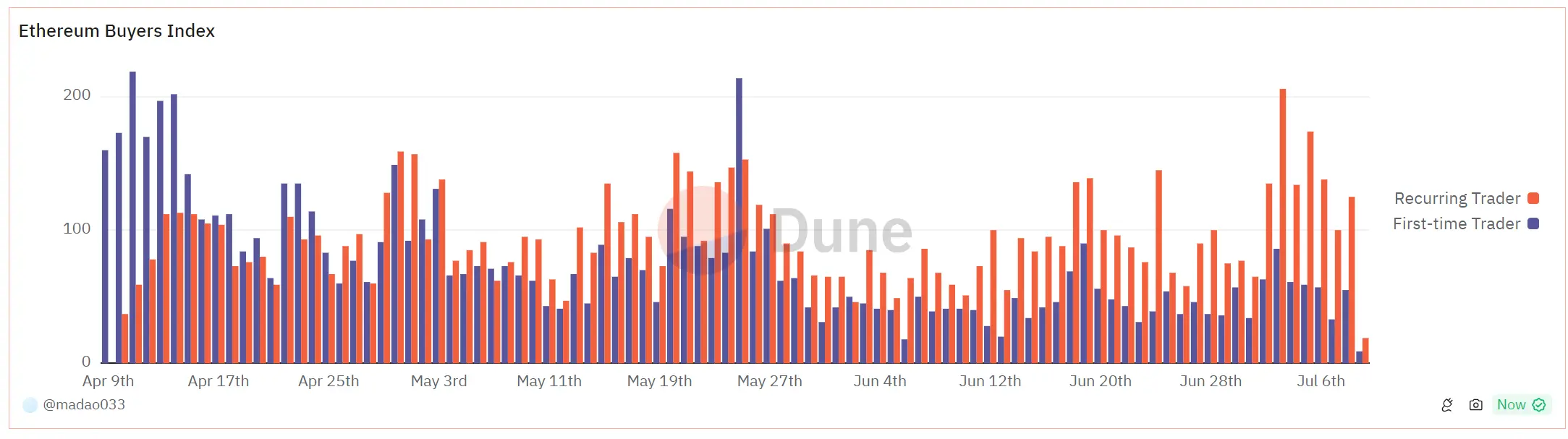

Since June 30th, the proportion of whale users' holdings has gradually increased, indicating that some whale users have started to bottom fish or build positions in PENDLE. This has a certain reference value for retail holders. However, due to the previous massive selling pressure, there are fewer new buyers in the current market, mostly repeat traders.

In general, when there are signs of a breakthrough in the number of new buyers among repeat traders, this is often a signal of a short-term price breakthrough, and vice versa.

Sharp Decline in PENDLE Price

1. Intensified Massive Selling Pressure

As mentioned earlier, the frequent high-value deposits by whales will inevitably create tremendous selling pressure in the market, which will greatly affect the market price and cause a rapid decline in the short term.

The magnitude of the decline from $6.17 on June 23rd to $3.45 on July 8th (about 44%) confirms the market's sensitivity to such massive sell orders.

2. General Market Sentiment Under Pressure

In the short term, due to the continuous influx of massive tokens into the market, panic may continue to hold, further depressing the coin price.

The operating methods of whales largely disrupt the psychology of retail holders and small traders, leading to continuous panic selling.

3. Potential Conditions for Market Rebound

If the peak of whale selling is confirmed or nearing its end, a brief period of price stability and moderation may occur, followed by a possible market self-recovery.

Once the market confirms that whales have completed massive selling, the remaining token value may gradually rise and find a new balance point.

Summary and Outlook

1. Short-term Observation

Currently, PENDLE tokens lack sufficient momentum, and the new buying volume cannot form significant support. Therefore, in short-term operations, attention should also be paid to the related risks of the overall market, to avoid potential losses from bottom fishing too early. In contrast, long-term investors may consider phased positions or dollar-cost averaging, which carries relatively lower risks and is more prudent.

Situation of New and Old PENDLE Traders (Source: Dune)

Future Factors

- Once the market digests these large transactions and there are no new major selling pressure or negative news affecting the price, it may gradually stabilize and start to rebound at new support levels.

- Attention should be paid to whether other whales or large holders show similar signs of operation.

The landing and TVL changes of Restaking track targets (such as Eigenlayer) may have a certain impact on the development of Pendle. Investors should pay attention to relevant data and flexibly adjust their investment strategies. However, considering the strong fundamentals of Pendle, in the long run, PENDLE is still an investment target worth paying attention to and choosing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。