Plume is making efforts to lower the threshold, enhance liquidity, and promote compliance to bring broader accessibility, liquidity, and innovation to RWA.

In June, a violin that once belonged to the Russian Empress Catherine II was used as collateral to borrow millions of dollars from Galaxy, sparking widespread discussions in the community about the RWA (Real World Assets) track.

The RWA track has long been considered the largest incremental market in the crypto world by tokenizing real-world assets to break traditional financial boundaries. We can see that leading Web3 players including Binance, as well as Web2 financial giants like BlackRock and Franklin Templeton, have shown strong interest in the RWA track. With the approval of Bitcoin and Ethereum spot ETFs, RWA-related protocols ONDO and MANTRA have also seen significant increases.

According to Boston Consulting Group's forecast, the tokenization market for global financial assets is estimated to reach $16 trillion by 2030, compared to the current $6 billion market value of the RWA track. In the foreseeable future, the RWA track still has enormous room for growth. Facing the regulatory uncertainty, technical challenges, and insufficient liquidity currently faced by the RWA track, the modular RWA L2 network Plume Network, aimed at simplifying deployment processes and lowering the entry barriers for traditional financial participants, has attracted widespread attention.

Recently, with the launch of the testnet, Plume Network has introduced testnet incentive activities to attract community attention: the activity is based on the concept of "global travel," where users can earn points and accumulate future airdrop tokens by exploring different countries (ecosystems), completing travel tasks, and inviting friends.

Previously, as the first modular EVM L2 network specifically designed for the RWA track, Plume Network has completed a $10 million seed round of financing led by Haun Ventures, with participation from well-known institutions such as Galaxy Ventures, Superscrypt, and A Capital. It has also attracted support from a group of angel investors including Eric Chen and Mirza Uddin from Injective, Anthony Ramirez from Wormhole Labs, and Calvin Liu from Eigenlayer.

This article aims to delve into Plume Network, understanding how the project provides one-stop customized services for the RWA track through technological innovation and ecosystem construction, as well as the specific gameplay of the testnet incentive activities, to explore the future development opportunities and challenges of Plume Network and the RWA track.

RWA: High Threshold, Liquidity, and Regulatory Challenges in the Trillion-Dollar Market

The concept of RWA (Real World Assets) has been around for a long time. It refers to tokens traded on the chain that represent real assets, serving as a mapping of real-world assets on the blockchain. In theory, any real-world asset can be tokenized, whether it's real estate, violins, commodities, or intellectual property.

Through blockchain technology, RWA can significantly reduce intermediary links and transaction costs, improving the efficiency of asset transactions. With the programmability of blockchain, on-chain assets can be easily split and combined, leading to more financial innovations. More importantly, the transparency and tamper resistance of blockchain provide higher transparency and traceability for RWA assets, increasing market trust and security.

In recent years, Web3 technologies have seen breakthrough developments: for example, the improvement in public chain performance and the development of cross-chain technology enable RWA assets to circulate in multiple ecosystems and be integrated into different scenarios. The continuous evolution of token standards also better meets the on-chain needs of a more diverse range of real-world assets, providing strong support for the development of the RWA track.

However, on the path to becoming a trillion-dollar market, RWA still faces some challenges:

On one hand, the entry barrier for traditional asset holders and ordinary users is high. Although many people have shown interest in RWA, there are technical and cognitive barriers to participation, and many RWA services currently have high fees, deterring many people from getting involved.

On the other hand, due to the lack of sound price discovery mechanisms for most RWA, the lack of active secondary markets, and the absence of unified trading standards and circulation channels for different types of RWA, the on-chain liquidity of RWA has been a challenge for entrepreneurs and investors.

In addition, the attitudes and rules of regulatory agencies in various countries towards the RWA field are not yet fully clear, bringing uncertainty to the development of RWA. Innovating in compliance is a major challenge facing the RWA track.

From Lowering Thresholds to Unleashing Innovation: Plume Builds One-Stop Customized Services for the RWA Track

As the first modular EVM L2 network specifically designed for the RWA track, Plume Network aims to lower the threshold for RWA and provide a platform for participants to exchange and invest in RWA through a powerful DeFi ecosystem, introducing incremental users and releasing on-chain liquidity for RWA assets, and building a vibrant ecosystem.

Plume Network's adaptation to the RWA track starts with the reconstruction of the underlying architecture:

First, Plume Network is built on Arbitrum Nitro, which also supports Arbitrum One and Arbitrum Nova. This choice ensures high compatibility and consistency with Ethereum, allowing most smart contracts on Ethereum and other EVM-compatible chains to seamlessly migrate to Plume Network, greatly reducing the migration costs and time for developers.

Second, Plume Network uses Celestia as the Data Availability (DA) layer, reducing gas costs by 99.9%, providing users with a more cost-effective trading environment. In addition, Plume Network also makes minor modifications to the state transition function based on Arbitrum Nitro and obtains certification from Ethereum Authentication Service (EAS), both of which will further reduce gas costs.

Facing the entry barriers for traditional asset holders and ordinary users, Plume Network aims to become the preferred platform for asset issuers to seamlessly deploy RWA projects and for investors to efficiently enter the capital market through a comprehensive end-to-end integrated technology stack.

For asset issuers, the RWA Launcher, a full-stack tokenization application introduced by Plume Network, is like a Lego supermarket, breaking down every aspect and module of RWA into Lego blocks for users to use and combine, helping to lower the threshold and unleash the innovative vitality of RWA.

RWA Launcher is completely open source, using the MIT license and free to use. Anyone, even those without coding knowledge, can run RWA Launcher following the installation and setup instructions. Through RWA Launcher, asset issuers can easily complete a one-stop service from on-chain identity creation, identity verification, deposits and withdrawals, asset deployment, to asset trading according to their needs. This not only simplifies the operation process but also significantly reduces the technical barriers and costs for users, encouraging more people to participate in the RWA ecosystem.

Considering the needs of different categories of real-world assets, Plume Network fully supports various token standards such as ERC-20, ERC-721, ERC-1155, ERC-3643, and more. This extensive support allows various types of assets to be tokenized and traded on Plume Network, greatly expanding the platform's applicability and flexibility.

Whether it's long-held wine collections, limited edition sneakers, works of avant-garde artists, physical assets, or non-physical assets such as stocks and carbon credit quotas, asset issuers can find solutions that meet their needs on Plume Network to achieve low-cost and low-threshold on-chain real-world assets.

After lowering the entry barrier, the bigger challenge is how to truly achieve "value flow" for these on-chain real-world assets in trading.

Plume Network has signed cooperation agreements with multiple ATS (tokenized securities trading venues that comply with regulations and are registered with FINRA) from the EU and North America, such as Texture Capital, Openfinance, and Archax. Asset issuers can seamlessly integrate with ATS trading systems through APIs, providing investors with primary and secondary market compliant trading services. In addition, Plume Network also supports DeFi primitives such as AMMs, NFT RWA Perp DEX, RWA lending, and more, further expanding the derivative scenarios for RWA assets. The broader trading activities not only provide users with better liquidity and more diverse participation opportunities but also provide developers with more innovation space, making the entire ecosystem more prosperous and diverse.

In terms of compliance, Plume Network has powerful compliance tools to help projects build and circulate in a regulated manner.

As an important part of the token standards supported by Plume Network, ERC 3643 is more compliant. It ensures that only users who meet specific standards can hold tokens through a built-in decentralized identity system called ONCHAINID. Issuers of ERC-3643 tokenized assets can access interfaces to set transfer restrictions, freeze tokens, burn tokens, and force transfer tokens, which are key operations for regulated RWA tokenization by securities regulatory agencies.

Furthermore, Plume Network provides a range of tools to help users easily address regulatory challenges, including KYC (Know Your Customer), KYB (Know Your Business), Anti-Money Laundering (AML), account abstraction, on-chain arbitration, and transfer agents. Through these compliance tools, Plume Network can help participants meet regulatory requirements in different regions and industries.

The seamless on-chain and trading of real-world assets achieved by the powerful technical stack would not be possible without the deep industry insights and product control of the Plume Network team, who have years of experience in traditional finance, the crypto market, and RWA.

According to official information, the core members of the Plume team have rich experience in traditional finance, the crypto market, and RWA:

Chris Yin, CEO of Plume, is a serial entrepreneur who founded Xpenser in 2012 and was acquired by Coupa a year later. He then joined several leading companies such as Scale Venture Partners, Rainforest QA, and Coupa Software in important positions.

Eugene Shen, CTO of Plume, has worked at Robinhood Crypto and dYdX, undertaking important development work.

Teddy Pornprinya, Chief Business Officer of Plume, joined Coinbase Ventures in 2021 and later joined Binance as a BD manager.

The team's impressive resumes provide comprehensive support for Plume in terms of technical security, market experience, and cooperation resources. Even though it is still in the testnet stage, the Plume Network ecosystem has already shown impressive performance.

Currently, Plume Network has attracted over 100 projects to build on its platform, covering various categories such as collectibles, synthetic assets, luxury goods, real estate, lending protocols, and perpetual DEX, demonstrating the diverse application potential of the Plume Network and the RWA track.

In addition, Plume Network will implement a series of incentive measures to continuously empower ecosystem expansion:

For developers, Plume has launched the Plume Aviation Academy program, providing technical training, resource support, and funding for developers interested in building RWA projects based on Plume.

For ordinary users, Plume previously launched an ambassador program to encourage users to earn rewards through promotion and community participation. Meanwhile, the Plume Network testnet incentive activity is ongoing, allowing users to earn points by participating in the testnet incentive activity.

Testnet incentive activities are about to be launched: Explore the world to win points and invite friends to accelerate points

Plume's testnet incentive activity is based on the concept of "global travel." Users can earn Plume points by visiting different countries (ecosystem projects), collecting stamps, completing travel tasks, and using invitation codes to invite friends. This activity aims to comprehensively test the network's functionality and performance, as well as encourage users to explore the Plume ecosystem and experience its rich and diverse products and services through a points reward mechanism.

In addition to exploring the ecosystem through participating in the testnet incentive activity, the official Plume social media has also announced a series of methods to earn more points.

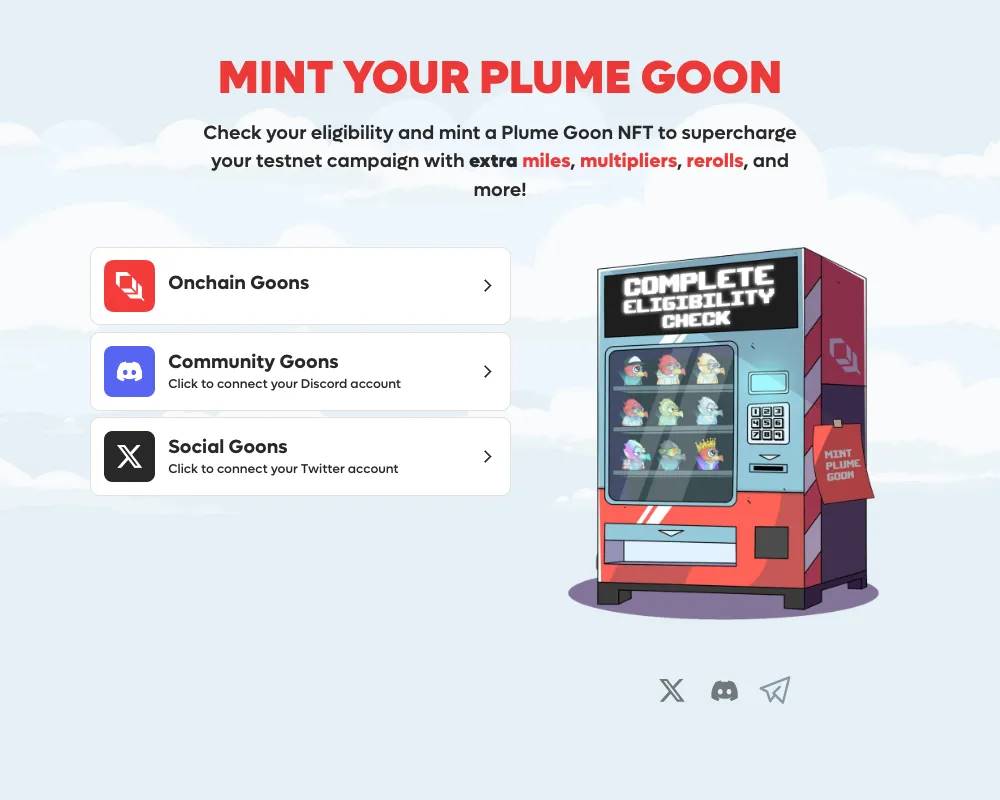

First, users can participate in minting Plume Goon NFTs to accelerate points.

In the setting of the Plume testnet activity, the function of Plume Goon is equivalent to a passport for the Plume ecosystem. Users can use Plume Goon to travel the world (Plume ecosystem) and explore different ecosystem sections to complete travel tasks and collect passport stamps. The more stamps users collect, the more generous the points rewards they will receive.

Users can log in to the Plume official website to link their wallets to check their eligibility to mint Plume Goon. If they are not eligible, users can join the Plume community and more partner communities to obtain minting eligibility.

Holding Plume Goon NFTs will greatly enhance users' testnet participation experience, including additional Plume points, point acceleration, and the opportunity to upgrade to rarer NFTs. Currently, the number of minted Plume Goon NFTs has exceeded 100,000.

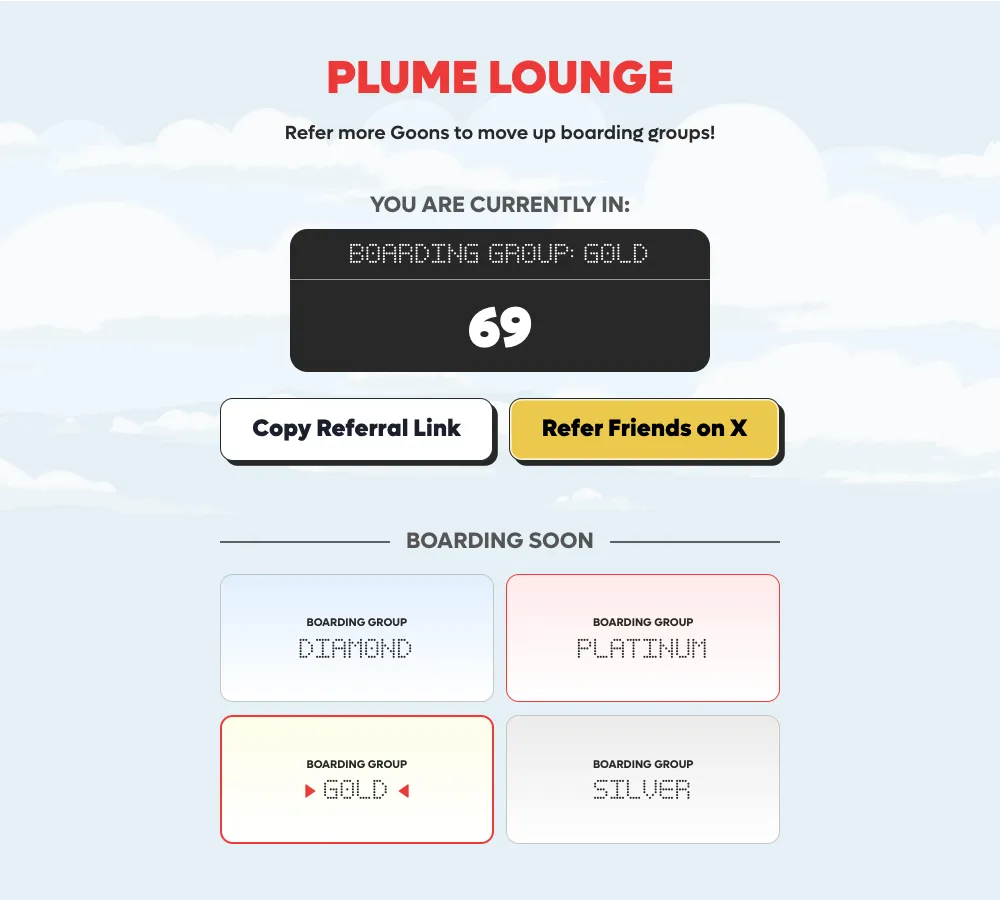

Next, users can continuously upgrade their boarding groups to earn more points acceleration by inviting friends.

The Plume testnet activity is divided into 4 different boarding groups:

Diamond boarding group

Platinum boarding group

Gold boarding group

Silver boarding group

Users with different contributions will be assigned to different boarding groups, each with different levels of points acceleration. Users can upgrade their boarding group by inviting friends. Once a user mints the Plume Goon NFT, they will receive an exclusive registration invitation code. Users can use this code to invite more users to participate in the Plume test. The more friends they invite, the higher the boarding group level, and the more generous the points rewards.

In addition, users can also earn more points through daily check-ins, following social media, and other methods to improve their ranking on the points leaderboard. A higher ranking on the points leaderboard will also result in points acceleration.

Similar to most projects where tokens have not yet been launched, the current Plume ecosystem incentives are presented in the form of points (Plume Miles). These points will be deeply linked to future token airdrops to reward early users for their support and contributions. Therefore, for most users, participating in this testnet incentive activity is an effective way to earn more points and accumulate airdrop chips.

Conclusion

Overall, RWA, as a key bridge connecting the traditional financial and cryptocurrency worlds, is demonstrating its enormous potential for development and vast room for growth. RWA represents a wide range of assets in the real economy, and its digitization and application on the blockchain will bring profound changes to the entire financial industry.

As the first modular EVM L2 network specifically designed for the RWA track, Plume is making efforts to lower barriers, enhance liquidity, and promote compliance, bringing broader accessibility, liquidity, and innovation vitality to RWA. With the launch of the testnet incentive activity and the achievement of several important milestones, it is foreseeable that Plume will once again usher in a new rapid development cycle in the near future. However, it is worth noting that the project is still in the early stages of the testnet, and the realization of Plume's vision for the RWA track will need to be observed after the mainnet launch.

Regardless, as a newcomer in the RWA track that has attracted significant attention from the community, we look forward to Plume Network serving as an important driver for the transformation of traditional finance into modernization, bringing new momentum and development opportunities to the entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。