The economic model is the most important design of blockchain with the goal of long-term operation, without a doubt.

By: Xiao Zhu Web3

Starting from the shutdown price of Bitcoin

Recently, with Mt. Gox starting to compensate Bitcoin and the German government frequently selling Bitcoin, the price of Bitcoin once fell below $54,000 (now it has risen back above $60,000), reaching the "shutdown price" for some Bitcoin mining machines.

According to a survey institution, if Bitcoin falls to $54,000, only ASIC mining machines with an efficiency of over 23W/T can be profitable, and only 5 models of mining machines can barely support this. This means that if the price of Bitcoin falls below the shutdown price, some small-scale risk-averse miners will seek to exit to stop losses. When these miners exit, they often sell Bitcoin for cash and sell mining machines at a lower price, causing further decline in the price of Bitcoin, a phenomenon known as Miner Capitulation.

The so-called shutdown price is actually the cost price of Bitcoin mining machines. So how is this cost price calculated? To answer this question, we must first understand the economic model and PoW mechanism of Bitcoin.

Bitcoin has pre-programmed a total supply of 21 million, with approximately one block mined every 10 minutes, rewarding miners with a certain amount of Bitcoin. The reward amount was 50 Bitcoin per block at the beginning of Bitcoin, and then the reward is halved every 210,000 blocks (approximately every four years). The most recent halving event occurred on April 23, 2024, at block height 840,000, reducing the reward to 3.125 Bitcoin per block. In addition to block rewards, miners also collect transaction fees for packaging transactions, with transaction fees generally ranging from 0.0001 to 0.0005 Bitcoin. Transaction fees are market-regulated, and the more users using Bitcoin for transfers, the busier miners will be. If the transaction fee is set too low, the transaction will be ignored by miners.

When transactions occur in the Bitcoin network, these transactions are placed in the memory pool (mempool). Then, miners select a set of transactions from the memory pool and try to form a new block. To do this, miners need to find a specific value from a random number and combine this specific value with the block data to generate a hash value that meets the network's difficulty target. This process is called "mining". The miner who first calculates a hash value that meets the conditions gains the right to record transactions, which is also known as successful mining. The difficulty target is a dynamic value that adjusts every 2016 blocks (approximately every two weeks) to maintain the average block time of Bitcoin at around 10 minutes. Therefore, the larger the network's computing power, the greater the difficulty target.

The computing power mentioned above is the ability of Bitcoin mining machines to mine, which is the number of hash collisions that can be performed per second. The current unit of computing power is generally TH/s, which is 10^12 hashes per second. The total network computing power is approximately 630 EH/s, which is 6.310^20 hashes per second. Therefore, theoretically, each T of computing power can mine about 810^(-7) Bitcoin per day. For miners, apart from the cost of purchasing mining machines and operating and managing mining farms, the main expense is the electricity cost for mining. Taking the Ant S19 Pro mining machine as an example, with a rated computing power of 110 T and a rated power consumption of 3250 W, it can be calculated that the daily power consumption per T of computing power is 0.709 kW. There is a huge difference in electricity costs in different countries and regions. Calculated at 0.055 u/kw, the cost of mining one Bitcoin is around $50,000. The following figure is the Bitcoin mining data from F2Pool, which is basically consistent with the author's estimation.

The above premises are all based on a total network computing power of 630 EH/s. Once "Miner Capitulation" occurs, the total network computing power will decrease, and the cost of mining one Bitcoin will also decrease. Similarly, if the price of Bitcoin rises, miners will find it profitable, and the total network computing power will increase, and the cost of mining one Bitcoin will also increase.

Therefore, the "shutdown price" of Bitcoin is actually the result of market regulation and the game between miners, and all of this is built on the simple and effective economic model of Bitcoin.

Economic model under PoS

In the economic model of PoW public chains represented by Bitcoin, miners are the most important participants. However, in PoS public chains (such as Ethereum and Solana), there is no role for miners. So what is their economic model like?

First of all, we need to know that the biggest difference between the PoS mechanism and the PoW mechanism is that under PoS, the nodes participating in consensus block production have an admission mechanism, which is usually achieved through staking. In this mechanism, nodes need to stake a certain amount of platform tokens to qualify for participating in network consensus. At the same time, the platform will issue platform tokens to these nodes as block rewards to incentivize them to contribute to the stability of the network. Under PoS, nodes participating in network consensus through staking are generally called validators.

Secondly, if the platform token has unlimited issuance (such as Ethereum and Solana), the issue of inflation of the platform token also needs to be considered. The issuance of platform tokens is usually achieved through validator block rewards, and destruction is generally carried out in the form of transaction fees, such as being recovered to the project's treasury or burned within the protocol. The issuance and recovery need to be balanced, allowing for inflation or deflation for a certain period of time, but cannot be long-term inflation or deflation, in order to maintain economic stability.

Finally, there are the functions of the platform token. Unlike Bitcoin, which can only be used as a transaction fee, the platform token in PoS has interest-bearing functions due to the staking block rewards. Therefore, some platforms also have delegated staking designs, which can reduce the circulation of platform tokens in the market and also maintain economic stability. What we commonly refer to as liquidity staking is usually designed based on delegated staking by third-party protocols, and the APR comes from staking block rewards (and MEV).

Ethereum

The initial supply of the Ethereum network is 72 million, of which 60 million was allocated to those who purchased ETH in the crowdfunding activities held in July and August 2014 (with an average sale price of about $0.3 per coin), and the remaining 12 million was distributed at the launch of the network in 2015, with half going to 83 early contributors to the protocol and the other half being retained by the Ethereum Foundation. The current total supply of the Ethereum network is approximately 120 million.

In September 2022, Ethereum transitioned from PoW to PoS (The Merge) and launched the beacon chain. The inflation design of the Ethereum network is divided into two stages: before Ethereum transitions to PoS, there is an annual issuance of approximately 4.84 million ETH, with an inflation rate of about 4%; after Ethereum transitions to PoS, there is an annual issuance of approximately 3.01 million ETH, with an inflation rate of about 2.5%. In fact, since Ethereum transitioned to PoS, due to EIP-1559 stipulating that a portion of ETH is burned as the network's base fee for each transaction, ETH has been deflationary most of the time, with an average deflation rate of 1.4%.

In the Ethereum network, if a node wants to become a validator on the beacon chain, it needs to stake 32 ETH. Staking more than 32 ETH will not increase the weight of the validator on the network. The beacon chain has 32 slots in each epoch, with each slot lasting approximately 12 seconds, and a block is produced in each slot. Ethereum issues rewards per epoch, and the amount is calculated from the base reward, which represents the average reward for each validator under the best conditions in each epoch. The proposer of the block can take 1/8 of the base reward, and the remaining rewards are distributed to voters (provided they make the same vote as the majority of other validators) and participants in the sync committee. The distribution of rewards is related to the effective balance of validators and the total number of active validators. For details on validator rewards, readers can learn about Ethereum's Gaper consensus, which is one of the most complex designs in the Ethereum protocol.

Due to the fact that staking on Ethereum requires a minimum of 32 ETH, does not support delegating ETH to other validators for staking, and has a 27-hour unlocking period for staked ETH, these rules pose certain obstacles for stakers. Therefore, in order to provide users with a more convenient staking environment, the market has seen the emergence of Liquid Staking Token (LST) protocols. The principle is to pool ETH together to bypass the minimum requirement of 32 ETH, eliminating the need for each user to operate their own validator. The staking pool will handle the corresponding operations and provide users with staking certificates to participate in other DeFi applications, thereby increasing capital utilization.

Lido, the industry leader in the field of Ethereum liquid staking, has introduced stETH, which has captured the majority of the market share in the Ethereum LST space. Lido allows ordinary users to stake any amount of ETH through the Lido platform, and the staked ETH can be converted to ETH at any time, addressing the pain points of native staking. Currently, there are 32.54 million staked ETH in the Ethereum network, accounting for 27% of the total supply, with Lido contributing 9.8 million, and stETH representing 30% of the staked ETH.

Solana

The initial supply of the Solana network is 500 million, with 38% allocated to the community reserve fund, 12.5% to team members, 12.5% to the Solana Foundation, and the remaining 37% to investors. The current total supply of the Solana network is approximately 580 million, with 460 million in circulation, representing an 80% circulation rate. The remaining 20% of SOL is locked in the hands of investors and the team, with the most significant unlocking event scheduled for March 2025, involving approximately 45 million coins.

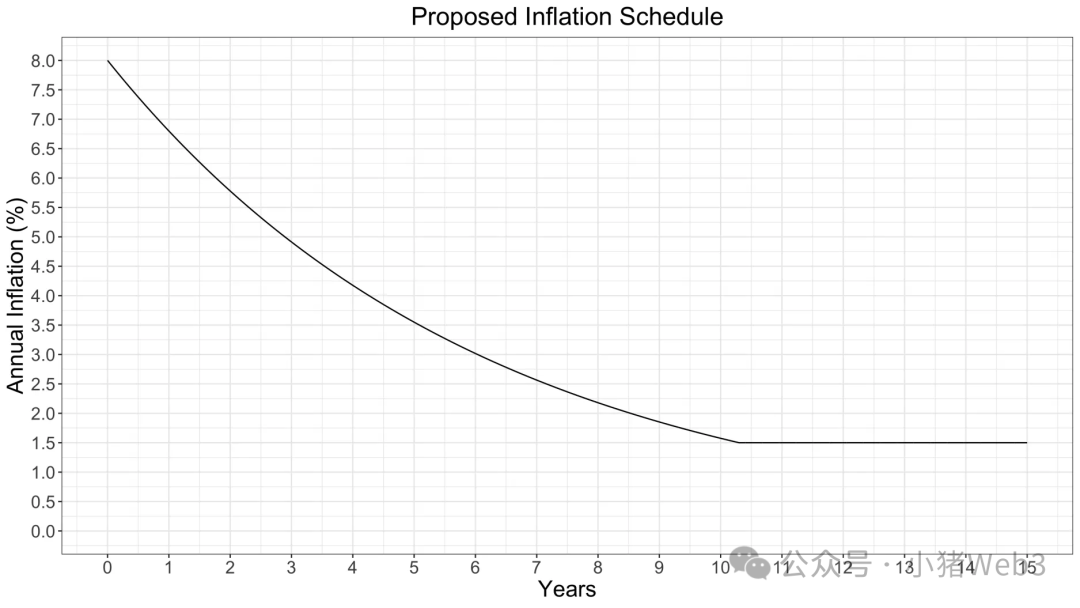

Solana's initial inflation rate is 8%, with an annual decrease rate of -15%, resulting in a long-term inflation rate of 1.5%.

The Solana network does not have a minimum staking amount requirement for validators, but the voting power and staking rewards of validators will be distributed in proportion to their staked amount. The Solana network supports delegate staking, allowing users to stake their SOL to existing validators to share rewards. Delegate staking does not mean delegating SOL to validators; SOL remains in the user's wallet, making it as secure as holding them. Currently, there are 1,500 validator nodes, with an average APR of around 7%.

Validators perform the work of validating transactions and proposing blocks: whenever a validator submits a correct and successful vote (which is a transaction in itself, with the validator paying the transaction fee), they earn points. There are no additional points for proposing blocks, and block rewards only include transaction fees contained in the block, with only 50% of the fees flowing to validators as block rewards, while the remaining 50% is burned. In a given epoch, validators accumulate these points, and they can "redeem" a certain proportion of SOL rewards at the end of the epoch. The redemption of points for rewards is calculated through equity-weighted calculations, meaning that validators receive a proportion of SOL based on their percentage of total points (the sum of all validators' points).

The current status of LST on the Solana network is significantly different from that of Ethereum. The staking ratio of circulating SOL in the Solana network exceeds 80%, far higher than Ethereum's 27%. However, LST only accounts for 6% of the staked supply (in comparison, Ethereum exceeds 40%). The main reason is that the Solana network natively supports delegate staking, and the DeFi protocol ecosystem is still in its early stages, with the problems that Lido and similar products are attempting to solve on Ethereum not existing on Solana. Jito is the leader in Solana network LST, allowing users to delegate their SOL to validators supporting MEV (Jito-Solana Validator Client) to become JitoSOL, with MEV earnings distributed as additional rewards to stakers. Therefore, the APR on the Jito platform is higher than delegate staking, currently reaching 7.92%, and JitoSOL represents 3% of staked SOL.

Conclusion

The economic model is the most important design of blockchain with the goal of long-term operation, without a doubt. Compared to the simple and effective economic model of PoW public chains represented by Bitcoin, the economic model design of PoS public chains represented by Ethereum and Solana is usually very complex—requiring consideration of staking mechanisms, incentive mechanisms, inflation parameters, and token functions.

From the perspective of the economic model of new public chains, the vast majority have adopted PoS rather than PoW consensus mechanisms. The reasons for this are not only that PoS is more energy-efficient, but also that it offers better throughput and transaction confirmation times, allowing for processing more transactions per second, making performance the cornerstone of blockchain's move towards large-scale adoption.

At the same cost, PoS is also more secure and easier to recover from attacks. Because validators are stakeholders, honest validators are rewarded, while malicious validators are punished—of course, the largest stakeholders will receive the most rewards, leading to wealth concentration issues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。